January 2026

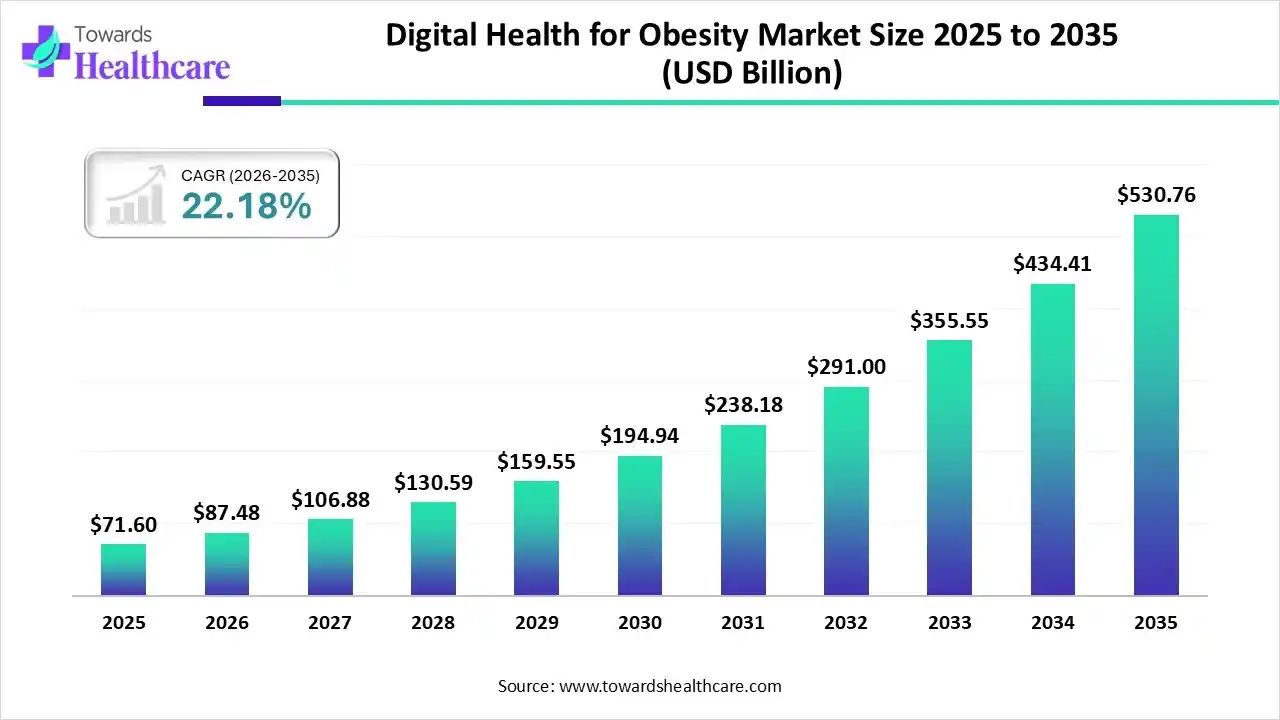

The global digital health for obesity market size was estimated at USD 71.60 billion in 2025 and is predicted to increase from USD 87.48 billion in 2026 to approximately USD 530.76 billion by 2035, expanding at a CAGR of 22.18% from 2026 to 2035.

The digital healthcare solutions are crucial due to the limitations of traditional care, enhanced patient engagement, and patient adherence.

| Key Elements | Scope |

| Market Size in 2026 | USD 87.48 Billion |

| Projected Market Size in 2035 | USD 530.76 Billion |

| CAGR (2026 - 2035) | 22.18% |

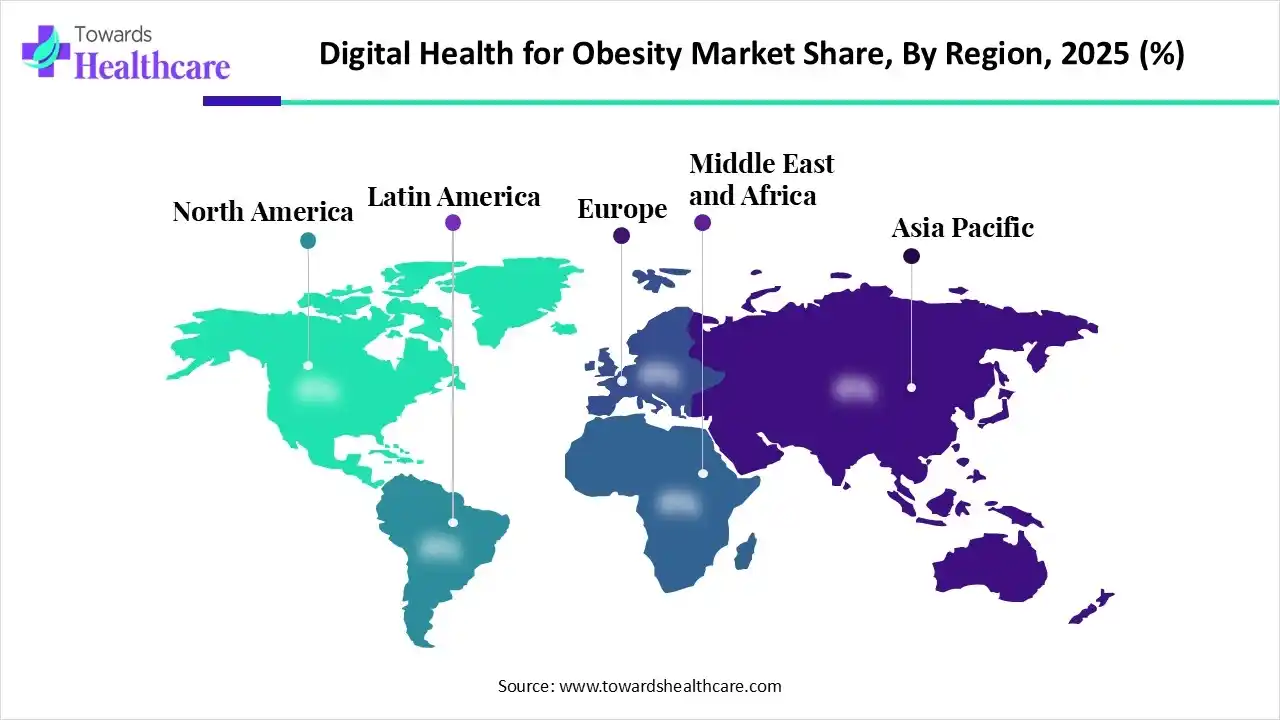

| Leading Region | North America |

| Market Segmentation | By Component, By End-Use, By Region |

| Top Key Players | Noom, WW International, Teladoc Health, Inc., Fitbit, Inc., Welldoc, Sidekick Health, Form Health, Healthify |

The digital health for obesity market is experiencing significant growth due to the presence of major players like WW International, Noom, MyFitnessPal, Fitbit, Inc., Teladoc Health, Inc., Sidekick Health, and Eli Lilly and Company. There is a strong preference to leverage patient data from digital solutions to improve real-world outcomes. The International Conference on Obesity and Digital Health Solutions and related campaigns aim to foster collaboration and innovation in this field.

AI is vital for obesity management for risk prediction, early detection, personalized interventions and coaching, real-time monitoring and feedback, etc. It enhances diagnostics, clinical decision support systems, drug discovery, and surgical planning, further expanding the digital health for obesity market. It enables predictive analytics, personalized interventions, and scalable support systems.

How does the Services Segment Dominate the Digital Health for Obesity Market in 2025?

The services segment dominated the market in 2025, owing to the increased access and convenience, self-monitoring and feedback, and personalized interventions associated with digital health services. They provide behavioral and psychological support and enhance clinical decision-making. They offer multidisciplinary care coordination and leverage social support networks.

Software

The software segment is expected to grow at the fastest CAGR in the digital health for obesity market during the forecast period due to the major role of software components in behavioral health support, self-monitoring, personalized interventions, enhanced accessibility, and remote care. The essential software tools are found in mobile health applications, telehealth platforms, AI/ML algorithms, and IoMT software. They are more efficient, scalable, and provide personalized approaches to obesity care.

What made Patient the Dominant Segment in the Digital Health for Obesity Market in 2025?

The patient segment dominated the market in 2025, owing to telemedicine, remote monitoring, and appointment management, coupled with enhanced access and convenience. The digital health platforms improve health management through medication adherence, health record access, and wellness tracking. The digital health solutions provide patients with personalized and proactive care through informed decision-making, proactive intervention, and preventative care.

Provider

The provider segment is estimated to grow at the fastest rate in the digital health for obesity market during the predicted timeframe due to the major role and benefits of digital health for healthcare providers in terms of improved operational efficiency and enhanced clinical decision-making. There is increased access to care and better patient management and outcomes. The advanced digital health solutions improve communication, collaboration, medical education, and training.

North America dominated the market in 2025, owing to high obesity rates, increased health awareness, proactive health management, and high healthcare expenditure. In July 2025, the Trump Administration partnered with Big Tech to launch a health data tracking program, aiming to bring U.S. healthcare into the digital age.

Furthermore, in August 2025, the Trump Administration launched a health data-sharing initiative that allows Americans to share medical records and personal health data across health systems and private tech platforms. This initiative is supported by more than 60 companies leading in the digital health for obesity market, including Amazon, Apple, Google, CVS Health, and United Health Group. These companies aim to improve access to patient health records and help professionals and patients manage chronic conditions such as obesity and diabetes. This initiative will also feature conversational AI for patient support, as well as digital tools such as medication-tracking applications and QR codes.

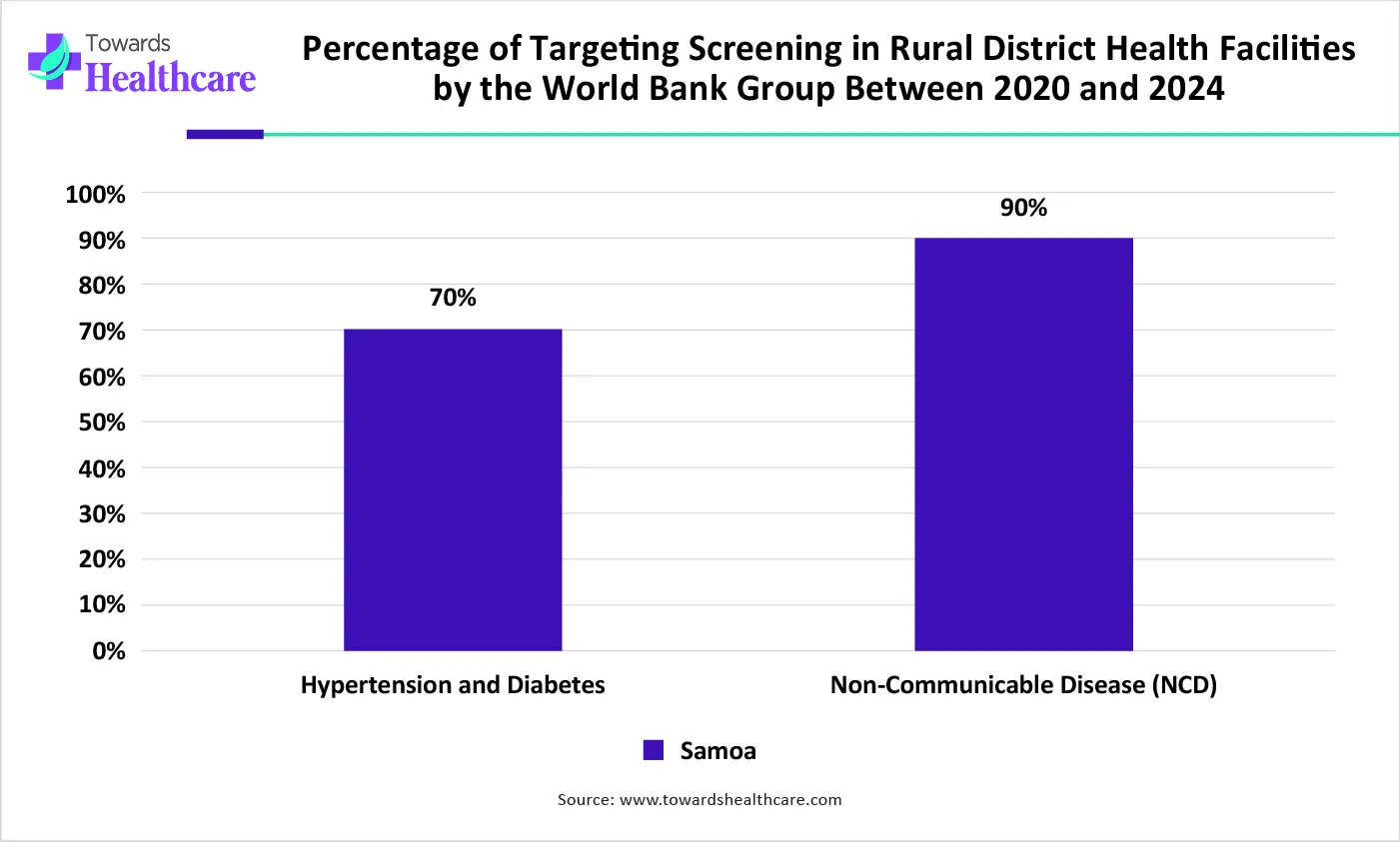

In September 2024, the World Health Organization (WHO) and the International Telecommunication Union (ITU) reported an additional investment of US$0.24 per patient per year in digital health interventions, such as mobile messaging, chatbots, and telemedicine, that will save millions of lives from deaths caused by non-communicable diseases. A new federal rule was launched by the Biden Administration to manage obesity and promote broader access to treatment options, including prescription weight-loss drugs.

Europe is expected to grow at a notable rate in the market in 2025, led by well-developed healthcare infrastructure, integration with GLP-1 therapies, and growing investments in healthcare. The WHO European Centre for Primary Health Care proclaimed that health systems across the globe must prioritize obesity prevention and management as a central pillar of public health, universal health coverage, and noncommunicable disease control. Ireland, Portugal, Slovenia, and Spain joined the WHO/Europe’s special initiative on noncommunicable diseases and innovation.

In December 2025, the European Investment Bank (EIB) and Angelini Ventures signed an agreement to launch €150 million partnership to boost digital health startups and finance the EU biotechnology.

Germany stands ahead in the digital health for obesity market as the global health partner of the World Health Organization (WHO), both aiming to strengthen global health security, combat antimicrobial resistance, and advance universal health coverage. Germany is committed to policies, robust health strategies, and helping with its expertise and funding to the WHO. In September 2025, Novo Nordisk and Smartpatient launched a digital support model for obesity care in Germany.

Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period due to high penetration of smartphones and the internet, patient-centric care, and healthcare awareness. The APAC region remains a geographic leader in digital health with its dominating markets, including Australia, Japan, and Hong Kong. The major investment areas are medical diagnostics focused on AI imaging and detection, research solutions driven by AI drug discovery platforms like Insilico Medicine, and health management solutions, including platforms that improve chronic care management and hospital workflows. Digital health funding across this region also prioritizes women’s health, oncology, geriatrics, and neurology.

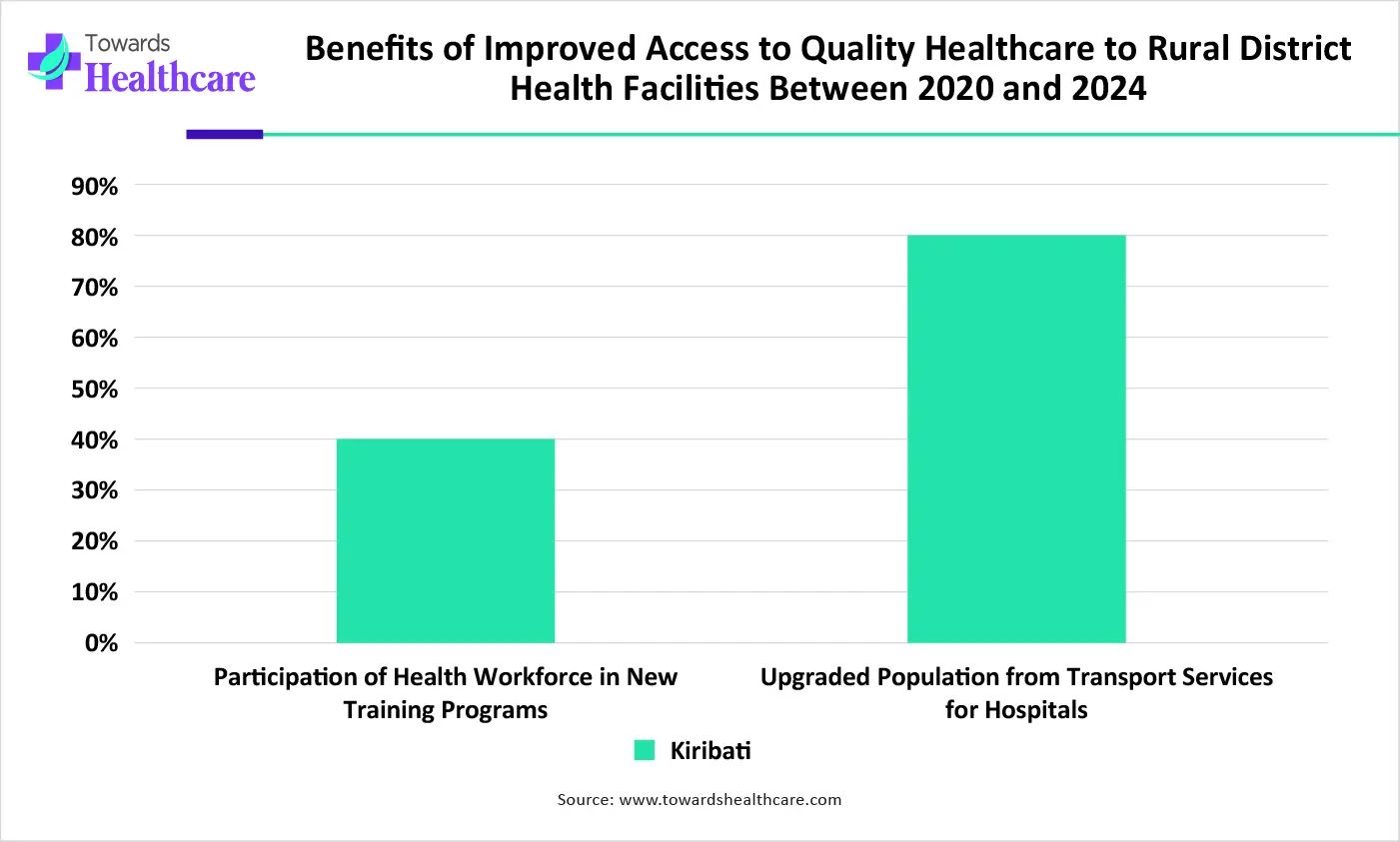

India is scaling solutions in the surging digital health for obesity market for population health, which include eSanjeevani, the government’s national telemedicine platform. This platform has delivered over a million consultations across urban and rural areas that have helped to fill the gaps in accessibility. India holds telemedicine practice guidelines, due to which it has a regulated foundation for virtual care.

| Sr. No. | Name of the Company | Headquarters | Latest Update |

| 1 | Noom | New York, New York, U.S. | In November 2025, Noom introduced a new diabetes lifestyle program and predictive glucose forecasting to tackle the diabetes crisis in America. |

| 2 | WW International | New York, New York, U.S. | In October 2025, WW International, Inc. reported 46% improvement in work-related quality of life and 53% improvement in overall quality of life. |

| 3 | Teladoc Health, Inc. | New York, U.S. | In October 2025, Teladoc Health, Inc. reported the inclusion of workplace safety capability to its AI-enabled Clarity monitoring solution for health systems and hospitals. |

| 4 | MyFitnessPal | Austin, Texas | In February 2025, MyFitnessPal reported the acquisition of meal-planning startup Intent. |

| 5 | Fitbit, Inc. | San Francisco, California, U.S. | Fitbit, Inc. features its AI-Powered Personal Health Coach, which uses Google's Gemini AI to offer personalized, data-driven interventions and goal setting. |

| 6 | Welldoc | Columbia, Maryland, United States | In October 2025, Welldoc expanded its AI-powered cardiometabolic platform to support metabolic dysfunction-associated steatohepatitis (MASH) and chronic kidney disease. |

| 7 | Sidekick Health | Kópavogur, Capital Region, Iceland | In April 2025, Sidekick Health and Ypsomed launched an integrated digital health solution for obesity management. |

| 8 | Ro | New York City | In November 2025, Ro planned to present eight research abstracts at ObesityWeek 2025. |

| 9 | Form Health | Boston, Massachusetts | In August 2025, Form Health selected the NovoCare platform of Novo Nordisk to expand access to science-based obesity care across the U.S. |

| 10 | Healthify | Bengaluru | In December 2025, Healthify partnered with Novo Nordisk India to launch an AI-enabled patient support program. |

By Component

By End-Use

By Region

North America

South America

Europe

Asia Pacific

MEA

January 2026

January 2026

January 2026

January 2026