January 2026

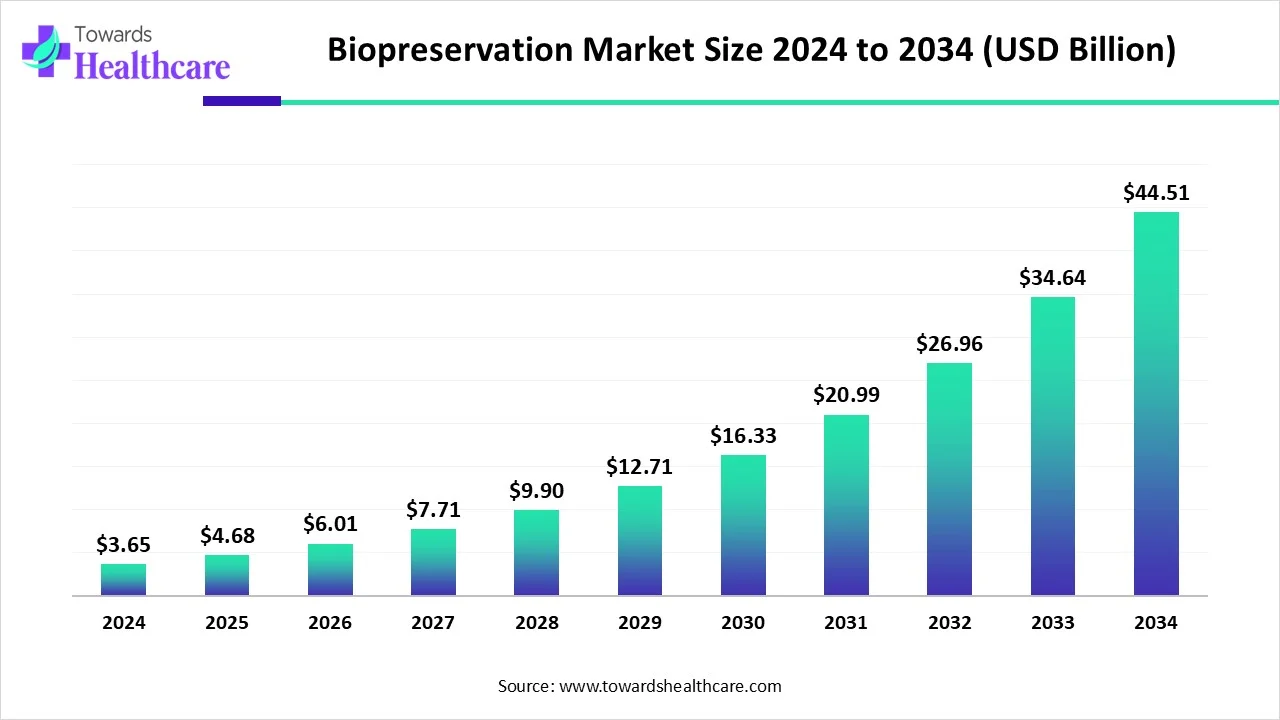

The global biopreservation market size is calculated at USD 4.68 billion in 2025, grows to USD 6.01 billion in 2026, and is projected to reach around USD 56.79 billion by 2035, rising at a 28.34% CAGR from 2026 to 2035.

| Metric | Details |

| Market Size in 2026 | USD 6.01 Billion |

| Projected Market Size in 2035 | USD 56.79 Billion |

| CAGR (2025 - 2034) | 28.34% |

| Leading Region | North America |

| Market Segmentation | By Product, By Application, By Region |

| Top Key Players | Azenta US, Inc., Biomatrica, Inc., BioLife Solutions, MVE Biological Solutions, LabVantage Solutions, Inc., Taylor-Wharton, Thermo Fisher Scientific, Inc., Panasonic Corporation, X-Therma Inc., PrincetonCryo., Stirling Ultracold |

Biopreservation is the process of preserving biotechnology material, such as cells. Tissue and organs, at low temperatures, to maintain their viability and functionality for future use. Innovation is driving growth in the biopreservation market by introducing advanced preservation techniques, such as cryopreservation and vitrification, which enhance the longevity and viability of biological samples. The integration of AI, automation, and improved storage equipment ensures greater precision and reliability. These advancements are expanding the scope of applications in regenerative medicine, biobanking, and cell therapy, making biopreservation more efficient, cost-effective, and accessible across healthcare and research sectors.

For Instance,

AI is revolutionizing the market by enabling real-time monitoring, predictive maintenance, and automation of storage systems. It improves sample integrity through advanced data analytics and enhances operational efficiency by integrating with IoT and Laboratory Information Management Systems (LIMS). AI also supports personalized medicine by ensuring the high-quality preservation of biological samples. These advancements reduce human error, lower costs, and optimize storage conditions, making biopreservation more reliable and scalable for research and therapeutic applications.

Growing Healthcare Expenditure

Growing healthcare expenditure drives the biopreservation market by increasing investment in advanced medical research, biobanking, and personalized medicine. Higher spending enables healthcare facilities and research institutions to adopt cutting-edge preservation technologies for storing cells, tissue, and organs. This supports the development of regenerative therapies and enhances the quality of patient care. As countries allocate more funds to healthcare, the demand for reliable and efficient biopreservation solutions continues to rise, fueling market growth.

High Cost of Advanced Technique

The high cost of advanced biopreservation techniques acts as a major factor in the market, especially for small research labs and healthcare facilities with limited budgets. Technologies like cryopreservation equipment, specialized storage systems, and preservation media require significant investment, making them less accessible in low- and middle-income regions. Additionally, the need for skilled personnel and maintenance further increases operational costs, limiting the widespread adoption of these advanced solutions despite their benefits.

For Instance,

Growing Demand for Personalized Medicine

The growing demand for personalized medicine offers a significant opportunity for the biopreservation market, as it depends on the secure storage of biological samples such as cells, tissues, and genetic material. These samples are essential for developing patient-specific treatments based on individual genetic profiles. As personalized medicine continues to expand, there will be a rising need for advanced biopreservation technologies to ensure sample integrity, support medical research, and enable the delivery of precise, effective therapies to individual patient needs.

For Instance,

The equipment segment held the largest revenue share in the biopreservation market due to the high cost and essential role of advanced storage systems like freezers and cryogenic tanks. Increasing demand for long-term preservation of biological samples in research, clinical trials, and biobanking drives continuous investment in reliable equipment. Technological advancements and the expansion of biobanking facilities further contribute to the market dominance.

The media segment is anticipated to grow at the fastest rate in the market due to increasing demand for high-quality preservation solutions that maintain cell integrity and viability. Growth in regenerative medicine, stem cell research, and cell-based therapies is driving the need for specialized media formulations. Additionally, the recurring use and replenishment of media in the storage processes contribute to higher consumption rates, further accelerating the market expansion of the biopreservation market.

In 2024, the biobanking segment held the highest shares of the market due to the growing demand for the long-term storage of biological samples such as blood, tissues, and cells. The rise in population-based studies, personalized medicine, and advancements in genomics has led to the expansion of biobanking facilities worldwide. This has increased the need for reliable preservation solutions, driving greater investment in equipment, media, and services tailored to biobanking applications.

The regenerative medicine segment is expected to grow at a faster CAGR in the biopreservation market during the forecast period due to the increasing use of stem cells, tissue engineering, and cell-based therapies. As research and clinical applications expand in treating chronic diseases and injuries, the demand for effective preservation methods rises. The need to maintain the viability and functionality of cells and tissues is driving the adoption of advanced biopreservation solutions in this rapidly evolving field.

North America dominated the market in 2024 due to its well-established healthcare infrastructure, strong presence of biobanks, and significant investments in biomedical research. The region benefits from advanced technologies, high adoption of regenerative medicine and personalized therapies, and a large number of ongoing clinical trials. Additionally, supportive government initiatives and funding for biopreservation-related research further strengthened market growth, positioning North America as the leading contributor to global revenue in this sector.

A significant driver is the increasing prevalence of chronic diseases and obesity, which necessitates advanced biopreservation techniques for long-term storage of biological samples. Additionally, the rising demand for regenerative medicine and personalized therapies has led to greater investment in biopreservation technologies. Government support and a favorable regulatory environment further bolster this growth, positioning the U.S. as a leading contributor to the global biopreservation market.

For Instance,

The Canadian market is expanding due to increasing investments in biomedical research, the growth of personalized medicine, and the expansion of biobanking initiatives. These factors are driving demand for advanced preservation technologies to store biological samples like tissues and stem cells. Additionally, the rising prevalence of chronic diseases and the need for long-term storage of biospecimens for research and therapeutic applications are contributing to market growth. This trend aligns with global advancements in regenerative medicine and cell-based therapies.

For Instance,

The Asia-Pacific market is expected to grow at the fastest CAGR due to rising chronic disease prevalence, an aging population, and increasing demand for personalized medicine. Rapid advancements in biopharmaceutical production and cryopreservation technologies are also fueling growth. Additionally, expanding healthcare infrastructure and increased investments in research and development across emerging countries like China and India are driving the region’s strong market potential.

The Chinese market is expanding due to increasing investments in biomedical research, the growth of personalized medicine, and the expansion of biobanking initiatives. These factors are driving demand for advanced preservation technologies to store biological samples like tissues and stem cells. Additionally, the rising prevalence of chronic diseases and the need for long-term storage of biospecimens for research and therapeutic applications are contributing to market growth. This trend aligns with global advancements in regenerative medicine and cell-based therapies.

The Indian market is expanding due to the rapid growth of the biotechnology and pharmaceutical sectors, along with increased government support for healthcare innovation. Rising awareness of stem cell banking, growing clinical research activities, and the demand for affordable healthcare solutions are further fueling the need for efficient biospecimen storage. Additionally, infrastructure improvements and increased foreign investments are enhancing the adoption of biopreservation technologies across research and medical institutions.

Europe is accelerating the market through strong government support, significant funding for research, and a well-established healthcare infrastructure. Leading countries like Germany, France, and the UK are investing heavily in regenerative medicine projects and fostering collaborations between academic institutions and industry. The European Medicines Agency’s approvals of innovative regenerative therapies also improve market access. Additionally, an aging population with increasing chronic diseases drives demand for regenerative treatments, further boosting market development.

For Instance,

The UK market is growing due to increasing investments in research and development, particularly in personalized medicine and advanced therapies. Strong government support and a favorable regulatory environment encourage innovation and faster approvals. The country’s robust healthcare infrastructure, skilled workforce, and collaboration between academia and industry further drive growth. Additionally, rising demand for effective treatments and biopharmaceutical products supports market expansion across multiple therapeutic areas.

Germany's market is expanding due to its robust healthcare infrastructure, substantial investments in biomedical research, and a strong presence of biobanks and pharmaceutical companies. The country's emphasis on precision medicine, stem cell research, and the development of novel therapies has increased the demand for advanced biopreservation technologies. Additionally, Germany's commitment to quality standards and regulatory frameworks ensures the safe storage and transport of biological materials, further driving market growth.

The Middle East and Africa are expected to grow significantly in the biopreservation market during the forecast period. The Middle East and Africa are experiencing a rise in the demand for biobanking. This is increasing the use of preserved samples for various research purposes. At the same time, they are being used in the development of personalized medications. Moreover, the growing diseases is increasing their use for storing the samples for diagnostic and treatment purposes. Furthermore, the growing clinical trials is also increasing their use for storing the samples throughout the trials.

Additionally, the growing innovation for the development of regenerative medicines, cell therapies, etc., is also increasing their use. Similarly, the growing interest in stem cell research is increasing its adoption. At the same time, the increasing medical tourism is also increasing the development of new diagnostic and treatment approaches, which in turn, is increasing the use of biopreservation. These developments are supported by the healthcare investments as well. Thus, this is promoting the market growth.

In July 2025, financial results for the second quarter were announced by Thermo Fisher Scientific Inc., as per the report, there was a rise from 3% to $10.85 billion in 2025 in the revenue for the quarter, where the second quarter of 2024 showed $10.54 billion. This, in turn, indicated a 2% growth of organic revenue. Additionally, $4.28 was reported for the second quarter of 2025 by the GAAP diluted EPS, where the second quarter of 2024 reported $4.04.

Similarly, the comparison between GAAP operating income for the second quarter of 2025 and 2024 was noted to be $1.83 billion and $1.82 billion, respectively. The GAAP operating margin for the second quarter of 2024 was 17.3% and for 2025 was 16.9%. $5.36 was recorded for the adjusted EPS in the second quarter of 2025, where the second quarter of 2024 was $5.37. Moreover, the adjusted operating income in the year-ago quarter was noted to be $2.35 billion, while the second quarter of 2025 was reported to be $2.38 billion. Furthermore, the adjusted operating margin was noted to be 21.9%, and for the second quarter of 2024, it was 22.3%.

In March 2025, the financial results for the fourth quarter and 2025 financial guidanceFourth Quarter 2024 Business Highlights were released by BioLife Solutions, Inc. It was mentioned that the sale of SciSafe Holdings, Inc., which was a previously wholly owned biostorage and services subsidiary, was completed with around $73.0 million in cash.

Additionally, their previously wholly owned freezer subsidiary, that is Arctic Solutions, Inc. sale was completed with approximately $6.1 million in cash. The fourth quarter of 2024 showed total revenue of $22.7 million, indicating a rise of 31%, or $5.3 million, compared to the fourth quarter of 2023, which showed $17.4 million in total revenue. Moreover, the 2024 total revenue was reported to be $82.3 million, which showed a rise of 8% from $75.9 million in 2023.

In May 2025, BioIVT, a global provider of biospecimen solutions for drug and diagnostic research, introduced VivoSTART™ Cryopreserved GMP Leukopaks. These leukopaks meet GMP standards, ensuring high-quality, safe, and traceable cellular materials for use in cell and gene therapy development and clinical trials. This launch highlights the company’s ongoing dedication to advancing cell therapy through reliable human-derived starting materials. (Source: Businesswire)

By Product

By Application

By Region

January 2026

January 2026

January 2026

January 2026