January 2026

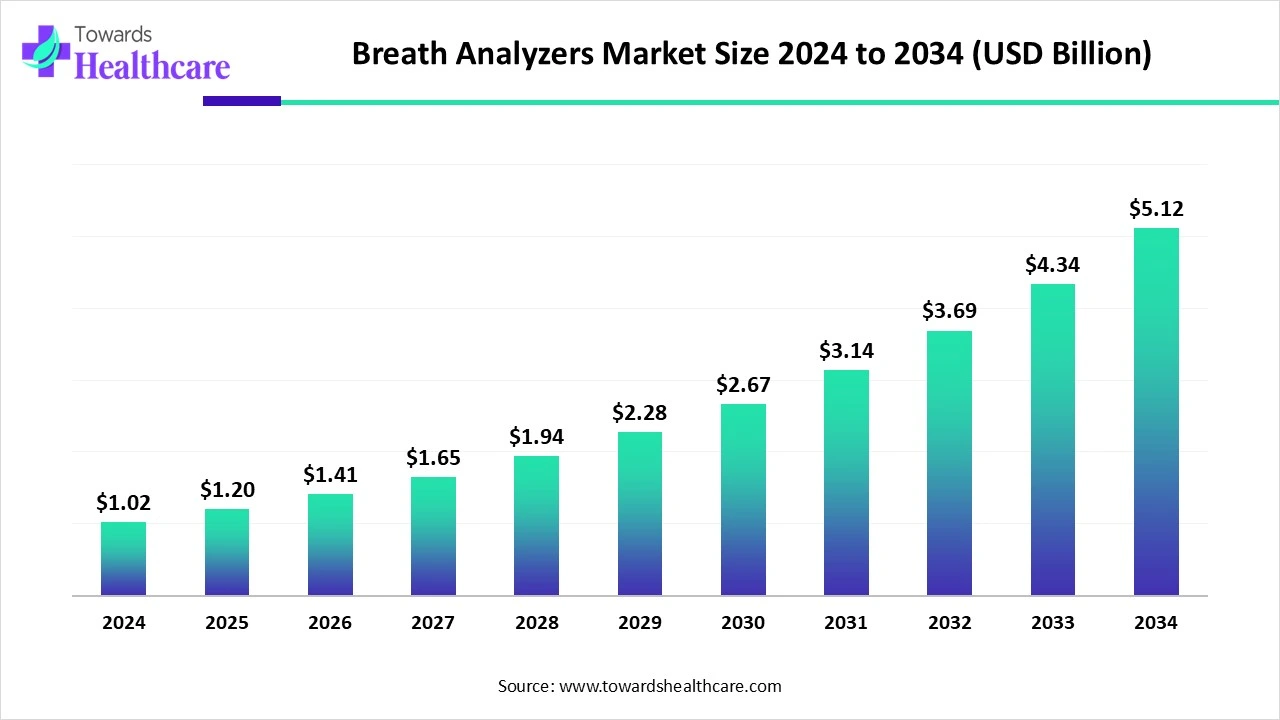

The global breath analyzers market size is calculated at US$ 1.2 billion in 2025, grew to US$ 1.41 billion in 2026, and is projected to reach around US$ 5.98 billion by 2035. The market is expanding at a CAGR of 17.44% between 2026 and 2035.

The growing alcohol consumption is increasing the drunk driving accidents. This is increasing the use of breath analyzers to detect alcohol levels. Their use is backed by strict government laws and policies. The growing health awareness is increasing their personal use. Their innovations are also increasing to enhance their clinical applications. With the use of AI, its accuracy, specificity, and sensitivity are being improved. Thus, these developments are increasing their use in different regions. Moreover, companies are collaborating, launching, and investing to promote their development. Thus, this promotes the market growth.

| Table | Scope |

| Market Size in 2026 | USD 1.41 Billion |

| Projected Market Size in 2035 | USD 5.98 Billion |

| CAGR (2026 - 2035) | 17.44% |

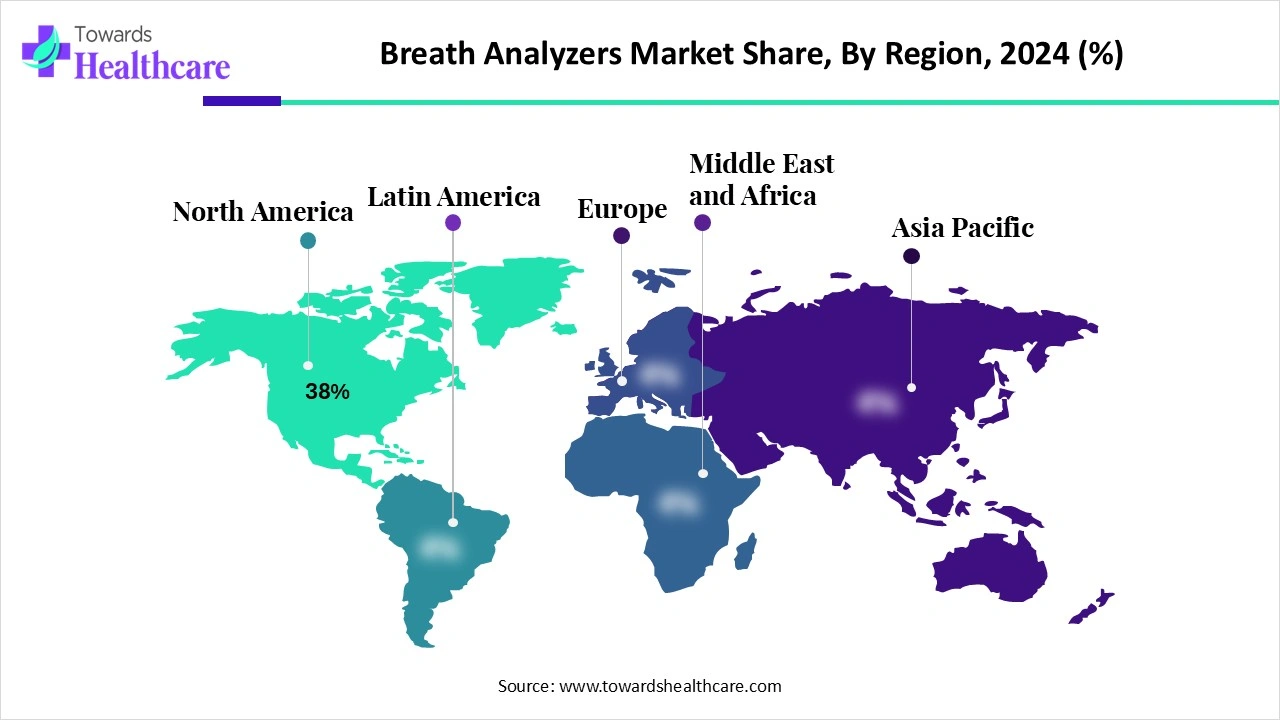

| Leading Region | North America by 38% |

| Market Segmentation | By Product Type, By Technology/Sensing Principle, By Application/Use Case, By End User, By Distribution Channel, By Region |

| Top Key Players | Dräger / Drägerwerk, Lifeloc Technologies, Lion Laboratories / LION, BACtrack, Intoximeters, Inc., Intoxalock, Smart Start, LifeSafer, AlcoPro / AlcoPro, Inc., Bedfont Scientific, Owlstone Medical, Sensit Technologies / Sensit, Figaro Engineering / Figaro USA, City Technology / Honeywell, Sensirion / Bosch Sensortec / Bosch, Picarro / PTR-MS / Ionicon, Alcohawk / AlcoHAWK, Regional OEMs / China-based device makers, Ignition interlock program managers & monitoring platforms, Contract manufacturers & sensor module OEMs |

The breath analyzers market comprises instruments and services that analyze exhaled breath to detect chemical markers, most commonly breath alcohol concentration (BAC) for law enforcement, road safety, and workplace testing, but increasingly including medical/clinical volatile organic compound (VOC) analysis (disease biomarkers), industrial safety monitors, and consumer wellness devices. Devices range from low-cost personal breathalyzers to handheld evidential units, fixed/desktop analyzers (including ignition-interlock systems), and advanced laboratory breath-analysis platforms (GC-MS, sensor arrays). Demand is driven by traffic safety enforcement, DUI/ignition interlock regulations, workplace safety programs, the growth of clinical breath diagnostics (non-invasive disease screening), and consumer interest in at-home alcohol monitoring and wellness trackers.

Increasing Personal Use: Due to growing awareness, there is a rise in the use of breath analyzers. This, in turn, is increasing their adoption by the consumers to avoid the risk of alcohol related accidents. Moreover, their availability on online platforms is increasing their adoption rates.

Growing Research and Development: There is an increase in the research and development of breath analyzers for enhancing applications. This, in turn, is leading to new collaborations among the industries as well as institutes. They are focusing on improving their accuracy and specificity, as well as innovations for the early detection of different diseases.

For instance,

AI plays an important role by analyzing the complete breath data of the breath analyzers. It helps in improving the accuracy, specificity, and sensitivity of the breath analyzers. At the same time, it also helps in the detection of biomarkers in the breath. This helps in the early detection of any diseases. Hence, it can also be used for monitoring diseased conditions. Moreover, the breath analyzers can also be integrated with smartphones with the use of AI. This helps in increasing its accessibility.

Growing Alcohol Abuse

There is a rise in alcohol abuse, which in turn is increasing the alcohol impaired accidents. Therefore, to minimize these accidents, new laws are regulations are being imposed by the government, which is increasing the use of breath analyzers. They are used for roadside testing, as well as to enhance the alcohol-free environment at workplaces. The use of portable breath analyzers and ignition interlock devices is also increasing. They are being used to identify the DUI offenders. Thus, this drives the breath analyzers market growth.

Regulatory Barriers

The breath analyzers must comply with the regulatory standard. If not, then they lead to lengthy clinical trials, increasing their cost. This can delay the launch of the product. Moreover, it can also lead to rejection or recall of the breath analyzers. This discourages their innovations.

Growing Use of Clinical Breath Analyzers

There is a rise in the demand for non-invasive diagnostics. This, in turn, is increasing the use of clinical breath analyzers. This helps in providing the patient with non-invasive and painless diagnostic approaches. Their use in the diagnosis of multiples is increasing. Moreover, they help in detecting the biomarkers present in patients with diseases such, cancer, asthma, infections, etc. This helps in the early detection of diseases. Furthermore, to improve the point-of-care diagnosis, innovations are being made in breath analyzers. Thus, this promotes the breath analyzers market growth.

For instance,

By product type, the portable/handheld breathalyzers segment held the dominating share of 58% in the market in 2024, because of its wide use for alcohol testing. It provides easy use. Moreover, its affordability and fast results enhanced its use. Thus, this contributed to the market growth.

By product type, the ignition interlock systems segment is expected to show the highest growth during the predicted time. They are being used to detect DUI offenders. This helps in improving road safety. Furthermore, their mandated use is growing due to the rising commercial model.

By technology/sensing principle type, the electrochemical fuel-cell sensors segment led the market with approximately a 52% share in 2024, due to their accuracy. They provided minimal error, which enhanced their use. It offered improved selectivity in alcohol detection. Furthermore, alcohol was detected irrespective of their level of consumption.

By technology/sensing principle type, the semiconductor metal-oxide (MOx) sensors segment is expected to show the highest growth during the upcoming years. These sensors help in the detection of alcohol and biomarkers. Additionally, due to their portability, their use is increasing. They are being used as personal devices due to their low cost.

By application/use case type, the law enforcement & road safety segment held the largest share of approximately 41% in the market in 2024, as the breath analyzers were used for roadside screening. This increased their use by the police for DUI testing. They were also used in forensic testing.

By application/use case type, the workplace & industrial safety segment is expected to show the highest growth during the forthcoming years. Due to strict government regulations, most of the industries are adopting breath analyzers to enhance workplace safety. This helps in reducing any alcohol-related accidents. Moreover, the use of portable breath analyzers is also increasing.

By end user, the public safety/law enforcement agencies segment led the global market with approximately 41% share in 2024, where the breath analyzers were used for alcohol testing. Their daily use increased their demand and adoption rates. They were mostly used by the police for highway patrols. They were also used in forensic labs.

By end user, the consumers/individuals segment is expected to show the fastest growth rate during the predicted time. Due to growing safety awareness, the use of breath analyzers is increasing. They are also being used for personal health monitoring. Furthermore, their portability and affordability are increasing their use.

By distribution channel type, the government & institutional procurement segment led the market in 2024, due to the increased use of breath analyzers by the police and military. They were used to improve public health safety. Their innovations were also supported by the funding. This enhanced the market growth.

By distribution channel type, the retail & e-commerce segment is expected to show the fastest growth rate during the upcoming years. The demand for breath analyzers is increasing due to growing health awareness. Their accessibility is increasing due to online sales and smartphone accessory channels. Moreover, their affordability and selectivity are enhancing their use.

North America dominated the breath analyzers market share 38% in 2024. North America consisted of large law enforcement fleets, which increased the demand for breath analyzers to identify DUI offenders. Moreover, the growing government initiatives are contributing to the same. Additionally, the mature ignition-interlock programs contributed to the market growth.

The demand for breath analyzers is increasing in the U.S due to their mandatory use at roadside breath testing. Their development is also supported by the government's investments. They are also being used for workplace testing to avoid any accidents. Furthermore, with the use of advanced technologies, their innovations are being promoted.

The presence of stringent laws and policies in Canada are increasing the use of breath analyzers to minimize drunk driving. Moreover, to increase awareness and promote the use of breath analyzers, public safety programs are also conducted. Their use in the healthcare sector is also increasing for the early detection of various diseases.

Asia Pacific is expected to host the fastest-growing breath analyzers market during the forecast period. Due to increasing vehicle fleet sizes, there is a rise in the use of breath analyzers to avoid the risk of alcohol related accidents. New laws are also being imposed by the government to enhance alcohol testing. At the same time, the expanding healthcare sector is also increasing its innovation and adoption, which is supported by investments for the diagnosis and monitoring of various diseases. Thus, this enhances the market growth.

The R&D of breath analyzers focuses on enhancing their accuracy, portability, sensitivity, and versatility to increase their applications, along with growing advancements in sensor technologies.

Key Players: Intoximeters, Drägerwerk, Inc., BACtrack, Lifeloc Technologies

The clinical trials and regulatory approval of the breath analyzers focus on the detection of risk levels for medical diagnostics.

Key Players: Lifeloc Technologies, Drägerwerk, Inc., Lion Laboratories, Intoximeters

The packaging and serialization of breath analyzers include packaging that protects their integrity, mouthpiece sterile materials, and a unique device identification (UDI) system for their regulatory traceability.

Key Players: DuPont de Nemours Inc., Berry Global, Amcor Plc, Oliver Healthcare Packaging, CCL Healthcare

User instructions, test preparation and interpretation information, and technical support are provided in the patient support and services of the breath analyzer.

Key Players: BACtrack, Lifeloc Technologies, FoodMarble Digestive Health Ltd., Drägerwerk

In April 2025, after announcing the non-exclusive distribution agreement between Cannabix Technologies Inc. and Alco Prevention Canada, the CEO of Cannabix Technologies, Rav Mlait, stated that truly innovative new technologies are being supplied to the marketplace for breath testing by Cannabix. New opportunities for the development of disruptive and innovative technologies are being provided by the growing breath testing for marijuana and alcohol segment, which will be the main focus of Cannabix, aiming to achieve new milestones in 2025.

By Product Type

By Technology/Sensing Principle

By Application/Use Case

By End User

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026