January 2026

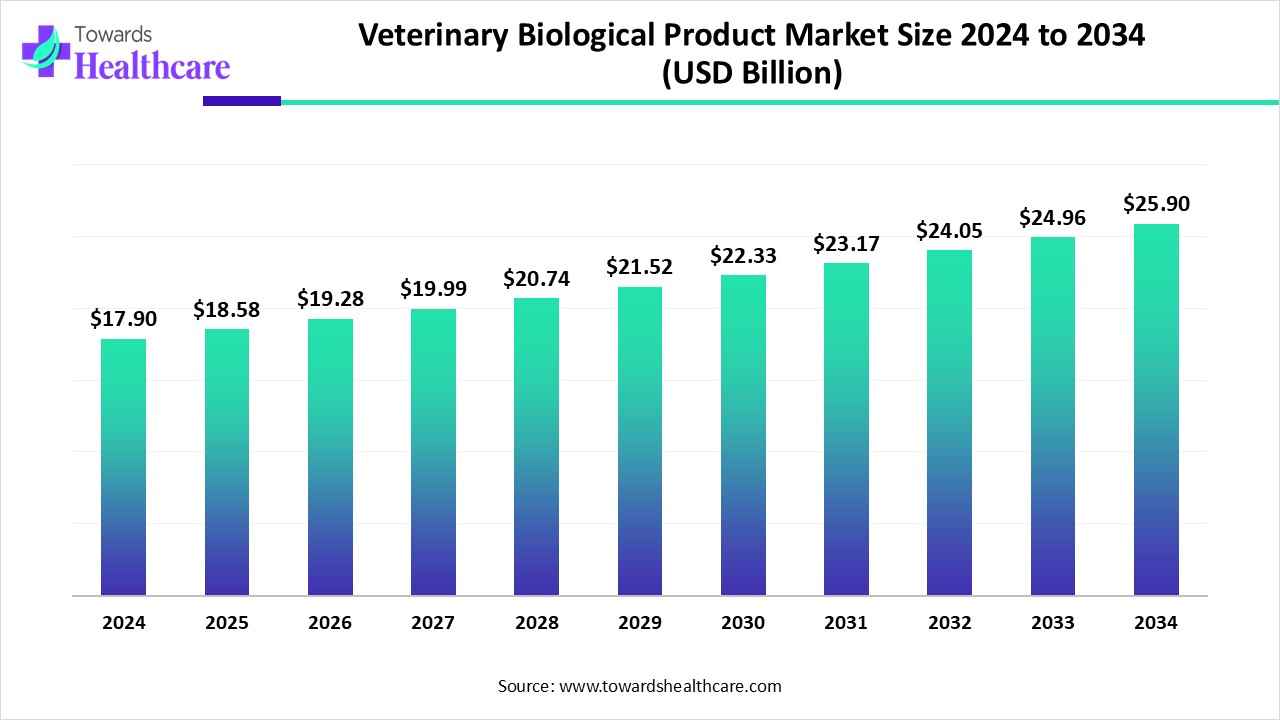

The global veterinary biological product market size is calculated at US$ 17.9 billion in 2024, grew to US$ 18.58 billion in 2025, and is projected to reach around US$ 25.9 billion by 2034. The market is expanding at a CAGR of 3.78% between 2025 and 2034.

Research suggests that veterinary products are effective in healthy animals to elicit a protective immune response. All products driving the veterinary biological product market are tested to provide a significant and clinically promising effect while reducing disease severity. The U.S. Animal and Plant Health Inspection Service under the U.S. Department of Agriculture (USDA) recently licensed these products in 2025, which include vaccines, bacterins, antibody products, diagnostic products, toxoids, etc.

| Table | Scope |

| Market Size in 2025 | USD 18.58 Billion |

| Projected Market Size in 2034 | USD 25.9 Billion |

| CAGR (2025-2034) | 3.78% |

| Leading Region | North America by 40% |

| Market Segmentation | By Product Type, By Animal Type, By Route of Administration, By Route of Administration, By Region |

| Top Key Players | Zoetis Inc., Merck & Co., Inc., Boehringer Ingelheim International GmbH, Elanco Animal Health Incorporated, IDEXX Laboratories, Inc., Ceva Santé Animale, Virbac, Neogen Corporation, Vetoquinol, Bimeda, Norbrook Laboratories Ltd., MSD Animal Health, Biogénesis Bagó, Vetanco S.A., Tianjin Ringpu Bio-Technology, Ashish Life Sciences, Zomedica, Hester Biosciences, AnimalCare, Eco Animal Health |

Advancements in biotechnology, recombinant DNA technology, mRNA platforms, and monoclonal antibodies boost the development of more efficient and targeted biologics. The veterinary biological product market encompasses a range of products derived from living organisms, including vaccines, bacterins, antisera, diagnostic kits, and other biologically-based agents. These products are primarily used to prevent, diagnose, or treat diseases in animals, operating through immunological processes to enhance the health and productivity of both companion animals and livestock. Regulatory bodies such as the U.S. Department of Agriculture's Animal and Plant Health Inspection Service (APHIS) oversee the licensing and approval of these products to ensure their safety, efficacy, and purity.

AI streamlines manual tasks and allows professionals to focus on their work. The standards of animal care are improved by the diagnostic abilities and predictive analytics of AI. Veterinary healthcare systems that are expanding the market get notable advantages of AI, such as treatment efficacy, enhanced accessibility, and optimized resource allocation. AI manages data analysis, provides decision-making support, and has automated manual healthcare systems.

The vaccines segment dominated the market in 2024, with a revenue share of 55%, owing to the key functions of vaccines in veterinary medicine to prevent and control diseases and protect public health. They ensure the economic stability of the animal health industry. Vaccines eliminate certain animal diseases on a global scale.

The biological therapeutics segment is expected to grow at the fastest CAGR in the veterinary biological product market during the forecast period due to its primary focus on preventing diseases through vaccination and providing targeted treatments with monoclonal antibodies. Modern therapeutics offers cell-based regenerative therapies and involves the use of recombinant proteins. Advances in biotechnology and genetic engineering expanded the product portfolio and its applications.

The livestock segment dominated the market in 2024, with a revenue share of 50%, owing to the major role of veterinary biological products in enhancing the productivity of livestock animals. These products improve food safety, reduce antibiotic use, and offer wide diagnostic applications. They are important in modern livestock management in ensuring economic stability, ethical animal welfare, and global food security.

The pet animals segment is estimated to grow at the fastest rate in the veterinary biological product market during the predicted timeframe due to the potential of cutting-edge biological treatments in regenerative therapy, like stem cell therapy and platelet-rich plasma therapy. Vaccines are the most vital veterinary biological products for pets, which stimulate immunity, build defense, and protect against deadly diseases. Biologics provide precise treatments for complex diseases that are hard to treat with conventional medications.

The parenteral segment dominated the market in 2024, with a revenue share of 70%, owing to the prominent role of parenteral administration in ensuring product effectiveness and facilitating different therapeutic strategies. The parenteral biological products include vaccines, serums and antibody products, recombinant proteins, stem cells, toxoids, and bacterins, which are useful for unconscious animals to achieve precision and control. All parenteral products are expensive, sterile, and require skilled administration due to stringent regulatory requirements.

The oral segment is anticipated to grow at a notable rate in the veterinary biological product market during the upcoming period due to the potential advantages of oral administration in mass immunization, reducing stress, stimulating mucosal immunity, and improving safety. The development of novel delivery systems and promising strategies for oral vaccines helps to overcome the challenges of oral administration. These modern delivery systems include nanoparticles, spore-based systems, viral vectors, and recombinant bacteria and yeast.

The veterinary hospitals & clinics segment dominated the market in 2024, with a revenue share of 45%, owing to the integral role in veterinary practice, including preventative medicine, treatment, therapy, diagnostics, and disease management. The hospitals and clinics related to animal health are experiencing the impact of veterinary biological products in clinical practice. They benefit from informed decision-making, patient management, and biosecurity.

The online/e-commerce platforms segment is predicted to grow at a rapid rate in the veterinary biological product market during the studied period due to expanded access and convenience, wider product selection options, and subscription services. The online or e-commerce channels enable direct-to-consumer delivery of specialty products. Specialized B2B platforms improve connectivity between manufacturers, veterinarians, and distributors to conduct transactions efficiently.

North America dominated the market in 2024, with a revenue share of 40%, owing to biotechnology innovations, mandatory vaccination programs, and expanded pet insurance. The American Association of Veterinary State Boards (AAVSB) addressed challenges faced by veterinarians that are associated with the veterinarian-client-patient relationship and a mid-level practitioner position. The Animal and Plant Health Inspection Service (APHIS) of the USDA plans to provide the funding for the year 2025 that will support animal disease preparedness and response activities.

The Institute for International Cooperation in Animal Biologics, located in the USA, introduced the Veterinary Biologics Training Program (VBTP) supports the USDA regulatory process to ensure safety, purity, potency, and efficacy of veterinary biologics like vaccines, diagnostic kits, bacterins, antisera, and other products of biological origin. The government initiatives taken in North America include activities and collaborations to address highly pathogenic avian influenza, updated diagnostic funding, and new regulatory guidelines.

The U.S. Animal and Plant Health Inspection Service under the U.S. Department of Agriculture (USDA) plays a critical role in the regulation of imports of veterinary biological products, including bacterins, vaccines, antisera, and diagnostic kits. It ensures the use of pure, safe, potent, and effective products to diagnose, prevent, and treat animal diseases in the U.S. The American Association of Veterinary Medical Colleges (AAVMC) proposed a statement in response to a plan of the U.S. Department of Agriculture to increase the number of veterinarians nationwide.

In August 2025, the U.S. Department of Agriculture (USDA) announced the expansion of the rural food animal veterinary workforce across the U.S. that will protect America’s food supply.

In 2024, approximately 89.7 million dogs and 73.8 million cats were owned in the U.S., with about 63% of households owning at least one pet. Regarding animal shelters, about 5.8 million dogs and cats entered shelters, while 4.2 million were adopted.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to disease control programs, harmonization of regulations, and increased investments in R&D to boost production capabilities and domestic manufacturing. The World Organization for Animal Health (WOAH) has taken the international effort to reduce, replace, and refine animal use in research and testing. Several countries, like Japan, the Republic of Korea, and some other regions, have launched national projects to reduce animal testing, which align with global regulations. These regulations promote the adoption of new alternatives to animal testing. Certain government initiatives aim to improve regulatory processes, increase animal vaccination, and enhance regional disease surveillance.

The Union Cabinet introduced the Livestock Health and Disease Control Program (LHDCP) with a clearance of ₹3,880 crore for the livestock health program for 2024-25 and 2025-26. The Cabinet has also allocated Rs. 75 Crore to distribute high-quality and affordable generic veterinary medicines. The Institute of Veterinary Biological Products aims to provide high-quality products to the state owners and enhance the production of eggs, milk, and meat for livestock and other animals.

In September 2024, Jitendra Singh, the science minister, proclaimed that the Bio-E3 policy launched by the Indian government aims to enable sustainable and efficient use of biological resources for innovation, scaling up, and biomanufacturing of enzymes, functional foods, bio-polymers, specialty chemicals, veterinary products, smart proteins, and precision biotherapeutics and services.

In 2024, India's livestock sector saw a 3.78% increase in milk production to 239.30 million tonnes, making it the world's largest producer. Egg production grew by 3.18% to 142.77 billion, and meat production rose by 4.95% to 10.25 million tonnes.

Europe is expected to grow at a notable rate in the market in 2024, led by EU veterinary medicine regulations, mandatory immunization campaigns, novel biologics, and advanced vaccine platforms. The European Medicines Agency (EMA) provides its recommendations for the authorization and safety monitoring of veterinary medicines. The EMA reported the medicines qualified for marketing and commercial authorization in 2024, which include 11 for companion animals, such as cats and dogs, and 13 for food-producing animals, such as pigs and cattle, and chickens. These are a total of 25 medicines, including 14 vaccines, and 7 were developed by a biotechnological process. The partnerships between European scientists and funders help to improve animal health and welfare.

Germany’s Medical Research Act aims to transform Germany into an attractive hub for medical innovation and pharmaceutical development. This act supports incentives for local clinical trials, confidential drug pricing, simplified clinical trial approvals, and harmonization of ethics committee processes. Germany adopted the national pharmaceutical strategy and supports clinical research institutions.

The R&D process for veterinary biological products encompasses several key stages, such as research and discovery, preclinical testing, clinical development, regulatory review and approval (licensing), manufacturing, quality control, and post-market surveillance.

Key Players: Zoetis Inc., Boehringer Ingelheim Animal Health, Merck Animal Health, Elanco Animal Health, Ceva Santé Animale, Virbac.

The primary distribution channels include veterinary hospitals and clinics, e-commerce, online pharmacies, traditional pharmacies, and offline retailers, which focus on cold chain logistics, product traceability, specialized handling, and regulatory compliance.

Key Players: Zoetis, Boehringer Ingelheim Animal Health, Virbac, Indian Immunologicals Ltd. (IIL), Elanco.

It offers companion animal support, livestock and production animal support, digitalization, remote monitoring, educational initiatives, and innovations in therapeutics.

Key Players: Zoetis, Elanco, Merck Animal Health, Boehringer Ingelheim, Virbac.

By Product Type

By Animal Type

By Route of Administration

By Distribution Channel

By Region

January 2026

December 2025

December 2025

October 2025