December 2025

The global life science market size is calculated at US$ 88.2 billion in 2024, grew to US$ 98.63 billion in 2025, and is projected to reach around US$ 269.56 billion by 2034. The market is expanding at a CAGR of 11.82% between 2025 and 2034.

The growing research and development activities and technological advancements boost the life science market growth. The life sciences sector is rapidly expanding, driven by the increasing number of new drug discoveries and the growing demand for biologics. The burgeoning medical device sector and the growing demand for personalized medicines also augment market growth.

Moreover, government and private organizations provide funding for life science research and manufacturing activities. The increasing number of life science startups and venture capital investments propels market growth. The future of the market is fueled by technological advancements in genomics and proteomics, molecular biology, and biomedical technologies. These advancements drive the latest innovations in research activities, leading to the development of innovative products.

| Metric | Details |

| Market Size in 2025 | USD 998.63 Billion |

| Projected Market Size in 2034 | USD 269.56 Billion |

| CAGR (2025 - 2034) | 11.82% |

| Leading Region | North America |

| Market Segmentation | By Type, By Application, By Therapeutic Areas, By Region |

| Top Key Players | AstraZeneca, Baker Tilly, BIOQuébe, Clarivate plc, Eli Lilly and Company, GlaxoSmithKline plc, Honeywell, Merck KGaA, Novartis, Novo Nordisk, Pfizer, Roche, Schrödinger, Inc., Thermo Fisher Scientific |

Life science is a broad field that deals with the study of living organisms and life processes. Companies operating in the fields of pharmaceuticals, biotechnology, medical devices, biomedical technologies, nutraceuticals, cosmeceuticals, food processing, and others are part of the life science sector. These companies focus on developing drugs, biologics, and medical devices to prevent, diagnose, treat, and cure chronic disorders, particularly in the healthcare sector. Thus, the life science ecosystem is indispensable in driving innovation, improving healthcare outcomes, and bringing lifesaving therapeutics and diagnostics to patients.

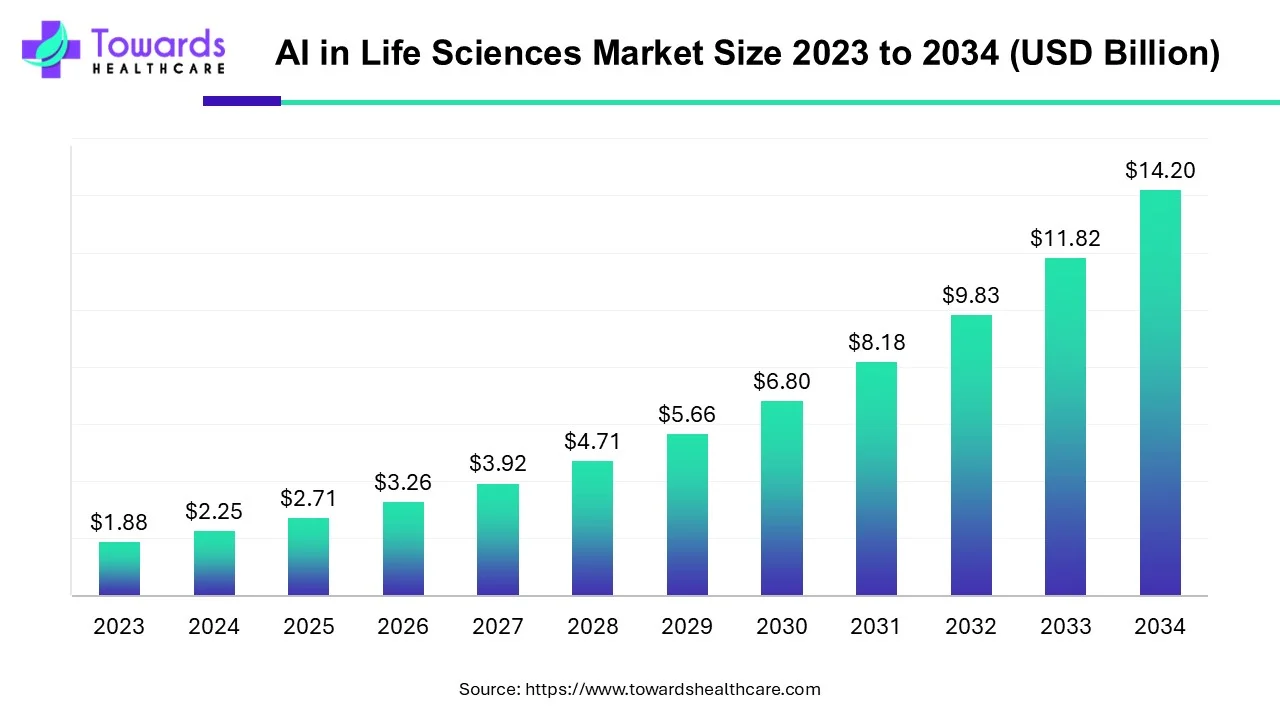

The global artificial intelligence in life sciences market size was valued at USD 2.25 billion in 2024 and is projected to rise to USD 2.71 billion in 2025, anticipated to reach approximately USD 14.20 billion in 2034, growing at a CAGR of 20.21% between 2024 and 2034.

Artificial intelligence (AI) can revolutionize all operations in the life science sector, from research to supply chain. It is widely used to accelerate drug discovery and development, automate the clinical trial process, and provide personalized care to patients. AI and machine learning (ML) algorithms can be integrated into numerous diagnostic tools for screening and early diagnosis of diseases, which are otherwise not detected by healthcare professionals.

The advent of wearable devices enables people to monitor their vital signs. This also allows healthcare professionals to keep track of patients’ conditions and make proactive decisions. AI and ML can also transform the manufacturing of medical products, enhancing efficiency and reproducibility. Moreover, they can automate the entire supply chain process, such as planning, production, management, and optimization. This leads to faster product delivery across different geographical locations.

For instance,

By using AI algorithms in life sciences develops new data, including virtual compounds, images, or text, is developed to escalate drug discovery, optimize clinical trials, and improve patient care. In the present era, the rising approaches in drug discovery, a growing adoption of personalized medicines, and increasing efforts to streamline processes are driving the generative AI in life sciences market growth. Basically, the generative AI is employed in novel drug target identification, which more rapidly supports in analysis of a huge amount of data and estimating efficient therapeutic applications. As well as, GenAI enables designing and screening potential drug candidates more effectively, resulting in a faster drug discovery process.

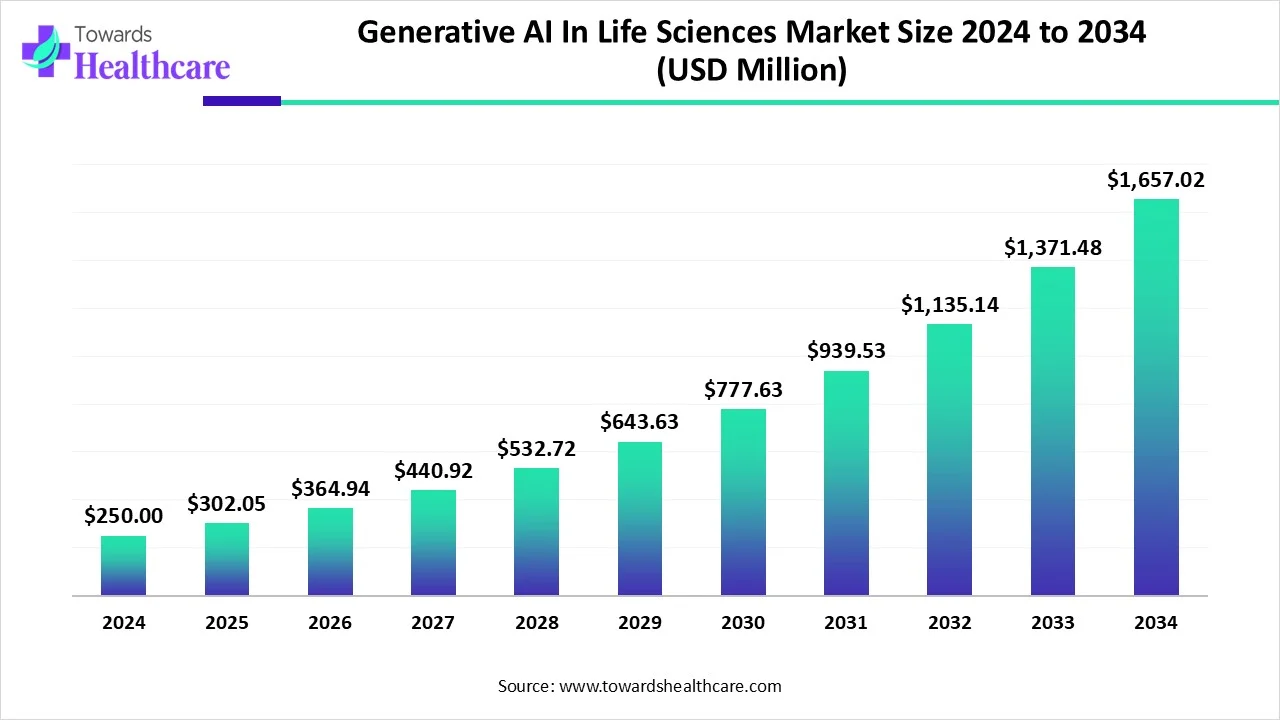

The global generative AI in life sciences market size is calculated at US$ 302.05 million in 2025, grew to US$ 364.94 million in 2026, and is projected to reach around US$ 1,657.02 million by 2034. The market is expanding at a CAGR of 20.82% between 2025 and 2034.

Axtria is a New Jersey-based company that works with 16 out of 20 life science companies globally. It operates in 70 countries and offers cloud-based platforms, enabling companies to scale innovations, such as predictive analysis, to anticipate the needs of healthcare professionals. Its GenAI solutions optimize outreach channels and provide personalized interactions to transform customer engagement. Shikha Singhal, Principal of Data Science at Axtria, said that the company is leading the charge with AI-based products and services that make digital transformations successful, paving the way for treatment innovations. The company is currently developing integrated data ecosystems and advancing analytics for clinical and commercial success. The company aims to become a leading expert in rare diseases and next-generation therapies.

New Drug Discovery Research

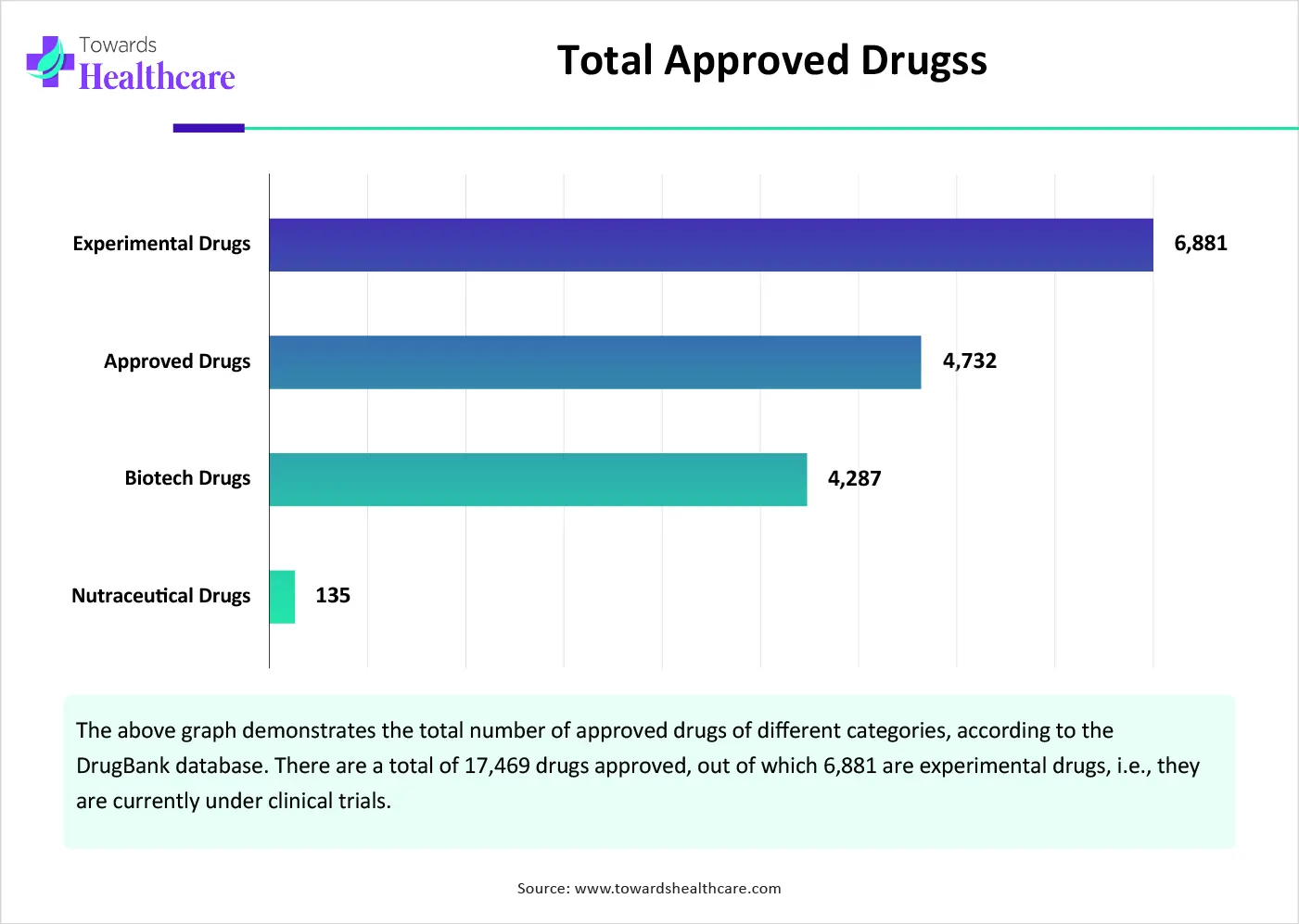

The major growth factor of the life science market is the new drug discovery research. The rising prevalence of chronic disorders and growing research activities lead to the development of novel drugs. New drug discovery involves a wide range of scientific disciplines, including biology, chemistry, and pharmacology. The drug discovery and development process comprises various steps from target identification to clinical research and regulatory approvals. New medicines are developed to foster scientific innovation, save lives, and improve the quality of life for millions of people. Numerous government organizations support new drug discovery through initiatives and funding.

Regulatory Compliance

The major challenge of the market is the need for regulatory compliance. The life science sector faces concerns related to laws, standards, and ethical guidelines for all its operations, including drug approvals and clinical trials. Life science companies need to keep track of the evolving regulatory landscape and adapt accordingly. Failure to do so may significantly impact the research, development, and commercialization of life science products.

Data Privacy

Another major challenge is data privacy, due to the rapid technological innovations. Companies adopt digital solutions to improve their workflow efficiency, which may lead to increased chances of cyberattacks and breaches of data privacy. The complex ethical, legal, and social landscapes hinder market growth.

What is the Future of the Life Science Market?

The future of the market is promising, driven by advancements in genetic engineering. Genetic engineering is the process of altering the genetic makeup, such as DNA and RNA, by using laboratory-based methods. Recent advancements in genetic engineering technology have opened up new pathways for innovation, with potential implications that could significantly impact society.

Genetic technologies, such as CRISPR/Cas9, have revolutionized the field of genetic engineering by enabling precise and efficient editing of genes. These advancements lead to the treatment of genetic and rare diseases and determine disease progression. Advances in genetic engineering also favor the development of personalized medicines, tailored to an individual’s specific genetic needs. Moreover, the increasing investments and collaborations among academic researchers and key players also create ample opportunities for future market growth.

The growing use of digital health technologies, such as telemedicine, also shows potential impact on the future of the life science sector. The demand for telemedicine increased during and after the COVID-19 pandemic. Wearable medical devices and healthcare apps are widely used for enhanced and personalized patient care. These tools can detect health issues early, offer tailored advice, and improve general well-being. It is estimated that more than 320 million people used healthcare-related applications in 2024 globally.

Life Science Market Size, By Type (USD Billion)

| Year | Pharmaceuticals | Biotechnology | Medical Devices | Life Science Tools | Digital Health Solutions |

| 2024 | 34.85 | 17.63 | 16.58 | 13.45 | 5.7 |

| 2025 | 38.17 | 20.84 | 18.64 | 15.44 | 6.52 |

| 2026 | 43.15 | 21.3 | 17.95 | 16.23 | 7.66 |

| 2027 | 47.54 | 22.63 | 18.48 | 17.78 | 6.91 |

| 2028 | 55.03 | 18.9 | 29.83 | 22.35 | 6.78 |

| 2029 | 63.34 | 20.25 | 23.84 | 22.43 | 5.33 |

| 2030 | 71.47 | 24.09 | 26.28 | 27.62 | 5 |

| 2031 | 79.92 | 27.4 | 41.06 | 30.43 | 7.97 |

| 2032 | 87.73 | 36.54 | 47.97 | 34.29 | 9.06 |

| 2033 | 96.63 | 42.63 | 48.73 | 34.85 | 18.23 |

| 2034 | 107.74 | 46.26 | 58.18 | 38.57 | 18.79 |

By type, the pharmaceuticals segment held a dominant presence in the market in 2024. This segment dominated because of the development of novel pharmaceuticals and the availability of generic alternatives. Several researchers develop small molecules as therapeutics, due to their ease of delivery and ability to target intracellular sites. Generic drugs are comparatively more affordable and easily available, making them a preferable choice by many people from low- and middle-income groups. The increasing R&D investments and collaborations also boost the segment’s growth. According to a report by McKinsey & Company, the R&D investment of CRO and CDMO grew 12% to 13% annually from 2014 to 2022.

By type, the biotechnology segment is expected to grow at the fastest CAGR in the market during the forecast period. The growing demand for biologics and advances in genomics, proteomics, and metabolomics augment the segment’s growth. Biologics provide targeted therapeutic action and reduce the chances of systemic side effects. The increasing preference for personalized medicines promotes the development of cell and gene therapy and other regenerative medicines. The U.S. Food and Drug Administration (FDA) approved 43 cell and gene therapies as of January 2025.

By type, the medical devices segment is expected to show a notable CAGR in the life science market over the coming years. Medical devices have been an integral part of everyday life for the prevention and diagnosis of diseases. The rising prevalence of lifestyle disorders, such as cardiovascular diseases and diabetes, promotes the use of medical devices. The U.S. FDA approved around 21 devices from January 2024 to October 2024. Integrating AI and ML has improved the functionality of medical devices with better outcomes. A recent survey reported that almost 1 in 3 Americans use a wearable device, like a smart watch or band, to track their health and wellness.

By application, the therapeutics segment led the global market in 2024. The rising prevalence of chronic disorders leads to the development of novel therapeutics. Therapeutics in the life science sector include small molecules, biologics, and medical devices. They play a vital role in extending human lifespan, improving quality of life, and managing chronic conditions. Advancements facilitate the design of recombinant therapeutics, antibody-based drugs, and vaccines. It is estimated that 30 recombinant therapeutics have been approved by various regulatory agencies around the world. Researchers also focus on developing novel drug delivery systems to modify drug transportation.

By application, the drug discovery & development segment is expected to grow with the highest CAGR in the market during the studied years. The growing new drug discovery research and the increasing number of clinical trials foster the segment’s growth. Stringent regulations necessitate pharma and biopharma companies to undergo preclinical and clinical trials to evaluate the safety and efficacy of novel drugs. Some researchers also focus on repurposing existing marketed drugs for different disorders. As of June 2025, 540,338 clinical trials were registered on the clinicaltrials.gov website.

By application, the diagnostics segment is expected to show a lucrative growth in the life science market in the studied years. Government organizations launch initiatives for screening and early diagnosis of chronic disorders. This encourages people to have regular body check-ups and use remote monitoring devices. According to a recent survey by Aflac, 51% of the 2,000 adults with cancer were diagnosed after a routine checkup or screening. This also helps healthcare professionals to provide early intervention, saving the lives of millions. As of March 2025, 188 companion diagnostic devices were approved by the U.S. FDA.

By therapeutic areas, the oncology segment held the largest revenue share of the market in 2024. The rising prevalence of cancer cases and their complexity contribute to the segment’s growth. The WHO projected that new cancer cases would reach 35 million by 2050, a 77% increase from 20 million in 2022. Several government organizations and regulatory bodies launch initiatives for screening, early diagnosis, and treatment of cancer. In 2023, 25 oncology novel active substances were launched globally, making a total of 193 cancer therapeutics since 2014. Over 2,000 new clinical trials were initiated in 2023 to assess novel therapeutics.

By therapeutic areas, the infectious diseases segment is expected to witness the fastest growth in the market over the forecast period. Infectious diseases, such as bronchitis, cold & flu, conjunctivitis, STIs, and foot fungus, are a major health concern, impacting millions of people globally. The Indian government launched the “Infectious Disease Biology Program” that supports R&D projects to eradicate the epidemics of AIDS, TB, malaria, and neglected tropical diseases, and combat hepatitis, waterborne diseases, and other communicable diseases by 2030.

By therapeutic areas, the cardiology segment is expected to grow significantly in the life science market from 2025 to 2034. The increasing prevalence of cardiovascular disorders governs the segment’s growth. Cardiovascular diseases (CVDs), such as heart disease, stroke, peripheral artery disease, and congenital heart disease, are major causes of morbidity and mortality among adults globally. It is estimated that 17.9 million people die every year from CVDs. Emerging biological therapies, such as gene therapy, stem cell therapy, and RNA-based treatments, are increasingly being developed to revolutionize the treatment of CVDs. Innovative medical devices, like smart implants, wearable devices, and minimally invasive surgeries, further potentiate the segment’s growth.

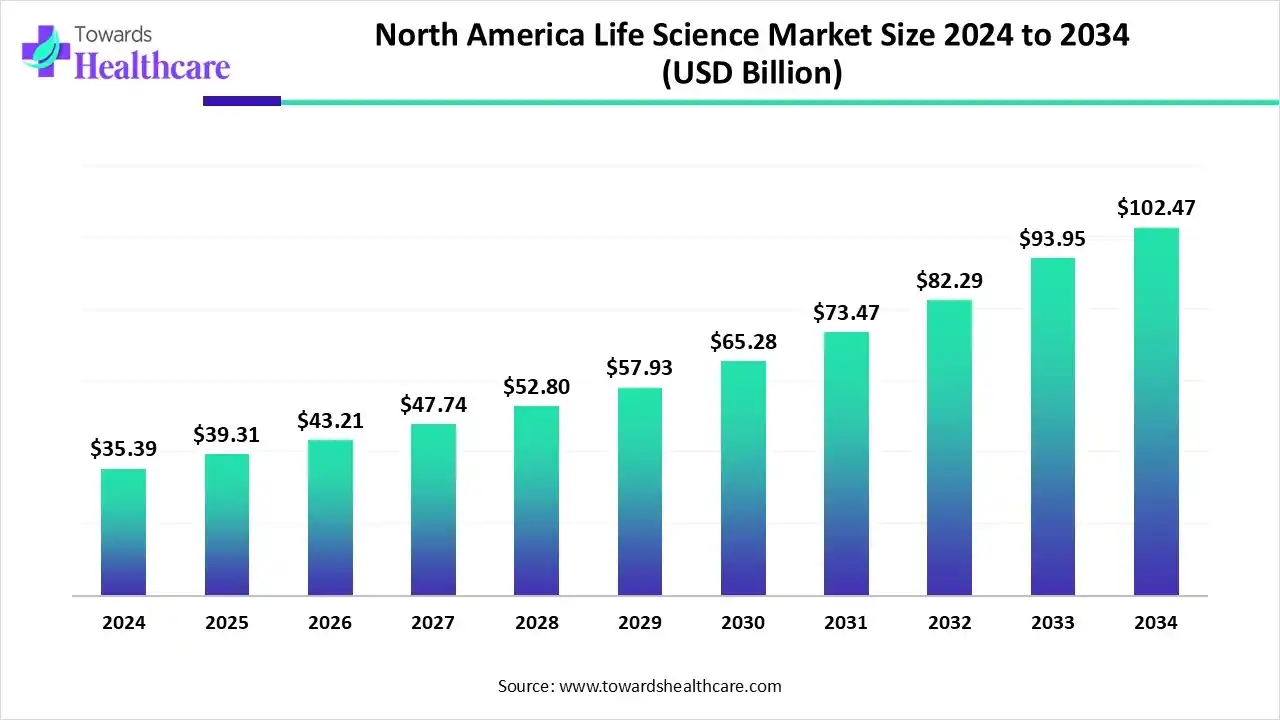

The North American life sciences market is valued at US$ 35.42 billion in 2024 and is expected to grow to US$ 39.25 billion in 2025. It is projected to reach approximately US$ 110.75 billion by 2034, expanding at a CAGR of 12.08% from 2025 to 2034.

North America dominated the global market in 2024. The presence of key players and favorable government support are the major growth factors of the market in North America. Other factors include new product launches and increasing collaborations. The presence of state-of-the-art research and development facilities promotes the development of innovative products. Advanced healthcare infrastructure also enables healthcare organizations to adopt cutting-edge technologies and provide advanced care to patients.

The U.S. life science market is set for strong growth, with revenues expected to reach hundreds of millions between 2025 and 2034. This rise is being driven by changing consumer needs and rapid technological advancements that are transforming the industry.

The FDA approved 50 new drugs in 2024, including 32 new chemical entities (NCEs) and 18 biologics. There were more than 45,000 life science companies in the U.S. as of early 2024, marking a 7% increase in the number of companies. The National Institute of Health (NIH) is the primary federal biomedical research agency in the U.S. that provides funding for various life science research activities. It invests approximately $48 billion in medical research annually. Out of these, nearly 83% is awarded for extramural research.

There are more than 2,000 life science companies across Canada. From 2019 to 2023, Canada reported a total of $25.9 billion in investments into more than 175 companies. In 2023, the Canadian biotech sector recorded $12 billion in 65 investment deals. Moreover, the Canadian government committed more than $308 million to drive groundbreaking research initiatives, strengthen Canada’s global competitiveness, and deliver real-world benefits for Canadians.

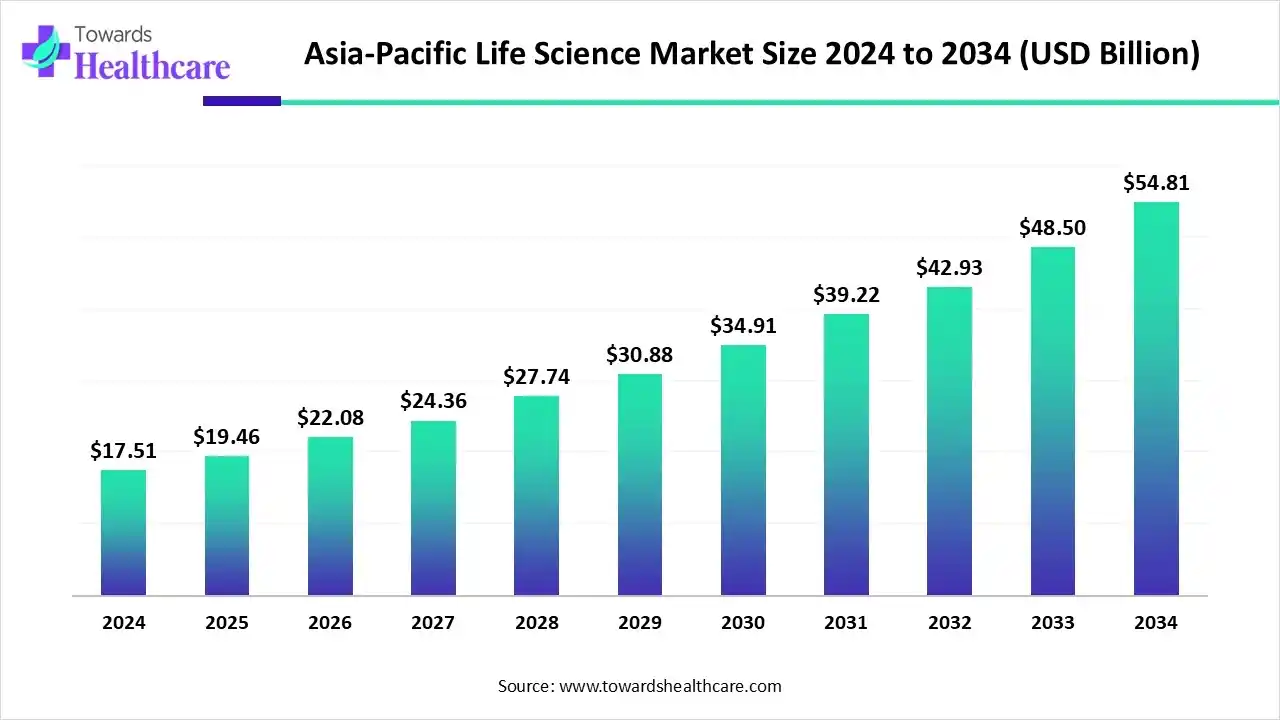

The APAC Life Science market, valued at US$ 17.51 billion in 2024, is projected to reach US$ 19.46 billion by 2025. By 2034, the market is anticipated to exceed US$ 54.81 billion, registering a steady CAGR of 12.09% over the forecast period.

Asia-Pacific is expected to grow at the fastest CAGR in the life science market during the forecast period. Countries like China, India, Japan, and Singapore are emerging as global leaders in the life science sector, with the increasing number of life science startups and venture capital investments. The burgeoning pharma & biotech sectors and increasing collaborations propel the market. Several government organizations launch initiatives for eradicating numerous chronic disorders and provide funding for research activities. The rising prevalence of chronic disorders and the growing geriatric population also contribute to market growth.

China is home to more than 3,000 life science companies, employing over 270,000 people. Beijing and Shanghai are emerging cities in the life science sector. China has more momentum with a patent growth of 379% from 2014. The most patent applications were from the biotechnology, pharmaceuticals, and medical technology fields. Shanghai and Beijing are the sixth and tenth-most active centers for global life sciences venture capital investments in the world, accounting for $1.7 billion in 2024.

In India, the total number of biotech startups increased from 5,365 to 8,531 from 2021 to 2023. According to the India Venture Capital Report 2025 by Bain & Company, the venture capital investment in the life science sector was approximately $13.7 billion, an increase of 1.4 times from 2023. This made India the second-largest venture capital destination in Asia-Pacific. The World Intellectual Property Organization (WIPO) reported that applicants residing in India submitted around 55.5% of patent applications in India’s IP office for the first time.

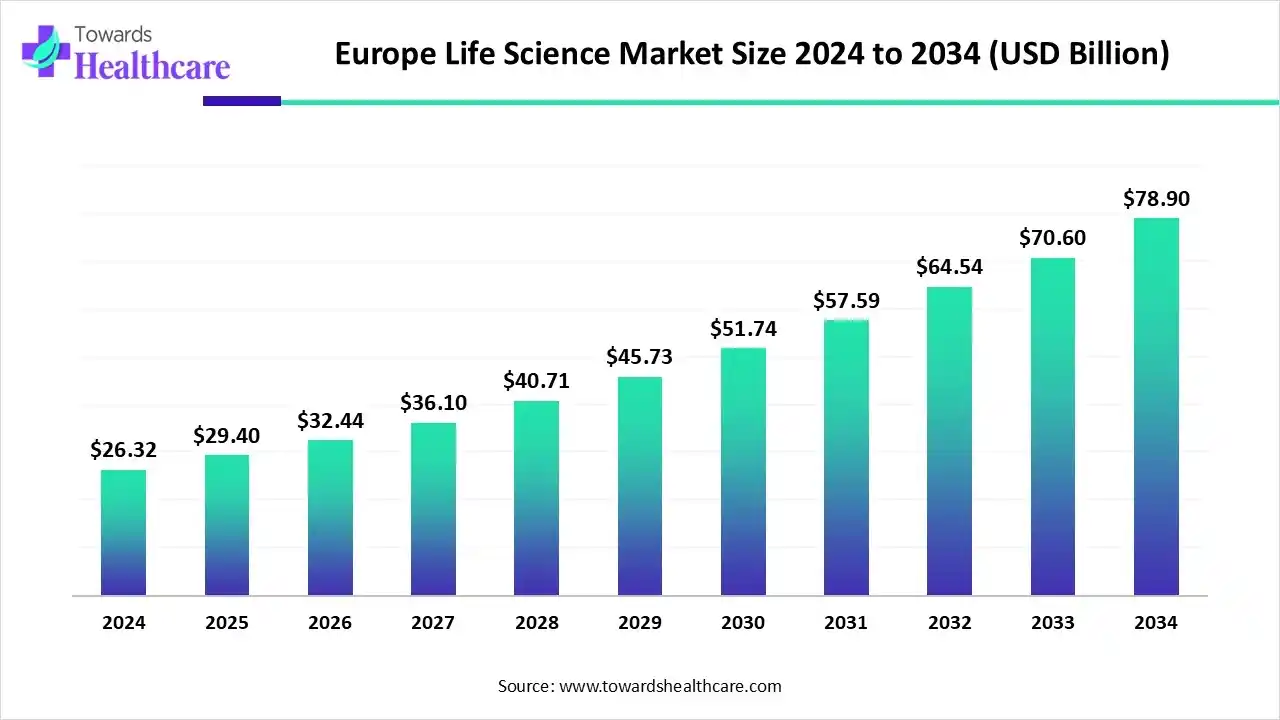

The European life sciences market is valued at US$ 26.32 billion in 2024 and is expected to grow to US$ 29.40 billion in 2025, with projections indicating it could reach approximately US$ 78.90 billion by 2034. This represents a CAGR of 11.61% from 2025 to 2034.

Europe is expected to grow at a considerable CAGR in the life science market in the upcoming period. The demand for life science research is increasing due to rising investments and favorable government support. The Trump Administration proposed to cut the NIH budget by $18 billion in May 2025. This opens doors for American scientists in Europe for advanced research due to the presence of favorable infrastructure and sufficient funding. Favorable trade policies for pharmaceutical and other life science products favor market growth. In 2023, Germany and Ireland were among the top three exporters of pharmaceutical products, accounting for $115 billion and $92 billion, respectively.

The life science sector in Germany is mainly driven by innovations in medical technology, pharmaceuticals, medical biotechnology, and digital health. Germany spends an average of €5,832 per capita on healthcare, ranking eighth largest in Europe. The German government recently launched the “Digital Health” initiative to support digitization in the healthcare sector.

In 2024, the UK exported £21.7 billion worth of pharmaceutical products to the world. These products were primarily exported to the U.S., Belgium, Germany, Ireland, and France. The UK government committed approximately £520 million, as part of the Life Sciences Innovative Manufacturing Fund (LSIMF), for life science manufacturing to fulfill the government’s goal of economic growth and build an NHS fit for the future.

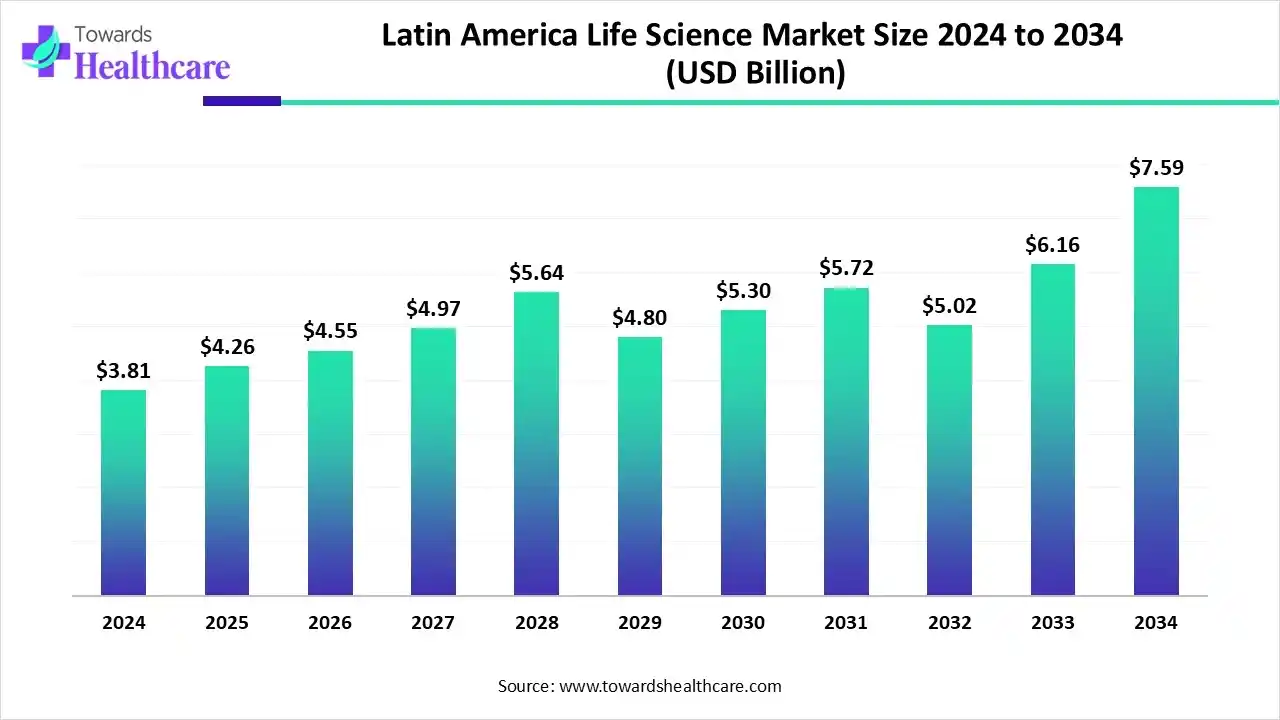

The Latin America life science market was valued at US$ 4.49 billion in 2024 and is projected to increase to US$ 4.90 billion by 2025. By 2034, the market is anticipated to exceed US$ 12.05 billion, expanding at a steady CAGR of 10.38%.

Latin America is considered to be a significantly growing area in the life science market, due to growing investments and the increasing number of biotech startups. Countries like Argentina, Brazil, Chile, and Mexico are at the forefront of rapidly expanding the life science sector. The increasing number of clinical trials and favorable regulatory landscape support the market. The growing research and development activities and the rising prevalence of chronic and rare disorders augment market growth. In Brazil, it is estimated that up to 13 million patients suffer from 7,000-8,000 rare diseases. Brazil conducts the highest number of clinical trials in Latin America, accounting for 1,723 recruiting and active, not recruiting trials as of June 6, 2025.

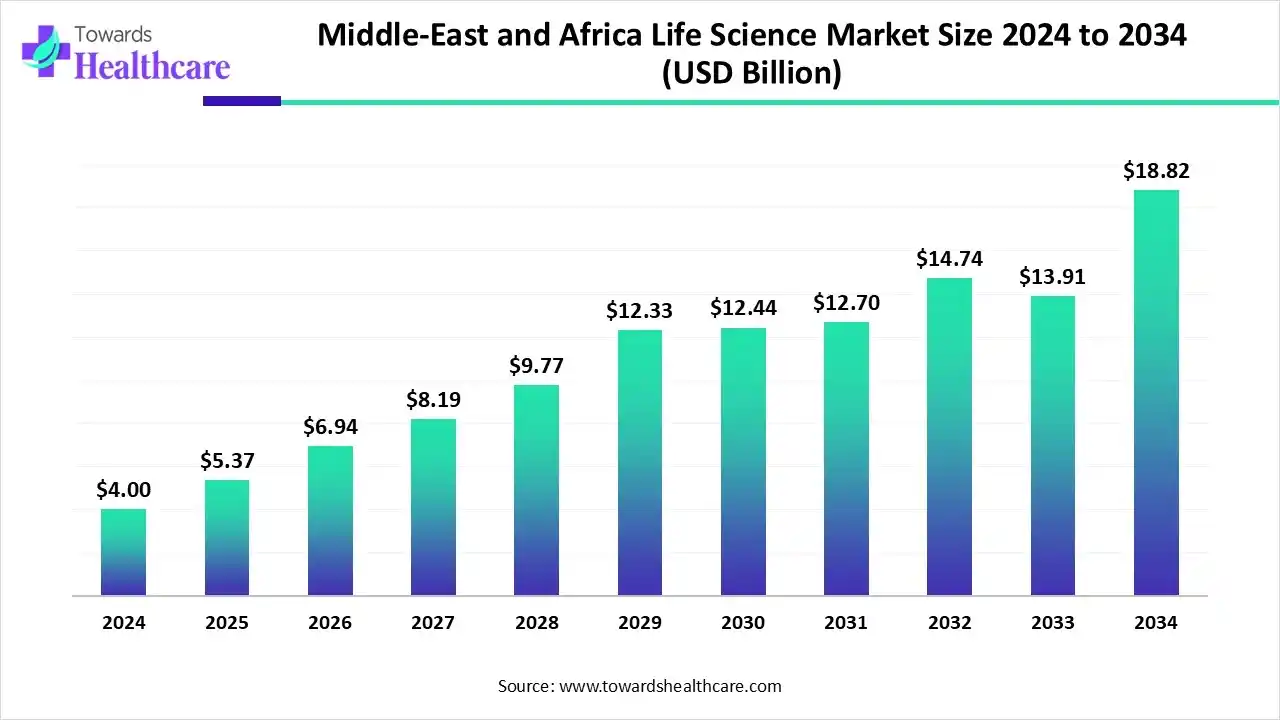

The Middle East and Africa life science market was valued at approximately USD 4.47 billion in 2024 and is expected to grow to USD 5.04 billion in 2025. By 2034, the market is projected to reach USD 13.07 billion, reflecting a robust CAGR of 11.32% during the forecast period.

The Middle East & Africa are expected to grow at a notable CAGR in the foreseeable future. The rising adoption of advanced technologies and growing investments by government and private organizations drive the market. The MEA government allocates around $10 billion in funding for research and development activities in the life science sector. The increasing number of clinical trials also contributes to market growth. In 2023, 845 clinical trials were conducted in the African region. Moreover, the rising population (more than 2.4 billion) and growing awareness of healthcare needs govern the market. The increasing collaboration and M&A activities fuel market growth. In Q3 2024, approximately $1.8 billion was raised for M&A activities in the MEA, an increase of 15285% from Q2 2024.

Darren Jones, Principal, Life Sciences Consulting at Baker Tilly, commented on the launch of stewardshipNOW that it empowers life science companies to manage the complexities with external funding in a compliant, ethical, and efficient way. He also said that the company’s collaboration with MediSpend combines strategic insight with advanced technology, helping organizations reduce administrative burden, mitigate risk, and execute their funding strategies with confidence and integrity.

By Type

By Application

By Therapeutic Areas

By Region

December 2025

November 2025

December 2025

October 2025