January 2026

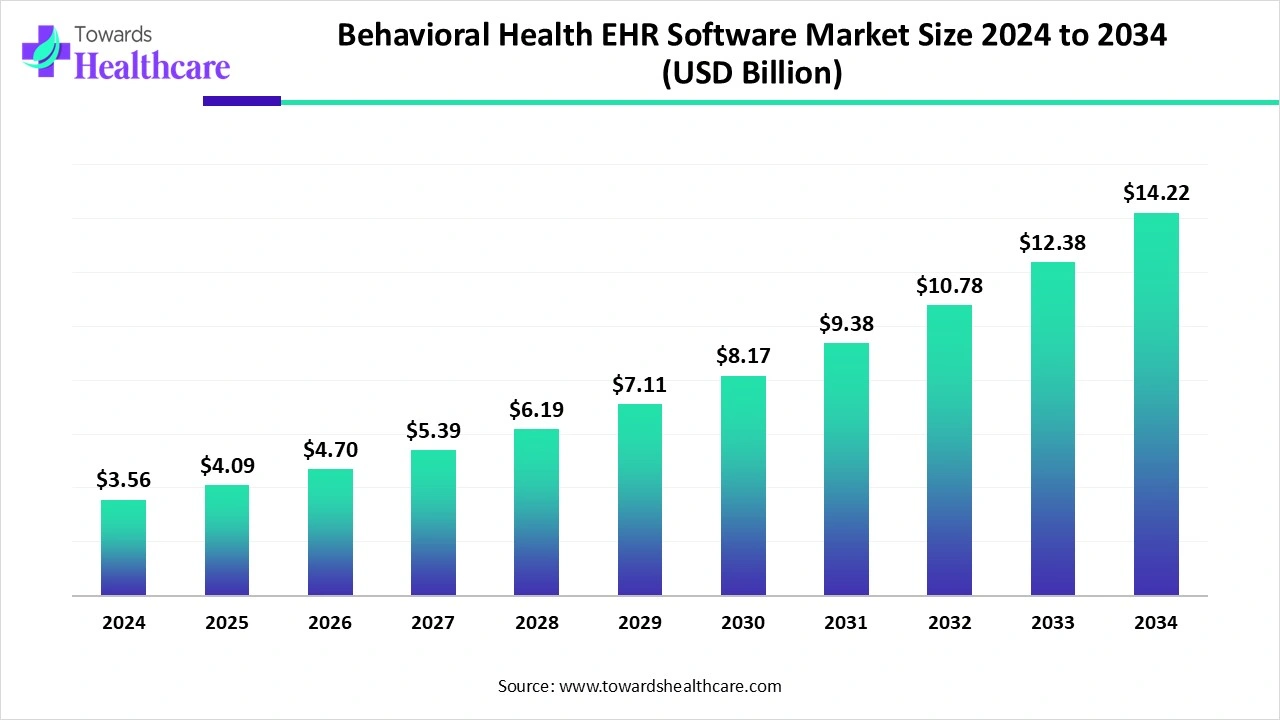

The global behavioral health EHR software market size marked US$ 3.56 billion in 2024 and is forecast to experience consistent growth, reaching US$ 4.09 billion in 2025 and US$ 14.22 billion by 2034 at a CAGR of 14.85%.

The behavioral health EHR software market is experiencing steady growth, driven by rising mental health awareness, increased adoption of digital health solutions, and supportive regulatory policies. Demand for integrated platforms that streamline patient records, improve care coordination, and enhance treatment outcomes is expanding. Innovations like AI, mobile accessibility, and telehealth integration are reshaping the market landscape. With growing investments, partnerships, and a shift toward data-driven, patient-centric care, the market is positioned for strong expansion in the coming years.

| Table | Scope |

| Market Size in 2025 | USD 4.09 Billion |

| Projected Market Size in 2034 | USD 14.22 Billion |

| CAGR (2025 - 2034) | 14.85% |

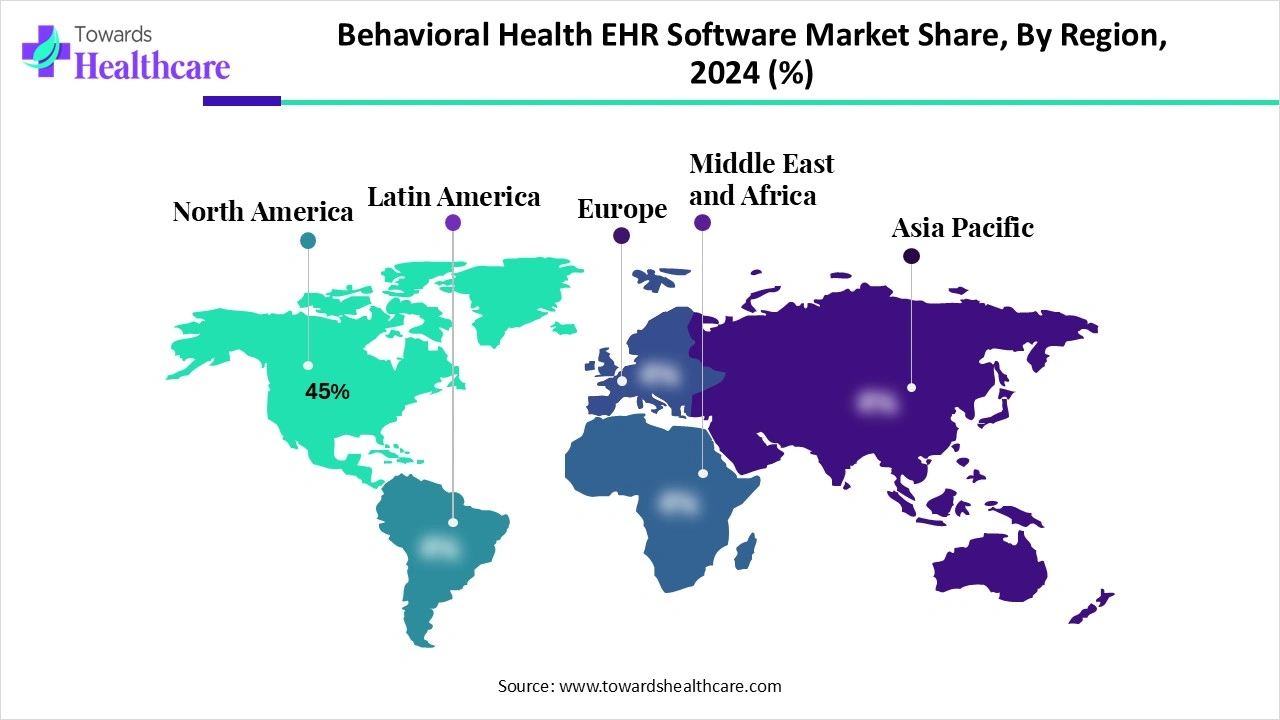

| Leading Region | North America 45% |

| Market Segmentation | By Component, By Delivery Mode, By Functionality, By End User, By Practice Size, By Region |

| Top Key Players | Cerner Corporation (Oracle Health), Epic Systems Corporation, Allscripts Healthcare Solutions (Veradigm), Netsmart Technologies, NextGen Healthcare, AdvancedMD, Kareo, Valant Behavioral Health EHR, Credible Behavioral Health (Qualifacts), Core Solutions, InSync Healthcare Solutions, Patagonia Health, Sigmund Software, DrCloudEHR, TenEleven Group, ClinicTracker, Accumedic Computer Systems, Meditab Software, BestNotes, Qualifacts Systems |

The behavioral health EHR software market HR Software Market refers to specialized electronic health record platforms tailored for the documentation, management, and coordination of behavioral and mental health services. These systems support providers with clinical workflows such as patient record management, treatment planning, e-prescribing, decision support, and progress tracking, while also offering administrative tools like billing, scheduling, and reporting. Unlike general EHRs, behavioral health solutions are designed to address the specific needs of psychiatrists, psychologists, therapists, and substance use disorder specialists. The growing prevalence of mental health conditions, regulatory incentives for EHR adoption, and the expansion of telehealth are driving demand. Cloud-based, hybrid, and mobile-enabled systems with interoperability and AI-driven analytics are reshaping this market and improving accessibility of behavioral healthcare.

The behavioral health EHR software market is evolving through greater use of mobile accessibility, patient engagement tools, and real-data sharing among care teams. Expanding integration with wearable devices and remote monitoring is enabling proactive interventions, while rising investments in digital mental solutions are accelerating its growth trajectory.

For Instance,

Telehealth Expansion: The growing acceptance of virtual care in behavioral health increases the need for EHR platforms that integrate telemedicine and remote patient management.

Technology Collaborations: Partnerships between EHR vendors and AI or cloud technology companies enable the integration of advanced features like predictive analytics, automation, and secure data storage, enhancing platform efficiency.

AI can influence the market by improving interoperability between systems, allowing seamless sharing of patient data across providers. It enhances clinical decision support by recommending treatment adjustments based on longitudinal patient records. AI also strengthens data security with advanced anomaly detection, reducing risks of breaches. Moreover, it supports population health initiatives by analyzing large datasets to uncover behavioral health trends, helping organizations design preventive strategies and allocate resources more effectively.

Growth Demand for Integrated Care and Patient-Centered Treatment

The demand for integrated care and patient-centered treatment fuels the behavioral health EHR software market because it supports continuity of care across diverse settings such as hospitals, clinics, and community programs. Patients increasingly expect tailored services that address both physical and mental health needs. EHR platforms designed for integrated care allow smoother care transitions, reduce administrative burdens, and enhance collaboration between providers. This growing expectation for a connected, individualized healthcare experience is accelerating the adoption of behavioral health EHR solutions.

For Instance,

High Implementation and Maintenance Cost

High implementation and maintenance costs restrain the behavioral health EHR software market because investing in staff training, workflow redesign, and data migration adds a significant financial burden. Smaller clinics often struggle to allocate resources for continuous system optimization and cybersecurity measures. These expenses, combined with health workflows, make adoption challenging. As a result, many providers delay or avoid HER implementation, limiting digital transformation and reducing overall efficiency and quality of care.

Telehealth and Remote Monitoring

Telehealth and remote monitoring present a promising opportunity in the behavioral health EHR software market as they enable continuous patient oversight outside traditional clinical settings. By integrating wearable devices, mobile apps, and virtual therapy sessions into EHRs, providers can collect real-time behavioral and physiological data. This supports proactive interventions, early identification of relapse or crisis, and data-driven treatment adjustments. Such digital tools enhance patient convenience, increase engagement, and open new revenue streams for practices adopting technology-driven behavioral health solutions.

In 2024, the software segment led the behavioral health EHR software market because an integrated EHR solution allows customization for therapy-specific workflows, such as progress notes, outcomes tracking, and care plans. These solutions enhance collaboration among multidisciplinary teams, enable secure patient data storage, and support regulatory compliance. The growing emphasis on digital transformation and value-based care encouraged providers to adopt advanced software features, making HER integration tools the preferred choice and contributing significantly to market revenue.

The managed services segment is projected to grow rapidly because behavioral health providers are seeking cost-effective ways to implement and maintain EHR systems without heavy in-house IT investment. These services offer tailored solutions, including data migration, user training, and performance monitoring, ensuring smooth system operation. Additionally, as regulatory requirements and cybersecurity concerns increase, managed service providers help practices stay compliant and secure. This convenience and expertise make managed services an attractive option, driving faster adoption and market expansion.

In 2024, the cloud-based segment dominated the behavioral health EHR software market because it enables rapid deployment and easy integration with third-party tools, such as analytics and patient engagement platforms. Providers benefit from lower upfront costs, predictable subscription models, and reduced IT maintenance responsibilities. Additionally, cloud EHRs support scalable storage for growing patient data and secure sharing across multiple care settings. These advantages make cloud solutions highly attractive for practices aiming to enhance efficiency and streamline operations, driving their market leadership.

The hybrid & web-based segment is projected to grow at the fastest CAGR because it offers flexible accessibility, allowing users to switch between on-premise and online platforms as needed. This approach reduces infrastructure costs while ensuring real-time data sharing and collaboration across global teams. Additionally, the growing adoption of cloud integration, cybersecurity enhancements, and increased demand for scalable solutions in clinical research and pharma manufacturing drive preference for hybrid and web-based models over traditional systems.

In 2024, the patient records management segment held the highest market share in the behavioral health EHR software market because it centralizes critical patient information, enabling providers to track treatment history, medications, and therapy progress efficiently. Advanced error management tools support automated documentation, error reduction, and compliance with regulatory standards. By offering a single source of truth for patient data, these systems improve care coordination, streamline administrative workflows, and enhance decision-making, making them indispensable for behavioral health practices and driving their market dominance.

The patient engagement & telehealth segment is projected to grow fastest because behavioral health providers are increasingly focusing on improving patient satisfaction and retention. EHR systems with integrated engagement tools allow automated surveys, symptom reporting, and virtual group therapy sessions, enhancing patient interaction and monitoring. Rising awareness of mental health, coupled with the need for scalable care solutions, encourages practices to adopt these functionalities, driving faster growth compared to other segments during the forecast period.

In 2024, hospitals dominated the behavioral health EHR software market because they handle complex care networks involving multiple specialized and require robust systems for patient monitoring, billing, and reporting. Their larger budgets allow investment in advanced EHR functionalities, including analytics, interoperability, and integrated telehealth. The need to coordinate care across emergency, inpatient, and outpatient departments, while ensuring regulatory compliance, drives widespread EHR adoption in hospitals, contributing to the highest revenue share among all end-user segments.

The behavioral health clinics segment is projected to grow fastest because these clinics are expanding rapidly to meet increasing demand for specialized mental health services. EHR adoption helps clinics manage high patient volumes, coordinate care with external providers, and optimize therapy-specific workflows. Cloud-based and managed EHR solutions reduce upfront costs and technical burden, making them accessible for smaller practices. This combination of rising patient demand and scalable, cost-effective technology adoption drives the segment’s fastest CAGR in the forecast period.

The large practices segment led the behavioral health EHR software market because they handle complex operations across multiple locations and specialties, requiring robust digital solutions. These practices benefit from economies of scale, enabling them to implement advanced EHR functionalities like outcome tracking, automated reporting, and patient engagement tools. Additionally, large practices prioritize interoperability and data security to support coordinated care, making them early security to support coordinated care, making them early adopters of integrated EHR systems. This widespread adoption drives a higher revenue share compared to smaller practices.

The small practices segment is projected to grow fastest because these clinics are expanding to meet the rising demand for mental health services in underserved areas. Affordable, subscription-based EHR solutions allow small practices to implement digital systems without large upfront investments. Additionally, the flexibility of modern EHRs helps small practices improve patient scheduling, documentation, and follow-up care. As more small clinics recognize the benefits of streamlined workflows and improved patient outcomes, adoption accelerated, driving the segment’s rapid CAGR during the forecast period.

North America led the market share 45% in 2024 because of the region’s focus on innovative healthcare solutions and widespread availability of advanced IT infrastructure. Providers increasingly adopted EHR systems to enhance care coordination, integrate behavioral and physical health services, and meet rising patient demand for digital health solutions. Additionally, high investment capacity, presence of major EHR vendors, and growing awareness of mental health services contributed to rapid adoption, securing North America’s largest revenue share in the market.

The U.S. market is expanding as providers seek solutions that enhance operational efficiency and improve clinical outcomes. Increasing investment in digital health technologies, including AI-driven analytics and mobile patient engagement tools, supports personalized care and proactive mental health management. Growing collaboration between behavioral health and primary care providers, along with the adoption of interoperable EHR systems, enables seamless data sharing and coordinated treatment. These factors are driving rapid EHR adoption and overall market growth in the U.S.

The Canadian market is growing as providers adopt technology to enhance workflow efficiency and patient engagement. Increasing integration of EHR systems with national health networks enables better data sharing across hospitals and clinics. Additionally, rising demand for remote mental health services and analytics-driven treatment planning encourages EHR adoption. Investments in cloud-based platforms and customized solutions for behavioral health further support market expansion, positioning Canada as a developing market for advanced digital mental healthcare solutions.

The Asia-Pacific market is projected to grow rapidly because emerging economies are investing heavily in modern healthcare IT systems. Increasing availability of affordable cloud-based and mobile EHR solutions allows smaller clinics and hospitals to adopt digital platforms quickly. Additionally, rising mental health awareness, government support for digital health initiatives, and the expansion of international EHR vendors in the region are accelerating adoption, making Asia-Pacific the fastest-growing market during the forecast period.

The Chinese market is growing as healthcare providers focus on modernizing clinical workflows and improving data-driven decision-making. Increasing demand for specialized mental health services, integration of behavioral health with general healthcare, and adoption of cloud-based and AI-enabled EHR solutions are key drivers. Additionally, rising collaboration with international EHR vendors and government support for digital health transformation are accelerating implementation, making China a high-potential market for behavioral health EHR software in the coming years.

The Indian market is expanding as clinics and hospitals increasingly adopt digital solutions to manage rising patient volumes efficiently. The growing penetration of smartphones and internet connectivity supports mobile-based EHR and telepsychiatry services. Additionally, private and corporate healthcare providers are investing in advanced EHR systems with features like outcome tracking, analytics, and patient engagement tools. These trends, combined with a focus on modernizing mental healthcare delivery, are driving rapid market growth in India.

In 2024, Europe is approaching the market by focusing on interoperability, patient-centered care, and the adoption of cloud-based systems across hospitals and clinics. Countries are investing in telehealth platforms, mobile engagement tools, and AI-enabled analytics to enhance mental health service delivery. Policymakers and providers are emphasizing standardized data exchange, regulatory compliance, and integration with national health networks. These efforts aim to improve care coordination, increase access to services, and drive efficient, technology-driven behavioral healthcare across the region.

The UK market is expanding as providers focus on modernizing mental healthcare delivery through digital solutions. Increasing integration of EHR systems with national health databases enables streamlined data sharing and improved patient monitoring. Rising investments in cloud-based platforms, AI-driven analytics, and mobile patient engagement tools help optimize treatment planning and operational efficiency. Additionally, the growing emphasis on preventive mental health care and personalized therapy is driving higher adoption of behavioral health EHR solutions across the UK.

The German market is growing as healthcare providers adopt technology to streamline administrative workflows and optimize clinical operations. Increasing focus on personalized mental health care and the integration of EHR systems with national health networks is driving adoption. Additionally, rising demand for remote consultations, mobile-based patient engagement, and compliance with strict data protection regulations encourage providers to implement advanced EHR solutions. These factors collectively support the rapid expansion of the market in Germany.

In October 2024, athenahealth introduced athenaOne for Behavioral Health, an integrated EHR and practice management solution that combines behavioral and primary care. It addresses challenges like limited provider availability, regulatory requirements, and low reimbursement, offering tailored workflows, patient engagement tools, and group therapy support. Chad Dodd, VP of Product Management, said, “athenaOne for Behavioral Health is designed to meet the unique needs of providers, helping them deliver comprehensive, personalized care while staying connected with their patients."

By Component

By Delivery Mode

By Functionality

By End User

By Practice Size

By Region

January 2026

January 2026

January 2026

January 2026