January 2026

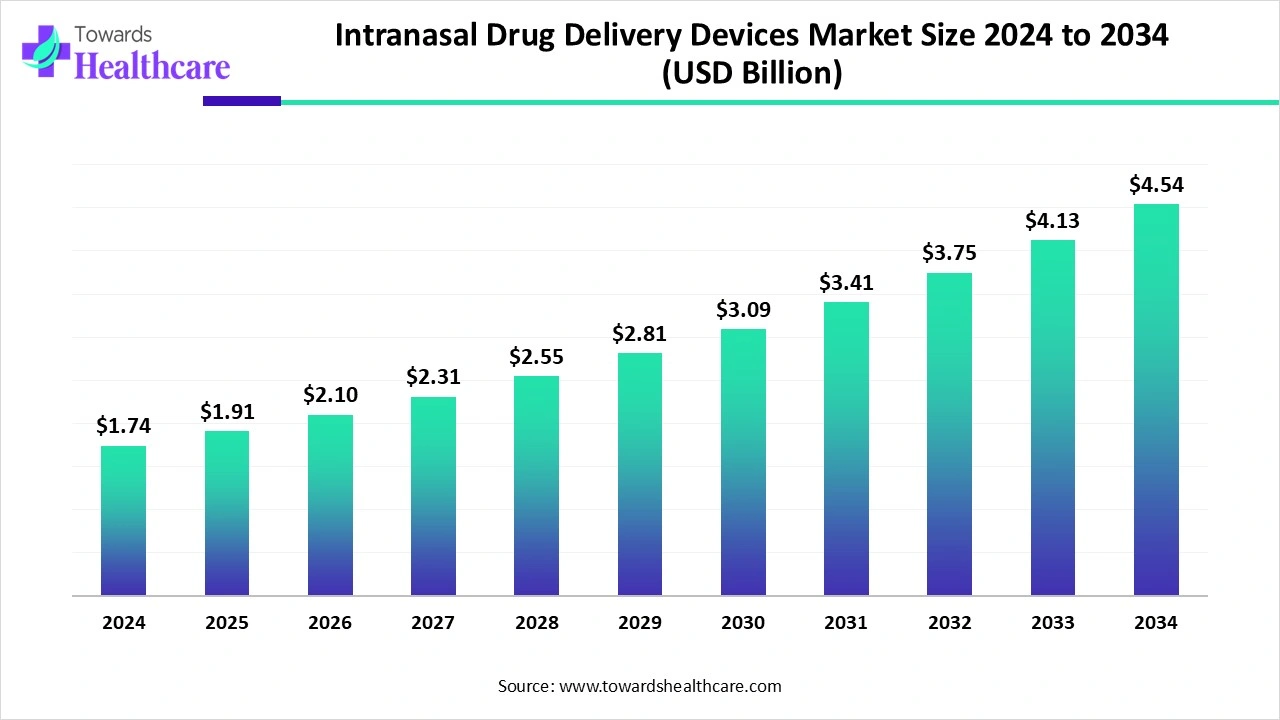

The global intranasal drug delivery devices market size is estimated at US$ 1.74 billion in 2024, is projected to grow to US$ 1.91 billion in 2025, and is expected to reach around US$ 4.54 billion by 2034. The market is projected to expand at a CAGR of 10.04% between 2025 and 2034.

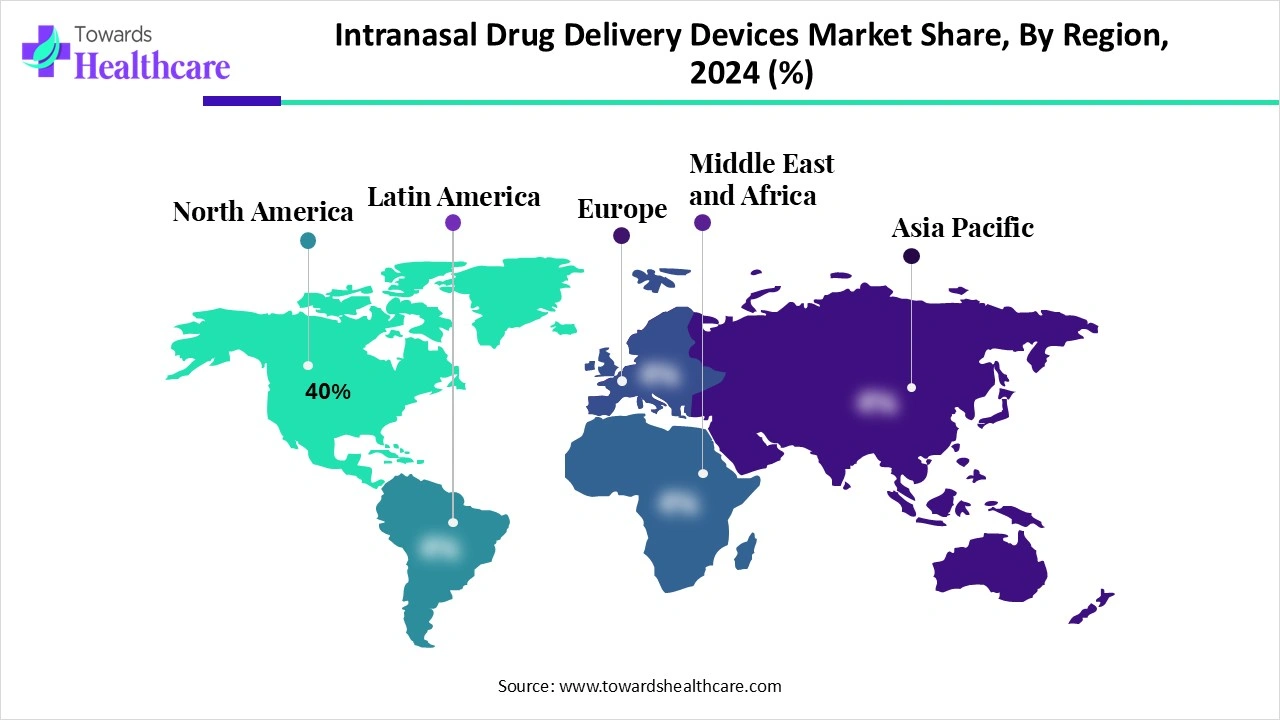

The intranasal drug delivery devices market is expanding rapidly due to the increasing trend of non-invasive drug administration, the increased onset of action, and enhanced patient compliance. Increasing technological advancement, growing prevalence of chronic diseases, and emergency therapeutics are driving the growth of the market. North America is dominant in the market due to increasing adoption of advanced technology, while the Asia Pacific is the fastest growing due to huge investments in the healthcare sector.

| Table | Scope |

| Market Size in 2025 | USD 1.91 Billion |

| Projected Market Size in 2034 | USD 4.54 Billion |

| CAGR (2025 - 2034) | 10.04% |

| Leading Region | North America by 40% |

| Market Segmentation | By Product Type, By Application, By Technology, By End User, By Region |

| Top Key Players | MetLife, Inc., Prudential Financial, Inc., Manulife Financial Corporation, Sun Life Financial, AIA Group Limited, AXA S.A., Allianz SE, Aviva plc, Legal & General Group, Zurich Insurance Group, Nippon Life Insurance, Dai-ichi Life Holdings, New York Life Insurance Company, Northwestern Mutual Life Insurance, MassMutual (Massachusetts Mutual Life Insurance Company), Guardian Life Insurance Company, China Life Insurance Company, Ping An Insurance Group, HDFC Life Insurance (India), LIC (Life Insurance Corporation of India) |

The intranasal drug delivery devices market refers to medical devices that administer drugs directly through the nasal cavity for local or systemic effects. This route bypasses hepatic first-pass metabolism, ensures rapid onset, and improves patient compliance, especially for emergency conditions and chronic diseases. Applications include neurological disorders (migraine, epilepsy, Parkinson’s), pain management, allergic rhinitis, hormone therapies, vaccines, and rescue medications such as naloxone for opioid overdose. Growth is driven by the rising prevalence of respiratory and CNS disorders, technological advancements in spray pumps and metered-dose inhalers, and increasing demand for needle-free, non-invasive delivery systems.

Increasing advancement in intranasal drug delivery devices with a focus on enhancing nose-to-brain delivery for systemic, local, and central nervous system diseases by application of nanotechnology, which contributes to the growth of the market.

For instance,

Increasing collaboration between the research institute and healthcare organization, which drives the growth of the market.

For Instance,

Integration of AI in intranasal drug delivery devices drives the growth of the market as AI-driven technology aids in various stages of medical device development, including drug discovery, optimization, and formulation. Integration of AI, in vitro experiments, and computer simulations should be used to assess the behaviour of intranasal drug delivery devices and preparations, combined with high-resolution imaging techniques and computational fluid dynamics simulations, to improve the drug delivery process. AI-driven technology improves medical device manufacturing efficiency and reduces limits through ML. The increase of AI allows medical devices to be poised to reshape both the quality of care for patients and the involvement of care delivery for medical care providers.

For Instance,

Increasing Applications of Needle-free Delivery Methods

Needle-free delivery methods provide quick and easy medication administration, offering faster relief without the discomfort of injections. Children and older adults are particularly impacted by needle aversion. Non-invasive systems decrease discomfort, enhance medication adherence, and ease the workload for caregivers and healthcare providers. The needle-free drug delivery sector is rapidly evolving, featuring innovations from traditional jet injectors to microneedles. Factors such as the rising number of needlestick injuries, increasing demand for painless drug delivery, growing preference for home healthcare and self-administration, and advancements in needle-free technologies are fueling the growth of the intranasal drug delivery market.

Major Challenges of Spray

The technical challenges of achieving a well-dispersed spray plume and optimizing drug penetration and coverage demand a thorough understanding of the formulation, delivery device, and patient use. This restricts the growth of the intranasal drug delivery devices market.

Increasing Utilization of Nanoparticles for Intranasal Delivery

The intranasal route has become a promising method for delivering treatments directly from the nose to the brain via the olfactory and trigeminal nerve pathways, thereby bypassing the BBB. Utilizing nanoparticles for intranasal delivery has demonstrated significant potential for targeted brain treatment. This approach offers benefits such as low doses, biocompatibility, and the ability to encapsulate both hydrophobic and lipophilic drugs. Nasal administration can also enhance brain-targeted drug delivery, achieving high pharmacological activity with lower drug amounts, which reduces the risk of side effects. It presents a highly promising pathway for treating central nervous system disorders.

For Instance,

By product type, the nasal spray devices segment led the intranasal drug delivery devices market, as administration of medication by the nasal cavity in the spray dosage form is a non-invasive process, which gives a fast onset of drug action. The nasal spray dosage form is affordable, easy to use, and self-administerable, improving patient compliance. A saline nasal spray supports rinsing away mucus and draining the sinuses of bacteria and germs, which lessens inflammation. It constricts blood vessels in the nasal lining and clears the nose quickly.

On the other hand, the nasal powders segment is projected to experience the fastest CAGR from 2025 to 2034, as these powders provide a drug delivery strategy that is appropriate for high dosage or low solubility APIs and predominantly enhance the stability of the product and the rate of absorption of the drug. Nasal powder manufacturing services comprise air jet micronization, specialized spray drying, high and low shear blending, and wet nano-milling, which offer particle control for powdered nasal products.

By application, the allergic rhinitis segment is dominant in the intranasal drug delivery devices market in 2024, as this type of devices allows for intended delivery to the nasal and sinus regions. The nasal cavity is splendidly supplied with blood vessels, which have a larger surface area, enabling fast absorption of the therapeutic agent. This allows for rapid onset of action, creating intranasal delivery an attractive choice in emergencies that require immediate relief from allergic rhinitis.

The neurological disorders segment is projected to grow at the fastest CAGR from 2025 to 2034, as utilizing pathways like the trigeminal and olfactory nerves, intranasal drug delivery enables the quick transport of the therapeutic agent to the brain, therefore improving both the bioavailability and targeting efficacy of the agent. Intranasal drug delivery over intravenous drug injection in lowering the risk of ischemic brain injury in neurological disorders.

By technology, the metered-dose spray pumps segment led the intranasal drug delivery devices market in 2024, as it is a portable aerosol device that uses a propellant to deliver the medicinal agent. It offers a multipurpose, reliable, self-contained, instantly available, affordable aerosol delivery system. It is used for pulmonary drug targeting, which enhances the therapeutic ratio intrinsic to aerosol therapy, lowers the local and systemic adverse effects, and allows application to the pulmonary airways of expressively larger doses of medicine than could otherwise be administered carefully.

The breath-powered delivery systems segment is projected to experience the fastest CAGR from 2025 to 2034, as this system allows the movement of the drug into the upper and posterior nasal regions beyond the narrow nasal valve, resulting in extended local exposure consistently, fast local absorption, and low total systemic exposure. The enhanced nasal deposition produced by the breath-powered device is related to pharmacokinetic advantages.

By end user, the hospitals & clinics segment led the intranasal drug delivery devices market in 2024, as intranasal delivery shows rapid action, enhances bioavailability, and improves the efficacy of the drug. Intranasal devices are gaining extensive acceptance because of novel device technologies that make them simpler to use and increase the overall product experience. Many patients fear injections as they cause pain, disease transmission, and an anaphylactic response; therefore, there is an increasing application of intranasal devices in hospitals and clinics.

On the other hand, the home healthcare segment is projected to experience the fastest CAGR from 2025 to 2034, as intranasal devices provide the potential to support improved nasal corticosteroid (NCS) adherence in allergic rhinitis (AR). Growing requirement for home care, pre-emptive treatments, primary diagnosis, shortening patient recovery times, and enhancing outcomes. Intranasal devices increase the residence period of the drug when the drug is delivered on the nasal mucosa, which is beneficial, particularly for local applications.

North America is dominant in the intranasal drug delivery devices market share 40% in 2024, due to increasing chronic conditions such as migraines, depression, allergic rhinitis, and chronic pain in this region, which increases demand for rapid and non-invasive drug delivery systems like intranasal delivery. Increasing spending from the government and public organizations in advanced healthcare services also drives the growth of the market.

For Instance,

In the United States, increasing adoption of high-tech drug delivery systems and the presence of an advanced R&D ecosystem for clinical trials of nasal drug products drive the growth of the market. Increasing access to the intranasal drug delivery system in the U.S., as it shows rapid action and is easy to use.

For Instance,

In Canada, increasing innovation in medical devices due to the presence of a strong ecosystem of hospitals, universities, and start-ups, vigorous government support for the manufacturing of qualitative medical devices, and a growing aging population, all these factors drive the growth of the market.

Asia Pacific is the fastest-growing region in the Intranasal Drug Delivery Devices Market in the forecast period, due to the increasing number of patients suffering from chronic diseases, and therefore, the growing demand for targeted therapies, which are the major growth factor of the market. Governments support medical devices by investing in healthcare infrastructure and technological innovation, contributing to the growth of the market.

The number of factors considered during R&D of intranasal drug delivery devices, such as moisture sensitivity, solubility, particle size, particle shape, and flow characteristics, will affect deposition and rate of absorption.

Key Players: OptiNose, Inc. and Nemera Development S.A

Clinical trials of intranasal drug delivery include feasibility/pilot trials, safety trials, efficacy trials, and post-market trials.

Key Players: Clinipace and Parexel

This device has been used in academic studies to deliver, for example, a topical steroid in patients with chronic rhinosinusitis and in a vaccine study.

Key Players: AptarGroup, Inc. and Kurve Technology, Inc.

In August 2025, Joris Silon, US Country President and Senior Vice President, stated, “The launch of FluMist Home is a transformational moment in the evolution of influenza protection, bringing a simple and accessible option directly into the hands of consumers. FluMist Home reflects the growing importance of direct-to-consumer offerings and underscores our commitment to continuous innovation, making it easier for people to get vaccinated and stay protected.”

By Product Type

By Application

By Technology

By End User

By Region

January 2026

January 2026

January 2026

January 2026