January 2026

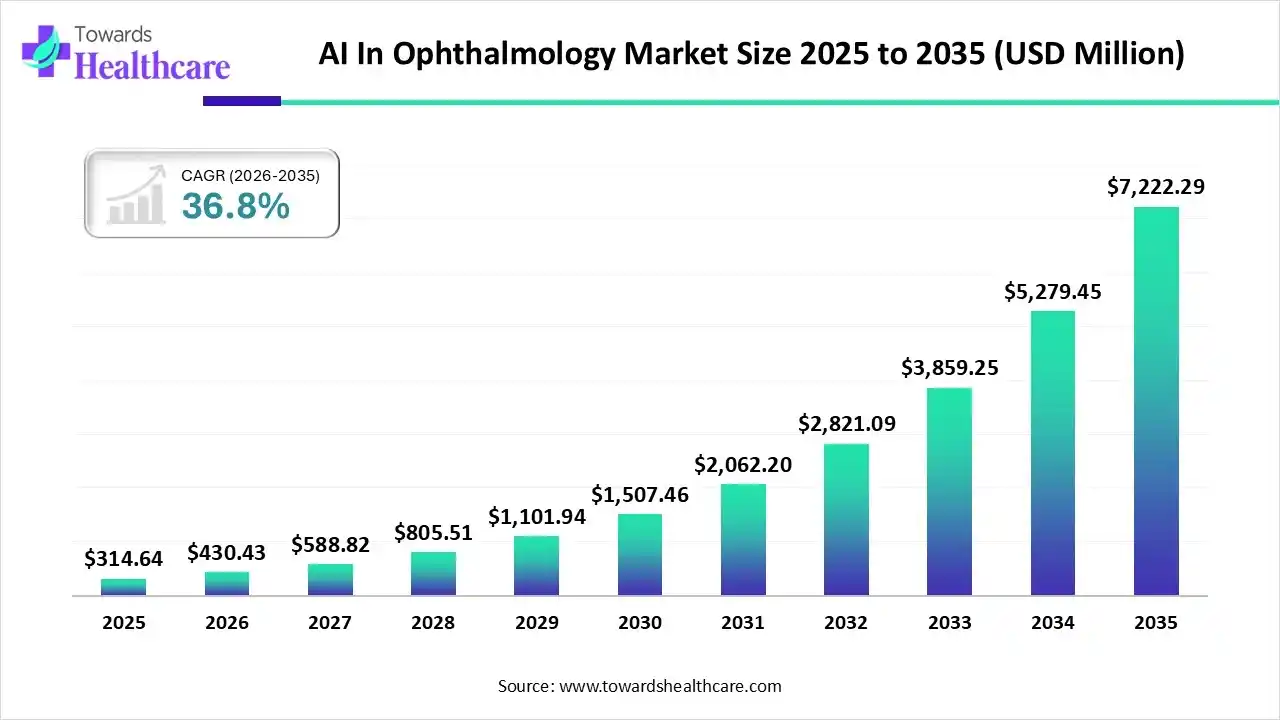

The global AI in ophthalmology market size was estimated at USD 314.64 million in 2025 and is predicted to increase from USD 430.43 million in 2026 to approximately USD 7222.29 million by 2035, expanding at a CAGR of 36.8% from 2026 to 2035.

Around the globe, specifically in the Asia Pacific, the geriatric population is highly prone to various eye diseases, such as diabetic retinopathy, glaucoma, and age-related macular degeneration (AMD). This is further bolstering demand for the more sophisticated AI solutions, including AI-integrated imaging devices, & other AI-driven diagnostics.

| Key Elements | Scope |

| Market Size in 2026 | USD 430.43 Million |

| Projected Market Size in 2035 | USD 7222.29 Million |

| CAGR (2026 - 2035) | 36.8% |

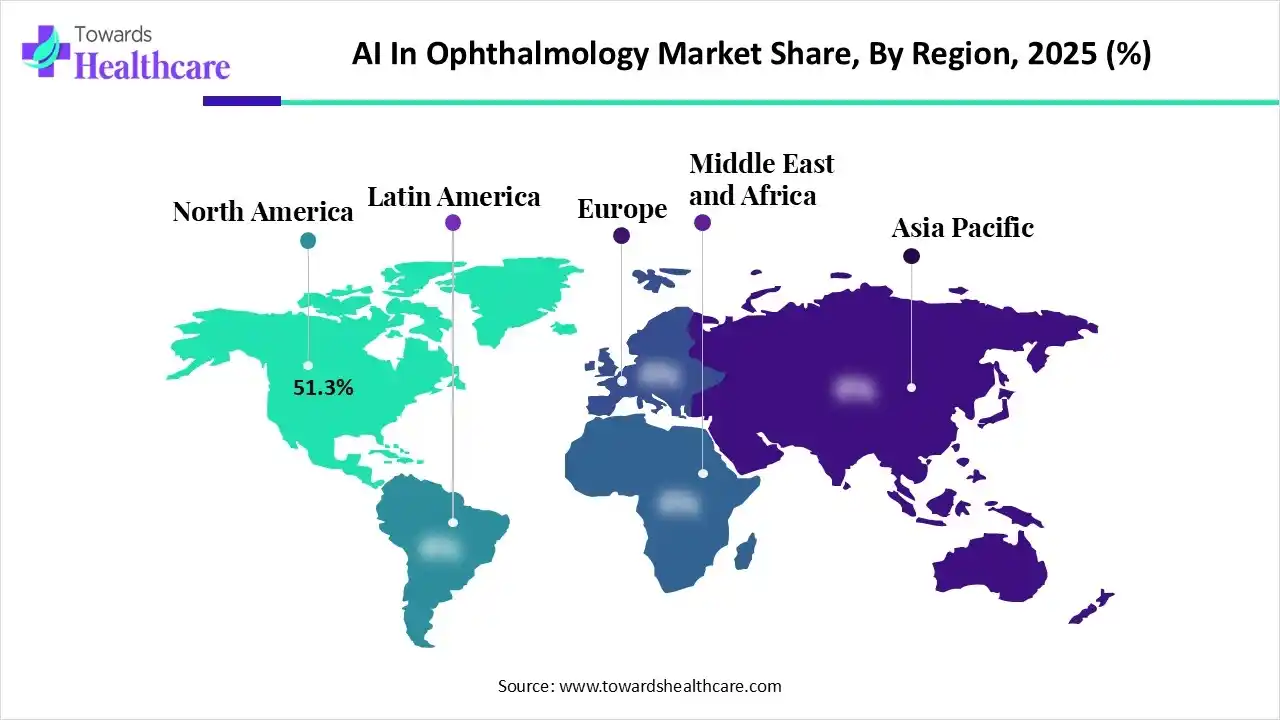

| Leading Region | North America by 51.3% |

| Market Segmentation | By Application, By Technology, By Product Type, By Disease Type, By End User, By Region |

| Top Key Players | Google Health/DeepMind, IBM Watson Health, ZEISS Group, Topcon Corporation, NIDEK, Retina-AI Health, Eyenuk, Visulytix, Airdoc, EyeArt AI |

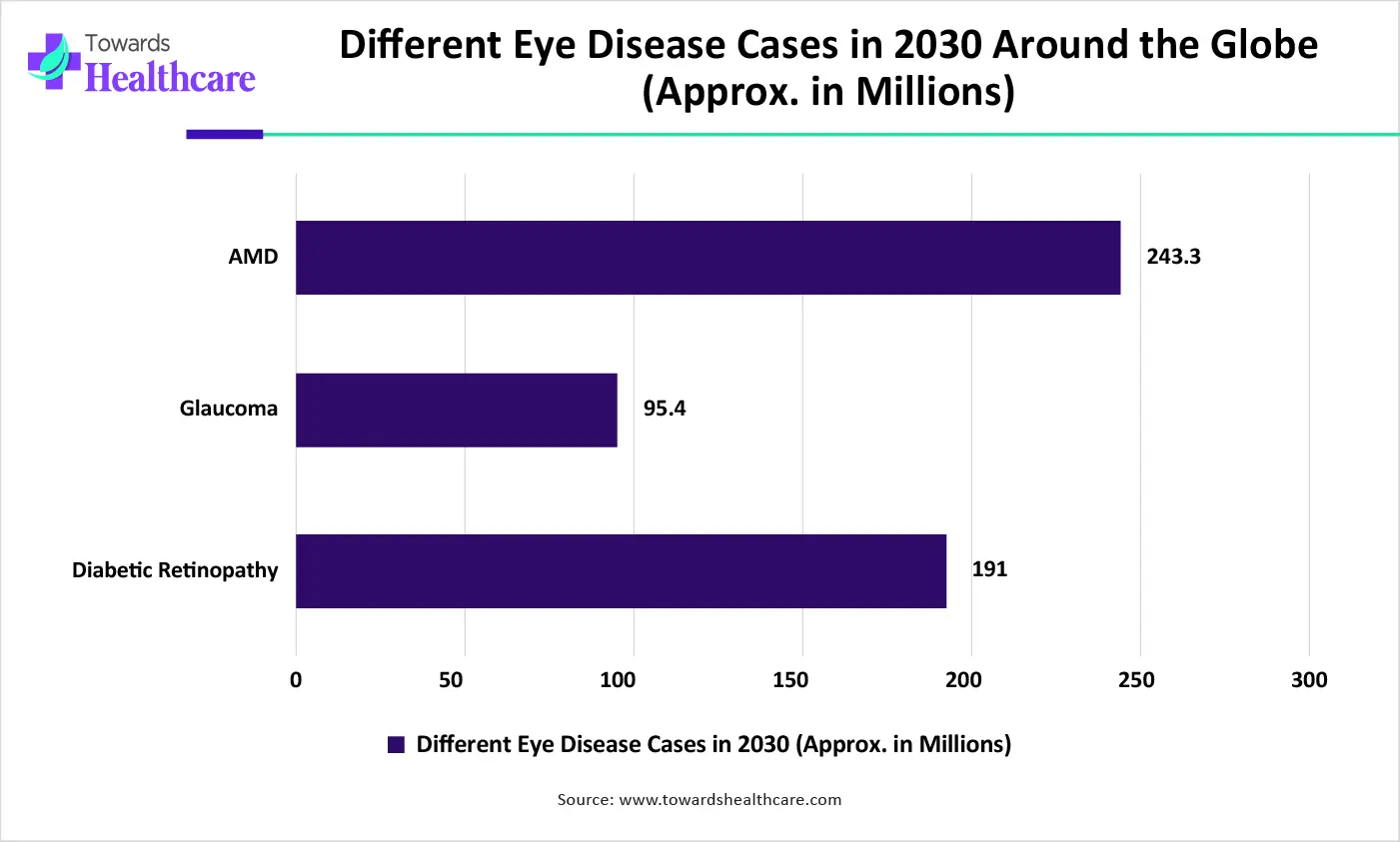

The AI in ophthalmology market includes artificial intelligence software, imaging tools, and decision-support systems designed to detect, diagnose, monitor, and predict eye diseases using advanced algorithms. The growing prevalence of diabetic retinopathy, macular degeneration, and glaucoma, combined with the rising adoption of tele-ophthalmology and the need for faster diagnostics, drives market growth. AI applications support retinal imaging interpretation, glaucoma risk assessment, cataract grading, surgical planning, and population-scale screening. Advancements in deep learning, cloud analytics, and automated image analysis further accelerate adoption.

Especially FDA-approved AI tools, including IDx-DR and EyeArt, are supporting the diagnosis of diabetic retinopathy (DR) without a doctor, easing specialist workload and advancing primary care screening.

An important trend is the adoption of AI to optimize OCT analysis for earlier diagnosis, with the emergence of novel AI-enabled imaging spaces, particularly the suprachoroidal area, and improved drug delivery for macular diseases.

In the prospective era, AI-driven tools will enable remote diagnostics, expand access to eye care in underserved areas, and support virtual consultations.

The market will spur the integration of AI with various data, such as imaging, EHR, and genetics, for holistic patient monitoring. It will also drive the development of smart contact lenses for continuous monitoring, such as glucose levels for people with diabetes.

| Company | Investments/Funding |

| Optain Health (September 2025) | Raised $26 million in Series A funding to boost its AI-enabled retinal imaging technology, Oculomics, in the US and globally. |

| German startup Skleo Health (July 2025) | Raises €3 million to eliminate preventable blindness with accessible AI-enhanced eye screenings |

| University of Colorado Anschutz Medical Campus (June 2025) | Its Department of Ophthalmology received a historic $40 million gift for the treatment and potentially cure eye diseases, such as macular degeneration and glaucoma, & emphasize basic science and adopt artificial intelligence to transform vision care in the years ahead. |

| Israeli eye surgery robotics company ForSight Robotics (June 2025) | Raised $125 million in a Series B round led by Eclipse, to boost development of the company’s ORYOM platform. This robotic system performs cataract surgery and treats other common eye diseases. |

| Remidio (March 2025) | Invested in Occuity to advance non-invasive systemic disease screening, developing Remidio’s presence in AI-enabled ophthalmic diagnostics. |

Which Application Dominated the AI In Ophthalmology Market in 2025?

In 2025, the diabetic retinopathy detection segment was dominant with a 28.7% share of the market. According to IJO, it was considered that by 2025, there would be over 592 million cases of diabetic retinopathy, demanding more advanced diagnostics. To this end, many studies have explored the integration of AI screening into primary care and diabetes clinics. Also, innovative solutions are supporting the detection of early-stage microaneurysms, with a focus on data privacy issues and annotation expenses.

Age-Related Macular Degeneration (AMD)

Moreover, the age-related macular degeneration (AMD) segment will expand rapidly. Primarily, the University of Missouri-Kansas City estimates that AMD will affect nearly 20 million Americans by 2030. Recent rigorous studies, including researchers at the UCL Institute of Ophthalmology and Moorfields Eye Hospital, designed an AI system for simplifying the recruitment of patients for geographic atrophy (GA) clinical trials & R U-Net++ assists in retinal layers and fluid (like subretinal fluid, intraretinal fluid, and pigment epithelial detachment) in OCT images.

Why did the Deep Learning Segment Lead the Market in 2025?

With a 36.8% share, the deep learning segment dominated the AI in ophthalmology market in 2025. The technology leverages automated image analysis, prioritizes high-risk cases for specialists (triage), and supports clinical documentation using natural language processing (NLP). Additionally, they are employed for the automated grading of nuclear cataracts and the determination of degenerative keratopathy (such as corneal rings), thereby improving the accuracy of classifying anterior segment images.

Machine Learning

In the coming era, the machine learning segment is predicted to register the fastest growth. This approach has broader advantages, such as advanced diagnostics, predictive modeling of disease growth, surgical support, the development of integrated explainable AI (XAI) for clinical trust, and the use of generative AI for evolving training data. One major example is the "Eye-XAI" system, which aims to improve accuracy in eye disease detection by providing transparent, interpretable insights into its diagnostic process through symptom analysis.

Disease Type Insights

Which Disease Type Led the AI In Ophthalmology Market in 2025?

The retinal disorders segment dominated the market with a 32.5% share in 2025. The rising diversity of these cases is driving the use of AI in clinical trials to analyze vast imaging datasets, thereby further supporting the identification and quantification of new biomarkers. Currently, Penn Medicine researchers have been putting efforts into AI applications for detecting cardiovascular risk indicators in retinal images.

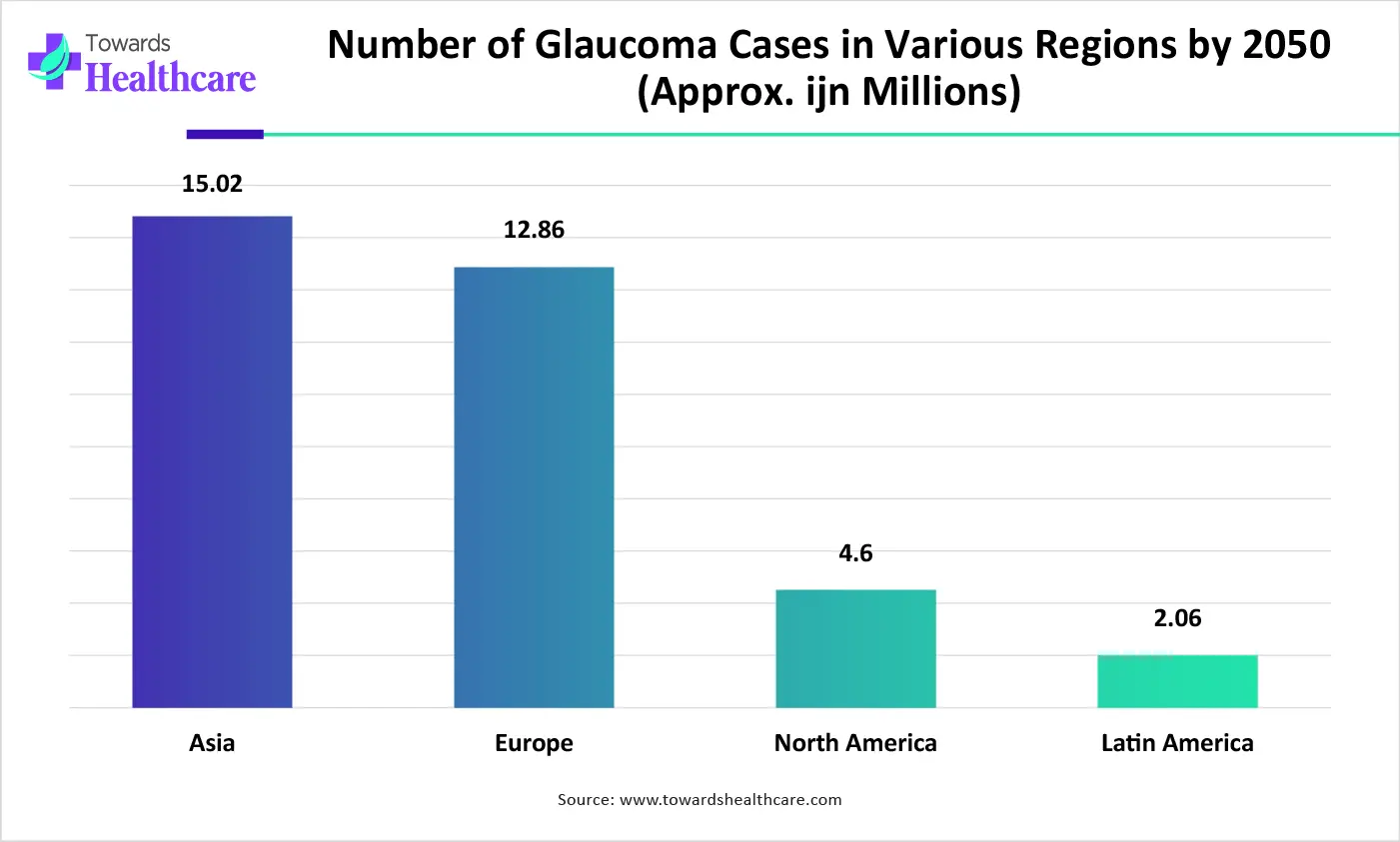

Glaucoma

The glaucoma segment will expand rapidly in the coming era. According to the WHO, there will be 95.4 million people aged 40-80 with glaucoma by 2030. In 2025, a study of Sequence-aware models (such as Gated Transformer Networks) found that visual field worsening could be detected up to 1.7 years earlier than conventional linear trend analyses. In February 2025, a study showed a hybrid approach using multiple lightweight deep learning models (total size ~112 MB) to analyze fundus images for multiple risk factors, such as optic disc cupping and hemorrhages.

What Made the AI Software Solutions Segment Dominant in the Market in 2025?

The AI software solutions segment captured a 45.5% share of the AI in ophthalmology market in 2025. These software solutions are widely adopted to assist with clinical documentation and to extract insights from Electronic Health Records (EHRs). Extensive developments, such as Altris AI's Optic Disc Analysis module, help evaluate optic disc parameters using OCT and also offer tailored glaucoma assessments.

AI-Integrated Imaging Devices

Whereas the AI-integrated imaging devices segment is anticipated to expand fastest. Emerging innovations, such as advanced OCT, fundus cameras, deep learning algorithms, and cloud-based platforms, are accelerating clinical precision, image resolution, and data accessibility. Certain leading firms, such as Iriscience, are involved in developing AI solutions that turn ordinary smartphones into portable diagnostic tools using video-based ocular imaging workflows.

How did the Hospitals Segment Dominate the Market in 2025?

With a 38.8% revenue share, the hospitals segment was dominant in the AI in ophthalmology market in 2025. In hospitals, AI escalates early detection, enhancing the accuracy and effectiveness of diagnosis and treatment, raising the accessibility of eye care. It also supports robotic-assisted systems to allow surgeons to carry out intricate operations with sub-micrometer precision.

Ophthalmic Clinics

During 2026-2035, the ophthalmic clinics segment will expand rapidly. For different eye disorders, these facilities are increasingly using AI solutions for boosting early intervention and customized treatment plans, expanding access via teleophthalmology, and executing AI-driven robotic surgeries, which finally lowers human error and vision loss. In India, many clinics are using AI approaches, such as MediVision Eye Care, Ojas Eye Hospital, specifically for cataract, AMD, and DR patients.

With a major share, North America registered dominance in the market in 2025. A specific catalyst is a rise in diabetic retinopathy, glaucoma, and age-related macular degeneration among the increasing geriatric population, with the presence of well-developed and advanced healthcare infrastructure, having AI-driven diagnostic and imaging technologies in clinical workflows.

For instance,

Whereas the US held the largest share of this regional market, due to the expanding advances and robust studies. Such as in 2025, "Eye Care Copilot" clinical trials were conducted by researchers at the Ohio State University Wexner Medical Center in a randomized controlled manner for testing a large-scale AI tool known as "EyeFM" (Eye Care Foundation Model).

Asia Pacific will register the fastest growth in the AI in ophthalmology market. As ASAP is experiencing a huge burden of an ageing population with many chronic diseases, which further results in cataracts, glaucoma, and diabetic retinopathy, it is ultimately fostering breakthroughs in ophthalmology. Currently, the governments of India and Thailand are introducing initiatives and aligning with technology players to locate AI-powered eye screening programs at a population scale.

However, India is anticipated to expand rapidly, with accelerating partnerships among research institutions, startups, and government bodies to unite AI into existing healthcare systems. Recently, Inviga Healthcare Fund made a substantial investment in Forus Health, a Bengaluru-based company that is known for its AI-assisted eye screening technologies, to emphasize conveying comprehensive last-mile diagnostics through an integrated digital platform.

Europe is estimated to show a lucrative growth in the AI in ophthalmology market during 2026-2035. This will be mainly fueled by continuous surgical planning and guidance, such as Alcon's Adi platform, which was demonstrated at the 2025 ESCRS meeting, further assisting in managing the logistics of cataract surgery, like inventory control and patient data flow between clinics and surgical centers. Alongside, the region is stepping into establishing an AI-driven video analysis platform called DeepSurgery, which prominently offers real-time supervision during cataract surgery.

Inclusion of significant efforts into predictive diagnostics, remote screening solutions, and regulatory approvals for clinical use is leveraging the German market. For instance, in 2025, the German health tech company deepeye Medical GmbH received European regulatory approval (CE mark) for its AI algorithm, deepeye TPS (Treatment Planning Support).

| Company | Headquarters | Contribution to AI in Ophthalmology Market |

| Google Health/DeepMind | Mountain View, CA, U.S. | Develops deep learning for analyzing retinal OCT images to detect 50+ eye conditions and prioritize urgent cases, and created FDA-cleared algorithms for diabetic retinopathy (DR) screening licensed for global use. |

| IBM Watson Health | Armonk, NY, U.S | Focuses on general healthcare AI, using data analysis for decision support and contributing to data integration and personalized medicine platforms that support broader healthcare diagnostics. |

| ZEISS Group | Oberkochen, Germany | Integrates AI into its ophthalmic diagnostic devices, such as OCT equipment, to improve image analysis and early diagnosis through internal R&D and strategic partnerships with research institutions. |

| Topcon Corporation | Tokyo, Japan | Develops AI-powered screening tools using noninvasive eye scans to identify indicators of systemic and neurological diseases in partnership with companies like Microsoft for broader health insights. |

| NIDEK | Gamagori, Japan | Partners with non-profits to deploy AI-assisted fundus cameras for scalable DR screening in underserved regions, enabling early detection and immediate referrals in developing countries. |

| Retina-AI Health | Houston, TX, U.S. | Develops autonomous AI solutions for disease detection and risk assessment, focusing on generalizable AI that works with various camera types to bridge the gap in annual eye screenings. |

| Eyenuk | Los Angeles, CA, U.S. | A leader in autonomous AI screening with its EyeArt system, the first FDA-cleared AI for autonomous detection of more-than-mild DR, also having CE marking for AMD and glaucoma detection. |

| Visulytix | London, UK | Developed "Pegasus" AI software that analyzes fundus and OCT images for signs of glaucoma, DR, and macular degeneration, collaborating with Orbis to provide free AI analysis via a telemedicine platform. |

| Airdoc | Beijing, China | Provides AI-based decision support solutions and has built a vast retinal image database. Its AI fundus cameras are used for early screening and predictive analysis of chronic diseases. |

| EyeArt AI | Los Angeles, CA, U.S. | The AI system developed by Eyenuk Inc. contributes significantly to the autonomous, FDA-cleared detection of diabetic retinopathy in primary care settings. |

By Application

By Technology

By Product Type

By Disease Type

By End User

By Region

North America

South America

Europe

Eastern Europe

Asia Pacific

MEA

January 2026

January 2026

January 2026

January 2026