January 2026

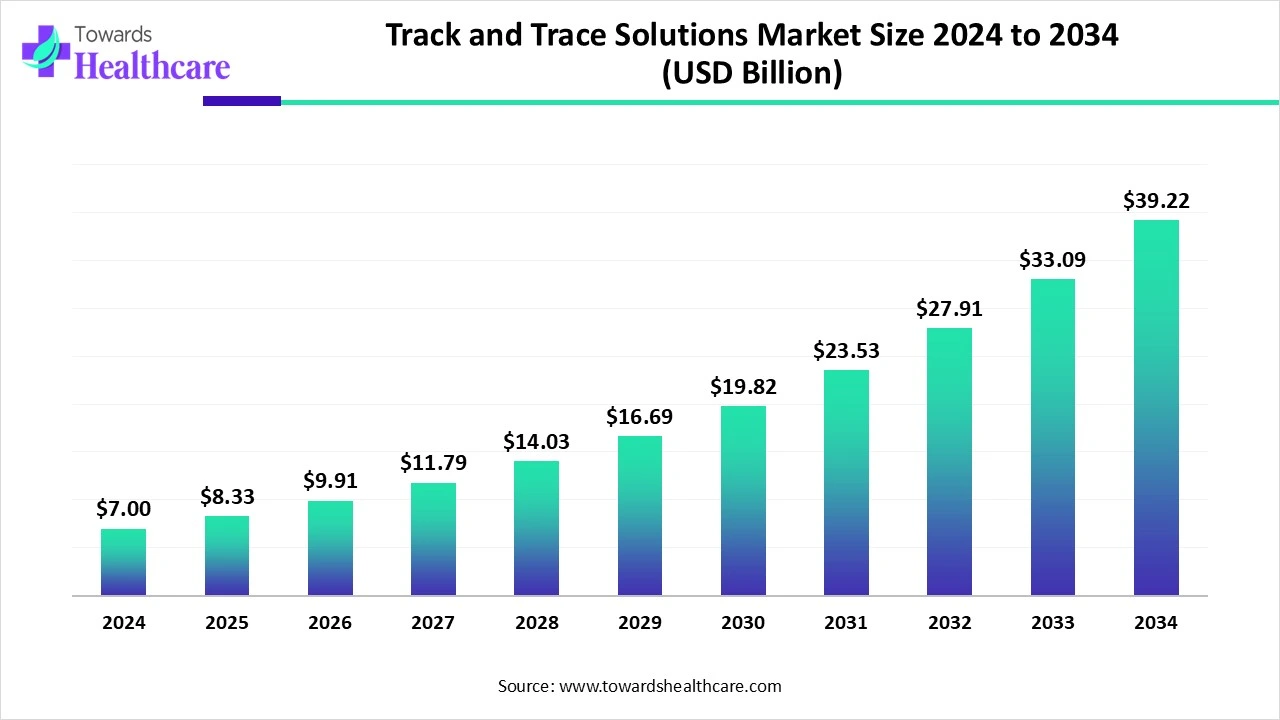

The global track and trace solutions market size is estimated at US$ 7 billion in 2024, is projected to grow to US$ 8.33 billion in 2025, and is expected to reach around US$ 39.22 billion by 2034. The market is projected to expand at a CAGR of 18.95% between 2025 and 2034.

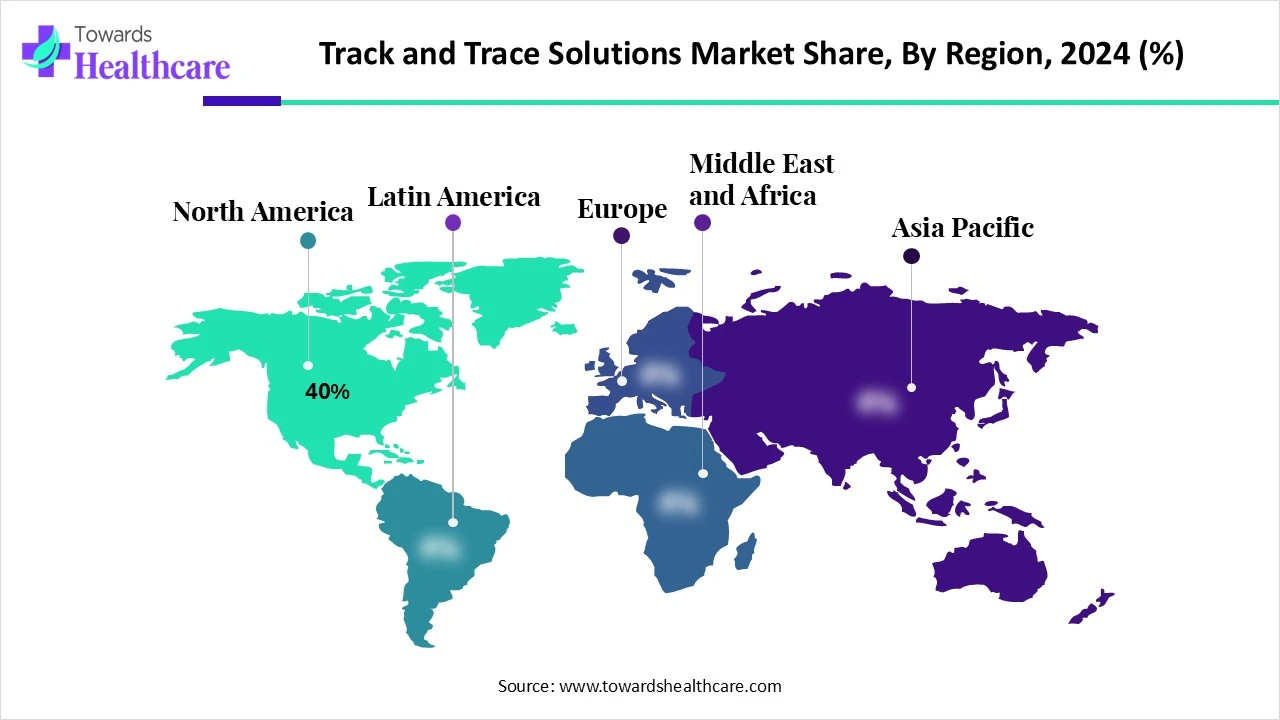

The track and trace solutions market is expanding rapidly due to enhanced supply chain transparency and ensuring product authenticity. This solution, containing RFID, barcodes, and serialization technology, allows real-time verification and monitoring of drug movement from manufacturing to the end user. North America is dominant in the market as healthcare organizations in this region are adopting advanced hardware and software technology, while the Asia Pacific is the fastest growing, with increasing drug recalls, increasing patient safety challenges, and increasing need for operational efficacy.

| Table | Scope |

| Market Size in 2025 | USD 8.33 Billion |

| Projected Market Size in 2034 | USD 39.22 Billion |

| CAGR (2025 - 2034) | 18.95% |

| Leading Region | North America Share 40% |

| Market Segmentation | By Solution Type, By Technology, By Component, By End User Industry, By Region |

| Top Key Players | Zebra Technologies Corporation, Systech International, Optel Group, Tracelink, Inc., SML Group, Honeywell International Inc., Avery Dennison Corporation, Adept Packaging Solutions, Antares Vision S.p.A, Digimarc Corporation, Videojet Technologies (Danaher Corporation), SoluM Co., Ltd., CipherLab Co., Ltd., Nedap N.V., Thinfilm Electronics ASA, T2K Group, HID Global Corporation, De La Rue plc, Controlant, Selerant |

The track and trace solutions market involves technologies and systems designed to monitor and authenticate products throughout the supply chain, from manufacturing to end-consumer delivery. These solutions enable real-time visibility, anti-counterfeiting, regulatory compliance, and inventory management across industries such as pharmaceuticals, food & beverage, logistics, and retail. In healthcare, track and trace solutions are critical for ensuring drug safety, preventing counterfeit medicines, and maintaining supply chain integrity. The market growth is fueled by increasing regulatory mandates, rising counterfeit threats, and advancements in IoT, blockchain, and RFID technologies.

Increasing collaboration among the healthcare institutions and government organizations for offering advanced track and trace system services, which drives the growth of the market.

For instance,

Increasing government support for track and trace solutions in various sectors such as pharmaceuticals and food & beverage, because of regulations goal at combating counterfeiting and confirming the safety of products, which contributes to the growth of the market.

For Instance,

Integration of AI in track and trace solutions drives the growth of the market, as AI-driven technology and machine learning (ML) are being progressively applied in track and trace solutions. These technologies are used to analyse huge amounts of data, offering significant insights into the supply chain operations. It used to recognize patterns and trends, enhance processes, and identify anomalies or latent challenges, such as diversion, fraud, or counterfeiting. AI is used to enhance prediction accuracy, leading to advanced inventory management and enhanced effectiveness. Track and trace systems equipped with AI collect and analyze data from various sources, such as IoT technology, GPS trackers, sensors, and RFID tags. This supports businesses to learn more related to the products and their exact location at each stage of their journey in the supply chain.

Increasing Issues of Drug Counterfeiting

Drug counterfeiting has become a global problem. No country can entirely prevent the sale of fake medicines within its pharmaceutical sector. Factors like weak regulations, porous borders, and limited healthcare access facilitate the spread of counterfeit drugs, which may lead to increased drug-resistant malaria. These counterfeits, produced in unregulated settings, often contain dangerous chemicals, risking public health. Moreover, counterfeit products moving through transportation networks pose safety risks for workers across different industries. This situation highlights the need for product authentication and patient safety measures, which in turn fuels the growth of the track and trace solutions market.

Lack of Adequate Training

Adequate training is crucial for employees to use the new system effectively. This includes both initial instruction and continuous support to handle any problems. Employees familiar with traditional methods might resist adopting new technologies. To overcome this resistance, effective change management strategies are necessary, such as clear communication about the benefits and providing support during the transition. This resistance limits the growth of the track and trace solutions market.

Recent Advancements in Cloud Technology

Track & trace systems will keep improving, providing more transparency and control, and ensuring pharmaceutical products stay safe, authentic, and traceable throughout their lifecycle. The use of cloud computing is changing how companies manage their supply chains. Cloud-based solutions offer a scalable and flexible way to handle data and processes, allowing companies to access information in real-time from any location. This is especially helpful for track and trace solutions, which need real-time visibility and transparency. Cloud solutions also deliver benefits like cost savings, better security, and less complexity, opening new opportunities in the track and trace solutions market.

For Instance,

By solution type, the serialization solutions segment led the track and trace solutions market, due to pharmaceutical serialization and track & trace being significant components of the current supply chain organization. Serialization contributes a unique identifier to every pharmaceutical product unit, while track & trace allows monitoring its journey throughout the supply chain. These processes play a significant role in safeguarding patient product safety, authenticity, and regulatory compliance.

On the other hand, the others segment is projected to experience the fastest CAGR from 2025 to 2034, as data analytics offers end-to-end visibility by incorporating data from different sources, allowing businesses to track shipments, monitor inventory, and classify bottlenecks in real-time. Tracking and tracing systems support identifying portions of the supply chain that take up too much time. Trace and track solutions are not just devices; they are revolutionizing the global supply chains.

By technology, the barcode segment is dominant in the track and trace solutions market in 2024, as this system allows precise strength tracking, enhancing decision-making and operational response times. This trace system improves operative workflows, accountability, and transparency, advantageous to organizations and consumers. Barcode asset tracking system over other tagging solutions is its simplicity to use. Barcodes are self-adhesive and can be easily attached to items throughout the workplace. A barcode file tracking system supports businesses to improve efficiency, accuracy, and security in their document organization processes.

The radio frequency identification (RFID) segment is projected to grow at the fastest CAGR from 2025 to 2034, as its wireless communication uses radio waves to convey information from RFID tags to an RFID reader. A reader instantaneously scans more than 100 tags, and it does not require line-of-sight visibility. This makes it simple to automate some processes that would otherwise need extra time and resources, and be subject to human error. Real-time access to larger amounts of detailed information supports enhanced inventory management, decision-making, forecasting, and more.

By component, the hardware segment led the track and trace solutions market in 2024, as hardware track and trace solutions provide many advantages for businesses, with improved supply chain visibility, growing efficiency, and reduced expenses. These solutions offer real-time tracking of goods, allowing better inventory management, rapid response to disruptions, and enhanced regulatory compliance.

The services segment is projected to experience the fastest CAGR from 2025 to 2034, as this service involves modern technologies that allow the real-time monitoring of products as they move through the supply chain. By using tools and technology such as barcodes, RFID tags, GPS, and advanced software, these solutions offer visibility in each stage of the logistics process. By enhancing inventory management, optimizing supply chain technology, and reducing losses due to theft or fraud. Track and trace solutions lead to noteworthy expense savings for pharmaceutical manufacturers.

By end-user industry, the pharmaceuticals segment led the track and trace solutions market in 2024, as a modern drug traceability system that confirms a transparent and clean supply chain, improves patient safety, and grows wider benefits like supporting rational drug use policies, optimizing recall procedures, and mitigating economic challenges such as parallel trade and reimbursement fraud. Develop pharmaceutical track and trace software and systems as significant in defence lines, tracking the pharmaceutical supply chain from production to end-users.

On the other hand, the food & beverage segment is projected to experience the fastest CAGR from 2025 to 2034, as track and trace solutions support monitoring and maintaining the quality of food & beverage products through the supply chain. It confirms that products meet security regulations and standards, lowering the challenges of contamination, spoilage, and foodborne illnesses. It also provides stakeholders, including consumers, with visibility in the entire supply chain.

North America is dominant in the market share by 40% in 2024, as the increasing adoption of advanced technology, such as track and trace software, is a significant factor for modern supply chains. It offers enhanced visibility, compliance, expense reduction, and improves consumer satisfaction. North America's progressive, innovative solutions support achieving an efficient, resilient, and transparent supply chain.

For Instance,

In the U.S., track and trace technology permits pharmaceutical businesses to store and transfer information securely, resulting in enhanced security and data accuracy. This country is a hub of some of the biggest pharma organizations worldwide. It is an as pharmaceutical sector that has been one of the pillars of industrialized economies and is progressively recognized as a significant industry in the developing world. Strong presence of leading pharmaceutical companies in the US, such as Vertex Pharmaceuticals, AbbVie, Bristol-Myers Squibb, Eli Lilly and Company, and Johnson & Johnson, which contributes to the growth of the market.

The Canadian government is applying stringent regulations to lower drug counterfeiting. Thus, increasing demand for track and trace solutions in medical organizations. Medicinal track-and-trace solutions secure Canada’s healthcare supply chain, lowering the chance of counterfeit drugs and providing important services, which drives the growth of the market.

Asia Pacific is the fastest-growing region in the track and trace solutions market in the forecast period, as the healthcare sector is progressively turning to the emerging healthcare sector as a novel frontier for medical development. Governments in this region are actively responding to rapid changes in therapeutic manufacturing; the significant countries such as India, China, Japan, and South Korea are dominant leaders due to a strong government base and growing domestic sector, which contributes to the growth of the market.

R&D significantly focuses effective track-and-trace system that supports pharmaceutical companies in managing their supply chain and reducing the challenges related to counterfeit drugs.

Key players: TraceLink, Antares Vision S.P.A., Optel Group, and Axway

Pharmaceutical serialization is a technology of transferring a unique serial number to every pharmaceutical package; goods can be identified and tracked.

Key players: Infosys, Bosch Packaging, SAP, Axway, and Xyntec Inc

Patient tracking systems in hospitals and clinics enhance clinical decisions, help with medical claims, lower risk, enhance quality of care, surge practice efficiency, progress patient communication, and approval.

Key players: GE Healthcare, Medtronic, Philips, Nihon Kohden, and Mindray

In March 2025, Nish Parekh, senior vice president and chief product officer, Omnicell, stated, “With a continuously evolving regulatory landscape, we believe we need to provide customers with innovative solutions that are designed not only to help support compliance but to remove cumbersome manual tasks from inventory management workflows.”

By Solution Type

By Technology

By Component

By End User Industry

By Region

January 2026

January 2026

January 2026

January 2026