February 2026

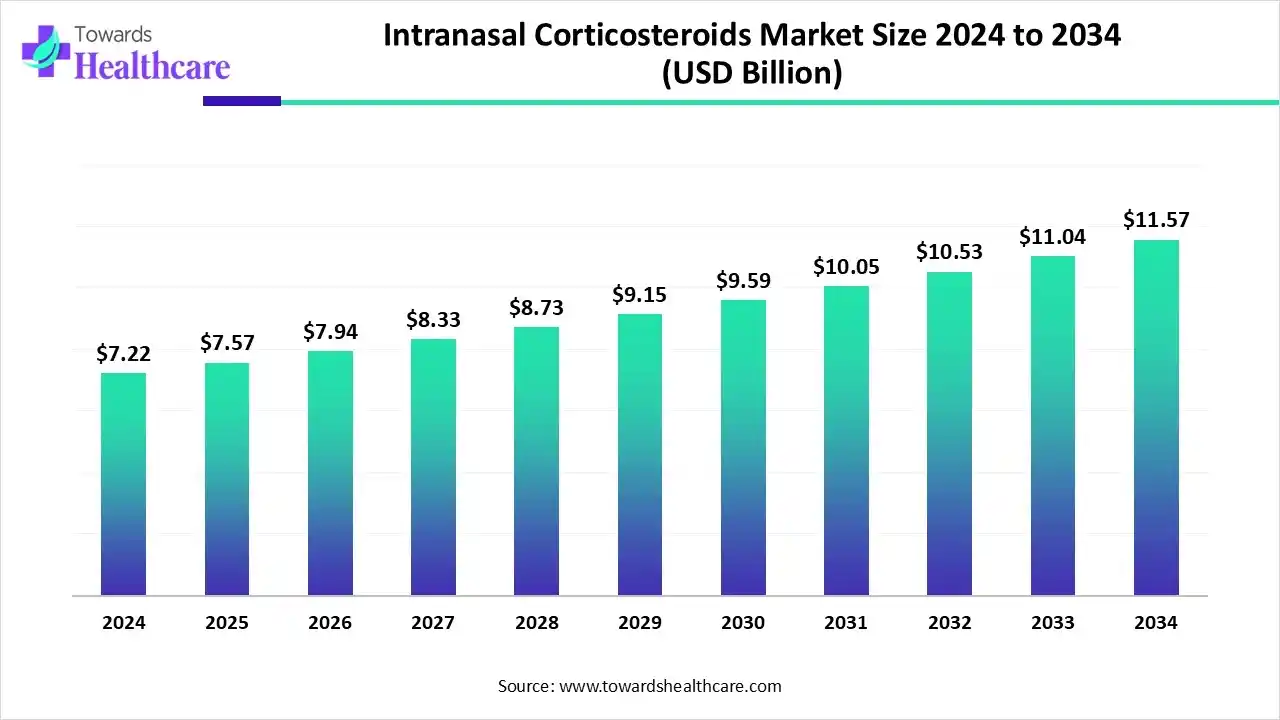

The global intranasal corticosteroids market size is calculated at US$ 7.57 billion in 2025, grew to US$ 7.94 billion in 2025, and is projected to reach around US$ 12.14 billion by 2035. The market is expanding at a CAGR of 4.84% between 2026 and 2035.

Around Japan, India, the U.S., and South Korea, major areas are bolstering their urbanization strategies and industrialization expansions, which are leading to the development of allergic rhinitis, mainly in the pediatric population. These cases are supporting the development of novel nasal spray candidates, either in combination therapies or the adoption of biosimilars. Moreover, the leading companies are achieving the latest FDA approval for innovative formulations used in AR. Whereas, the emergence of digital platforms is also boosting feasible consultations from pharmacists and doctors.

The intranasal corticosteroids market includes steroid formulations administered via the nasal route (via sprays, drops, or aerosol devices) used for the treatment of allergic rhinitis, nonallergic rhinitis, nasal polyps, sinusitis, and sometimes adjunctive for asthma/COPD. The market is driven by the increasing prevalence of allergic conditions, air pollution, upper respiratory infections, seasonal allergies, and growing awareness and adoption of non-oral (localized) treatment options with fewer systemic side effects. These medications help reduce inflammation in the nasal passages, relieve congestion, sneezing, runny nose, and improve nasal airflow.

Growing Allergic Conditions

Due to growing air pollution, rapid urbanization, and climate change, the incidence of allergic rhinitis and chronic sinusitis is increasing, which is increasing the use of intranasal corticosteroids.

Blooming Therapeutic Options

The growing health awareness is increasing the use of intranasal corticosteroids, which is driving new opportunities and accelerating the development of new combination therapies, paediatric sprays, and specialty formulations.

Shift Towards Self-Care

The growing geriatric population and health awareness are increasing the shift towards self-care, increasing the R&D focused on the development of self-administered, non-invasive intranasal corticosteroid therapies.

Expanding E-Commerce Platforms

Rapid digitalization is increasing the launch of new digital health tools and online pharmacies, which is increasing the accessibility of the intranasal corticosteroids, promoting home care, and enhancing patient adherence to the treatment.

| Program | Key Details & Impact |

| Asthma and Allergic Diseases Cooperative Research Centers (AADCRC) | In January 2025, the U.S. National Institute of Allergy and Infectious Diseases (NIAID) announced a funding opportunity for its AADCRC program. |

| The Coalition for Epidemic Preparedness Innovations (CEPI) | A global partnership offered a $5 million grant in February 2025 for developing spray-dried RNA vaccines suitable for mucosal delivery. |

| Indian Government | In January 2025, it amended its Drugs Rules to introduce new licensing standards (Schedule TB) for Ayurvedic, Siddha, and Unani (ASU) nasal sprays. |

AI is showing promising advantages in the development of personalized treatment, enhancing drug delivery, and improving formulation. Alongside, AI-assisted platforms are being incorporated in the analysis of whole-slide images of nasal polyps, which further supports diagnosing and classifying inflammation based on the specific type of inflammatory cells present. AI algorithms are assisting biomarker discovery by analyzing patients' multi-omics datasets, and also play their major role in the prediction of risk of adrenal insufficiency from prolonged topical corticosteroid use.

| Table | Scope |

| Market Size in 2026 | USD 7.94 Billion |

| Projected Market Size in 2035 | USD 12.14 Billion |

| CAGR (2026 - 2035) | 4.84% |

| Leading Region | North America by 40% |

| Market Segmentation | By Product Type/Formulation, By Active Ingredient/Drug Molecule, By Indication/Therapeutic Use, By Channel/Distribution, By Region |

| Top Key Players | Merck & Co. Inc., Bayer AG, Teva Pharmaceutical Industries Ltd., Viatris/Mylan, Cipla Limited, Novartis AG, Boehringer Ingelheim, Lupin Pharmaceuticals, Sun Pharmaceutical Industries, Sandoz / generic steroid producers, Hikma Pharmaceuticals, Almirall, Perrigo |

Which Product Type/Formulation Dominated the Intranasal Corticosteroids Market in 2024?

In 2024, the nasal sprays segment led with nearly 65% share of the market. A rise in global cases of respiratory and allergic disorders, and expanding patient preference for convenient, effective, self-administered treatments, are fueling the demand for nasal sprays. Current development encompasses new delivery systems, such as Exhale Delivery Systems, which offer robust penetration into the sinuses and the progression of bioabsorbable drug-eluting stents for targeted, long-term drug delivery. The widespread use of sinonasal polyps and even a potential adjunct in the management of COVID-19 outcomes, with the reduction of viral load in the nose.

Whereas, the novel delivery forms segment is anticipated to expand fastest in the coming era. The market is immensely transforming dry powder inhalers, pressurized metered-dose aerosols, and exhalation delivery to gain superior drug deposition in the nasal cavity and sinuses. Additionally, key players are accelerating the use of nanoemulsions, solid lipid nanoparticles (SLNs), and nanostructured lipid carriers (NLCs) to achieve enhanced bioavailability. The raised emphasis on thermolabile, low-residue foams, including those containing betamethasone valerate, as well as novel hydrogel and mucoadhesive polymer patches.

Why did the Fluticasone Segment Lead the Market in 2024?

The fluticasone segment dominated with nearly 28% share of the intranasal corticosteroids market in 2024. The segment is mainly driven by its broad-spectrum efficiency for allergic rhinitis, once-daily dosing with optimized patient compliance, and possession of a robust safety profile with reduced systemic absorption. In 2024, the FDA approved product XHANCE (fluticasone propionate) for the treatment of chronic rhinosinusitis without nasal polyps in adults.

During 2025-2034, the new molecules/biosimilar versions segment will expand rapidly. The significant companies are stepping into combination sprays, especially Dymista (azelastine and fluticasone) and Ryaltris (mometasone and olopatadine) combine an antihistamine with a corticosteroid, and the use of cubosomes, a lipid-based nanoparticle for the intranasal delivery of drugs to the brain. In 2025, the FDA approved Omlyclo (omalizumab-igec), a biosimilar to the biologic Xolair, utilized in severe asthma and nasal polyps.

What Made the Allergic Rhinitis Segment Dominant in the Market in 2024?

In the intranasal corticosteroids market, the allergic rhinitis segment registered dominance with an approximate 52% revenue share in 2024. A prominent driver is the growing diseases, environmental pollution, climate change, and urbanization, which are leading to the rise in allergic rhinitis instances. Currently, the market is emphasizing the adoption of advanced allergen immunotherapy (sublingual and subcutaneous) and novel delivery solutions for existing treatments. A recent study says that adults have 10-30% chances of AR. (World Allergy Organization).

Moreover, the pediatric allergic rhinitis segment will register rapid expansion during 2025-2034. Due to an overactive immune response to inhaled allergens like pollen, dust mites, animal dander, and mold spores, it is impacting children's health. Day by day, the globe is boosting diagnosis with component-resolved diagnostics to find allergens and predict outcomes, and exploring mHealth tools for better patient monitoring and tailored management. A 2024-2025 study leverages the data, such as a 5.38% prevalence of allergic rhinitis (AR) in children, affecting 486 out of 9039 children.

Which Channel/Distribution Led the Intranasal Corticosteroids Market in 2024?

In 2024, the retail pharmacies segment captured nearly 56% share of the market. Their broader accessibility, convenience, and pharmacist serving as a key intervention, with significant guidance for self-care, are supporting the development of retail pharmacies. Also, they are facilitating new formulations, generic versions, and the integration of digital health tools. Pharmacists are expanding information regarding new product innovations, like user-friendly delivery systems, preservative-free sprays, and combination therapies used in AR.

However, the e-commerce/online pharmacies segment is predicted to witness rapid expansion. The ongoing raised consumer demand for convenience, cost savings, and discretion is influencing the exploration of these pharmacies. They are supporting home delivery and auto-refill subscriptions to enhance consumer comfort with digital health and e-commerce. Moreover, the adoption of digital solutions is further providing affordability, virtual consultations with pharmacists & doctors, and personalized therapies for the diverse population.

By capturing nearly 40% revenue share, North America registered dominance in 2024. North America is increasingly accelerating over-the-counter (OTC) availability, technological innovations in drug delivery, and the increasing consumer preference for self-administered and non-invasive treatments through digital solutions. Also, the major players are exploring smart nasal delivery systems and app-connected tools with improved patient adherence, a surge in personalized therapy using biomarker screening.

For instance,

Revolutionary Device Technology is Supporting the U.S. Market

The U.S. intranasal corticosteroids market is experiencing major growth due to the rising emphasis on innovations in nasal spray delivery systems. This further enables more accurate, painless drug delivery, raising the patient's convenience and ease of use. Additionally, the U.S. is focusing on combination therapies that combine a corticosteroid with an antihistamine in a single spray for more comprehensive symptom control.

Based on 2024 data, approximately 50 million people in the U.S. have allergic rhinitis, representing about 15% of the population. In 2021, the Asthma and Allergy Foundation of America (AAFA) reported a slightly different figure, stating 81 million people (26% of adults and 19% of children) had been diagnosed with seasonal allergic rhinitis.

A Surge in Product Innovations is Fueling the Canadian Market

Nowadays, in Canada, numerous manufacturers are fostering the creation of innovative formulations, specifically extended-release, preservative-free, and dual-action anti-inflammatory-antihistamine sprays. According to 2024 data, up to 20% of the general population in Canada is estimated to have a diagnosis of allergic rhinitis. This translates to approximately 9.4 million people annually. The prevalence of the condition is believed to be increasing, negatively affecting daily life, work, and school performance.

For instance,

Asia Pacific is anticipated to witness the fastest growth in the intranasal corticosteroids market during 2025-2034. As many countries of ASAP are shifting towards bolstering urbanization and industrialization, which further resulted in greater air pollution and ultimately rising allergic rhinitis and chronic sinusitis cases. For these concerns, several public health initiatives and consumer education campaigns are promoting awareness regarding nasal hygiene and effective allergy management, which demand advanced nasal solutions, mainly in Japan, India, and South Korea.

Escalating India Expert Recommendations are Impacting the Indian Market

Day by day, India’s huge population is facing allergic issues, like rhinitis, due to the growing air pollution complexities in developing cities, which is boosting the adoption of novel treatments. For this, in July 2024, the Association of Otolaryngologists of India (AOI) restated that intranasal corticosteroids (INCS) can be increasingly used as a key measure for allergic and non-allergic rhinitis.

High Prevalences of Allergic Rhinitis are Driving the Japanese Market

The expanding density of urbanization and a rise in millions of cases of cedar pollen allergy, or hay fever, are leading to a growth in allergic rhinitis patients in Japan. This further fosters demand for more efficient nasal treatments, including ICS, and other innovative delivery systems. Alongside, consumers are preferring low-odor, compact sprays which assist manufacturers to establish with preservative-free formulations, improving comfort and tolerability.

Europe is expected to grow significantly in the intranasal corticosteroids market during the forecast period, due to the increasing prevalence of allergic rhinitis, driven by growing air pollution. The growing health awareness is also increasing the early detection of allergic conditions, which is also increasing the use of intranasal corticosteroids. Moreover, well-established healthcare systems are also increasing their availability, which is promoting the market growth.

UK Intranasal Corticosteroids Market Trends

The presence of advanced healthcare infrastructure in the UK is increasing the use of intranasal corticosteroids to deal with the growing incidence of allergic rhinitis. The growing health awareness and healthcare investments are also driving their development, where the growing online platforms are also increasing the availability and access to these intranasal corticosteroids.

South America is expected to grow significantly in the intranasal corticosteroids market during the forecast period, due to expanding healthcare, which is increasing access to intranasal corticosteroids. The rapid urbanization is also increasing the incidence of allergic rhinitis, where the growing health awareness is driving their adoption rates. Additionally, advanced industries and the increasing development of genetic products are also enhancing the market growth.

Brazil Intranasal Corticosteroids Market Trends

The growing availability of the intranasal corticosteroids as an OTC drug in Brazil is increasing their adoption rates to tackle the growing occurrence of allergic rhinitis. The expanding healthcare and early diagnosis of these diseases are also increasing their demand. Moreover, expanding pharmacies and distribution channels are also increasing their adoption rate.

In preclinical studies, researchers work on a candidate drug's bond with glucocorticoid receptors (GRs) in the cells, then assess all pharmacological parameters, and finally, develop a robust formulation with enhanced efficacy.

Key Players: GSK (GlaxoSmithKline plc), Merck & Co., Inc., AstraZeneca, Sanofi, etc.

The intranasal corticosteroids market integrates all the required ingredients, like API, excipients & vehicles to develop an effective formulation. Finally, through multiple steps, it converts into solutions or suspensions.

Key Players: Aptar Pharma, Impel Pharmaceuticals, OptiNose, etc.

It mainly comprises proper administration technique, education on expectations and potential side effects, and continuous patient monitoring.

Key Players: Patient Access Network (PAN) Foundation, NowPatient, MedlinePlus, etc.

By Product Type/Formulation

By Active Ingredient/Drug Molecule

By Indication/Therapeutic Use

By Channel/Distribution

By Region

February 2026

February 2026

February 2026

February 2026