February 2026

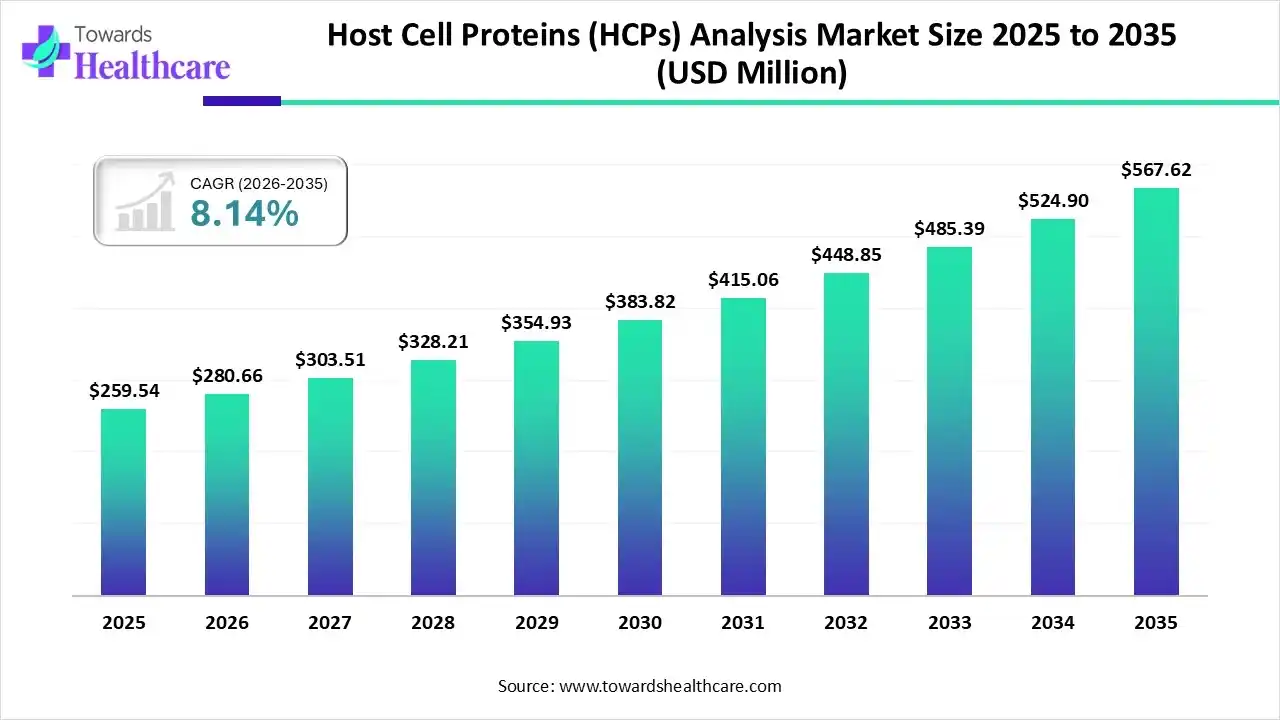

The global host cell proteins (HCPs) analysis market size was estimated at USD 259.54 million in 2025 and is predicted to increase from USD 280.66 million in 2026 to approximately USD 567.62 million by 2035, expanding at a CAGR of 8.14% from 2026 to 2035.

The market is expanding steadily, driven by increasing biologics and biosimilars production, stringent regulatory requirements, and rising demand for advanced analytical techniques to ensure product safety, purity, and quality.

Host cell protein analysis is the process of detecting and quantifying residual proteins from host cells used in biologic manufacturing to ensure product purity, safety, and regulatory compliance. The host cell proteins (HCPs) analysis market is growing due to the rapid expansion of biologics and biosimilars manufacturing. Stringent regulatory guidelines mandate the detection of residual host cell impurities to ensure drug safety and efficacy. Additionally, advancements in analytical technologies such as ELISA and mass spectrometry, along with increased outsourcing to specialized testing providers, are further accelerating market growth.

| HCP Analysis Techniques | Year of Development /Adoption | Type of Test |

| Multi-Reflecting ToF LC-MS | 2025 | High-resolution LC-MS proteomics test |

| Sensitivity-Enhanced TMT-Labelled MS | 2025 | Mass Spectrometry with single boosting for deep profiling |

| High-Throughput LC-MS Workflow | 2024 | Streamlined LC-MS identification & quantification |

| Advanced LC-MS Sample Prep Strategies | 2024-2025 | Improved digestion and preparation for robust measurement |

Artificial intelligence can revolutionize the host cell proteins (HCPs) analysis market by enabling faster and more accurate data interpretation, predictive impurity profiling, and automated assay optimization. AI-driven analytics can enhance sensitivity in detecting low-level HCPs, reduce manual errors, and shorten development timelines. Additionally, machine learning models support real-time process monitoring, improving quality control efficiency and ensuring consistent regulatory compliance.

| Key Elements | Scope |

| Market Size in 2026 | USD 280.66 Million |

| Projected Market Size in 2035 | USD 567.62 Million |

| CAGR (2026 - 2035) | 8.14% |

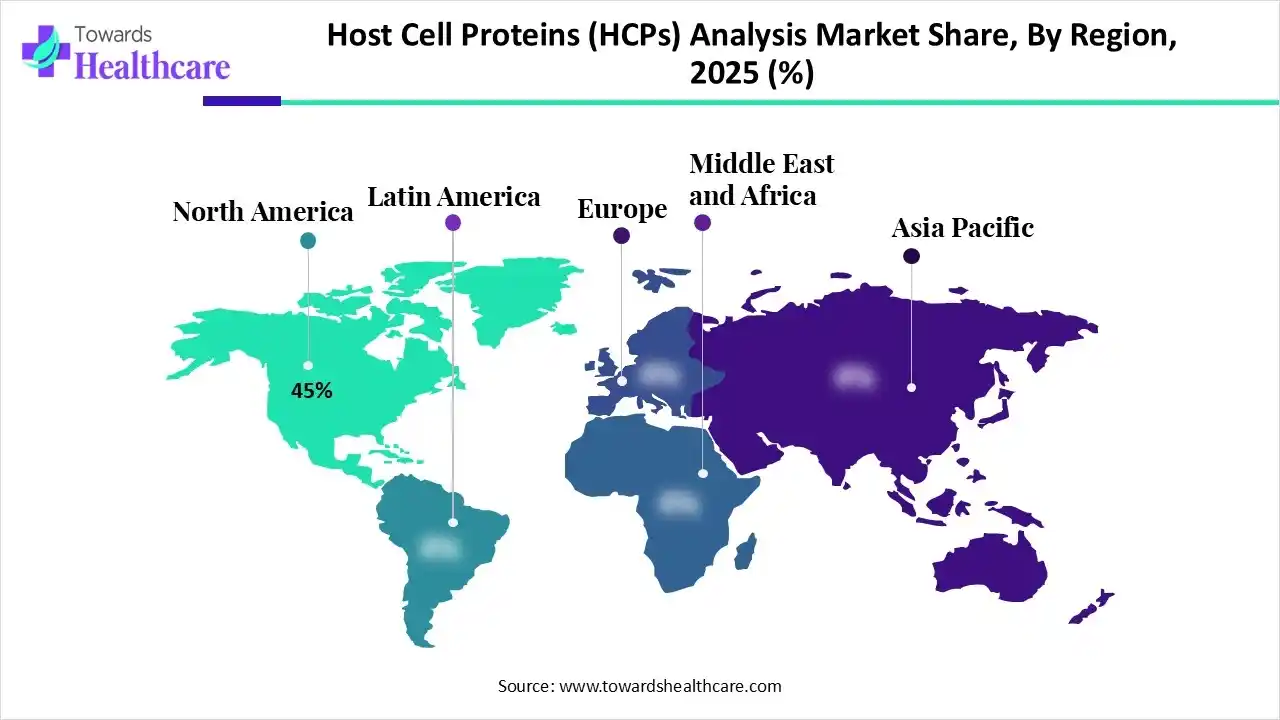

| Leading Region | North America by 45% |

| Market Segmentation | By Technology, By Application, By End-User, By Region |

| Top Key Players | Cygnus Technologies (Maravai LifeSciences) , Thermo Fisher Scientific Inc., Bio-Rad Laboratories, Inc., Charles River Laboratories, Merck KGaA (MilliporeSigma) |

Why Did the ELISA-based Assays Segment Dominate in the Market in 2025?

The ELISA-based assays segment dominated the host cell proteins (HCPs) analysis market with a share of approximately 38% in 2025 due to its proven reliability, high sensitivity, and strong regulatory acceptance for routine HC monitoring. ELISA assays are cost-effective, easy to standardize, and well-suited for high-throughput testing, making them ideal for quality control across large-scale biologics and biosimilars manufacturing processes, supporting consistent compliance and product safety.

Mass Spectrometry (LC-MS/MS)

The mass spectrometry (LC-MS/MS) segment is expected to grow at the fastest CAGR during the forecast period due to its ability to provide detailed identification, quantification, and characterization of individual HCPs. Unlike traditional assays, LC-MS/MS offers higher sensitivity, broader protein coverage, and deeper impurity, making it increasingly valuable for complex biologics, biosimilars development, and advanced regulatory submission.

How the Quality Control (QC) Segment Dominated the Host Cell Proteins (HCPs) Analysis Market in 2025?

The quality control (QC) segment dominated the market in 2025 due to the critical need for routine monitoring of residual impurities during biologics manufacturing. Strict regulatory requirements mandate consistent HCP testing to ensure product safety, purity, and batch-to-batch consistency. High testing frequency, standardized workflow, and widespread adoption of validated assays further strengthened QC's dominant market position.

Biopharmaceutical Manufacturing

The biopharmaceutical manufacturing segment is expected to grow at the fastest CAGR during the forecast period due to the expanding production of complex biologics and biosimilars. Increasing process complexity requires continuous HCP monitoring across upstream and downstream stages. Additionally, rising regulatory scrutiny, scale-up activities, and the need for real-time impurity control are driving greater adoption of HCP analysis throughout manufacturing workflows.

Why the Biopharmaceutical Companies Segment Dominated the Host Cell Proteins (HCPs) Analysis Market?

The biopharmaceutical companies segment dominated the market with a revenue share of approximately 60% due to their direct involvement in biologics and biosimilars development and large-scale manufacturing. These companies conduct frequent HCP testing to meet strict regulatory requirements, ensure product safety, and maintain batch consistency. Strong in-house analytical capabilities, high testing volumes, and continuing process optimization further supported their leading market share.

Contract Research Organizations (CROs)

The contract research organizations (CROs) segment is expected to grow at the fastest CAGR during the forecast period due to increasing outsourcing of analytical and quality testing by biopharmaceutical companies. CROs offer cost-effective, specialized HCP analysis expertise, advanced instrumentation, and regulatory support. Growing biologics pipelines, faster development timelines, and limited in-house capabilities are driving greater reliance on CRO services.

North America dominated the global host cell proteins (HCPs) analysis market with a share of approximately 45% in 2025 due to its strong biopharmaceutical industry, high biologics and biosimilars production, and early adoption of advanced analytical technologies. The presence of major biopharma companies, well-established CROs, and stringent regulatory frameworks, requiring rigorous impurity testing, further supported high demand for HCP analysis solutions across research, development, and commercial manufacturing stages.

U.S. Market Trends

The U.S. led the host cell proteins (HCPs) analysis market in 2205 by capturing the largest revenue share due to its strong concentration of biopharmaceutical companies, extensive biologics pipelines, and high manufacturing volumes. Stringent FDA regulatory requirements increased the need for rigorous HCP testing across development and commercial stages. Additionally, early adoption of advanced analytical technologies, strong CRO presence, and sustained R&D investments further reinforced the country’s market leadership.

Asia Pacific is anticipated to grow at the fastest CAGR in the host cell proteins (HCPs) analysis market during the forecast period due to the rapid expansion of biopharmaceutical manufacturing, increasing biologics and biosimilars production, and rising investments in life science infrastructure. Growing outsourcing to regional CROs, improving regulatory frameworks, and cost-effective manufacturing capabilities are accelerating demand for HCP analysis across research, development, and commercial manufacturing activities.

India Market Trends

India is anticipated to grow at a rapid CAGR during the forecast period due to its expanding biopharmaceutical manufacturing base, rising biosimilars development, and increasing investments in life science infrastructure. Strong presence of contract research and manufacturing organizations, cost-effective operations, growing regulatory alignment with global standards, and increasing focus on quality and compliance are driving higher adoption of HCP analysis across development and production stages.

Europe is expected to grow at a notable CAGR in the host cell proteins (HCPs) analysis market during the forecast period due to its well-established biopharmaceutical industry and increasing biologics and biosimilars development. Stringent regulatory requirements emphasize robust impurity profiling, driving demand for HCP analysis. Additionally, rising R&D investments, strong academic-industry collaboration, and growing outsourcing CROs are supporting consistent market expansion across the region.

UK Market Trends

The UK is anticipated to grow at a rapid CAGR during the forecast period due to its strong life science ecosystems, increasing biologics and advanced therapy developments, and supportive government initiatives. Rising investments in biopharmaceutical R&D, expanding presence of CROs and CDMOs, and strict regulatory focus on product quality and safety are driving higher adoption of HCP analysis across development and manufacturing activities.

| Companies | Headquarters | Offering |

| Cygnus Technologies (Maravai LifeSciences) | California, US | Platform-specific and custom HCP ELISA kits, orthogonal impurity testing. |

| Thermo Fisher Scientific Inc. | Massachusetts, US | HCP ELISA kits, LC-MS/MS instruments, and integrated HCP analysis workflows. |

| Bio-Rad Laboratories, Inc. | California, US | HCP ELISA kits, immunoassay reagents, and QC testing solutions. |

| Charles River Laboratories | Massachusetts, US | HCP testing services, custom ELISA development, and MS-based HCP profiling. |

| Merck KGaA (MilliporeSigma) | Darmstadt, Germany | HCP ELISA kits, sample preparation reagents, and MS-compatible impurity analysis tools. |

By Technology

By Application

By End-User

By Region

February 2026

February 2026

February 2026

January 2026