February 2026

The global sleep trackers market size was estimated at USD 28.69 billion in 2025 and is predicted to increase from USD 30.88 billion in 2026 to approximately USD 59.90 billion by 2035, expanding at a CAGR of 7.64% from 2026 to 2035.

![]()

The market is growing steadily due to rising awareness of sleep health, increasing lifestyle disorders, and the adoption of wearable health technologies. Demand is driven by smartwatches, fitness bands, and mobile apps offering AI-based sleep analysis, remote monitoring, and personalized wellness insights across consumers and the healthcare segment.

| Key Elements | Scope |

| Market Size in 2026 | USD 30.88 Billion |

| Projected Market Size in 2035 | USD 59.90 Billion |

| CAGR (2026 - 2035) | 7.64% |

| Leading Region | North America |

| Market Segmentation | By Technology, By Device, By Application, By End-user, By Region |

| Top Key Players | Fitbit, Apple Inc., Withings, ResMed, Sleepace, Garmin Ltd, Huawei Device Co., Ltd, Fossil Inc., Oura Health Oy, Amazon |

AI is accelerating growth in the market by enabling advanced sleep pattern analysis, personalized recommendations, and early detection of sleep disorders. Machine learning improves accuracy by integrating biometrics like heart rate and breathing, while predictive insights and smart alerts enhance user engagement, clinical adoption, and demand across consumer and healthcare markets.

Sleep trackers are increasingly using AI to deliver personalized insights, predictive sleep scores, and tailored recommendations, improving accuracy, user engagement, and long-term adoption.

Future growth will see wider integration with healthcare systems, enabling remote patient monitoring, sleep disorder screening, and clinician-approved data for diagnosis and treatment support.

Sleep trackers will connect seamlessly with smart beds, home automation, and wellness platforms, creating holistic sleep environments and driving demand for integrated, data-driven sleep solutions.

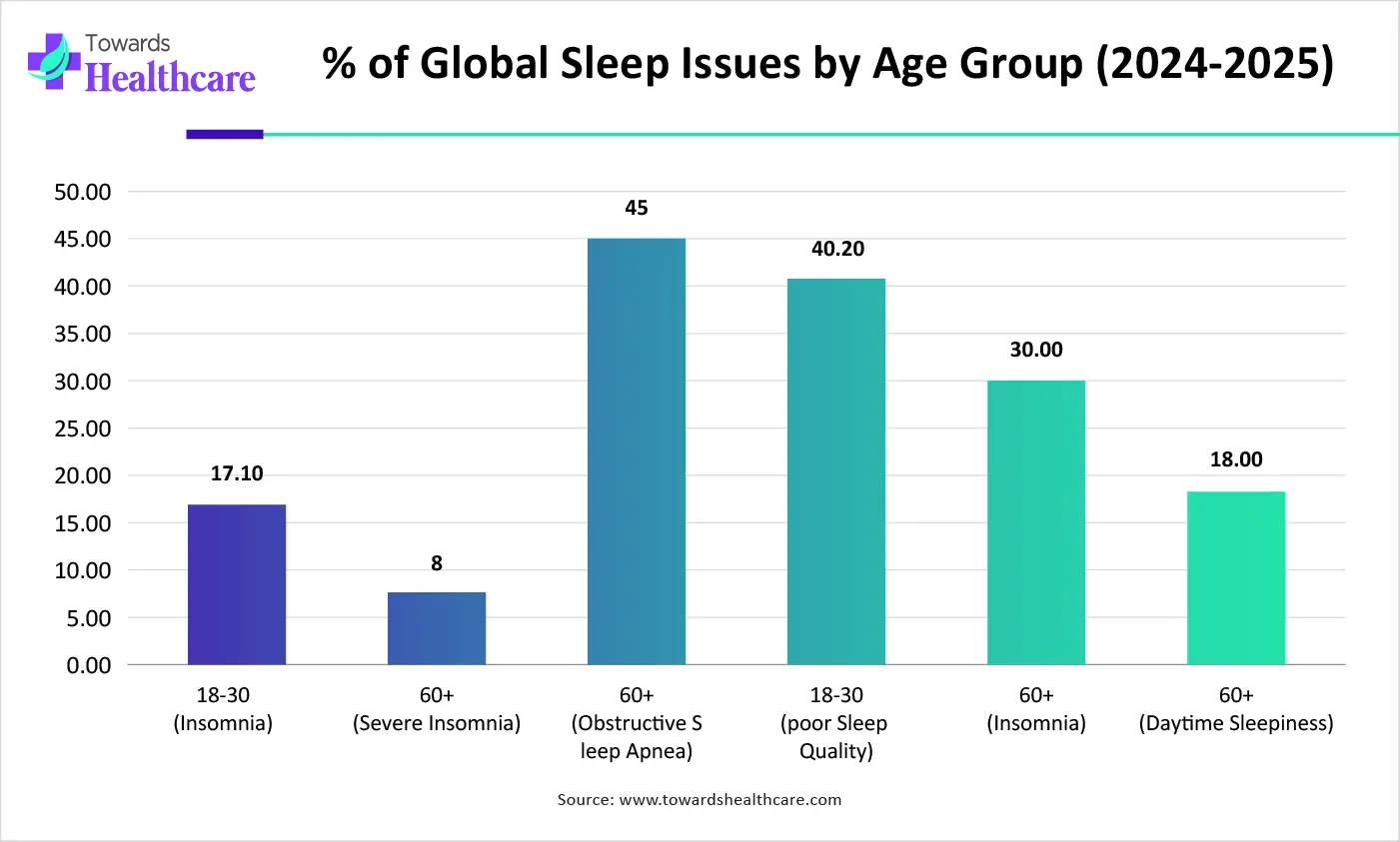

| Age Group | Year | % of Experiencing Sleep Problems |

| 18-30 | 2025 | 17.10% suffering from insomnia |

| 60+ | 2025 | 8% facing severe insomnia |

| 60+ | 2024 | 45% have obstructive sleep apnea |

| 60+ | 2024 | 40.20% suffer from poor sleep quality |

| 60+ | 2024 | 30% have insomnia |

| 60+ | 2024 | 18% have daytime sleepiness |

Why Did the Actigraphy-based Devices Segment Dominate in the Market in 2025?

In 2025, the actigraphy-based devices segment dominated the sleep trackers market due to their non-invasive, user-friendly design and cost-effectiveness. These devices accurately monitor movement patterns to estimate sleep duration and quality, making them popular for both consumer and clinical use. Their ability to provide continuous, long-term sleep data without disrupting daily routine contributed to widespread adoption and a significant market share.

Polysomnography-integrated

The polysomnography-integrated segment is expected to grow at the fastest CAGR due to its high accuracy in diagnosing sleep disorders and providing detailed insights into sleep stages, breathing, and other physiological parameters. Increasing awareness of sleep health, rising prevalence of sleep disorders, and demand for clinical-grade monitoring at home and in healthcare settings are driving adoption, making this advanced technology a key growth in the sleep trackers market.

What Made the Watches Segment Dominant in the Market in 2025?

The watches segment led the sleep trackers market due to their multifunctionality, ease of use, and widespread consumer adoption. Smartwatches combine fitness tracking, notifications, and sleep monitoring in a single wearable, offering continuous, non-intrusive data collection. Their compatibility with mobile apps and integration with health platforms further boosted their popularity and market dominance.

In July 2025, Samsung Electronics introduced the Galaxy Watch8 with enhanced health capabilities. The smartwatch offers personalized sleep guidance, running coaching, and advanced metrics such as antioxidant and vascular load tracking, supporting customized wellness routines and contributing to stronger segment growth.

Ring

The ring segment is expected to register the fastest CAGR due to its compact, comfortable, and unobtrusive design, making it ideal for continuous sleep monitoring. An advanced sensor in smart rings can track heart rate, oxygen levels, and sleep stages with high accuracy. Growing consumers' preference for discreet wearables, coupled with increasing awareness of sleep health and demand for personalized insights, is driving rapid adoption in this segment.

In July 2024, Samsung introduced the Galaxy Ring, its latest wearable aimed at consumers interested in advanced health-tracking technology.

How the Clinical Health Monitoring Segment Dominated the Market in 2025?

The clinical health monitoring segment led the sleep trackers market due to the growing use of wearable devices in diagnosing and managing sleep disorders. These trackers provide valuable data for healthcare professionals to monitor sleep patterns, detect conditions like sleep apnea, and guide treatment plans. Increasing adoption of remote patient monitoring integration with telemedicine, and demand for accurate, real-time clinical insights contributed to the segment’s market leadership.

In December 2024, DormoTech obtained U.S. FDA clearance for DormoVision X, an AI-enabled, wireless home sleep testing solution. This cloud-based platform supports clinical sleep diagnostics and remote health monitoring.

Personal Wellness & Lifestyle Improvement

The personal wellness & lifestyle improvement segment is expected to grow at the fastest CAGR due to rising consumers' focus on healthy living, stress management, and quality sleep. Wearable sleep trackers offer personalized insights, daily sleep scores, and actionable recommendations, encouraging better habits. Increasing adoption of smartwatches and fitness devices for self-care is driving rapid growth in this segment.

In June 2025, SmartRingX introduced 3-, 6-, and 12-month wellness programs offering real-time tracking of sleep, stress, and recovery. The initiative focused on proactive health management by combining comfortable design with continuous performance monitoring to encourage sustainable, long-term healthy habits.

How Does the Business-to-Business Segment Dominate the Market in 2025?

In 2025, the business-to-business segment held the largest sleep trackers market share as healthcare providers, clinics, and wellness centers increasingly adopted sleep trackers for patient monitoring and clinical assessments. Businesses leveraged those devices for research, remote patient care, and integration with health management systems. Corporate wellness programs and partnerships with device manufacturers also contributed to widespread deployment, strengthening the segment dominance in the market.

Business-to-Consumer

The business-to-consumer segment is projected to grow at the fastest CAGR rising health awareness, increasing integration in self-monitoring, and the popularity of wearable devices like smart watches and rings. Consumers are adopting sleep trackers for personalized insights, lifestyle optimization, and preventive healthcare. Easy accessibility through online platforms and integration with wellness apps further accelerates adoption, driving the rapid growth in the B2C market.

![]()

North America dominated the sleep trackers market due to high awareness of sleep health, widespread adoption of wearable technologies, and the strong presence of leading market players. Rising prevalence of sleep disorders, advanced healthcare infrastructure, and increasing use of remote patient monitoring further supported market leadership. Favourable reimbursement policies, early adoption of AI-driven health solutions, and strong consumer spending on wellness technologies also contributed to the region’s market dominance.

The U.S. led the market due to high consumer adoption of wearable devices, a strong focus on preventive healthcare, and rising awareness of sleep disorders. The presence of major technology and medical device companies, advanced digital health infrastructure, and growing use of remote patient monitoring supported market growth. Favorable regulatory progress, increasing investments in health technology, and widespread availability through online and retail channels further strengthened the country’s market leadership.

In January 2025, Samsung introduced the Galaxy Fit 3 in the U.S., featuring sleep tracking, snoring detection, blood oxygen monitoring, and heart rate measurement. These advanced capabilities are supporting wider adoption of sleep tracking devices and contributing to market growth in the country.

Europe is expected to grow at the fastest CAGR in the sleep trackers market due to increasing awareness of sleep health, rising prevalence of lifestyle-related sleep disorders, and strong government support for digital health initiatives. Growing adoption of wearable technologies, expansion of telemedicine services, and integration of sleep monitoring into public healthcare systems are driving demand. Additionally, regulatory alignment and rising consumer focus on preventive wellness are accelerating market growth across the region.

In June 2024, Zepp Health broadened the availability of its Amazfit Helio Ring by introducing it in Europe and lowering its price. This move improved accessibility and affordability, supporting stronger adoption and driving growth across the regional sleep trackers market.

The UK market is expanding due to rising awareness of sleep disorders, increasing stress-related lifestyle issues, and growing adoption of wearable health technologies. Strong digital health initiatives, wider use of remote patient monitoring, and integration of sleep data into healthcare services support growth. Increasing consumer focus on preventive wellness, availability of advanced smartwatches and rings, and supportive healthcare infrastructure are further driving market expansion in the UK.

Asia Pacific is expected to grow at a notable rate in the market due to rising health awareness, increasing prevalence of sleep disorders, and rapid adoption of wearable technologies. Expanding middle-class populations, growing smartphone penetration, and improving access to digital healthcare are supporting demand. Additionally, rising disposable incomes, urbanization, and strong growth in countries such as China, India, and Japan are accelerating market expansion across the region.

India is expected to grow at a notable rate in the sleep trackers market due to rising awareness of sleep health, increasing prevalence of lifestyle-related disorders, and rapid adoption of affordable wearable devices. An expanding middle-class population, growth of digital health platforms, and increasing smartphone penetration support demand. Additionally, improving healthcare access, growing interest in preventive wellness, and the availability of cost-effective smartwatches and rings are accelerating market growth across the country.

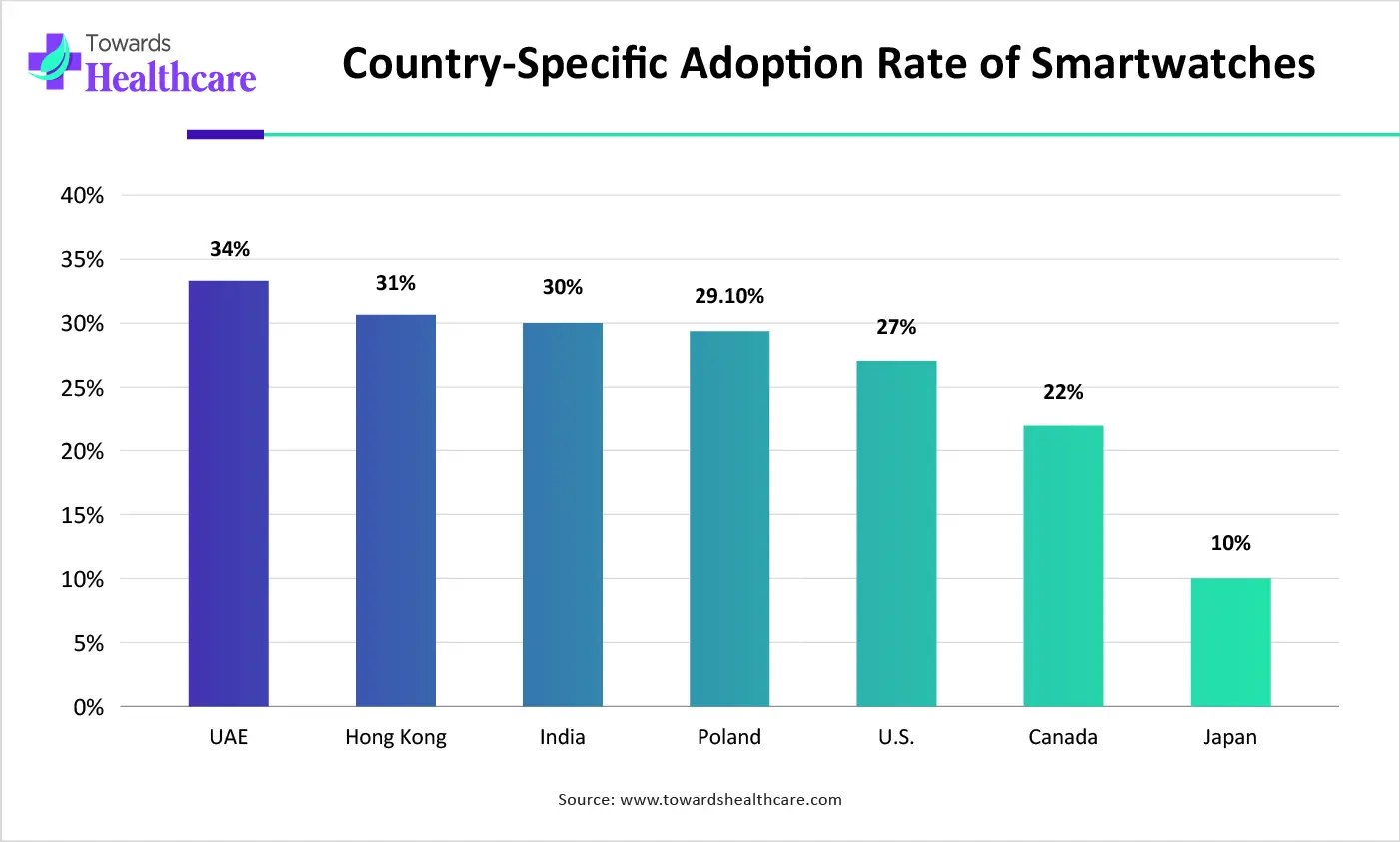

| Country | Adoption Rate |

| UAE | 34% |

| Hong Kong | 31% |

| India | 30% |

| Poland | 29.10% |

| U.S. | 27% |

| Canada | 22% |

| Japan | 10% |

![]()

| Companies | Headquarters | Offerings |

| Fitbit | U.S. | Fitness trackers and smartwatches with sleep stages, sleep scores, SpO₂ tracking, and AI-driven sleep insights. |

| Apple Inc. | U.S. | Apple Watch with advanced sleep tracking, heart rate, blood oxygen monitoring, and integration with the Apple Health ecosystem. |

| Withings | France | Smartwatches, sleep mats, and health devices offering sleep stages, respiration tracking, and clinical-grade sleep analysis. |

| ResMed | U.S. | Medical sleep monitoring devices, CPAP systems, and connected digital health platforms for sleep apnea and clinical sleep management. |

| Sleepace | China | Smart sleep monitors, trackers, and sleep improvement solutions focused on home sleep environment and sleep quality analysis. |

| Garmin Ltd | U.S. | Smartwatches and fitness wearables with sleep scores, body battery metrics, heart rate variability, and recovery insights. |

| Huawei Device Co., Ltd | China | Smartwatches and bands featuring sleep stages, SpO₂ monitoring, heart rate tracking, and AI-based sleep health analytics. |

| Fossil Inc. | U.S. | Fashion-focused smartwatches with basic sleep tracking, heart rate monitoring, and lifestyle wellness features. |

| Oura Health Oy | Finalnd | Ōura Ring smart ring provides detailed sleep stages, readiness scores, body temperature trends, and recovery metrics. |

| Amazon | U.S. | Wearable health devices and health ecosystem services supporting sleep tracking, activity monitoring, and wellness insights. |

By Technology

By Device

By Application

By End-user

By Region

February 2026

February 2026

February 2026

February 2026