Antithrombin Market Size and Regional Insights with Market Value Chain Analysis

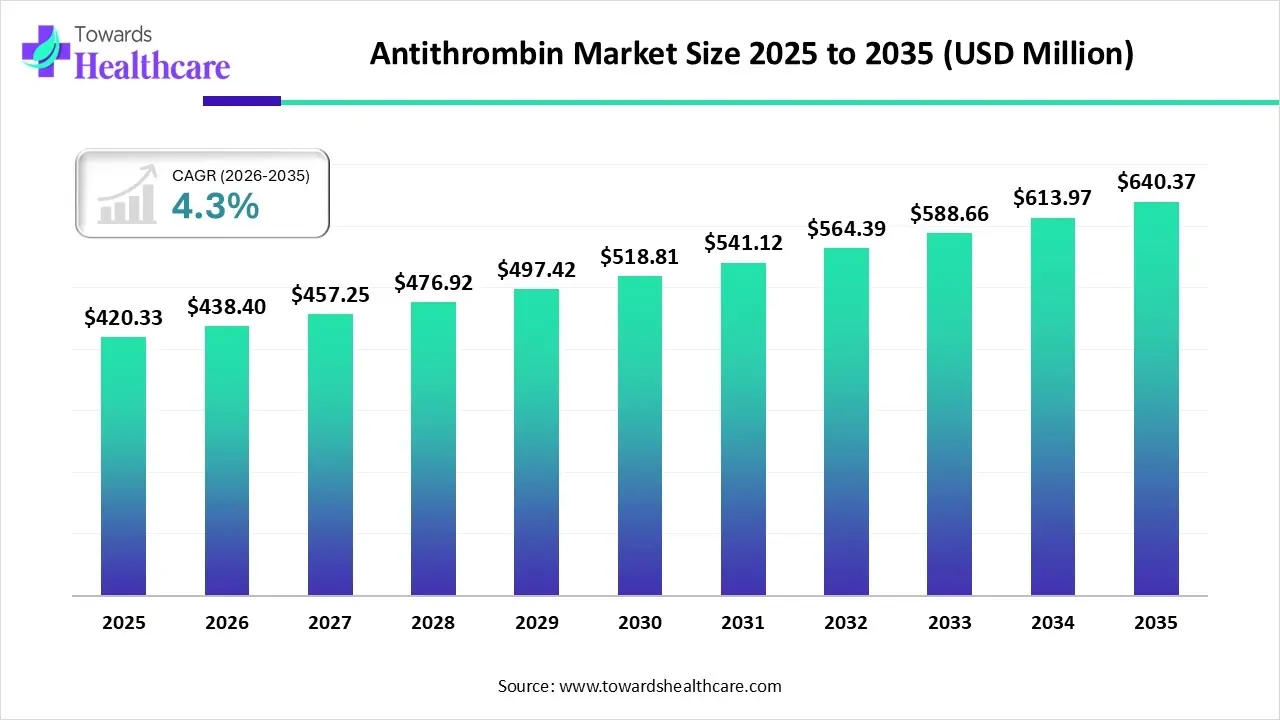

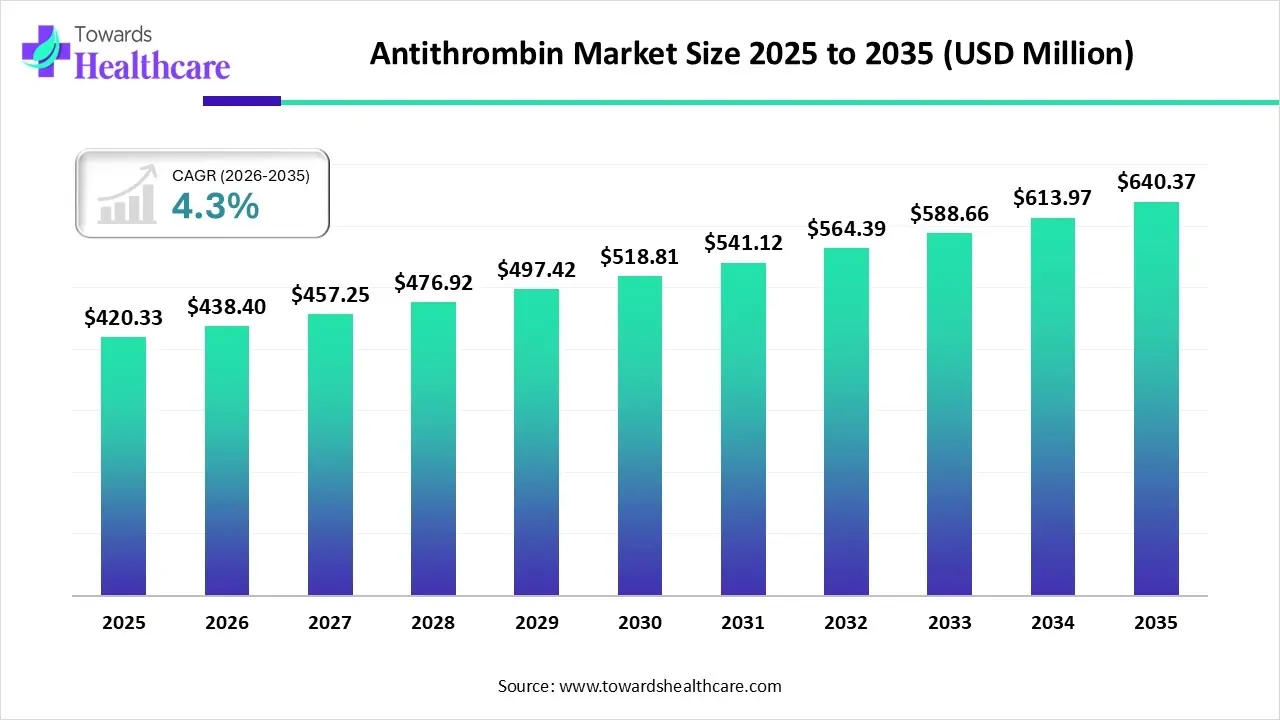

The global antithrombin market size is calculated at US$ 420.33 in 2025, grew to US$ 438.4 million in 2026, and is projected to reach around US$ 640.37 million by 2035. The market is expanding at a CAGR of 4.3% between 2026 and 2035.

Technological convergence and changing clinical paradigms are driving a significant transformation in the antithrombin market. As scientists work to restore endogenous antithrombin synthesis through genome correction techniques, emerging gene editing platforms are upending traditional ideas of protein replacement. In the meantime, engineered antithrombin variants with increased inhibitory profiles or longer half-lives are being found more quickly thanks to developments in bioinformatics and molecular modeling.

Key Takeaways

- The antithrombin market will likely exceed USD 420.33 million by 2025.

- Valuation is projected to hit USD 640.37 million by 2035.

- Estimated to grow at a CAGR of 4.3% starting from 2026 to 2035.

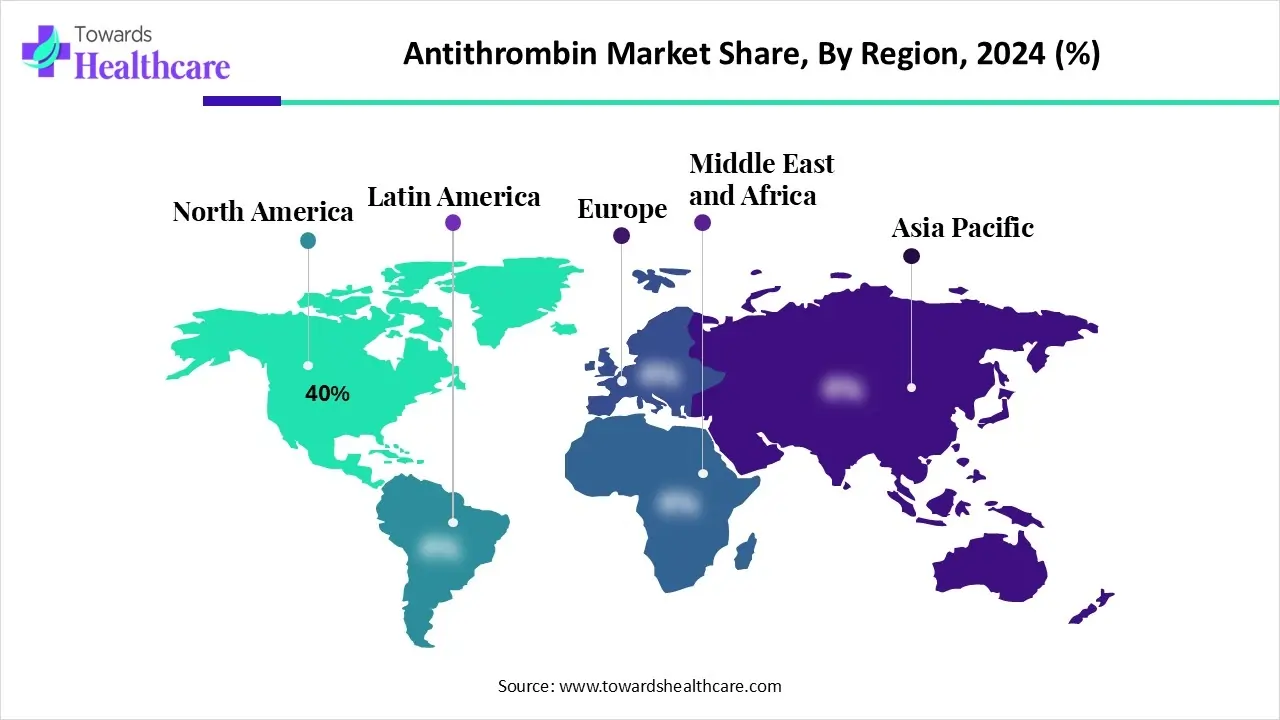

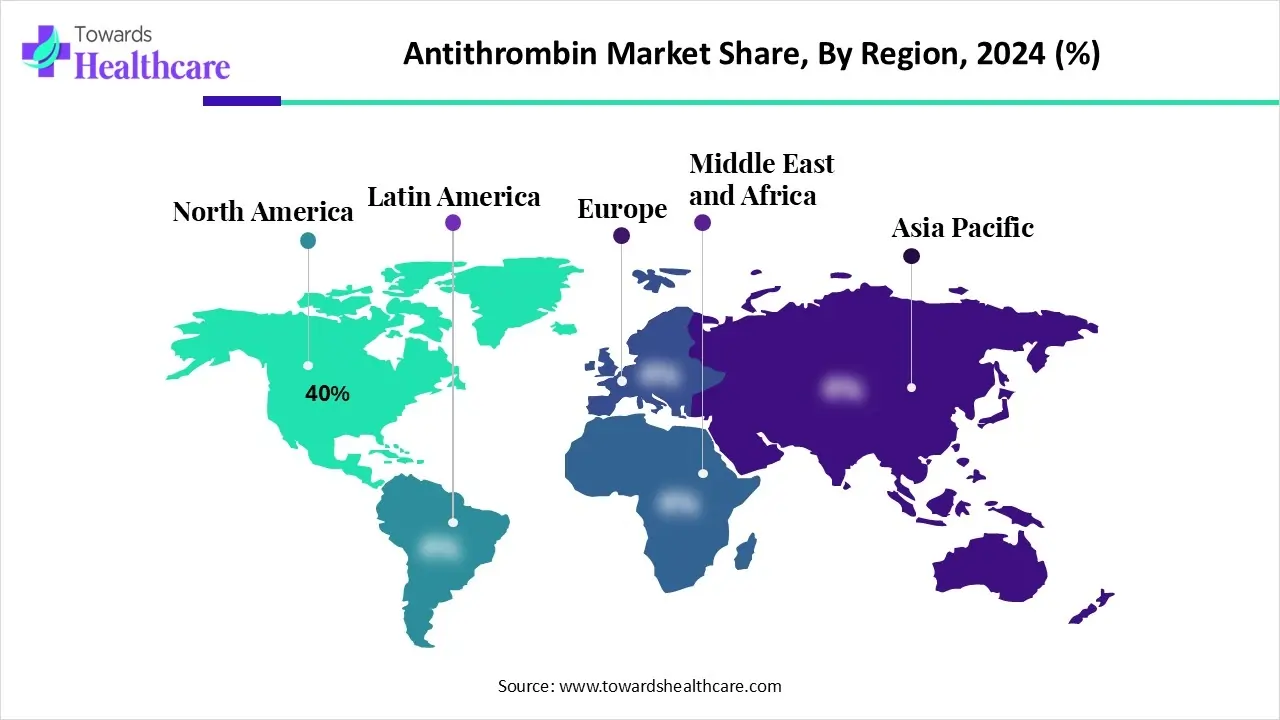

- North America dominated the antithrombin market with a revenue of approximately 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product type, the plasma-derived antithrombin segment dominated the market with a revenue of approximately 60% in 2024.

- By product type, the recombinant antithrombin (rAT) segment is expected to grow at the fastest CAGR of 10-12% during the forecast period.

- By end-user, the hospitals & surgical centers segment dominated the market with a revenue of approximately 55% in 2024.

- By end-user, the specialty clinics segment is expected to grow at the fastest CAGR of 10% during the forecast period.

- By route of administration, the intravenous segment dominated the market with a revenue of approximately 90% in 2024.

- By route of administration, the subcutaneous segment is expected to grow at the fastest CAGR of 15% during the forecast period.

- By distribution channel, the hospital pharmacies segment dominated the market with a revenue of approximately 50% in 2024.

- By distribution channel, the specialty drug distributors segment is expected to grow at the fastest CAGR of 9-10% during the forecast period.

Key Indicators and Highlights

| Key Elements |

Scope |

| Market Size in 2025 |

USD 420.33 Million |

| Projected Market Size in 2035 |

USD 640.37 Million |

| CAGR (2025 - 2035) |

4.3% |

| Leading Region |

North America by 40% |

| Market Segmentation |

By Product Type, By End-User, By Route of Administration, By Distribution Channel, By Region |

| Top Key Players |

CSL Limited, Grifols, S.A., Takeda Pharmaceutical Company Limited (which acquired Shire Plc), Octapharma AG, LFB USA, Kedrion S.p.A, Lee Biosolutions, Scripps Laboratories, rEVO Biologics, Inc., Thermo Fisher Scientific, Siemens Healthcare GmbH, Diapharma Group, Inc., Merck KGaA, Pfizer Inc., Sanofi, Novartis AG, Bio-Techne Corporation, Biocon Ltd., Jiangsu Hengrui Medicine Co., Ltd., China Biologic Products, Inc. |

What is Antithrombin?

The antithrombin market is driven by the increasing prevalence of thrombosis, rising use in surgical and obstetric care, adoption in neonatal/pediatric care, growing biologics manufacturing, wider application in rare disease management, and advances in recombinant technology that improve production scalability and safety profiles.

The global antithrombin market covers the production, purification, formulation, distribution, and clinical use of antithrombin (AT) products, including antithrombin III concentrates derived from plasma, recombinant antithrombin produced through bioengineering, and antithrombin used in research and diagnostics. Antithrombin is an essential serine protease inhibitor used to prevent and treat thrombotic complications in patients with hereditary antithrombin deficiency, disseminated intravascular coagulation (DIC), sepsis-related coagulopathy, cardiopulmonary bypass surgery, and in heparin-resistant conditions.

Antithrombin Market Outlook

- Industry Growth Overview: The rising number of surgical procedures requiring anticoagulation therapy and the rising prevalence of blood clotting disorders are driving the market. Recombinant antithrombin is one example of a biotechnology advancement that improves safety and efficacy and has sustained market growth over the past ten years.

- Global Expansion: Because of its sophisticated healthcare system and high level of awareness, North America currently has the largest antithrombin market share. Due to the increasing incidence of thrombotic diseases in China and India as well as better healthcare facilities, the Asia-Pacific region is expected to grow at the fastest rate.

- Major Investors: Grifols, CSL, Takeda Pharmaceutical Company, and Octapharma AG are important investors and businesses. These players participate in R&D funding and strategic initiatives for innovative treatments, such as the Grifols/Endpoint Health partnership for the treatment of sepsis.

What is the Role of AI in the Antithrombin Market?

The antithrombin’s production and quality control frameworks are changing due to automation and artificial intelligence. AI algorithms are being used more and more for formulation modeling, process optimization, and protein structure prediction, which lowers human error and speeds up drug development. Furthermore, AI-powered platforms are being incorporated into clinical trial management and pharmacovigilance to improve patient safety profiling and enable real-time adverse event monitoring.

Segmental Insights

Product Type Insights

Which Product Type Dominated the Antithrombin Market in 2024?

Plasma-Derived Antithrombin

The plasma-derived antithrombin segment accounted for approximately 60% of market revenue in 2024. The delicate balance between clotting and bleeding is demonstrated by the use of products derived from human plasma to prevent thrombosis and control bleeding. Concentrates of plasma-derived antithrombin (pdAT) can be used to treat congenital antithrombin (AT) deficiency-related venous thromboembolism (VTE).

Recombinant Antithrombin (rAT)

The recombinant antithrombin (rAT) segment is expected to grow at the highest rate of 10-12% in the antithrombin market during 2025-2034. The main benefit of recombinant antithrombin over plasma-derived products is its improved safety profile, which removes the possibility of spreading blood-borne infections. Because it doesn't rely on human blood donations, it also offers more consistent potency and a dependable supply.

Antithrombin Assay Kits

The antithrombin assay kits segment is estimated to achieve a significant growth rate in the market during the upcoming period. An activity assay should be used for preliminary testing in order to diagnose antithrombin deficiency. One recommendation for laboratory testing to identify antithrombin deficiency is to use an activity assay for preliminary testing. In order to effectively guide and monitor anticoagulation therapy, they are also crucial.

End-User Insights

How Hospitals & Surgical Centers Dominated the Antithrombin Market in 2024?

The hospitals & surgical centers segment dominated the market, accounting for approximately 55% of revenue in 2024. The Centers for Disease Control and Prevention state that compared to a traditional hospital setting, the surgical hospital setting is frequently safer and cleaner, lowering the risk of infection by almost half. Additionally, procedures carried out in a surgery center usually result in faster completion times and shorter recovery times.

Speciality Clinics

The specialty clinics segment is expected to grow at the highest growth rate of 10% in the antithrombin market during 2025-2034. Specialized clinics have a positive impact on patient care and outcomes that goes beyond the individual healthcare provider. Specialized clinics will continue to play a crucial role in developing clinical expertise, encouraging innovation, and influencing the direction of healthcare as medicine advances.

Diagnostic Laboratories

The diagnostic laboratories segment is estimated to achieve a significant growth rate in the market during the upcoming period. Precision medicine, expedited workflows, and data-driven decision-making are the hallmarks of the transformative era that the health care and diagnostics sector is entering. Artificial intelligence (AI) and automation are being strategically integrated into laboratories as personalized healthcare becomes the norm.

Route of Administration Insights

How did the Intravenous Segment Dominate the Antithrombin Market in 2024?

The intravenous segment dominated the market, accounting for approximately 90% of revenue in 2024. For acute, life-threatening conditions like severe sepsis or disseminated intravascular coagulation (DIC), intravenous administration offers instantaneous and complete bioavailability, enabling a quick onset of action. In a controlled hospital setting, the doctor can precisely achieve high plasma concentrations of the drug and closely monitor its effects.

Subcutaneous

The subcutaneous segment is expected to grow at the highest growth rate of 15% in the antithrombin market during 2025-2034. For chronic conditions (such as maintenance therapy for hereditary AT deficiency), subcutaneous administration is recommended, with an emphasis on patient comfort and quality of life. It eliminates the need for repeated IV access, cuts down on time spent in the infusion clinic, requires fewer resources for medical professionals, and permits at-home treatment.

Distribution Channel Insights

What Made Hospital Pharmacies Dominant in the Antithrombin Market in 2024?

The hospital pharmacies segment accounted for approximately 50% of market revenue in 2024. One of the most important divisions in hospitals that handles the acquisition, storage, compounding, dispensing, production, testing, packaging, and distribution of medications is the hospital pharmacy. This department is also in charge of pharmaceutical science and education research, which is conducted by qualified and experienced pharmacists. The hospital pharmacy significantly affects the cost of medical care.

Specialty Drug Distributors

The specialty drug distributors segment is expected to grow at a 9-10% CAGR in the antithrombin market during the forecast period. In order to support pharmaceutical companies and guarantee that patients with uncommon illnesses have access to the medication they require at the appropriate time, specialty distributors are essential. In order to meet patient demand, a lot of specialty pharmacies now provide distribution services.

Online/Direct Biopharma Supply

The online/direct biopharma supply segment is estimated to achieve a significant growth rate in the market during the upcoming period. By utilizing digital technologies and optimizing the supply chain, online/direct biopharma supply offers notable benefits in terms of efficiency, cost-effectiveness, and patient experience.

Regional Insights

How North America Became Dominant in the Antithrombin Market in 2024?

North America accounted for approximately 40% of the antithrombin market revenue in 2024. This is mostly because antithrombin concentrates are growing in the region. The expansion of the regional market is also boosted by supportive U.S. government investments on plasma-derived products.

VTE in the U.S.: High Incidence, High Costs, and Sudden Fatalities

Venous thromboembolism affects up to 900,000 in the U.S. annually. About 25% of individuals with PE experience sudden death as their initial symptom. Between 60,000 and 100,000 Americans are thought to die from VTE every year. According to economic analyses, the U.S. spends between $5 and $10 billion annually on healthcare related to VTE, with direct medical costs of about $20,000 per case of incidence.

Rapid Growth in Hospital Infrastructure Drives the Asia Pacific

Asia Pacific is estimated to host the fastest-growing antithrombin market during the forecast period. Interest in advanced antithrombin products is being driven by the rapid expansion of hospital infrastructure, the rising incidence of coagulation disorders, and the growing awareness among clinicians. Public health investments in sepsis management and government initiatives to improve critical care capabilities further accelerate market evolution. At the same time, developing domestic biopharma capabilities in nations like China, Japan, and India promises to bring in new players, competitive pricing structures, and possible export dynamics.

Thrombosis in India: Escalating CVD and Antithrombin Needs

In India, intravascular thrombosis-related cardiovascular disease (CVD) is becoming a major public health issue due to a complex interaction of socioeconomic, genetic, and lifestyle factors. In the upcoming years, reducing the rising incidence of CVD and intravascular thrombosis will require raising public health awareness, encouraging treatment compliance, and expanding access to medical resources.

Prevalence of Thrombotic Disorders Drives Europe

Europe is expected to grow at a significant CAGR in the antithrombin market during the forecast period, motivated by the rising incidence of thrombotic disorders, robust healthcare systems, and significant R&D expenditures made by major pharmaceutical companies. Significant adoption is occurring in nations such as France, the United Kingdom, and Germany due to their sophisticated hospital networks and established clinical research facilities. Growth in the market is also being aided by the expansion of specialty treatment facilities and the regulatory approval of innovative treatments.

Underassessment of UK VTE Risk Boosts Antithrombin Demand

Of the 3.4 million admitted patients in the UK, 91% had a VTE risk assessment. Both NHS and independent sector providers achieved an assessment rate of 91%. London received the highest assessment (93%), while Yorkshire, the North East, and the North West received the lowest (88%). Remarkably, only 29% of integrated care boards (12 out of 42) met the operational requirement of evaluating 95% or more of their admissions.

South America: A Rising Tide in Hemostasis

The South America antithrombin market is poised for considerable expansion, driven by rising awareness and improving healthcare infrastructure across the region. A significant driver is the high burden of venous thromboembolism hospitalization, especially in Brazil, which reports an average of over 46,000 cases annually. This growing incidence heightens the need for effective anticoagulant therapies.

Brazil: The Anticoagulation Powerhouse

Brazil stands out as a key growth engine in South America's antithrombin market due to its massive patient population and rising number of surgical procedures. Data from the broader Brazilian anticoagulation therapy market, which includes antithrombin use, indicates that Deep Vein Thrombosis treatment alone accounts for a substantial share of revenue. This underscores the robust demand.

Middle East and Africa (MEA): Untapped Therapeutic Potential

The MEA antithrombin market is poised for promising growth, particularly in the therapeutics segment. Advancements in critical care settings and increased investment in sophisticated healthcare services are bolstering adoption. The region is seeing diversification of demand across various applications, including cardiovascular surgery, which accounts for over 40% of global consumption.

UAE: Healthcare Investment Drives Demand

The United Arab Emirates is a focal point for growth, supported by substantial government initiatives and favorable reimbursement policies for antithrombotic drugs. As a high-income country, the UAE is rapidly adopting advanced recombinant products to treat conditions such as deep vein thrombosis.

Antithrombin Market Value Chain Analysis

R&D

It includes preclinical testing to find novel antithrombin products and comprehend mechanisms, as well as basic research and target identification (such as SERPINC1 gene variants).

Companies involved in the research and development phase include Grifols, CSL Behring, Takeda, Octapharma, LFB, Kedrion, and Siemens Healthineers.

Clinical Trials and Regulatory Approvals

It involves using human subjects in a series of trial phases to demonstrate safety and efficacy before submitting and receiving regulatory approval (e.g., FDA, EMA).

Companies managing clinical trials and seeking regulatory approvals include Grifols, CSL Behring, Takeda, Octapharma, LFB, Kedrion, and Siemens Healthineers.

Formulation and Final Dosage Preparation

It involves converting the active pharmaceutical ingredient (API) into a final product (e.g., injectable solution, specific dosage units) that is stable and ready for the market.

Companies responsible for formulating and preparing the final antithrombin products for market include Grifols, CSL Behring, Takeda, Octapharma, LFB, Kedrion, and Siemens Healthineers.

Company Landscape

1. Grifols, S.A.

Company Overview

- Corporate Information (Headquarters, Year Founded, Ownership Type):

- Headquarters: Sant Cugat del Vallès, Barcelona, Spain

- Year Founded: 1909 (precursor laboratory)

- Ownership Type: Publicly traded (MCE: GRF, MCE: GRF.P, NASDAQ: GRFS)

- History and Background:

- Pioneered in the plasma industry, tracing roots to a clinical analysis lab established in 1909.

- A global leader in essential plasma-derived medicines and transfusion medicine.

- One of the world's largest plasma collection networks (approximately 400 centers).

- Key Milestones/Timeline:

- 1988: Opened first subsidiary in Portugal, beginning international expansion.

- 2006: Listed on the Madrid stock exchange.

- 2011: Began trading on NASDAQ following the acquisition of Talecris Biotherapeutics.

- 2025 (Nov): Received expanded FDA approval for THROMBATE III in pediatric patients.

- Business Overview:

- Focuses on the research, development, manufacturing, and commercialization of plasma-derived medicines and other biopharmaceuticals.

- The largest plasma collector in Europe and third largest worldwide.

- Total revenue was €7.2 billion in 2024.

- Business Segments/Divisions:

- Biopharma: Plasma-derived therapies (including antithrombin, immunoglobulins, albumin, alpha-1 antitrypsin, etc.).

- Diagnostic: Transfusion medicine, clinical and immunological diagnostics.

- Bio Supplies: Biological supplies for research and manufacturing.

- Others: Includes Grifols Engineering, which designs and builds plasma and manufacturing facilities.

- Geographic Presence:

- Provides products and solutions in more than 110 countries.

- Plasma collection network spans North America, Europe, Africa, and the Middle East, with a presence in China through a partnership.

- Key Offerings:

- Antithrombin: THROMBATE III® (Antithrombin III [Human]) - indicated for hereditary antithrombin deficiency (hATd).

- Other Biologics: IG, Albumin, A1PI, Coagulation factors.

- End-Use Industries Served:

- Hospitals and Specialty Clinics (especially Intensive Care, Hematology, Pulmonology, Neurology).

- Transfusion and Clinical Diagnostic Laboratories.

- Life-Science Research.

- Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Successfully completed the delisting of Biotest in June 2025 following its acquisition.

- Partnerships & Collaborations: Completed the sale of a 20% equity stake in Shanghai RAAS (SRAAS) and forged a strategic alliance with Haier Group in June 2024.

- Product Launches/Innovations: Grifols' Biotest received its first regulatory approval for its new fibrinogen concentrate (Prufibry®) in Germany (November 2025).

- Capacity Expansions/Investments: Targeting a plasma fractionation capacity of 26 million liters per year by 2026.

- Regulatory Approvals: Received U.S. FDA expanded indication for THROMBATE III® to include pediatric patients with hATd (November 2025).

- Distribution channel strategy: Highly integrated global plasma collection, fractionation, and distribution network ensures a stable supply chain for its plasma-derived products.

- Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Proprietary plasma fractionation processes and viral inactivation technologies for high-quality plasma products.

- Research & Development Infrastructure: Over 1,200 researchers across 12 R&D centers globally.

- Innovation Focus Areas: Plasma-derived treatments, recombinant antibody drugs, and new therapies for neurological, immunological, and hematological disorders.

- Competitive Positioning:

- Strengths & Differentiators: Vertically integrated business model (plasma collection to final product), large and growing global plasma collection network, and a strong pipeline for rare and chronic diseases.

- Market presence & ecosystem role: A dominant global player in the plasma protein therapeutics market, serving a critical role as a primary supplier of life-saving, plasma-derived medicines.

- SWOT Analysis:

- Strengths: Vertical integration, leading global plasma collector, strong revenue growth in Biopharma (12.1% in Q3 2024).

- Weaknesses: Significant debt load, reliance on plasma supply.

- Opportunities: Expansion into China via SRAAS/Haier partnership, new indications for existing therapies (e.g., pediatric THROMBATE III approval).

- Threats: Competition from recombinant and synthetic alternatives, regulatory scrutiny, plasma collection variability.

- Recent News and Updates:

- Press Releases: November 18, 2025: Grifols receives expanded U.S. FDA indication for THROMBATE III to include pediatric patients with hereditary antithrombin deficiency.

- Industry Recognitions/Awards: Named one of TIME magazine’s "World’s Best Companies 2025" and one of Forbes’ World's Best Employers for the second consecutive year.

2. CSL Behring (CSL Limited)

Company Overview

- Corporate Information (Headquarters, Year Founded, Ownership Type):

- Headquarters: Melbourne, Victoria, Australia (CSL Limited) / King of Prussia, Pennsylvania, USA (CSL Behring)

- Year Founded: 1916 (Commonwealth Serum Laboratories)

- Ownership Type: Publicly traded (ASX: CSL, OTC: CSLLY)

- History and Background:

- Originated as a government-owned body in Australia. Privatized in 1994.

- CSL Behring was established through the integration of Centeon, Aventis Behring, and ZLB Bioplasma, focusing on plasma protein biotherapeutics.

- Key Milestones/Timeline:

- 1916: Founded as Commonwealth Serum Laboratories in Australia.

- 2004: Acquisition of Aventis Behring forms CSL Behring.

- 2022: Completed the acquisition of Vifor Pharma, expanding into iron deficiency and nephrology.

- 2025 (Nov): Announced investment of approximately $1.5 billion in the U.S. to manufacture plasma-derived therapies.

- Business Overview:

- A leading global biotechnology company driven by a promise to save lives and protect the health of people.

- Discovers, develops, manufactures, and markets biopharmaceuticals.

- CSL Group Revenue for FY2025 was US$15.6 billion.

- Business Segments/Divisions:

- CSL Behring: Global leader in plasma protein biotherapies, including antithrombin, immunoglobulins, albumin, and coagulation factors.

- CSL Seqirus: Global leader in influenza vaccines.

- CSL Vifor: Global leader in iron deficiency and nephrology (acquired in 2022).

- CSL Plasma: Operates one of the world's largest plasma collection networks (over 349 centers).

- Geographic Presence:

- Delivers products to patients in more than 100 countries.

- Major manufacturing presence in the US, Germany, Switzerland, and Australia.

- Key Offerings:

- Antithrombin: ATNF (Antithrombin Human) and Thrombate III (in certain markets/legacy products). CSL Behring's primary product for AT replacement is a plasma-derived concentrate.

- Other Biologics: HAE treatments (e.g., ANDEMBRY®), Immunoglobulins (Hizentra®, Privigen®), Recombinant and Plasma-derived Coagulation Factors.

- End-Use Industries Served:

- Hospitals and Specialty Clinics (Hematology, Immunology, Critical Care).

- Dialysis and Nephrology Centers (through CSL Vifor).

- Public Health Programs (via CSL Seqirus vaccines).

- Key Developments and Strategic Initiatives:

- Mergers & Acquisitions: Focus on integrating CSL Vifor to strengthen its position in specialty pharmaceuticals.

- Partnerships & Collaborations: Partnered with Dutch biotech VarmX BV in September 2025 to develop a first-in-class investigational coagulation treatment. Signed an LOI with the pan-Canadian Pharmaceutical Alliance (pCPA) in October 2025 for public reimbursement of its Hemophilia B gene therapy, HEMGENIX®.

- Product Launches/Innovations: Launched ANDEMBRY® (garadacimab) in Japan and received EU/Swiss approval in early 2025 for Hereditary Angioedema (HAE).

- Capacity Expansions/Investments: Major investment of approximately $1.5 billion announced in November 2025 for U.S. plasma-derived therapies manufacturing.

- Regulatory Approvals: Received Swissmedic and European Commission approval for ANDEMBRY® (garadacimab) in HAE prevention (Feb 2025).

- Distribution channel strategy: Utilizes a combination of direct sales and distribution partners to serve its global market, leveraging its large CSL Behring business for plasma product distribution.

- Technological Capabilities/R&D Focus:

- Core Technologies/Patents: Expertise in plasma fractionation, recombinant protein technology, and emerging cell and gene therapy platforms.

- Research & Development Infrastructure: Over 2,000 R&D employees globally; R&D investment of $5.8 billion over the last 5 years.

- Innovation Focus Areas: Advancing treatments in hematology, immunology, respiratory/cardiovascular/metabolic disorders, and vaccines. Strong focus on gene therapy (e.g., HEMGENIX®).

- Competitive Positioning:

- Strengths & Differentiators: Broad and diversified portfolio across CSL Behring, Seqirus, and Vifor; global R&D footprint; strong financial performance (Net Profit After Tax of US$3.0 billion in FY25); integrated plasma collection.

- Market presence & ecosystem role: A dominant force in global plasma therapies, flu vaccines, and specialty pharmaceuticals, holding a key position in rare disease treatment markets.

- SWOT Analysis:

- Strengths: Diversified revenue streams (plasma, vaccines, nephrology), strong R&D pipeline, global scale, industry-leading quality/safety standards.

- Weaknesses: High cost of plasma sourcing, market competition for innovative therapies.

- Opportunities: Growth of CSL Vifor in nephrology, expansion of gene therapy (HEMGENIX®), and geographic market penetration (e.g., MEA).

- Threats: Development of synthetic/recombinant alternatives to plasma products, public health crises impacting plasma collection.

- Recent News and Updates:

- Press Releases: November 18, 2025: CSL announces approximately $1.5 billion investment in U.S. manufacturing for plasma-derived therapies. October 26, 2025: CSL Honored as Overall Winner of the 2025 ISPE Facility of the Year Awards for its Broadmeadows facility.

- Industry Recognitions/Awards: Overall Winner of the 2025 ISPE Facility of the Year Awards (Pharma 4.0 category).

Top Vendors in the Antithrombin Market & Their Offerings

| Company |

Offerings |

Contributions to Antithrombin Market |

Market Role |

Key Highlights |

| Takeda Pharmaceutical Company Limited |

Plasma-derived antithrombin; coagulation therapies |

Expands global therapeutic access and supports critical-care use |

Major global supplier |

Strong regulatory focus and large manufacturing base |

| Octapharma AG |

Human plasma-derived antithrombin concentrates |

Ensures reliable supply for surgical and ICU thrombosis management |

Leading European producer |

Robust plasma-fractionation capabilities |

| LFB USA |

Antithrombin concentrates |

Serves hereditary AT deficiency and specialized clinical needs |

Niche U.S. biotherapeutics player |

Focus on rare-disease biologics |

| Kedrion S.p.A |

Plasma-derived antithrombin |

Expands donor-based production for hospitals worldwide |

Key plasma-therapy provider |

Broad global plasma-collection network |

| Lee Biosolutions |

Antithrombin reagents and biomarkers |

Supports diagnostics, assays, and research applications |

Specialized biochemical supplier |

Enables lab testing and innovation in AT analysis |

Top Companies in the Antithrombin Market

- CSL Limited

- Grifols, S.A.

- Takeda Pharmaceutical Company Limited (which acquired Shire Plc)

- Octapharma AG

- LFB USA

- Kedrion S.p.A

- Lee Biosolutions

- Scripps Laboratories

- rEVO Biologics, Inc.

- Thermo Fisher Scientific

- Siemens Healthcare GmbH

- Diapharma Group, Inc.

- Merck KGaA

- Pfizer Inc.

- Sanofi

- Novartis AG

- Bio-Techne Corporation

- Biocon Ltd.

- Jiangsu Hengrui Medicine Co., Ltd.

- China Biologic Products, Inc.

Recent Developments in the Antithrombin Market

- In November 2025, the U.S. Food and Drug Administration (FDA) approved an expanded indication for THROMBATE III, the company's antithrombin III [human concentrate], to include pediatric patients with hereditary antithrombin deficiency (hATd), according to a statement released by Spanish plasma-based drug manufacturer Grifols (MCE: GRF).

- In March 2025, the first antithrombin-lowering (AT) treatment, Qfitlia (fitusiran), was approved by the U.S. Food and Drug Administration (FDA) for routine prophylaxis to prevent or lessen the frequency of bleeding episodes in adult and pediatric patients (aged 12 or older) with hemophilia A or B, with or without factor VIII or IX inhibitors.

Segments Covered in the Report

By Product Type

- Plasma-Derived Antithrombin

- Recombinant Antithrombin (rAT)

- Antithrombin Assay Kits (Diagnostic Use)

- Antithrombin Products for Research/Industrial Use

By End-User

- Hospitals & Surgical Centers

- Diagnostic Laboratories

- Specialty Clinics (cardiology, hematology)

- Research Institutes & Biopharma Companies Shape

By Route of Administration

- Intravenous (IV)

- Subcutaneous (under development/emerging)

- Laboratory Reagent Use

By Distribution Channel

- Hospital Pharmacies

- Specialty Drug Distributors

- Online/Direct Biopharma Supply

- Research & Diagnostic Supply Distributors

By Region

- North America

- U.S.

- Canada

- Mexico

- Rest of North America

- South America

- Brazil

- Argentina

- Rest of South America

- Europe

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA