March 2026

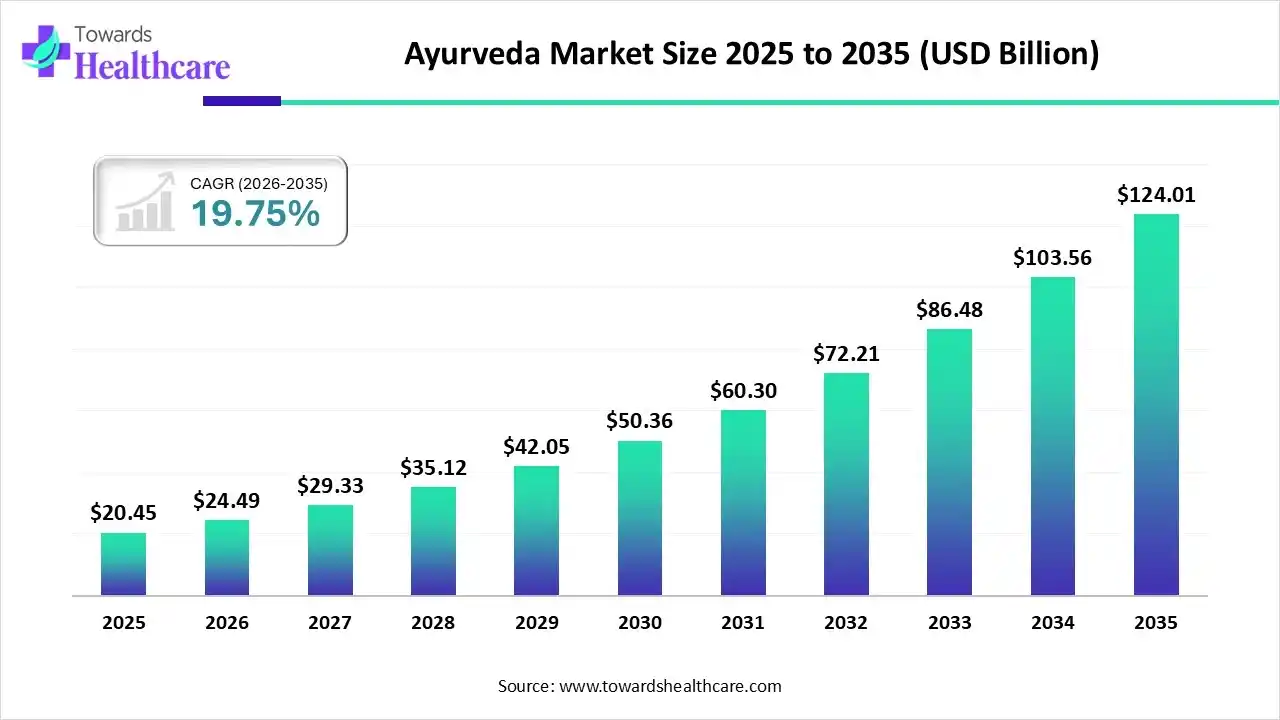

The global ayurveda market size was estimated at USD 20.45 billion in 2025 and is predicted to increase from USD 24.49 billion in 2026 to approximately USD 124.01 billion by 2035, expanding at a CAGR of 19.75% from 2026 to 2035.

Several governments are promoting initiatives to leverage traditional studies in modern science to progress the integration of these two sectors. Besides this, the era is increasingly using AI algorithms to strengthen e-commerce solutions and other digital platforms to explore the diversity of Ayurveda.

| Key Elements | Scope |

| Market Size in 2026 | USD 24.49 Billion |

| Projected Market Size in 2035 | USD 124.01 Billion |

| CAGR (2026 - 2035) | 19.75% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Form, By Application, By Indications, By Distribution Channel, By End Use, By Region |

| Top Key Players | Kerala Ayurveda Ltd., Patanjali Ayurved Limited, Dabur Ltd., Kerry Group (Natreon Inc.), Viccolabs, Himalaya Global Holdings Ltd., Emami Ltd., Bio Veda Action Research Co., Amrutanjan Health Care Limited, Baidyanath |

Firstly, it is an ancient Indian holistic healing system with a history extending across 5,000 years, and the ayurveda market is primarily fueled by the accelerating consumer preference for natural, holistic health. Nowadays, expanding awareness of traditional remedies, the post-pandemic emphasis on immunity, and the convenience of e-commerce for products, especially herbal supplements and chemical-free skincare are also impacting the overall market progression. Whereas the WHO recently updated the ICD-11 (International Classification of Diseases) with the official launch of a dedicated module for Ayurveda, Siddha, and Unani, this further enables systematic global reporting and data collection to develop an evidence base.

Globally rising adoption and application of artificial intelligence are assisting the respective market as well, specifically through the enhancements in diagnostics. For this, Nadi Tarangini, an AI-driven tool, evolved, which immensely utilizes machine learning and IoT sensors for traditional pulse (Nadi) diagnosis processing pulse data to facilitate reports on Dosha imbalances with higher consistency and accuracy than manual solutions. Alongside, the emergence of AI systems in the analysis of a patient's Prakriti, Vikriti, genetic information (Ayurgenomics), and lifestyle data to suggest enhanced tailored diet, lifestyle changes, and herbal formulations.

The market is pushing extensive clinical trials and evidence-based research to validate traditional Ayurvedic practices and establish global belief via alliances among research institutions and the industry, with a focus on proving the effectiveness of formulations using modern scientific approaches.

Day by day, the worldwide consumers are raising demand for natural and herbal products, particularly in skincare, haircare, and supplements, which is fostering as people look for natural choices to chemical-laden conventional options.

Researchers of this era are stepping towards models to integrate the best practices of Ayurveda and conventional medicine, specifically to manage chronic non-communicable diseases, cancer care, and lifestyle disorders.

How did the Herbal Segment Dominate the Ayurveda Market in 2025?

In 2025, the herbal segment captured the biggest revenue share of the market. The segmental growth is mainly propelled by a rise in health consciousness and distress regarding the side effects of synthetic health solutions. Currently, the key leaders are leveraging nanoformulations, liposomes, and phytosomes to enhance the bioavailability and pharmacokinetic profiles of herbal drugs, ensuring excellent absorption and efficacy. The recent studies show that Ashwagandha (Withania somnifera) is highly employed as an adaptogen, with its greater efficiency in lowering cortisol levels, optimizing sleep quality, and boosting mental resilience.

Herbomineral

The herbomineral segment is predicted to expand rapidly. Many of the herbomineral have greater efficacy in digestion, detoxification, nutrient absorption, immunity, growth of the tissues, and treating chronic diseases, such as anaemia, diabetes, and respiratory/nervous system disorders. The latest instance of the "green synthesis" of metallic nanoparticles, including gold and silver, with the use of herbal extracts, which are implemented to functionalize them for increased therapeutic effects and targeted drug delivery, like for cancer cells.

Which Application Led the Ayurveda Market in 2025?

The medical/therapy segment registered dominance with a major share of the market in 2025. The globe is stepping towards preventive care, wellness tourism, and broadened e-commerce for easier access. A breakthrough comprises ayurvedic principles for mental well-being, which encompass therapies, such as Shirodhara and the use of nootropic herbs, by combining them with advanced psychotherapeutic techniques to wholly detect stress, anxiety, and insomnia.

Personal

In the future, the personal segment is anticipated to expand significantly. Consumers are increasingly using natural and organic beauty products, with rigorous Ayurvedic ingredients in toothpaste and mouthwashes. As well as the wide adoption of herbal shots, juices, teas, and nutraceuticals infused with ingredients, especially Ashwagandha and Brahmi, have an immersive role in daily wellness, immunity, and managing lifestyle concerns. Healthcare providers are accelerating virtual clinics and AR/VR-based experiences for remote Panchakarma guidance and substantial healing spaces.

Why did the Skin/Hair Segment Dominate the Market in 2025?

In 2025, the skin/hair segment captured the largest revenue share of the ayurveda market. It is driven by raised preference for Ayurvedic solutions mainly in eczema, pigmentation, dandruff, sensitivity, and hair thinning. Rising efforts in traditional methods include the broader use of neem, aloe vera, turmeric, ashwagandha, and Brahmi. A recent trial demonstrated the evaluation of the safety and efficacy of Vedistry Haldi+ Tablet to enhance general skin health and highlight issues, such as acne and hyperpigmentation.

Nervous System

Moreover, the nervous system segment is estimated to grow at the highest CAGR. Globally accelerating cases of stress, anxiety, and neurodegenerative disorders are fueling demand for natural, holistic, and chemical-free healthcare solutions. The adaptation of meditation, yoga, Rasayana herbs, especially Ashwagandha, Brahmi, and Nasya therapy, are supporting to bolster the brain's neuroplasticity naturally.

Which Distribution Channel Led the Ayurveda Market in 2025?

The retail & institutional sales segment held a major share of the market in 2025. The worldwide fostering acceptance of Ayurveda and its immersive effectiveness & safety are supporting advancements in digital marketing, with raised government support. Whereas, institutional sales are widening via hospitals and wellness centers, & retail spurs on accessibility and e-commerce. Additionally, the Indian government is developing 20,000 Ayurvedic health and wellness centers across the country under the Ayushman Bharat National Ayurveda Mission.

E-Sales

The e-sales segment is predicted to witness notable expansion. They offer greater accessibility, customized wellness needs, transparency in ingredients, and a move towards self-care, with provision for supplements, personal care, and immunity boosters. A prominent example is Reliance Retail, which has its Tira platform and is encouraging the Ayurvedic beauty and wellness space with a premium in-house brand, available for online purchase and in physical stores.

Why did the Home Settings Segment Dominate the Ayurveda Market in 2025?

In 2025, the home settings segment led the market & will expand notably in the future. These approaches are providing enhanced cost-effectiveness, accessibility, and strengthened remote consultations. Shuddhi App is a recently designed AI-based platform that offers virtual consultations with certified Ayurvedic doctors and precision health tracking and lifestyle monitoring within the app. The emergence of sophisticated fitness trackers and smartwatches is also assisting in tracking real-time health data.

In the ayurveda market, the Asia Pacific captured the biggest share in 2025, due to the rising post-pandemic emphasis on preventive care, with the progression of e-commerce to strengthen product accessibility. Ongoing advances include e-commerce solutions, like Himalaya, BetterAlt, product novelty, such as Dabur's reinforced supplements, united healthcare, like spa/clinic fusion, and scientific validation.

India Market Trends

India has a major role in the market, as recently, the World Health Organization (WHO) revealed its first technical brief on "Mapping the Application of Artificial Intelligence in Traditional Medicine", which underlined India's innovative work in the field. Also, India's government introduced the "IndiaAI Mission" with a substantial budget to assist AI advances in AYUSH (Ayurveda, Yoga, Unani, Siddha, and Homeopathy).

During the prospective period, the Middle East & Africa will expand rapidly in the Ayurveda market, as the region is promoting popular Ayurvedic therapies, such as Shirodhara & Abhyanga, that are staples in spas, mainly for stress relief. Besides this, the region is transforming personal care through the progression of Ayurvedic cosmetics and hair care products. Recently, in late 2025, GlobeMedz introduced a healthcare initiative in Dubai for bridging international patients with Ayurvedic consultations and medical matching across the UAE and India.

Saudi Arabia Market Trends

However, Saudi Arabia has been emphasizing the regulatory sector, such as the National Center for Complementary and Alternative Medicine (NCCAM) under the Saudi Ministry of Health (MOH), which is promoting the evolution of quality control standards and licensing requirements for practitioners. This ultimately focuses on the integration of Traditional and Complementary Medicine (T&CM) into the mainstream healthcare system.

Europe is predicted to experience a significant growth in the Ayurveda market. The region is bolstering digital integration, expanded research & regulation, i.e., ICD-11 updates, CONSORT guidelines for trials, and accelerated demand for tailored wellness for stress/lifestyle issues. This prominently comprises the progression of Ayurvedic activities and education in Latvia and the Baltic region from Planet Ayurveda and the Indian Ambassador.

UK Market Trends

Recent regulatory implementations in the UK encompass new UK medicines licensing rules under the Windsor Framework, which require all medicinal products, with traditional herbal registrations supplied to the UK, to convey a "UK Only" label.

| Company | Description |

| Kerala Ayurveda Ltd. | They provide diverse products, like herbal oils, wellness supplements, skincare items, and treatments for women's health, digestion, and metabolic balance. |

| Patanjali Ayurved Limited | It offers different health supplements, medicines, personal care, natural foods, and herbal home care |

| Dabur Ltd. | It has a portfolio of over 250 herbal/Ayurvedic products across different categories to combine traditional Ayurvedic principles with advanced science for developing wellness and personal care solutions. |

| Kerry Group (Natreon Inc.) | This especially facilitates a portfolio of science-backed, branded Ayurvedic botanical ingredients created for use in functional foods, beverages, and dietary supplements. |

| Viccolabs | Its offerings include skin care, oral care, pain relief, and hair/grooming. |

| Himalaya Global Holdings Ltd. | It is expanding various pharmaceuticals, personal care, baby care, wellness, nutrition, and animal health solutions. |

| Emami Ltd. | This firm unveiled Zandu, Kesh King, BoroPlus, and Navratna. |

| Bio Veda Action Research Co. | It provides a rigorous range of different Ayurvedic and natural personal care products. |

| Amrutanjan Health Care Limited | This explores the pain and congestion management and women's hygiene segments, with their roots in Ayurvedic principles. |

| Baidyanath | It has unveiled over 700 formulations and products by integrating ancient wisdom with modern science to promote holistic wellness. |

By Form

By Application

By Indications

By Distribution Channel

By End Use

By Region

March 2026

March 2026

March 2026

March 2026