March 2026

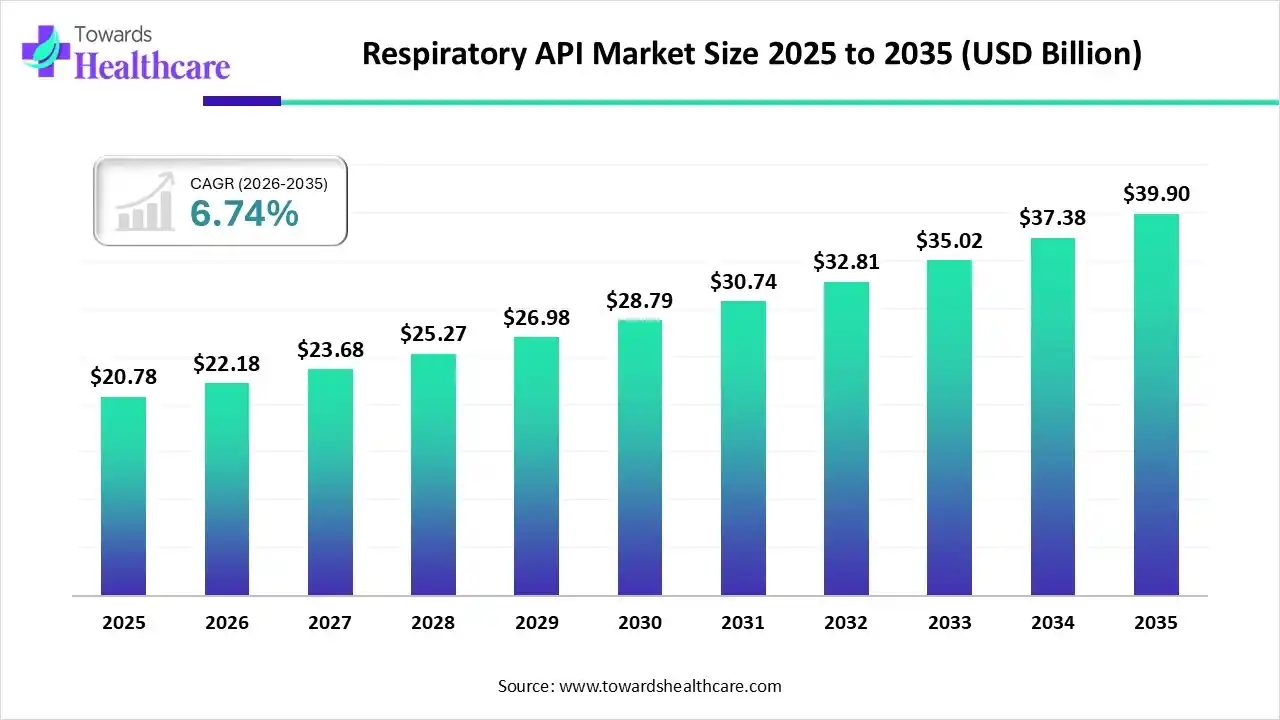

The global respiratory API market size is expected to be worth around USD 39.9 Billion by 2035, from USD 20.78 billion in 2025, growing at a CAGR of 6.74% during the forecast period from 2026 to 2035.

The respiratory API market is experiencing robust growth, driven by the growing geriatric population and increasing demand for small molecules as therapeutics. The rising burden of respiratory disorders globally encourages developers to manufacture large quantities of active pharmaceutical ingredients (APIs) for the treatment of respiratory diseases. Technological advancements, such as artificial intelligence (AI) and machine learning (ML), present future opportunities for market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 22.18 Billion |

| Projected Market Size in 2035 | USD 39.9 Billion |

| CAGR (2026 - 2035) | 6.74% |

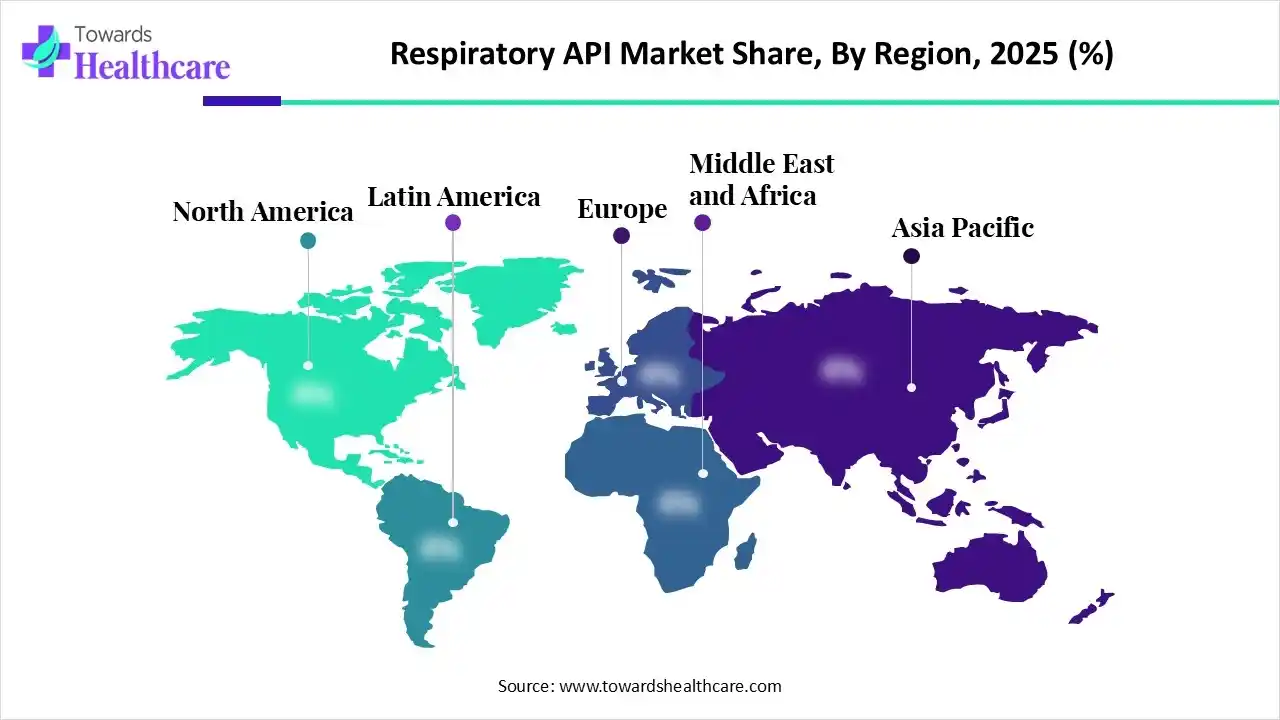

| Leading Region | North America |

| Market Segmentation | By Type, By Formulation Type, By Region |

| Top Key Players | Spectrum Chemical Mfg. Corp., Coral Drugs, Inke S.A., Dr. Reddy’s Laboratories, Cipla Ltd., Wuhan Fortuna Chemical Co., Ltd., Orion Corporation, Lupin Ltd., Cambrex Corporation, AstraZeneca, Teva Pharmaceuticals |

The respiratory API market encompasses the development, manufacturing, and supply of APIs for the treatment of a wide range of respiratory disorders, including asthma, COPD, and allergies. APIs help combat infections of the upper respiratory tract (nose, nasal passages, sinuses, and throat), respiratory airways (larynx, trachea, and bronchi), and lungs. Some common examples of respiratory APIs include budesonide, beclomethasone, ciclesonide, formoterol, and azelastine that act through different mechanisms.

AI has emerged as a promising tool in various aspects of respiratory disorders, from research to manufacturing and the supply chain. AI and ML can analyze vast amounts of data and help design novel, potent candidates. They can enhance the accuracy, reliability, and interpretability of research data related to respiratory illnesses. AI can also streamline the manufacturing process through predictive analytics and automation. This enables manufacturers to detect potential errors and make proactive decisions. Moreover, AI and ML can reduce the time-to-market by accelerating the regulatory process.

Which Type Segment Dominated the Respiratory API Market?

The bronchodilators segment held a dominant position in the market in 2025, due to the need to manage respiratory conditions at the target site. Bronchodilators help relieve symptoms by relaxing the muscles around the airways and also help clear mucus from the lungs. They are generally delivered through inhalers and nebulizers. They are available in short-acting and long-acting forms, providing a wide range of responses to patients based on their conditions.

Combination Drugs

The combination drugs segment is expected to grow at the fastest CAGR in the market during the forecast period. Combination drugs offer the benefits of multiple drugs and provide a synergistic effect. They enhance patient compliance, reduce different dose regimens, achieve higher disease control, and boost therapeutic effectiveness. They are essential to maintain and improve the quality of life.

Why Did the Oral Segment Dominate the Respiratory API Market?

The oral segment contributed the biggest revenue share of the market in 2025, due to high patient convenience and ease of administration. Oral drugs are comparatively cost-effective and do not require any specialized device to deliver within the body. They are the safest method of drug delivery and convenient for repeated or prolonged use. They are available in various forms, including liquids and tablets. They can be sustained-release or immediate-release.

Inhalation

The inhalation segment is expected to expand rapidly in the market in the coming years. The inhalation route is highly preferred as it provides targeted treatment directly into the lungs. Drugs administered through the inhalation route can be delivered by patients of all age groups. They bypass the first-pass metabolism and are considered to be the most effective anti-inflammatory treatment for long-term management of respiratory conditions.

North America dominated the global market in 2025. The availability of state-of-the-art research and development facilities, a robust healthcare infrastructure, and favorable regulatory support are major factors that drive market growth in North America. The region has a well-established clinical trial infrastructure, encouraging sponsors to conduct their clinical trials. Government organizations provide research funding to promote the development of novel APIs.

U.S. Market Trends

The U.S. conducts the highest number of clinical trials in the world. As of 9th January 2025, a total of 34 clinical trials were registered on the clinicaltrials.gov website related to respiratory APIs, out of the total 69 trials. In addition, the Department of Health and Human Services (HHS) Administration for Strategic Preparedness and Response (ASPR) recently invested $44 million to bolster the supply chain of essential medicines.

Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period. The increasing burden of respiratory illnesses, the growing geriatric population, and the presence of key players augment the market. Countries like China, India, Japan, and South Korea have a favorable manufacturing infrastructure, encouraging foreign players to set up their manufacturing facilities in the region. The growing demand for generic alternatives and the increasing number of pharmaceutical startups also contribute to market growth.

India Market Trends

Key players, such as Dr. Reddy’s Laboratories, Cipla Ltd., and Lupin Ltd., are major contributors to the market in India. India is a leading global market for generic APIs and drugs. Favorable trade policies in India also bolster market growth. India exports nearly 25% of the global supply of generic respiratory APIs. The majority of the exports go to Latin America, Africa, ASEAN, CIS, and the Middle East.

Europe is expected to grow at a notable CAGR in the foreseeable future. Favorable government support and increasing R&D investments propel market growth. Government organizations support the development of respiratory APIs through initiatives and funding. People are becoming aware of screening and early diagnosis of respiratory disorders. The growing demand for personalized medicines and the rising adoption of advanced technologies foster market growth.

UK Market Trends

In the UK, the rate of emergency admissions for respiratory disease in England increased by 7% from FY2023 to FY2024, accounting for 854,922 admissions. In response, the British Thoracic Society (BTS) urged the UK government to prioritize improvements in services for people with lung conditions. The NHS 10 Year Health Plan aims to provide greater access to high-quality care.

| Companies | Headquarters | Offerings |

| Spectrum Chemical Mfg. Corp. | New Jersey, United States | It is a leading distributor of numerous APIs, including those for respiratory disorders. |

| Coral Drugs | New Delhi, India | It delivers and manufactures cGMP-compliant, backward-integrated inhalation APIs like budesonide, fluticasone, and mometasone. |

| Inke S.A. | Barcelona, Spain | It has specialized in the development and manufacturing of active ingredients for use in respiratory inhalation therapies for the last two decades. |

| Dr. Reddy’s Laboratories | Hyderabad, India | It is a leading manufacturer and supplier of high-quality APIs for respiratory conditions, including cetirizine, montelukast, desloratadine, and fexofenadine. |

| Cipla Ltd. | Mumbai, Maharashtra | Cipla has a huge API pipeline comprising over 75 complex developments in the therapy areas of oncology, diabetology, and respiratory. |

| Wuhan Fortuna Chemical Co., Ltd. | Wuhan, China | It specializes in providing respiratory API of premium quality, including expectorant, antitussive, and anti-asthmatic. |

| Orion Corporation | Espoo, Finland | The company has over three decades of experience in pulmonary pharmaceutical development, producing inhalers, dry powder formulations, and APIs. |

| Lupin Ltd. | Mumbai, India | It is a leading player in developing and delivering APIs for the treatment of COPD and asthma. |

| Cambrex Corporation | New Jersey, United States | It is a global supplier of generic APIs, including Terpin Hydrate, an expectorant used to relieve cough and support respiratory tract clearance. |

| AstraZeneca | Cambridge, United Kingdom | The company focuses on chronic respiratory diseases, including asthma and COPD, as well as immune-driven diseases. |

| Teva Pharmaceuticals | Tel Aviv-Yafo, Israel | It aims to address the respiratory health burden through innovation, research, and patient-centric care. |

By Type

By Formulation Type

By Region

March 2026

March 2026

March 2026

March 2026