November 2025

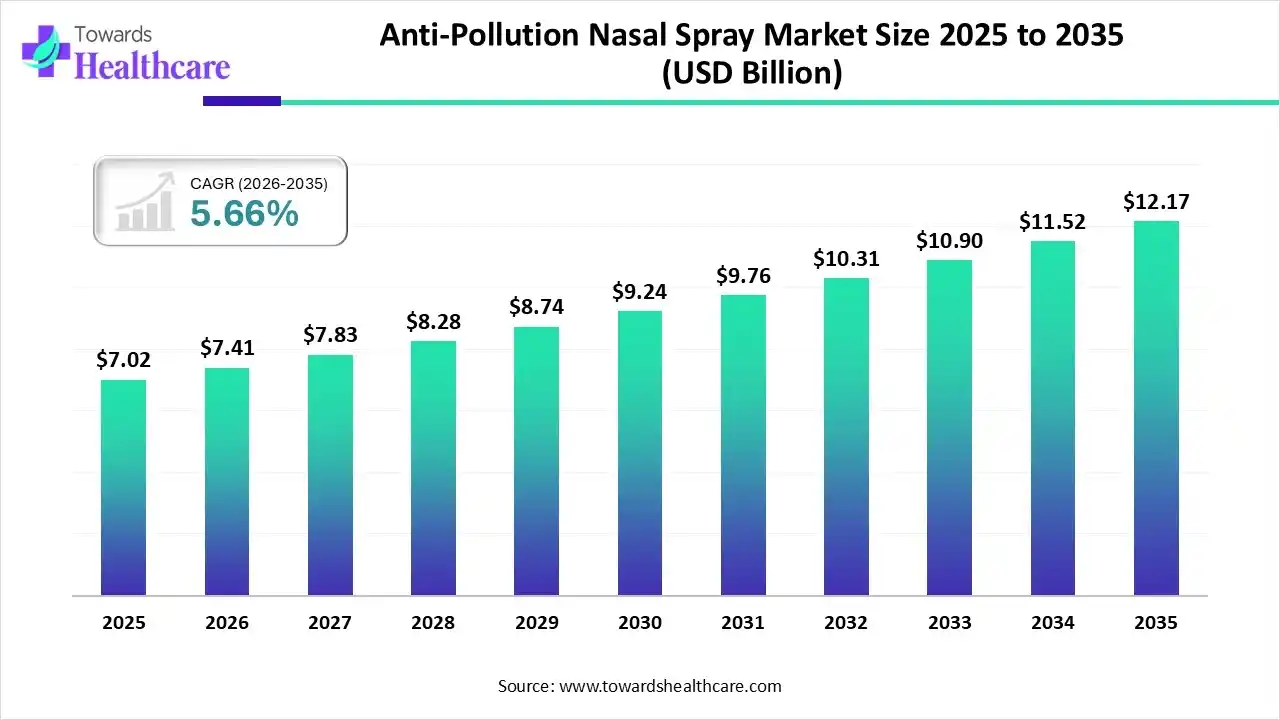

The global anti-pollution nasal spray market size was estimated at USD 7.02 billion in 2025 and is predicted to increase from USD 7.41 billion in 2026 to approximately USD 12.17 billion by 2035, expanding at a CAGR of 5.66% from 2026 to 2035.

Day by day, the world is running with a substantial rise in urbanization and industrialization, which is propelling demand for advanced and more efficacious nasal sprays. Groundbreaking in hydrating nasal sprays, biodegradable barriers, and smart devices is promoting companies' global marketing through the widespread progress of online channels. However, countries are facing a major growth in air pollution, which is impacting the national regulations and requiring further upgrades to these regulations.

| Key Elements | Scope |

| Market Size in 2026 | USD 7.41 Billion |

| Projected Market Size in 2035 | USD 12.17 Billion |

| CAGR (2026 - 2035) | 5.66% |

| Leading Region | North America |

| Market Segmentation | By Product, By Distribution Channel, By Region |

| Top Key Players | Haleon plc, GSK plc, Merck plc, NeilMed Pharmaceuticals, Himalaya Wellness, Xlear, Inc., Aurena Laboratories AB, Innovexia, Iskon Remedies, Xenone Healthcare |

These sprays develop a protective barrier or cleanse the nasal passages to shield against airborne irritants, such as dust, pollen, smoke, and fine particulate matter (PM2.5), with minimal respiratory irritation, congestion, and potential allergy concerns, which are common in urban areas with high pollution levels. The anti-pollution nasal spray market is mainly fueled by increasing air pollution, expanded respiratory issues, such as allergies and asthma, wider consumer awareness of preventive health, and the convenience of over-the-counter (OTC) accessibility. However, the leading firms are emphasising a combination of pollution-blocking agents with decongestants or anti-inflammatory agents for symptomatic relief.

Nowadays, researchers are increasingly using AI-powered modelling platforms to condense the progression of the cycle and improve physical spray properties, particularly droplet size and plume geometry. Moreover, numerous firms are establishing "smart" nasal spray devices that leverage sensors and connect to mobile apps. Whereas AI algorithms foster the analysis of data from these sensors, like force, plume geometry, dosing frequency for tracking correct usage, personalise dosing schedules, and facilitate real-time feedback to both patients and clinicians, they finally focus on raising treatment adherence and efficacy.

The era is highly encouraging the use of herbal, drug-free, and non-toxic ingredients, including saline, xylitol, aloe vera, and eucalyptus oil, for safe, daily use, aiding with clean-label preferences.

The market has been boosting the use of realistic nasal casts and advanced cell culture models to robustly anticipate the regional deposition of sprays and the impact of mucus on absorption and particle removal.

Researchers are focusing on the nasal cavity as a selective route to deliver drugs to the central nervous system (CNS) for the treatment of neurological issues. As well as consistent trials in intranasal vaccines and antiviral agents, like nitric oxide nasal sprays for COVID-19, which use the nasal mucosa for systemic and mucosal immunity.

Which Product Dominated the Anti-Pollution Nasal Spray Market in 2025?

The pollution defense products segment held the biggest revenue share of the market in 2025. This year, countries in South Asia, especially Bangladesh, Pakistan, & India, and parts of Africa, such as Chad, DRC, are facing poor air quality, i.e., high PM2.5, which is accelerating demand for pollution defense products. These products broadly employ saline, aloe vera, activated charcoal, and essential oils. Including Otrivin & Physiomer, Flonase, Theraflu, and local/Ayurvedic brands are also establishing anti-pollution solutions with similar natural and barrier-forming ingredients.

Hydrating Nasal Sprays

Moreover, the hydrating nasal sprays segment is anticipated to expand rapidly in the anti-pollution nasal spray market. In the last few years, a study has shown that nearly 10% and 30% of adults and up to 40% of children are affected by allergic rhinitis per year. For these cases, key players are encouraging innovation in hydrogel-based sprays provides a protective, moisturizing shield inside the nasal cavity to trap airborne allergens & viruses before they reach the mucosa. Polyrizon's PL-14 is under the progression stage, which facilitates extended, non-pharmacological protection.

Why did the Retail Pharmacies Segment Lead the Market in 2025?

In 2025, the retail pharmacies segment captured the dominating revenue share of the anti-pollution nasal spray market. They provide immediate, broader availability, which makes them seamless for consumers who are looking for rapid, non-prescription solutions for pollution-related issues. However, they offer diverse kinds of sprays, like saline/isotonic sprays, such as Otrivin Breathe Clean, corticosteroid sprays, like Fluticasone Furoate, and natural ingredient sprays, which contain glycerin, sea salt, etc.

Online Channels

In the coming era, the online channels segment is predicted to show the fastest growth. This is also known as e-pharmacies, which offer more convenience, discounts, and digital health trends. Also, the world is emphasizing preventive healthcare, easy OTC access, and product innovation, specifically natural/multi-functional sprays. Haleon plc, NeilMed Pharmaceuticals, Himalaya Wellness Company, Xlear, Inc., etc are widely offering their online channels for novel and effective nasal sprays for various populations, like pediatric, adult, and geriatric.

In 2025, North America led the anti-pollution nasal spray market due to the booming urbanization and industrialization. Specifically, Canada was ranked 93rd in the most polluted cities, with an annual average PM2.5 concentration of 10.3 micrograms per cubic metre of air (μg/m³), which is observed two to three times beyond the WHO's recommended level.

Furthermore, the Environmental Protection Agency revealed a final rule in 2005 for simplifying state strategies and air quality protection requirements for ozone standards, which includes developing universal default deadlines for states to submit execution plans.

For instance,

Due to the rising severe air pollution, escalating respiratory and allergy instances, mainly in China, India, and Japan, will assist in the rapid expansion of the anti-pollution nasal spray market in the Asia Pacific. Whereas Japan is stepping into the advances through "regulatory agility," which covers a Ministry of Health approval for a once-weekly fluticasone propionate spray for chronic rhinosinusitis. Alongside, South Korea & Japan are transforming "smart" nasal sprays, which characterise AI-powered sensors to monitor usage patterns and facilitate feedback to clinicians via mobile apps.

India Market Trends

Substantial initiatives in India, such as the National Clean Air Programme (NCAP) and initiatives by pharmaceutical leaders, are widening general awareness regarding respiratory health and the significance of nasal hygiene in polluted environments, which further fuels demand for these products.

Europe will expand significantly in the anti-pollution nasal spray market. Eastern European countries, particularly Bosnia and Herzegovina, North Macedonia, and Serbia, are generally facing increased levels of pollutants as compared to Nordic nations, like Iceland, Estonia, Finland, and Sweden. Besides this, the region is shifting towards major advances in ground-breaking ultra-soft pump mechanisms, fine-mist systems, & sophisticated microdroplet technology, for ensuring coating of the nasal passages for better efficacy and comfort.

Germany Market Trends

Germany has major companies, especially Merck KGaA and Bayer AG, which promotes nasal spray market and are well-positioned to use their strong distribution networks for diverse nasal care products, such as those used in polluted environments.

For instance,

| Comapny | Description |

| Haleon plc | This facilitates various options under its brand Otrivin, such as Otrivin Breathe Clean for natural saline cleansing, and the Otrivin Nasal Mist for decongestion and comfort. |

| GSK plc | It has explored a saline-based nasal wash, called Otrivin Breathe Clean. |

| Merck plc | This specializes in Mometasone Furoate, a generic version of Nasonex for allergic and nonallergic rhinitis. |

| NeilMed Pharmaceuticals | Specifically, it’s a variety of saline nasal sprays and irrigation kits that are marketed as efficacious for clearing nasal passages of pollutants. |

| Himalaya Wellness | It facilitates Bresol-NS Saline Nasal Solution, an herbal-infused saline spray. |

| Xlear, Inc. | Its offerings include Xlear Saline Nasal Spray with Xylitol, by using xylitol to moisturize, soothe, and cleanse nasal passages. |

| Aurena Laboratories AB | This provides nasal sprays through its Sparkling Saline Technology, which applies carbonated saline/seawater microbubbles. |

| Innovexia | It explored its prominent INNOMIST-F N/S (Fluticasone furoate) and INNOMIST DROP (Sodium Chloride 0.65%). |

| Iskon Remedies | A firm emphasizes standard medical formulations like decongestants and saline solutions. |

| Xenone Healthcare | It facilitates various nasal sprays for therapeutic indications, like allergy treatment, nasal decongestion, and hydration. |

By Product

By Distribution Channel

By Region

November 2025

February 2026

November 2025

November 2025