February 2026

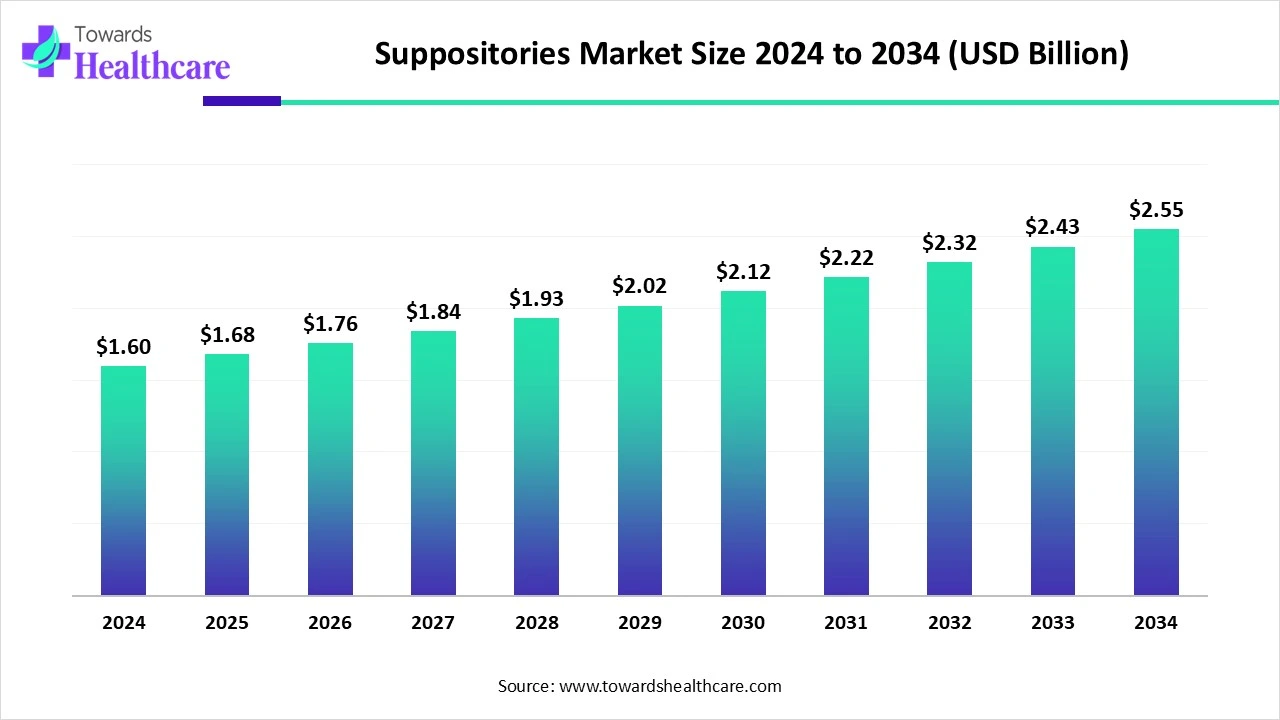

The global suppositories market size is calculated at US$ 1.6 billion in 2024, grew to US$ 1.68 billion in 2025, and is projected to reach around US$ 2.55 billion by 2034. The market is expanding at a CAGR of 4.67% between 2025 and 2034.

There is a rise in the use of suppositories due to growing diseases, the geriatric population, and awareness. This, in turn, is increasing their development by various companies, which is leading to new acquisitions and investments. To enhance its development and properties, the use of AI is increasing. Their use in different regions is driven by growing focus on research and development and increasing population. Thus, to deal with their growing demand, the companies are launching and initiating clinical trials for the newly developed suppositories. Hence, these developments are promoting the market growth.

| Table | Scope |

| Market Size in 2025 | USD 1.68 Billion |

| Projected Market Size in 2034 | USD 2.55 Billion |

| CAGR (2025 - 2034) | 4.67% |

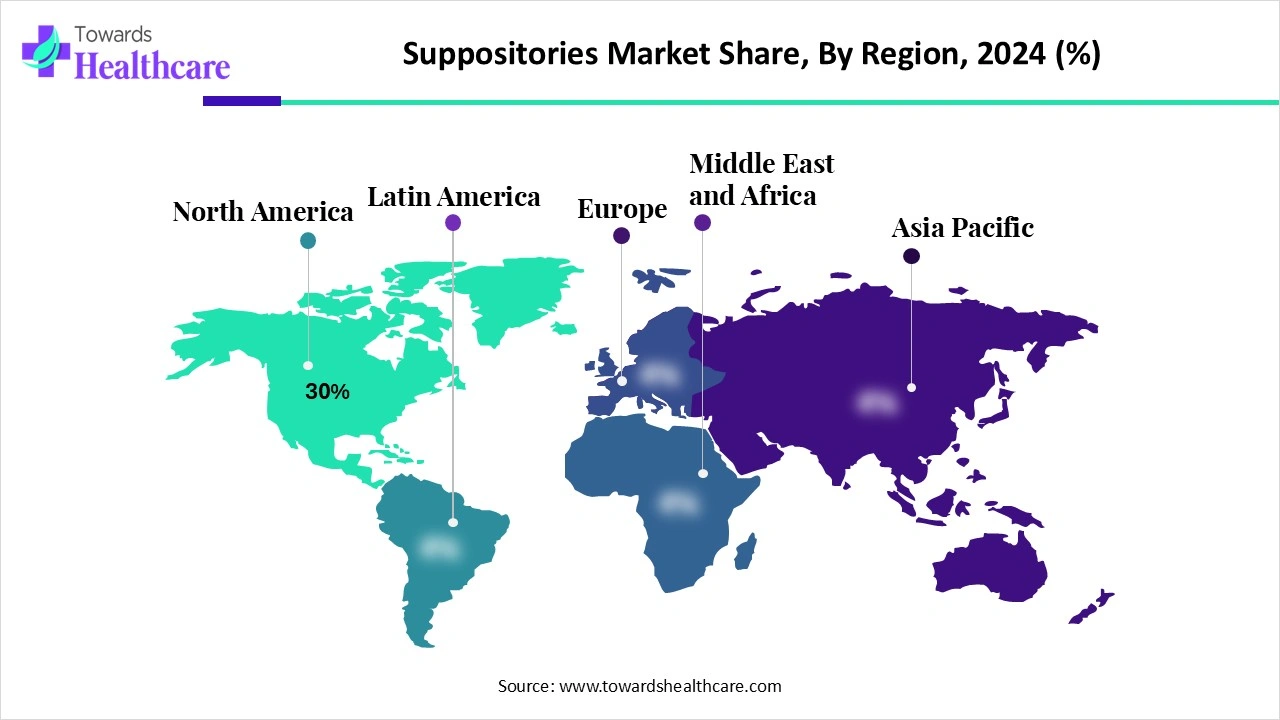

| Leading Region | North America Share 30% |

| Market Segmentation | By Type, By Application/Therapeutic Area, By End User, By Formulation Base, By Region |

| Top Key Players | Pfizer Inc., GlaxoSmithKline plc, Ferring Pharmaceuticals, Teva Pharmaceutical Industries Ltd., Novartis AG, Mylan N.V., Johnson & Johnson, Sanofi S.A., Bristol-Myers Squibb, Abbott Laboratories, Boehringer Ingelheim, Cipla Limited, Sun Pharmaceutical Industries Ltd., Hikma Pharmaceuticals, Pharmathen S.A., Recordati S.p.A., Wockhardt Limited, Meda AB, Lupin Limited, Astellas Pharma Inc |

The Suppositories Market encompasses pharmaceutical formulations designed for rectal, vaginal, or urethral administration, offering targeted or systemic drug delivery. Suppositories are solid dosage forms that melt, dissolve, or soften at body temperature to release active pharmaceutical ingredients (APIs), allowing drugs to bypass first-pass metabolism, achieve rapid absorption, and enhance patient compliance in cases of gastrointestinal disturbances, nausea, or dysphagia. This market spans multiple therapeutic categories, including pain management, anti-inflammatory, anti-fungal, laxatives, anti-emetics, and anti-infectives, and serves end users such as hospitals, retail pharmacies, and clinics. Growth drivers include the rising prevalence of gastrointestinal and gynecological disorders, increasing demand for pediatric and geriatric formulations, innovations in excipients and biodegradable bases, and a shift toward localized drug delivery for improved efficacy and reduced systemic side effects.

Expanding pipeline: Different types of suppositories are being developed due to growing women’s health issues, chronic diseases, aging population, etc. This, in turn, is increasing their development as well as distribution. Moreover, the growing acquisitions and investments are supporting these advancements.

For instance,

AI is being used in the development of suppositories as it helps in predicting the compatibility between the drug and excipients. It also helps in the optimization of the ingredients and formulation. At the same time, for the development of personalized suppositories, especially for pediatric patients, AI is being used. AI models are being used for the development of thermostable suppositories. It also helps in identifying the rising demand for suppositories in different regions and promotes their distribution, optimizing the cold chain logistics.

Increasing Palliative Care

The demand for the use of suppositories in the palliative care settings is increasing. This, in turn, is increasing their adoption rates in patients suffering from nausea, vomiting, or unconsciousness. Hence, with the use of suppositories, targeted action, along with sustained release, is also provided. Moreover, patients with chronic diseases such as neurodegenerative diseases or any other terminal illness are increasing their use. At the same time, they are also being increasingly used in home care settings. Thus, this drives the suppositories market growth.

Limited Acceptance Rate

The insertion of suppositories in the rectum or vagina often makes the patients uncomfortable. This, in turn, decreases their use. Moreover, the lack of awareness of its use as an alternative to oral dosage forms also reduces their adoption rates. Thus, this limits the use and acceptance rate of suppositories.

Advancements in Rectal Suppositories

Due to the growing use of suppositories, various developments are being conducted. Suppositories with controlled release and enhanced bioavailability are being developed to improve patient comfort and reduce their dosing frequency. At the same time, to deal with the storage conditions, new thermostable suppositories are also being developed. Moreover, new suppositories for the management of seizures are also being formulated. Similarly, to expand its applications, suppositories to deliver hormones or cancer drugs are also being researched. Thus, these advancements are promoting the suppositories market growth.

For instance,

By type, the rectal suppositories segment led the market with approximately 55% share in 2024, because of its wide range of applications. This increased their use in different types of patients and age groups. Moreover, their faster action and emergency use enhanced their use. This contributed to the market growth.

By type, the vaginal suppositories segment is expected to show the highest growth during the predicted time. Growing awareness about women’s health is increasing their demand. They are being used for various infectious or fertility issues. New herbal and probiotic vaginal suppositories are also being developed.

By application/therapeutic area type, the gastrointestinal disorders segment held the largest share of approximately 40% in the market in 2024, as the suppositories provided faster relief. They were used for the treatment of constipation, IBD, and haemorrhoids. This increased their use in the aging population.

By application/therapeutic area type, the gynecological disorders segment is expected to show the fastest growth rate during the predicted time. This, in turn, is increasing the use of vaginal suppositories. The growing demand for hormonal therapies is also increasing their adoption. They are also being used for menopause care.

By end user, the hospitals segment led the global market with approximately 50% share in 2024, as they used suppositories for emergency conditions. They were mostly used for palliative care. This increased their use for the treatment of various disorders. Moreover, the presence of trained personnel promoted its use.

By end user, the homecare settings segment is expected to show the highest growth during the upcoming years. The growing chronic diseases and geriatric population are increasing the use of suppositories in home care settings. Moreover, the presence of instruction along with applicators is increasing its safe use. This is enhancing the patient comfort.

By formulation base type, the cocoa butter-based segment held the dominating share of approximately 45% in the market in 2024, due to its fast-melting property. This accelerated the drug release, providing a rapid onset of action. They showed enhanced biocompatibility with reduced side effects or irritation. Thus, this enhanced the market growth.

By formulation base type, the PEG (polyethylene glycol)-based segment is expected to show the fastest growth rate during the upcoming years. They provided controlled releases, reducing the dosing frequency. It also demonstrates enhanced compatibility for both hydrophilic and lipophilic drugs. This increased their use for the development of targeted and mucoadhesive suppositories.

North America dominated the suppositories market share 30% in 2024. The presence of well-developed industries with advanced R&D infrastructure in North America increased the research and development focusing on suppository development. The investments supported their development. Thus, this contributed to the market growth.

The industries in the U.S are developing various vaginal suppositories for the treatment of various women's health problems. At the same time, the growing use of rectal suppositories is also increasing their development. Moreover, the growing use of CBD suppositories for pain management is also increasing.

Different types of plant-based or cannabis-based suppositories are being developed in Canada. They are being used for hormonal therapies or analgesics. Additionally, the growing adoption of vaginal suppositories is contributing to the development of paraben-free and vaginal probiotics formulations.

Asia Pacific is expected to host the fastest-growing suppositories market during the forecast period. Asia Pacific is experiencing a rise in the pediatric and geriatric population, which in turn is increasing the demand for suppositories. The growing awareness about the gynecological disorders is also contributing to the same. Moreover, due to expanding healthcare, its manufacturing and access are being enhanced. Thus, this is promoting the market growth.

The R&D of suppositories focuses on the development of controlled-release, targeted, personalized, herbal, and probiotic formulations.

Key players: AG, Novartis AG, Sanofi

3 different methods, such as rolling (hand-shaping), cold compression, and molding (fusion), are the methods used for formulating suppositories.

Blister, strip, and bottle are the commonly used packaging types, where blister packs composed of Alu/PE or PVC/PE are becoming the preferred option as they offer ease of handling, application, and dispensing.

Key players: CordenPharma, Recipharm AB, NextPharma Technologies

The patients are being provided with instructions or guidelines for the use of suppositories, which is increasing their safety and compliance with the treatment.

In September 2024, after revealing the URO Boric Acid Suppositor, the OB/GYN and medical advisor at O Positiv Health, Dr. Jessica Shepherd, commented that to provide exceptional comfort and maximum efficacy, they have used soothing aloe, boric acid, and lactic acid for formulating the URO boric acid vaginal suppository. Thus, with this formulation, the urgent vaginal health needs are addressed by offering a gentle touch.

By Type

By Application/Therapeutic Area

By End User

By Formulation Base

By Region

February 2026

February 2026

February 2026

February 2026