February 2026

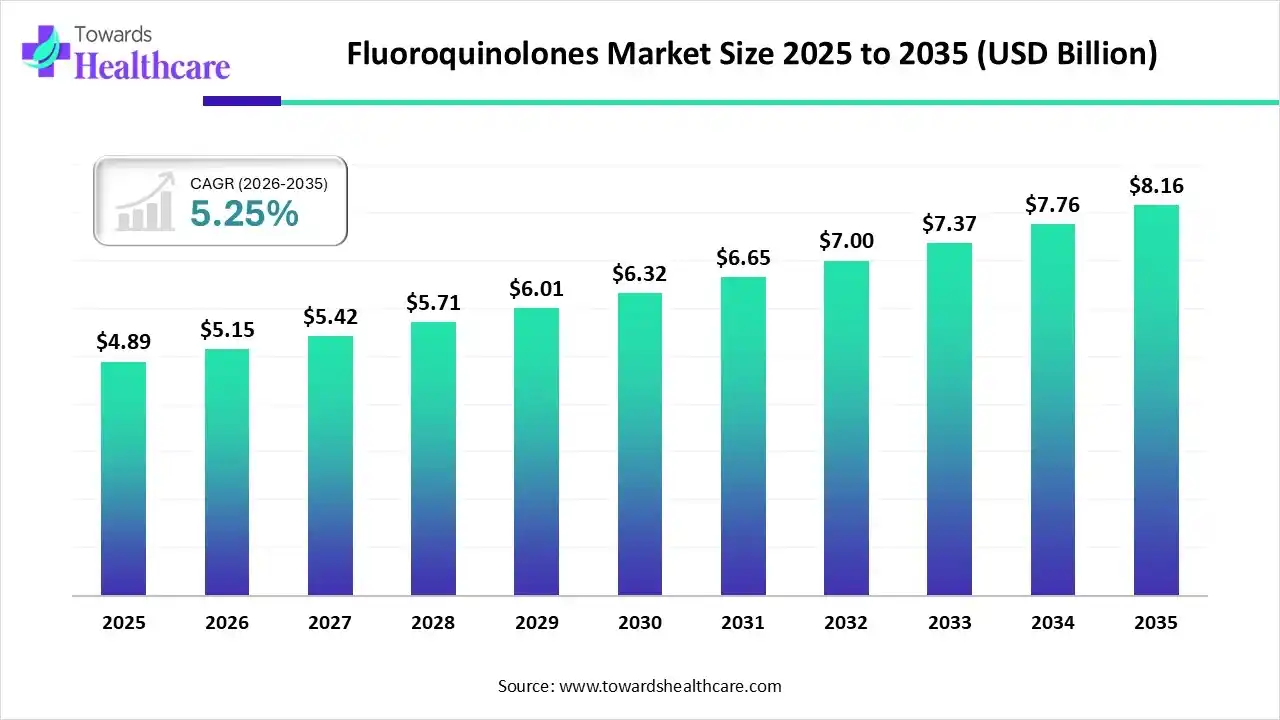

The global fluoroquinolones market size was estimated at USD 4.89 billion in 2025 and is predicted to increase from USD 5.15 billion in 2026 to approximately USD 8.16 billion by 2035, expanding at a CAGR of 5.25% from 2026 to 2035.

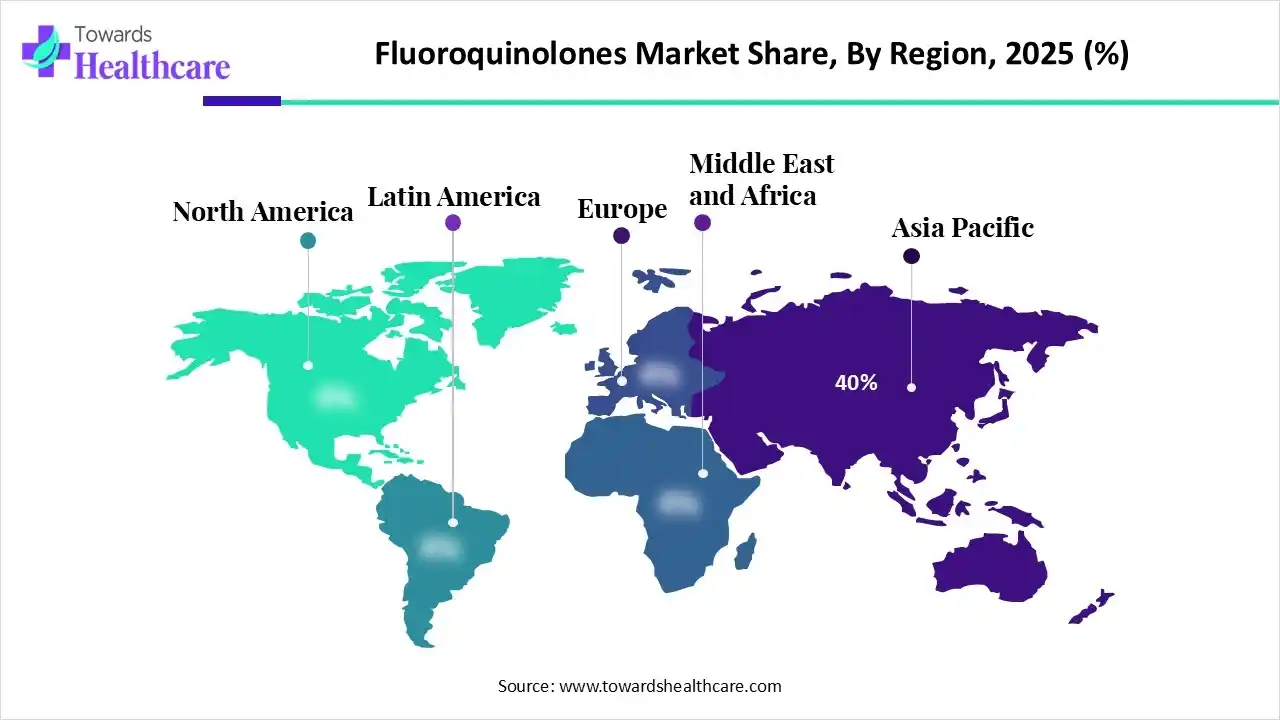

The global fluoroquinolones market is driven by widespread use in treating respiratory, urinary, and gastrointestinal infections, supported by broad-spectrum efficacy and established clinical acceptance. Asia-Pacific dominates due to expanding generic manufacturing, high disease burden, improving healthcare access, and strong antibiotic demand across emerging economies with regulatory oversight and stewardship initiatives.

| Key Elements | Scope |

| Market Size in 2026 | USD 5.15 Billion |

| Projected Market Size in 2035 | USD 8.16 Billion |

| CAGR (2026 - 2035) | 5.25% |

| Leading Region | Asia Pacific by 40% |

| Market Segmentation | By Molecule, By Route of Administration, By Therapeutic Indication, By End-User, By Drug Type, By Antimicrobial Resistance Application, By Region |

| Top Key Players | Bayer AG, Pfizer Inc., Johnson & Johnson (Janssen), Novartis / Sandoz, Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Ltd., Cipla Limited, Merck & Co., Inc., Hikma Pharmaceuticals plc, Dr. Reddy’s Laboratories Ltd. |

Fluoroquinolones are a class of broad-spectrum synthetic antibiotics that inhibit bacterial DNA gyrase and topoisomerase IV, effectively treating bacterial infections. They are widely used for respiratory, urinary tract, gastrointestinal, and skin infections. The global fluoroquinolones market is driven by rising infectious disease burden, growing hospital admissions, expanding generic drug production, improved healthcare access in emerging economies, and continued demand for cost-effective, orally administered antibiotics.

AI integration is enhancing the global fluoroquinolones market by optimizing drug discovery, accelerating compound screening, and identifying novel antibiotic candidates with improved efficacy and safety profiles. Advanced analytics support more accurate disease surveillance, guiding targeted antibiotic use and stewardship. AI-driven predictive models improve supply chain planning and demand forecasting, reducing shortages. Clinical decision support tools help physicians select appropriate fluoroquinolone therapies, minimizing resistance risks and improving patient outcomes, ultimately boosting market efficiency and growth.

Fluoroquinolones continue to be widely prescribed for respiratory, urinary tract, and gastrointestinal infections. Their broad-spectrum activity, oral availability, and cost-effectiveness support continued use, particularly in regions facing high infectious disease prevalence.

Growing concerns around antimicrobial resistance and adverse effects are reshaping prescribing practices. Regulatory agencies are promoting cautious use, influencing demand patterns while encouraging optimized dosing, restricted indications, and stronger pharmacovigilance across global healthcare systems.

The fluoroquinolones market is increasingly driven by generic fluoroquinolones following patent expirations. Strong manufacturing capabilities in Asia-Pacific enhance supply stability and affordability, supporting widespread adoption in emerging markets while intensifying competition among pharmaceutical producer

Hospitals and governments are emphasizing antibiotic stewardship to reduce misuse. These initiatives aim to preserve drug efficacy while ensuring appropriate clinical use, shaping future market growth through controlled demand rather than unrestricted volume expansion.

Rising healthcare infrastructure investments and expanded access to essential medicines in developing regions support continued fluoroquinolone consumption. Public health programs and increased hospital penetration contribute to steady long-term demand despite regulatory tightening.

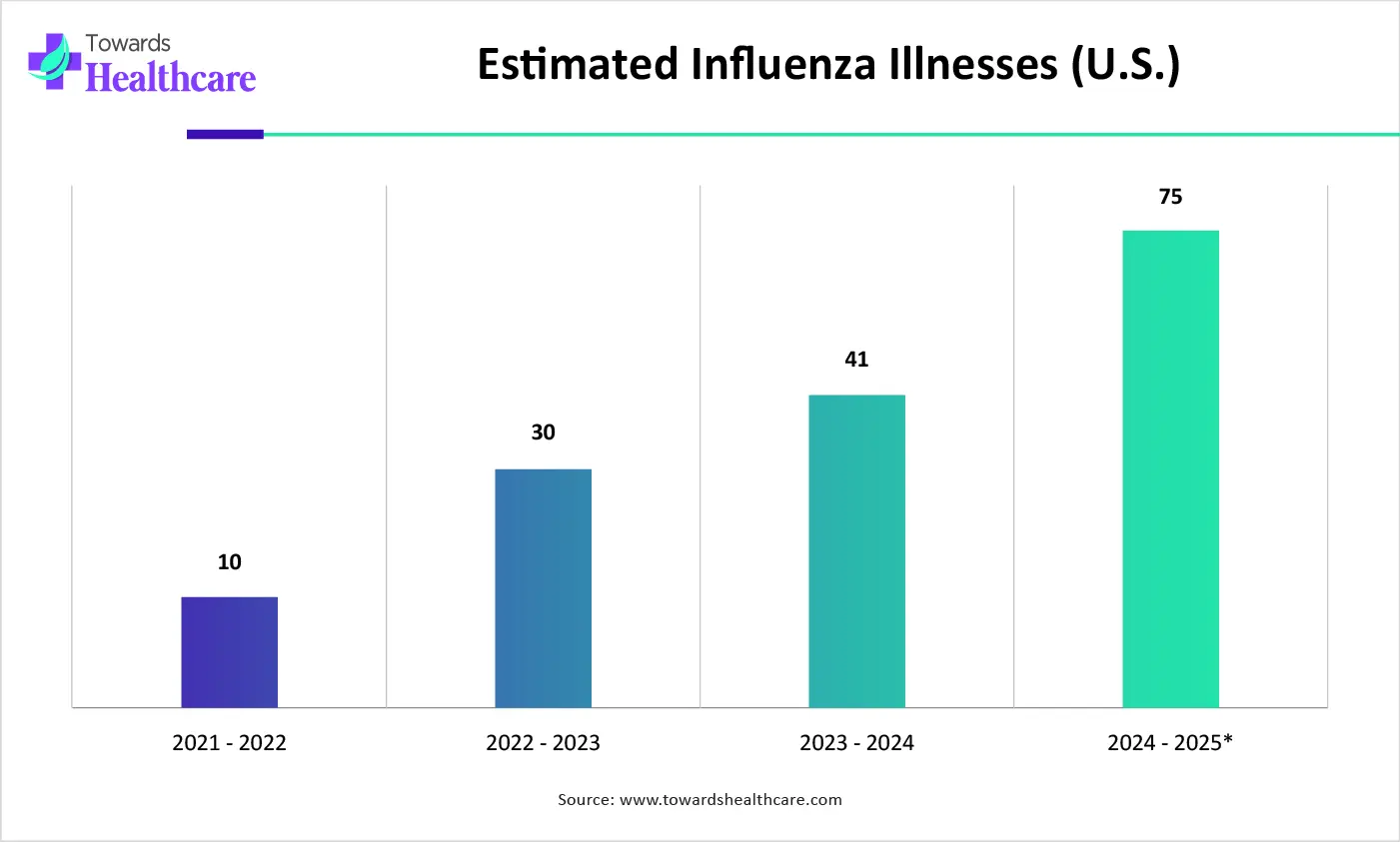

| Year | Estimated Influenza Illnesses (U.S.) (In Millions) |

| 2021-2022 | ~ 10 million |

| 2022-2023 | ~ 30 million |

| 2023-2024 | ~ 41 million |

| 2024-2025 | ~ 75 million (prelim) |

Which Molecular Segment Dominated the Fluoroquinolones Market?

The ciprofloxacin segment dominates the global market with a share of approximately 38% due to its broad-spectrum efficacy, extensive clinical acceptance, and wide use in urinary, respiratory, and gastrointestinal infections. Strong availability of cost-effective generics, inclusion in essential medicines lists, and high prescription rates across hospitals and outpatient settings further reinforce its market leadership.

Delafloxacin & Next-Generation Agents

The delafloxacin & next-generation agents segment is estimated to be the fastest-growing segment, with a CAGR of approximately 12% due to improved activity against resistant pathogens, enhanced safety profiles, and expanded indications for skin and respiratory infections. Growing concerns over resistance to older agents, regulatory approvals for newer molecules, and increasing hospital adoption drive accelerated uptake of these advanced therapies.

Why Did the Oral Fluoroquinolones Segment Dominate the Fluoroquinolones Market?

The oral fluoroquinolones segment dominates the global market with a share of approximately 65% because oral formulations offer high bioavailability with systemic efficacy, are easy and non-invasive to administer, and significantly improve patient compliance. These factors make them well-suited for outpatient care and broad community use, reducing healthcare costs and enhancing accessibility compared with parenteral routes.

Parenteral/Injectable Fluoroquinolones

The parenteral/injectable fluoroquinolones segment is anticipated to be the fastest-growing route, with a CAGR of approximately 10% in the fluoroquinolones market because it enables rapid, direct delivery into the bloodstream with higher bioavailability and immediate therapeutic effect, making it vital for severe, hospital-based infections and critical care. Its growth is also driven by advanced healthcare infrastructure, rising complicated bacterial cases, and innovation in injectable delivery technologies.

Which Therapeutic Indication Segment Led the Fluoroquinolones Market?

The respiratory tract infections segment dominates the global market because these antibiotics are highly effective against common respiratory pathogens causing pneumonia, bronchitis, and sinusitis. Their broad-spectrum activity, frequent clinical use due to the high prevalence of respiratory infections worldwide, and strong prescription patterns in both community and hospital settings drive this leading application segment.

Urinary Tract Infections (UTIs)

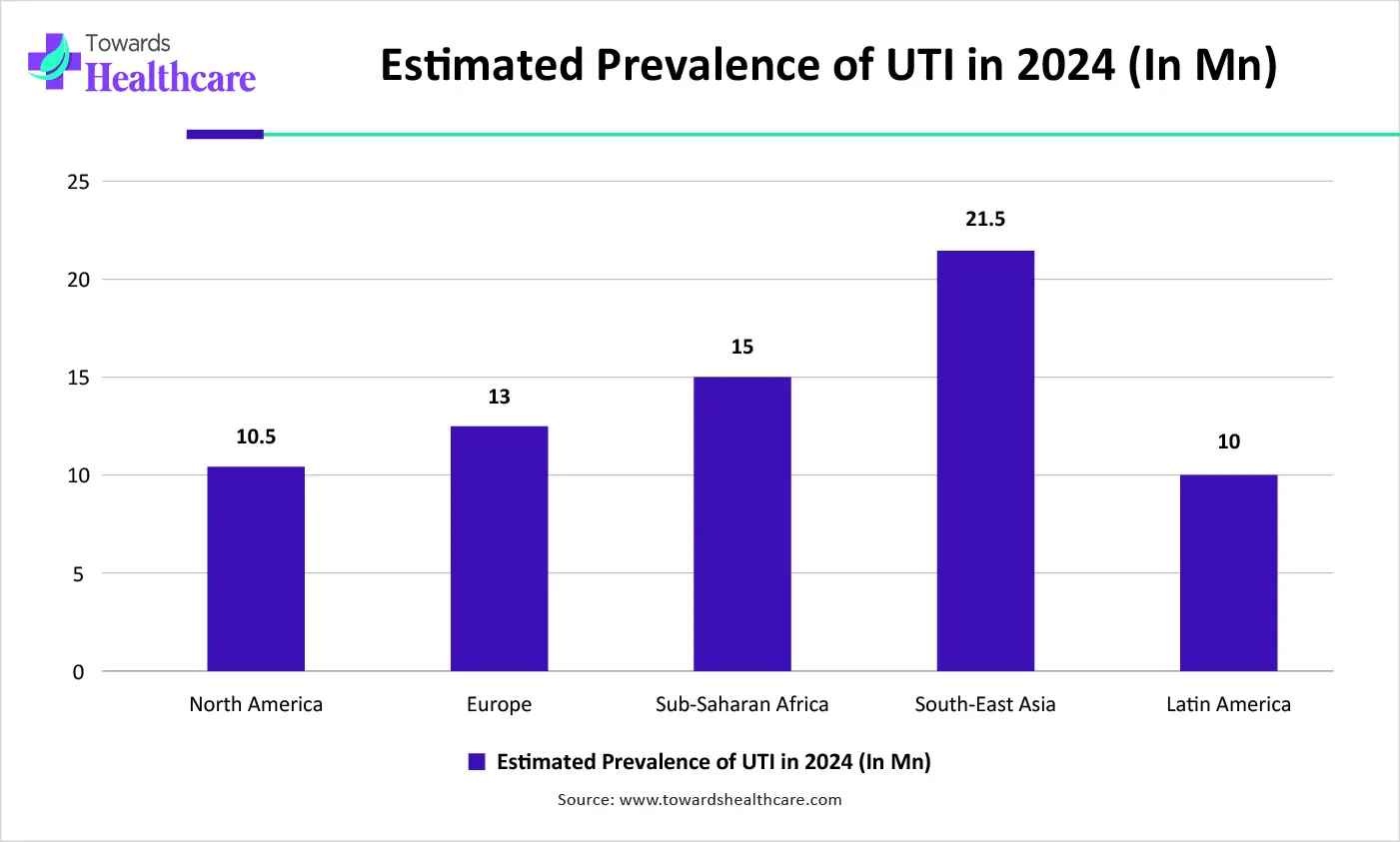

The urinary tract infections (UTIs) segment is estimated to be the fastest growing in the global fluoroquinolones market due to the high and rising prevalence of UTIs worldwide, especially among women, combined with fluoroquinolones’ broad-spectrum efficacy against common uropathogens and strong clinical adoption for both uncomplicated and complicated infections, which increases prescribing and treatment demand.

Why Did the Hospitals & Inpatient Settings Segment Dominate the Fluoroquinolones Market?

The hospitals & inpatient settings segment dominates the global market with a share of approximately 45% because hospitals treat a high volume of severe and complicated bacterial infections requiring broad‑spectrum antibiotics, intravenous administration, monitored care, and strict clinical protocols. Their advanced infrastructure, diagnostic capabilities, and bulk procurement further sustain high fluoroquinolone utilization in inpatient care.

Outpatient & Ambulatory Care Centers

The outpatient & ambulatory care centers segment is anticipated to be the fastest growing in the global fluoroquinolones market, with a CAGR of approximately 10% because rising outpatient antibiotic prescriptions, expanding primary care access, and telemedicine‑enabled diagnosis increase demand for convenient, effective treatments. Oral, easy‑to‑administer fluoroquinolones support decentralized care, improve adherence, and reduce hospital stays, driving broader use in clinics and ambulatory settings.

Which Drug Type Segment Dominated the Fluoroquinolones Market?

The generic fluoroquinolones segment dominated the market with a share of approximately 70% because patent expirations allow many manufacturers to enter with cost‑effective alternatives that expand access and lower prices, encouraging wider prescribing and use, especially in price‑sensitive regions. Increased regulatory support for generic approvals and competitive pricing boosts adoption across healthcare settings, driving high-volume sales relative to branded drugs.

Branded Fluoroquinolones

The branded fluoroquinolones segment is estimated to be the fastest-growing segment, with a CAGR of approximately 9% because established brands benefit from strong physician trust, recognized clinical performance, and extensive marketing that reinforce prescriber preference. Brand reputation and perceived quality often outweigh cost, leading to sustained use in key markets. Additionally, major pharmaceutical companies support these products with ongoing promotion, regulatory familiarity, and wide distribution networks that maintain market leadership.

What made the Standard Susceptible Pathogen Use Segment the Dominant Segment in the Market?

The standard susceptible pathogen use segment dominates the global market with a share of approximately 70% due to its broad-spectrum efficacy, proven clinical outcomes, and strong physician preference. Its established safety profile, widespread hospital adoption, and alignment with standard treatment guidelines for common bacterial infections reinforce its leading position over more specialized or newer alternatives.

Resistant/Complicated Infection Use

The resistant/complicated infection use segment is estimated to be the fastest-growing, with a CAGR of approximately 12% in the global fluoroquinolones market due to rising antibiotic resistance, increasing prevalence of multidrug-resistant infections, and growing demand for advanced therapeutic options. Enhanced efficacy against complicated infections and expanding clinical applications in hospitals further drive its rapid adoption worldwide.

Asia Pacific dominated the fluoroquinolones market in 2025 with a share of approximately 40% due to its large population base, high prevalence of bacterial infections, and expanding healthcare infrastructure. Growing awareness of infectious disease management, increasing accessibility of advanced antibiotics, and rising government initiatives to combat infectious diseases further strengthen the region’s leading position in fluoroquinolone consumption.

China Market Trends

China leads the Asia-Pacific market due to its large population, high infection prevalence, expanding healthcare infrastructure, and strong pharmaceutical manufacturing capabilities. Government support for antibiotic accessibility and increasing awareness of infectious disease management further strengthens China’s dominant position.

North America is estimated to host the fastest-growing fluoroquinolones market during the forecast period due to rising cases of antibiotic-resistant infections, increasing adoption of advanced healthcare technologies, and the strong presence of key pharmaceutical companies. Enhanced awareness of infectious disease management and expanding hospital networks further drive rapid fluoroquinolone usage across the region.

U.S Market Trends

The U.S. dominates the North America market due to its advanced healthcare infrastructure, high prevalence of bacterial infections, and strong pharmaceutical industry presence. Widespread adoption of innovative antibiotics, robust regulatory support, and growing awareness of effective infection management reinforce the country’s leading position in fluoroquinolone consumption.

Europe is expected to grow at a significant CAGR in the fluoroquinolones market during the forecast period due to increasing antibiotic resistance, rising awareness of infectious disease management, and expanding healthcare infrastructure. Strong government initiatives, adoption of advanced treatment protocols, and the growing presence of key pharmaceutical companies further drive fluoroquinolone usage, supporting the region’s steady market expansion.

UK Market Trends

The UK dominates the Europe fluoroquinolones market due to its advanced healthcare system, high adoption of innovative antibiotics, and strong regulatory framework. Rising awareness of bacterial infection management, a well-established pharmaceutical industry, and widespread hospital and outpatient antibiotic usage further reinforce the UK’s leading position within the European market.

| Region | Estimated UTI Cases (Millions, 2024) |

| North America | 10.5 |

| Europe | 13 |

| Sub-Saharan Africa | 15 |

| South-East Asia | 21.5 |

| Latin America | 10 |

| Vendor | Headquarters | Key Fluoroquinolone Offerings / Focus |

| Bayer AG | Leverkusen, Germany 🇩🇪 | Ciprofloxacin/moxifloxacin formulations, including branded and ophthalmic products |

| Pfizer Inc. | New York City, USA 🇺🇸 | Broad portfolio of fluoroquinolone antibiotics, including branded and generic formulations. |

| Johnson & Johnson (Janssen) | New Brunswick, New Jersey, USA 🇺🇸 | Levofloxacin (Levaquin) and other infectionmanagement therapies. |

| Novartis / Sandoz | Basel, Switzerland 🇨🇭 | Generic fluoroquinolone products through the Sandoz generics division. |

| Teva Pharmaceutical Industries Ltd. | Petah Tikva, Israel 🇮🇱 / US operations 🇺🇸 | Generic fluoroquinolones (ciprofloxacin, etc.) for global markets. |

| Sun Pharmaceutical Industries Ltd. | Mumbai, India 🇮🇳 | Generic moxifloxacin and levofloxacin formulations. |

| Cipla Limited | Mumbai, India 🇮🇳 | Wide range of generic fluoroquinolone antibiotics. |

| Merck & Co., Inc. | Whitehouse Station, New Jersey, USA 🇺🇸 | Branded and generic fluoroquinolone products within the broader antibiotic portfolio. |

| Hikma Pharmaceuticals plc | London, United Kingdom 🇬🇧 | Generic pharmaceutical products, including fluoroquinolone antibiotics. |

| Dr. Reddy’s Laboratories Ltd. | Hyderabad, India 🇮🇳 | Generic levofloxacin and related fluoroquinolone formulations. |

By Molecule

By Route of Administration

By Therapeutic Indication

By End-User

By Drug Type

By Antimicrobial Resistance Application

By Region

February 2026

February 2026

February 2026

February 2026