March 2026

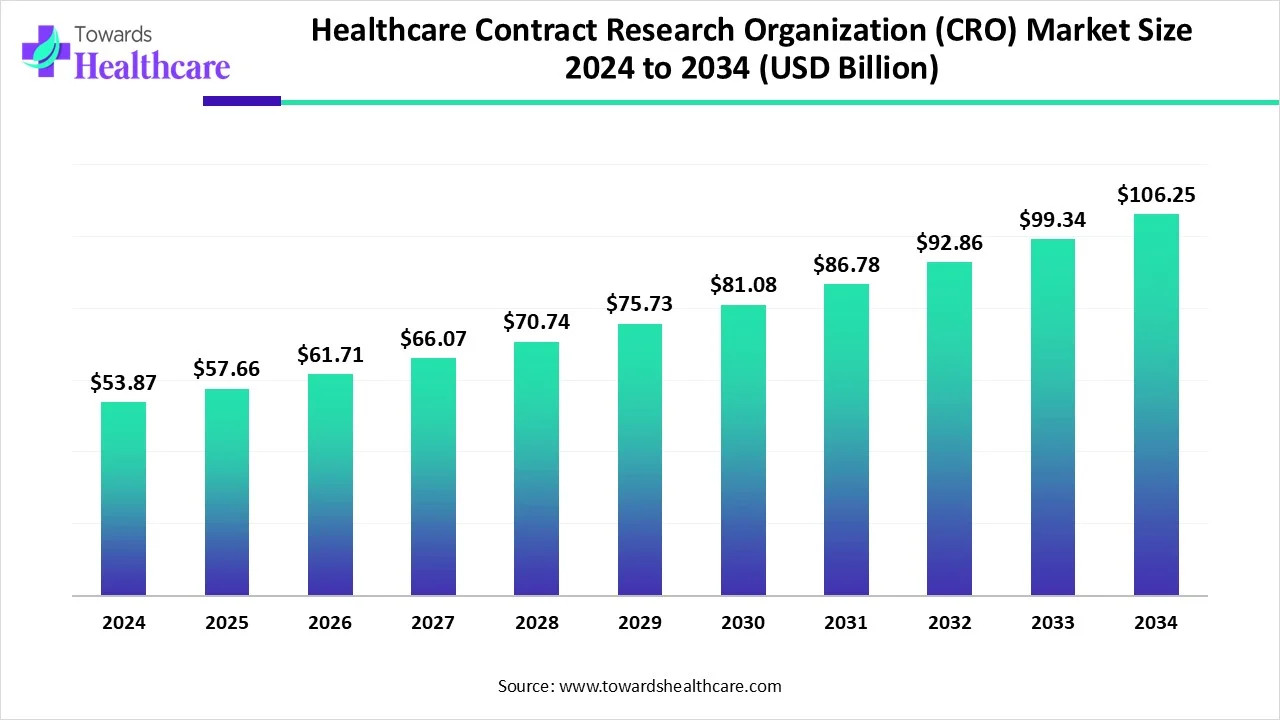

The global healthcare contract research organization (CRO) market size is calculated at USD 53.87 in 2024, grew to USD 57.66 billion in 2025, and is projected to reach around USD 106.25 billion by 2034. The market is expanding at a CAGR of 7.04% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 57.66 Billion |

| Projected Market Size in 2034 | USD 106.25 Billion |

| CAGR (2025 - 2034) | 7.04% |

| Leading Region | North America |

| Market Segmentation | By Type, By Service, By Therapeutic Area, By Molecule, By Region |

| Top Key Players | ICON Plc, Charles River Laboratories, Syneos Health, IQVIA Inc., GVK Biosciences Private Limited (Aragen), LabCorp, Parexel International Corporation, Thermo Fisher Scientific, CTI Clinical Trial & Consulting, PSI, Medpace, Ergomed, WuXi AppTec, Worldwide Clinical Trials, Medidata Solutions, Inc, Pharmaron GMBH, SGS SA, KCR S.A., Advanced Clinical Research Services, LLC, Pharm-Olam, LLC (Allucent) |

The healthcare contract research organization (CRO) market is growing rapidly due to that provides clinical trial services for various industries such as biotechnology, pharmaceutical, and medical device industries. There are various types of CROs, but typical CRO services in the medical device sector include clinical trial planning, regulatory affairs, site selection and initiation, clinical monitoring, recruitment support, management of data management, trial logistics, medical writing, biostatistics, and management of project management. CROs also facilitate the process of drug development through managing different features of clinical trials, including data collection, patient recruitment, study design, reporting results, and government compliance. CROs decrease operational expenses through offering access to expertise and resources without the requirement for extensive internal infrastructure, which causes the growth of the market.

AI Integration in the Healthcare Contract Research Organization is driving the growth of the market as applications of AI in CROs provide several benefits, like enhanced data quality, improved safety of patient safety, and quicker trial completion. AI-based data analysis detects outliers and anomalies that may impact the results of the trial, ensuring data integrity and reliability of the data. The integration of AI into medical care services promises heightened diagnostic accuracy, informed decision-making strategy, and optimized planning of the treatment, therefore potentially lowering medical errors and enhancing outcomes for the patients.

Rising Pharmaceutical Investment

The scope and length of clinical development are being stretched by the pharmaceutical industry's increasing investment in advanced therapies such as gene editing, antibody-drug conjugates, and trispecific antibodies. These therapies require complex trial designs, extended research timelines, and specialized expertise; thus, they significantly increase operational and financial burdens on sponsors. Precision medicine has further intensified the cost by demanding patient recruitment strategies and trial protocols that are personalized and complex. To deal with these challenges while enhancing efficiency, most pharma companies, as well as biotech firms, are increasingly adopting a strategy of outsourcing clinical development work to CROs. This trend will allow sponsors to decrease overhead costs, access therapeutic and regulatory knowledge, and also expedite go-to-market timelines, which in turn becomes a major driver for the growth of the global healthcare contract research organization (CRO) market.

Regulatory Complexity

The passage of drug development through the complicated and heterogeneous regulatory systems of the global marketplace is an enormous challenge for contract research organizations (CROs) and pharmaceutical companies. At the same time, as regulators tighten their rules to protect patients and ensure data integrity, they have increased compliance burdens, which in turn lead to longer approval times, higher operational costs, and more administrative overhead for CROs, especially those that work across multiple jurisdictions.

Technological Innovation

The trial landscape is transforming with the advanced technologies, such as artificial intelligence (AI) and machine learning, revolutionizing the space while offering significant opportunities to Contract Research Organizations (CROs). Integrating robust remote access solutions into contingency plans as well as core operational strategies will enable CROs to keep trials up and running when physical sites are disrupted. It is these flexible capabilities that not only protect CRO operations in the future but also allow them to take advantage of changes in demand within the healthcare and life sciences sectors, hence driving growth within the global market for CRO services.

By type, the clinical services segment dominated the healthcare contract research organization (CRO) market in 2024 as CROs provide a broad range of services to medicinal organizations, including data management, clinical trial management, and consulting in regulatory affairs. By collaborating with a CRO, medicinal companies access all of these services in a single location, instead of working with multiple vendors, which helps to streamline the clinical trial management process and reduces the requirement for extra resources and expertise, also controlling the cost of the product.

By type, the preclinical studies segment is projected to witness rapid growth during the forecast period in the healthcare contract research organization (CRO) market in 2024. Preclinical CROs have access to modern facilities, technologies, and equipment which not readily available in-house for biotechnology and pharmaceutical organizations. By outsourcing to a CRO, consumers benefit from these resources and the need for potential investment. Preclinical CROs particularly focus on dedicated project management teams responsible for certifying that projects are performed in an efficient and timely manner. This comprises coordinating actions such as monitoring progress, managing timelines, and confirming that resources are allocated efficiently to meet the goal of the project.

By service, the clinical monitoring segment dominated the healthcare contract research organization (CRO) market in 2024 as CROs increase their adoption of remote monitoring and remote site access of clinical trial technology in their business model. Its support in managing documents, either manually or via email, is time-consuming and difficult to track. CROs offer comprehensive management of clinical trials, with monitoring progress, keeping timelines and budgets, and coordinating the different teams.

By service, the regulatory/medical affairs segment is expected to grow at the fastest CAGR during 2025-2034. CRO provides instant access to virtually in conduct a successful clinical development program for the government. CROs support in mitigating challenges associated with drug development by ensuring detailed monitoring, planning, and compliance with government requirements. CROs offer expertise in handling different challenges that arise during clinical trials, reducing the likelihood of expensive delays and errors in clinical trials.

By therapeutic area, the oncology segment led the healthcare contract research (CRO) market in 2024. CRO plays a vital role in ensuring the integrity and accuracy of the data collected in the clinical trial. An oncology CRO acts as a tactical partner for cancer clinical trials, offering inclusive resources and services to ensure the effective execution of these complex studies. CROs support in navigating different regulatory necessities, design robust study protocols, select suitable analytical sites, and ensure compliance with proper guidelines in oncology studies.

By therapeutic area, the CNS disorders segment is anticipated to grow at the fastest CAGR in the healthcare contract research organization (CRO) market during the forecast period. CROs bring significant efficacy to CNS disorders related to clinical trials. CROs have established networks of investigators and sites, allowing rapid and effective patient CROs also provide proper data management systems that allow real-time access to study data, ensuring precise and appropriate decision-making strategy. CROs play a significant role in the smooth operation of CNS disorders clinical trials. Partnering with CROs also offers access to innovative methodologies and modern technologies.

By molecule, the pharmaceuticals segment led the healthcare contract research organization (CRO) market in 2024. CROs help in global drug development by offering access to worldwide networks of medical sites, culturally aware recruitment strategies, and local regulatory expertise. It facilitates multi-regional trials and ensures compliance with various government frameworks in different countries.

By molecule, the medical device segment is estimated to be significantly growing in the healthcare contract research organization (CRO) market during 2025-2034. Medical Device CRO offers extensive advantages that increase the efficacy of the development of the product, improve compliance, and eventually, enhance outcomes for patients. Advancements in technology are set to revolutionize the operations of medical device CROs. Revolutions like big data analytics and artificial intelligence are revolutionizing the data is processed and analysed in medical devices.

North America dominated the healthcare contract research organization (CRO) market in 2024, as North America is the hub of some of the major pharma organizations worldwide, and American customers have access to the most advanced medical products worldwide, although at a cost. North American companies are growing, outsourcing clinical trials and research activities to CROs. The biotech sector in North America is growing due to substantial venture capital in medical start-ups. In 2023, more than $20 billion in funds raised advanced ideas in biotech startups such as Beam Therapeutics. The government systems of North America, particularly the FDA regulatory novelty, tend to balance revolution with safety.

For Instance,

The United States presents a robust regulatory framework for sponsors and investigators, capitalizing on regional strengths while addressing various challenges. This approach is essential for advancing clinical research and introducing new therapies, consequently driving growth in the healthcare contract research organization market. Additionally, the flexible infrastructure in the United States supports clinical research coordination and administrative tasks for trials, further fueling market expansion. Health expenditure in the U.S. rose by 7.5% in 2023, reaching $4.9 trillion or $14,570 per person. This growth significantly outpaced the 4.6% increase seen in 2022, contributing to market growth. (Source - AMA)

In Canada, the pharmaceutical industry depends significantly on Contract Research Organizations (CROs) to streamline drug development. The growth of CROs has been fueled by heightened investment in research and development, an increase in clinical trials, and patent expirations. The country boasts a robust R&D ecosystem, a wealth of skilled professionals, top-notch academic institutions, extensive research networks, and abundant opportunities for collaborative research and skills enhancement, all of which bolster market growth.

For Instance,

Asia Pacific is estimated to host the fastest-growing healthcare contract research organization market during the forecast period, as the Asia Pacific (APAC) region provides a clinical trial environment that adheres to global standards, precisely the International Council for Harmonisation (ICH) and Good Clinical Practice (GCP) guidelines. A growing aging population expressly drives services of contract research organizations (CRO) as the enlarged demand for clinical trials, for instance, the number of persons aged 60 years or older who are living in Asia is expected to more than double, from 606 million in 2020 to 1.3 billion by 2050. The percentage of the global population aged 60 and older who are residing in Asia will also increase from 57% in 2020 to 62% in 2050, which contributes to the growth of the market. (Source - PMC)

CROs' services in China have recently been considered as the crucial and highly versatile integrator of local R and D capability for global drug discovery and innovation. CROs offer services particularly in three areas: discovery biology (26%), preclinical (21%), and pharmaceutical development (14%). China’s clinical trials sector is endlessly developing, driven by governing reforms and modern advancements in technology.

In India, Clinical trials are significantly affordable without compromising their quality. Also, India is the hub of extremely qualified clinical scientists, researchers, and medical care professionals. These cost benefits make India more attractive for outsourcing preclinical, clinical services, which raises the demand for the healthcare contract research organization market. The huge demand for new therapies for cancer and the growing complexity of oncology clinical trials led to an extreme focus on advanced oncology research, which caused the growth of the market.

Europe is expected to grow significantly in the healthcare contract research organization (CRO) market during the forecast period because of quick technological progressions and increasing urbanization in European countries are inspiring numerous pharmaceutical and biotech organizations to outsource their research and development to several contract research organizations. Growing demand for research and development outsourcing and clinical trials is contributing growth of the market. European CROs are significant in helping pharmaceutical and biotechnology companies to plan and execute their clinical trial services in Europe.

For Instance,

In Germany, the medical care sector has enlarged its spending on research and development (R&D) by 9.8% in 2023. The growing budget of R&D and readiness to spend in the next 5 years creates a significant opportunity for CRO companies, as pharmaceutical companies are progressively outsourcing research events to private and academic CROs as an approach to stay competitive and flexible in the world. Germany is a hub of Europe's major pharmacological market, which causes the growth of the market.

The Middle East & Africa are expected to grow at a notable CAGR in the foreseeable future. The growing research and development activities and the need for novel products potentiate the need for healthcare CROs. The increasing collaboration of key players with CROs facilitates market growth. The region has an expanding research and manufacturing infrastructure, as well as the presence of key players, which is contributing to market growth. Government organizations provide funding and launch initiatives to support CROs.

Companies like IROS, Fortrea, and Novotech CRO provide research and clinical trial services to the UAE healthcare organizations. The UAE is leading the transformation of the Middle East’s pharmaceutical sector. The region recorded $6.9 billion in pharmaceutical trade in 2023, including imports of $5.5 billion and exports of $1.4 billion.

Different CROs in South Africa are Bio Analytical Research Corporation (BARC), SGS SA, and IAVI to provide personalized services. The South African government allocates about R850 million to the South African Medical Research Council (SAMRC) annually for medical research. It also aims to spend 1.5% of its GDP on R&D by 2030.

In October 2024, Dr. Wilson, Chairperson of Franklin Biolabs, stated that our common goal is to link groundbreaking research with the creation of transformative therapies for patients suffering from serious and debilitating conditions. Source: (PR Newswire)

By Type

By Service

By Therapeutic Area

By Molecule

By Region

March 2026

March 2026

March 2026

February 2026