January 2026

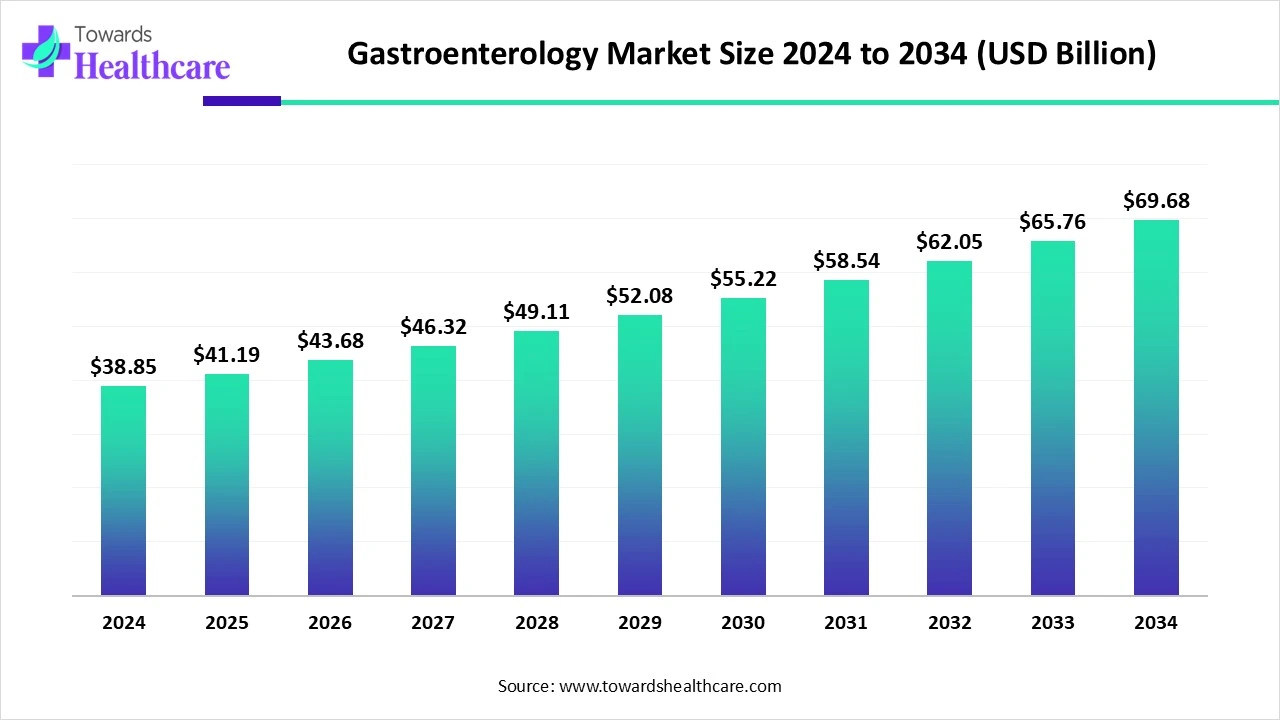

The global gastroenterology market size is calculated at US$ 38.85 billion in 2024, grew to US$ 41.19 billion in 2025, and is projected to reach around US$ 69.68 billion by 2034. The market is expanding at a CAGR of 6.04% between 2025 and 2034.

The gastroenterology market is expanding due to rising demand for less invasive procedures. Endoscopy has become increasingly popular among patients and medical professionals due to technological advancements, including narrow band imaging, high-definition imaging, and capsule endoscopy, among others. The increase in cases of gastrointestinal illnesses due to dietary and lifestyle changes has made early diagnosis and treatment even more crucial. Other factors driving market expansion include rising healthcare costs in developing countries and an increase in the number of people affected by gastrointestinal disorders. Demand is also growing as the population ages. However, the high cost of gastrointestinal devices and the stringent regulatory approvals may hinder market growth throughout the foreseeable period.

| Metric | Details |

| Market Size in 2025 | USD 41.19 Billion |

| Projected Market Size in 2034 | USD 69.68 Billion |

| CAGR (2025 - 2034) | 6.04% |

| Leading Region | North America |

| Market Segmentation | By Type, By Distribution Channel, By Application, By Route of Administration, By Region |

| Top Key Players | Abbott Laboratories, Johnson & Johnson, AbbVie Inc., Salix Pharmaceuticals, GlaxoSmithKline Plc., ALLERGAN, Takeda Pharmaceutical Company Limited, AstraZeneca, Astellas Pharma US, Inc., Pfizer Inc. |

The American College of Gastroenterology states that the study of the normal and abnormal functioning of the esophagus, stomach, small intestine, colon, rectum, pancreas, gallbladder, bile ducts, and liver is known as gastroenterology. A noticeable trend is the rise in the use of less invasive treatments and sophisticated diagnostics. Innovations like AI-powered imaging and robotically assisted surgery are being used by healthcare practitioners to improve patient outcomes. Patient education programs are also becoming more popular, enabling people to gain a better understanding of their gastrointestinal health.

Incorporating artificial intelligence (AI) will inevitably transform the practice of gastroenterology and hepatology (GI) over the next decade. The application of AI in healthcare is not new, but it is rapidly evolving, and the field's future is beginning to take form. AI has the ability to enhance and expedite clinical and procedural practice, as well as GI research. The application of AI in gastroenterology has demonstrated significant promise due to the large body of machine learning research on picture recognition.

The Rising Cases of Gastrointestinal Diseases

$111.8 billion was spent on GI health care in 2021. A gastrointestinal diagnosis or symptom resulted in 2.9 million hospitalizations and 14.5 million ED visits. 315,065 new gastrointestinal cancers were identified. GI illnesses resulted in 281,413 fatalities. It is expected that 23.5 million GI endoscopies were carried out in 2022. $3.6 billion, or 7.4% of the NIH budget, was allocated to GI research in 2023. It is estimated that the number of fatalities from digestive diseases would increase to 1.8 million by 2050 (95% UI: 1.5–2.1 million).

Strict Regulatory Frameworks

Strict international regulatory frameworks are another significant barrier for the gastroenterology industry. The additional financial burden on manufacturers to comply with these regulations drives up the cost of endoscopy devices. This, in turn, affects patients' capacity to pay for operations, particularly in underdeveloped nations where healthcare funds are limited.

What are the Opportunities in the Gastroenterology Market?

The expanding use of customized medicine and microbiome-based therapies presents a substantial business opportunity. Advances in genetic fingerprinting and gut microbiota research have made it possible to create more customized treatment regimens that improve patient satisfaction and efficacy. The increased need for telemedicine and less invasive procedures, which are expanding access to gastroenterology care, is driving the market's growth even more.

By type, the branded segment led the gastroenterology market in 2024. One of the main benefits of brand-name medications is the level of consumer trust in them. These drugs have undergone extensive clinical trials and have been proven to be safe and effective, giving patients peace of mind that they are receiving the best therapy possible for their condition. The marketing initiatives of pharmaceutical companies also contribute to raising public awareness of particular diseases and their cures.

By type, the generics segment is estimated to grow at the highest CAGR during the upcoming period. Although the quality of generic medications is closely monitored, many individuals find them to be a more affordable alternative due to their reduced cost. Since generics are based on already-approved FDA formulas, significant initial research and testing expenditures are not required. This allows for substantial price savings by allowing generic medications to enter the market more quickly and at a lower cost than name-brand medications.

By distribution channel, the retail pharmacies segment was dominant in the gastroenterology market in 2024. Of the four types of pharmacies, retail chains are the largest and most prevalent, accounting for one-third of stores and approximately one-third of prescription revenue. To become a preferred site, retail pharmacies may try to understand and meet the needs of their clients in this evolving environment.

By distribution channel, the online pharmacies segment is anticipated to grow at the highest CAGR from 2025-2034. Clients may purchase prescription medications and e-services online through a web-based pharmacy, which allows them to obtain prescriptions and services from the comfort of their homes in a timely and easy manner. E-pharmacies are gradually replacing the role that local chemists have traditionally played by providing over-the-counter medications for common illnesses, chatbots for instant first aid, test labs, recommendations for local doctors, or assistance in finding doctors, home delivery of medications, information about the medications, etc.

By application, the Crohn’s disease segment held the largest share of the gastroenterology market in 2024. Crohn's disease is most common in North America, Northern Europe, and New Zealand. A bimodal distribution is shown by the fact that the condition most frequently develops between the ages of 15 and 30 and 40 and 60. Compared to rural settings, cities have a greater frequency of Crohn's disease. The condition is more common in Northern Europeans and those of Jewish ancestry (incidence 3.2 per 1000 individuals). Africans, Asians, and South Americans have low prevalences. However, recent studies show that the frequency has dramatically grown across Asia, Australasia, and Africa's rapidly industrializing regions.

By application, the ulcerative colitis segment is estimated to be the fastest-growing during the forecast period. Across the globe, North America and Northern Europe have the highest rates of inflammatory bowel disease. A lifestyle and environment that are more Westernized are closely associated with inflammatory bowel disease. Nine to twenty cases of ulcerative colitis occur for every 100,000 people annually. Every year, there are between 156 and 291 instances per 100,000 people. Ulcerative colitis is more common in adults than Crohn's disease. However, Crohn's disease is more common in children than ulcerative colitis.

By route of administration, the injectables segment led the gastroenterology market in 2024. Due to their precise administration and quick absorption, injectable drugs are used in gastroenterology for both systemic and local therapies. Endoscopic needle injection is a crucial application, encompassing methods such as submucosal injection for procedures like EMR and ESD. Certain gastrointestinal disorders are treated by injections of various materials, including tissue adhesives, sclerosing agents, and hemostatics.

By route of administration, the oral segment is expected to grow at the highest CAGR during the upcoming timeframe. Overcoming the gastrointestinal (GI) tract's constraints to enhance medicine delivery and efficacy is the main goal of oral administration in gastroenterology going forward. Along with a better comprehension of GI physiology and how it affects medication absorption, innovations include sophisticated drug delivery methods like nanoparticles and microfabrication.

North America dominated the gastroenterology market in 2024. The usage of sophisticated gastrointestinal devices and technology is increasing. When compared to other parts of the world, the region's high per capita healthcare spending and generally favorable reimbursement rules are driving the market's expansion. In addition, the U.S. and Canada are home to the best medical schools in the world. These countries have traditionally been among the first to adopt most new life-saving technology. As a result, there is now a high demand for newly created digestive products.

In January 2025, a group of practicing physicians, the American College of Gastroenterology (ACG), and the American Gastroenterological Association (AGA) GI Opportunity Fund joined Oshi Health, the only national multidisciplinary gastroenterology (GI) medical practice, in its recent $60 million Series C fundraise. The goal is to address the pressing need for more accessible and comprehensive care offerings for the 70 million Americans who suffer from gastrointestinal (GI) conditions. (Source - PR Newswire)

The Québec City Convention Centre in Quebec, Canada, hosted the Joint 2025 Canadian Digestive Diseases WeekTM and Canadian Liver Meeting Conference (CDDW™-CLM) from February 28 to March 2, 2025. Along with the scientific lectures, the conference featured networking activities aimed at fostering relationships, generating fresh concepts, and promoting teamwork. Participants were urged to use these chances to broaden their professional networks and have thought-provoking conversations that frequently result in motivating and fruitful consequences. (Source - CDTRP)

Asia Pacific is estimated to host the fastest-growing gastroenterology market during the forecast period. Due to a number of factors, including the growing population, the occurrence of gastrointestinal disorders, population aging, rising R&D costs, and significant unmet healthcare needs. Among the leading businesses in Asia Pacific are Takeda Pharmaceutical Company Limited, Gnova Biotech, and Doctris Lifescience.

China is responsible for 70% of new cases of cardia and 50% of new cases of non-cardia gastric cancer (GC), making it the fifth most common cause of cancer-related death worldwide. The rapidly aging population of China, which is expected to reach 395 million people over 65 by 2050, increases the burden of disease because aging is still a risk factor that cannot be changed.

According to projections, there will be 29.8 million Indians with cancer in 2025, up from 26.7 million in 2021. According to studies, China and India combined may be responsible for almost 6.5 million additional instances of stomach cancer in the ensuing decades.

Europe is expected to grow significantly in the gastroenterology market during the forecast period, because of significant product launches aimed at enhancing diagnostic capabilities and patient care. The regional market is witnessing advancements in imaging techniques and microbiome analysis, which improve the ability to identify and treat gastrointestinal problems. Due to a combination of technological advancements and growing awareness of gastrointestinal health issues, Europe is positioned as a significant contender in the developing business.

Every year in Germany, stomach cancer claims the lives of around 10,000 individuals and causes about 15,000 new cases of the disease. In terms of cancer treatment, Germany is thought to be among the top nations. Access to state-of-the-art medical equipment, sophisticated surgical methods, and all-encompassing multidisciplinary treatment benefits patients. Innovative methods of treating stomach cancer in Germany, including immunotherapy, targeted medicines, minimally invasive surgery, and specialist procedures like PIPAC and HIPEC, provide patients with advanced or difficult cases with fresh hope.

In July 2024, according to M.V. Ramana, CEO of Branded Markets (India & Emerging Markets), Dr. Reddy's, our gastrointestinal products, which include popular brands like Omez® and RazoTM, have been trusted by patients and medical experts for more than thirty years. We are happy to provide patients in India with access to Vonoprazan (Vono™), a first-in-class medication, by utilizing our experience in this therapeutic field. The non-exclusive patent licensing arrangement with Takeda is a component of our ongoing endeavors to satisfy unmet needs and improve the quality of care by partnering strategically to bring cutting-edge medications to Indian patients. (Source - Angel One)

By Type

By Distribution Channel

By Application

By Route of Administration

By Region

January 2026

December 2025

December 2025

December 2025