February 2026

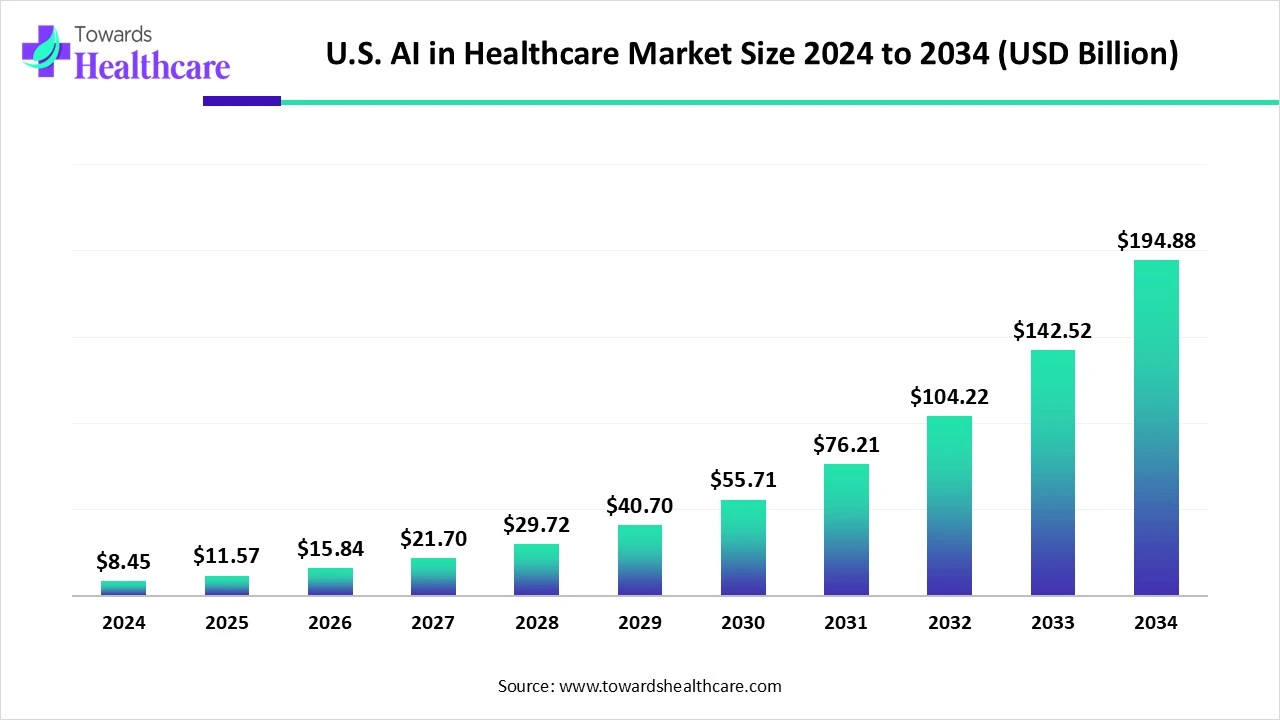

The U.S. AI in healthcare market size stood at US$ 8.45 billion in 2024, grew to US$ 11.57 billion in 2025, and is forecast to reach US$ 194.88 billion by 2034, expanding at a CAGR of 36.97% from 2025 to 2034.

The U.S. AI in healthcare market is experiencing rapid growth, driven by advancements in machine learning, natural language processing, and big data analytics. The integration of AI technologies is drug discovery and patient monitoring, improving both efficiency and clinical outcomes. Widespread adoption of electronics health records, telehealth platforms, and wearable devices is generating vast datasets, enabling AI systems to deliver more accurate predictions and personalized care.

Strong investments from technology companies, healthcare providers, and government bodies are accelerating innovation, while supportive regulatory frameworks ensure safe and effective implementation. The market is also benefiting from the increasing demand for precision medicine and the need to reduce healthcare costs through automation and predictive analytics.

| Table | Scope |

| Market Size in 2025 | USD 11.57 Billion |

| Projected Market Size in 2034 | USD 194.88 Billion |

| CAGR (2025 - 2034) | 36.97% |

| Market Segmentation | By Application, By Technology, By End User, By Deployment Mode |

| Top Key Players | IBM Watson Health, Google Health (DeepMind), Microsoft Healthcare, Amazon Web Services (AWS) Healthcare, NVIDIA Corporation, Tempus Labs, PathAI, Aidoc, Butterfly Network, Zebra Medical Vision, Viz.ai, Olive AI, Caption Health, Freenome, Qventus, Arterys, AliveCor, Berkeley Lights, Corti, Health Catalyst |

The U.S. AI in Healthcare Market encompasses artificial intelligence technologies applied across healthcare delivery, including diagnostics, treatment planning, patient monitoring, administrative automation, and drug discovery. AI tools leverage machine learning, natural language processing, computer vision, and robotics to enhance clinical decision-making, improve patient outcomes, reduce operational costs, and streamline healthcare workflows. The U.S. market leads globally due to its advanced healthcare infrastructure, high R&D investments, extensive health data availability, and supportive regulatory environment.

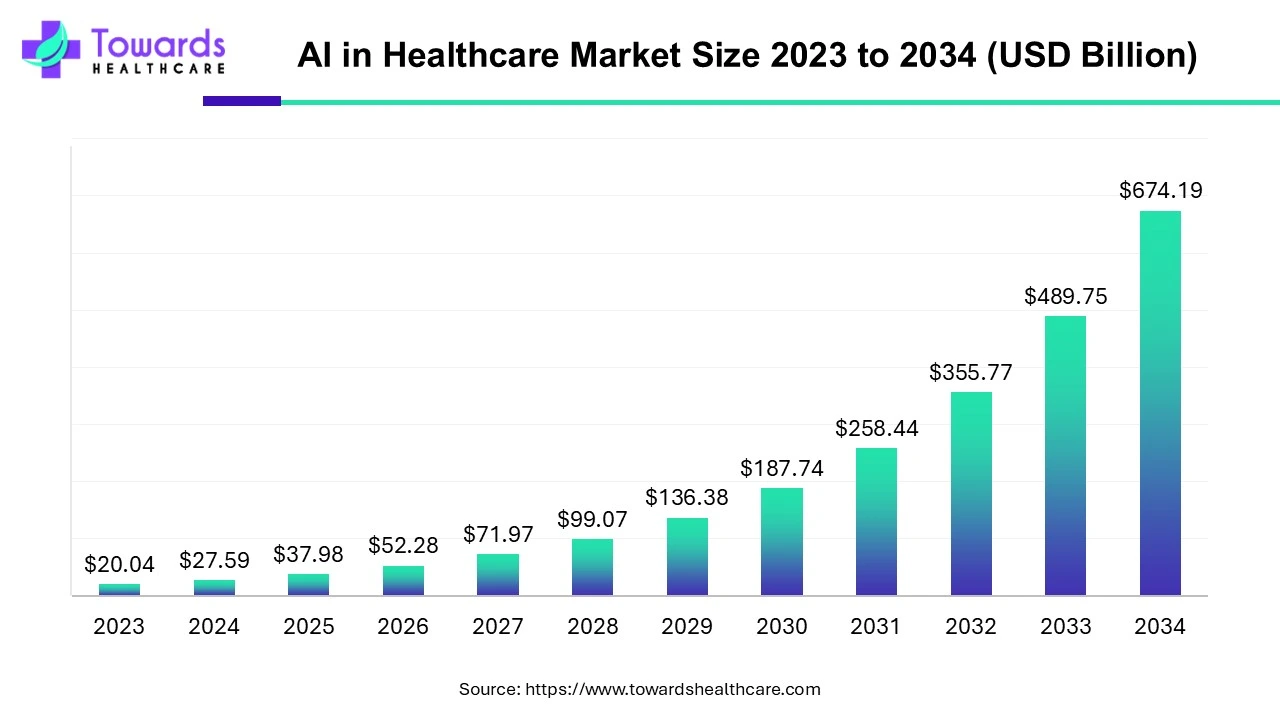

The AI in healthcare market is expected to grow from USD 37.98 billion in 2025 to USD 674.19 billion by 2034, at a CAGR of 37.66%, driven by advanced technology adoption, innovations in clinical research, and rising demand for personalized healthcare.

Adoption of Inorganic Growth Strategies

Adoption of inorganic growth strategies such as partnerships and collaborations can significantly drive the growth of the U.S. AI in healthcare market by enabling faster technology integration, broader market reach, and enhanced innovation. Collaborations between healthcare providers, AI technology firms, and research institutions facilitate the co-development of advanced solutions tailored to clinical needs.

For instance,

Wide-scale Adoption of Generative AI

A significant 85% of healthcare leaders including payers, health systems, and technology groups are exploring or implementing generative AI capabilities, with many projects moving from proof-of-concept to deployment.

Explosion of AI Clinical Decision Support Tools

AI-powered platforms like OpenEvidence are becoming integral: used by over 40% of U.S. physicians daily, and deployed across more than 10,000 hospitals. Their tools are valued in the billions, reflecting dramatic adoption and investment.

Generative AI in Administrative Workflows

Startups such as Abridge are gaining traction, raising significant funding and planning strategic acquisitions to expand AI-driven solutions for clinical notes, billing, decision support, and care management.

Advanced Patient Monitoring Innovation

At the Cleveland Clinic, a pioneering AI system analyzes real-time EEG data in ICU settings detecting neurological issues like seizures within seconds, vastly reducing traditional delays in diagnosis.

Ethical and Regulatory Oversight Intensifies

States like Illinois are taking proactive regulatory steps to ban AI-powered therapy without licensed professionals involved, addressing concerns over safety and misuse. Meanwhile, AI facial recognition tools (e.g., “FaceAge”) that assess health indicators via facial features are stirring ethical debate over validity and potential misuse.

Growing Need for ROI-Driven AI Investments

Healthcare organizations are displaying more risk tolerance in investing in AI, but also demanding that solutions demonstrate tangible ROI through improved efficiency, cost savings, or clinical outcomes.

AI Tools Tackle Clinician Burnout

There’s a clear push toward AI scribes and ambient assistance technologies to relieve administrative burdens, freeing clinicians to focus on patient care and reducing burnout.

Rapid Regulatory Clearing of AI Tools

The FDA’s expanding list of authorized AI/ML-enabled devices (spanning imaging, cardiology, ultrasound, and more) lowers adoption risk for providers. ONC’s TEFCA/interoperability rules are pushing nationwide exchange of electronic health information, fuel for training and deploying AI. Medicare/commercial pathways are emerging and being refined for clinical AI, making deployments financially sustainable. A projected shortfall of up to ~86,000 physicians by 2036 intensifies demand for AI that automates documentation, triage, diagnostics, and care coordination.

Data Privacy and Security Concerns & Clinical Skepticism, and Workflow Disruption

The key players operating in the market are facing the Strict HIPAA regulations, along with growing patient sensitivity to how their health data is used, which creates barriers to widespread AI adoption, especially for cloud-based or cross-institutional AI solutions. Many clinicians are hesitant to rely on AI insights due to concerns about accuracy, liability, or disruption to established workflows, slowing acceptance in real-world practice.

Capital Inflows & Startup Activity & Shift to Value-Based Care & Operational Efficiency

AI captured the majority of U.S. digital health funding in early 2025, with large rounds for clinical documentation, decision support, and drug discovery accelerating product maturity and market education. Payers and providers are prioritizing tools that improve outcomes per dollar exactly where AI can reduce denials, speed coding, optimize staffing, and cut waste. (Supported by reimbursement and investment trends.)

Explosion of Usable Clinical Text & Imaging Data

EHR ubiquity and imaging volume, combined with LLM advances, make ambient scribing, summarization, and multimodal decision support practical at scale. (Enabled by FDA clearances and TEFCA.)

Pharma & Life-Sciences Pull.

Drug discovery and trial operations increasingly rely on AI, creating cross-sector demand that spills into provider settings (e.g., patient finding, real-world evidence). Well-funded players are consolidating talent and tech, speeding category maturation and enterprise-grade offerings.

The diagnostics segment dominates the market due to its ability to enhance accuracy, speed, and efficiency in disease detection across imaging, pathology, and laboratory testing. Advanced AI algorithms assist radiologists and pathologists by identifying anomalies with higher precision and reducing human error. The rising prevalence of chronic diseases and cancer, coupled with increasing imaging volumes, drives demand for AI-powered diagnostic tools. Moreover, favourable reimbursement policies, regulatory approvals, and growing adoption of digital imaging systems further bolster the segment. Hospitals and diagnostic centers are leveraging AI to optimize workflows, improve patient outcomes, and reduce operational costs, solidifying their market leadership.

The administrative workflow automation segment is anticipated to be the fastest-growing application area in the U.S. AI in healthcare market due to the urgent need to reduce clinician burnout and improve operational efficiency. AI-powered tools streamline tasks such as medical coding, prior authorization, billing, appointment scheduling, and documentation, saving time and minimizing errors. The increasing adoption of electronic health records (EHRs) and the push toward value-based care models further accelerate demand for automation. Additionally, hospitals and physician practices are seeking solutions to optimize resource allocation, reduce administrative costs, and ensure compliance, making AI-driven workflow automation a critical growth driver in the healthcare ecosystem.

The machine learning (ML) segment dominates the U.S. AI in healthcare market due to its versatility, proven effectiveness, and broad applicability across clinical and operational functions. ML algorithms can analyze vast amounts of structured and unstructured healthcare data—including EHRs, imaging, genomics, and claims to detect patterns, predict outcomes, and support clinical decision-making. Its ability to continuously learn and improve over time enhances diagnostic accuracy, treatment recommendations, and patient risk stratification. Furthermore, regulatory approvals and integration with existing healthcare IT systems, along with strong investment in ML-based solutions, have established it as the most widely adopted and reliable AI technology in the U.S. healthcare sector.

The deep learning (DL) segment is estimated to grow at the fastest rate in the U.S. AI in healthcare market due to its exceptional ability to process complex, high-dimensional data such as medical imaging, genomics, and multimodal clinical records. Deep learning algorithms excel at detecting subtle patterns in radiology scans, pathology slides, and ECGs, enabling faster and more accurate diagnostics. Advances in computing power, cloud infrastructure, and the availability of large annotated datasets have accelerated model development and deployment. Additionally, increasing FDA approvals for deep learning-based diagnostic and decision-support tools, along with strong interest from hospitals and pharmaceutical companies, are driving rapid adoption and market expansion.

The hospitals & health systems segment dominates the U.S. AI in healthcare market due to their large patient volumes, extensive clinical workflows, and significant data resources, which make AI implementation both impactful and cost-effective. Hospitals leverage AI for diagnostics, administrative workflow automation, predictive analytics, and patient monitoring, improving operational efficiency and clinical outcomes. Rising demand for precision medicine, chronic disease management, and value-based care further drives adoption. Additionally, hospitals and health systems have greater access to capital and infrastructure to integrate AI tools, while partnerships with technology providers and regulatory support for AI-enabled solutions strengthen their position as the leading end-users in the market.

The diagnostic laboratories & imaging centers segment is anticipated to be the fastest-growing end-user segment in the U.S. AI in healthcare market due to the increasing demand for rapid, accurate, and high-volume diagnostic services. AI technologies enhance imaging interpretation, pathology analysis, and lab result processing, improving precision while reducing turnaround times. The rising prevalence of chronic diseases, cancer, and cardiovascular conditions drives the need for advanced diagnostic tools. Additionally, regulatory approvals for AI-powered diagnostic devices, growing adoption of digital imaging systems, and the push for operational efficiency and cost reduction in labs and imaging centers further accelerate AI integration, making this segment a key growth driver in the market.

The cloud-based segment is both the dominant and fastest-growing deployment mode in the U.S. AI in healthcare market due to its scalability, cost-effectiveness, and accessibility. Cloud platforms enable healthcare providers to store and analyze vast amounts of medical data, including electronic health records, imaging, and genomic information, without the need for heavy on-premise infrastructure. This flexibility supports real-time collaboration across hospitals, clinics, and research institutions, improving patient outcomes through faster decision-making. The surge in telemedicine, remote patient monitoring, and AI-driven diagnostic tools further boosts cloud adoption. Additionally, leading technology companies are partnering with healthcare organizations to enhance cloud-based AI applications, while robust cybersecurity measures and compliance with HIPAA regulations strengthen trust, ensuring rapid and sustained market expansion.

For instance,

The U.S. leads AI in healthcare due to a uniquely dense mix of academic medical centers, Big Tech–EHR partnerships, clear (and evolving) guardrails, and strong public R&D funding. Clinically, the FDA now maintains an actively updated list of AI-enabled devices authorized for U.S. use, giving innovators and hospitals unusual regulatory clarity for adoption.

Policy Levers Also Help: ONC’s HTI-1 rule added first-of-its-kind algorithm transparency requirements for certified health IT, while HHS published a sector-wide AI strategic plan that coordinates oversight from research through delivery. Federal investment pipelines, NIH’s Bridge2AI data initiatives, and ARPA-H awards continue to seed high-quality datasets and translational programs, and reimbursement pathways (e.g., CPT 92229 for autonomous diabetic-retinopathy screening) lower adoption friction. On the industry side, deep collaborations such as Microsoft–Epic accelerate generative-AI workflows in electronic health records.

Recent developments Underscore Momentum and Flux: the FDA’s AI device list was refreshed in July 2025; Microsoft unveiled a diagnostic AI orchestrator reported to outperform physicians on complex cases; and federal oversight is shifting after the January 2025 revocation of the 2023 AI executive order, signaling a pro-innovation but still supervised environment.

In February 2025, Kees Wesdorp, PhD, President and CEO of RadNet’s Digital Health division, stated that at DeepHealth, the company is harnessing the transformative power of AI to develop efficient solutions that are deeply rooted in real-world clinical needs. AI adoption at scale in radiology, in DeepHealth, Inc. company’s opinion, can only be accomplished by integrating AI into clinical and operational workflows and integrating data to enable radiologists and care teams that DeepHealth, Inc. company rely on disjointed devices and various data sources. DeepHealth, Inc. company is thrilled to present its next-generation population screening and radiology informatics solutions at ECR 2025, which are intended to improve clinical confidence, operational effectiveness, and care delivery throughout the radiology continuum.

By Application

By Technology

By End User

By Deployment Mode

February 2026

February 2026

February 2026

February 2026