February 2026

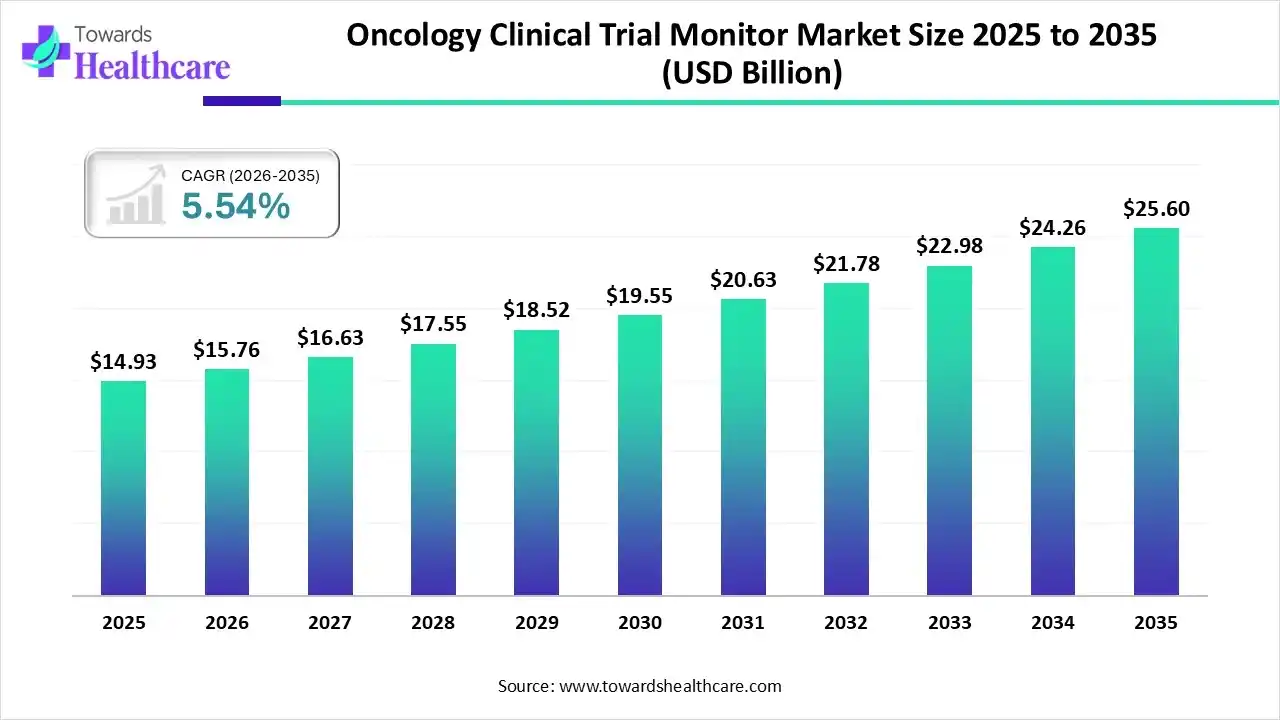

The global oncology clinical trial monitor market size was estimated at USD 14.93 billion in 2025 and is predicted to increase from USD 15.76 billion in 2026 to approximately USD 25.6 billion by 2035, expanding at a CAGR of 5.54% from 2026 to 2035.

The worldwide accelerating number of diverse cancer cases and demand for advanced personalized treatments are supporting the growth of the oncology clinical trial monitor. Alongside, leaders are exploring AI algorithms for assessment, biomarker identification, and evolving advanced wearables.

Across the globe, the oncology clinical trial monitor market is driven by the rising demand for tailored oncology treatments, which require complex, specialized trials. Alongside the ongoing conduct of decentralised clinical trials (DCTs) using remote monitoring, wearables, and telemedicine, this ultimately impacts the overall market progression. The latest developments include ADCs, such as trastuzumab deruxtecan (Enhertu), which emphasise the management of unique toxicity profiles and study of faster treatment progression.

Primarily, AI has a major role in imaging and pathology analysis, where its models, such as Prov-GigaPath, Owkin’s models, and CHIEF, are employed in the analysis of digital pathology slides and imaging, to offer quicker, more precise tumor assessment and biomarker identification. Moreover, AI-driven in silico trials and digital twin technologies are highly used to simulate patient responses, enhancing trial designs and lowering the need for rigorous physical trials.

Many leading firms are moving towards crucial data points that can impact patient safety and study integrity.

Extensive real-time, centralized, and integrated data platforms will enable monitoring teams to visualize and prevent risks, like missing data, query rates, and protocol deviations, across various sites simultaneously.

The market is fostering the unification of ePROs and digital tools to record, in real-time, the patient's outlook on symptom burden and treatment side effects.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.57 Billion |

| Projected Market Size in 2035 | USD 2.74 Billion |

| CAGR (2026 - 2035) | 6.34% |

| Leading Region | North America by 47% |

| Market Segmentation | By Technology, By Therapeutic Area, By Route of Administration, By End-User, By Region |

| Top Key Players | Arvinas, Inc., Bristol Myers Squibb (BMS), Pfizer Inc., Nurix Therapeutics, Inc., Kymera Therapeutics, C4 Therapeutics, Inc. |

How did the Phase I Segment Lead the Market in 2025?

In 2025, the phase I segment held the largest share of the oncology clinical trial monitor market. As this phase focuses on preliminary efficacy assessments is increasingly demanding advanced monitoring. However, phase I trials are using hybrid models that embrace home nursing visits for lab draws and electronic Patient-Reported Outcomes (ePROs) to lower the patient burden.

Phase III

In the future, the phase III segment will expand rapidly. This was mainly fostered to secure FDA/EMA approval, which requires stricter monitoring to ensure safety and efficiency against standard treatments. Specific instances, like the late-stage colorectal cancer trials, including the DYNAMIC-III study, are executing the predictive value of MRD negativity to recommend adjuvant chemotherapy decisions in real time.

Which Study Design Dominated the Oncology Clinical Trial Monitor Market in 2025?

The interventional segment captured the biggest share of the market in 2025. Particularly, parallel-group, randomized controlled trials are the benchmark for assessing new drugs, devices, and treatment regimens. A recent effort, the City of Hope rolled out an AI platform, HopeLLM, to support summarizing patient histories, finding trial matches, and getting data for research, which bolsters patient screening.

Observational

Moreover, the observational segment is estimated to expand fastest. This is prominently driven by their rapidity, affordability, and ease of conduct compared to large-scale RCTs, which makes them unique for monitoring long-term treatment effects. Transformative prospective observational studies widely using circulating tumor DNA (ctDNA) to monitor minimal residual disease (MRD) and track tumor evolution in real-time.

Why did the Lung Cancer Segment Lead the Market in 2025?

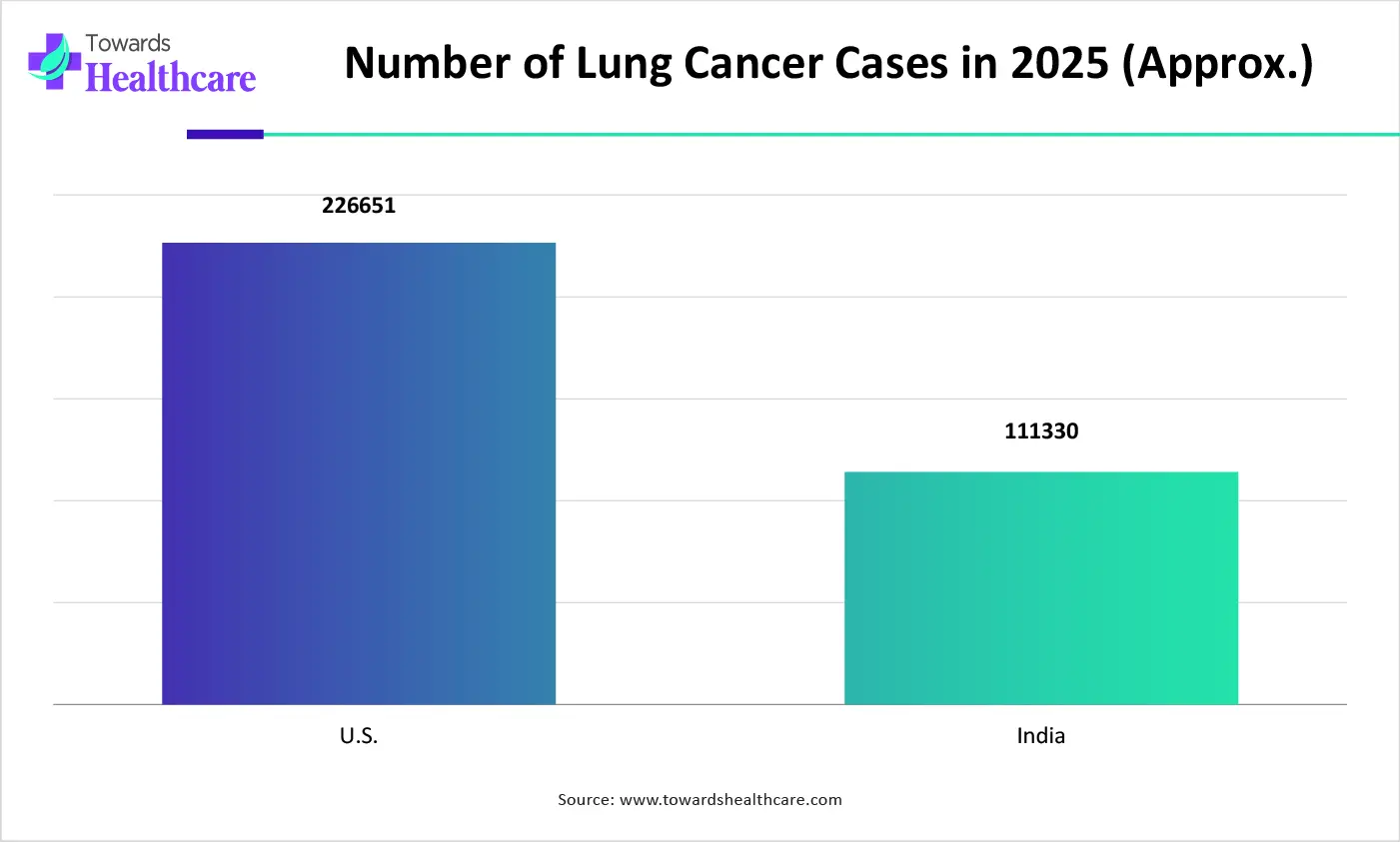

In 2025, the lung cancer segment held the dominating share of the oncology clinical trial monitor market. Globally accelerating cases of NSCLC, especially due to aging populations, smoking behaviors, and air pollution, are propelling the need for new treatment alternatives. The latest solutions include liquid biopsy and ctDNA, which is used to track minimal residual disease (MRD), identify resistance mutations before symptoms appear, and monitor tumor clonal evolution.

Breast Cancer

The breast cancer segment will witness rapid growth. In the future, the APAC will have nearly 2.7 million cases of breast cancer, with escalating emphasis on triple-negative, HER2-positive, and HR-positive breast cancer, which are fueling the segmental progression. Many trials are exploring the revolution of oral PROTACs, like vepdegestrant, with their superior efficacy over traditional injections, such as fulvestrant, in ESR1-mutant cancers.

North America registered dominance in the oncology clinical trial monitor market, due to increased research and development investments, a massive number of biopharmaceutical firms, and faster adoption of sophisticated monitoring technologies. Additionally, Clinical Research Associates (CRAs) in Canada are exploring 100% remote monitoring roles, especially for US-based trials, which depend on Electronic Trial Master Files (eTMF) and Electronic Data Capture (EDC) systems.

U.S. Market Trends

Whereas the U.S. was a major contributor to the market, as it is promoting remote monitoring solutions for home-based infusions and patient-reported symptoms, including the adoption of Canopy by New York Cancer and Blood Specialists.

Asia Pacific is anticipated to expand at the fastest CAGR in the oncology clinical trial monitor market. As this region is facilitating cost-effective clinical trials over the US or Europe is impacting as a substantial driver. China and India are highly adopting AI-enhanced Clinical Trial Management Systems (CTMS), decentralized trials (DCT), and eConsent, which revolutionizes monitoring, specifically for remote patient monitoring in India and high-tech site management in China.

China Market Trends

Moreover, China is playing a vital role in bolstering CAR-T trials for solid tumors in the lung, liver, and also monitoring has stepped to emphasize the logistics of handling tailored products and confirming rapid, accurate data reporting to manage cytokine release syndrome (CRS).

Europe is experiencing a notable expansion in the oncology clinical trial monitor market. A recent regulation transformation includes the novel Health Technology Assessment (HTA) regulation, which necessitates Joint Clinical Assessments (JCA) for oncology.

UK Market Trends

However, the UK is encouraging the breakthrough of digital tools, such as the Cancer Core Europe DART (CCE-DART) sub-study are assessing the use of digital tools for monitoring patient data in phase 1 or 2 trials. Alongside, monitors in the UK are stabilizing on-site visits for crucial tasks with remote monitoring for data review.

| Company | Description |

| IQVIA Inc | Its offerings include integration of specialized therapeutic expertise with sophisticated risk-based monitoring (RBM) and real-world data analytics. |

| Charles River Laboratories | They facilitate a global network of clinical pathology labs to assist Phase I-III trials with hematology, biochemistry, and urinalysis under GCP standards. |

| ICON Plc | A firm explores a tech-enabled model by combining on-site, remote, and centralized monitoring. |

| Parexel International Corporation | Its offering encompasses Phase I to IV studies with over 2,500 sites and 80+ ex-agency regulators. |

| WuXi AppTec | They facilitate a complete set of various services, from early-stage discovery to late-stage clinical monitoring and bioanalysis. |

| Syneos Health | Their offering comprises clinical trial management, clinical research associates, and site monitoring leads. |

| Labcorp Drug Development | A company provides an end-to-end oncology clinical trial monitoring and assistance framework |

| PPD Inc. | It is exploring comprehensive, technology-enabled monitoring solutions for oncology clinical trials. |

| Medpace, Inc. | A firm is emphasizing vital study using centralized data reviews, on-site monitoring, and remote visits to confirm safety and data integrity. |

| Allucent | Their offerings include experienced monitors skilled in RECIST/CTCAE criteria, complex medical records, and precision patient recruitment. |

By Phase

By Study Design

By Cancer Type

By Region

February 2026

February 2026

February 2026

February 2026