February 2026

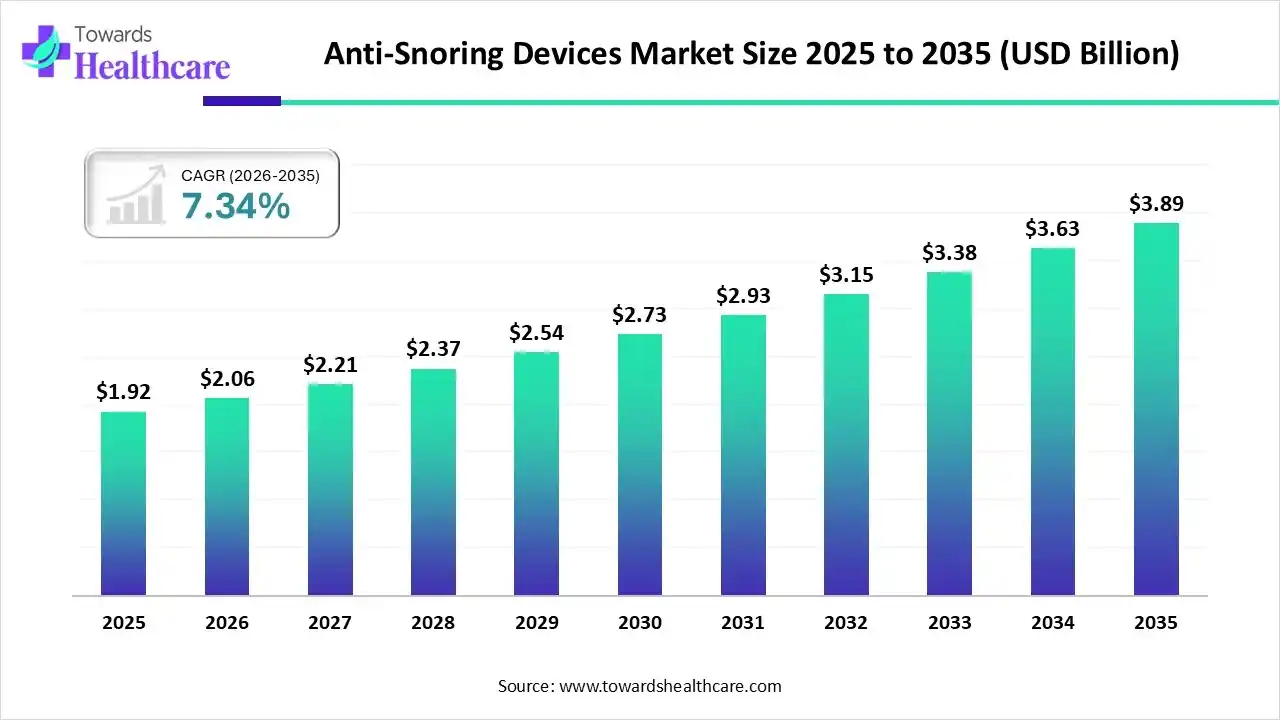

The global anti-snoring devices market size was estimated at USD 1.92 billion in 2025 and is predicted to increase from USD 2.06 billion in 2026 to approximately USD 3.89 billion by 2035, expanding at a CAGR of 7.34% from 2026 to 2035.

The anti-snoring devices market is driven by rising awareness of sleep disorders, growing adoption of homecare solutions, and increasing preference for non-invasive treatments. Technological advancements, including smart wearables and AI-enabled monitoring, are enhancing product effectiveness and user comfort. North America dominated the market due to high diagnosis rates, strong healthcare infrastructure, and widespread consumer acceptance of advanced sleep-care devices.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.06 Billion |

| Projected Market Size in 2035 | USD 3.89 Billion |

| CAGR (2026 - 2035) | 7.34% |

| Leading Region | North America |

| Market Segmentation | By Device Type, By Gender, By Age Group, By Distribution Channel, By End User, By Region |

| Top Key Players | ResMed, Philips Respironics (Royal Philips), SomnoMed, ProSomnus Sleep Technologies, Fisher & Paykel Healthcare, ZQuiet (Sleeping Well LLC), Smart Nora |

Anti-snoring devices are tools designed to reduce or prevent snoring by improving airflow during sleep. These devices include nasal dilators, mouthpieces, chin straps, and smart positional aids. The anti-snoring devices market is driven by rising awareness of sleep-related issues, increasing preference for non-invasive solutions, and growing demand for home-based sleep care. Additionally, technological advancements, such as sensor-based devices and app-enabled monitoring, are improving treatment effectiveness and user comfort. Expanding diagnosis of sleep apnea, higher stress levels, and lifestyle-related sleep disturbances are further supporting market adoption.

AI integration can significantly enhance anti-snoring devices by enabling real-time detection, analysis, and response to snoring patterns. Using sensors and machine-learning algorithms, AI can identify sleep positions, breathing irregularities, and vibration levels, allowing devices to automatically adjust their functioning for better airflow. AI-powered systems can also personalize treatment by learning user habits over time and providing tailored recommendations through mobile apps. This improves accuracy, comfort, and long-term effectiveness. Additionally, AI-enabled data tracking helps users and healthcare professionals gain deeper insights into sleep quality, making anti-snoring therapy more proactive and user-centric.

Which Device Type Segment Dominated the Anti-Snoring Devices Market?

The oral appliances segment dominates the market because these devices offer a simple, non-invasive, and comfortable solution for improving airflow during sleep. They are widely preferred due to their ease of use, portability, and effectiveness in reducing mild to moderate snoring. Increased recommendations from sleep specialists, growing adoption of custom-fit designs, and rising consumer preference for home-based, low-maintenance treatments further strengthen this segment’s leadership.

EPAP Therapy Devices

The EPAP therapy devices segment is estimated to be the fastest growing due to their non-invasive design, ease of use, and proven effectiveness in improving nighttime airflow. These devices require no power source, making them convenient for home and travel use. Growing clinical validation and rising preference for simple, low-maintenance snoring solutions further accelerate their adoption.

Why Did the Male Patients Segment Dominate the Anti-Snoring Devices Market?

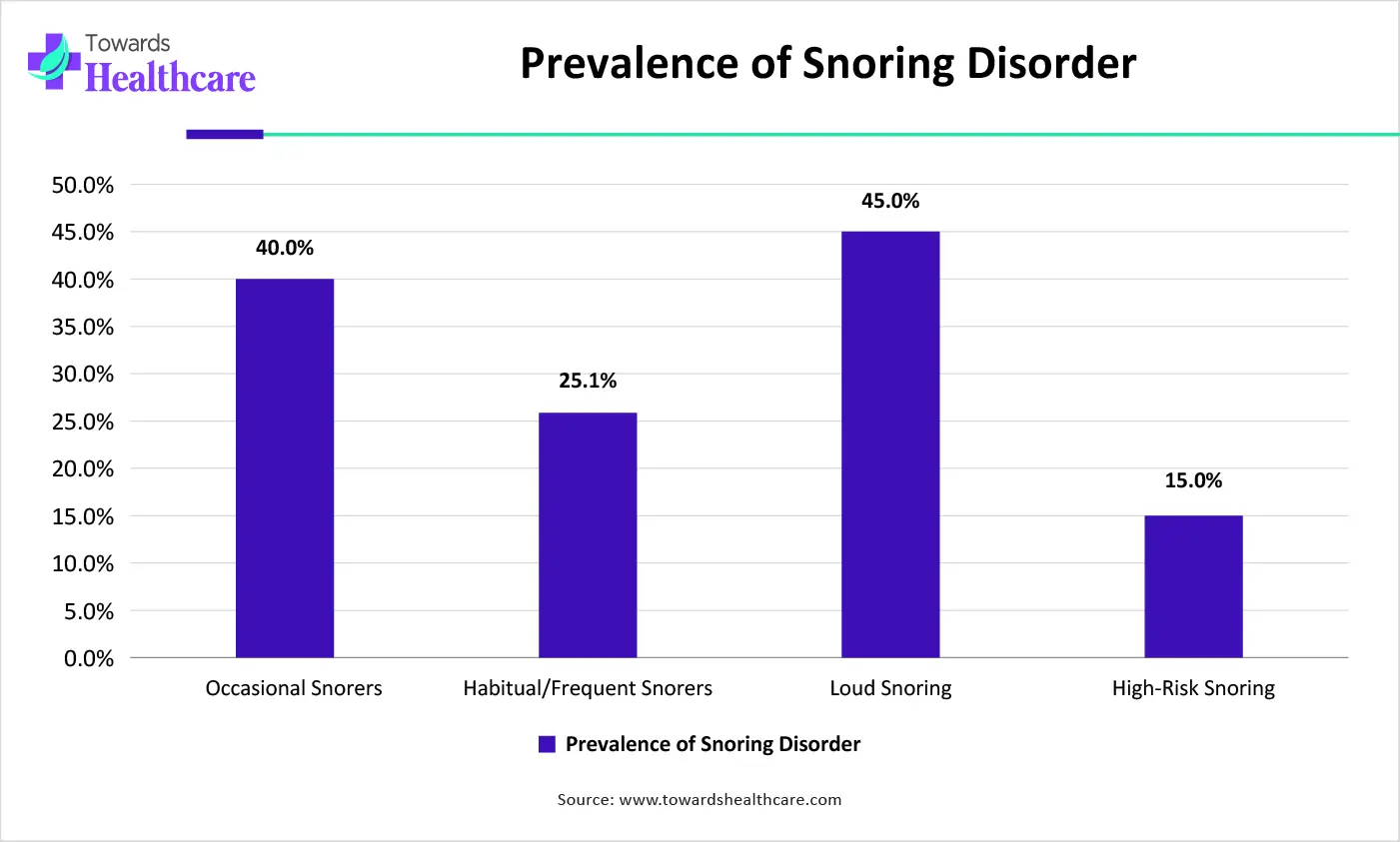

The male patients segment dominated the market in 2025 because snoring and sleep apnea are more prevalent among men due to anatomical factors, lifestyle habits, and higher rates of obesity. Greater diagnosis of sleep-related disorders and stronger adoption of home-based treatment solutions among men further contribute to the segment’s leading market share.

Female Patients

The female patients segment is anticipated to be the fastest-growing in the anti-snoring devices market due to rising awareness of sleep health among women, increasing diagnosis of sleep-related disorders, and growing focus on wellness and preventive care. Changing lifestyle patterns, stress-related sleep issues, and higher adoption of non-invasive homecare solutions further accelerate segment growth.

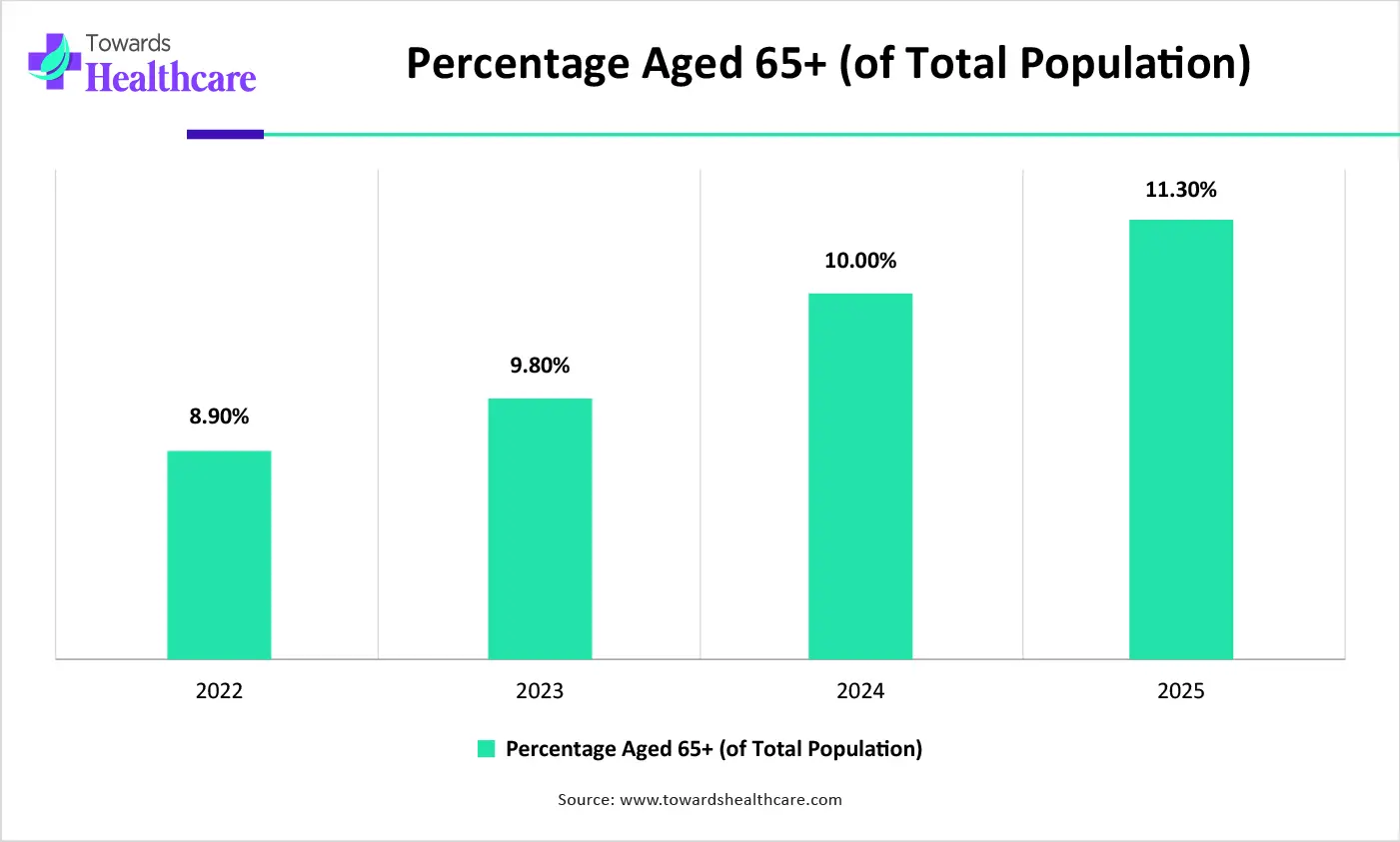

Why Did the Segment Above 60 Years Dominate the Anti-Snoring Devices Market in 2025?

The above 60 years segment dominates the market because snoring and sleep apnea become more common with age due to muscle relaxation in the airway and age-related respiratory changes. Higher diagnosis rates, greater reliance on medical sleep aids, and increased adoption of non-invasive homecare devices further strengthen this segment’s leading position.

| Year | Percent aged 65+ (of total population) |

| 2022 | 8.90% |

| 2023 | 9.80% |

| 2024 | 10.00% |

| 2025 | 11.30% |

Between 40-60 Years

The between 40-60 years segment is estimated to be the fastest-growing in the anti-snoring devices market due to rising lifestyle-related sleep disorders, higher stress levels, and increasing obesity rates in this age group. Growing awareness of sleep health, early diagnosis of snoring and mild sleep apnea, and strong preference for convenient, non-invasive homecare devices are further driving rapid adoption.

Which Distribution Channel Segment Led the Anti-Snoring Devices Market?

The hospital pharmacies segment dominated the market in 2025 because hospitals serve as primary points for diagnosis and prescription of snoring and sleep apnea treatments. Strong collaborations with healthcare providers, availability of clinically validated devices, and trust in professional guidance drive higher adoption. Additionally, hospital pharmacies facilitate access to advanced and custom-fit anti-snoring solutions, reinforcing their market leadership.

Online Pharmacies

The online pharmacies segment is anticipated to be the fastest-growing in the market due to the convenience of home delivery, wider product variety, and easy access to both standard and advanced devices. Rising e-commerce adoption growing consumer preference for contactless purchases, and availability of customer reviews and guidance further accelerate the segment’s rapid growth.

Why is Home Care Settings the dominant segment in the Anti-Snoring Devices Market?

The home care settings segment dominates the market due to increasing consumer preference for convenient, non-invasive, and self-administered solutions. Growing awareness of sleep health, rising lifestyle-related sleep disorders, and the availability of easy-to-use devices, such as oral appliances and smart wearables, drive adoption. Additionally, the comfort, privacy, and flexibility offered by home-based treatments further strengthen this segment’s leadership.

Hospitals & Clinics

The hospitals & clinics segment is estimated to be the fastest-growing due to increasing diagnoses of sleep disorders rising referrals from healthcare professionals, and the adoption of clinically validated anti-snoring devices. Advanced treatment options and growing patient awareness further drive rapid uptake in medical settings.

North America dominates the market due to high awareness of sleep disorders, widespread adoption of home-based sleep solutions, and the strong presence of leading device manufacturers. Advanced healthcare infrastructure, higher diagnosis rates of sleep apnea, and growing use of smart, technology-enabled sleep aids further strengthen the region’s market leadership.

The U.S. dominates the North America anti-snoring devices market due to strong consumer awareness, high prevalence of sleep-related disorders, and rapid adoption of innovative, non-invasive sleep solutions. Robust healthcare support, availability of advanced diagnostic facilities, and the presence of key device manufacturers further boost the country’s leadership. Additionally, strong demand for smart, connected sleep devices enhances its market dominance.

Asia-Pacific is the fastest-growing region in the anti-snoring devices market due to rising awareness of sleep health, increasing urban stress levels, and growing lifestyle-related sleep disorders. Expanding healthcare access, rising disposable incomes, and greater acceptance of affordable, non-invasive sleep solutions are accelerating adoption. Additionally, technological advancements and the availability of mobile-linked smart devices support rapid regional growth.

China dominates the Asia-Pacific market due to its large population affected by lifestyle-driven sleep disorders, increasing awareness of sleep health, and strong adoption of affordable homecare solutions. The country benefits from rapid technological innovation, expanding local manufacturing capabilities, and growing availability of smart, app-connected devices. Rising healthcare spending and wider access to sleep diagnostics further reinforce China’s market leadership.

Europe is growing at a notable rate in the anti-snoring devices market due to rising awareness of sleep-related disorders, strong adoption of non-invasive treatment options, and increasing emphasis on home-based sleep solutions. Supportive healthcare policies, technological innovation, and expanding access to advanced diagnostic services further accelerate the region’s growth.

The UK dominates the European market due to high awareness of sleep disorders, strong preference for clinically validated, non-invasive solutions, and widespread availability of advanced diagnostic services. The country benefits from robust healthcare support, rapid adoption of smart sleep technologies, and a strong presence of leading manufacturers and distributors, which collectively reinforce its regional leadership.

| Vendor | Main anti-snoring offerings | Headquarters |

| ResMed | CPAP devices & masks (sleep-disordered-breathing portfolio); also supports oral-appliance therapy as part of treatment options. | San Diego, California, USA. |

| Philips Respironics (Royal Philips) | NightBalance positional therapy device (a wearable that reduces positional OSA/snoring); broad sleep/respiratory portfolio. | Amsterdam / global HQ for Philips is the Netherlands (Philips Respironics operations in multiple countries). |

| SomnoMed | Prescription custom mandibular advancement devices (oral appliances / MRDs) for snoring and mild–moderate OSA. | Sydney, New South Wales, Australia. |

| ProSomnus Sleep Technologies | Precision, custom-fit mandibular advancement devices (digital/custom MADs) are marketed as a non-CPAP therapy. | Pleasanton / San Francisco Bay Area (headquarters & manufacturing), California, USA. |

| Fisher & Paykel Healthcare | CPAP masks, nasal interfaces, and related respiratory devices are used in the treatment of snoring/OSA. | East Tāmaki (Auckland), New Zealand. |

| Vivos Therapeutics | Vivos CARE oral medical devices (DNA/mRNA appliances) that expand airway/arch — used to reduce snoring and treat OSA. | Highlands Ranch / Littleton, Colorado, USA. |

| ZQuiet (Sleeping Well LLC) | OTC mandibular advancement mouthpieces (ready-to-use/consumer MADs) to reduce snoring. | Lewiston / United States (company based in the U.S.). |

| Theravent (TheraVent / Provent technology) | EPAP-based disposable nasal devices / OTC and prescription EPAP therapy (creates expiratory positive airway pressure to reduce snoring/OSA). | San Jose, California, USA. |

| Smart Nora | Contact-free “smart pillow” system that detects snoring and gently repositions the head/pillow to stop snoring episodes | Toronto, Ontario, Canada. |

| Panthera Dental / Panthera Sleep | CAD/CAM custom intraoral sleep appliances (D-SAD and other MADs) for snoring and mild–moderate OSA. | Québec, Québec, Canada. |

By Device Type

By Gender

By Age Group

By Distribution Channel

By End User

By Region

February 2026

February 2026

February 2026

February 2026