February 2026

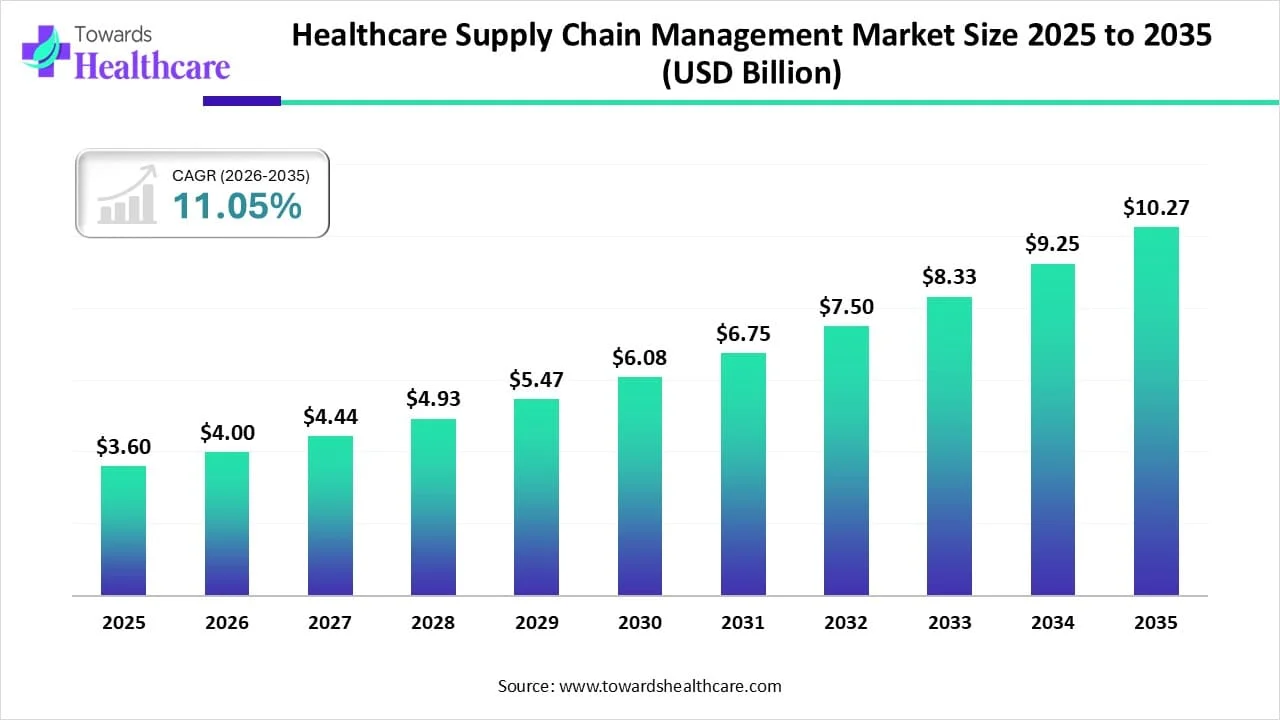

The global healthcare supply chain management market size is calculated at USD 3.60 billion in 2025, grow to USD 4 billion in 2026, and is projected to reach around USD 10.27 billion by 2035. The market is expanding at a CAGR of 11.05% between 2026 and 2035.

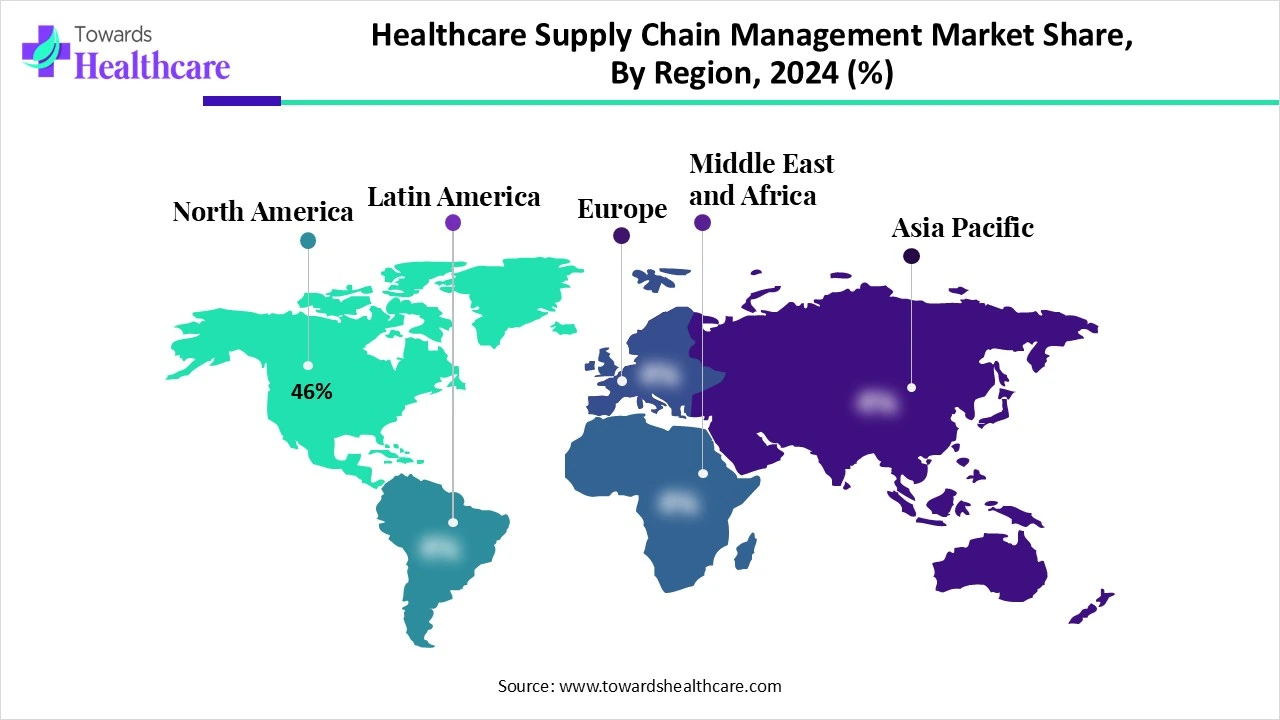

The healthcare supply chain management market is growing rapidly due to the rising need for efficiency, cost reduction, and real-time visibility in healthcare operations. Technological advancements such as AI, IoT, and blockchain are streamlining inventory management and enhancing product traceability. Cloud-based solutions and regulatory compliance are further supporting market expansion. North America leads due to strong infrastructure, while Asia-Pacific is expected to grow fastest, driven by increased healthcare investments and digital transformation across emerging economies.

| Metric | Details |

| Market Size in 2026 | USD 4 Billion |

| Projected Market Size in 2035 | USD 10.27 Billion |

| CAGR (2025 - 2034) | 11.05% |

| Leading Region | North America share by 46% |

| Market Segmentation | By Component, By Delivery Mode, By Function, By End User, By Regions |

| Top Key Players | Oracle Corporation, SAP SE, Infor Inc., McKesson Corporation, Cardinal Health, Inc., Siemens Healthineers, GHX (Global Healthcare Exchange), IBM Corporation, Tecsys Inc., LogiTag Systems, Medius (formerly Wax Digital), Manhattan Associates, Smith & Nephew plc (via SCM digital tools), Jump Technologies, Inc., Zuellig Pharma, Vizient, Inc., O&M Systems, OptiFreight Logistics (Cardinal Health unit), LLamasoft (a Coupa company), Tradeshift |

The market refers to the integrated processes, technologies, and strategies used to ensure the efficient flow of medical products, services, and information across the healthcare ecosystem from manufacturers and distributors to hospitals, pharmacies, and patients. It involves procurement, inventory control, logistics, demand forecasting, and data analytics, helping reduce costs, minimize waste, and improve patient outcomes. The market has gained traction with the digitization of healthcare, adoption of AI/IoT, and supply disruptions from global health events such as COVID-19. Innovation is reshaping healthcare supply chain management by integrating AI, IoT, and blockchain technologies. These advancements improve inventory accuracy, enhance real-time tracking, and streamline logistics. Ass a result, healthcare providers benefit from reduced costs, faster decision-making, and improved delivery efficiency, ultimately leading to better patient outcomes and a more responsive supply chain.

For Instance,

AI is transforming the market by improving efficiency, accuracy, and decision-making. It helps forecast demand, optimize inventory levels, and predict supply disruptions, reducing waste and stockouts. AI also enhances route planning for timely deliveries and ensures better resource allocation. With real-time analytics and automation, AI supports faster, data-driven decisions, ultimately lowering costs and improving patient care through a more responsive and reliable supply chain.

Rising Healthcare Services Demand

The growing demand for healthcare services is driving the healthcare supply chain management market, as rising patient volumes require the timely and efficient delivery of medical supplies, equipment, and pharmaceuticals. Healthcare providers must ensure uninterrupted access to essential resources, pushing them to adopt advanced supply chain solutions. Efficient management helps reduce delays, control costs, and maintain quality care. As healthcare systems expand, the need for streamlined and responsive supply chains becomes increasingly critical, fueling market growth.

For Instance,

High Implementation and Maintenance Costs of Advanced Technologies

The high implementation and maintenance cost of advanced technologies is a significant restraint in the healthcare supply chain management market. Many healthcare providers, especially in developing regions or smaller institutions, face budget constraints that make it difficult to invest in sophisticated systems like AI, IoT, or blockchain. These technologies often require substantial upfront investment, specialized training, and ongoing maintenance, which can limit their adoption. As a result, cost barriers hinder digital transformation and slow overall market expansion.

Rising Shift Towards a Sustainable Supply Chain

The growing shift towards sustainable supply chains presents a major future opportunity in the healthcare supply chain management market. As environmental concerns and regulatory pressure increase, healthcare organizations are focusing on reducing waste, lowering carbon emissions, and using eco-friendly materials. Embracing sustainability not only supports compliance and corporate responsibility but also enhances operational efficiency and cost savings. This shift opens doors for innovative solutions and technologies that enable greener, more resilient, and ethically managed supply chain practices.

For Instance,

The software segment led the market during the studied year because of its ability to streamline complex processes and enhance operational visibility. These digital tools support better coordination across procurement, logistics, and inventory, helping organizations respond swiftly to disruptions. With growing reliance on data-driven insights and automation, software solutions have become essential for improving supply chain accuracy and ensuring the timely delivery of medical supplies, securing their leading shares in the market.

The services segment is expected to register the fastest rate in the healthcare supply chain management market as healthcare providers seek external expertise to manage complex supply chain operations. The growing reliance on third-party vendors for tasks like data management, workflow optimization, and compliance support is fueling demand. Additionally, the need for continuous system upgrades, training, and troubleshooting services is driving rapid expansion of the market during the forecast period.

In 2024, the cloud-based segment held the market due to its flexibility, real-time data access, and cost-effective deployment. Cloud solutions enable seamless integration across multiple facilities, improve collaboration, and support remote monitoring of inventory and logistics. Their scalability and ease of updates make them ideal for evolving healthcare needs. As digital transformation accelerates, the demand for cloud-based platforms continues to rise, driving both their current dominance and fastest projected growth rate in the coming years.

The 2024, the inventory & warehouse management segment held the healthcare supply chain management market in revenue share due to the growing need for accurate stock control and efficient storage of medical supplies. This function is critical in preventing shortages, reducing waste, and ensuring the timely availability of essential products. With rising demand for real-time inventory tracking and automation in warehousing, healthcare providers increasingly invest in advanced solutions, making this market the largest contributor to market revenue.

For Instance,

The supplier performance management segment is predicted to grow rapidly in the healthcare supply chain management market due to the increasing need for reliable, transparent, and quality-driven supplier relationships. As healthcare systems face supply disruption and demand fluctuations, organizations are focusing more on evaluating and improving supplier efficiency, compliance, and delivery timelines. Advanced analytics and performance monitoring tools are being adopted to optimize sourcing strategies, reduce risks, and ensure consistent supply, driving rapid growth of the market.

In 2024, the healthcare providers (Hospitals &Clinics) segment dominated the market as they manage complex, high-volume procurement processes and require seamless coordination to avoid disruptions in patient care. Their dependence on the continuous availability of drugs, devices, and critical supplies has pushed them to adopt robust supply chain systems. Additionally, the growing focus on operational efficiency and cost control in clinical settings has further fueled their leading shares in the market.

For Instance,

The group purchasing organizations (GPOs) segment is expected to grow at the fastest rate in the healthcare supply chain management market due to its ability to simplify vendor negotiations and offer competitive pricing through bulk purchasing. GPOs also provide valuable services like contract management, compliance support, and data-driven insights. As healthcare providers aim to reduce procurement costs and improve efficiency, GPOs are becoming an increasingly attractive option, driving their rapid growth during the forecast period.

North America dominated the healthcare supply chain management market share by 46% in 2024 due to its advanced healthcare infrastructure, widespread adoption of cutting-edge technologies, and strong presence of major industry players. The region benefits from high healthcare spending, robust regulatory frameworks, and early adoption of cloud-based and AI-driven solutions. Additionally, the growing demand for efficient inventory and logistics management in the U.S. and Canadian health systems further strengthens the region’s leading position in the global market.

For Instance,

The U.S. market is experiencing significant growth, driven by the increasing need to reduce operational costs and enhance efficiency across healthcare systems. Hospitals and providers are adopting advanced technologies like AI, IoT, and cloud-based solutions to optimize inventory, improve demand forecasting, and streamline procurement processes. Additionally, the shift towards value-based care and the emphasis on regulatory compliance are prompting investments in robust supply chain infrastructures, positioning the market for continued expansion.

For Instance,

The Canadian market is expanding rapidly, driven by increasing demand for efficient logistics and inventory optimization in hospitals and clinics. The integration of advanced technologies like AI, IoT, and blockchain enhances real-time tracking and predictive analytics, improving supply chain efficiency. Significant investments in healthcare infrastructure, particularly in provinces like Ontario, Quebec, and British Columbia, further support this growth. Additionally, Canada's robust regulatory framework and focus on cost containment contribute to the market's upward trajectory.

Asia-Pacific is expected to grow at the fastest rate in the market due to rising healthcare infrastructure investments, increasing adoption of digital technologies, and expanding patient populations. Emerging economies like China, India, and Southeast Asian countries are modernizing their healthcare systems and embracing cloud-based and AI-powered supply chain tools. Additionally, the growing focus on cost efficiency, regulatory improvements, and government support for digital health transformation is accelerating market growth across the region.

For Instance,

China’s market is growing steadily due to government initiatives like "Healthy China 2030," which emphasize infrastructure modernization and digital transformation. The adoption of AI, IoT, and big data is enhancing inventory tracking and demand forecasting. Additionally, the rise of healthcare e-commerce platforms like JD Health is improving the efficiency of medical supply distribution, further driving market expansion across the country.

India's market is expanding due to the rapid digitalization of healthcare infrastructure and the increasing need for operational efficiency. The growing demand for real-time data tracking, automation, and inventory optimization across hospitals and pharmaceutical companies is encouraging the adoption of advanced supply chain solutions. Government initiatives promoting the use of health IT systems and investments in smart healthcare facilities further support market expansion. Additionally, the rising prevalence of chronic diseases and the need for uninterrupted access to essential medical supplies are propelling demand for reliable and agile supply chain networks.

For Instance,

Europe is accelerating its market due to several key factors. The European Union's regulatory frameworks, such as the EU4Health program, aim to strengthen healthcare systems and reduce reliance on external suppliers. Technological advancements, including the adoption of AI, IoT, and blockchain, are enhancing operational efficiency and transparency. Additionally, the shift towards value-based care and the need to manage an aging population are driving the demand for streamlined and cost-effective supply chains. Collaborations between logistics companies and healthcare providers further support this growth.

The UK's market is expanding due to the adoption of digital technologies like AI and IoT, enhancing operational efficiency. Government initiatives, such as the NHS's 10-year plan, emphasize digital transformation and decentralized care, further driving growth. Additionally, the increasing demand for temperature-controlled logistics, especially for sensitive pharmaceuticals, is propelling the market forward. These factors collectively contribute to the robust expansion of the UK's healthcare supply chain sector.

Germany's market is expanding due to significant investments in digital technologies, including AI, IoT, and automation, which enhance operational efficiency and transparency. The country's robust logistics infrastructure and its role as a central hub in the European Union facilitate cross-border healthcare logistics. Additionally, the emphasis on regulatory compliance and the need to manage an aging population contribute to the market's growth.

The Middle East & Africa are expected to grow at a considerable CAGR in the upcoming period. The rapidly expanding healthcare supply chain infrastructure, through investments by government and private organizations, augments the market. The region is considered one of the key emerging regions in the healthcare and life science industries, with the increasing demand for healthcare and pharmaceutical products.

DHL Group, a German company, announced plans to invest €500 million in healthcare services in Africa and the Middle East over the next five years. The company aims to create growth opportunities in Africa, particularly in time-critical shipments of vaccines, stem cells, and cryogenics. It projects a total revenue of $33.8 billion by 2030.

Latin America is expected to grow at a notable CAGR in the healthcare supply chain management market in the foreseeable future. The burgeoning healthcare sector and healthcare expenditure boost the market. Favorable government support and growing investments in the healthcare sector propel market growth. The presence of key players, rising adoption of digital solutions, and evolving regulatory landscape foster the market.

Brazil mainly imports healthcare products from the U.S. and Europe. The healthcare supply chain is shaped by the government’s central role in the public healthcare system. Brazil’s Health Regulatory Agency (ANVISA) is the counterpart of the FDA that regulates healthcare products and their supply chain in Brazil.

Global tariffs are posing a serious threat to the healthcare supply chain, particularly due to U.S. import duties on medical goods from major manufacturing nations. These tariffs are driving up costs, causing supply delays, and risking shortages of vital medical equipment and pharmaceuticals. In response, ECRI has introduced new data tools to support healthcare providers in navigating these challenges. Its Supply Chain Navigator helps over 4,000 health systems make informed, strategic purchasing decisions, especially for tariff-affected PPE like masks and gloves, by identifying safe, cost-effective alternatives. (Source - ECRI)

By Component

By Delivery Mode

By Function

By End User

By Region

February 2026

February 2026

February 2026

February 2026