December 2025

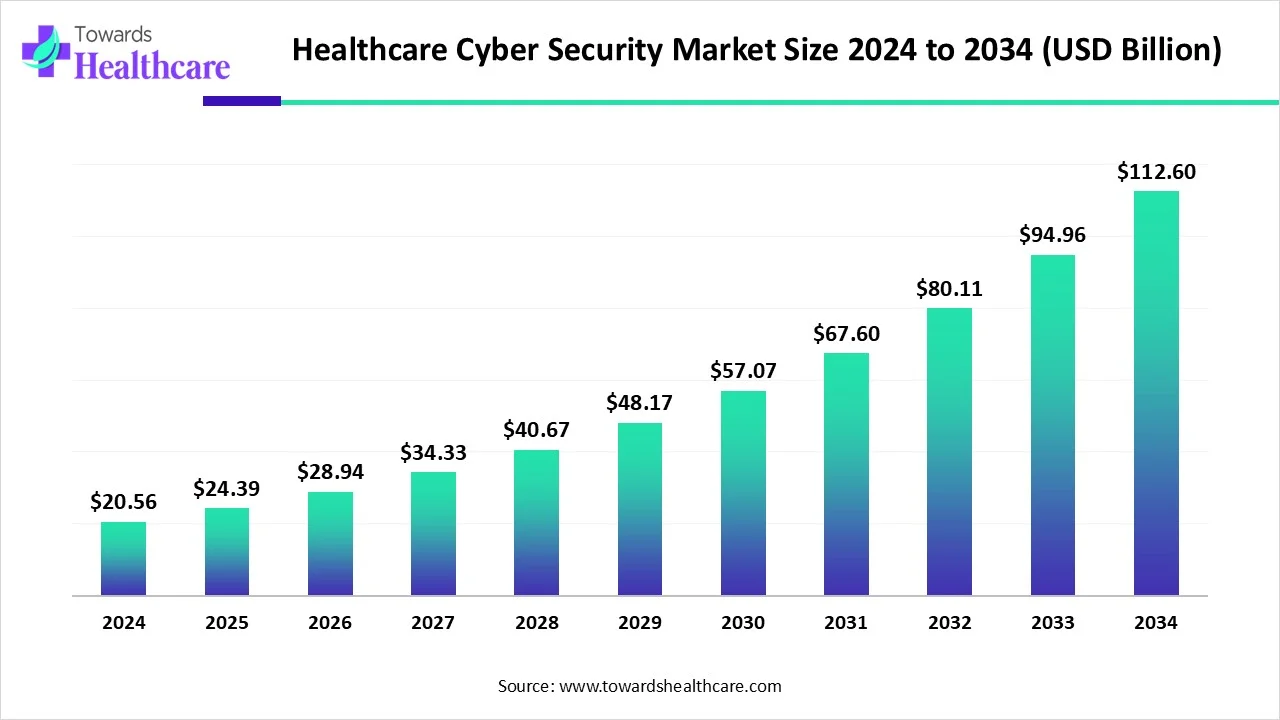

The global healthcare cyber security market size is calculated at USD 20.56 billion in 2024, grow to USD 24.39 billion in 2025, and is projected to reach around USD 112.6 billion by 2034. The market is expanding at a CAGR of 18.54% between 2025 and 2034.

The healthcare cyber security market is growing rapidly due to increasing cyberattacks targeting sensitive patient data and the widespread adoption of digital technologies like healthcare IoT devices and telehealth. These advancements have expanded vulnerabilities, prompting healthcare organizations to invest in stronger cybersecurity measures. Additionally, strict regulations such as HIPAA require robust data protection, making cybersecurity a top priority for patient safety and operational continuity. Despite challenges like skill shortages and complex IT systems, the urgent need to safeguard information continues to drive significant growth in this market.

| Metric | Details |

| Market Size in 2025 | USD 24.39 Billion |

| Projected Market Size in 2034 | USD 112.6 Billion |

| CAGR (2025 - 2034) | 18.54% |

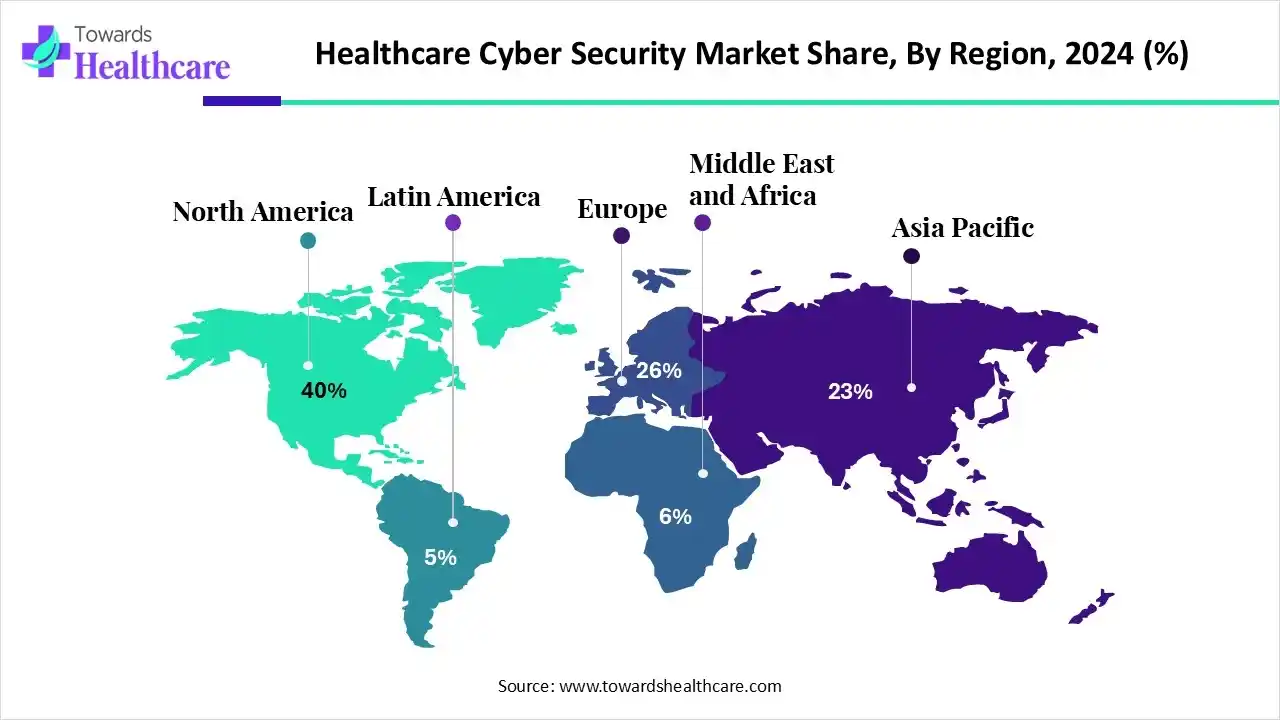

| Leading Region | North America share by 40% |

| Market Segmentation | By Type, By Type of Threat, By End-use, By Regions |

| Top Key Players | Cisco Systems, Inc., IBM, Marubeni Information Systems Co., Ltd., Symantec Corporation, Trend Micro Incorporated, McAfee, LLC., Intel Corporation, AO Kaspersky Lab, Lockheed Martin Corporation, Northrop Grumman, Imperva; Fortinet, Inc., Medigate (Claroty) |

Healthcare cybersecurity refers to the protection of electronic health data and digital systems from unauthorized access, breaches, and cyber threats to ensure patient privacy, data integrity, and system security. Innovation is significantly transforming the healthcare cybersecurity market by introducing advanced technologies like AI, machine learning, and blockchain to detect, prevent, and respond to cyber threats more efficiently. These innovations enhance real-time threat monitoring, automate response systems, and secure sensitive patient data. As healthcare systems become more digital and interconnected, innovative solutions are crucial for safeguarding electronic health records, ensuring regulatory compliance, and maintaining patient trust in an increasingly complex cybersecurity.

For Instance,

AI is making significant strides in healthcare cybersecurity by integrating advanced machine learning and real-time threat detection tools. These systems can autonomously identify suspicious activity across networks and patient databases, significantly reducing breach response times. Predictive analytics powered by AI help preemptively spot vulnerabilities, while automated patch management ensures timely security updates. Additionally, intelligent access controls powered by behavioral analytics offer more robust protection for sensitive medical data. Altogether, these innovations are reshaping the healthcare cybersecurity landscape.

Rising Cyberattacks and Data Breaches

The growing number of cyberattacks and data breaches in healthcare is a major driver for the cybersecurity market. These incidents often target sensitive patient data and disrupt essential medical services, leading to significant financial and reputational losses. As threats become more complex, healthcare organizations are prioritizing robust cybersecurity measures to protect data, comply with regulations like HIPAA, and ensure uninterrupted care. This rising need for protection is fueling demand for advanced cybersecurity solutions in the sector.

For Instance,

Insufficient Training and Scarcity of knowledgeable IT staff

Insufficient training and a shortage of skilled IT professionals are major challenges in cybersecurity. Many healthcare organizations lack properly trained staff to handle complex cyber threats, leaving systems vulnerable. The scarcity of knowledgeable personnel also delays threat detection and response, increasing the risk of data breaches and system failures. This gap in expertise highlights the urgent need for investment in cybersecurity education and workforce development to strengthen defense against growing digital threats.

LOT Security Plays a Critical Role in Healthcare Cybersecurity Sector

loT security presents a key future opportunity in the healthcare cybersecurity market because of the growing use of connected medical devices, such as monitors, pumps, and imaging systems. These devices improve patient care but also create new entry points for creating a new entry point for cyber threats. Ensuring strong loT security helps protect sensitive patient data, maintain device functionality, prevent data, maintain device functionality, and prevent disruptions in critical care. As loT adoption in healthcare rises, the demand for specialized cybersecurity solutions to safeguard these devices is expected to grow.

The antivirus and antimalware segment dominated the market in 2024 because these tools are essential for protecting systems from common and frequent threats like viruses, ransomware, and malicious software. Healthcare organizations rely on them as a first line of defense to prevent unauthorized access, data breaches, and disruption in patient care. Their widespread use, ease of deployment, and ability to detect known threats make them a core component of cybersecurity strategies in healthcare.

The intrusion detection system/ Intrusion prevention system segment is projected to experience the fastest growth in the healthcare cybersecurity market. This is mainly due to the rising need for real-time monitoring and automated response to cyber threats. IDS/IPS solutions help detect suspicious activities, block unauthorized access, and safeguard sensitive medical data. With growing concern over network vulnerabilities and data breaches, healthcare organizations are increasingly adopting these systems to strengthen their security infrastructure and protect patient information.

The malware segment led the market in 2024 because ransomware and other malware attacks became increasingly sophisticated and frequent, targeting hospitals and clinics that rely on sensitive patient data and critical systems. These attacks often disrupted operations and forced organizations to pay ransoms to restore access. The widespread use of connected medical devices and electronic health records also expanded vulnerabilities, making healthcare institutions prime targets and reinforcing malware’s leading market share in cybersecurity solutions.

The advanced persistent threat segment is projected to grow significantly in the healthcare security market due to the increasing sophistication and frequency of targeted cyberattacks on healthcare organizations. As healthcare providers adopt more digital technologies and store sensitive patient data, they become prime targets for APTs. Additionally, strict regulatory requirements and the need for robust data protection drive investments in advanced security solutions, making APT protection a top priority and fueling its rapid market growth.

The Hospitals segment dominated the healthcare cyber security market in 2024. Hospitals are increasingly vulnerable in the cybersecurity market due to the rapid adoption of digital health records, widespread use of connected medical devices, and the high value of patient data. These factors make hospitals attractive targets for cybercriminals. Additionally, many hospitals face challenges such as limited cybersecurity resources, outdated systems, and staff shortages, which further weaken their defenses. As cyber threats continue to evolve, hospitals must prioritize strong security measures to protect patient data and ensure uninterrupted healthcare services.

The pharmaceuticals segment is expected to grow rapidly in the healthcare cybersecurity market because pharmaceutical and biotechnology companies face increasing cyber threats targeting their valuable intellectual property, clinical trial data, and supply chain information. As drug development processes become more digitized and AI-driven, the risk of data breaches and cyberattacks rises sharply. These companies are investing heavily in advanced cybersecurity to protect sensitive research, manufacturing, and regulatory data, driving rapid growth of the market.

North America dominated the market share by 40% due to its advanced healthcare infrastructure, high adoption of digital health technologies, and stringent data protection regulations like HIPAA. The region faces increasing cyber threats targeting electronic health records, driving demand for robust cybersecurity solutions. Additionally, significant investments in healthcare IT and the presence of key cybersecurity firms contribute to market leadership. Growing awareness about patient data privacy further supports North America’s dominance in the healthcare cybersecurity landscape.

The rapid adoption of digital health technologies like electronic health records (EHRs), telemedicine, IoT devices, and cloud-based solutions has expanded the attack surface, making robust cybersecurity essential. Regulatory requirements such as HIPAA, new FDA mandates for medical device security, and growing concerns about data privacy are driving healthcare organizations to invest heavily in advanced security solutions. Additionally, increased government and private sector collaboration, a strong presence of leading cybersecurity vendors, and ongoing digital transformation in healthcare further fuel market growth.

For Instance,

The Canadian market is expanding rapidly due to increasing cyberattacks targeting medical facilities, accelerated digital health adoption, and the proliferation of connected medical devices. Stringent privacy regulations like PIPEDA and provincial health information acts are driving investment in security solutions. Government initiatives supporting digital health infrastructure and growing awareness of data protection needs following high-profile breaches have made cybersecurity a top priority for healthcare organizations across Canada.

The Asia Pacific market is growing at the fastest rate due to rapid digitization of healthcare, and increased adoption of electronic health records, telemedicine, and IoT devices, which expand the attack surface for cybercriminals. Rising cyberattacks especially ransomware combined with a shortage of skilled cybersecurity professionals and stricter government regulations, are pushing healthcare organizations to invest heavily in advanced cybersecurity solutions. Countries like India and China are leading this surge as they modernize healthcare infrastructure and enforce new data protection laws

China's market is rapidly expanding due to strict government regulations, digital transformation, and rising cyber threats. Regulations compel healthcare organizations to invest in robust security measures. The increasing adoption of electronic health records, telemedicine, and IoT devices expands the attack surface. The rise in cyberattacks, including ransomware, necessitates advanced cybersecurity solutions. Significant public and private sector investments further drive the adoption of AI and cloud-based security. Hospitals, as a critical segment, contribute significantly to market growth by prioritizing the protection of sensitive patient data.

India’s market is experiencing rapid growth driven by the widespread adoption of digital health technologies, increased use of electronic health records, and the expansion of telemedicine services. The surge in cyberattacks targeting sensitive patient data and critical healthcare infrastructure has heightened awareness and investment in advanced security solutions. Government initiatives and regulatory measures are also pushing healthcare providers to strengthen their cybersecurity posture. Additionally, the growing use of cloud-based platforms, IoT devices, and mobile health applications is expanding the attack surface, making robust cybersecurity essential for ensuring data privacy and operational continuity in India’s evolving healthcare sector.

Europe is accelerating the market by investing in advanced security solutions, such as endpoint protection and threat detection, and boosting funding through EU initiatives like the Digital Agenda for Europe. Increased cyberattacks and strict regulations, including GDPR and the NIS2 Directive, are driving healthcare organizations to strengthen defenses and adopt new technologies, leading to rapid market growth.

For Instance,

The UK market is expanding as organizations focus on modernizing legacy IT systems and integrating advanced authentication methods. Growing collaboration between the public and private sectors is fostering innovation in security technologies. Additionally, heightened public awareness about data privacy is pushing healthcare providers to prioritize robust cybersecurity frameworks, ensuring trust and resilience in the face of evolving digital threats.

Germany’s market is growing due to a surge in cyberattacks targeting hospitals and digital health systems, alongside government initiatives to strengthen cybersecurity frameworks. The rapid adoption of electronic health records, telemedicine, and connected devices has increased vulnerabilities, prompting healthcare providers to invest in advanced security solutions and comply with evolving data protection regulations

Latin America is considered to be a significantly growing area in the healthcare cyber security market, due to the increasing use of advanced technologies in healthcare organizations and a surge in cyberattacks. The risk of cyberattacks is increasing in the region due to increased geopolitical attention, including foreign investments from China. Stringent regulations and favorable government policies promote the use of healthcare cybersecurity. Healthcare organizations are increasingly adopting cybersecurity strategies.

The Health-ISAC launched the “Brazilian Critical Infrastructure Threat Landscape and Implications for Healthcare Organizations” report that demonstrates how geopolitical forces shape health sector security. It also organized a workshop to provide a unique platform for learning about threats and best practices, collaborating with peers, and fostering resilience against Brazil’s evolving threat landscape.

The Middle East & Africa are expected to grow at a notable CAGR in the healthcare cyber security market in the foreseeable future. The increasing digitization in the healthcare sector, backed by several government and private investments, bolsters market growth. Institutions and key players conduct seminars, workshops, and conferences to increase awareness about cybersecurity measures and the availability of innovative tools. ISMG hosted “The Cybersecurity Summit: Africa 2025”, a virtual, one-day event, to tackle Africa’s most urgent security challenges head-on. South Africa (65%), Nigeria (10%), and Kenya (4%) accounted for the highest participation.

It is estimated that more than 80% of healthcare facilities in the UAE use some form of electronic records with Universal Electronic Medical Recorder. Telemedicine initiatives are also making significant strides in transforming the digital landscape of the UAE. The Department of Health – Abu Dhabi regulates and provides the Abu Dhabi Healthcare Information and Cyber Security (ADHICS) Standard to regulate healthcare data in the region.

In April 2025, Full Spectrum, a fast-growing company in medical device and digital health development, introduced a new range of cybersecurity services to meet the rising demand for secure healthcare technology. With increasing interconnectivity, ensuring data privacy and device safety has become more critical. An FBI report revealed that many connected hospital devices have serious vulnerabilities, and many older devices lack security updates. In 2023 alone, nearly 1,000 security flaws were found, highlighting the urgent need for stronger cybersecurity in health tech. (Source - Businesswire)

By Type

By Type of Threat

By End-use

By Region

December 2025

December 2025

December 2025

December 2025