February 2026

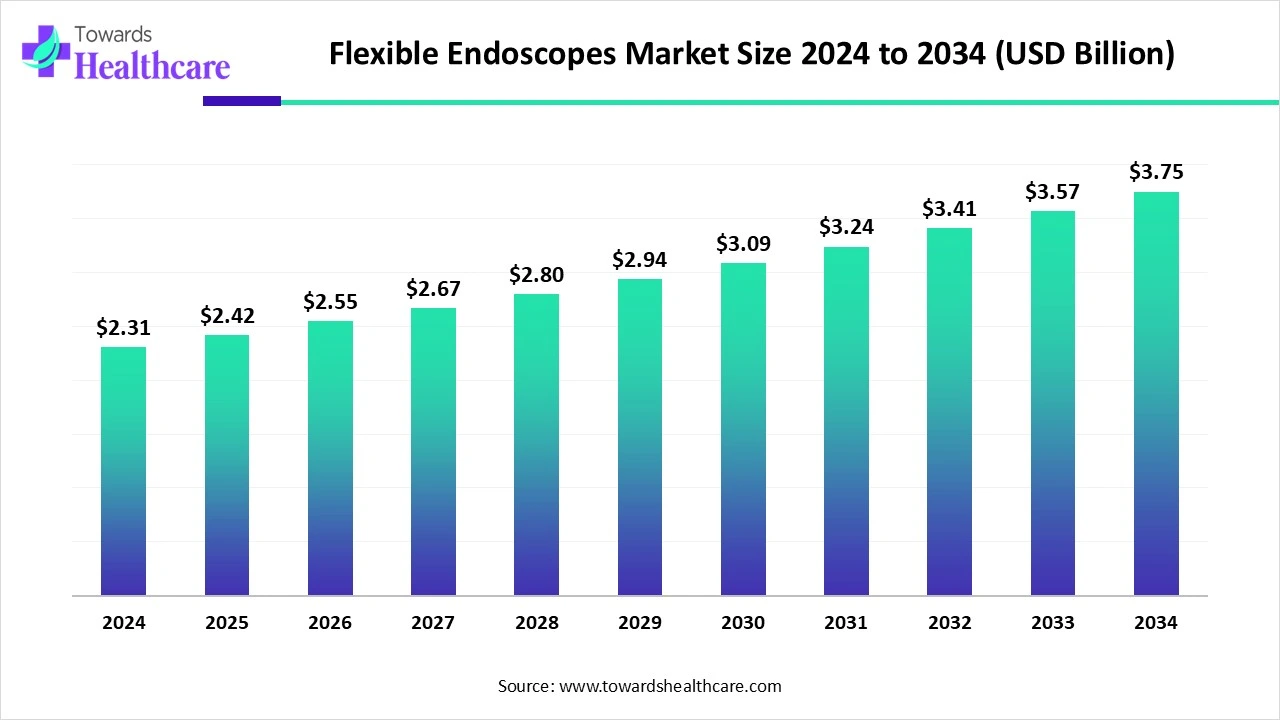

The global flexible endoscopes market size is calculated at US$ 2.31 in 2024, grew to US$ 2.42 billion in 2025, and is projected to reach around US$ 3.75 billion by 2034. The market is expanding at a CAGR of 4.97% between 2025 and 2034.

The growing elderly population, the pervasiveness of chronic illnesses, and growing awareness of early diagnosis are all driving the market for flexible endoscopes. Additionally, hospitals are putting more of an emphasis on expanding their endoscopic departments and investing in technologically advanced endoscopy equipment, especially in industrialised nations. Endoscope sales are being boosted by this. Accordingly, the need for endoscopes is increasing due to pertinent advancements in endoscopic technologies that improve patient safety and increase precision and dependability on diagnosis and treatments.

| Table | Scope |

| Market Size in 2025 | USD 2.42 Billion |

| Projected Market Size in 2034 | USD 3.75 Billion |

| CAGR (2025 - 2034) | 4.97% |

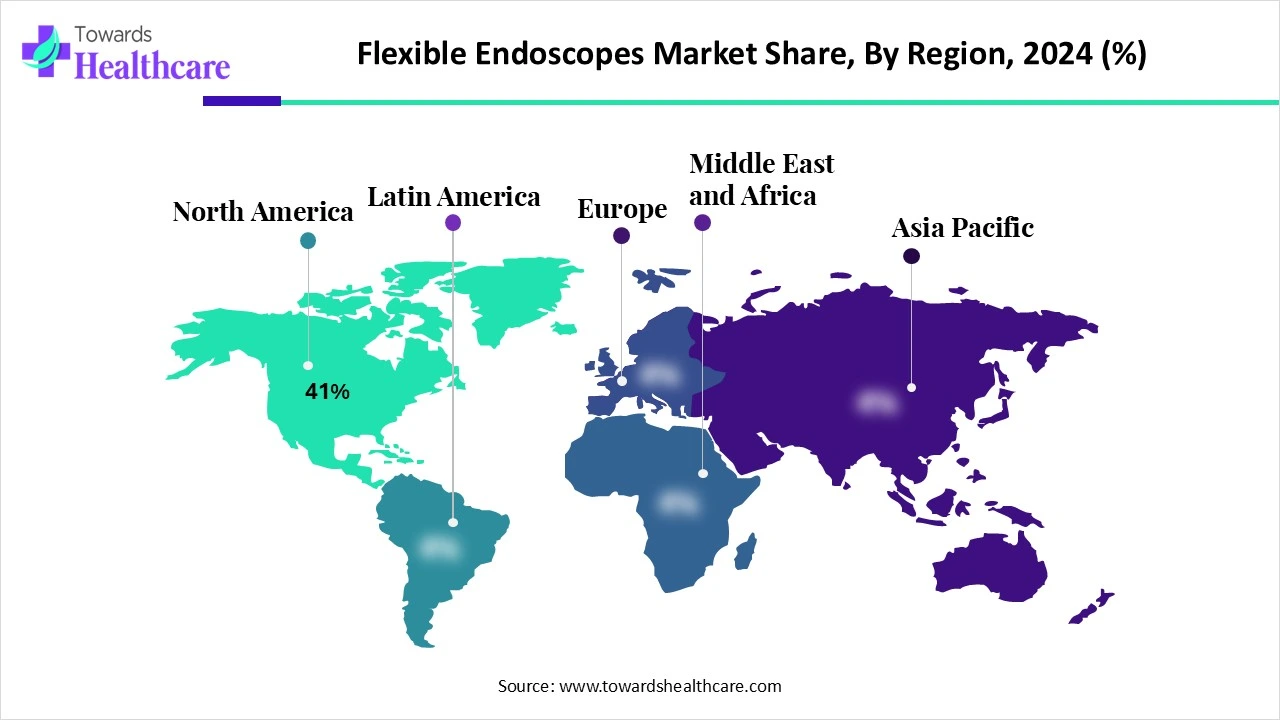

| Leading Region | North America Share 41% |

| Market Segmentation | By Product Type, By Application, By End User, By Technology, By Region |

| Top Key Players | Olympus Corporation, Fujifilm Holdings Corporation, Pentax Medical, Ambu A/S, Karl Storz SE & Co. KG, Boston Scientific Corporation, Richard Wolf GmbH, Cook Medical, Smith & Nephew plc, Medtronic plc, Conmed Corporation, Intuitive Surgical, Inc., Stryker Corporation, Karl Leibinger Medizintechnik, Vision-Sciences, Inc., Boston Imaging, EndoChoice Inc., Interacoustics A/S, Aohua Endoscopy Co., Ltd., Xenocor Inc. |

The flexible endoscopes market consists of medical devices used to visualize and treat internal organs or tissues via natural orifices or small incisions using flexible, steerable tubes equipped with imaging and instrument channels. These endoscopes are widely used in gastroenterology, pulmonology, urology, gynecology, ENT, and general surgery. Compared to rigid endoscopes, flexible versions allow greater navigation, patient comfort, and minimally invasive diagnostics and interventions. Growth is driven by the rising prevalence of gastrointestinal, respiratory, and urologic conditions, early cancer screening programs, and the adoption of single-use flexible endoscopes.

Rising focus on endoscopy training by international organizations: Endoscopy training takes several forms and is conducted all around the world. Different requirements may play a role in this, but cultural and customary factors are probably also to blame. Additionally, employing qualified specialists is a problem in many emerging and impoverished nations. As a result, significant global organisations are educating specialists in endoscopy-related fields.

For instance,

AI is radically changing the market for flexible endoscopes by improving patient safety, procedural efficiency, and diagnostic accuracy. Endoscopic devices are increasingly using AI algorithms to help doctors identify anomalies in real time that the human eye may otherwise overlook. With capabilities like virtual biopsy guiding, automated picture enhancement, and patient outcome prediction analytics, AI helps optimise procedures. It reduces performance variances, standardises endoscopic operations, and may even minimise procedure durations. Future diagnostic and therapeutic procedures might be even more accurate, individualised, and less invasive thanks to the continuous advancement of AI-powered flexible endoscopes, which would raise the bar for patient care.

Rising Demand for Minimally Invasive Diagnosis & Interventions

The benefits of minimally invasive surgery (MIS) over open surgery, including less blood loss, a shorter hospital stay, less discomfort after surgery, and improved cosmesis, are making MIS the standard of treatment. The endoscope, a flexible tube equipped with a camera and light source, is one of the primary tools used in MIS to allow surgeons to view the inside organs and tissues. Medical information systems may be altered by Autonomous Flexible Endoscopes (AFE), which extend the capabilities of traditional endoscopes. With the use of advanced technologies like robotic systems, computer vision, and artificial intelligence (AI), these autonomous devices can carry out tasks within the patient's body on their own.

What is Restraining the Flexible Endoscopes Market?

One of the advantages and disadvantages of flexible endoscopes is their adaptability. Compared to rigid endoscopes, the picture quality is inferior, which occasionally results in a less accurate representation. Additionally, they are more sensitive to handle and manage, and using them calls for specialised knowledge and training. To prevent cross-infection, they need to be cleaned and maintained thoroughly. As a result, they are more expensive to buy and maintain than rigid endoscopes.

Robotic-Assisted Surgeries are Expected to Drive the Market

Future growth in flexible endoscopes is anticipated as a result of more robotically assisted surgeons doing procedures. It will continue to expand in the future with the aid of telehealth and telemedicine. The commercialisation of robotic therapeutic endoscopes that can perform a range of treatments, including transendoluminal peritoneal surgery and GI surface dissection, is imminent. Clinical demands, together with shifting global demographics and the prevalence of chronic illnesses, are driving this rate of technological advancement. To ensure patient safety and the effectiveness of the procedure, minimally invasive instruments must be precise, which is described as the robotic arms following the user's selected route as precisely as possible.

By product type, the reusable flexible endoscopes segment held the major share of the flexible endoscope market in 2024. When properly sterilised, reusable endoscopes are safe for patients and have a proven track record of producing high-quality pictures and improved capabilities with integrated technology. Because of their manoeuvrability, superior picture clarity, durability, handling, suction power, and simplicity of connection with medical records, reusable endoscopes may be the preferable option for sophisticated diagnostic and therapeutic operations. Furthermore, reusable endoscopes are frequently chosen due to their sufficient insertion channel diameters, which facilitate the simpler passage of equipment and devices.

By product type, the single-use flexible endoscopes segment is estimated to witness the fastest rate during the forecast period. Single-use endoscopes are thought to work better under anaesthesia and during standard diagnostic procedures since they may be locally stored at the place of use, allowing for prompt access in emergency situations. Furthermore, single-use endoscopes are convenient and portable, which makes it unnecessary for endoscopic personnel to relocate and set up the tower cart and makes it possible to enter the body through challenging openings.

By application, the gastrointestinal (GI) endoscopy segment was dominant in the flexible endoscope market in 2024. One of the major developments that is supporting precise and less invasive therapy for GI disorders is the use of flexible endoscopy. One of the main benefits of flexible endoscopy is its ability to aid in early illness detection, among its many other benefits. By allowing direct visualisation and investigation of the GI tract, flexible endoscopy can identify a number of potentially fatal disorders early on. With flexible endoscopy, medical practitioners may thoroughly inspect different GI tract parts.

By application, the urology segment is anticipated to grow at the highest rate during the upcoming period. It is evident that flexible ureteroscopes (fURS) have therapeutic value. As technology has advanced significantly over the last three decades and urologists have gotten more comfortable with ureteroscopic procedures, fURS has emerged as a crucial tool in their toolbox. They are essential for the diagnosis and treatment of upper tract cancer in addition to renal and ureteral stones.

By end-user, the hospitals & ambulatory surgical centers (ASCs) segment led the flexible endoscope market in 2024. To provide the best quality of healthcare service, the hospital employs highly skilled medical professionals and technicians. It provides a large number of clinical services. In multispecialty hospitals, diagnostic services are set up to give all kinds of facilities access to the latest technology, medical gadgets, and technologies while also ensuring that patients receive the fastest possible results. The healthcare business is changing daily.

By end-user, the emergency & ICU units segment is expected to be the fastest-growing during 2025-2034. Time can be the difference between life and death in emergency medical care. When a patient presents with significant internal bleeding, acute stomach pain, or inexplicable vomiting, prompt and precise diagnosis is crucial. The endoscope, a thin, flexible tube with a camera that lets medical professionals see into the digestive tract, is one of the most effective instruments in a clinician's toolbox during such emergencies. Endoscopy stands out as a technology that combines speed, accuracy, and the ability to save lives amid the turmoil of an emergency department.

By technology, the video endoscopes segment held the largest share of the flexible endoscope market in 2024. The most recent technological development in gastrointestinal tract surveillance is video endoscopy. Three video endoscope devices have surfaced in the last two years to advance digital imaging. Using a high pixel count charge-coupled device (CCD) has significantly improved a video-endoscope's diagnostic capabilities, which are approaching those of a stereomicroscope as picture quality improves.

By technology, the endoscopes with integrated therapeutic tools segment is anticipated to experience the highest growth during the forecast period. Natural orifice transluminal endoscopic surgery (NOTES) is a result of the adaptation of flexible endoscopy, which was first created for tissue sampling and diagnostics, for therapeutic purposes. Endoscopic treatments can be used to heal bleeding ulcers, dilate constricted airways, and remove tumours, among other therapeutic operations.

North America dominated the flexible endoscopes market share by 41% in 2024. because of a sophisticated healthcare system, widespread use of state-of-the-art medical equipment, and robust government backing for healthcare advancements. Flexible endoscopic operations are in high demand due to the established healthcare facilities in these areas and the rapidly increasing awareness of early illness identification. North America has become a major market due to the existence of dominant market players, favourable reimbursement practices, and the rising prevalence of chronic illnesses including pulmonary and gastrointestinal conditions.

According to findings from a retrospective research that was published in The American Journal of Gastroenterology, there are substantial healthcare inequities and death rates linked to the prevalence and burdens of digestive disorders in the United States. In addition, the industry is being driven by a significant presence of major companies.

For instance,

At around 18%, Canada has one of the highest incidences of irritable bowel syndrome (IBS) in the world, compared to 11% worldwide. 40% of people with IBS also have significant levels of anxiety and despair. The frequency of CD and UC in Canada is among the highest in the world, with 374 and 456 cases per 100,000 people, respectively.

Asia Pacific is estimated to host the fastest-growing flexible endoscopes market during the forecast period. According to the flexible endoscopes market report, the market is driven by rising healthcare investments, rapid urbanisation, and the rising incidence of respiratory and gastrointestinal disorders in China, India, and Japan. China leads the area in the use of sophisticated endoscopic technology in diagnostic and hospital settings, thanks to government programmes to upgrade the infrastructure for healthcare. Flexible, affordable endoscopes for diagnosis and treatment are becoming more and more popular in India because to the country's expanding healthcare industry.

China has a high rate of gastrointestinal malignancies. One of the most prevalent pathologic EC subtypes in China is oesophageal squamous cell carcinoma (ESCC). The Medium-to-Long-Term Plan for Prevention and Control of Chronic Diseases (2017–2025) and the Plan for Cancer Prevention and Control (2019–2022) were published under the auspices of Healthy China 2030. China pledged to increase the capacity for cancer screening and early detection in its most current Action Plan for Cancer Prevention and Control (2023–2030), which also set a major goal to raise the overall 5-year cancer survival to 46.6% by 2030.

Over the past few years, stomach cancer has grown in importance in India's healthcare system. With more than 60,000 instances of stomach cancer identified annually, India is seeing a worrying increase in stomach cancer incidence. According to the Global Cancer Observatory, stomach cancer is one of the top 10 most common malignancies in India. The most frequent causes of these geographical differences include socioeconomic circumstances, genetic predispositions, and different eating habits.

Europe is expected to grow significantly in the flexible endoscopes market during the forecast period. Flexible endoscopes and their attachments have become more popular in Europe due to a growing desire to reduce the risk of infection and improve therapeutic results. The market is expected to develop as a result of the rising diagnosis rate brought on by the growing prevalence of functional gastrointestinal disorders as well as a number of other chronic diseases, including diabetes, cancer, and cardiovascular disorders.

In Germany, stomach cancer affects about 14,500 individuals annually. Compared to women, men are more frequently impacted. Age also raises the chance of getting sick. Men often develop this malignancy at age 71, while women typically do so at age 75.

In May 2025, Olympus declared the arrival of a new drying cabinet for endoscopes. According to Patrick Romano, Vice President, GI Business Unit Leader, Olympus Corporation of the Americas, "We put patient safety first, and this latest drying cabinet is part of a larger infection prevention portfolio and strategy to help facilities address their reprocessing needs." We are thrilled to introduce ScopeLocker Air and provide reprocessing continuing education workshops to the committed professionals who attend the SGNA annual convention. Olympus is still dedicated to offering information and solutions to support medical professionals in giving their patients the best care possible.

By Product Type

By Application

By End User

By Technology

By Region

February 2026

February 2026

February 2026

February 2026