January 2026

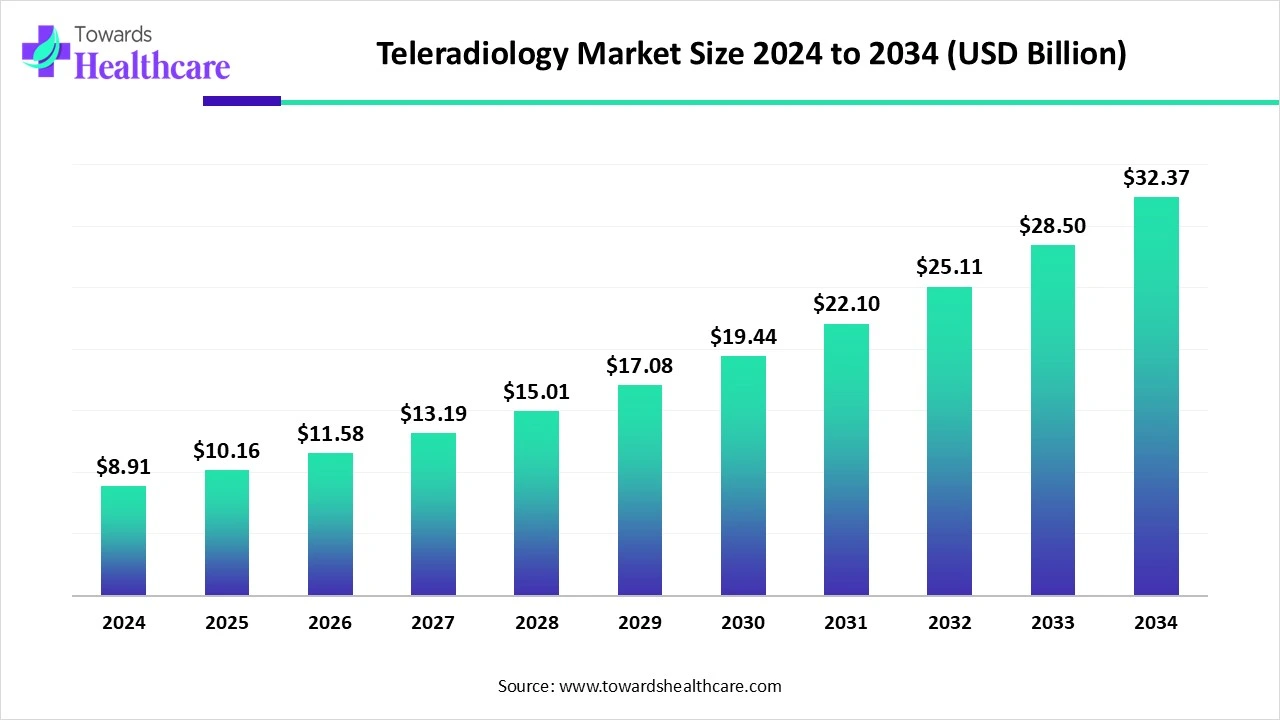

The global teleradiology market size is calculated at US$ 10.16 billion in 2025, grew to US$ 11.61 billion in 2026, and is projected to reach around US$ 38.43 billion by 2035. The market is expanding at a CAGR of 14.23% between 2026 and 2035.

The teleradiology market is an integral part of telehealth services, which assists radiologists in the interpretation of medical images such as CT scans, MRI scans, X-rays, and other medical images and test reports. It is an excellent platform that delivers error-free diagnosis, is essential during medical emergencies, and connects with qualified radiologists at any location. It saves a lot of time and effort during emergencies and allows the safe transfer of complex medical data.

The 24/7 and 365-day availability and access to these cost-effective services increase their use by radiologists at medical centers. These solutions are widely applicable in specialized sectors such as cardiology, neurology, and orthopaedics, which enable efficient information sharing and communication between junior and senior doctors. Tele radiology serves as an effective medium for patients and doctors to get a second opinion or for long-distance healthcare education.

| Table | Scope |

| Market Size in 2025 | USD 10.16 Billion |

| Projected Market Size in 2035 | USD 38.43 Billion |

| CAGR (2026 - 2035) | 14.23% |

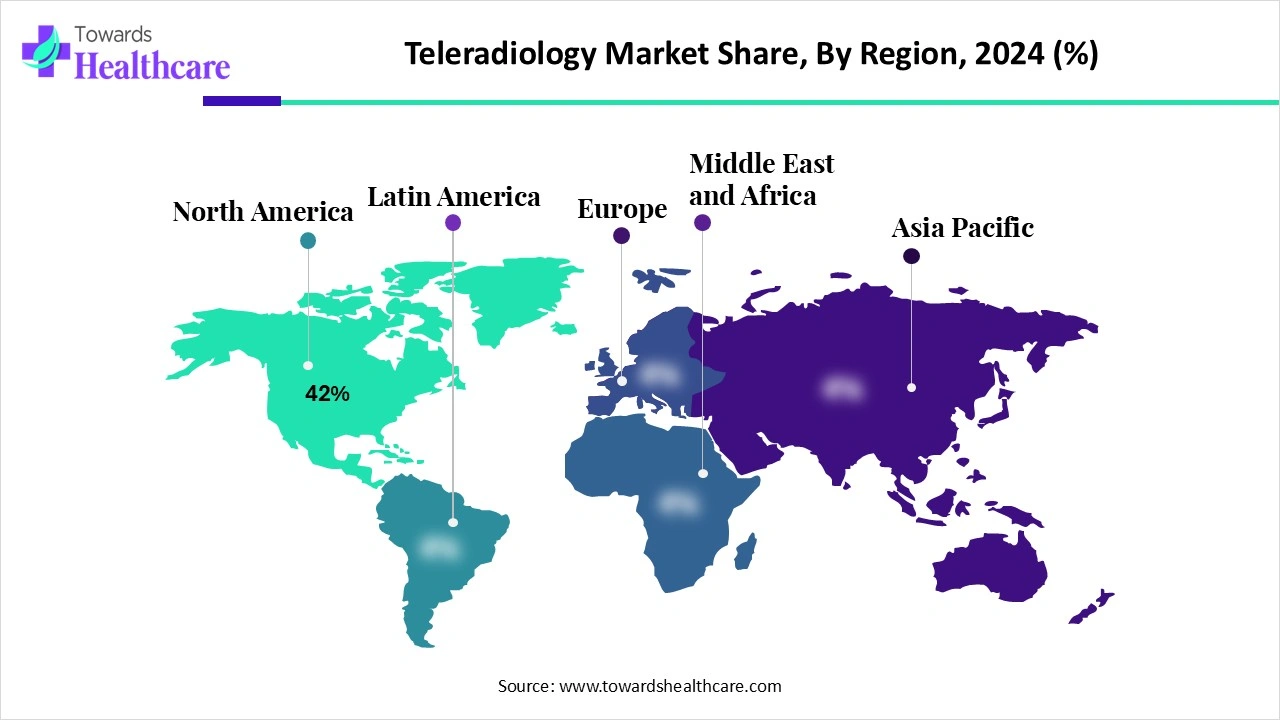

| Leading Region | North America by 42% |

| Market Segmentation | By Service Type, By Imaging Modality, By Technology Component, By End User / Buyer, By Region |

| Top Key Players | Radiology Partners, vRad / Virtual Radiologic, Everlight Radiology, Telemedicine Clinic, Teleradiology Solutions, NightShift / NightHawk-style service providers, Agfa HealthCare, Sectra, Ambra Health, Intelerad, GE Healthcare, Philips, Nuance / Microsoft, Aidoc, Viz.ai, RamSoft, TeleRay / Regional European & Latin American providers, Apollo TeleHealth / large hospital groups offering teleradiology services, Image interpretation marketplaces & freelance networks, Specialist subspecialty read boutiques |

Teleradiology is the remote transmission, interpretation, and reporting of medical images (X-ray, CT, MRI, ultrasound, nuclear medicine) using secure networks, PACS/cloud platforms, and structured reporting workflows. It enables after-hours/night coverage, subspecialty reads, second opinions, workload balancing across geographies, and rapid stroke/trauma triage. The market blends service providers (outsourced reads), enterprise imaging/teleradiology software, connectivity & cloud-PACS, and emerging AI/triage integrations that speed urgent-case detection and reporting. The major growth drivers include imaging volume growth, radiologist shortages, the need for 24/7 coverage, consolidation of imaging networks, increasing adoption of cloud workflows, and regulatory/quality demands for subspecialty interpretation.

Artificial intelligence drives transformation in data processing and data evaluation, which presents opportunities to resolve tedious and time-consuming tasks with AI solutions. AI has wide applications in pattern detection and classification, while AI tools enhance diagnostic accuracy and efficiency. AI helps to detect abnormalities during medical imaging. It is also used during neuroimaging, CT and MRI scans, and chest imaging. AI tools are used to target high-incidence diseases such as breast cancer, lung cancer, and stroke.

What are the Major Drifts in the Teleradiology Market?

The emerging trends in teleradiiology services are the integration of artificial intelligence into radiology, which has revolutionized the telehealth industry. The improvements in diagnostic imaging and the expanding independent telehealth facilities are driving major shifts in medical imaging and radiology. The increased focus on fil the gaps of workforce shortages in radiology and delivering patient-centered care drives a technological revolution.

What are the Potential Challenges in the Teleradiology Market?

Certain challenges arise during the implementation of teleradiology in rural settings to solve the limited access to radiology services. The other challenges include technological limitations, regulatory and legal barriers, workforce shortages, data security concerns, and cultural acceptance issues.

What is the Future of the Teleradiology Market?

Tele-radiology holds a significant promise to enhance healthcare access in underserved and rural regions. It enhances clinical decision-making, improves access to timely diagnostics, and delivers cost savings for rural patients who need to travel to urban centers for radiology services. Telehealth and its various applications, including teleeradiology, have delivered positive outcomes globally, including in countries like India, Brazil, etc. The remote services are feasible and help to reduce regional health inequities. The considerable socio-economic growth factors in rural areas include investments in infrastructure, supportive regulatory frameworks, workforce training, secure data management, and telehealth models. They help to improve healthcare outcomes and reduce disparities.

The primary/routine interpretation segment dominated the market in 2024, owing to the benefits of routine interpretation to healthcare facilities and clinicians in terms of improved workflow efficiency, faster turnaround times, cost savings, and access to subspecialty expertise. It also drives scalability and distribution of workload among healthcare professionals and clinical researchers. Patients experience numerous benefits, such as expanded access to care, timely emergency care, higher quality reporting of conditions, and improved treatment outcomes.

The after-hours/night coverage segment is expected to grow at the fastest CAGR in the market during the forecast period due to various advantages of these services to hospitals and healthcare facilities, including 24/7 access to expertise, increased throughput, cost-effectiveness, and liability. Radiologists experience increased earnings, reduced distractions, flexible scheduling, workload distribution, and professional development. Moreover, patients are enabled to access improved care in underserved areas with increased satisfaction and equitable access.

The CT & X-ray segment dominated the market in 2024, owing to the major advantages of the integration of teleradiology into CT and X-ray, which include increased access to specialists, faster diagnosis, improved quality, and accuracy. CT scans remain vital for the rapid assessment of trauma patients for bleeding or internal injuries and other health conditions. Digital X-rays provide high-resolution images with improved diagnostic accuracy.

The MRI segment is expected to grow at the fastest CAGR in the market during the forecast period because MRI scans deliver higher diagnostic accuracy and enhanced emergency care. These are scalable services offered by healthcare providers that are helpful in case of radiologist shortages. These services improve the quality of care and help expand diagnostic capabilities.

The cloud/enterprise PACS & image sharing platforms segment dominated the market in 2024, owing to the excellent benefits of these services in enhancing healthcare accessibility and collaborations. They drive cost reduction, scalability, and streamlined workflow and efficiency. They can protect data and achieve regulatory compliance through enhanced security and reliability.

The AI/triage & CAD integration segment is expected to grow at the fastest CAGR in the market during the forecast period because these solutions help in improved detection of abnormalities and reduced misdiagnosis. The expanded cloud-based infrastructure contributes to remote accessibility and scalability. AI and CAD enable automated tasks and faster reporting of medical emergencies.

The hospitals & health systems segment dominated the market in 2024, owing to the educational and training opportunities for ordinary people and patients provided by hospitals and health systems. There is a wide use of teleradiology by health systems to provide various services to clinics and hospitals in remote areas. They enable secure data management and increased investments in infrastructure.

The imaging centers & outpatient clinics segment is expected to grow at the fastest CAGR in the market during the forecast period due to tremendous technological advancements. There is a seamless integration of teleradiology solutions with clinic and imaging center systems such as PACS and RIS, which drives efficient workflow management and image sharing. These facilities enable secure data handling and access to care in underserved areas.

North America dominated the teleradiology market share 42% in 2024, owing to the aging population and the growing demand for imaging. The Drug Enforcement Administration (DEA), located in Washington, introduced rules for the prescribing of controlled medications through telemedicine. It has expanded patient access to complex therapies. The Centers for Medicare & Medicaid Services (CMS) and Health and Human Services (HHS) have proposed final rules to address changes to Medicare and Medicaid programs and policies to ensure updated payment systems. The Health Resources and Services Administration (HRSA) reported that the DEA and HHS planned to prescribe controlled medications via telehealth and extended telemedicine capabilities. Federally Qualified Health Centers (FQHCs) and Rural Health Clinics (RHCs) play major roles as distant site providers for most telehealth services.

In August 2025, the Radiological Society of North America introduced the AI hybrid reading strategy for screening mammography that improves the interpretation of mammograms.

The National Diagnostic Imaging (NDI) is contributing to providing US-based teleradiology and remote radiology reporting services through coverage and interpretation of diagnostic imaging in all 50 states. The NDI is delivering improved patient care in the U.S. in 2025. Moreover, the growth of the National Diagnostic Imaging teleradiology company is driven by a notable shortage of radiologists in the U.S.

In January 2025, the Canadian Association of Radiologists (CAR) planned to improve patient outcomes and Canadian radiology.The CAR remains a high professional standard for medical imaging across Canada. The CAR provides excellent patient care and better healthcare.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period. This regional growth is attributed to emergency services, specialty expertise, and expanding healthcare access. The Economic and Social Commission for Asia and the Pacific (ESCAP) stands as the regional hub to drive co-operation among Asian Pacific countries and achieve sustainable development. The private sector, including mid-tier and top-tier hospitals and nursing homes, drives the growth of hospitals in this region.

Southeast Asia experiences regional collaborations and drives country-specific projects by overcoming challenges related to cybersecurity, public trust, and interoperability. The Pacific Islands are driving government efforts through international partnerships like India-Fiji collaboration and digital infrastructure efforts. International initiatives are the global initiative on digital health managed by the WHO in collaboration with the International Telecommunication Union to ensure telehealth services are more accessible.

In July 2025, the Indian Government launched the Skilling for AI Readiness (SOAR) program to empower school students with AI skills, which includes 15-hour modules for grades 6 to 12.

There are several opportunities in India’s healthcare sector across various healthcare industries, such as hospitals, diagnostics, pharmaceuticals, medical insurance, medical equipment and supplies, and telemedicine. The government sectors, including district hospitals, healthcare centers, and general hospitals, contribute to the expansive reach of hospitals. Moreover, the diagnostics industry revolves around businesses and laboratories that offer analytical and diagnostic services.

China made efforts to launch a pilot program for the expansion of value-added telecom services. The State Council Information Office, the People’s Republic of China, focuses on promoting high-quality development. In July 2025, China’s National Medical Products Administration (NMPA) introduced China’s strategy to advance high-end medical devices in 2025.

Europe is expected to grow at a notable rate in the market in 2024, led by the growth of outpatient services and data security frameworks. According to the WHO, 40 countries in the WHO European region hold a national telehealth strategy to promote telehealth. This digital health strategy encompasses teleeradiology, telemedicine, and telepsychiatry services across the region. Since pandemics, European countries have experienced huge success in the adoption and use of telehealth and other digital health solutions. There is a regional digital health action plan for the WHO European region for the period of 2023 to 2030. Efforts will be made to identify solutions that are patient-centered, and this activity is supported by the European Commission.

In July 2025, the Government of the UK launched the 10-year health plan to bring the National Health Service (NHS) closer to home with easier accessibility and care.

France is experiencing regulatory and reimbursement developments. It also drives national digital health strategies like the France 2030 investment plan, digital health acceleration strategy, and medical AI training. Teleradiology is a growing market in France, driven by government initiatives that encourage technological adoption in underserved rural areas.

The United Kingdom drives the national AI action plan for healthcare and makes significant investments in the radiology IT sector. Advancements in radiology play a critical role in improving image analysis and assisting clinicians with accurate diagnosis.

In October 2025, Dr. Gurson, CEO and co-founder of Rad AI, proclaimed that the company believes in the major role of AI in the empowerment of radiology. He also said that the company drives the mission to deliver AI-driven solutions that reduce burnout, save time, and boost patient care.

By Service Type

By Imaging Modality

By Technology Component

By End User / Buyer

By Region

January 2026

January 2026

January 2026

January 2026