February 2026

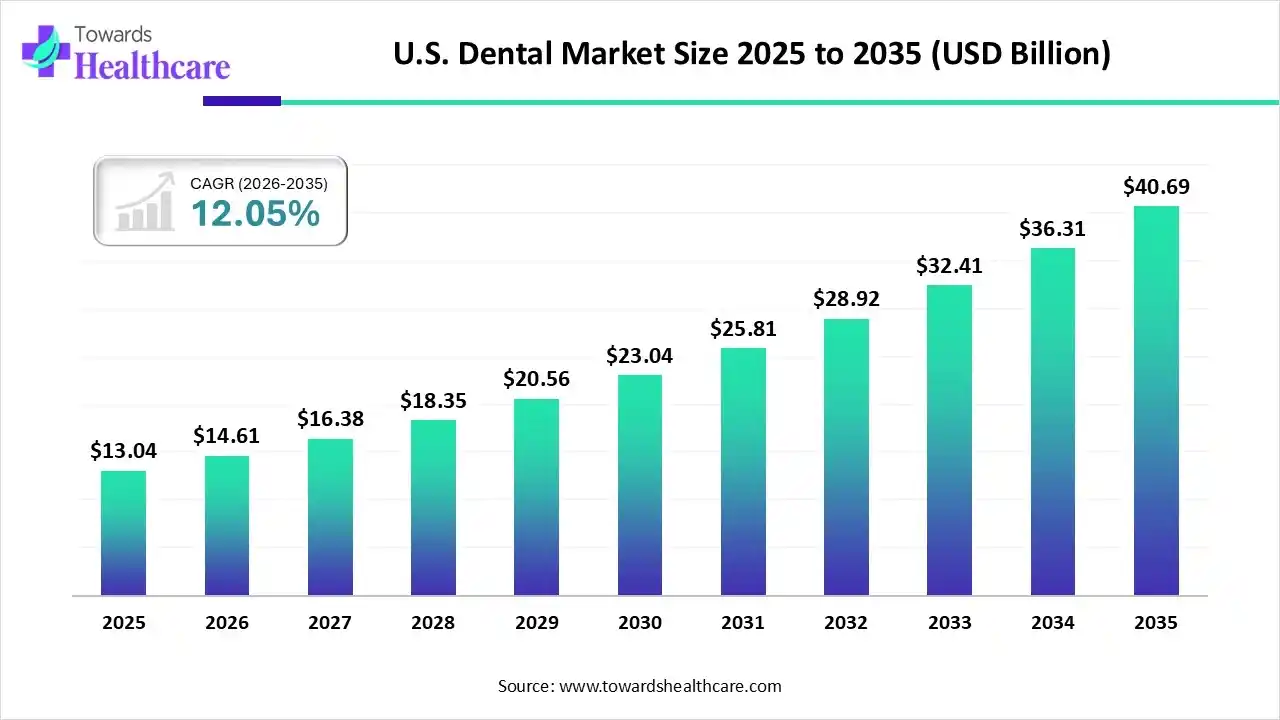

The U.S. dental market size was estimated at USD 13.04 billion in 2025 and is predicted to increase from USD 14.61 billion in 2026 to approximately USD 40.69 billion by 2035, expanding at a CAGR of 12.05% from 2026 to 2035.

Due to growing dental problems, the demand for dental products and services across the U.S. is increasing. AI technologies are being integrated with various products to enhance their application, features, and access by promoting the use of tele-dentistry platforms. The companies are also investing and launching various products, where the growing insurance coverage and oral health awareness are increasing their innovations and early adoption, promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 14.61 Billion |

| Projected Market Size in 2035 | USD 40.69 Billion |

| CAGR (2026 - 2035) | 12.05% |

| Market Segmentation | By Type, By End-User |

| Top Key Players | Straumann Group, Dentsply Sirona, Envista Holdings Corp., Henry Schein Inc., 3M Company, Align Technology Inc., Ivoclar, Patterson Companies, Inc., A-dec, Ultradent Products Inc., Hu-Friedy Group, Midmark |

The U.S. dental market is driven by a growing geriatric population, oral health awareness, and technological innovations. The U.S. dental products encompass products that are used for the diagnosis, treatment, prevention, and maintenance of oral health across the U.S. The U.S. dentistry offers various products and services to enhance oral health, where they also offer cosmetic procedures, restoration procedures, and specialized care, along with the use of dental consumables and advanced equipment.

The use of AI in analyzing dental images is increasing as it offers faster and more accurate results. Different types of AI models are also being developed to identify dental caries, oral cancer, or periodontal diseases, where they are also being used in the development of personalized treatment strategies. They are also being used in developing virtual assistance and chatbots, which help in appointment scheduling, billing, and resolving queries, enhancing the workflow and patient outcomes.

Due to growing demand for teeth whitening, clear aligners, and veneers to enhance the overall appearance, the demand for cosmetic dentistry is increasing driving its acceptance rates.

Digital dentistry is expanding due to growing digital innovations, which in turn, is enhancing the access of dental services to patients across remote areas, offering improved diagnostic and treatment options, and enhancing their outcomes.

The companies are developing various biocompatible, durable, and aesthetic products, 3D printing platforms, and intraoral scanners, along with advanced equipment, which is encouraging their early adoption.

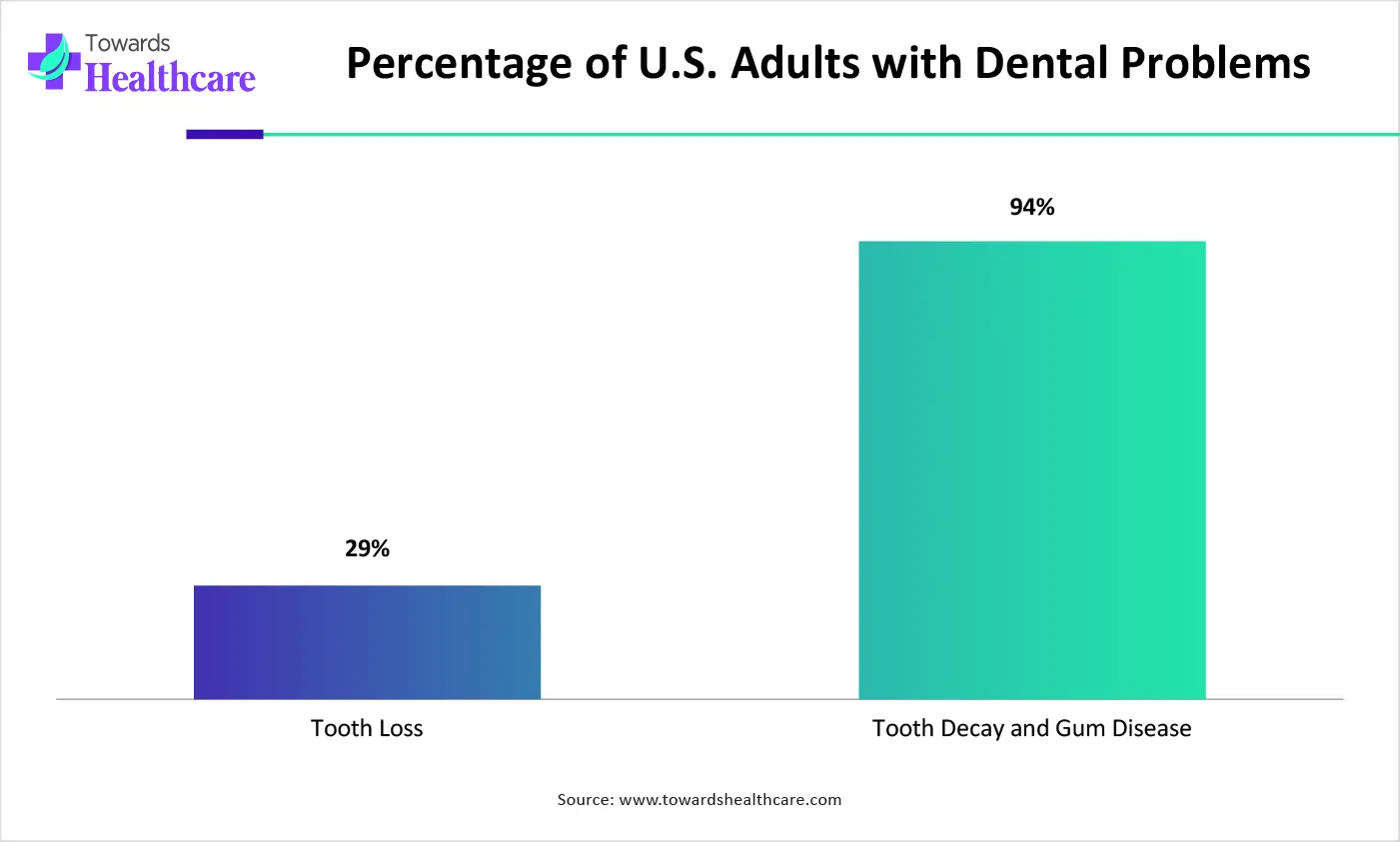

| Dental Problems | Affected U.S. Adults |

| Tooth Loss | 29% Adults |

| Tooth Decay and Gum Disease | 94% Adults |

What Made Dental Consumables the Dominant Segment in the U.S. Dental Market in 2025?

The dental consumables segment led the market in 2025, due to their repeated use. Different types of consumables were utilized for various dental procedures, which increased their demand and adoption rates. At the same time, the growth in dental clinics and a rise in oral health awareness increased their use.

Dental Equipment

The dental equipment segment is expected to show lucrative growth during the predicted time, due to increasing demand for a minimally invasive approach. This, in turn, is driving their innovations as well as the adoption of advanced technologies. Furthermore, a growing aging population and digital dentistry are also encouraging their utilization.

Which End User Type Segment Held the Dominating Share of the U.S. Dental Market in 2025?

The solo practices segment held the dominating share in the market in 2025, due to their personalized patient care and expanding practices. This increased their preference for routine checkups and minor procedures. Additionally, their enhanced availability also increased their acceptance for various dental procedures.

DSO/Group Practices

The DSO/group practices segment is expected to show the highest growth during the upcoming years, due to its expansion. They also offer advanced tools and equipment, where the growing investments are increasing the adoption of advanced technologies. This, in turn, is attracting the patients, increasing the bulk purchase of various consumables.

The U.S. dental market is expected to be the fastest-growing during the forecast period, due to growth in oral health awareness, which is driving the demand for preventive and cosmetic dentistry. At the same time, the growing geriatric population is also increasing the use of various dental treatment options as well as online platforms. Additionally, increasing disposable income and the presence of insurance policies are also attracting patients.

The U.S. also consists of advanced industries that are contributing to the development of various dental products, equipment, minimally invasive approaches, and tele-dentistry platforms. Moreover, growing innovations are also driving their AI-based innovations, where the growing cosmetic dentistry is also increasing the adoption of advanced technologies. Thus, all these factors are promoting the market growth.

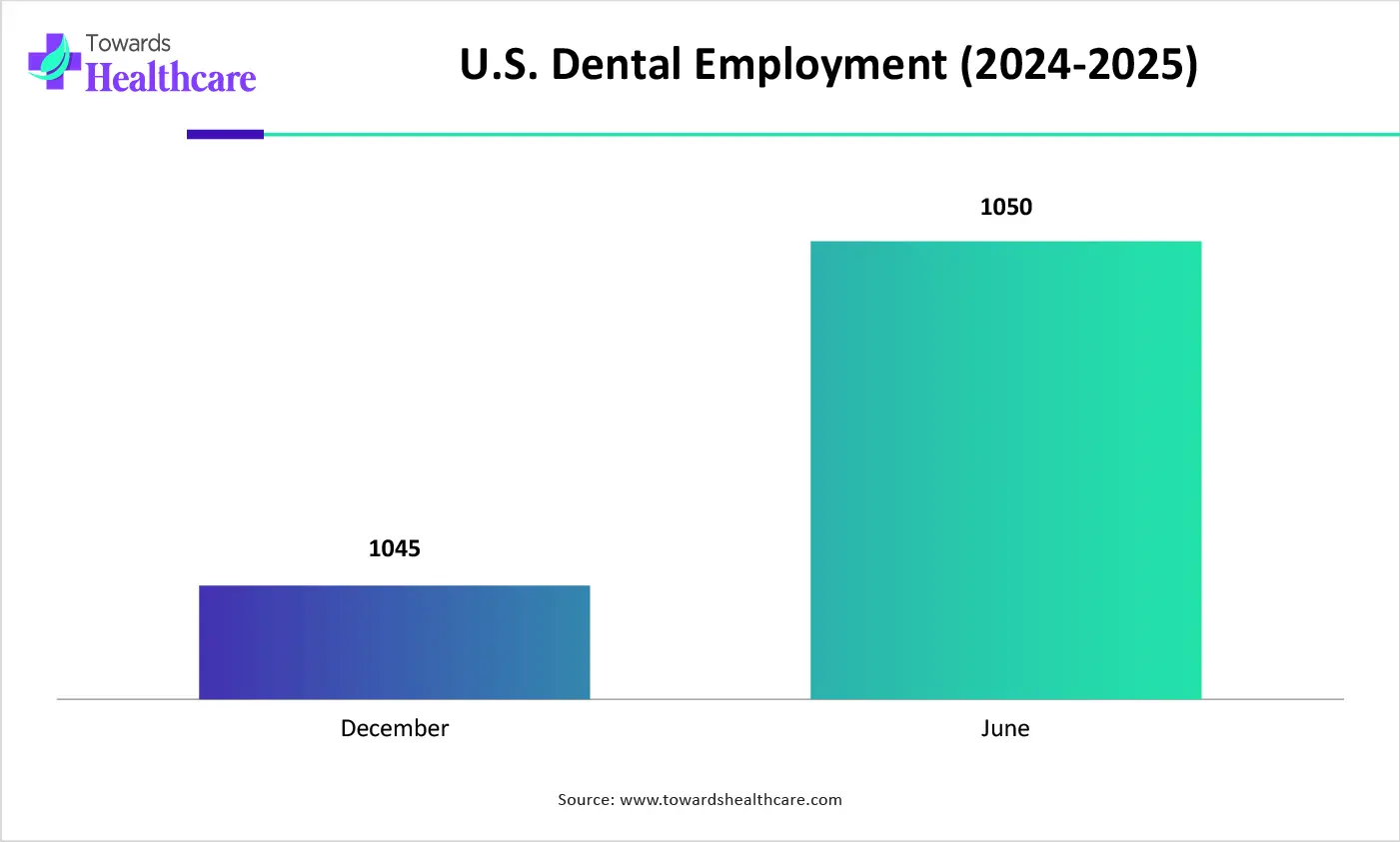

| Month & Year | Growth in the U.S. Dental Employment |

| December 2024 | 1045 |

| June 2025 | 1050 |

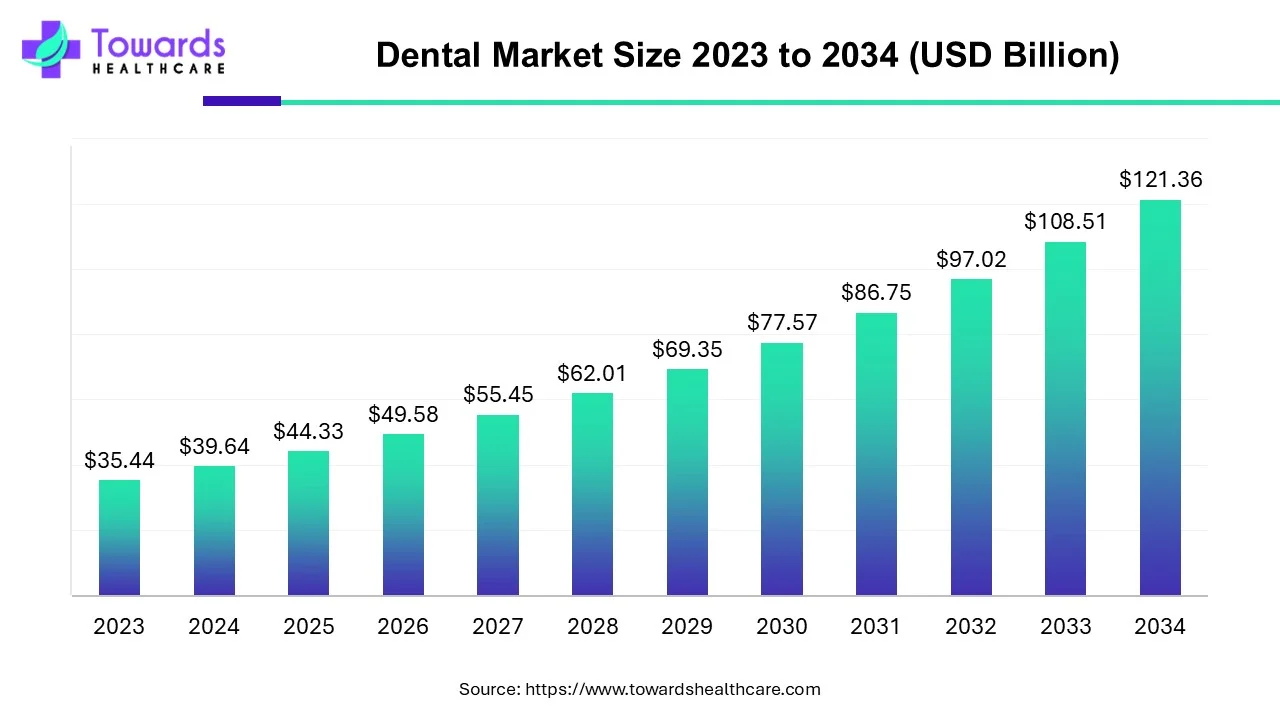

The global dental market size is calculated at USD 39.64 billion in 2024, grew to USD 44.33 billion in 2025, and is projected to reach around USD 121.36 billion by 2034. The market is expanding at a CAGR of 11.84% between 2025 and 2034.

| Companies | Headquarters | U.S. Dental Products |

| Straumann Group | Basel, Switzerland | Dental implants, prosthetics, oral scanners, clear aligners, etc. |

| Dentsply Sirona | North Carolina, U.S. | CAD/CAM solutions, dental chairs, restorative materials, digital imaging systems, etc. |

| Envista Holdings Corp. | California, U.S. | Nobel Biocare, KaVo, and Kerr |

| Henry Schein Inc. | New York, U.S. | Offers dental supplies, equipment, and practice management software |

| 3M Company | Minnesota, U.S. | Dental cements, adhesives, restorative materials, orthodontic products, etc. |

| Align Technology Inc. | California, U.S. | Invisalign clear aligners and iTero intraoral scanners |

| Ivoclar | Schaan, Liechtenstein | Restorative materials, adhesives, digital dentistry systems, and removal prosthetics |

| Patterson Companies, Inc. | Minnesota, U.S. | Dental consumables, X-ray equipment, etc. |

| Zimmer Biomet | Indiana, U.S. | Dental implants, regenerative bone graft materials, and abutments |

| A-dec | Oregon, U.S. | Dental chairs, complete dental operatory equipment, etc. |

| Ultradent Products Inc. | Utah, U.S. | Teeth whitening products, etchants, tissue management products, etc. |

| Colgate-Palmolive | New York, U.S. | Provides OTC oral care products |

| Hu-Friedy Group | Illinois, U.S. | Offers high-quality dental instruments for various procedures |

| Midmark | Ohio, U.S. | Dental chairs, operatory lights, sterilization equipment, and delivery units |

By Type

By End-User

February 2026

February 2026

February 2026

February 2026