March 2026

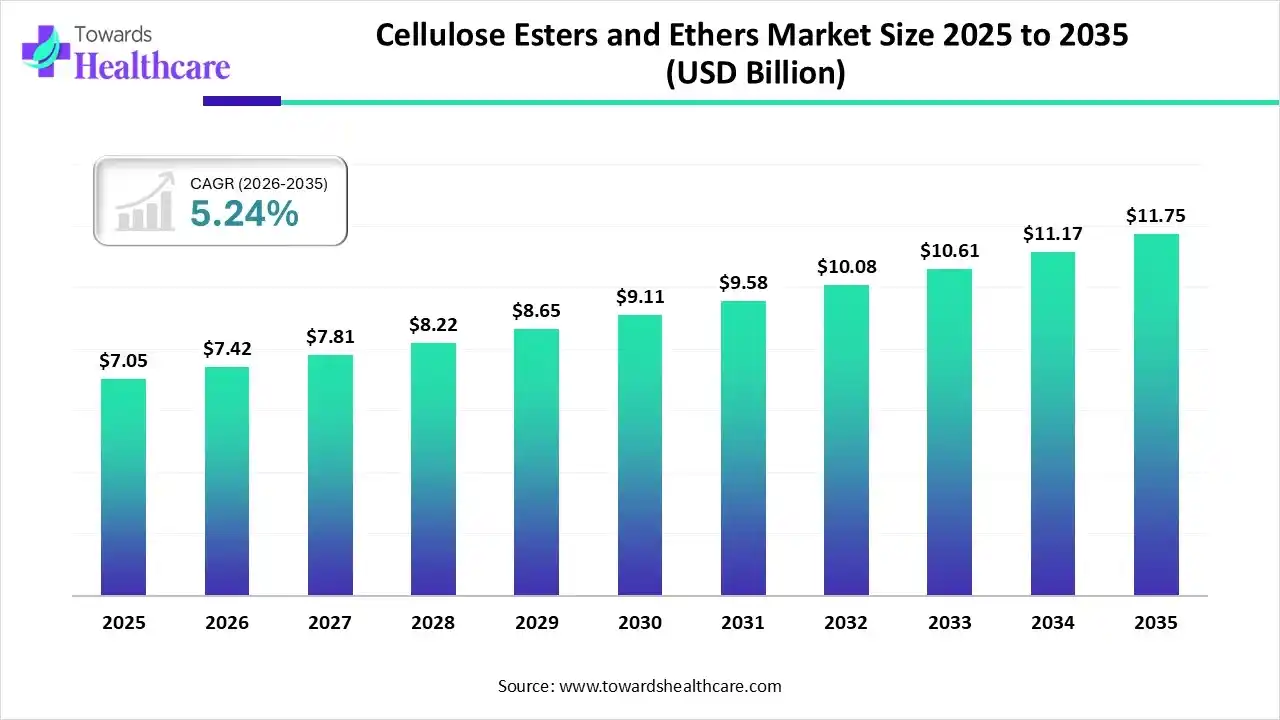

The global cellulose esters and ethers market size was estimated at USD 7.05 billion in 2025 and is predicted to increase from USD 7.42 billion in 2026 to approximately USD 11.75 billion by 2035, expanding at a CAGR of 5.24% from 2026 to 2035.

Day by day, the globe is highly demanding biodegradable solutions, such as diverse cellulose derivatives, which are used in the development of various pharmaceuticals and personal care products. Whereas, in the pharma industries, cellulose derivatives are broadly incorporated into controlled-release products and innovative drug delivery solutions. However, AI is increasingly transforming nanotechnology & 3D printing applications.

| Key Elements | Scope |

| Market Size in 2026 | USD 7.42 Billion |

| Projected Market Size in 2035 | USD 11.75 Billion |

| CAGR (2026 - 2035) | 5.24% |

| Leading Region | North America |

| Market Segmentation | By Type of Cellulose Derivative, By Application, By Region |

| Top Key Players | Eastman Chemical Company, Celanese Corporation, Dow Inc., Ashland Inc., Nouryon, Rayonier Advanced Materials, Shin-Etsu Chemical Co., Ltd, Borregaard, Daicel, J.M. Huber (CP Kelco) |

The global cellulose esters and ethers market involves chemically modified cellulose polymers, further developing them to be either water-soluble or insoluble, for use in various industries, including pharmaceuticals, construction, food, and personal care. However, the worldwide market is driven by a rise in efforts into eco-friendly, bio-based materials, with extensive demand in food & beverages, personal care, and pharmaceuticals. Alongside this, the leading firms are bolstering novelty in synthesis approaches, including one-pot protection/acylation transformations, as well as the progression of nanocellulose-based smart coatings.

Primarily, AI is widely assisting in evolving sustainable and controllable synthesis plans, especially the adoption of specific ionic liquids for cellulose processing, for enhancing effectiveness and lowering environmental effects. Moreover, advanced ML models have been created and validated to anticipate and improve the yield and crystallinity of cellulose nanocrystals (CNCs). The widespread applications of highly advanced gen AI methods in successfully developed & validated formulations for 3D printing purposes, like for a long-acting HIV inhibitor implant.

Nowadays, a significant trend is the increasing preference for natural, biodegradable options to synthetics, which accelerates demand for cellulose derivatives, mainly in plant-based capsules (HPMC).

Researchers are working on the implementation of combined cellulose esters and ethers with other bioplastics to design innovative materials with synergistic properties, specifically raised moisture barriers or optimized mechanical strength, for specialized packaging and tablet coatings.

More specific step shifting towards the creation of cellulose-based materials to adhere to biological tissues, with enhanced drug residence time and absorption, mainly for topical or mucosal applications.

| Investment | Description |

| Eastman Chemical Company (August 2025) | partnered with Huafon Chemical to develop a joint facility to produce cellulose acetate yarn for localized production and product novelty in Eastman Naia cellulose acetate filament yarns in China. |

| Technology Development Board (TDB), Department of Science and Technology (DST) (June 2025) | Extended their financial support to M/s Nitika Pharmaceutical Specialties Private Limited, Nagpur, for their project titled “Manufacture of Complex Excipients”, such as cellulose derivatives, using a Quality by Design (QbD) approach. |

| Univar (May 2025) | Collaborated with Shandong Group for the supply of cellulose ether and pharmaceutical excipient |

Which Product Led the Cellulose Esters and Ethers Market in 2025?

In 2025, the cellulose acetate segment captured the dominating share of the market. Except for other industries, in pharma, this can be hugely used as a binder, thickener, stabilizer, and film-former to enhance drug delivery and product quality. The current era is promoting the wider adoption of CA to form semi-permeable coatings on tablets and microparticles, prominently in osmotic pump-type tablets, which enable a steady and predictable release of medication over time. Recently, Eastman Chemical Company unveiled various cellulose acetate products, particularly for sustainable pharmaceutical and other packaging applications.

Carboxymethyl Cellulose

In the future, the carboxymethyl cellulose segment is anticipated to expand rapidly. It acts as a binder, thickener, and disintegrant in tablets, with use in eye drops, which drives demand from increasing healthcare needs, chronic diseases, and R&D. Furthermore, it has a transformative role in 3D bioprinting applications for tissue engineering scaffolds and drug carriers to encourage tissue regeneration. By using CMC, pharma researchers are exploring its impacts in stabilizing water-in-oil-in-water (W/O/W) multiple emulsions, which have extensive potential in oral delivery and formulation integrity in the intestinal tract.

How did the Pharmaceuticals Segment hold a Lucrative Share of the Market in 2025?

In 2025, the pharmaceuticals segment registered significant growth in the cellulose esters and ethers market. The adoption is empowered by their role as biocompatible excipients in controlled-release drugs, tablets, capsules, and wound healing. The greater use of cellulose acetate in separating membranes, films, and also in microspheres for drug delivery due to its toughness and transparency is propelling the overall segmental expansion. Robust research has shown cellulose-based nanoparticles for targeted tumor chemotherapy applications, with boosted drug selectivity and reduced systemic toxicity.

Cosmetics and Personal Care

The cosmetics and personal care segment is predicted to register rapid expansion. Cellulose esters and ethers are increasingly used as rigorous thickening, stabilizing, moisturizing, and film-forming properties in lotions, shampoos, and makeup. Whereas, spheroidal cellulose powders with specific particle sizes, like 2 to 7 µm, are being utilized in facial creams and lotions to bolster application properties, stability, and texture, and potentially minimize the appearance of skin imperfections. The recent developments include plant-derived Cellulobeads, which are used as exfoliants or texturizers in products.

In 2025, North America captured the largest share of the cellulose esters and ethers market, due to an extensive demand from pharmaceuticals and personal care. Alongside, the region is promoting novelty in microcrystalline cellulose (MCC) products with particular particle sizes, like 20 to 50 microns, for enhancing disintegration times in solid dosage forms. Besides this, many North American producers included nearly 100,000 tons of capacity for pharmaceutical and food-grade derivatives between 2023 and 2025.

U.S. Market Trends

However, the U.S. was a major contributor in this market in 2025, as certain players have integrated cellulose ethers with hydrocolloid dressings and transdermal patches for chronic wound management, which uses their moisture-retention and gel-forming properties.

For instance,

Asia Pacific will expand fastest in the cellulose esters and ethers market, as several governments, like India and China, are fostering bio-materials-related policies. Also, the region is experiencing a huge demand for biodegradable/eco-friendly products and a widened R&D sector. Moreover, the worldwide producers are highly shifting their manufacturing facilities to APAC, as this region offers minimal production costs and excellent service to domestic developing markets.

India Market Trends

However, Indian researchers are increasingly leveraging the integration of cellulose ethers with sensors and tracking tools to track real-time drug release and patient compliance, mainly for chronic illnesses.

For instance,

Europe is predicted to expand notably in the cellulose esters and ethers market, due to the expanding EU Green Deal and increased environmental regulations. This is mainly propelled by a rise in demand for cellulose derivatives produced through sustainable processes and from renewable sources. Additionally, EU regulations, like REACH certification requirements, are bolstering the purity and safety of pharmaceutical excipients.

Germany Market Trends

Germany will grow significantly, with the recent expansion of robust facilities, such as Shin-Etsu Chemical, completed a storage capacity for pharmaceutical cellulose in Germany. Also, they are emerging with a new production facility for L-HPC (Low-substituted Hydroxypropyl Cellulose), which is estimated to be completed by the second half of 2026.

| Company | Description |

| Eastman Chemical Company | They facilitate a vast portfolio of cellulose esters for coatings, inks, pharma, electronics, and eyewear. |

| Celanese Corporation | It explores cellulose acetate in the realm of cellulose esters and a specific drug delivery platform, VitalDose EVA, an ethylene vinyl acetate copolymer. |

| Dow Inc. | A firm specializes in cellulose ethers for pharmaceutical purposes, a product line historically branded as METHOCEL. |

| Ashland Inc. | This is a significant supplier of cellulose ethers for the pharmaceutical industry, specifically as excipients in oral solid dosage and injectable formulations. |

| Nouryon | It prominently emphasizes high-purity Carboxymethyl Cellulose (CMC) and ideal non-ionic cellulose ethers, including EHEC and MEHEC. |

| Rayonier Advanced Materials | This mainly offers high-purity cellulose (HPC), which acts as a crucial precursor for the manufacturing of different pharmaceutical cellulose esters and ethers |

| Shin-Etsu Chemical Co., Ltd | A company usually facilitates a comprehensive diversity of cellulose ethers and esters for pharmaceutical uses, such as METOLOSE, PHARMACOAT, L-HPC, HPMCP, and Shin-Etsu AQOAT. |

| Borregaard | It provides speciality cellulose as a raw material for other manufacturers to produce diverse cellulose derivatives. |

| Daicel | This offers different cellulose-based derivatives for the pharmaceutical and healthcare areas. |

| J.M. Huber (CP Kelco) | It usually provides cellulose gum (Sodium Carboxymethylcellulose) for pharmaceutical purposes under the CEKOL brand name. |

By Type of Cellulose Derivative

By Application

By Region

March 2026

March 2026

March 2026

March 2026