February 2026

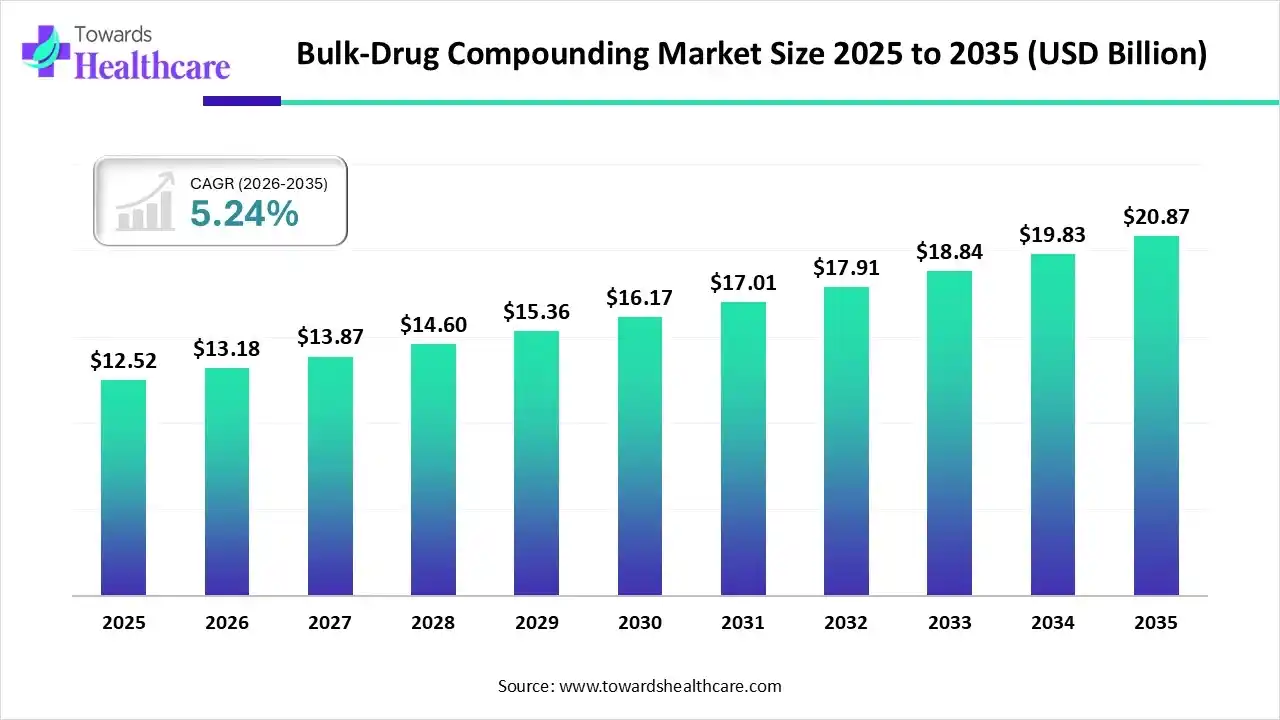

The global bulk-drug compounding market size was estimated at USD 12.52 billion in 2025 and is predicted to increase from USD 13.18 billion in 2026 to approximately USD 20.87 billion by 2035, expanding at a CAGR of 5.24% from 2026 to 2035.

The market is expanding steadily, supported by growing demand for personalized therapies, management of drug shortages, and increased use of customised formulations across hospitals, clinics, and specialty pharmacies worldwide.

Bulk drug compounding is the preparation of customized medications in large quantities using active pharmaceutical ingredients to meet specific patient or clinical needs not addressed by commercially available drugs. The bulk-drug compounding market is growing due to rising demand for personalized medicines, frequent drug shortages, and increasing prevalence of chronic and rare diseases. Hospitals and pharmacies rely on compounded drugs to tailor dosages, improve patient compliance, and ensure continuous therapy when commercial drugs are unavailable.

| Chronic Diseases | Estimated Morbidity | Estimated Global Mortality |

| CVD | 523 million | 18 million |

| Diabetes | 589 million | 3.4 million |

| Cancer | 20 million | 10.3 million |

| Respiratory Diseases | 21000 | 9200 |

| HIV | 40.8 million | 6,30,000 |

AI can enhance the bulk-drug compounding market by optimizing formulation accuracy, predicting drug demand, and reducing wastage. It supports quality control through real-time monitoring, improves regulatory compliance, and enables data-driven personalization of therapies, leading to higher efficiency, safety, and faster turnaround times in compounding operations.

Demand for tailored therapies will rise as patient-specific dosing and unique combinations become more common, pushing compounding services to develop specialized, precision medicines that large manufacturers don’t offer.

Automation, AI, and digital quality systems will boost efficiency and accuracy, allowing faster production, improved compliance, and reduced errors in compounding operations, strengthening market competitiveness.

Growth in outpatient clinics, specialty pharmacies, and telehealth will increase reliance on compounded drugs, especially for rare diseases and niche treatments, broadening the market’s reach and long-term potential.

| Key Elements | Scope |

| Market Size in 2026 | USD 13.18 Billion |

| Projected Market Size in 2035 | USD 20.87 Billion |

| CAGR (2026 - 2035) | 5.24% |

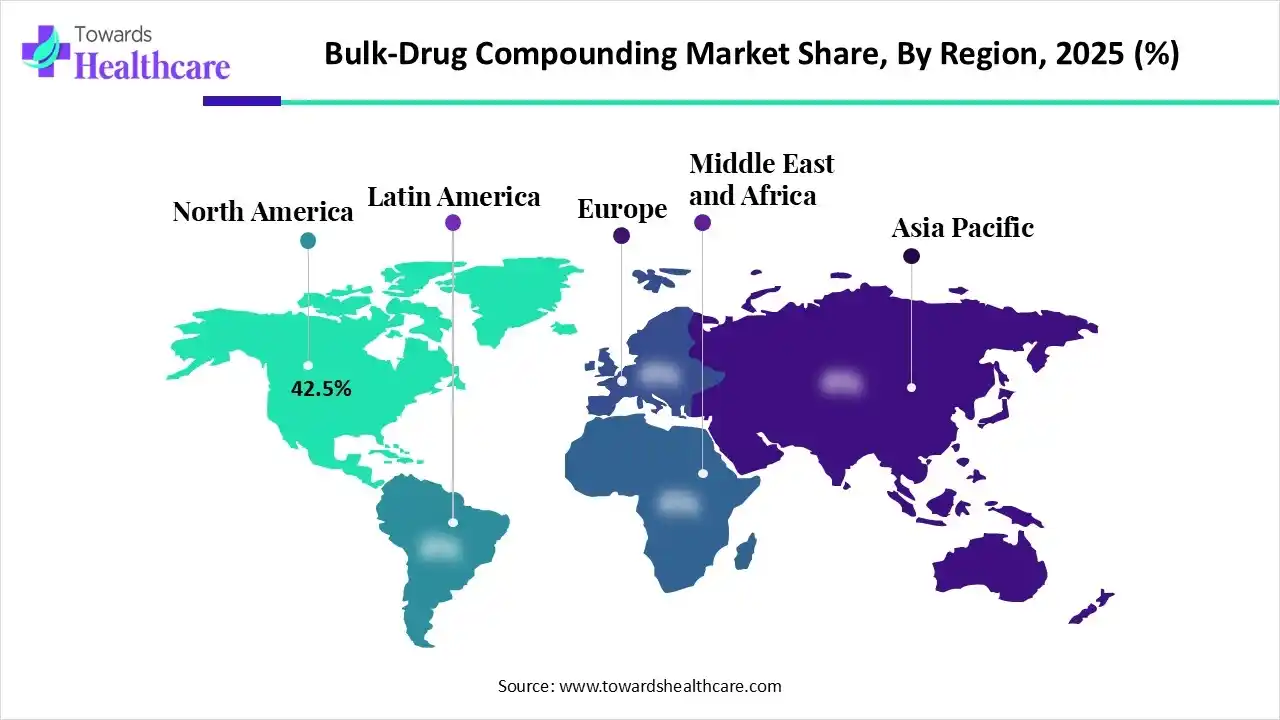

| Leading Region | North America by 42.5% |

| Market Segmentation | By Compounding Type, By Sterility, By Product/Form, By Therapeutic Area, By Region |

| Top Key Players | Fagron NV, B. Braun SE, Baxter International Inc., Fresenius Kabi AG, QuVa Pharma, Inc. |

Why Did the 503B Outsourcing Facilities Segment Dominate in the Market in 2025?

The 503B outsourcing facilitates segment dominated the bulk-drug compounding market with a share of approximately 62% in 2025 due to its ability to supply large-scale, standardized compounded drugs under stricter regulatory oversight. Hospitals increasingly prefer these facilities to manage drug shortages, reduce in-house compounding risks, and ensure consistent quality. Strong demand for sterilizing instruments and cost-efficient production is expected to drive the fastest growth during the forecast period.

How the Sterile Compounding Segment Dominated the Bulk-Drug Compounding Market in 2025?

The sterile compounding segment dominated with a revenue share of approximately 58% in 2025 because healthcare providers increasingly require injectable, high-purity medications for surgeries, oncology, and critical care. Strict quality standards and safety needs make sterile compounded drugs essential when commercial options aren’t available. This demand, along with rising chronic disease treatments and hospital reliance on ready-to-use sterile products, propelled the segment’s market share and growth.

Non-sterile Compounding

The non-sterile compounding segment is expected to grow at the fastest CAGR because of rising demand for customized oral, topical, and powder formulations that aren’t widely available commercially. As more patients require personalized dosages, flavors, or allergen-free options, pharmacies and clinics will increasingly turn to non-sterile compounding, especially for chronic conditions, pediatric care, and dermatological treatments.

Why Did the Oral (Capsules, Syrups) Segment Dominate in the Market in 2025?

The oral (Capsules, Syrups) segment dominated the bulk-drug compounding market with a share of approximately 39% in 2025 because these formulations are widely prescribed for chronic conditions, pediatric needs, and dose-specific treatments. Easy administration, high patient compliance, and frequent demand for customized strengths or flavors boosted their use. Pharmacies and healthcare products increasingly rely on compounded oral products to meet individual patient requirements not fulfilled by standard commercial drugs.

Parenteral (Injectables/IV)

The parenteral (Injectables/IV) segment is expected to grow at the fastest CAGR because hospitals and specialty clinics increasingly need sterile, ready-to-administer injections for critical care, oncology, and complex therapies. Customized IV formulations help manage drug shortages and enhance treatment precision. Their higher clinical demand, strict safety requirements, and limited commercial availability drive rapid adoption and market growth throughout the forecast period.

How the Pain Management Segment Dominated the Bulk-Drug Compounding Market in 2025?

The pain management segment dominated the market with a share of approximately 31% in 2025 because of the high and growing demand for tailored analgesic treatments, especially for chronic pain, post-surgical care, and cancer-related pain. Compounded pain medications allow customized dosage and routes of administration when standard products don’t meet patient needs, boosting their use in hospitals, clinics, and specialty pharmacies and driving market share.

Hormone Replacement Therapy (HRT)

The hormone replacement therapy (HRT) segment is expected to grow at the fastest CAGR because aging populations and increased awareness of hormonal imbalance are boosting demand. Personalized HRT formulations help tailor doses for menopausal symptoms, endocrine disorders, and gender-affirming care. Limited availability of one-size-fits-all commercial products drives clinics and pharmacies to compounded solutions, accelerating market growth throughout the forecast period.

North America dominated the global bulk-drug compounding market with an estimated 42.5% share in 2025 due to strong regulatory frameworks, widespread adoption of 503A and 503B facilities, and high demand for personalized therapies. Advanced healthcare infrastructure, frequent drug shortages, and growing use of compounded sterile and non-sterile formulations across hospitals and clinics further supported the region’s market leadership.

U.S. at the Forefront of the Bulk-Drug Compounding Market

The U.S. led the market in 2025 by capturing the largest revenue share due to its well-established compounding regulations, strong presence of 503A and 503B facilities, and high healthcare spending. Rising demand for personalized medicine, effective management of drug shortages, and widespread adoption of compounded sterile products across hospitals and specialty clinics further reinforced the country’s market leadership.

Asia Pacific is expected to register the fastest CAGR during the forecast period due to expanding healthcare infrastructure, rising prevalence of chronic diseases, and growing demand for affordable personalized medicine. Increasing hospital capacity, improving regulatory support, rapid urbanization, and higher awareness of customized therapies across emerging economies such as India and China are accelerating the adoption of bulk drug compounding services in the region.

India: A High-Growth Hub in Bulk Drug Compounding

India is anticipated to grow at a rapid CAGR during the forecast period due to expanding healthcare infrastructure, rising chronic disease burden, and increasing demand for cost-effective personalized medicines. Growth in hospital networks, improving regulatory clarity, strong pharmaceutical manufacturing capabilities, and higher awareness of compounded therapies across urban and semi-urban regions are accelerating market adoption.

Europe is anticipated to grow at a notable CAGR during the forecast period due to increasing demand for personalized therapies, aging population growth, and rising prevalence of chronic diseases. Strong healthcare systems, expanding hospital pharmacies, supportive regulatory frameworks, and growing reliance on compounded medicines to address drug shortages are driving consistent market expansion across key European countries.

UK’s Rapid Growth in the Bulk-Drug Compounding Market

The UK is anticipated to grow at a rapid CAGR during the forecast period due to rising demand for personalized medicines, an aging population, and increasing chronic disease prevalence. Strong NHS support for specialized treatments, growing use of compounded drugs to manage supply gaps, advancements in hospital pharmacy services, and improving regulatory guidance are accelerating market growth across the country.

| Companies | Headquarters | Offerings |

| Fagron NV | Rotterdam, Netherlands | Fagron supplies compounding products, raw materials, excipients, equipment, and sterile/non-sterile formulations to pharmacies, hospitals, and healthcare providers worldwide, supporting personalized medicine and compounding services. |

| B. Braun SE | Melsungen, Germany | A major medical and pharmaceutical company offering a wide range of healthcare products, including infusion and injection systems, surgical instruments, hospital supplies, and devices for patient care and therapy. |

| Baxter International Inc. | Illinois, USA | Provides medical supplies and therapies such as sterile IV solutions, infusion systems, parenteral nutrition, dialysis products, anesthesia, and critical care pharmaceuticals. |

| Fresenius Kabi AG | Homburg, Germany | Specializes in life-saving medicines and technologies for infusion, transfusion, clinical nutrition, and IV generic drugs, serving critically and chronically ill patients globally |

| QuVa Pharma, Inc. | Texas, USA | Focuses on 503B sterile injectable compounding services for hospitals and health systems, offering ready-to-administer compounded medications and data/analytics solutions to optimize pharmacy operations |

By Compounding Type

By Sterility

By Product/Form

By Therapeutic Area

By Region

February 2026

February 2026

February 2026

February 2026