January 2026

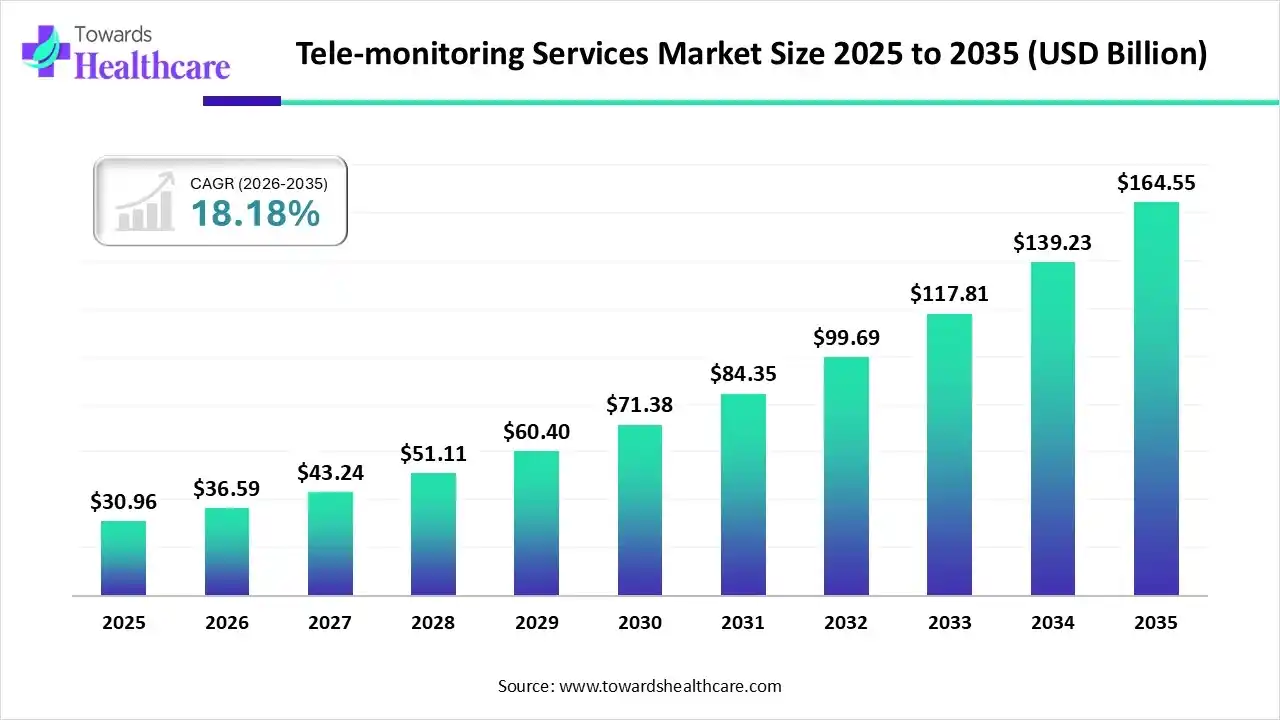

The global tele-monitoring services market size was estimated at USD 30.96 billion in 2025 and is predicted to increase from USD 36.59 billion in 2026 to approximately USD 164.55 billion by 2035, expanding at a CAGR of 18.18% from 2026 to 2035.

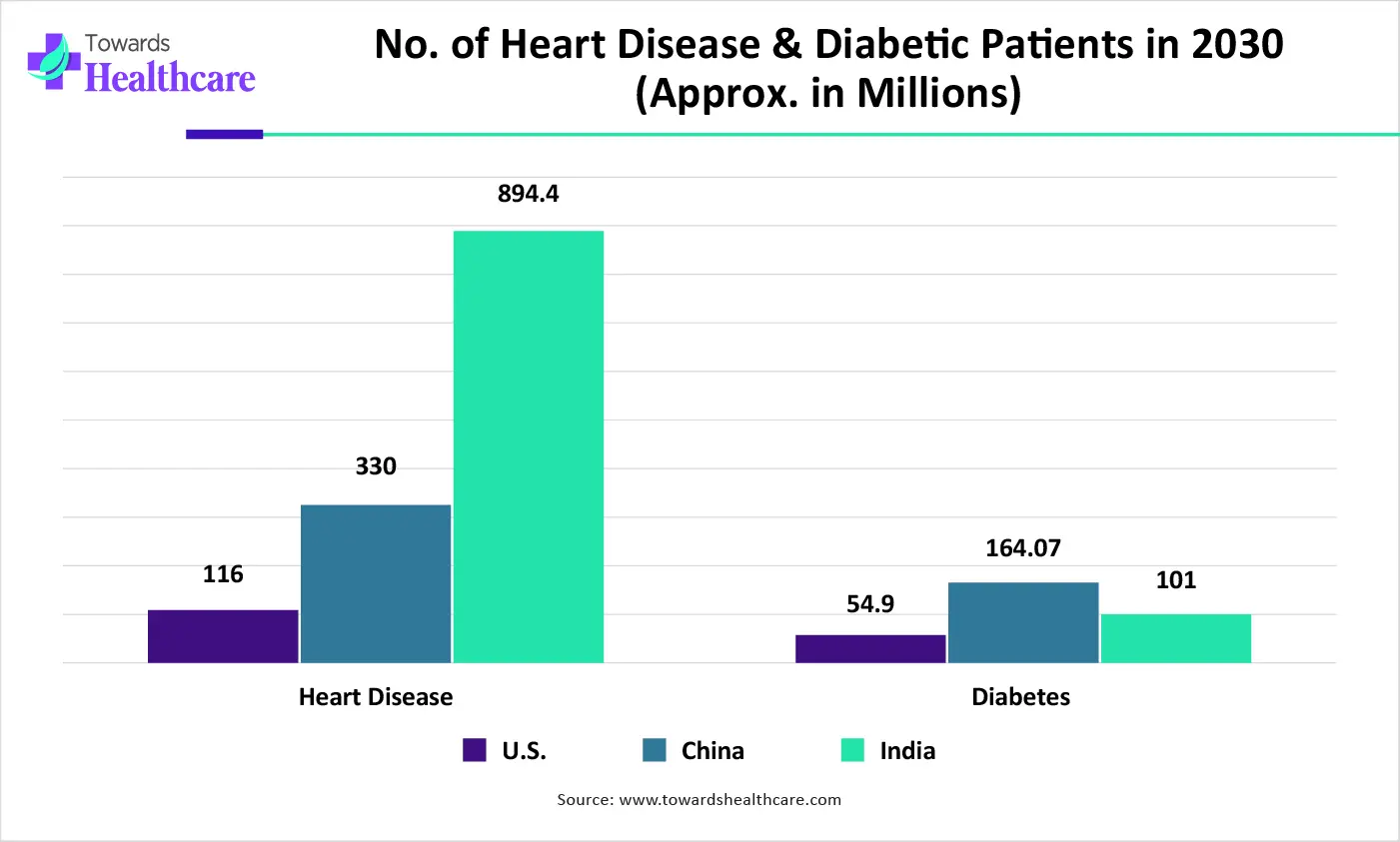

Day by day, the worldwide rising chronic disease prevalence, especially cardiovascular and diabetes, mainly in the geriatric population, is fostering the development of more convenient and remote patient monitoring platforms. By using AI integrations, many companies are exploring diverse wearables, medical drones, and other solutions to overcome different barriers in the underserved and rural areas.

| Key Elements | Scope |

| Market Size in 2026 | USD 36.59 Billion |

| Projected Market Size in 2035 | USD 164.55 Billion |

| CAGR (2026 - 2035) | 18.18% |

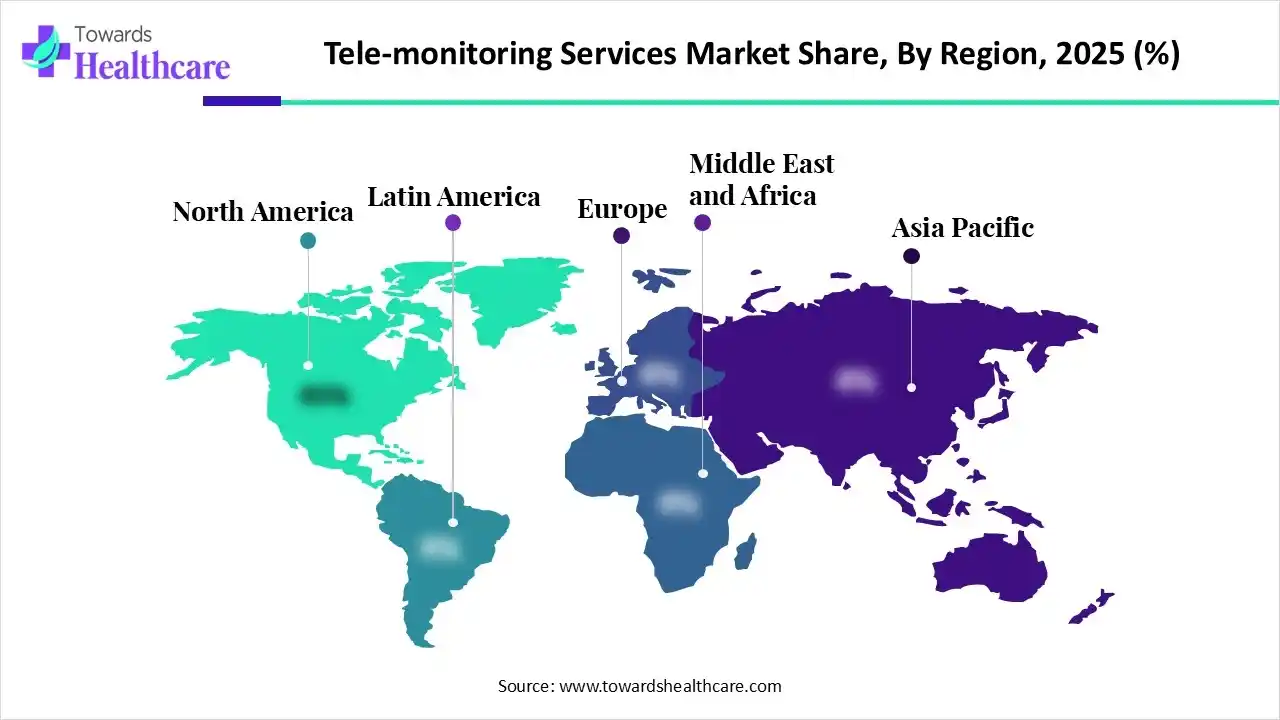

| Leading Region | North America |

| Market Segmentation | By Service, By Payment Model, By Device, By Facility, By End-use |

| Top Key Players | vTitan, Philips, Graphnet Health & Luscii,Vitalacy, Inc., OMRON Healthcare, Inc., Philips Healthcare, Teladoc Health, Inc., Koninklijke Philips N.V., Twilio Inc., Medtronic, GE Healthcare, TeleMedCare |

A healthcare service that employs technology to monitor a patient's health remotely and enables them to receive care at home is considered a tele-monitoring service. The current expansion of the tele-monitoring services market is fueled by a rise in incidences of chronic diseases, an expanding geriatric population, and the post-pandemic increase in the adoption of telehealth. Day by day, the global leaders are leveraging substantial developments in developing smarter wearables, as well as AI-driven solutions for predictive analytics and automated documentation, and the progression of "hospital-at-home" models.

In 2025, AI is assisting in surpassing major developments in the tele-monitoring services, such as compact integration of wearables with telemedicine platforms for automatic alerts, coupled with AI-enabled virtual assistants for lowering administrative load. Alongside, many notable efforts are fostering customized care strategies for chronic conditions, such as diabetes, as demonstrated in Appinventiv’s DiabeticU.

The globe and tech firms are broadly using artificial intelligence for the analysis of vast datasets from remote monitoring, also supporting earlier detection of diseases, including sepsis, with improvements in diagnostic accuracy.

Nowadays, remote patient monitoring is acting as a vital part of proactive, home-based care, with services to progress more nuanced, condition-specific modules.

For improving mental health and behavioral health, companies are offering remote monitoring to facilitate discreet and accessible care, lower stigma, and enable early intervention.

During the prospective period, various firms will focus on the security and quality of patient data that is created during the diagnosis and treatment.

The market is pushing patient-oriented models at the center of their care, with the implementation of diverse telemedicine, wearables, and other digital tools.

Different players are launching 5G networks to offer rapid speeds and minimal latency, making high-definition video consultations the norm with ensured feasibility, real-time data transmission, mainly in rural and underserved areas.

| Company | Key Offerings in the Tele-monitoring Services Market |

| OMRON Healthcare, Inc. | A vital leader, OMRON provides telemonitoring services through its VitalSight platform, emphasizing remote blood pressure monitoring and hypertension management. |

| Philips Healthcare | This significant company offers the Patient Information Center (PIC iX) for a unified view of patient data and provides mobile apps for clinicians. |

| Teladoc Health, Inc. | Teladoc developed a Solo virtual care platform that supports remote patient monitoring for hospitals and health systems. |

| AMD Global Telemedicine | AMD specializes in combining its AGNES Connect platform with integrated medical devices like stethoscopes, spirometers, and vital signs monitors. |

| Koninklijke Philips N.V. | A prominent entity, it offers connected devices, data platforms, and clinical services to facilitate remote patient monitoring and intervention. |

| Twilio Inc. | Twilio offers cloud communications platforms and APIs that enable healthcare providers to build custom telehealth and patient engagement solutions, including secure messaging and video conferencing for remote care. |

| Nihon Kohden Corporation | This company provides patient monitoring systems and medical devices that integrate into hospital networks, supporting data transfer for remote viewing and analysis by clinicians. |

| Medtronic | Medtronic offers remote patient monitoring solutions primarily for managing chronic conditions like cardiovascular disease and diabetes, utilizing connected devices such as pacemakers and insulin pumps with data platforms. |

| GE Healthcare | GE provides comprehensive patient monitoring systems (e.g., CARESCAPE) that capture critical data, facilitating remote surveillance and clinical decision support through integrated software solutions. |

| TeleMedCare | TeleMedCare provides a range of integrated telehealth systems that include vital signs monitors and a data management platform for chronic disease management and aged care. |

Which Service Dominated the Tele-monitoring Services Market in 2025?

In 2025, the remote patient monitoring (RPM) segment held a major share and is estimated to register the fastest growth during 2026-2035. Specifically, a rise in the ageing population, which is highly susceptible to the different chronic health issues, is increasingly demanding robust and home-based care. For this, many key players are bolstering more specific and nuanced modules for the management of COPD, hypertension, and diabetes. Additionally, ongoing studies are fostering the combination of home monitoring, electronic data transmission, and coaching with connected devices to optimise blood pressure control.

How did the Government/Public Payers Segment Lead the Market in 2025?

In 2025, the government/public payers segment held the dominating share of the tele-monitoring services market. With expenditure lowering through certain hospital visits, and minimal infrastructure requirements, with raised need for chronic disease management is impacting the overall payment solutions. In India, till January 2025, above 73 crore (730 million) Ayushman Bharat Health Accounts have been generated, which enable seamless access and sharing of digital health records. Alongside, Rural Health Clinics (RHCs) and Federally Qualified Health Centers (FQHCs) are employing the standard RPM CPT codes to streamline the billing process.

Insurance Reimbursement

On the other hand, the insurance reimbursement segment is expected to grow fastest. The latest approaches comprise the U.S. Centers for Medicare & Medicaid Services (CMS) with particular codes for home health services facilitated via synchronous telehealth and RPM. The era has been leveraging through many commercial insurers to integrate with some Medicare flexibilities to enable providers to verify specific payer guidelines to overcome the diversification in rural areas.

Why did the Wearables/Remote Sensor Segment Dominate the Market in 2025?

In the tele-monitoring services market, the wearables/remote sensor segment led in 2025 and will expand rapidly during the forecast period. Ongoing technological breakthroughs, including sensor technology, AI, IoT, and mobile apps, and raised accuracy, longer battery life, and wireless connectivity are making them more user-friendly and efficient. Current efforts are exploring discreet patches and biosensors (like the VitalPatch or BioButton) in hospital-at-home programs and for post-operative recovery are allowing for to monitoring of multiple vitals, such as ECG, heart rate, respiratory rate, and temperature simultaneously.

Which Facility Led the Tele-monitoring Services Market in 2025?

In 2025, the tele-hospitals segment accounted for the dominating share of the market. Expansion of AI, machine learning, 5G connectivity, and electronic health records (EHRs) is helping to boost in effectiveness and accessibility of telemedicine services. Whereas hospitals are widely using app-based programs and AR/VR solutions for physical therapy, pain management, and mental health support, which enable patients to manage their recovery from home.

Tele-Home

In the coming era, the tele-home segment is predicted to witness rapid expansion as telemonitoring services support all kinds of economic populations, which is fostering the prospective development of tele-home. Companies are executing FDA/CE-approved, Bluetooth or 5G-enabled devices (e.g., smart glucose monitors, ECG-driven smartwatches) for transmitting real-time data to cloud-based Electronic Health Record (EHR) systems. The globe is revolutionizing medical drones for contactless delivery of medications, vaccines, and surgical supplies to remote or difficult-to-access areas.

What Made the Patients Segment Dominant in the Market in 2025?

The patients segment registered dominance with a major share of the tele-monitoring services market in 2025. The segment is driven by well-developed AI-assisted tracking, which captures subtle cardiac data, and continuous glucose monitoring (CGM) systems for real-time analysis and automating insulin delivery. Recently, in 2025, Medtronic received FDA approval and unveiled the MyCareLink Smart Monitor for pacemaker patients.

Providers

The providers segment is estimated to expand rapidly in the upcoming years. Prominent players, like Philips, Medtronic, GE Healthcare, Siemens Healthineers, Teladoc Health, and American Well, are involved in the robust developments in tele-monitoring solutions. Continuous extensive collaborations, such as BioIntelliSense and Hicuity Health, are providing consistent, managed patient monitoring for hospitals and healthcare systems.

In 2025, North America captured the largest revenue share of the market. Escalating cases of cardiovascular disease and diabetes, with raised demand for seamless and convenient virtual consultations and remote monitoring, are acting as major drivers in the regional market. In 2025, the region will have leveraged Teladoc Health's growth of at-home testing and Doctor On Demand's introduction of remote lab ordering.

The US market registered dominance in 2025, through new alliances, such as Zoom's integration with Suki's AI for documentation, with innovative products, like VerifiNow's PatientVerifi for secure patient identity verification.

For instance,

In the future, the Asia Pacific is anticipated to expand rapidly in the tele-monitoring services market. Different countries' governments are promoting policies, digital health initiatives, and investments in healthcare infrastructure, which are catalyzing remote care and telemedicine services. Alongside, consistent shifting towards the development of “hospital-at-home” models, particularly, recently created Singapore general hospitals’ MIC@Home program, are assisting with comprehensive general solutions for patients.

| Metric | Count (as of Dec 31, 2024) |

| Total Patients Served | > 330,000,000 |

| Health Facilities (Spokes) | 131,147 |

| Hubs | 16,849 |

| Online OPDs | 681 |

| Healthcare Providers | 230,235 |

Whereas Japan will expand at the fastest CAGR, due to the upgraded reimbursement frameworks to accelerate financial support for remote consultations across hospitals and clinics in October 2025. Moreover, the NEC Corporation implemented its RPM offerings in September 2025, which combine AI-enabled predictive alerts and secure data transmission to support clinicians with proactive interventions for cardiovascular and respiratory patients.

With notable growth, Europe has been stepping towards transforming the tele-monitoring services market landscape, especially in Belgium. In this country, they have executed a new framework for reimbursing telemonitoring for heart failure patients in April 2025, with approval of numerous applications for use within this scheme. From March 2025, the European Health Data Space (EHDS) regulation made effective with an emphasis on facilitating secure cross-border data sharing, for further enhancing integration of tele-monitoring services.

However, Germany will expand at a lucrative CGAR during 2026-2035, as it has initiated the launch of an electronic patient record (ePA), a basic digital infrastructure to allow feasible data sharing among diverse healthcare providers, hospitals, and patients.

For instance,

| Company | Launches |

| Everdrone | In December 2025, it unveiled the first drone-based emergency medical service in France. |

| vTitan | In November 2025, it introduced vCardio, an AI-driven cardiac monitor created to offer continuous ECG monitoring. |

| Philips | In September 2025, a company launched a smart telemetry platform for cardiac monitoring to offer consistent, enterprise-wide connectivity beyond the bedside. |

| Graphnet Health & Luscii | In September 2025, they launched an advanced remote monitoring platform, Graphnet Remote Monitoring. |

| Vitalacy, Inc. | In February 2025, it unveiled its AI-enabled Virtual Care solution for expanding patient safety, reducing hospital falls, and improving hospital efficiency through 24/7 AI-powered remote monitoring. |

By Service

By Payment Model

By Device

By Facility

By End-use

By Region

North America

South America

Europe

Asia Pacific

MEA

January 2026

January 2026

January 2026

January 2026