February 2026

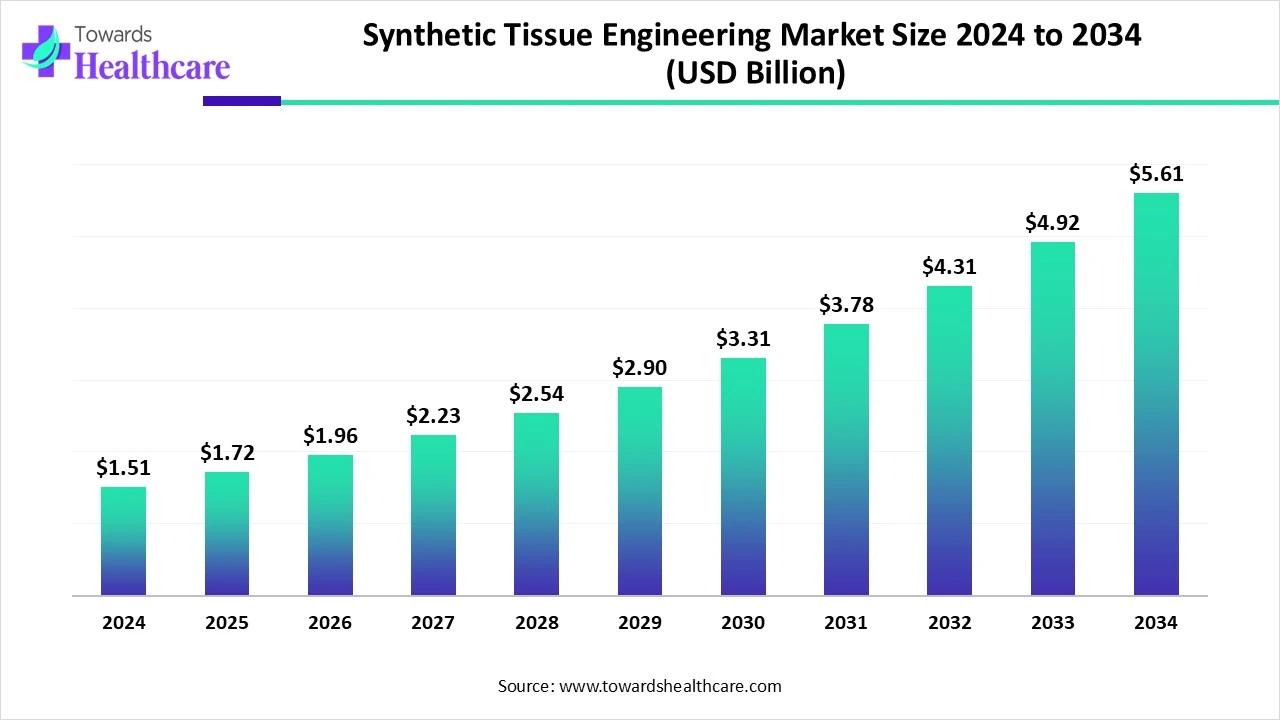

The global synthetic tissue engineering market size is calculated at US$ 1.72 billion in 2025, grew to US$ 1.97 billion in 2026, and is projected to reach around US$ 6.47 billion by 2035. The market is projected to expand at a CAGR of 14.14% between 2026 and 2035.

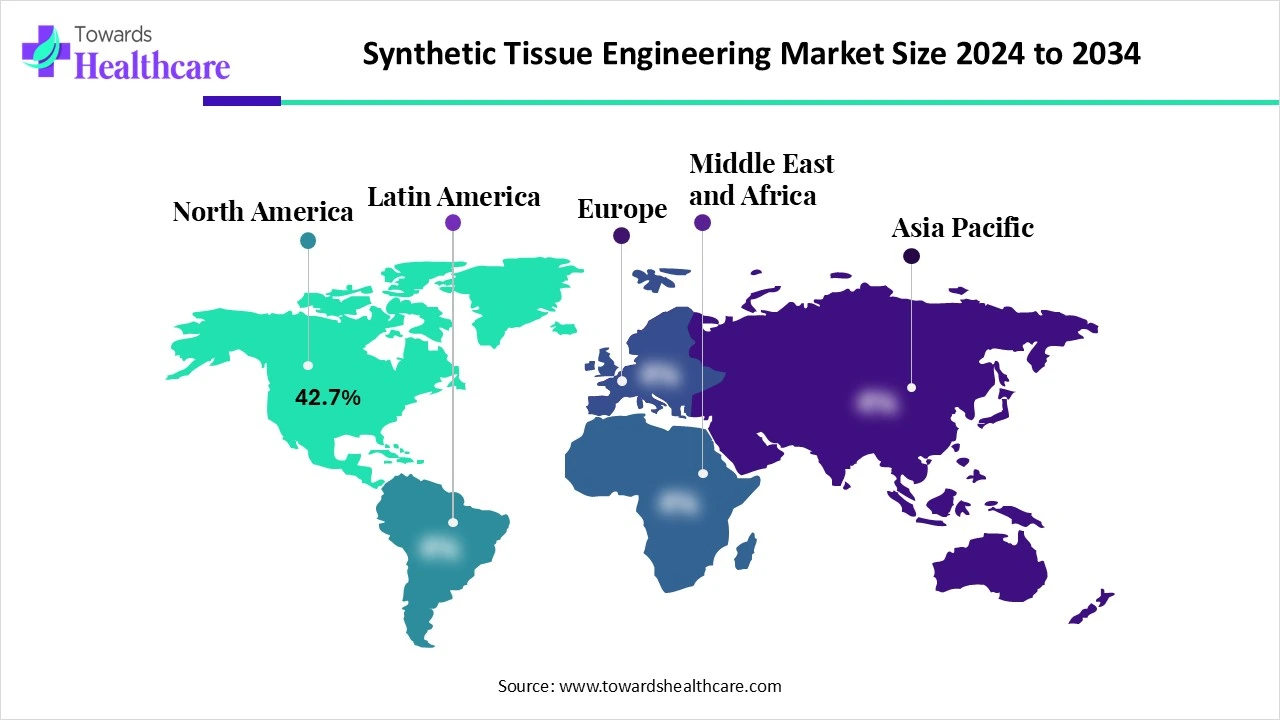

The synthetic tissue engineering market is expanding due to the growing incidence of chronic disease and advanced biomaterials such as 3D bioprinting. North America is dominated in the market by strong R&D infrastructure, high healthcare spending, and increasing government and private funding. Asia Pacific is the fastest-growing region as regulatory support and strong leading players such as Zimmer Biomet, AbbVie, Medtronic plc, and Baxter International contribute to the growth of the market.

| Metric | Details |

| Market Size in 2026 | USD 1.72 Billion |

| Projected Market Size in 2035 | USD 6.47 Billion |

| CAGR (2026 - 2035) | 14.14% |

| Leading Region | North America Share by 43% |

| Market Segmentation | By Material Type, By Scaffold Type, By Application, By End User, By Fabrication Technology, By Region |

| Top Key Players | Organovo Holdings Inc., 3D Bioprinting Solutions, CollPlant Biotechnologies Ltd., Cyfuse Biomedical K.K., BICO Group AB, Advanced Solutions Life Sciences, Poietis, Matricelf Ltd., Aspect Biosystems, RegenHU, Allevi Inc., Nanofiber Solutions, EnvisionTEC, TissUse GmbH, CELLINK, Xeltis AG, MedPrin Regenerative Medical Technologies, Symatese, BioInks, Modern Meadow |

The synthetic tissue engineering market refers to the global industry focused on the development, manufacturing, and application of engineered tissues created using synthetic biomaterials rather than naturally derived matrices. These synthetic scaffolds serve as three-dimensional structures designed to support cellular attachment, proliferation, and tissue regeneration. Synthetic tissue constructs are used for research, regenerative medicine, drug development, disease modeling, and organ/tissue transplantation. Key materials used include polylactic acid (PLA), polyethylene glycol (PEG), polycaprolactone (PCL), polyglycolic acid (PGA), polyurethanes, and other biocompatible polymers.

Integration of AI in the synthetic tissue engineering drives the growth of the market as AI-driven technology enhances tissue engineering by computational modeling, biomaterial design, personalized medicine, and cell culture optimization. Increasing applications of AI in organ tissue engineering, including bone, heart, nerve, skin, cartilage, and employing different machine learning (ML) algorithms for data analysis, prediction, and optimization. AI improves tissue engineering by enhancing biomaterial and scaffold designs, predicting interactions with tissues, and advancing rationalization. This leads to rapid and more affordable innovations by lowering the volume of trial and error. It enhances advanced microscopy methods, allowing accurate, non-invasive, and quantitative analysis of cell cultures, which drives the growth of the market.

Increasing Advancements in 3D Bioprinting

3D bioprinting offers advantages over traditional tissue engineering techniques. It improves upon older methods by enabling a more automated process with high precision and customization for each application. This technology plays a key role in tissue engineering, which focuses on creating functional tissues for regenerative medicine and drug testing. Tissue regeneration and reconstruction could allow for repairing or replacing damaged tissues and organs. Additionally, 3D bioprinting has shown potential in constructing transplantable hard organs and tissues, fueling the growth of the synthetic tissue engineering market.

Challenges in Achieving Neovascularization

A key challenge in tissue engineering is neovascularization, which is crucial for supplying oxygen and nutrients to cells within constructs. Achieving comprehensive neovascularization throughout a cell–scaffold construct in in vitro tissue engineering is nearly impossible, thereby restricting the growth of the synthetic tissue engineering market.

Innovation in Polyurethane-Based Implants

In tissue engineering, polyurethane-based implants are increasingly popular due to their high biocompatibility and inertness. These implants are mainly used in hard tissues like bone and soft tissues such as cartilage, muscles, skeletal tissues, and blood vessels. Progress has been made in enhancing PU's biostability and biocompatibility. However, for artificial blood vessels, there is still a need to balance material stability and biocompatibility to ensure long-term in vivo performance, which requires further optimization. Recently, smart shape-memory PUs with adjustable shape-recovery capabilities have shown promising results in biomedical applications like wound healing, opening opportunities for growth in the synthetic tissue engineering market.

For Instance,

Why the Polycaprolactone (PCL) Segment Dominated the Market?

By material type, the polycaprolactone (PCL) segment led the synthetic tissue Engineering Market, due to it provides several advantages, like biodegradability, high strength, and biocompatibility. It withstands solvents, oil, water, and chlorine. By improving polycaprolactone (PCL) scaffold characteristics through structural modifications, with surface treatments, pore architecture management, and the combination of biomaterials such as hydroxyapatite (HA). These modifications goal to advance scaffold conformation, cellular behavior, and mechanical performance, with specific emphasis on the role of mesenchymal stem cells in the regeneration of bone.

On the other hand, the hydrogels segment is projected to experience the fastest CAGR from 2025 to 2034, as hydrogels used as scaffolds which mimic the extracellular matrices, to offer the structural integrity and bulk for cellular organization and morphogenic guidance, to condense and deliver cells, to act as tissue barriers and bioadhesives, to serve as depots for medicine, and to bring bioactive moieties that inspire the natural reparative procedures.

Why the Porous Scaffolds Segment Dominated the Market?

By scaffold type, the porous scaffolds segment is dominant in the synthetic tissue engineering market in 2024, as these scaffolds with higher porosities and a homogeneous, consistent pore network are extremely useful for tissue engineering. Porous scaffolds have significantly improved mechanical characteristics than scaffolds processed using various methods. These improved mechanical properties are predominantly significant for bone-TE, which has much superior stiffness and strength than other tissues.

The 3D printed scaffolds segment is expected to grow at the highest rate during the forecast period, as 3D printed scaffolds are prepared for optimized tissue engineering. For the suitable formation of tissue architecture, the seeding cells need a 3D environment/matrix similar to that of the ECM. The ECM serves as a medium to offer proteins and proteoglycans, among other nutrients, for cellular growth. 3D printing offers tissue engineers a way to design scaffolds accomplished of imitating the multifaceted structures of the ECM

Why is the Regenerative Medicine Segment Dominant in the Market?

By application, the regenerative medicine segment led the synthetic tissue engineering market in 2024 due to tissue engineering in regenerative medicine pursues to replace or regenerate diseased or damaged tissues, organs, and cells, a complex endeavor, but one that has great potential for the practice of drugs. Advanced technologies under investigation range from biomaterial/cell constructs for restoring different tissues and organs, to stem cell therapies, to immune therapies. It provides hope for patients with injuries, last-stage organ failure, or other medical issues.

In the regenerative medicine segment, the bone grafts subsegment dominated the market in 2024 as bone tissue engineering is considered a limitless source of bone production without the need for donor site morbidity and other autogenous bone grafting boundaries. There are no challenges of infection transmission or refusal as occur with demineralised bone derived from human cadavers or animal sources.

The cosmetic and reconstructive surgery segment is projected to experience the fastest CAGR from 2025 to 2034, as tissue engineering has huge potential for clinical impact in reconstructive surgery. Reconstructive surgery is used to enhance body function. Approximately 85-90% of people reported better scar quality with tissue engineering techniques, reflecting superior cosmetic results and negligible scarring compared to outdated reconstructive approaches.

Which End-User was Dominant in the Market in 2024?

By end user, the academic and research institutes segment led the synthetic tissue engineering market in 2024, as synthetic tissue engineering allows tissues to develop their extracellular matrix, resulting in tissue that recapitulates the biochemical and biomechanical characteristics of native tissue. These new therapies resulting from regenerative medicine and tissue engineering technology may provide new hope for patients with injuries, end-stage organ failure, or other medical issues.

On the other hand, the biotechnology and pharmaceutical companies segment is projected to experience the fastest CAGR from 2025 to 2034, as tissue engineering is a developing biotechnological area, which combines different features of medicine, cell and molecular biology, engineering, and materials science to regenerate, repair, or replace injured tissues. Tissue-engineered constructs made of biotechnology-derived materials are preferred due to their chemical and physical composition, which provides both high versatility and support to enclose/ incorporate relevant signalling molecules and genes known to cathartically induce tissue repair.

Why was the Electrospinning Segment Dominant in the Market in 2024?

By fabrication technology, the electrospinning segment led the synthetic tissue engineering market in 2024 due to it provide the advantage of producing fibres with a huge surface-to-volume ratio, reliable structure, tunable porosity, and malleability to conform to a wide range of sizes and forms. Electrospinning has been recognized and serves as one of the maximum useful techniques based on the similarity between electrospun fibres and the native tissues.

On the other hand, the 3D bioprinting segment is projected to experience the fastest CAGR from 2025 to 2034, as its greatest impactful and obvious use of bioprinting is in biotech and healthcare. From regenerative medicine to organ transplants, bioprinting promises to transform lives.

North America was dominant in the synthetic tissue engineering market share by 43% in 2025, as in this region, increasing applications of regenerative medicine, due to its robust research infrastructure and significant funding. The presence of leading universities and research institutions is at the forefront of stem cell research and tissue engineering, which promotes innovation in tissue engineering, driving the growth of the market.

For Instance,

The U.S. Synthetic Tissue Engineering Market Trends

The U.S. has a dynamic regulatory environment which increasing medical innovation. Growing access to health insurance and medical services continues to increase as the U.S. advances policy and implements new modalities in which to deliver progressive medical care, which contributes to the growth of the market. The U.S. is at the forefront of medical innovation by investing more in research, which has led to novel treatments that utilize synthetic tissues.

Canada Synthetic Tissue Engineering Market Trends

In Canada, with a strong focus on research, development, and healthcare services. Increasing biotech institutions provide some of the best programs in biotechnology. Also, the presence of advanced biotech research centers such as The Canadian Institute for Advanced Research (CIFAR) is a Canadian-based worldwide research organization that brings composed teams of top researchers from around the world, which contributes to the growth of the market.

Asia Pacific is expected to host the fastest-growing market during the upcoming timeframe, as increasing supportive government funding and policies for research in regenerative medicine are driving the growth of the market. Increasing incomes, the spread of health insurance, modern lifestyle factors adding to the burden of disease, and ageing populations have increased demand for synthetic tissue engineering in the treatment of end-stage organ failure in low- and middle-income countries in Asia Pacific.

The China Tissue Engineering Market Trends

Recent Chinese government policies emphasized domestic biotech innovation. A novel national strategy has been vital to the sector’s growth. China’s research and innovation abilities in biotechnology are ahead of its domestic demand in healthcare, chemicals, energy, and agriculture. China is tremendously expanding its biotech sector with some start-ups and recognized organizations that mostly focus on synthetic tissue and regenerative therapy.

The India Synthetic Tissue Engineering Market Trends

India has a vast genetic variety, cost-effective clinical trials, and adherence to worldwide regulatory standards, making India a chosen destination for biotech testing and development, which is increasing the demand for synthetic tissue engineering.

Europe is notably growing in the market during the forecast period, as European countries' increasing populations, significantly due to immigration within Europe and from outside Europe, and due to surges in life expectancy and population momentum, which creates strong demand for tissue-engineered products. Also, strong research and industry expertise, a focus on life sciences and healthcare, and the potential for biotech to address societal complexities such as resource scarcity and climate change.

The German Synthetic Tissue Engineering Market Trends

Germany has robust conditions for biotech novelty, including first-class fundamental research in numerous future-oriented sectors, a vigorous industrial base in the chemical and pharmaceutical industries, and a steady influx of worldwide science, engineering, and technology, which contributes to the growth of the market. Germany offers the perfect environment for the production and development of investigation-intensive, high-grade products, which increases the demand for synthetic tissue engineering services.

The UK Synthetic Tissue Engineering Market Trends

The UK biotechnology manufacturing has been flourishing in recent times. The UK government announced a package called ‘Life Sci for Growth’ in 2023, in which £650 million ($804 million) would be spent to improve the nation’s life sciences field. The UK is undergoing robust growth, driven by technical advancements and increased spending on medical care, which contributes to the growth of the market.

South America is expected to grow significantly in the synthetic tissue engineering market during the forecast period, due to growing healthcare investments. The growing number of chronic injuries are also increasing the use of synthetic tissue engineering to enhance healing. Additionally, expanding healthcare infrastructures, demand for personalized solutions, and increasing collaborations are also enhancing the market growth.

Brazil Synthetic Tissue Engineering Market Trends

The expanding healthcare infrastructure in Brazil is increasing the adoption rates of the synthetic tissue engineering solutions for the development of various treatment options. The growing R&D activities and increasing advancements in regenerative medicines are also increasing their demand, which is further backed by government investments.

MEA is expected to grow significantly in the synthetic tissue engineering market during the forecast period, due to growing serious injuries and burns. Additionally, expanding healthcare infrastructure and growing investment from various sources are also increasing their adoption rates. Furthermore, the growing medical tourism is also driving their demand, promoting the market growth.

Saudi Arabia Synthetic Tissue Engineering Market Trends

The growing government initiatives in Saudi Arabia are increasing the use of synthetic tissue engineering for the development of regenerative medicines. The growing chronic disease and expanding healthcare infrastructure are also increasing their adoption rates. Additionally, increasing collaborations and investments are also accelerating their innovations.

R&D

Clinical Trials and Regulatory Approvals

Packaging and Serialization

Distribution to Hospitals, Pharmacies

Patient Support and Services

In May 2025, Andy Orth, Chief Executive Officer of City Therapeutics, “Partnering with Biogen represents a meaningful milestone in our mission to expand the therapeutic reach of RNAi, as we pioneer the next generation of RNAi technology for breakthrough medicines."

By Material Type

By Scaffold Type

By Application

By End User

By Fabrication Technology

By Region

February 2026

February 2026

February 2026

December 2025