February 2026

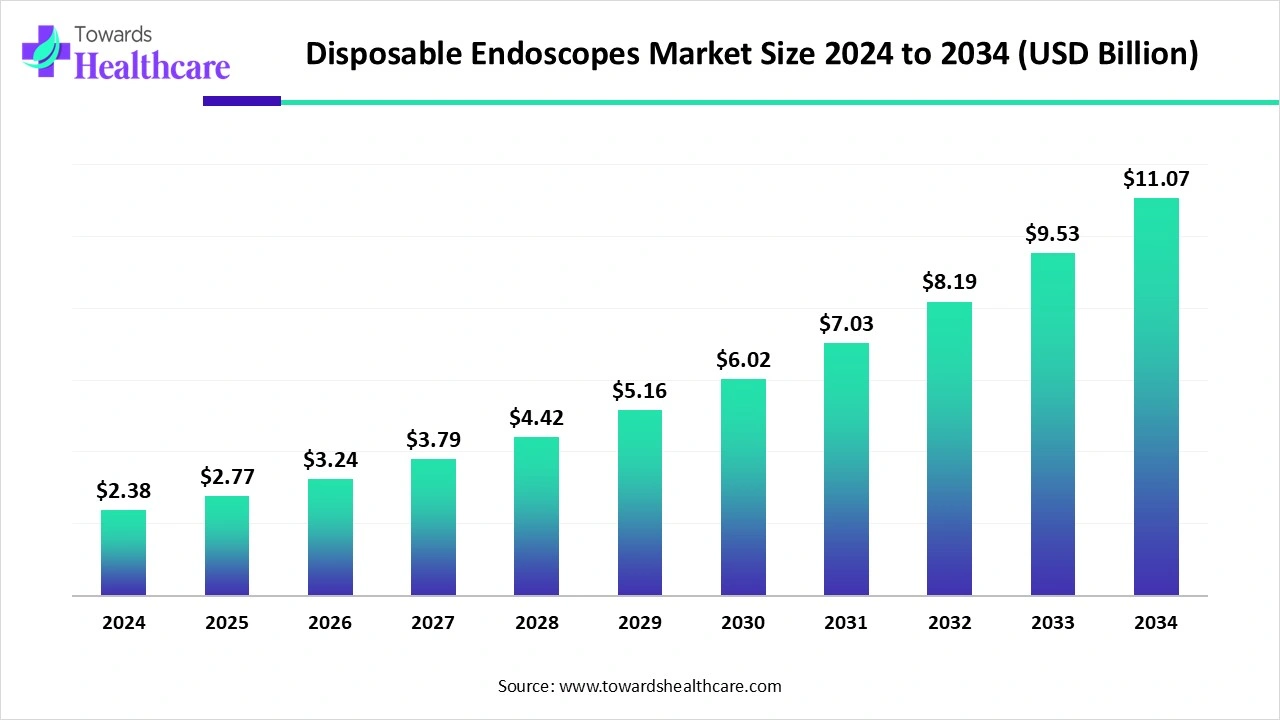

The global disposable endoscopes market size is estimated at US$ 2.77 billion in 2025, is projected to grow to US$ 3.24 billion in 2026, and is expected to reach around US$ 12.88 billion by 2035. The market is projected to expand at a CAGR of 16.59% between 2026 and 2035.

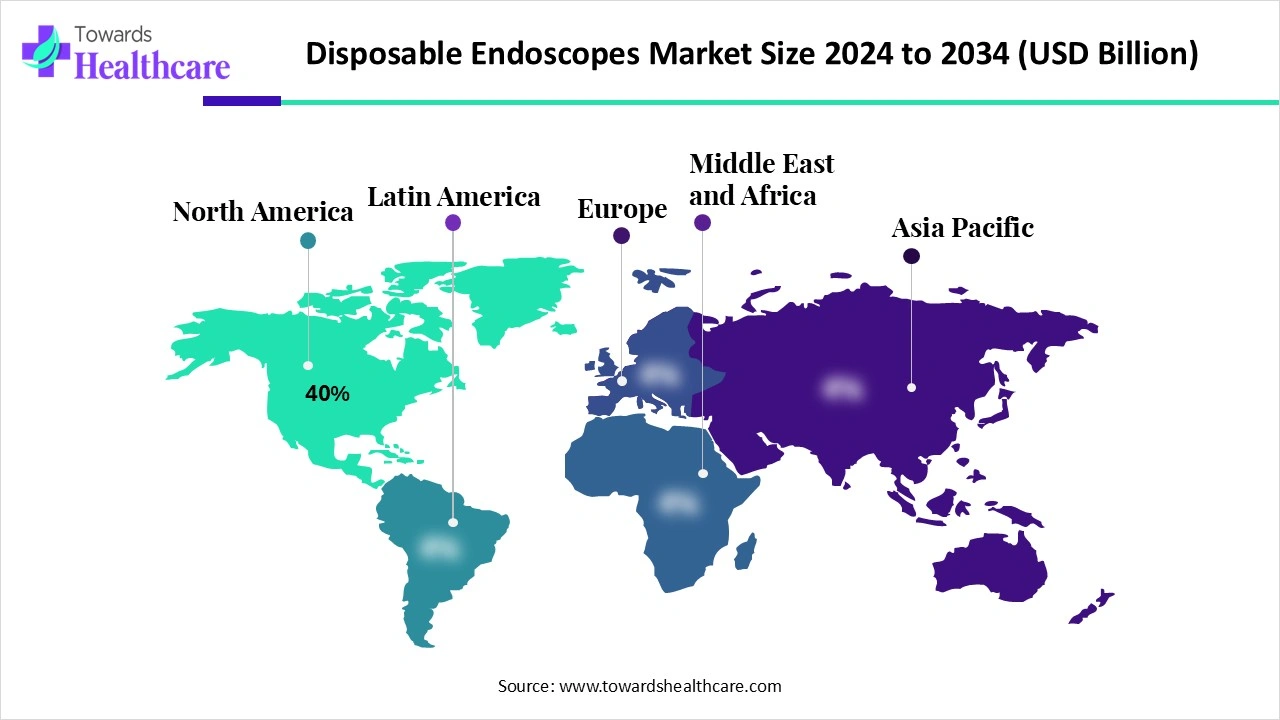

The disposable endoscopes market is growing due to advancements in technology, the growing need for infection control, and cost-effective solutions. Medical care professionals are shifting towards the disposable endoscope due to its lower cross-contamination challenges and elimination of processing expenses. North America is dominant in the market due to increasing government support and spending in healthcare, while the Asia Pacific is the fastest growing in the market due to increasing disposable incomes and increasing chronic diseases.

| Table | Scope |

| Market Size in 2026 | USD 3.24 Billion |

| Projected Market Size in 2035 | USD 12.88 Billion |

| CAGR (2026 - 2035) | 16.59% |

| Leading Region | North America by 40% |

| Market Segmentation | By Product Type, By End User, By Procedure Type, By Region |

| Top Key Players | Ambu A/S, Boston Scientific Corporation, Medtronic plc, Pentax Medical (Hoya Corporation), Fujifilm Holdings Corporation, CONMED Corporation, KARL STORZ SE & Co. KG, Smith & Nephew plc, Cook Medical, ERBE Elektromedizin GmbH, Halyard Health (now part of Owens & Minor), Merit Medical Systems, Inc., EndoChoice, Inc., Vision Sciences, Inc., Micro-Tech (Nanjing) Co., Ltd., Steris plc, Zhejiang Kangli Medical Instrument Co., Ltd., Shandong Weigao Group, Hangzhou Edge Medical Technology, Guangdong Landwind Medical Instrument Co., Ltd. |

The disposable endoscopes market refers to single-use endoscopic devices designed for minimally invasive procedures across gastroenterology, pulmonology, urology, ENT, and other surgical applications. Unlike reusable endoscopes, disposable endoscopes eliminate cross-contamination risks, reduce hospital reprocessing costs, and enhance workflow efficiency. Market growth is driven by infection control concerns, rising surgical procedures, technological advancements in imaging, and increasing adoption in hospitals and outpatient centers.

Increasing government support for the medical device manufacturing and adoption of novel technology, which contributes to the growth of the market.

For instance,

Increasing collaboration between the government organization and healthcare companies, which drives the growth of the market.

For Instance,

Integration of AI in disposable endoscopes drives the growth of the market as AI allows real-time visual feedback throughout endoscopic measures, significantly increasing the precision and safety of medicine administration. AI-driven endoscopy has the strength to enhance both patient results and instantaneously lower physician workload. These AI-powered systems analyse huge amounts of endoscopic imagery, offering immediate feedback to clinicians and highlighting areas of concern that the human eye might overlook.

AI is transforming the landscape of endoscopic technology by improving diagnostic precision and growing the efficiency of medical care services. AI-based endoscopy has immense promise in transforming healthcare diagnostics and enhancing patient outcomes. AI-driven technology can offer real-time data analysis and prognostic insights, which is attractive for diagnostic precision and management of resources.

Growing Interest in Disposable Endoscopes

Increasing interest in single-use, disposable endoscopes has increased due to worries about infection risks with reusable types. It is suggested that switching to sterilization methods or adopting sterile, disposable endoscopes is vital for patient safety. These single-use devices could reduce downtime and enhance safety during procedures. They also eliminate reprocessing, associated costs, staffing needs, and training requirements. An early study comparing a disposable sheath for fiber optic sigmoidoscopy with traditional reprocessing highlighted the market potential for disposable endoscopes.

Major Challenges in the Disposable Endoscope

Several factors influence reprocessing effectiveness, such as non-adherence to guidelines, using damaged endoscopes, employing insoluble products during endoscopy, insufficient cleaning, contaminated rinse water, and inadequate drying before storage. These issues hinder the growth of the disposable endoscope market.

Increasing Advancement in Endoscopy Technology

Endoscopy is a groundbreaking medical technique that has revolutionized how healthcare professionals investigate and treat various conditions. Its minimally invasive approach is crucial in modern diagnostics, allowing physicians to examine the gastrointestinal tract and other internal organs without resorting to traditional surgery. Endoscopy has become a vital component of medical practice across multiple specialties, including gastroenterology, pulmonology, and urology.

It has proven to be a reliable and effective diagnostic method, leading to better patient outcomes. These technological improvements have significantly expanded endoscopy's role in diagnosing and managing numerous medical issues, making it an increasingly essential tool in medicine and opening opportunities for the disposable endoscopes market.

By product type, the gastroscopes segment led the disposable endoscopes market, as gastroscopy supports the diagnosis of different conditions, including gastroesophageal reflux disease (GERD) and duodenal ulcers. Doctors use gastroscopy to look at the stomach from the front and side and make a diagnosis. Endoscopy is relatively harmless, fast, and easy. It is an efficient way to ensure that there are no serious illnesses.

On the other hand, the others segment is projected to experience the fastest CAGR from 2025 to 2034, as endoscope offers light and magnification, and they allow measures to be performed in the ears with lower pain and less potential for injury. ENT endoscopy is shown as an advanced solution for more precise diagnosis and treatment of various ENT challenges. Laparoscopic surgery allows physicians to see inside the body without making large cuts, leading to quicker times.

By end user, the hospitals segment is dominant in the disposable endoscopes market in 2024, as disposable endoscope solutions in hospitals remove expenses related to reusable endoscopes and provide several advantages, including a relatively lower capital investment and the elimination of endoscope reprocessing, service, and repair expenses. Healthcare physicians find disposable endoscopes suitable because they are simple to dispose of. They don’t require superior handling or disposal processes; therefore, they are disposed of in regular trash. This saves time and resources for healthcare professionals.

The specialty clinics segment is projected to grow at the fastest CAGR from 2025 to 2034, as these clinics specialize in diseases of the digestive system and use an endoscopy to diagnose and manage diseases that affect the upper part of the digestive system. Endoscopy Clinic performs a broad range of endoscopic processes, which allow both treatment and diagnosis of gastrointestinal disorders, like cancers, polyps, peptic ulcers, and blockages of the bile ducts, including stones, inflammation, and tumors.

By procedure type, the diagnostic procedures segment led the disposable endoscopes market in 2024, as endoscopy is used to identify cancer, inflammation, celiac disease, obstructions, bleeding, ulcers, and ulcerations. An analytical endoscopy is an inspection of internal organs using an instrument such as an endoscope. It allows physicians to diagnose, examine, and treat situations without the requirement for complicated surgery.

The therapeutic procedures segment is projected to experience the fastest CAGR from 2025 to 2034 as these procedures offer important advantages by allowing a broad range of therapies, like eliminating polyps, regulating bleeding, and widening narrow areas. The procedure of endoscopy is challenge-free. It has a low risk and is regarded as one of the harmless medical therapeutics.

North America is dominant in the market share by 40% in 2024, due to the presence of advanced healthcare infrastructure, increasing spending on modern medical devices, and increasing healthcare awareness are the major drivers of the market. The increasing prevalence of chronic diseases and the huge presence of disposable endoscopes manufacturing companies such as Ambu, Olympus, Karl Storz, Boston Scientific, and Pentax contribute to the growth of the market.

For Instance,

In the United States, there is an increasing focus on infection control, which is increasing the demand for disposable endoscopes due to increasing infectious outbreaks. The U.S. government provides a higher budget for the manufacturing of healthcare devices, which contributes to the growth of the market.

Canada's medical devices industry is highly diversified, and there is a greater adoption of durable medical equipment. Technological advancements such as robotic surgery and mobile health, combined with government spending, drive the growth of the market.

Asia Pacific is the fastest-growing region in the disposable endoscopes market in the forecast period, due to increasing urbanization and increasing awareness regarding infection control. The increasing prevalence of chronic diseases such as cancer, cardiovascular disease, and renal disease increases the demand for disposable endoscopes. Cost efficacy of disposable products reduces costs related to reprocessing, cleaning, and sterilization, which contributes to the growth of the market.

Manufacturers are investing heavily in R&D to enhance usability and performance. R&D processes include pre-cleaning, leak testing, manual cleaning, visual inspection, storage, and documentation.

Key Players: Olympus and Boston Scientific

The pilot trial is to demonstrate the efficacy, feasibility, safety, and clinical outcomes of third-space endoscopic procedures completed using a disposable endoscope platform.

Key Players: Ambu A/S, and Karl Storz

Disposable endoscopes lower the challenges of post-procedure infection caused by cross-contamination. Health care providers working in different specialties, including gastroenterology, otolaryngology, gynecology, and orthopaedics.

Key Players: Hoya and Medtronic

In August 2025, Graham Reeve, Chief Operating Officer-West, stated, “As a leading global MedTech company, Olympus remains committed to providing advanced options to help physicians offer their patients the best care possible. Our goal is to elevate the standard of endoscopy, and Extended Depth of Field (EDOF) technology represents Olympus’ most advanced scope technology to help physicians drive the best clinical outcomes for advancing gastrointestinal procedures.”

By Product Type

By End User

By Procedure Type

By Region

February 2026

February 2026

February 2026

February 2026