January 2026

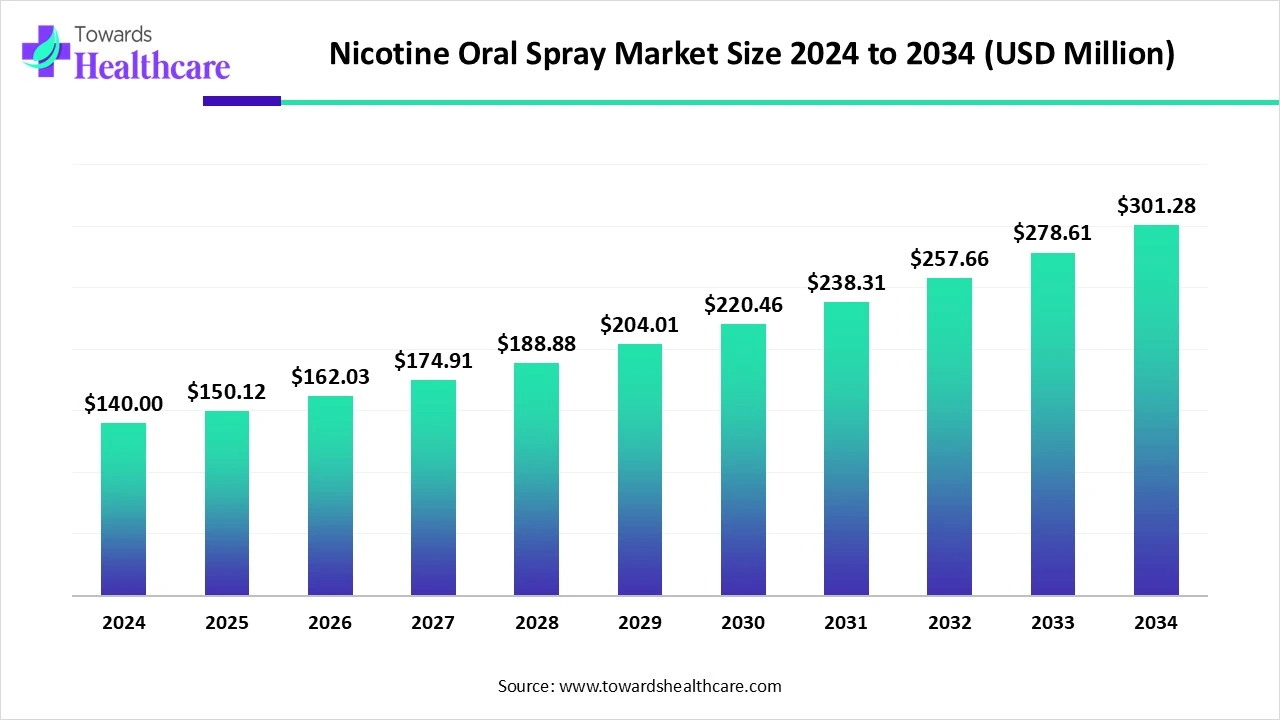

The global nicotine oral spray market size is calculated at US$ million140 in 2024, grew to US$ 150.12 million in 2025, and is projected to reach around US$ 301.28 million by 2034. The market is expanding at a CAGR of 7.94% between 2025 and 2034.

The use of nicotine oral spray is increasing globally as an alternative to smoking and vaping. This is increasing their development, which is being supported by the funding from both the private and government sectors. AI is also being used to enhance its safety, efficacy, and production. Due to its faster relief along with other advantages, its adoption is increasing in different regions. New agreements and conferences are leading to various collaborations among the companies, enhancing their development. This is promoting the market growth.

| Metric | Details |

| Market Size in 2025 | USD 150.12 Million |

| Projected Market Size in 2034 | USD 301.28 Million |

| CAGR (2025 - 2034) | 7.94% |

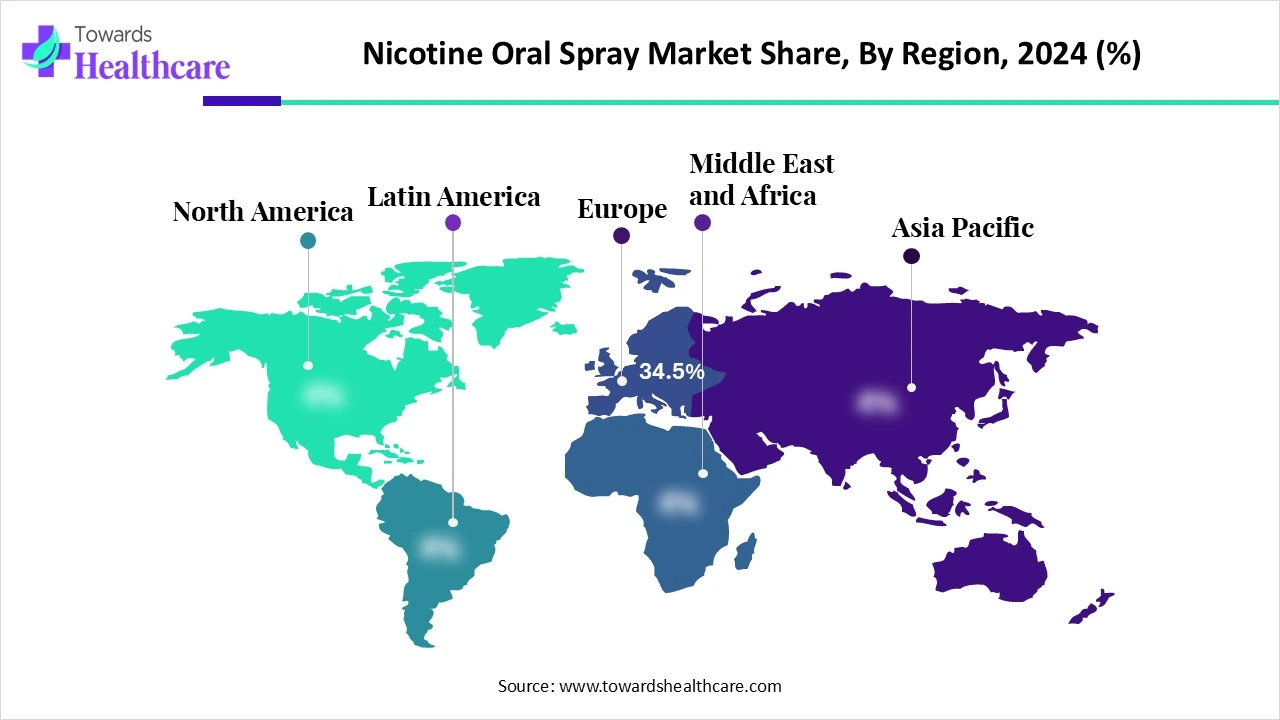

| Leading Region | Europe share by 34.5% |

| Market Segmentation | By Product Type, By Nicotine Concentration, By Distribution Channel, By End User, By Dosage Frequency, By Region |

| Top Key Players | Johnson & Johnson, GlaxoSmithKline plc, Perrigo Company plc, Cipla Health Ltd., Fertin Pharma A/S, Enorama Pharma AB, Fontem Ventures, British American Tobacco, Glenmark Pharmaceuticals, Rusan Pharma Ltd., Niconovum AB, Zonnic (Swedish Match), Sato Pharmaceutical Co., Ltd., Aurora Pharmaceuticals, Harker Herbals, Apotex Inc., Velissariou Health Products, Beijing Sciecure Pharmaceutical Co., Ltd., Syntrix Biosystems, G.D. Searle LLC |

The Nicotine Oral Spray Market comprises products designed to aid in smoking cessation and nicotine replacement therapy (NRT) by delivering a rapid, controlled dose of nicotine through the oral mucosa. These sprays, typically administered by spraying into the mouth or under the tongue, provide quick absorption and are used to reduce withdrawal symptoms and cravings. The market includes both prescription-based and over-the-counter (OTC) nicotine sprays, with formulations varying in nicotine concentration, flavor, and delivery mechanism. The rising awareness of the health hazards of smoking, regulatory support for NRTs, and preference for discreet, fast-acting alternatives to patches and gum are driving growth.

The use of AI in the development of nicotine oral spray is increasing. AI helps in the analysis of the pharmacokinetics and drug-excipient interactions, which optimizes the formulation. It is also being used to monitor the spraying frequencies as well as their doses, which promotes its safe and effective use and reduces the chances of missing the doses. Moreover, the use of AI in their research and development is also increasing these side effects and enhancing their production.

Increasing Health Awareness

The growing awareness about smoking leading to cancer, heart diseases, etc., is increasing globally. At the same time, increasing health campaigns and programs are also contributing to the same. Thus, this is increasing the use as well as the demand for nicotine oral sprays. These sprays are often associated with controlled doses, which increase their acceptance. Moreover, they are also being used as an alternative to vaping. These sprays don’t consist of any smoke, which attracts the individuals trying to quit smoking. Thus, this drives the nicotine oral spray market growth.

Stringent Regulatory Requirements

The nicotine oral sprays must be approved by the regulatory bodies of the respective countries. This can delay their commercialization. Moreover, the cost associated with their manufacturing and clinical trials to meet the regulatory standards is also high. This makes the spray development time-consuming and expensive, limiting their production.

Growing Smoking Cessation

A large volume of the population is trying to quit smoking. At the same time, increasing bans on smoking in public laid by the government, as well as health campaigns, are increasing the adoption of nicotine oral sprays. These sprays provide faster relief, which increases their reliance than other NRTs. This, in turn, is increasing their innovation and production. Moreover, their availability is also being increased with the use of online platforms. Thus, all these developments are promoting the nicotine oral spray market.

For instance,

By product type, the multi-dose spray segment held a dominating share of 47.5% in the market in 2024. The multi-dose spray provided precise dosing, which increased their long-term use. At the same time, their affordability enhanced its adherence. This contributed to the market growth.

By product type, the sublingual spray segment is expected to show the fastest growth rate at a notable CAGR during the predicted time. The sublingual spray shows quick absorption and faster action. Moreover, it provides comfort compared to the nasal sprays, due to which its use is growing.

By nicotine concentration type, the medium-dose segment led the market with a 42.3% share in 2024. It was widely used as a smoking cessation option as it was suitable for light and heavy smokers. Furthermore, due to its minimal side effects, its use increased.

By nicotine concentration type, the high-dose segment is expected to show the highest growth during the upcoming years. It shows reduced dosing frequency. Moreover, its faster relief action is also increasing its adoption. Additionally, growing innovations are driving its demand.

By distribution channel type, the pharmacies & drug stores segment held the largest share of 36.8% in the market in 2024. They provided different types of nicotine sprays. At the same time, they also provided professional advice, which increased the reliability of these stores. Thus, this enhanced the market growth.

By distribution channel type, the online retail segment is expected to show the fastest growth rate during the upcoming years. They offer a wide range of nicotine sprays, which enhances convenience. It also provides a review that can be compared before purchasing any products. Furthermore, the discounts are also attracting people.

By end user, the adult smokers segment led the global market with a 54.2% share in 2024. The nicotine oral spray was mostly used by adult smokers to quit smoking. It helped in managing the cravings in this age group. Moreover, the hospitals also prescribe it as NRT, which enhances its use.

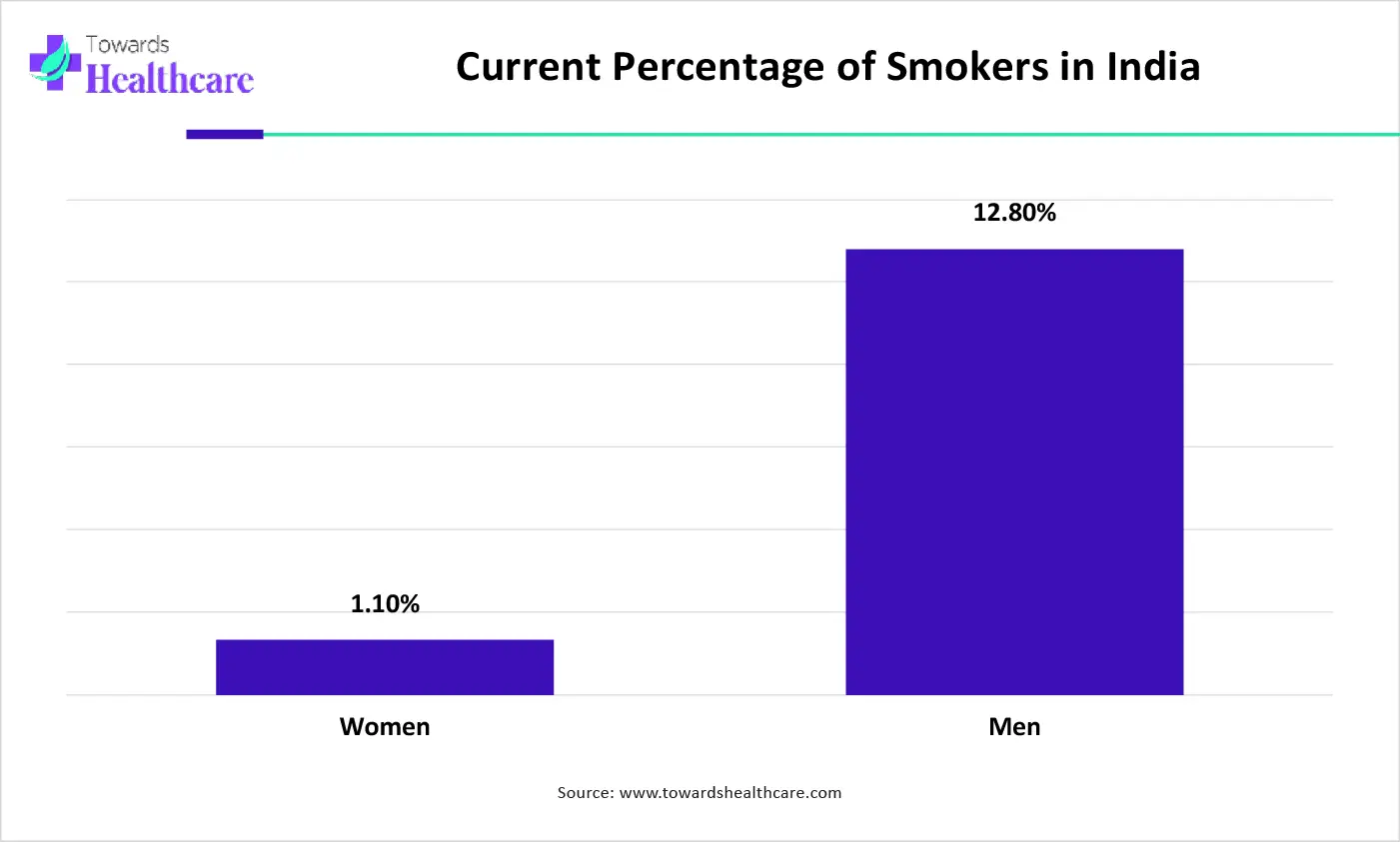

The graph represents the total percentage of smokers in India. It indicates that there is a rise in male smokers. Hence, it increases the demand for nicotine oral sprays as an alternative to smoking. Thus, this in turn will ultimately promote the market growth.

By end user, the E-cigarette users seeking cessation segment is expected to show the highest growth during the predicted time. The growing health concerns are increasing the use of nicotine oral sprays among these users. Furthermore, the users who want to quit vaping are recommended NRTs, which increases their use.

By dosage frequency type, the multiple-use segment held the largest share of 46.1% in the market in 2024. This was used by users with enhanced nicotine cravings. Thus, they provided faster action with improved safety and efficacy, without the risk of overdose. This promoted the market growth.

By dosage frequency type, the high-frequency segment is expected to show the fastest growth rate during the upcoming years. Its use among heavy smokers is increasing for the management of their nicotine cravings. Thus, their frequent use provides relief for their urges, as well as promotes their adherence.

Europe dominated the nicotine oral spray market share by 34.5% in 2024. The industries in Europe contributed to the increased innovations of the nicotine oral sprays. Moreover, the presence of reimbursement policies increased their use. Thus, this contributed to the market growth.

A large number of people in Germany use the nicotine oral sprays, due to their familiarity with the smokeless and oral nicotine products. Additionally, the growing awareness is also increasing their acceptance rates. This, in turn, is increasing their development, as well as clinical trials.

The industries present in the UK contribute to the increased development of nicotine oral spray. At the same time, the presence of well-known brands is enhancing their use. Furthermore, to enhance smoking cessation in adults, they are shifting toward these alternatives.

Asia Pacific is expected to host the fastest-growing nicotine oral spray market during the forecast period. Asia Pacific consists of a large volume of smokers, which in turn is increasing the demand for nicotine oral sprays. The growing awareness is also increasing their use. Thus, this enhances the market growth.

The use of nicotine oral sprays in China is increasing to enhance smoking cessation. At the same time, new policies and rules are being introduced by the government, which are encouraging the use of these sprays. This, in turn, is increasing their production as well.

The expanding healthcare in India is increasing the development of these sprays. Their generic manufacturing is also increasing their affordability and acceptance rates. Moreover, the growing health awareness programs and campaigns by the government are also increasing the use.

North America is expected to grow significantly in the nicotine oral spray market during the forecast period. The growing number of smokers and health awareness in North America is increasing the dependence on the nicotine oral spray. Moreover, their growing advancements are driving their use. This is promoting the market growth.

The demand for the use of nicotine oral spray is increasing in the U.S. to deal with the rising rates of smoking, as well as growing health awareness. Moreover, the government is introducing various policies to enhance its use and availability. Thus, this is accelerating their use as an alternative to NRT.

Different types of nicotine oral sprays are being developed by the industry in Canada. Additionally, their availability on online platforms enhances their use. Thus, their use is increasing to quit smoking or to minimize the risk of other smoking-related diseases.

In January 2025, after announcing the pre-commercialization agreement by Rapid Dose Therapeutics Corp. to develop novel market-ready nicotine products, its CEO, Mark Upsdell, stated that their commitment to provide science-based alternatives to smoking to consumers is supported by this agreement. With an aim to offer safer alternatives to adult smokers, they will be finalizing the development of these innovative products and will be launching them in the market in 2025.

By Product Type

By Nicotine Concentration

By Distribution Channel

By End User

By Dosage Frequency

By Region

January 2026

January 2026

November 2025

November 2025