February 2026

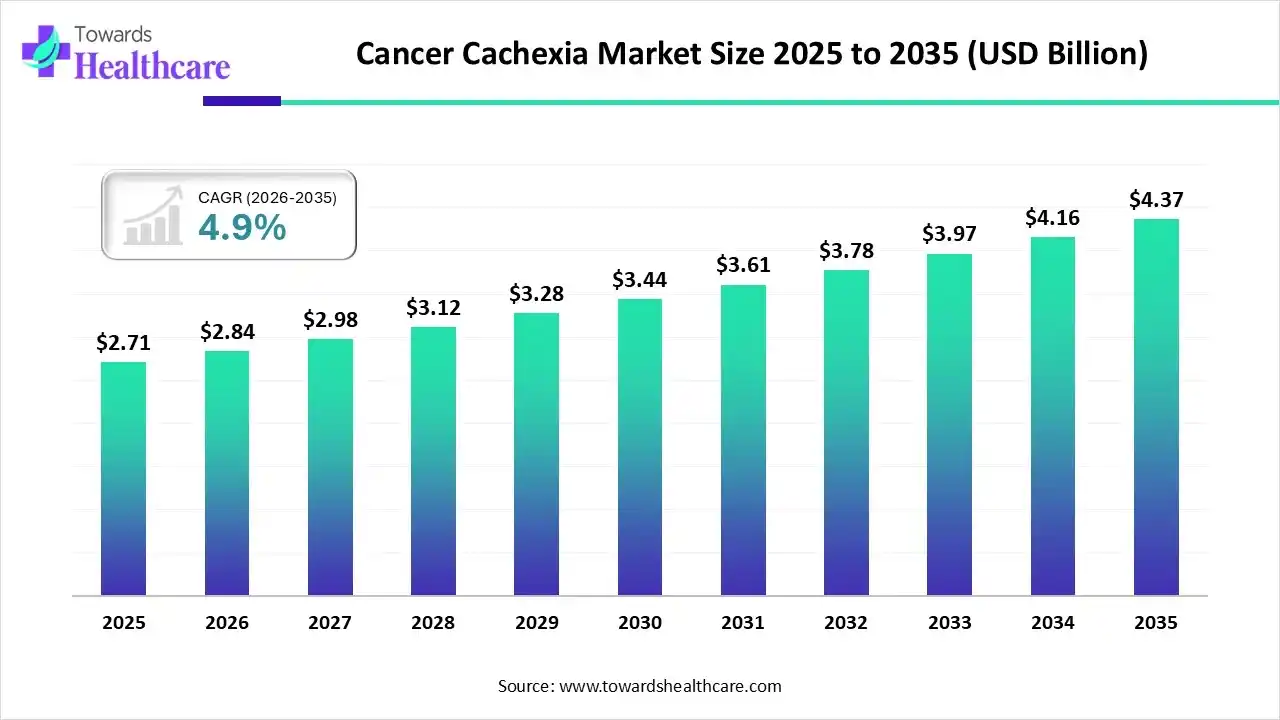

The global cancer cachexia size was estimated at USD 2.71 billion in 2025 and is predicted to increase from USD 2.84 billion in 2026 to approximately USD 4.37 billion by 2035, expanding at a CAGR of 4.9% from 2026 to 2035.

The growing global cancer burden is increasing the cases of cancer cachexia, which is fueling the demand for their effective treatment options. AI is also being used to develop and optimize various treatment options and monitoring devices, where companies are investing and launching various products targeting the disease. Moreover, the presence of advanced healthcare, growing adoption of advanced treatment options, and stringent regulations are promoting the market growth.

| Key Elements | Scope |

| Market Size in 2026 | USD 2.84 Billion |

| Projected Market Size in 2035 | USD 4.37 Billion |

| CAGR (2026 - 2035) | 4.9% |

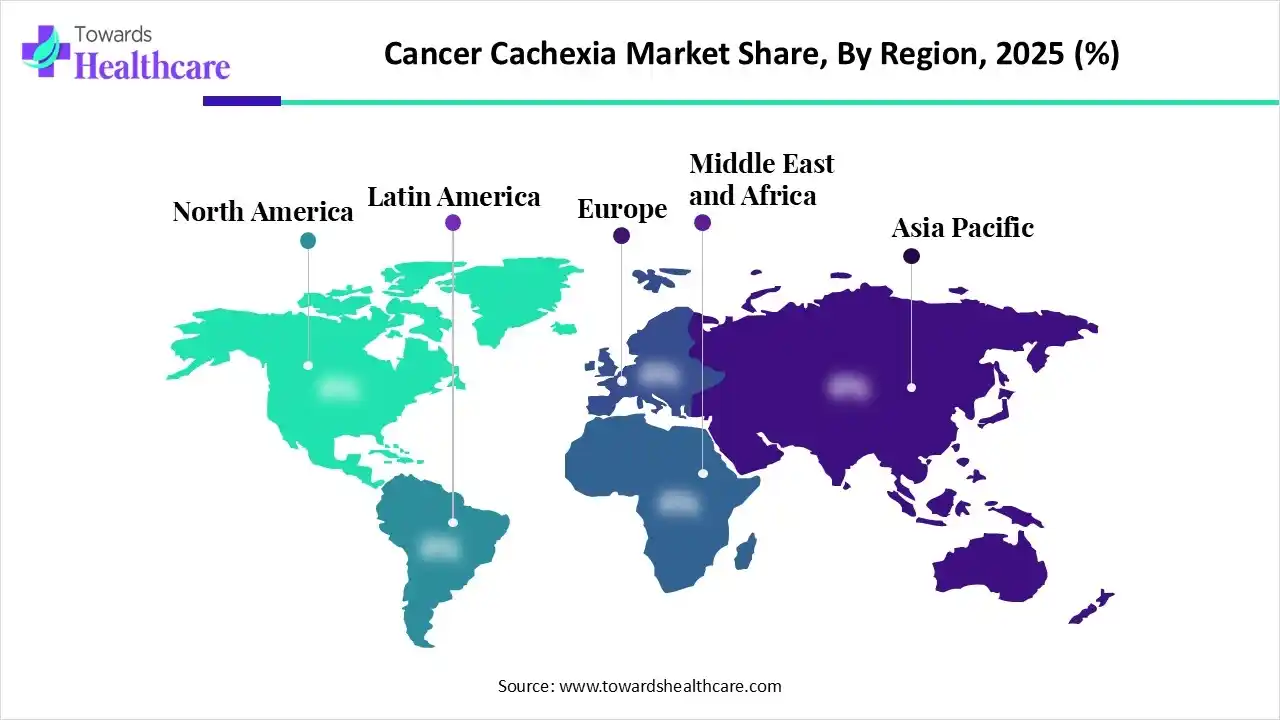

| Leading Region | North America |

| Market Segmentation | By Treatment, By Type, By Distribution Channel, By Region |

| Top Key Players | Helsinn Group, Pfizer, Inc., Ono Pharmaceutical Co., Ltd., Actimed Therapeutics, Aeterna Zentaris Inc., AVEO Oncology, Artelo Biosciences, Tetra Bio-Pharma, NGM Biopharmaceuticals, Endevica Bio |

The cancer cachexia market is driven by increasing cancer burden and unmet clinical need for effective weight and muscle preservation treatments. Cancer cachexia refers to the complex metabolic syndrome leading to weight loss, appetite loss, and muscle wasting, which occurs in various cancer patients. Therefore, treatments such as appetite stimulants, anti-inflammatory agents, anabolic agents, metabolic modulators, and nutritional interventions are provided to the patient with cancer cachexia.

Different types of AI models are being developed to detect patients at high risk of developing cachexia. It also detects biomarkers and predicts patient response to the treatment, identifying early metabolic changes and promoting the development of personalized therapies. It is used in drug discovery and development, where their continuous disease monitoring also helps in tracking the cachexia progression, which is increasing their use in the development of various devices.

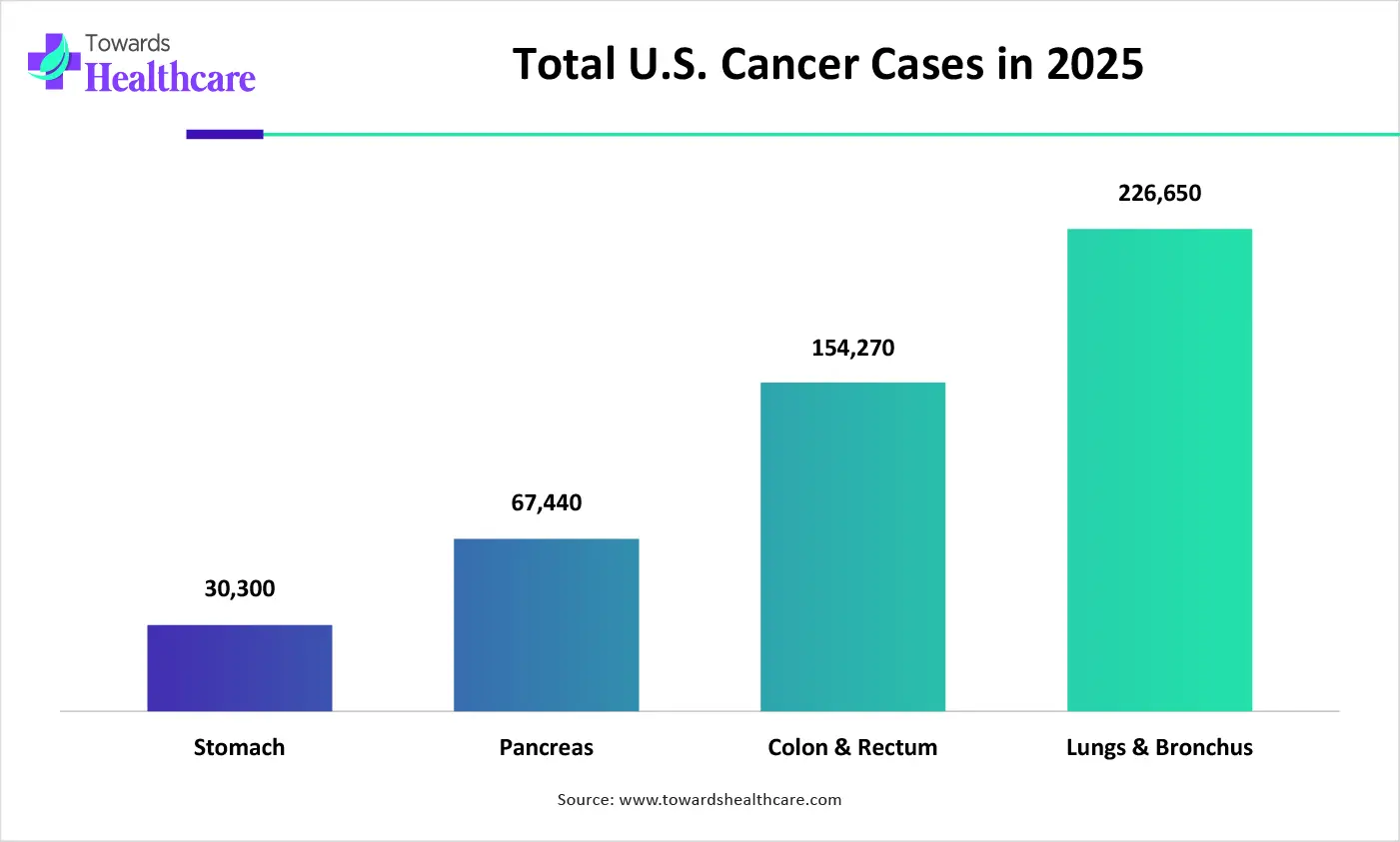

The incidence of various cancer types like gastrointestinal, lung, and pancreatic cancer is increasing the number of cachexia cases, which is driving the demand for effective treatment options.

The companies are focusing on developing personalized medications depending on the patient's genetic and metabolic profile.

Different types of wearable devices and software are being developed to monitor the muscle mass and weight of cancer cachexia patients, which is increasing their adoption rates.

| Cancer Types | New cases |

| Stomach | 30,300 |

| Pancreas | 67,440 |

| Colon & Rectum | 154,270 |

| Lungs & Bronchus | 226,650 |

Why Did the Appetite Stimulants Segment Dominate in the Cancer Cachexia Market in 2025?

The appetite stimulants segment held the largest share in the market in 2025, as they helped in addressing weight loss by increasing appetite and calorie intake. They also offered a rapid onset of action, which increased their adoption rates. Additionally, their wide availability also increased their use and acceptance rates.

Cannabinoid Receptor Agonists

The cannabinoid receptor agonists segment is expected to show the fastest growth rate during the predicted time, due to their appetite stimulation action by targeting CB1 or CB2 receptors. At the same time, the growing preference for natural therapies and protective relief from pain and nausea is also increasing their use.

Which Type Segment Held the Dominating Share of the Cancer Cachexia Market in 2025?

The lung cancer segment held the dominating share of the market in 2025, due to growth in its incidence rates. This increased the number of patients with cancer cachexia, which enhanced the use of various treatment options. This, in turn, increased their innovations to reduce muscle wasting and weight loss.

Pancreatic Cancer

The pancreatic cancer segment is expected to show the highest growth during the forthcoming years, as it can lead to maximum cancer cachexia cases. Moreover, their rapid progression is also increasing their severity. Similarly, the lack of treatment options is increasing the use of various treatment options and enhancing innovations.

What Made Hospital Pharmacies the Dominant Segment in the Cancer Cachexia Market in 2025?

The hospital pharmacies segment led the market in 2025, due to growth in the patient volume. They also provided supportive care along with other treatment options. At the same time, they also offered supervision, which helped to monitor the severe cases, which enhanced the patient trust, and increased patient outcomes and dependence on them.

Online Pharmacies

The online pharmacies segment is expected to show the fastest growth rate during the upcoming years, as they offer a wide range of treatment options and enhance accessibility across remote areas. They are also providing home deliveries, which is enhancing the patient's convenience and comfort. Similarly, discounts are also attracting them.

North America dominated the cancer cachexia market in 2025, due to the growth in the incidence of cancer cases. The presence of advanced healthcare infrastructure also increased the use of various treatment options, where the early adoption of advanced solutions also enhanced their acceptance rates. The industries are also contributing to their R&D, where the growing healthcare investments have also increased their use, which has contributed to the market growth.

The presence of the advanced healthcare sector is increasing the use of various treatments in the U.S. to tackle the growing cancer cachexia. This, in turn, is driving the innovation where the R&D investments are supporting them. Additionally, increasing awareness is also increasing their early diagnosis and demand for effective treatment.

| Stomach Cancer Deaths in 2025 | 10,780 |

| Stomach Cancer New Cases in 2025 | 30,300 |

Asia Pacific is expected to host the fastest-growing cancer cachexia market during the forecast period, due to expanding healthcare infrastructure. This is increasing the number of oncology centers, which is increasing the use of various advanced therapies and appetite stimulants, while rapid urbanization is also increasing their incidence rates. The growing government initiatives are also increasing their acceptance rates, enhancing the market growth.

The growing pancreatic and gastrointestinal cancer cases in India are increasing the demand for effective treatment options to reduce the risk of cancer cachexia. India is also experiencing a rise in the oncology centres, which are increasing the adoption of various cancer cachexia treatment options, which are supported by funding.

Europe is expected to grow significantly in the cancer cachexia market during the forecast period, due to the presence of an advanced healthcare sector, which is increasing the use of appetite stimulants and other supportive treatment options. The increasing cancer incidences are also driving their R&D and clinical trials where the growing government health awareness programs are also increasing their early diagnosis, promoting the market growth.

The UK is increasingly adopting various supportive treatment options to overcome cancer cachexia. The presence of an advanced healthcare system and growing cancer cases are also increasing their use. Moreover, the growing focus on enhancing the quality of life is also promoting their innovations.

| Companies | Headquarters | Cancer Cachexia Treatment Products |

| Helsinn Group | Lugano, Switzerland | Anamorelin and Adlumiz |

| Pfizer, Inc. | New York, U.S. | Ponsegromab |

| Ono Pharmaceutical Co., Ltd. | Osaka, Japan | Anamorelin |

| Actimed Therapeutics | Berkshire, UK | S-pindolol benzoate |

| Aeterna Zentaris Inc. | Quebec City, Canada | AEZS-130 |

| AVEO Oncology | Massachusetts, U.S. | Rilogrotug |

| Artelo Biosciences | California, U.S. | ART27.13 |

| Tetra Bio-Pharma | Ontario, Canada | Caumz |

| NGM Biopharmaceuticals | Francisco, U.S. | NGM120 |

| Endevica Bio | Michigan, U.S. | TCMCB07 |

By Treatment

By Type

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026