November 2025

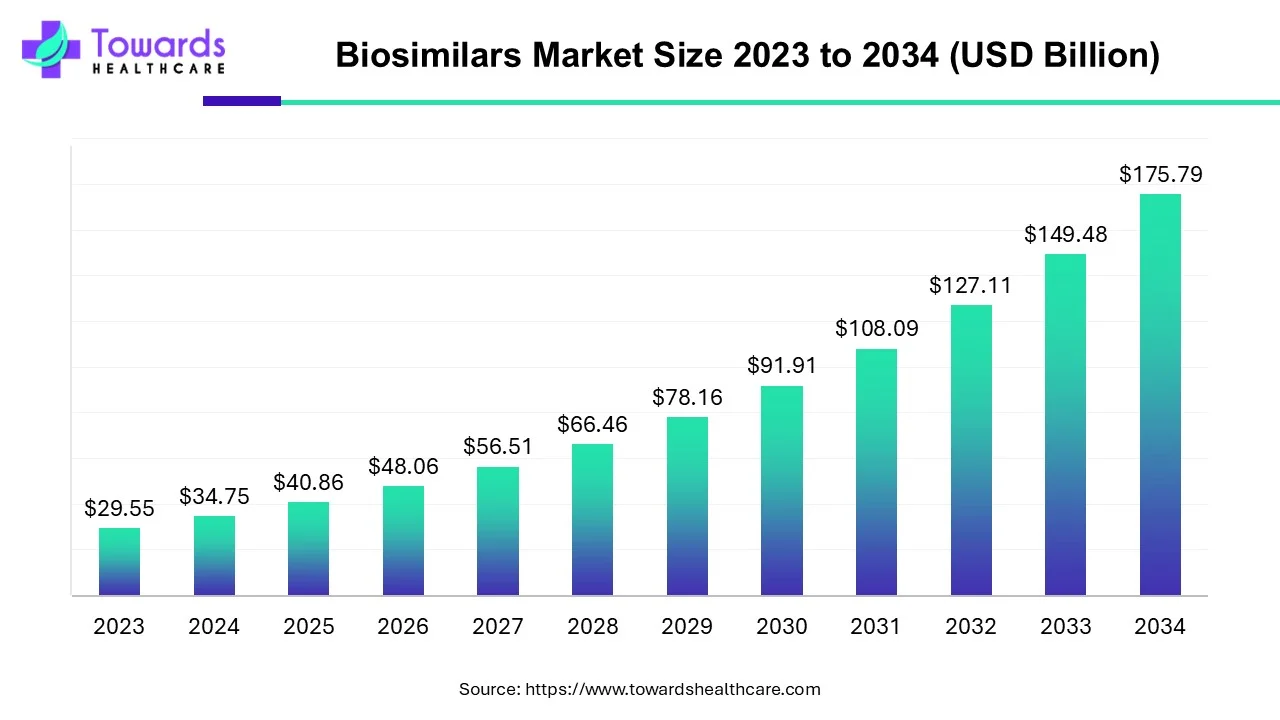

The global biosimilar market size is estimated to grow from USD 34.75 billion in 2024 at 17.6% CAGR (2025 to 2034) to reach an estimated USD 175.79 billion by 2034, as a result of the rising prevalence of cancer, and cost effectivity of biosimilars.

Biosimilars are biological products that are highly similar to and have no clinically meaningful differences from, an existing FDA-approved reference product. They are also referred to as follow-on biologics, subsequent-entry biologics, or biogenerics. Biosimilars are not identical to their reference products, as they are derived from living cells that may have slight differences in their manufacturing processes. However, they have demonstrated similar efficacy, safety, and quality as their reference products in rigorous clinical trials.

Biosimilars offer significant cost savings compared to their reference products, making them an attractive option for patients, healthcare providers, and payers. The biosimilar market has been growing rapidly in recent years, driven by patent expirations of several biologic drugs and increasing demand for affordable biologic treatments.

The development and approval of biosimilars involve complex regulatory processes, as they are subject to more rigorous requirements compared to traditional generic drugs. Biosimilar manufacturers must demonstrate a high degree of similarity to their reference products in terms of quality, safety, and efficacy through extensive clinical studies. This involves conducting head-to-head comparisons of the biosimilar and the reference product in clinical trials to demonstrate their similarity.

Additionally, chronic diseases like rheumatoid arthritis, anemia, leukopenia, inflammatory bowel disease, psoriasis, and different types of cancer are treated with biosimilars. Moreover, these medications should cost 10 to 40% less than their reference products. More patients will have access to these medications as a result, which encourages adherence and enhances health outcomes for those patients who most need them. Biosimilars may cause patients to switch to more affordable treatments. They might also increase competition in the market for biologics, forcing businesses to change their prices in order to draw in and keep customers. In fact, it has been calculated that in their first ten years on the market, FDA-approved biosimilars could save consumers and the healthcare system up to $250 billion.

Artificial intelligence (AI) revolutionizes the way biosimilars are developed, improving efficiency in time and quality of research and production of these medications. AI can assist researchers in decoding the complex structures of proteins, making it easier to develop biosimilars. AI and machine learning (ML) algorithms can assess the properties of biosimilars. Convolutional neural networks help monitor the morphological features of particles in biosimilars and enable the tracking of the consistency of particles in a drug product. AI and ML can also aid in optimizing manufacturing processes, enhancing accuracy, and reducing manual errors. AI-enabled predictive analytics can anticipate problems in production and supply chain, optimize logistics, and reduce costs. Additionally, ML and deep learning tools can analyze large volumes of data from preclinical and clinical studies.

Biosimilars are emerging as a promising option for cancer treatment, offering a more affordable and accessible alternative to expensive biologic drugs. Biologics are complex, large-molecule drugs that are derived from living cells and are widely used in cancer treatment. However, the high cost of biologics has limited access to cancer treatment for many patients, especially in developing countries.

Biosimilars, on the other hand, are designed to be highly similar to the original biologic drug, with no clinically meaningful differences in terms of safety, efficacy, and quality. They offer a more affordable alternative to biologics while maintaining similar clinical outcomes.

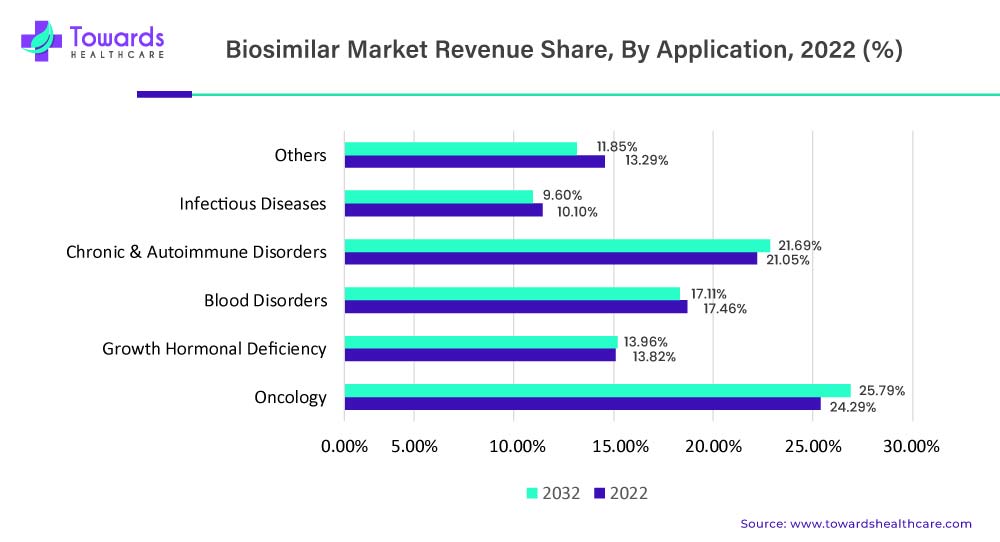

Several biosimilars have been approved for cancer treatment, including biosimilars of monoclonal antibodies used in the treatment of breast cancer, colorectal cancer, and non-Hodgkin's lymphoma. Biosimilars of granulocyte colony-stimulating factor (G-CSF) have also been approved for the treatment of neutropenia, a common side effect of chemotherapy. The oncology applications accounted for contributing the largest market share of around 24.29% in 2022 and are further projected to continue their dominance and register the fastest growth in the upcoming years.

The use of biosimilars in cancer treatment has the potential to increase access to life-saving treatments for patients, particularly in low- and middle-income countries where cost is a major barrier to treatment. Biosimilars can also help reduce the financial burden on healthcare systems, allowing more patients to receive the treatment they need. Biosimilars have become an important part of cancer treatment as they offer more affordable and accessible options for these critical therapies.

However, there are also concerns about the safety and efficacy of biosimilars, as they are not exact copies of the original biologic drug. While regulatory agencies require biosimilars to undergo extensive testing and clinical trials before approval, some experts argue that more research is needed to fully understand the long-term safety and efficacy of biosimilars. Biosimilars have the potential to play a significant role in addressing the growing burden of cancer worldwide, by improving access to affordable and effective treatments. However, ongoing research and monitoring will be necessary to ensure that biosimilars are safe and effective for patients.

Biosimilars also offer significant cost savings for healthcare systems and insurers, which has led to greater investment in their development and increased collaboration between biosimilar manufacturers and healthcare providers. As more biosimilars become available, patients will have greater access to affordable and effective treatments, improving their quality of life and overall health outcomes.

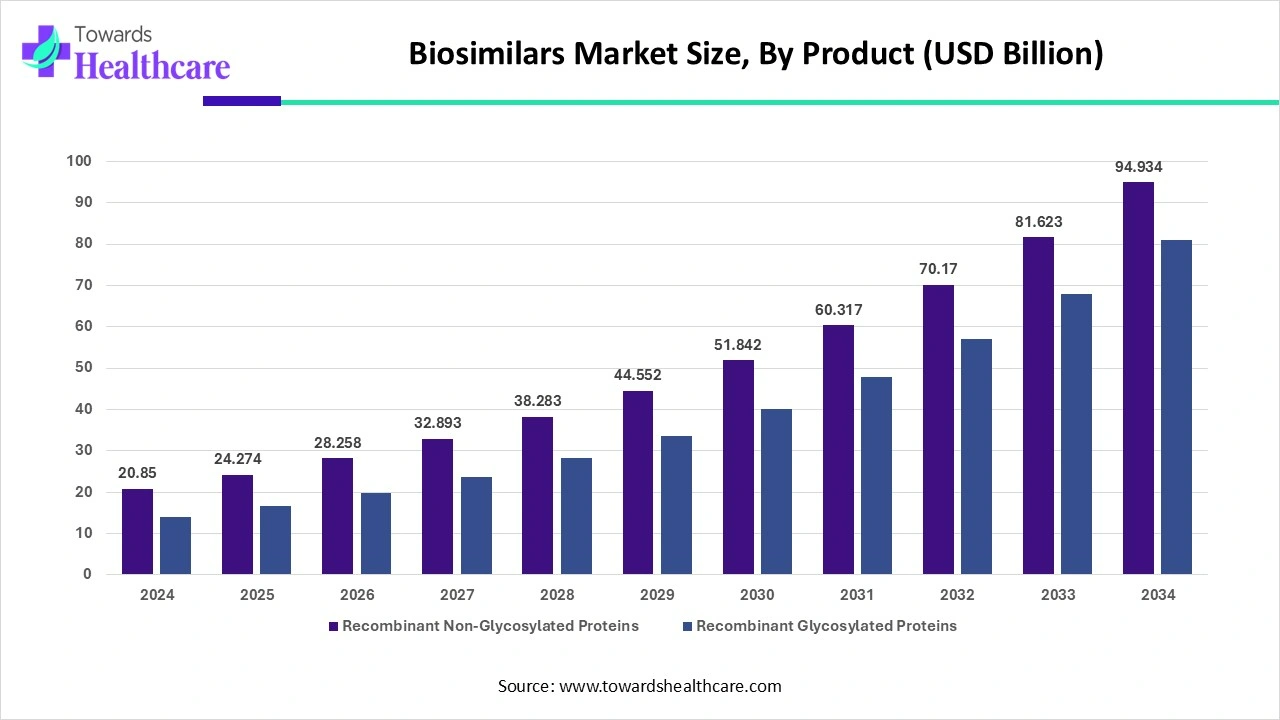

By product, the recombinant non-glycosylated proteins segment held a dominant presence in the market in 2024. Recombinant non-glycosylated proteins refer to proteins produced through recombinant techniques and do not have glycosylation. They contain growth hormones, insulin, and interferon. These proteins are used to treat a wide range of chronic disorders. The rising incidences of chronic disorders such as cancer and diabetes potentiate the segment’s growth.

By product, the recombinant glycosylated proteins segment is projected to expand rapidly in the market in the coming years. Recombinant glycosylated proteins refer to proteins that are produced through recombinant technique and have been modified with sugar molecules after translation, i.e., glycosylated. Some examples of recombinant glycosylated proteins include insulin, growth factors, hormones, monoclonal antibodies, etc. They are modified to achieve the desired therapeutic effect. Technological advancements and increasing R&D investments promote the segment’s growth.

By application, the chronic & autoimmune disorders segment led the global biosimilars market in 2024. The rising incidences and prevalence of autoimmune disorders and other chronic disorders favor the development of novel biosimilars. It is estimated that around 1 in 10 individuals suffer from autoimmune disorders globally. In the U.S. more than $100 billion are spent for the treatment of autoimmune disorders. The use of biosimilars significantly reduces the cost of treatment. Thus, the rising prevalence of biosimilars and high treatment expenses propel the segment’s growth.

By application, the oncology segment is anticipated to grow with the highest CAGR in the market during the studied years. The increasing incidences and prevalence of cancer, growing cancer therapeutics research, and new product launches augment the segment’s growth. One or more biosimilars for around 7 biologicals used for treating cancer are commercially available in the U.S.

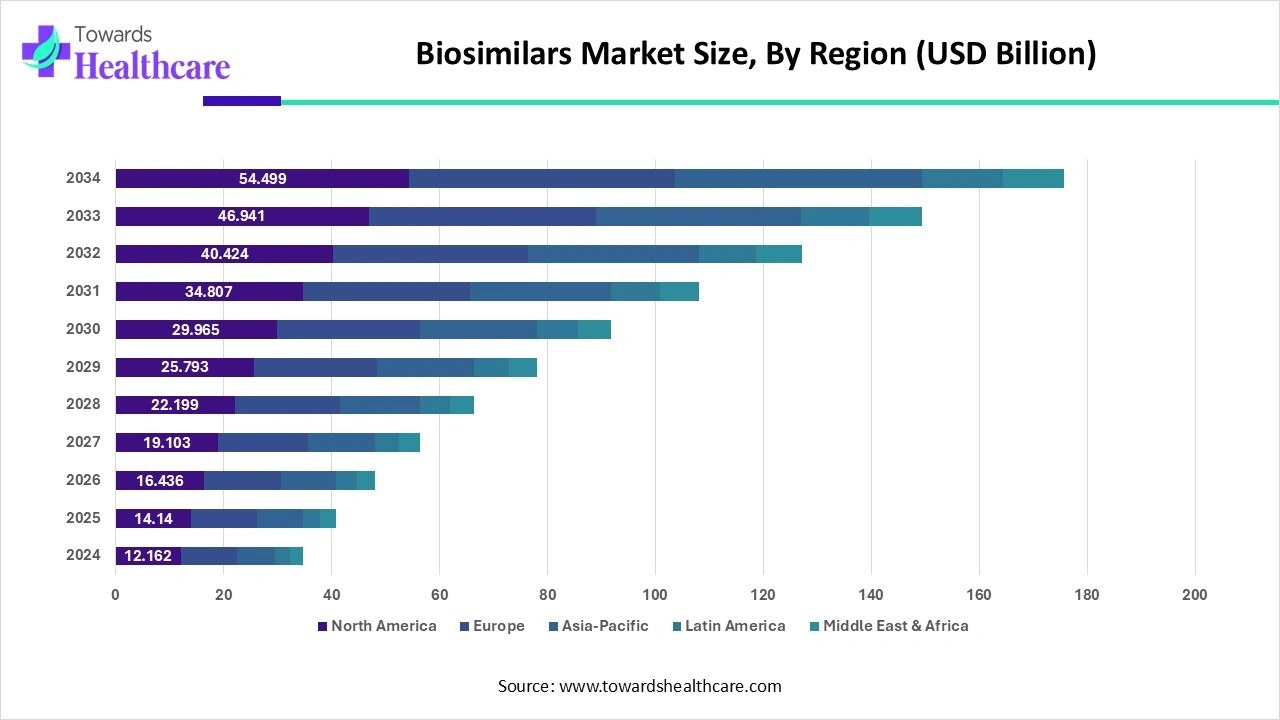

North America held the largest share of the biosimilars market in 2024. The favorable regulatory frameworks by regulatory agencies of the U.S. and Canada result in new product launches in the region. The U.S. Food and Drug Administration approved 3 biosimilars each in the first and second quarters of 2024. Likewise, Health Canada approved 6 biosimilars in 2023 for different diseases. In Canada, a total of 59 biosimilars are approved as of March 2024. The state-of-the-art research and development facilities potentiate the development of novel biosimilars. According to IQVIA, the spending on biosimilars is estimated to increase to $20-49 billion in 2027 and cumulative sales of $129 billion over five years.

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period. The growing research and development activities, increasing healthcare expenditure, and the rising number of patent expiries drive the market. China has the highest number of patents in the region. As of March 2024, China filed 67 new patents for biologics. The rising incidences of chronic disorders also augment the market growth. The increasing number of product launches also potentiates the market. As of February 2023, China’s NMPA approved more than 20 biosimilars. India is regarded as the “Pharmacy of the World.” It exports more than 60% of the global vaccine demand. India ranks 6th globally in terms of patent applications, with 64,480 patent filings in 2023.

Europe is estimated to host a significantly growing biosimilars market during the forecast period. This is because of the rise in technological advancements as well as patient demands. This is further supported by the government, which enhances the market growth.

UK Market Trends

The industries in the UK are adopting various technological advancements, which in turn, amplify the manufacturing process as well as the research conducted on biosimilars. This also increases the collaboration between industries.

Germany Market Trends

Due to the rising demand for the use of biosimilars, the industries in Germany are focusing on the development of the same for various diseases. This is also supported by the government investments as well as regulatory bodies, which help in the approval process. Furthermore, due to the compliance with the guidelines, it also increases the safety and satisfaction of the patients.

The Middle East & Africa are considered to be a significantly growing area, due to the rising prevalence of chronic and rare disorders and the growing demand for personalized medicines. People mostly prefer affordable treatments due to the rising economic burden of chronic diseases. The growing research and development activities facilitate the development of novel biosimilars. The MENA nations have favorable regulatory frameworks for generic alternatives to biologics.

UAE Market Trends

Companies like Biocon Biologics, BioLogic, and Biologix Pharma are the major manufacturers and distributors of biosimilars in the UAE. Pharmaceuticals account for approximately 35% of the total healthcare expenditure in the Health Authority Abu Dhabi (HAAD). This potentiates the demand for biosimilars.

Saudi Arabia Market Trends

The Saudi Food and Drug Authority (SFDA) regulates the approval of biosimilars in Saudi Arabia. As of 2024, the SFDA has approved a total of 38 biosimilars for different indications. It is estimated that the Kingdom of Saudi Arabia spends about 20% of its total health expenditure on pharmaceuticals.

They have been a driving force for growth in the pharmaceutical industry in recent years, as they offer a cost-effective alternative to the reference product. Biosimilars are approved based on their similarity to the reference product, rather than through clinical trials, which reduces the cost of development and speeds up the approval process.

One of the significant benefits of biosimilar drugs is their potential to reduce healthcare costs. Biosimilars are typically priced lower than their reference products, as the cost of development is lower due to the use of an already approved drug as a reference. This lower pricing allows for increased access to life-saving treatments and improved healthcare outcomes, particularly in developing countries. The biosimilar market has been growing rapidly, with many companies investing in the development and commercialization of biosimilar drugs.

A biosimilar's cost-effectiveness is determined by its relative effectiveness because it is anticipated to be less expensive than the biological comparator. The American Journal of Managed Care reports that the cost of biosimilars is roughly 30% less than that of their parent or branded counterparts. Biosimilars offer patients access to highly effective therapies while also saving money. In comparison to innovator biologics, the cost of developing biosimilars is cheaper. The price of a biosimilar will be lower since R&D expenses will be lower. Due to manufacturer pricing rivalry, less expensive biosimilars frequently cause reference biologics to cost less.

In the upcoming years, demand for biosimilar medications is anticipated to rise due to its notable cost-to-benefit ratio. Less than 10% of the average sales price was typically offered as a launch discount for the majority of biosimilars in the US, followed by an average annual price drop of 10% to 15%. When more biosimilars hit the market, including those that treat chronic conditions in which there are more than five competitive medicines, businesses need to think about how this approach might alter. For example, the introduction of up to 8 adalimumab biosimilars in the United States in 2023 may bring about certain market dynamics. Companies producing biosimilars should think about the best distribution method and strategy for each medication in each market.

The global biosimilars market has been experiencing significant growth in recent years, driven in part by a surge in the number of cancer patients worldwide. As more people are diagnosed with cancer, there is a greater demand for treatments, including biologic drugs such as monoclonal antibodies and growth factors. However, these treatments can be expensive, and many patients may not have access to them due to cost barriers.

Biosimilars have become an important part of cancer treatment in recent years, offering patients more affordable and accessible options for critical therapies. Many biologic drugs used in cancer treatment, such as monoclonal antibodies and growth factors, are expensive and can be difficult for patients to access due to high costs. Biosimilars offer a more cost-effective alternative that can increase patient access to life-saving treatments.

One example of a biosimilar used in cancer treatment is trastuzumab, which is used to treat HER2-positive breast cancer. The biosimilar version of trastuzumab has been shown to be just as effective as the original drug in clinical trials, while also being more affordable for patients. Biosimilars of other cancer treatments, such as bevacizumab and rituximab, have also been developed and are being used in many countries around the world.

In addition, biosimilars have the potential to provide significant cost savings for healthcare systems and insurers, who are under pressure to reduce spending on expensive biologic treatments. This has led to greater interest and investment in biosimilar development, as well as increased collaboration between biosimilar manufacturers and healthcare providers to improve patient access and uptake.

The surge in cancer patients, combined with the cost savings and other benefits offered by biosimilars, is driving the growth of the biosimilars market. As more biosimilars become available, patients will have greater access to affordable and effective treatments, improving their quality of life and overall health outcomes.

The development and manufacturing of biosimilars can be a significant challenge for companies in the biopharmaceutical industry due to its high complexity and associated costs. Compared to traditional small-molecule drugs, biosimilars are larger and more complex molecules, which require extensive research and development efforts to demonstrate similarity to the reference biological drug.

The manufacturing of biosimilars is complex and presents significant challenges compared to traditional small-molecule drugs. One of the main difficulties in biosimilar manufacturing is ensuring that the final product is highly similar to the reference biologic drug, both in terms of its physical structure and biological activity. This requires a highly controlled manufacturing process that must be carefully designed and optimized to ensure that the product consistently meets the required quality and safety standards.

Another challenge in biosimilar manufacturing is the variability in raw materials, which are derived from living cells and can be highly sensitive to changes in manufacturing conditions. This can lead to variations in the final product, which can affect its safety and efficacy. To mitigate this, manufacturers need to implement rigorous quality control measures throughout the manufacturing process to ensure that the final product meets the necessary specifications.

The manufacturing process for biosimilars involves the use of living cells and specialized equipment, which can be expensive to acquire and maintain. The production process also requires stringent quality control measures to ensure the consistency and safety of the final product. This necessitates the need for significant investments in equipment, infrastructure, and expertise.

In addition to the complexity and cost of development and manufacturing, regulatory requirements can also act as a restraint in the biosimilar market. The regulatory pathway for biosimilars is different from that of traditional small-molecule drugs and requires extensive clinical testing to demonstrate safety and efficacy. This can result in a longer time to market and increased development costs.

Patent expirations of biologic drugs have opened up opportunities for biosimilar manufacturers to enter the market and offer lower-cost alternatives to patients. This has led to increased competition and price pressure, driving the growth of the biosimilar market. In addition, the search for new indications for existing biologic drugs has also created opportunities for biosimilar manufacturers. As more indications are discovered and approved for biologic drugs, there is a growing demand for biosimilars to provide more affordable options for these treatments.

Furthermore, the increasing adoption of biosimilars by healthcare providers and patients is another opportunity for the biosimilar market. As more data becomes available on the safety and efficacy of biosimilars, and as healthcare systems seek to reduce costs, the use of biosimilars is expected to increase.

The development of biosimilars for complex biologic drugs, such as monoclonal antibodies, also presents an opportunity for biosimilar manufacturers. While the development and manufacturing of biosimilars for these drugs can be challenging, the potential market size and cost savings make it an attractive opportunity for manufacturers who can successfully navigate the regulatory and technical hurdles. In recent years, there have been more biologics for which patents have expired. As a result, the focus has shifted to the creation of biosimilars. Because there are so many biosimilars in various stages of development, the market for biologics is probably going to slow down soon.

The increasing demand for biosimilars in emerging markets, such as Asia and Latin America, presents a significant growth opportunity for biosimilar manufacturers. As these markets continue to grow and develop, the demand for affordable biologic drugs is expected to increase, creating a larger market for biosimilars.

The biosimilar market has seen a surge in start-up companies in recent years, creating a thriving ecosystem of innovative companies focused on developing biosimilar drugs. These start-ups are often smaller, nimbler, and more focused than traditional pharmaceutical companies, allowing them to move quickly and take on higher levels of risk. One of the main advantages of biosimilar start-ups is their ability to focus on niche markets and specific therapeutic areas, rather than attempting to compete directly with established biopharmaceutical companies. This allows them to develop biosimilars for conditions that are not well-served by existing treatments, as well as for diseases that are prevalent in developing countries but may not be a priority for larger pharmaceutical companies.

Another advantage of biosimilar start-ups is their ability to leverage new technologies and manufacturing processes, often at a lower cost than traditional biopharmaceutical companies. This allows them to develop biosimilars more quickly and at a lower cost, potentially improving patient access and affordability.

However, biosimilar start-ups also face significant challenges, including the high cost of research and development, the complex regulatory landscape, and the need for extensive manufacturing capabilities. Despite these challenges, the emergence of the biosimilar start-up ecosystem has brought increased innovation and competition to the biosimilar market, ultimately benefiting patients by providing more affordable and accessible treatments.

Despite these challenges, biosimilar start-ups are expected to play an important role in the development and commercialization of biosimilars in the coming years, as the demand for these treatments continues to grow and more patents on reference biologics expire. With their focus on innovation, cost-effectiveness, and patient access, biosimilar start-ups have the potential to transform the biopharmaceutical industry and improve healthcare outcomes for patients around the world.

Richard Saynor, CEO of Sandoz, announced that the company’s sales reached $623 million in the first three months of 2024, an increase of 21% from the first quarter of last year. He also added that the biosimilar sales represented 25% of the total company sales. The rising trend was due to Hyrimoz biosimilar and the recently acquired Cimerli biosimilar. He envisioned that the recent acquisition will lay a stronger foundation of the company for future product launches.

By Product

By Application

By Region

November 2025

November 2025

November 2025

November 2025