December 2025

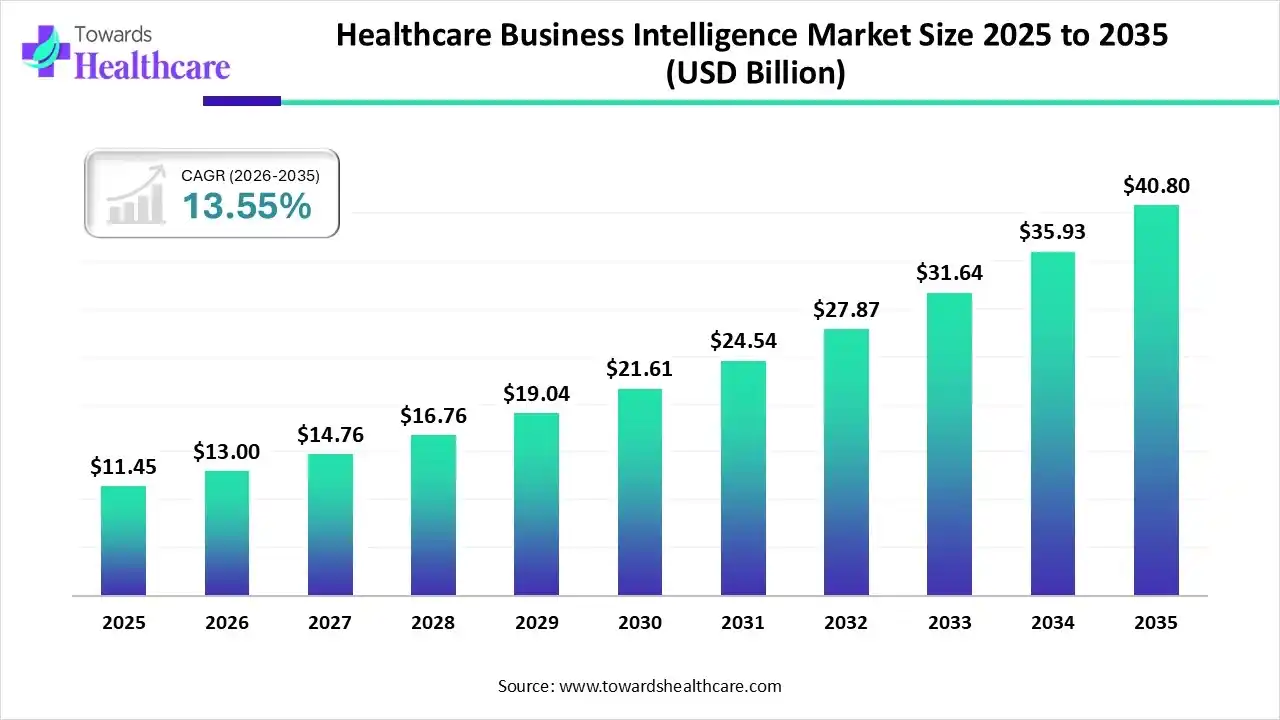

The global healthcare business intelligence market size was estimated at USD 11.45 billion in 2025 and is predicted to increase from USD 13 billion in 2026 to approximately USD 40.8 billion by 2035, expanding at a CAGR of 13.55% from 2026 to 2035.

The healthcare business intelligence market is driven by the rising need for data-driven decision-making, improved patient outcomes, and operational efficiency. North America dominated the market due to advanced healthcare IT adoption, strong provider networks, and supportive regulations. Growing use of AI-enabled analytics, cloud platforms, and real-time reporting further accelerates BI integration across hospitals, payers, and life sciences organizations.

| Key Elements | Scope |

| Market Size in 2026 | USD 13 Billion |

| Projected Market Size in 2035 | USD 40.8 Billion |

| CAGR (2026 - 2035) | 13.55% |

| Leading Region | North America |

| Market Segmentation | By Component, By Mode of Delivery, By Application, By End Use, By Deployment, By Region |

| Top Key Players | Microsoft Corporation, IBM Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., Tableau Software, LLC, Qlik Technologies, Inc., MicroStrategy Incorporated, Information Builders, Inc., Sisense Inc. |

Healthcare business intelligence (healthcare BI) refers to the use of advanced analytics, data visualization, and reporting tools to convert large volumes of healthcare data into actionable insights. The healthcare business intelligence market is driven by growing demand for data-driven decision-making, increasing digital transformation across hospitals, adoption of AI and cloud analytics, and the push for improved patient outcomes and operational efficiency.

Healthcare BI helps healthcare providers, payers, and life sciences organizations track clinical performance, optimize workflows, reduce costs, and enhance care quality. It integrates data from electronic health records, financial systems, and patient management tools to support strategic planning, predictive analytics, and real-time monitoring.

AI integration enables BI systems to combine and analyze massive, multi-source healthcare data (electronic health records, imaging, finances, operational metrics), delivering real-time insights, predictive analytics, and smarter resource planning. It helps hospitals anticipate patient surges, optimise staffing and bed usage, streamline workflows, and support early disease-detection and preventive care.

For instance, in 2025, Honey Health raised seed funding to power an AI-based back-office automation platform for hospitals, easing admin burden and improving operational BI. Meanwhile, an AI-enabled ERP framework proposed in 2025 demonstrated how event-driven process orchestration can enhance financial, supply-chain, and operational analytics for healthcare enterprises.

BI is used to track outcomes, patient satisfaction, readmissions, and quality of care. These tools help design interventions tailored to patients, supporting better clinical results while promoting efficiency in value-based care models.

As healthcare data grows, BI platforms are emphasizing data governance, privacy, and secure sharing. Open APIs and standardized interfaces improve interoperability between legacy and modern systems, ensuring safe and effective cross-institutional data use.

Healthcare BI is increasingly providing real-time dashboards and alerts for hospital operations, patient flow, and clinical decision support. This enables faster responses to emergencies, staffing optimization, and improved patient outcomes.

As more stakeholders hospitals, labs, insurers, telehealth providers, and even home-based care, generate data, the need for BI tools that can integrate diverse data sources and provide unified analytics will grow. This will foster cross-system collaboration and more holistic care management.

BI will be used to streamline hospital workflows, optimize resource use (beds, staff, supplies), reduce waste, and support value-based care, aligning cost, quality, and outcomes. Healthcare providers will rely on BI not only for clinical insights but also for financial, operational, and administrative optimization.

In countries with growing digital health adoption (including markets like India), BI will become vital to support telehealth, remote monitoring, and digital‑health infrastructure. As these markets invest more in digitization, BI adoption is likely to increase.

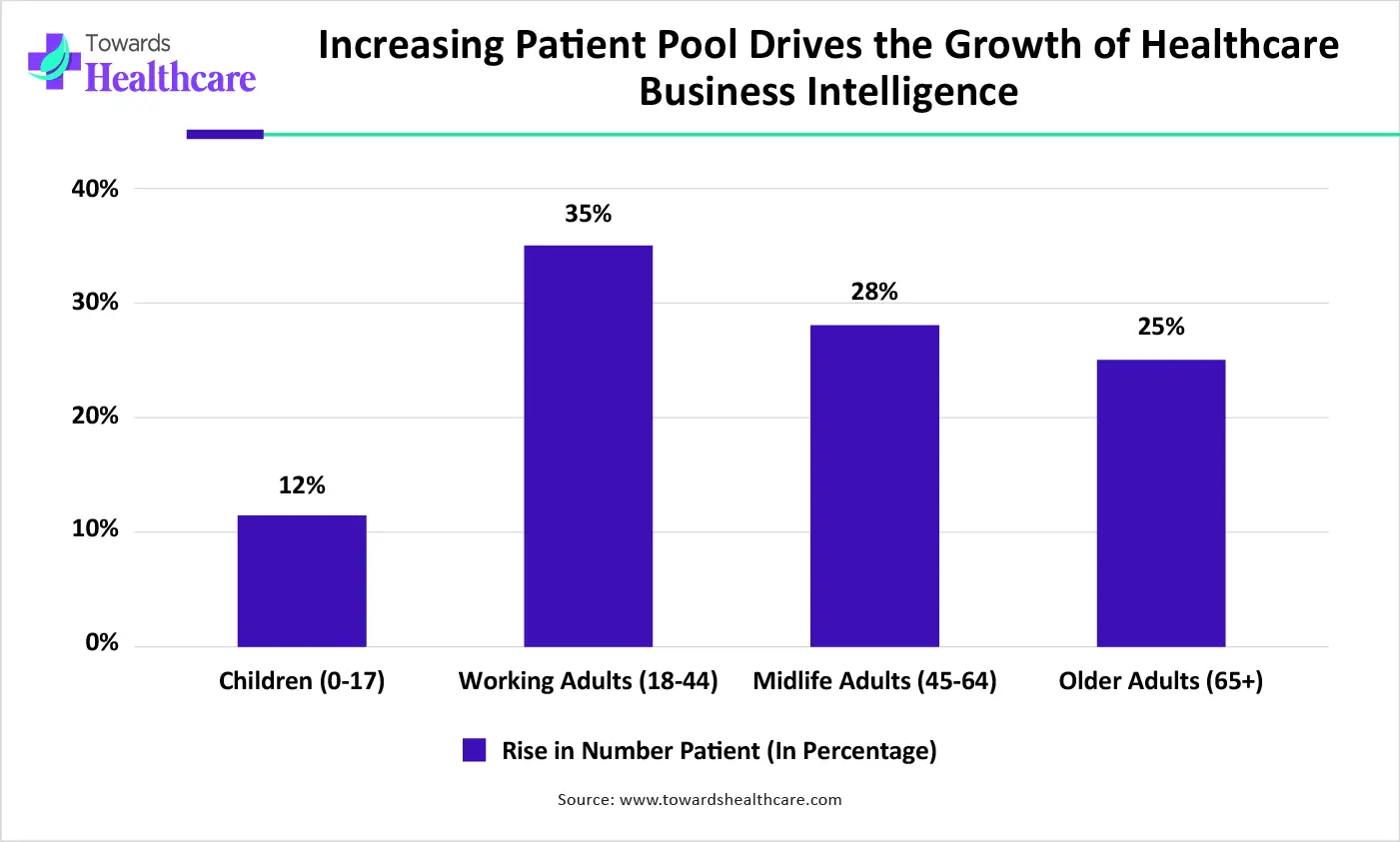

A rising patient pool increases demand for timely diagnostics, coordinated care, and efficient resource management, pushing healthcare providers to adopt advanced business intelligence solutions.

Which Component Segment Dominated the Healthcare Business Intelligence Market?

The software segment dominates the market because hospitals, payers, and life sciences companies increasingly rely on advanced analytics platforms for real-time insights, data visualization, and predictive modeling. Growing adoption of cloud-based BI tools, AI-driven dashboards, and interoperable EHR-integrated systems strengthens software demand. Additionally, continuous updates, automation capabilities, and scalability make software more essential than services or hardware in modern healthcare analytics.

Services

The services segment is estimated to be the fastest-growing in the market due to rising demand for implementation support, data integration, and customization of complex BI platforms. Healthcare providers increasingly rely on consulting, training, and managed services to optimize analytics workflows. Additionally, the need for continuous system upgrades, compliance support, and real-time data management drives strong growth in professional and managed BI services.

Why Did the Cloud-Based Segment Dominate the Healthcare Business Intelligence Market?

The cloud-based segment dominates the market and is expected to grow at the fastest CAGR during the forecast period due to its scalability, lower maintenance costs, and ability to support real-time analytics. Healthcare providers prefer cloud platforms for easier integration with EHRs, faster data processing, and remote accessibility. Additionally, strong security enhancements, rapid AI adoption, and the need for flexible, upgrade-friendly systems continue to drive the shift toward cloud-based BI solutions.

On-Premises

The on-premises segment is estimated to be a significantly growing delivery mode in the healthcare business intelligence market due to rising demand for tighter data control, enhanced security, and full ownership of sensitive patient information. Many healthcare institutions with strict compliance requirements prefer on-site systems to manage large datasets. Additionally, organizations with robust internal IT infrastructure choose on-premises BI for customization, higher performance, and seamless integration with legacy systems.

Why Did Self-Service BI Hold a Dominant Segment in the Healthcare Business Intelligence Market?

The self-service BI segment dominates the healthcare business intelligence market because it empowers clinicians, administrators, and decision-makers to access and analyze data without relying on IT teams. Its user-friendly dashboards, drag-and-drop tools, and quick reporting improve workflow efficiency. Growing demand for real-time insights, faster decision-making, and customizable analytics strengthens the adoption of self-service BI across hospitals, payers, and life sciences organizations.

Which Application Segment Led the Healthcare Business Intelligence Market in 2025?

The financial analysis segment dominates the market as providers and payers increasingly rely on BI tools to optimize revenue cycles, manage costs, and improve budgeting. Real-time insights into billing, claims, and operational expenses help reduce inefficiencies. Additionally, growing focus on value-based care, regulatory compliance, and financial performance monitoring drives widespread adoption of BI for financial analysis in healthcare organizations.

Patient Care

The patient care segment is anticipated to be the fastest-growing application in healthcare business intelligence due to rising demand for personalized treatment, improved patient outcomes, and real-time clinical decision support. BI tools enable predictive analytics, care coordination, and population health management, helping providers deliver efficient, data-driven, and patient-centered healthcare services.

Which End Use Segment Dominated the Healthcare Business Intelligence Market in 2025?

The healthcare payers segment dominates the market as insurers and payers leverage BI tools to optimize claims management, risk assessment, and cost control. Advanced analytics help improve member services, detect fraud, and support value-based care models, driving widespread adoption of BI solutions across payer organizations.

Healthcare Manufacturers

The healthcare manufacturers segment is anticipated to be the fastest-growing in the market due to increasing demand for data-driven insights in drug development, production planning, and supply chain optimization. BI tools help manufacturers enhance operational efficiency, ensure regulatory compliance, and support research and development, driving faster adoption of advanced analytics solutions.

North America dominates the healthcare business intelligence market due to its advanced digital healthcare infrastructure, high adoption of electronic health records, and strong shift toward value-based care. The region benefits from robust regulatory support, significant investments in AI-driven analytics, and the presence of major BI vendors. Additionally, strong R&D capabilities and a skilled data analytics workforce accelerate innovation and adoption across providers and payers.

The U.S. leads the North America healthcare business intelligence market due to its highly digitalized healthcare ecosystem, widespread EHR adoption, and strong focus on value-based care. The presence of major BI technology vendors, large-scale investments in AI and cloud analytics, and a complex healthcare reimbursement system further drive demand. Additionally, strong research institutions and advanced data-governance frameworks accelerate innovation and adoption.

Asia-Pacific is the fastest-growing region in the healthcare business intelligence market due to rapid digital transformation, rising adoption of electronic health records, and expanding healthcare infrastructure. Government initiatives supporting health IT, growing investments in AI and cloud solutions, and increasing demand for operational efficiency drive growth. Additionally, large patient populations and rising healthcare expenditure accelerate BI adoption across hospitals and diagnostics.

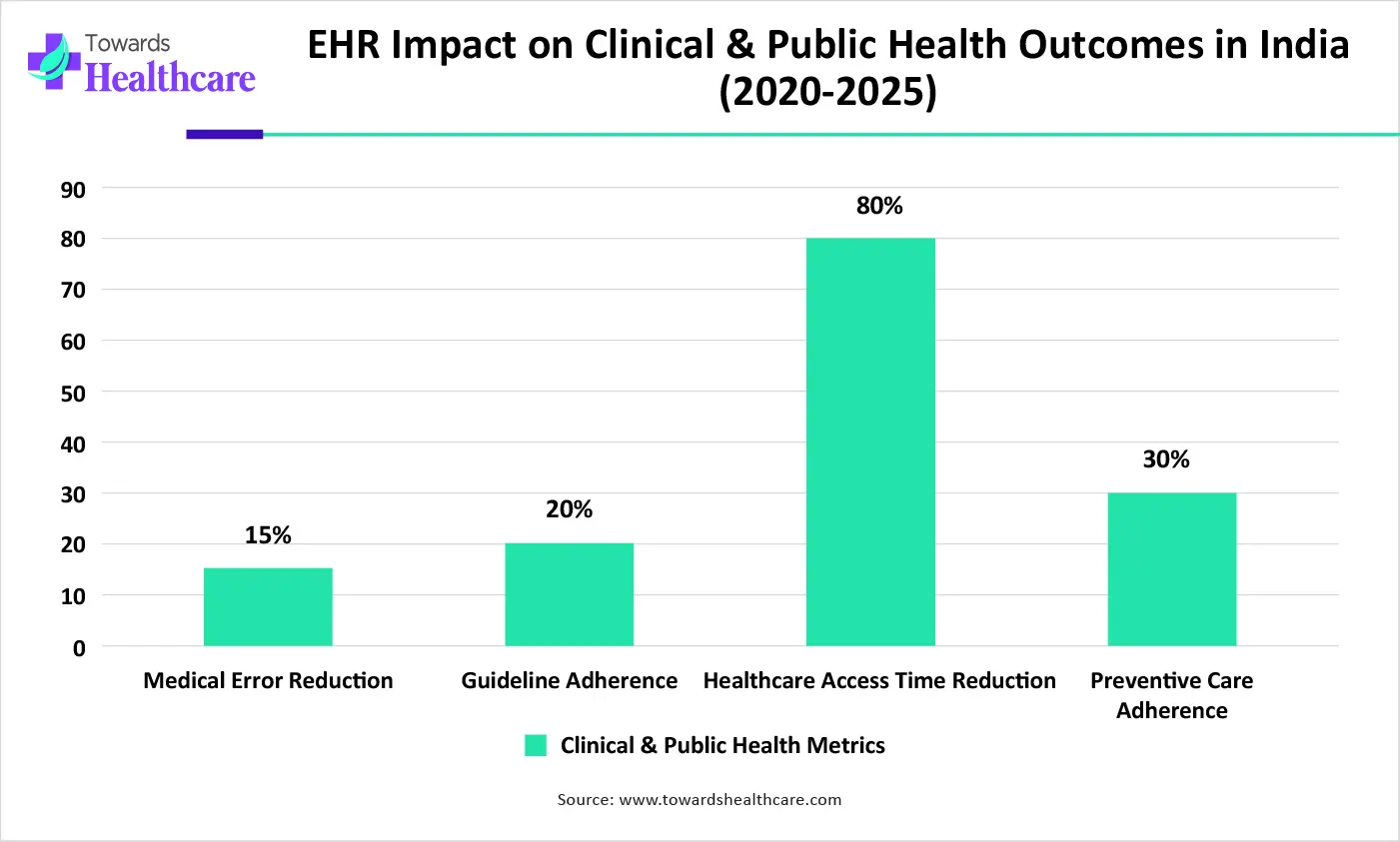

India is growing in the Asia-Pacific healthcare business intelligence market due to its rapid healthcare digitalization, large-scale adoption of electronic health records, and strong government support for health-IT modernization. Significant investments in AI, big data, and cloud platforms strengthen analytics capabilities. Additionally, India’s massive patient population, expanding hospital networks, and fast-growing biotech and pharmaceutical sectors create high demand for advanced BI solutions.

Europe is a notably growing region in the healthcare business intelligence market due to its strong regulatory push for digital health, rising adoption of interoperable EHR systems, and expanding investments in AI-driven analytics. The region benefits from coordinated government initiatives, a growing focus on value-based care, and increasing demand for efficiency in public healthcare systems. Additionally, advanced research institutions and cross-border data-sharing efforts further accelerate the adoption of BI across hospitals and health networks.

The UK is a dominant country in the Europe healthcare business intelligence market due to its highly digitalized National Health Service, strong adoption of EHR and data-standardization frameworks, and major government-backed digital health initiatives. The country invests heavily in AI, predictive analytics, and cloud-based platforms. Additionally, its advanced research ecosystem, strong health informatics workforce, and emphasis on improving care efficiency accelerate BI implementation nationwide.

| Sr. No. | Vendor/Company | Headquarters | Key Offerings & Strengths in Healthcare BI / Analytics |

| 1 | Microsoft Corporation | Redmond, Washington, United States | Offers Power BI (and related cloud analytics), widely used in healthcare for visualization, dashboards, and real-time reporting across clinical, financial, and operational data. Integration with Microsoft Cloud for Healthcare helps consolidate EHRs, claims, and operations data for unified analytics. |

| 2 | IBM Corporation | Armonk, New York, United States | Provides advanced analytics and AI-driven tools (formerly via Watson Health / related divisions) to perform deep analysis of structured/unstructured data, support clinical decisionmaking, patient outcomes, and operational efficiency. |

| 3 | Oracle Corporation (incl. its healthcare subsidiary) | Redwood Shores, California, United States | Combines robust BI/analytics tools, cloud infrastructure, and EHR/healthdata integration, suitable for population health management, clinical, financial, and operational analytics for large hospital systems. |

| 4 | SAP SE | Walldorf, Germany | Offers enterprisegrade BI/analytics platforms (e.g., SAP HANA, BusinessObjects) tailored for healthcare, enabling operational analytics, financial management, regulatory compliance, and integration with hospital information systems. |

| 5 | SAS Institute Inc. | Cary, North Carolina, United States | Delivers powerful predictive analytics, datamining, and populationhealth analytics for providers/payers, helping detect trends, manage risk, forecast outcomes, and support data-driven decisionmaking in clinical and administrative domains. |

| 6 | Tableau Software, LLC (by Salesforce) | Seattle, Washington, United States | Known for highly intuitive, interactive data visualization and dashboard capabilities. Widely used across hospitals and health systems for quality improvement, clinical benchmarking, and strategic reporting, making complex data accessible to non-technical users. |

| 7 | Qlik Technologies, Inc. (Qlik/QlikSense /QlikView) | King of Prussia, Pennsylvania, United States | Offers datadiscovery, visualization, and analytics platforms tailored for healthcare, facilitating integration of data from multiple sources (EHRs, claims, operations), enabling cross-system analytics and reporting. |

| 8 | MicroStrategy Incorporated | Tysons Corner, Virginia, United States | A longstanding BI vendor offering enterprise-grade analytics and BI platforms. In the healthcare context, useful for operational and financial analytics, reporting, and dashboards, especially by larger organizations needing scalable BI infrastructure. |

| 9 | Information Builders, Inc. (now under TIBCO or similar) | United States (original company U.S.-based) | Provides WebFOCUS BI and analytics platforms with healthcare-specific applications, helping institutions manage reporting, compliance, operational, and financial analytics across clinical and administrative data. |

| 10 | Sisense Inc. | New York City, New York, United States | Offers a full-stack BI platform that enables healthcare organizations to analyze complex datasets from multiple sources, including EHRs, claims, and operational data, suitable for both small clinics and larger health systems, offering flexibility, scalability, and self-service BI. |

By Component

By Mode of Delivery

By Application

By End Use

By Deployment

By Region

North America

South America

Europe

Asia Pacific

MEA

December 2025

December 2025

December 2025

December 2025