January 2026

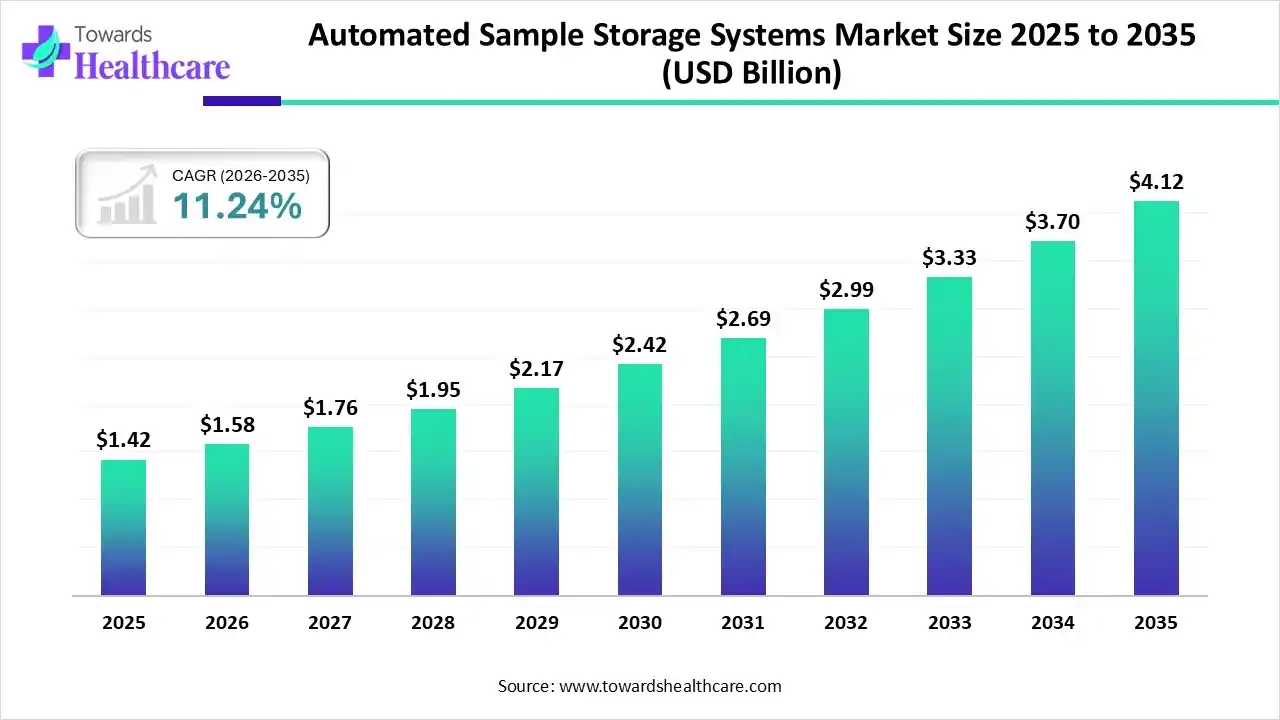

The global automated sample storage systems market size is calculated at USD 1.42 billion in 2025, grew to USD 1.58 billion in 2026, and is projected to reach around USD 4.12 billion by 2035. The market is expanding at a CAGR of 11.24% between 2026 and 2035. Technological advancements, growing research and development, and increasing investments drive the market.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.58 Billion |

| Projected Market Size in 2035 | USD 4.12 Billion |

| CAGR (2026 - 2035) | 11.24% |

| Leading Region | North America |

| Market Segmentation | By Product, By Sample, By End-User, By Region |

| Top Key Players | A. Menarini Diagnostics, Askion Biobanking, Azenta Lifesciences, B. Medical Systems, Beckman Coulter, Inc., Biotron Healthcare, Hamilton Company, Healthmark Industries, Kardex Group, PHC Holding, SPT Labtech, Supply Point Systems, Thermo Fisher Scientific, Vidir Vertical Solutions |

An automated sample storage system utilizes computerized systems for storing biological and compounded samples at ultra-low temperatures. The refrigerated storage systems enable samples to be automatically returned to the track for re-testing or discharged according to programmable timing. These automated sample storage devices maintain sample integrity, flexibility, and reliability. They ensure the quality of storage samples during both short—and long-term storage. This, ultimately, enables researchers to focus more on research through accurate, small-footprint automated sample storage, maximize productivity, and gain an automation advantage by spending less time managing samples.

The growing demand for automation in the pharmaceutical and biotechnological processes due to the latest technological advancements increases the demand for automated sample storage systems. The burgeoning life science sector and increasing investments favor market growth. Additionally, growing research and development activities, including novel drug discovery and development, require the storage of complex products, thereby boosting the market. The increasing number and demand for biobanks also support the automated sample storage systems market.

The benefits of artificial intelligence (AI) in laboratory operations have encouraged numerous researchers to integrate automation into their daily tasks. AI in automated sample storage systems enables researchers to focus more on research and innovation. The RFID technology is used in these systems in the form of an embedded microchip for faster and more reliable sample identification and excellent real-time sample tracking possibilities. Predictive analytics uses AI and machine learning (ML) technologies to identify anomalies, forecast future outcomes, and fix problems using storage automation capabilities. ML collects large amounts of data from storage infrastructure and trains predictive analytics to understand trends. Hence, predictive analytics offer several advantages, including better performance and resource use, lower administrative overhead, reduced downtime, and optimized workloads.

Growing Research and Development

The growing research and development activities in pharmaceutical, biotechnology, and other life sciences sectors increase the demand for automated sample storage systems. R&D activities involving new drug discovery and development, precision medicines, cell and gene therapy, and genomics and proteomics research. The increasing investments & collaborations and favorable government policies and initiatives augment the market growth. Additionally, suitable regulatory frameworks for new product launches and new drug approvals favor market growth. The growing R&D activities result in an increasing number of clinical trials. The growing number of clinical trials requires the storage of large amounts of samples and the efficient tracking of samples. Automated storage systems facilitate storing samples at optimum temperatures, eliminating the need for manual operations.

High Installation Cost and Lack of Trained Professionals

The automated sample storage systems market faces formidable challenges, including the high installation cost of the equipment. The initial investment costs for automated systems are around five to ten times higher than for manual operations. It is estimated that the ten-year running costs for fully serviced automated systems are between €500,000 to €5 million. This limits the affordability of many laboratories in low- and middle-income countries. Another major challenge of the market is the lack of trained professionals. The expenses involved in the training of personnel hinder the market growth.

Rising Demand for Biobanking

A biobank is a type of biorepository that stores biological samples for use in research. The increasing incidences of hematological and other chronic disorders increase the demand for biobanks. Biobank researchers investigate the fundamental characteristics of diseases that lead to advances in patient care. People are becoming more aware of blood donations, especially in underdeveloped and developing countries, resulting in a rising number of biobanks. Additionally, the growing R&D activities frequently require cell lines and tissues for in vitro investigation and other purposes. Technological advancements such as artificial intelligence (AI) have revolutionized the way biobanks function. The increasing investments and collaborations favor biobank networking, both locally and internationally. Biobank networking enables several sites for collection and, occasionally, storage to come together into a single platform for resource sharing and exchange.

North America held the largest share of the automated sample storage systems market in 2025. The presence of key players, state-of-the-art research and development activities, technological advancements, and favorable government policies drive the market. The US government actively supports the use of automated sample storage systems by promoting the development and construction of biobanks, academic research institutes, and pharmaceutical companies. The presence of key players such as Hamilton Company, Beckman Coulter, Azenta Life Sciences, Thermo Fisher Scientific, etc., holds the major share of the global market. The market is also driven by increasing government investments in pharmaceutical R&D. The Canadian Government invested more than $2.2 billion in 40 projects in the biomanufacturing, vaccine, and therapeutics ecosystem.

The presence of state-of-the-art research and development facilities and favorable government support encourages advanced research activities. The U.S. government allocates about 1% of all federal spending in the life science sector. The U.S. is a global leader in the life sciences sector. Regulatory agencies streamline regulatory pathways to promote product innovations.

Europe is considered to be a significantly growing area, due to the rapidly expanding biotech sector and the rising adoption of advanced technologies. Government bodies support the use and deployment of innovative products and equipment in pharmaceutical and biotech companies. Key players, such as LVL Technologies, Askion Biobanking, Hamilton Company, and Sysmex Europe, provide automated sample processing systems to European companies.

Germany is the fourth-largest pharmaceutical market in the world. Pharma sales in Germany are increasing at a rapid rate by approximately 8% from 2023 to 2024, reaching more than EUR 55 billion. German companies adopt automated systems to enhance their productivity and deliver high-quality products. Moreover, foreign companies also set up their facilities in Germany to expand their presence and strengthen their market position.

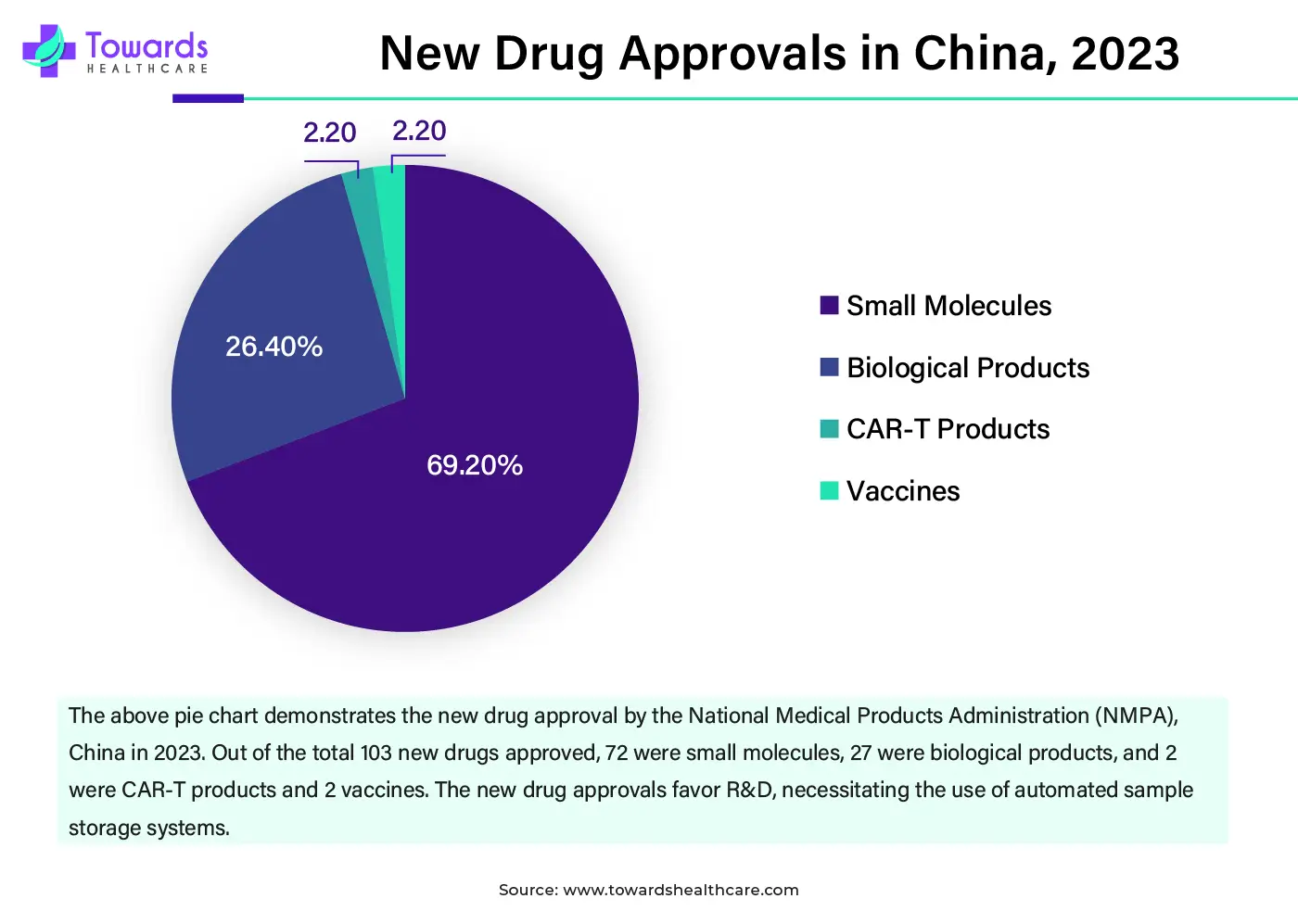

Asia-Pacific is projected to host the fastest-growing automated sample storage systems market in the coming years. The rising incidences of chronic disorders, growing research and development activities, and increasing investments & collaborations drive the market. The increasing awareness of sample storage through automated systems is driven by technological advancements in the region. There are 19 registered biobanks in India. The growing R&D activities such as new drug discovery & development, genomics & proteomics, and precision medicine promote the market. In China, a total of 103 novel drugs were approved in 2023, out of which 15 were for rare diseases. In India, the development of precision therapeutics is part of the new BioE3 policy, contributing 36% of the national bioeconomy. The Japanese government aims to increase startup investment to $72.4 billion by March 2028, with a $734 million government budget allocation to support Deep Tech-related startups and $2.2 billion dedicated to supporting drug discovery-related startups.

Which Product Segment Dominated the Automated Sample Storage Systems Market?

By product, the automated compound storage system segment held a dominant presence in the market. Numerous pharmaceutical companies have adapted automated compound storage facilities to provide thousands of compounds for several scientists. The growing drug discovery research, increasing investments, and technological advancements augment the segment’s growth. Drug discovery research requires a huge library of compounds that interact with the desired target. An automated compound storage system enables the collecting, processing, organizing, and storing of these compounds for experimental purposes.

By product, the automated liquid handling system segment is expected to grow at the fastest rate in the automated sample storage systems market during the forecast period. An automated liquid handling (ALH) system is a device that performs liquid transfers via computerized systems. It speeds up the pipetting and dispensing process, thereby increasing accuracy for various liquid types and volumes. The growing demand for automated systems, reducing the workload on researchers, and reducing reagent costs through assay miniaturization potentiate the segment’s growth.

Why Did the Compound Samples Segment Dominate the Automated Sample Storage Systems Market?

By sample, the compound samples segment led the global market. Compound samples include drug candidates and formulations such as tablets, suspensions, gels, etc. These compounds require effective storage conditions and space for use in research activities. The growing R&D for new drug discovery & development and the growing demand for compound samples in academic research institutes and biobanks promote the segment’s growth.

By sample, the biological samples segment is anticipated to grow with the highest CAGR in the automated sample storage systems market during the studied years. Biological samples, such as cell lines, tissues, cell and gene therapy products, proteins, etc., require stringent storage conditions to eliminate the degradation of samples. An automated sample storage system facilitates sample integrity, security, and efficiency. The growing demand for biological products for the treatment of various chronic disorders and favorable government support boost the segment’s growth.

Which End-User Segment Dominated the Automated Sample Storage Systems Market?

By end-user, the pharmaceutical & biotech companies segment dominated the market. The segment’s growth is attributed to the growing research and development activities in pharmaceutical & biotech companies, favorable infrastructure, and suitable capital investments. The increasing number of pharmaceutical & biotech companies globally also favor the segment’s growth. In the US, there are more than 5,000 pharmaceutical companies and 2,363 biotech companies as of 2023.

By end-user, the biobanks segment is projected to expand rapidly in the automated sample storage systems market in the coming years. The growing demand for biobanks to store numerous samples such as DNA/RNA, protein & antibiotics, plasma, and serum potentiates the segment’s growth. Introducing automation in biobanks streamlines the entire process, including traceability of samples, sample preservation, secure storage, and quicker retrieval of samples.

Jon Newman-Smith, R&D Director at Peak Analysis and Automation, commented on developing an automated cold storage interface for one of Europe’s largest private pathology providers, Laboratoire Cerba, that the key requirement for the laboratory to meet the growing number of blood testing possibilities is the ability to sort and store the samples at different temperatures. He also added that the cold storage for blood tests operates at 4oC, while other samples need to keep longer with storage at -20oC. Hence, automated cold storage is required.

By Product

By Sample

By End-User

By Region

January 2026

December 2025

November 2025

December 2025