February 2026

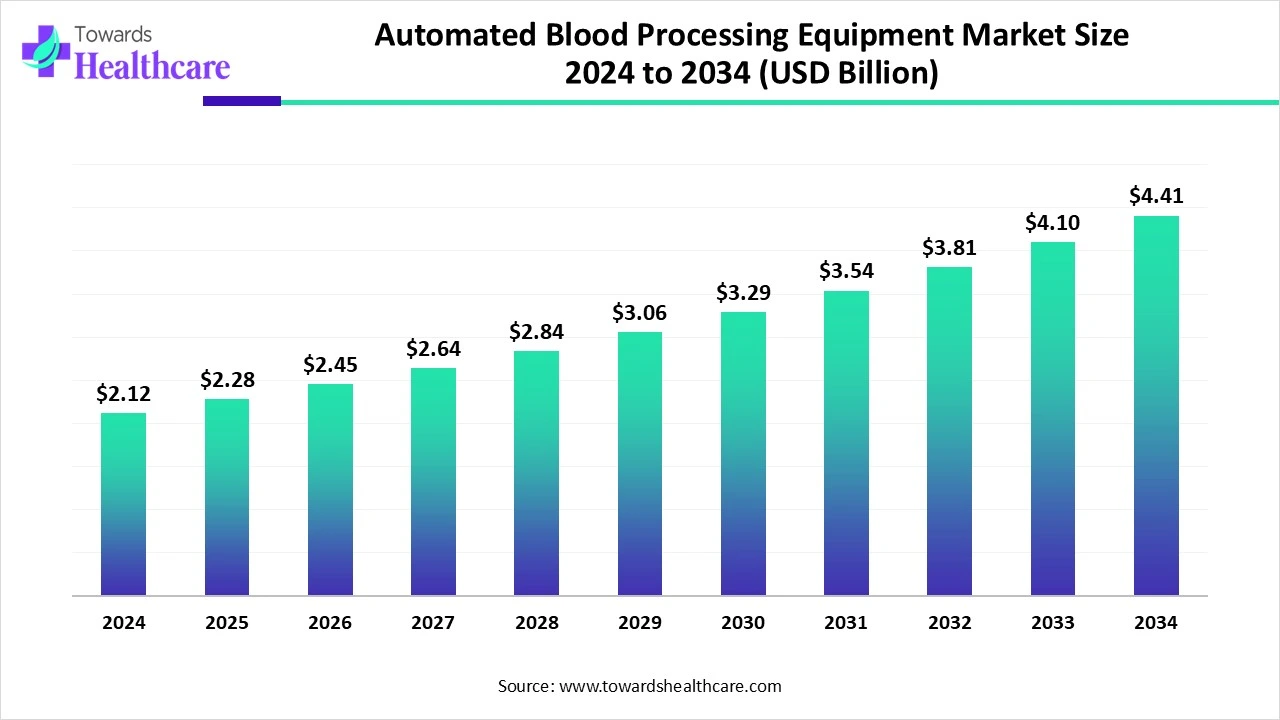

The global automated blood processing equipment market size is calculated at US$ 2.12 in 2024, grew to US$ 2.28 billion in 2025, and is projected to reach around US$ 4.41 billion by 2034. The market is expanding at a CAGR of 7.65% between 2025 and 2034.

The global automated blood processing equipment market is experiencing major growth due to several contributing factors, including rising cases of chronic diseases such as cancer, kidney conditions, and hemophilia are demanding more blood transfusions. As well as enhancing the adoption of technological advancements coupled with AI and IoT in different blood banks and diagnostic centres. Along with this, increasing initiatives and awareness campaigns to accelerate blood donation rates around the world. In the coming era, various opportunities such as breakthroughs in robotics, AI, and IoT technologies will expand the market.

| Metric | Details |

| Market Size in 2025 | USD 2.28 Billion |

| Projected Market Size in 2034 | USD 4.41 Billion |

| CAGR (2025 - 2034) | 7.65% |

| Leading Region | North America |

| Market Segmentation | By Type, By Accessory Equipment, By End Use, By Application,By Region |

| Top Key Players | Terumo Corporation, Haemonetics Corporation, Grifols S.A., Macopharma, Fresenius Kabi AG, Beckman Coulter, Immucor, Kawasumi Laboratories, Sysmex, Ortho Clinical Diagnostics |

The automated devices that are used to separate, process, and prepare blood components from whole blood, often employed in transfusion or future production, are called automated blood processing equipment. Moreover, systems encompass steps such as centrifugation, component separation, and expression of components into designated bags. Around the world, nowadays, rising cases of chronic diseases, road traffic accidents, and surgical approaches that require a greater supply of blood and blood products are majorly impacting demand for the respective equipment. Also, the global automated blood processing equipment market is driven by accelerating innovation in automation, robotics, and digitalization dominated the development of robust and reliable blood processing systems, enhancing sample integrity and minimizing human errors.

As AI has been revolutionizing blood processing via automation, enhancing effectiveness and accuracy in different applications. Because robust application of AI algorithms in the analysis of huge datasets of genetic and molecular information to detect possible drug targets and increase the development of novel therapies for blood concerns is boosting the adoption of AI in different blood processing. Moreover, AI improves resource allocation in blood banks, anticipates demand, and ensures potential inventory management. Basically, in hematology, AI-driven systems analyze blood samples, determine cells, and detect abnormalities with higher speed and precision than conventional approaches.

Growing Awareness and Technological Advancements

Globally, accelerating chronic conditions and road accidents, along with surgical procedures, are demanding for greater supply of blood and blood products is propelling the market growth. As well as around the world, rising awareness campaigns and initiatives regarding blood donation and technological breakthroughs in automation, robotics, and digital techniques are boosting the automated blood processing equipment market.

Increasing Spending and the Complexity of Equipment

The rising challenges in the automated blood processing equipment market are the requirement for crucial capital investments in equipment, which poses hurdles for smaller or resource-limited organizations. Besides this, the need for specialized maintenance and potential repairs in complex machinery results in major recurring costs.

Emerging AI & robotics, with the Expansion of Blood Banks and Transfusion Centers

In the future, the increasing demand for blood and blood products is propelling the need for strong and automated blood processing systems in various blood banks and transfusion centres. As well as the integrated robotics with AI in blood operating equipment is resulting in enhanced automation, accuracy, and effectiveness, generating opportunities for manufacturers to establish advanced systems.

By type, the blood cell separators segment held a significant revenue share of the market in 2024. As this segment plays a major role in tissue generation, wound healing, and other biological processes, it enables efficient separation and preparation of blood components in numerous therapeutic and research applications, driving the segment growth.

By type, the blood storage systems segment is expected to grow rapidly during the forecast period. These systems have a vital significance in the maintenance of blood products at specific temperature conditions, which ensures their availability for transfusion and other medical uses. Also, the growing blood donation instances, breakthroughs in preservation technology, and rising blood disorder cases are impacting the market growth.

By accessory equipment, the hemoglobin analyzer segment showed a notable growth in the automated blood processing equipment market in 2024. The segment is propelled by the growing cases of anaemia and other blood-related conditions, the rising development of point-of-care (POC) devices, and non-invasive methods with integrated digitalization approaches. Moreover, the growing preventive healthcare awareness is also boosting the demand for this accessory equipment in the market.

By accessory equipment, the automated blood collection systems segment is expected to grow rapidly in the coming years. Many factors, such as escalating healthcare expenses, rising awareness about blood donation, and increasing chronic disease instances, are impelling the segment expansion. Furthermore, this segment utilizes advanced technologies to simplify blood collection for diagnostic testing and transfusions, accelerating its adoption around the globe.

By end use, the blood banks segment held the largest revenue share of the market in 2024. The segment is influenced by the escalating automation in blood collection and storage, with breakthroughs in technologies, and boosting healthcare spending. As well as the raised blood donor management systems, coupled with advanced technologies, are majorly contributing to this segment expansion.

By end use, the diagnostic centers segment is expected to grow at the fastest CAGR in the predicted timeframes. The rising demand for accurate and effective blood testing, especially for different infectious conditions and genetic disorders, along with accelerated blood collection centres and advancements in blood sampling technologies, is driving the segment growth.

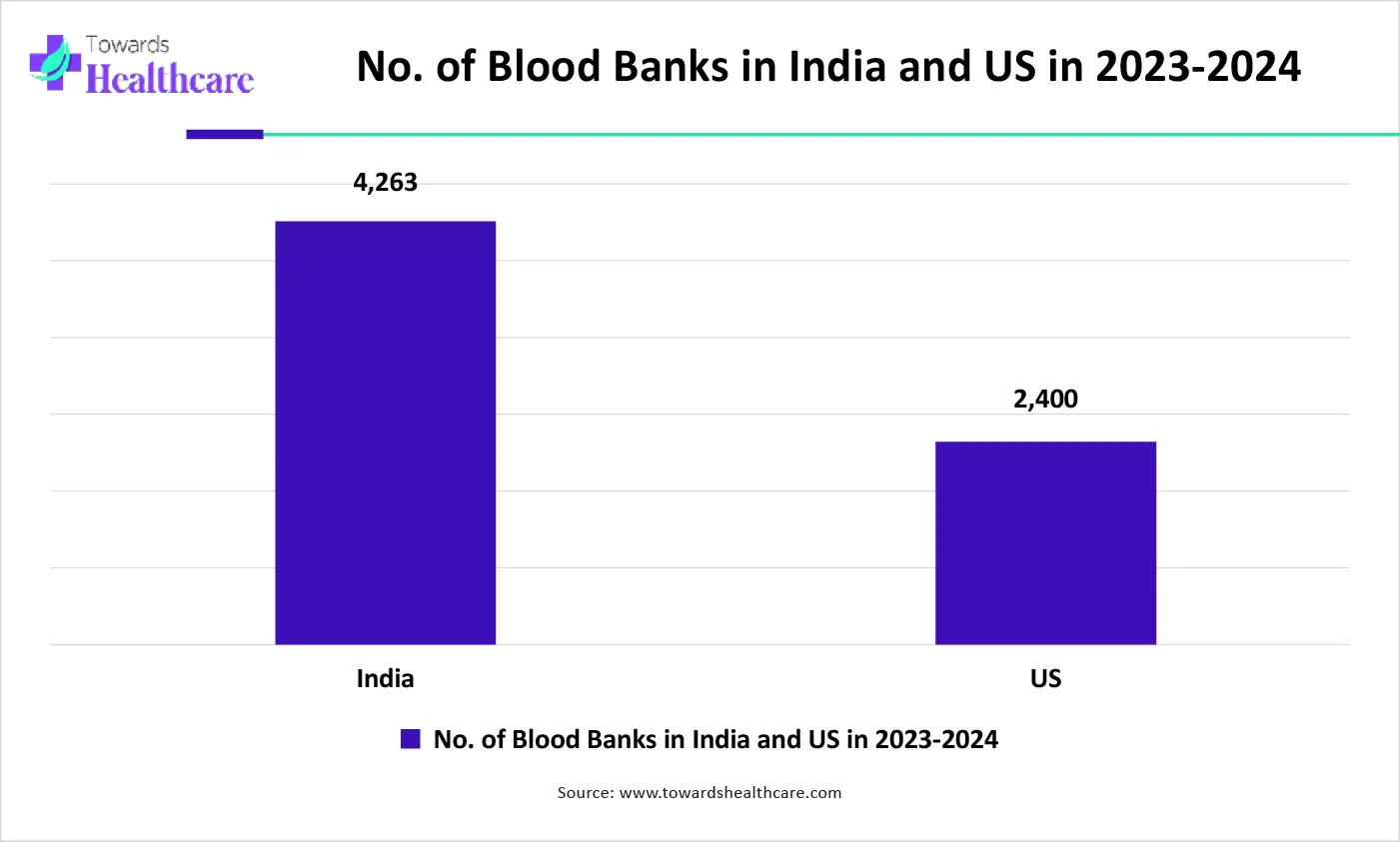

The graph displays the number of blood banks in India and the US in 2023-2024. However, around the world, the rising blood disorders and chronic conditions like cancer, kidney, and heart diseases need efficient blood transfusions acquired from various blood banks, as well as accelerating automation in blood collection and storage, with breakthroughs in technologies, and boosting healthcare spending, driving the blood bank segment and market growth.

By application, the blood transfusion segment held the major revenue share of the global automated blood processing equipment market in 2024. In this era, growing chronic disease cases and a geriatric population are boosting demand for blood transfusions, impacting the expansion of the segment. However, rising technological advancements and automations in different blood transfusion technologies are also accelerating the overall growth of the market.

By application, the blood component separation segment is expected to grow at the fastest CAGR in the upcoming years. The specialized procedures, such as therapeutic apheresis, where specific blood components are removed or exchanged, are enhancing the demand for blood component separation approaches. Moreover, it enables faster and reliable production of blood products for transfusion, therapeutic procedures, and laboratory analysis, influencing the segment growth.

North America held the major revenue share of the global automated blood processing equipment market in 2024. The market is fueled by rising cases of issues such as cancer, kidney disorders, and hemophilia, which demand blood transfusions. Also, the growing technological innovations in automation, like AI coupled with IoT, are enhancing effectiveness, accuracy, and safety in blood processing, and are boosting the adoption of automated blood processing equipment in this region.

The market is propelled by increased blood donation counts due to rising public awareness campaigns and community engagement efforts, which ultimately enhance demand for automated processing equipment to maintain increased blood volume. Besides this, the US has been incurring major healthcare expenses, which fuels the adoption of novel technologies like automated blood processing systems.

Canada is experiencing major growth due to accelerating instances of blood disorders, which demand for rising number of blood collection centers, such as hospitals and specialized blood banks. Along with this Canadian government supports and encourages investments in centralized blood processing assists further market growth.

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. In ASAP, increasing chronic disease cases, including diabetes, heart conditions, need for more blood transfusions and advanced blood processing techniques, are enhancing the demand for the same equipment. As well as several developing countries in ASAP, like China and India, are boosting investment in healthcare infrastructure and services, accelerating the adoption of automated blood processing technologies.

In China, the market is fueled by raised advancements in automation, including technologies like AI, IoT, and robotics in blood processing, enhancing effectiveness, traceability, and standardization. Also, China has robust production facilities and an R&D investment approach that makes it a key player in market expansion.

The Indian market is driven by growing chronic disease incidences, including cancer, kidney conditions, and hemophilia need specialized blood components, and enhancing awareness through public campaigns is encouraging people to donate blood, resulting in to need for potential processing of donated blood.

Europe is experiencing significant market growth, impelled by a growing geriatric population that needs greater medical procedures, utilizes blood products, and accelerated surgical procedures, trauma instances, and the management of chronic conditions highly demand blood components like plasma and platelets.

The German government has taken steps in blood donation campaigns, and investments in healthcare infrastructure are driving the market growth. Besides this, expansion in the number of blood banks and diagnostic laboratories is demanding for automated blood processing devices and consumables.

For instance,

In the UK, the robust government policies encouraging safe transfusion practices and enhanced funding for healthcare services are assisting the market growth, especially with the National Health Service (NHS).

By Type

By Accessory Equipment

By End Use

By Application

By Region

February 2026

January 2026

December 2025

December 2025