January 2026

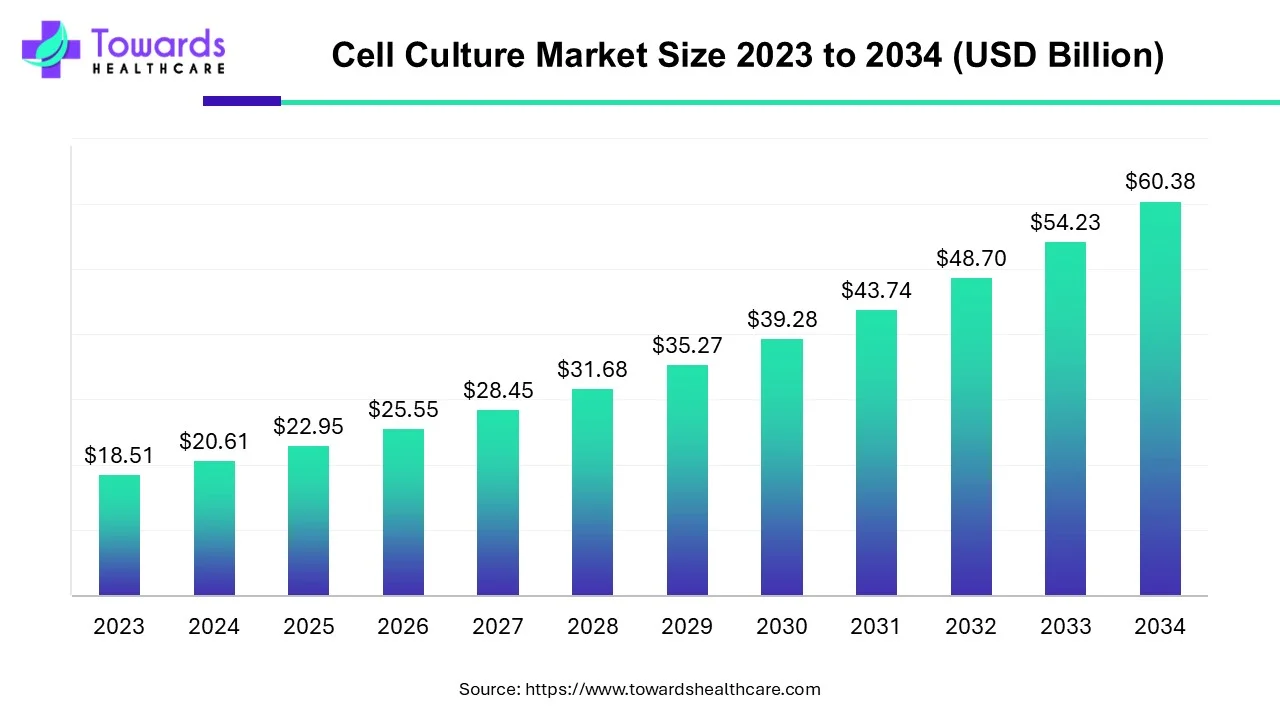

The global cell culture market size is calculated at USD 20.61 billion in 2024, grew to USD 22.95 billion in 2025, and is projected to reach around USD 60.38 billion by 2034. The market is expanding at a CAGR of 11.35% between 2024 and 2034.

Cell culture is a technique in which cells are extracted from plants, animals, humans, or microorganisms and are grown in a controlled laboratory environment. Cells are either directly obtained from an organism or from a cell line or cell strain that has previously been established. The technique in which cells are obtained from an organism is called primary cell culture. These cells are grown in a nutrient medium comprising essential nutrients such as amino acids, carbohydrates, vitamins and minerals, growth factors, and essential hormones. Additionally, gases like oxygen and carbon dioxide as well as physicochemical factors such as pH, temperature, and humidity play an essential role.

The growing cellular and molecular biology research to study the normal physiology and biochemistry of cells and mutagenesis & carcinogenesis increase the demand for cell culture techniques. Cell culture techniques are also used to study the effects of drugs and toxic compounds on the cells and in drug screening and development. Hence, the growing drug discovery and development research due to rising incidences of chronic disorders boosts market growth. Additionally, the increasing demand for biological therapeutics such as vaccines and therapeutic proteins augment the market.

The integration of artificial intelligence (AI) in laboratory processes, especially in the cell culture process, has shown potential advantages. Several researchers have investigated the role of AI in cell culture. AI can streamline the entire cell culture process by introducing automation in feeding and passaging, thereby eliminating human intervention. It standardizes the procedure and ensures consistency and reproducibility of 2D and 3D culture techniques. The latest advancements in automated imaging and cloud storage allow researchers to inspect the culture process remotely. AI can provide real-time data and can send notifications when milestones are reached. Additionally, machine learning (ML) algorithms make protocol development more flexible and powerful and can trigger decision-making by either being automated or managed by a scientist. Hence, incorporating AI in the cell culture process overcomes the challenges of conventional cell culturing, such as 24/7 observation, which is time-consuming, prone to error, and difficult to reproduce.

Growing Demand for Biological Therapeutics

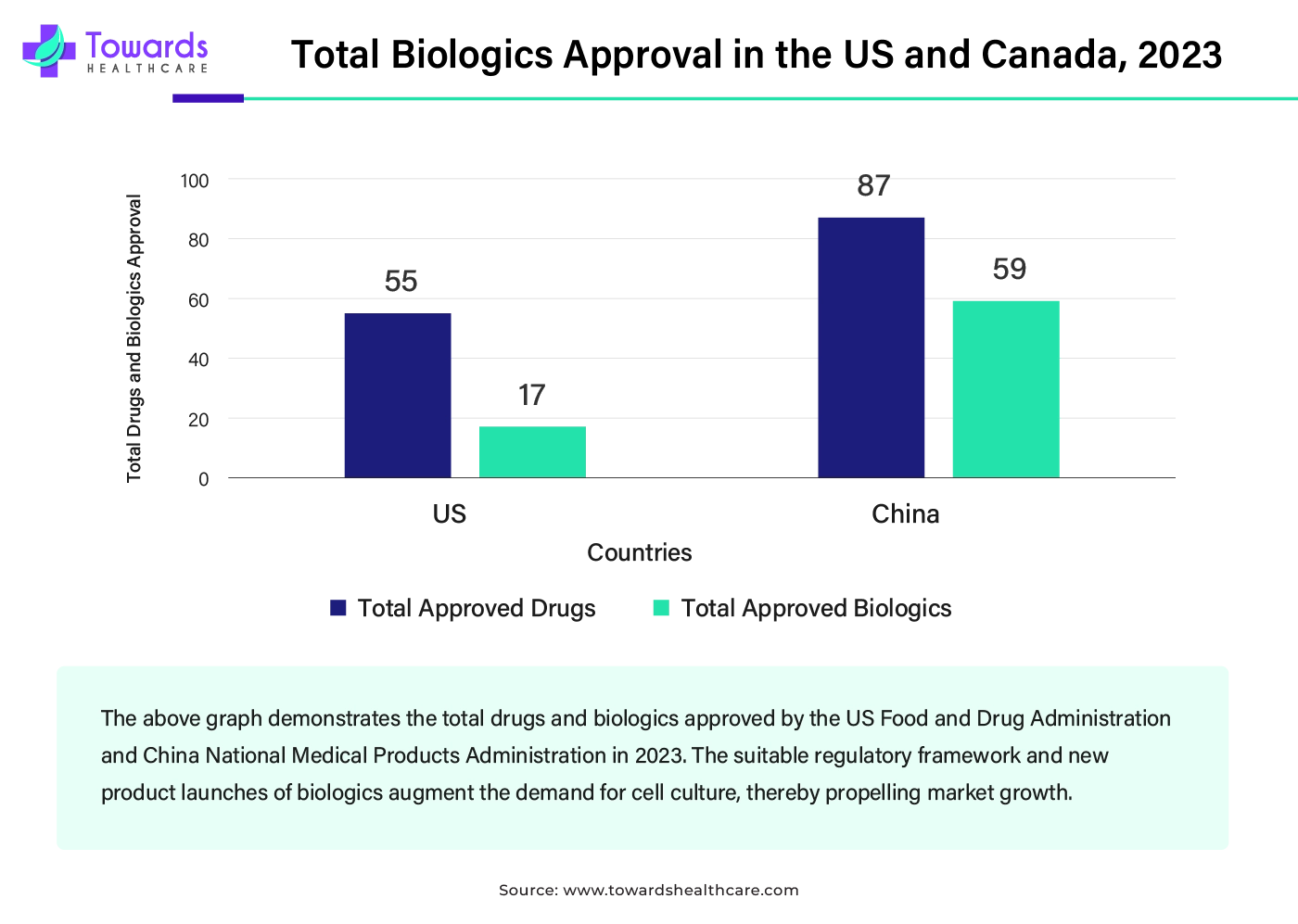

The burgeoning biotechnology sector and enhanced efficiency of biological therapeutics increase the demand for biologics. The increasing number of commercially approved biologics has potentially led to the rising manufacturing of biologics. Biologics include insulin, vaccines, therapeutic proteins, and monoclonal antibodies. The COVID-19 pandemic era has increased the demand for vaccines, thereby potentiating cell culture market growth. The increasing investments and collaborations surge biotechnology research and development and manufacturing. Cell culture techniques are used in large-scale manufacturing of biologics. According to the WHO report, vaccines purchased by middle-income countries account for 60% of the global volumes and 34% of the value, while high-income countries represent 29% of the global volumes and 63% of the value. The average biopharmaceutical-industry supplier estimated overall growth in bioprocess-related sales by a rate of 13.1% in 2023.

Cross-Contamination

The major challenge of the cell culture market is the inter- and intra-specific cross-contamination and cell misidentification. Contamination of the cells with bacteria, fungi, yeast, viruses, and chemicals leads to false and irreproducible results, restricting market growth.

Regenerative Medicine

Regenerative medicine is a rapidly emerging field owing to rising incidences of chronic disorders, growing demand for personalized medicines, and recent advancements in technology, thereby promoting cell culture market growth. Regenerative medicine therapies include stem cells that can be proliferated in laboratory environments in a culture dish. The expanding applications of stem cells in research, tissue regeneration, genetic diseases, and cancer therapies have significantly increased their demand. The cell culture process is an important technique for reproducing stem cells. For the development of therapeutics, stem cell cultivation is also utilized to extract the chemicals and exosomes released by the stem cells. These stem cells can regenerate tissues within the body and have long-term health benefits for the patient.

By product, the consumables segment held a dominant presence in the cell culture market in 2023. Some common examples of consumables include sera, media, cell culture vessels, and plastics such as plates and flasks, pipettes, pipette tips, culture tubes, and chamber slides. These consumables help to reduce the risk of contamination and provide an aseptic environment for the cultures. The growing research and development results in the development of novel consumables. The increasing demand for cell culture techniques propels the use of consumables as they get easily used up during the procedure. Also, these consumables help to increase yield, reduce variability, and increase the chances of success.

By product, the stem cell culture media sub-segment held a notable share in the cell culture market in 2023. Stem cell culture media are specialized solutions to support the proliferation, differentiation, growth, and cryopreservation of stem cells. The demand for stem cell culture media from the consumables segment was increased, owing to increased demand for stem cells and other biotechnology products. The rising chronic disorders such as genetic disorders, cancer, and autoimmune disorders, and growing stem cell research potentiate the segment’s growth.

By application, the biopharmaceutical production segment led the global cell culture market in 2023. The burgeoning biotechnology and biopharmaceutical sectors potentiate the production of biological therapeutics such as vaccines, monoclonal antibodies, and other therapeutic proteins. Modern techniques such as cell culture technology and recombinant DNA technologies are constantly evolving for the development of biologics. Latest advancements are made to develop media that support high cell productivity and yield, enhancing the efficiency and profitability of biopharmaceutical production.

By application, the diagnostics segment is expected to grow at the fastest rate in the cell culture market during the forecast period. Cell culture techniques play a vital role in diagnosing human diseases, especially infectious disorders. They provide the required setting for detecting and identifying numerous pathogens in humans. The rising incidences of infectious disorders and genetic disorders augment the segment’s growth. The future of cell culture techniques in diagnostics is promising, driven by the availability of cells with known genotypes, rising screening programs for affected individuals, and detection of carriers.

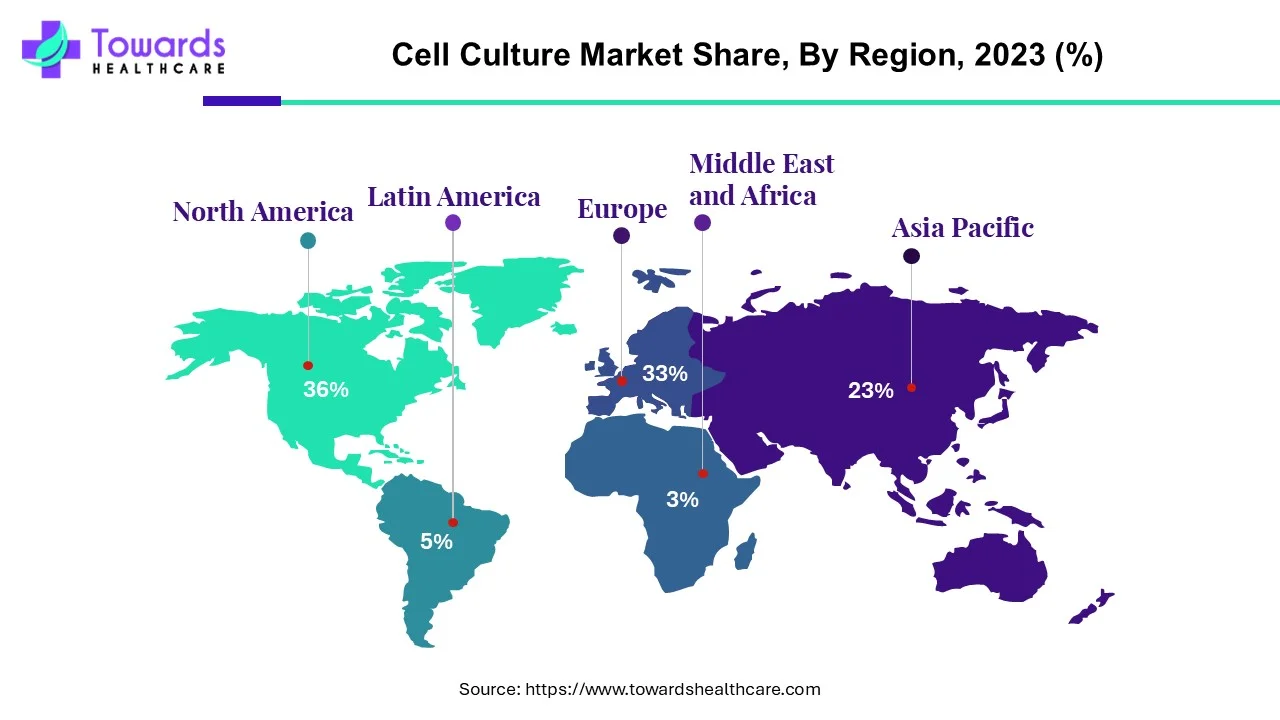

North America held the largest share of the cell culture market by 36% in 2023. The presence of key players, state-of-the-art research and development facilities, increasing investments, and technological advancements drive the market. Countries like the US and Canada are at the forefront of governing the cell culture market in North America. The US Department of Energy announced an investment of $220 million for biomanufacturing R&D and scale-up to accelerate the expansion of domestic biomanufacturing. It also invested $178 million in fostering biotechnology and biomanufacturing innovation. Similarly, the Government of Canada announced investing $171.6 million in five science and research organizations in Ottawa to boost biotechnology research and innovation. Additionally, the presence of key players such as Thermo Fisher Scientific, STEMCELL Technologies, GlaxoSmithKline, etc. holds the major share of the market in the region.

For instance,

Asia-Pacific is anticipated to grow at the fastest rate in the cell culture market during the forecast period. The rising incidences and prevalence of chronic disorders, growing research and development activities, favorable government support, and increasing manufacturing drive the market. Asia-Pacific is rapidly progressing in technology based on 3D cell culture. Japan and South Korea are at the forefront of 3D cell culture technology. The government of Japan has been focusing increasingly on cell-based regenerative medicine through investments in research facilities. Similarly, South Korea conducts several R&D projects to cater to the high demand for stem cell therapies. China’s National Medical Products Administration (NMPA) released a pilot plan to allow non-end-to-end manufacturing of biologics, which will end by 31st December 2026. India is the world’s largest vaccine producer accounting for 60% of the total vaccine production globally.

Europe is expected to grow at a notable rate in the foreseeable future. The growing research and development activities, such as new drug discovery and biologics development, boost the market. The European Medicines Agency (EMA) regulates the approval of novel drugs and biologics in Europe. The EMA granted 114 drugs for marketing authorization, of which 46 had new active substances. The increasing investments, collaborations, and mergers & acquisitions enable pharmaceutical and biotech companies to access cutting-edge technologies. Cell culture also finds applications in vaccine production. The EU has been a leader in vaccine research, development, and manufacturing, hosting 22% of the global clinical trials over the past two decades, and the research facilities are affiliated with the world’s largest vaccine companies.

Latin America is expected to grow significantly in the cell culture market during the forecast period. The growing research and development in the industries of Latin America is increasing the demand for cell culture. The growing development of vaccines, biologics, regenerative medicines, etc., as well as drug discoveries, is also contributing to the same. At the same time, the growing interest in cancer research by the institutions is also increasing the use of cell culture. These growing innovations are being supported by the regulatory agencies by providing guidelines, promoting their development. Thus, this drives the market growth.

The Middle East and Africa are expected to show lucrative growth in the cell culture market during the forecast period. The Middle East and Africa are experiencing a rise in chronic diseases such as cancer, autoimmune diseases, etc. This, in turn, is increasing the demand for new and effective treatment options. Therefore, the industries are developing new biologics, which is increasing the demand for cell culture. Moreover, advanced technologies are being adopted to enhance the production of cell therapies. Similarly, 3D culture systems and organ-on-a-chip technologies are also being utilized. Furthermore, the investments and funding are being provided by the government to enhance their development. Thus, this is promoting the market growth.

Cell Microsystems and OMNI Life Science (OLS) announced a strategic partnership to launch three products – CERO 3D Cell Culture Incubator & Bioreactor, CASY Cell Counter and Analyzer, and TIGR Tissue Grinder & Dissociator, in the US and Canadian markets. Gary Pace, CEO of Cell Microsystems, commented that their partnership with OLS and their other recent collaboration with Fluxion Biosciences enhance the company’s ability to support the research capabilities of their customers, paving the way for significant scientific breakthroughs.

In January 2025, after announcing the collaboration between CTMC and Syenex, the CEO of CTMC, Jason Bock, said that, to amplify the supply of transformative cell therapies to patients is their mission. They have expanded access to a suite of validated technologies by merging advanced systems of Syenex in their lentiviral and retroviral vector manufacturing platforms. Thus, to highlight the complex challenges in efficiency and scalability, comprehensive technical solutions will be provided to their biotech partners with the help of this integration.

By Product

By Application

By Region

January 2026

January 2026

January 2026

January 2026