January 2026

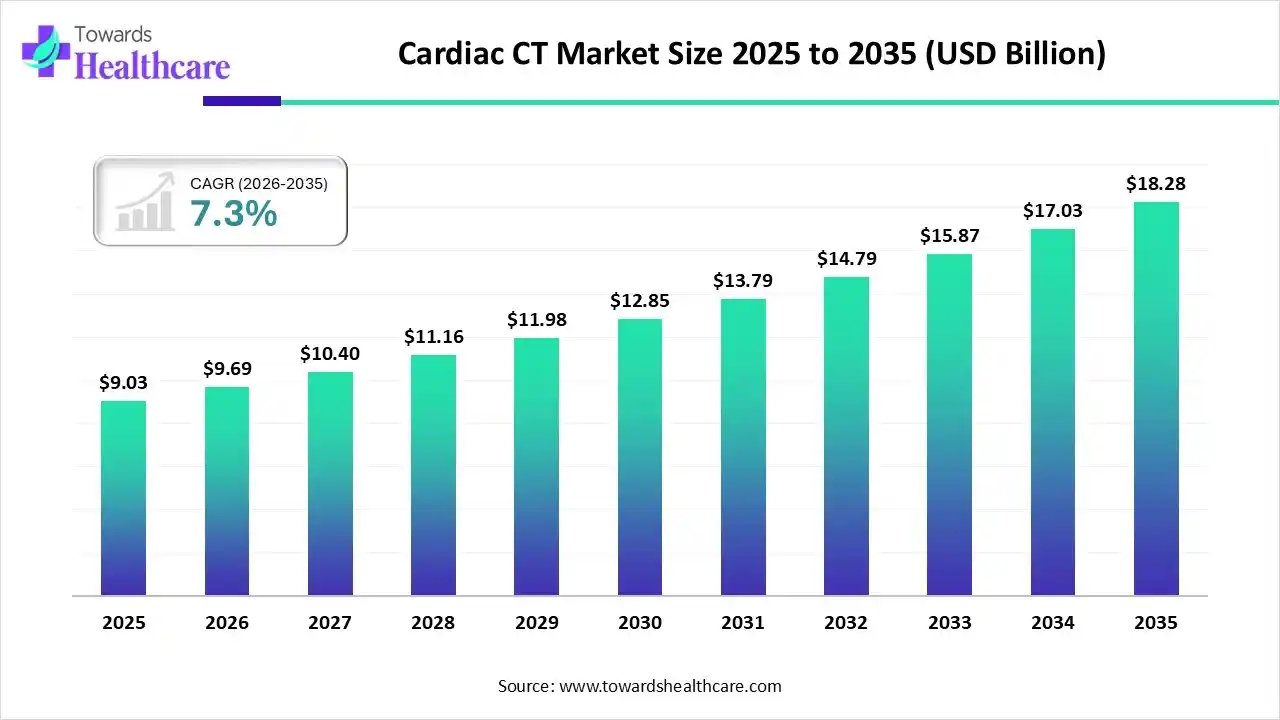

The global cardiac CT market size was estimated at USD 9.03 billion in 2025 and is predicted to increase from USD 9.69 billion in 2026 to approximately USD 18.28 billion by 2035, expanding at a CAGR of 7.3% from 2026 to 2035.

The market is expanding robustly, driven by rising cardiovascular disease prevalence, technological advances like AI, high-resolution scanners, and growing demand for non-invasive diagnostics, with strong growth expected across the region.

Cardiac CT is a non-invasive imaging technique that uses computed tomography to produce detailed images of the heart and coronary arteries, helping diagnose cardiovascular conditions accurately and quickly. The market is growing due to the rising prevalence of cardiovascular diseases, increasing demand for early and accurate diagnosis, and growing preference for non-invasive imaging procedures. Technological advancements such as high-resolution scanners, faster imaging, and AI-based analysis improve diagnostic accuracy and workflow efficiency.

AI can revolutionize the cardiac CT market by enhancing image reconstruction, reducing scan time, and minimizing radiation exposure while improving diagnostic accuracy. Advanced algorithms enable automated detection of coronary artery disease, plaque characterization, and functional analysis. AI-driven workflow optimization streamlines image interpretation, reduces reporting time, and supports clinical decision-making, increasing efficiency for healthcare providers and expanding the adoption of cardiac CT in routine cardiovascular care.

| Key Elements | Scope |

| Market Size in 2026 | USD 9.69 Billion |

| Projected Market Size in 2035 | USD 18.28 Billion |

| CAGR (2026 - 2035) | 7.3% |

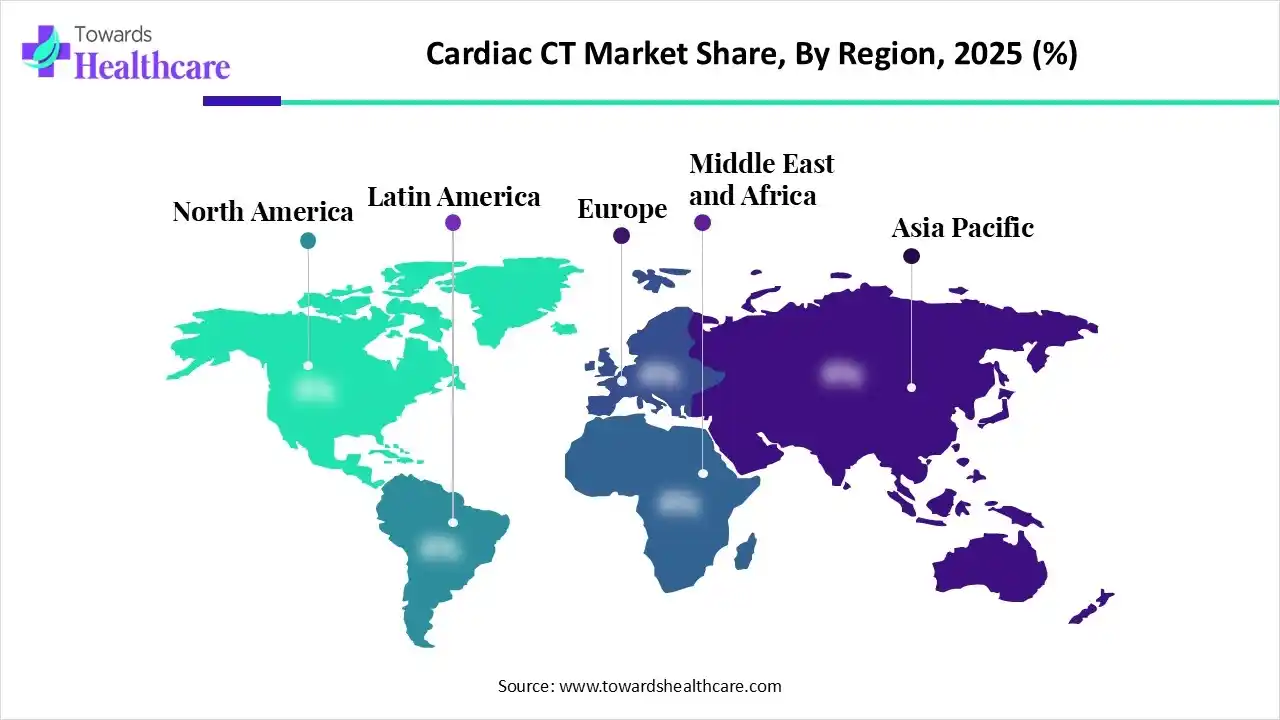

| Leading Region | North America |

| Market Segmentation | By Offering, By Product Type, By Application, By End User, By Distribution Channel, By Region |

| Top Key Players | Siemens Healthineers AG, GE HealthCare, Canon Medical Systems Corporation, Koninklijke Philips N.V. , Shimadzu Corporation, Samsung Medison Co., Ltd. |

Why Did the System Segment Dominate in the Market in 2025?

The system segment dominated the cardiac CT market in 2025 due to high demand for advanced CT scanners with superior image quality, faster acquisition, and lower radiation doses. Hospitals and diagnostic centers prioritized system upgrades to support rising cardiac case volume, AI-enabled imaging, and non-invasive diagnostics. Additionally, high capital investments, expanding cardiac care infrastructure, and increased adoption of multi-slice and high-end CT systems significantly contributed to the segment’s market leadership.

Software

The software segment is expected to grow at the fastest CAGR during the forecast period due to increasing adoption of AI-powered image analysis, automated reporting, and advanced visualization tools in cardiac CT. Growing demand for faster diagnosis, improved accuracy, and workflow efficiency is driving software upgrades. Additionally, the rising use of cloud-based platforms, subscription models, and integration with hospital IT systems is accelerating software adoption across healthcare facilities.

How the Single Source CT Segment Dominated the Cardiac CT Market in 2025?

The single-source CT segment dominated the market in 2025 due to its wide availability, cost-effectiveness, and suitability for routine cardiac imaging. These systems provide high temporal resolution, reliable image quality, and lower operational complexity, making them ideal for hospitals and diagnostic centers. Their compatibility with AI software. lower maintenance costs, and strong adoption in mid-volume settings further supported widespread use and market leadership.

Dual Source Cardiac CT

The dual source cardiac CT segment is expected to grow at the fastest CAGR during the forecast period due to its superior temporal resolution, enabling accurate imaging in patients with high or irregular heart rates. These systems reduce motion artifacts, improve diagnostic confidence, and often eliminate the need for heart-rate control medications. Growing adoption in advanced cardiac centers, rising complex cardiac cases, and increasing preference for high-precision, non-invasive diagnostics are key growth drivers.

Why Coronary CT Angiography Segment Dominated the Cardiac CT Market?

The coronary CT angiography segment dominated the market due to its high accuracy in detecting coronary artery disease and assessing plaque buildup non-invasively. It is widely used for early diagnosis, risk stratification, and emergency evaluation of chest pain. Faster scan times, improved resolution, and growing clinical acceptance as a first-line diagnostic tool further strengthened its dominance across hospitals and diagnostic imaging centers.

Calcium Scoring

The calcium scoring segment is expected to grow at the fastest CAGR due to rising emphasis on early risk assessment and preventive cardiology. Calcium scoring offers a quick, low-dose, and cost-effective method to detect coronary artery calcification in asymptomatic patients. Growing awareness of cardiovascular risk and expanding adoption by outpatient diagnostic centers are key factors driving rapid market growth.

Why Hospitals Segment Dominated the Cardiac CT Market?

The hospitals segment led the market due to their large patient volumes, advanced infrastructure, and capabilities to invest in high-end CT systems. Hospitals require cardiac CT for emergency care, routine diagnostics, and pre-surgical evaluations. The availability of specialized radiologists, integration with hospital IT systems, and increasing demand for non-invasive cardiac imaging in both inpatient and outpatient settings further strengthened the segment’s market leadership in 2025.

Diagnostic & Imaging Centers

The diagnostic & imaging centers segment is expected to grow at the fastest CAGR during the forecast period due to increasing outpatient cardiac imaging demand and preference for quick, cost-effective, non-invasive diagnostics. These centers are rapidly adopting advanced cardiac CT systems with AI-enabled software for faster, accurate results. Expanding healthcare access, rising awareness of early cardiac disease detection, and partnership with hospitals further drive their accelerated market growth.

What Made Direct Tender the Dominant Segment in the Cardiac CT Market in 2025?

The direct tender segment held the largest market share in 2025 because hospitals and large healthcare providers preferred purchasing CT systems directly from manufacturers to ensure customized solutions, better pricing, and after-sales support. Direct tender allows bulk procurement, faster delivery, and integration with existing hospital infrastructure. Strong manufacturer hospital relationships and the need for service contracts and warranties further reinforced direct tender as the leading distribution channel.

Third Party Distributor

The third-party distributor segment is expected to grow at a notable rate during the forecast period due to increasing demand from small and mid-sized hospitals, diagnostic centers, and emerging markets that lack direct manufacturer access. Distributors offer flexible financing, local support, and quicker delivery of cardiac CT systems. Their ability to provide multi-brand options, maintenance services, and training solutions drives adoption and accelerates market growth in underserved regions.

North America dominated the market in 2025 due to high healthcare spending, advanced medical infrastructure, and widespread adoption of cutting-edge imaging technologies. The region benefits from a large patient pool with cardiovascular diseases, a strong presence of major CT systems manufacturers, and rapid integration of AI-enabled diagnostics, supporting reinforced workflow and accurate imaging, which collectively reinforce market leadership in both hospitals and diagnostic centers.

U.S. Market Trends

The U.S. led the market by capturing the largest revenue share due to advanced healthcare infrastructure, high adoption of cutting-edge CT systems, and substantial investment in AI-enabled imaging technologies. A large population with cardiovascular diseases, strong reimbursement policies, and widespread availability of specialized cardiac care centers further boosted systems demand, making the U.S. the dominant revenue contributor in the global market.

Asia Pacific is anticipated to grow at the fastest CAGR in the market during the forecast period due to the increasing prevalence of cardiovascular diseases, rising healthcare expenditure, and expanding hospital infrastructure. Growing awareness of non-invasive diagnostics, rapid adoption of advanced CT technologies, and government initiatives to improve cardiac care accessibility in emerging economies like China and India are driving demand, making the region a key growth hotspot in the global market.

India Market Trends

India is anticipated to grow at a rapid CAGR in the market during the forecast period due to rising cardiovascular disease prevalence, increasing awareness of early diagnosis, and expanding healthcare infrastructure. Adoption of advanced CT systems, government initiatives to improve cardiac care, and growing investments in private hospitals and diagnostic centers are driving demand.

Europe is anticipated to grow at a notable CAGR in the market during the forecast period due to the increasing prevalence of cardiovascular diseases, the rising geriatric population, and strong healthcare infrastructure. Growing adoption of advanced CT technologies, integration of AI-enabled imaging software, and supportive government initiatives for early diagnosis and preventive cardiology are driving market demand.

Cardiac CT Market in the UK Set for Rapid Expansion

The UK is anticipated to grow at a rapid CAGR in the market during the forecast period due to increasing cardiovascular disease prevalence, rising demand for early and non-invasive diagnostics, and widespread adoption of advanced CT technologies. Supportive government healthcare initiatives, growing investment in private hospitals and diagnostics centers, and integration of AI-enabled imaging software to improve diagnostic accuracy and workflow efficiency are key factors driving market growth in the country.

| Companies | Headquarters | Offerings |

| Siemens Healthineers AG | Erlangen, Germany | Offers advanced cardiac CT systems such as the SOMATOM series and NAEOTOM Alpha with dual-source and photon-counting technologies, plus specialized cardiac CT software to improve coronary imaging and functional assessment. |

| GE HealthCare | Illinois, USA | Provides high-performance CT scanners like the Revolution and Optima series optimized for cardiac imaging with deep-learning reconstruction and AI-enhanced cardiac workflows that improve image quality and reduce dose. |

| Canon Medical Systems Corporation | Tochigi, Japan | Offers Aquilion series CT systems known for high-resolution imaging, low radiation dose, and cardiac-focused applications. |

| Koninklijke Philips N.V. | Netherlands | Provides cardiac CT solutions, including advanced CT scanners (e.g., CT 5300, Spectral CT) and post-processing software designed to enhance cardiovascular imaging accuracy and workflow efficiency. |

| Shimadzu Corporation | Kyoto, Japan | While primarily known for X-ray and other imaging systems, Shimadzu participates in CT imaging markets that support diagnostic workflows; cardiac CT use may involve integrated imaging solutions within broader diagnostic suites |

| Samsung Medison Co., Ltd. | South Korea | Known mainly for diagnostic ultrasound, Samsung also collaborates on mobile and point-of-care CT solutions (e.g., mobile CT scanners through partnerships like NeuroLogica) that can support cardiac imaging in diverse settings. |

By Offering

By Product Type

By Application

By End User

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026