January 2026

The insulin degludec market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034. This surge is attributed to evolving consumer preferences and technological advancements reshaping the industry.

The leading countries, like Japan, China, Australia, and the UK, are exploring innovations in diabetes management solutions by integrating novel insulin devices with smartphone apps. Moreover, the global insulin degludec market is facing a rise in type 1 & type 2 DM, which further elevates demand for easy-to-administer, convenient, and affordable insulin devices, like insulin pens. Alongside, companies are immensely involved in developing novel delivery approaches for insulin, such as inhaled, minimally invasive patches, and nano-carriers for delivery.

The insulin degludec market covers all commercial activity around insulin degludec, a long-acting basal insulin analogue used to manage type 1 and type 2 diabetes. Key value drivers are clinical efficacy (stable 24+ hour basal coverage, lower hypoglycaemia risk), branded vs biosimilar pricing dynamics, device partnerships, regulatory approvals, and payer coverage; barriers include IP and regulatory hurdles for biosimilars, manufacturing complexity, and reimbursement variability across regions.

The market includes originator prescription products, biosimilar/development candidate versions, associated delivery systems (pre-filled pens, cartridges, pumps, needles), diagnostic and monitoring integrations (BGMs/CGMs that influence dosing), distribution channels (hospitals, retail pharmacies, specialty pharmacies, and direct-to-patient programs), and supporting services such as patient education and reimbursement/managed-care arrangements.

The globe is experiencing a huge rise in diabetic patients, which is enhancing demand for advanced therapeutic solutions, such as smart insulin pen systems. For this, Medtronic and Lilly companies have invented their solutions, like Medtronic's InPen and Lilly's Tempo platform. This enables monitoring insulin doses and integrating with CGM data via smartphone apps. Moreover, the market is leveraging sophisticated CGM approaches, like Dexcom G7 15-day sensor and the Eversense 365, which allows more accurate dosing decisions for all insulin users, with inclusion of those on degludec.

In 2024, the branded long-acting insulin segment captured 85% revenue share of the global insulin degludec market. The globe is increasingly preferring long-acting insulins with their streamlined dosing and lowered hypoglycemia risk, and product advances that are providing extended duration and flexible dosing schedules. The market is stepping into the launch of biosimilars, the phase-out of some older products, and the progress of once-weekly options.

Whereas the generic/biosimilar long-acting insulin segment will expand rapidly. The rising expenses of branded insulins are accelerating demand for reduced spending biosimilars, which further expands patient accessibility and support in the reduction of economic burden on the healthcare system. The ongoing patent expirations of insulin glargine are assisting biosimilar manufacturers in entering the market with minimized expenditures. The latest solutions include Merilog (insulin aspart-szjj) is the third insulin biosimilar product approved by the FDA, as well as Eli Lilly’s Rezvoglar (insulin glargine-aglr) and Mylan/Biocon’s Semglee (insulin glargine-yfgn).

The prefilled pens segment led with 75% revenue share of the market in 2024. The segment is driven by their ease and being more discreet to use over the conventional vials and syringes, which fosters better patient adherence to their treatment strategies. The most seen advantage is that the pen wirelessly shares data to a smartphone app, recording the dose, date, and time of each injection. Recently, Sanofi introduced SoloSmart, a data sensor that combines with its SoloStar prefilled pens to record insulin injection data in real-time.

Although the other delivery segment is anticipated to register the fastest growth. These solutions are non-invasive, as well as emphasizing lowering or eliminating the pain, inconvenience, and psychological stress of multiple daily injections. The exploration of novel delivery systems, including advanced automated insulin delivery (AID) or "artificial pancreas" systems, applies algorithms to more accurately handle blood glucose levels. Whereas inhaled insulin has been explored with comparable safety and efficacy to subcutaneous insulin in clinical trials.

In 2024, the type 2 diabetes mellitus segment held a 60% share of the insulin degludec market. The major drivers are the involvement of ultra-long-acting profile, reduced risk of hypoglycemia, and enhanced glycemic control, especially over fasting plasma glucose (FPG). The key players are boosting the use of nanoparticle delivery systems, like liposomes, that are increasing the oral absorption of insulin. According to NCBI, it is estimated that to rise to 643 million (11.3%) by 2030 and to 783 million (12.2%) by 2045 of diabetic patients, mainly type 2 DM.

Moreover, the other segment will expand at a rapid CAGR. This mainly comprises pregnant women due to a lack of long-term randomized clinical trials. In the last few years, the French consensus has updated their based on real-world data, which has accelerated recommendations for the AID system employed in children, particularly in very young children. Recently, in 2025, a study presented that off-label use of semaglutide and tirzepatide led to major reductions in HbA1c and body weight in this population.

The subcutaneous injection segment led with 95% revenue share of the insulin degludec market in 2024. A rise in patient preference for self-administered, user-friendly devices, such as pre-filled pens, is facilitating dose accuracy and ease of use, improving compliance. Recent approaches include dissolving microneedle patches that are made up of water-soluble or biodegradable materials that contain insulin, further enabling simple, painless self-administration. The exploration of automated insulin delivery (AID) systems has evolved into hybrid and advanced hybrid closed-loop (HCL and AHCL) systems.

However, the alternative routes segment is predicted to witness rapid expansion. This primarily encompasses the oral route in capsule formulation with absorption enhancers or enzyme inhibitors and minimally invasive patches, which utilize microneedle technology, including smart glucose-responsive patches. The incorporation of "poke and swell," which is derived from Hydrogel-forming microneedles by using a polymer to absorb interstitial fluid and swell, with more sustained and controlled insulin release. Other solutions consist of nano-carriers, hybrid systems, etc.

By capturing a 45% share, the retail pharmacies segment registered dominance in the market in 2024. The wider presence and feasible accessibility for patients to pick up prescriptions for insulin degludec and related supplies are impacting the overall expansion. Alongside the growing instances of diabetes, and ongoing breakthroughs in delivery systems like long-acting pens are also escalating the demand from retail pharmacies.

Whereas the online pharmacies/e-commerce/DTC refill programs segment is anticipated to expand rapidly. Involvement of Netmeds, Apollo Pharmacy, and PharmEasy in India sells insulin degludec like any other prescription drug and also provides convenience, competitive pricing, and at-home delivery. Additionally, certain pharmaceutical companies, such as Novo Nordisk (the original manufacturer of Tresiba), are facilitating patient assistance or savings programs. Recently developed RefillGenie is a telehealth platform is works with licensed healthcare professionals to process refills for existing medications, particularly insulin, and send the prescription to a pharmacy.

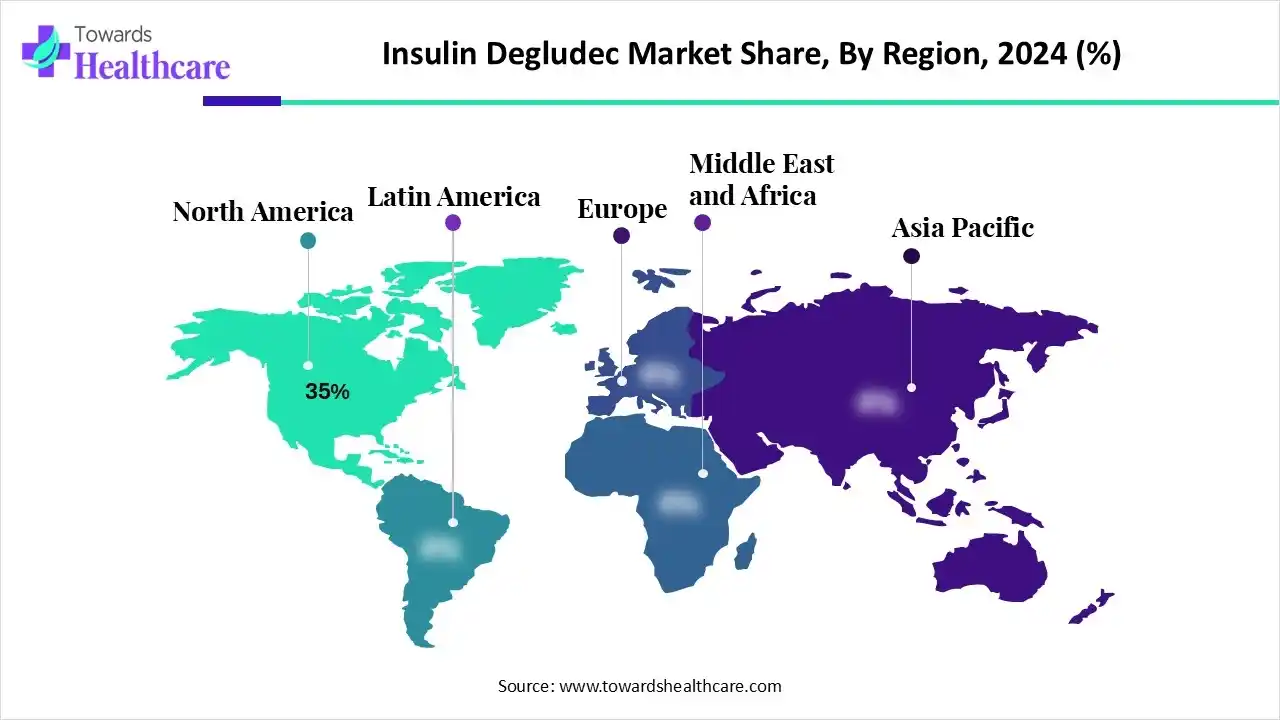

In 2024, North America’s market held a 35% revenue share, due to the increasing Type 2 DM and the presence of advanced healthcare infrastructure. The leading companies are increasingly investing in R&D for new insulin formulations and delivery systems, including smart pens and continuous glucose monitors. Besides, they are leveraging novel smart insulin pens with Bluetooth, the launch of inexpensive generic and biosimilar insulins, and robust research into new "smart insulin" for automated regulation of blood glucose and reducing hypoglycemia. As per NIH, the cases of diabetes (type 2 diabetes and type 1 diabetes) will rise by 54% to more than 54.9 million Americans between 2015 and 2030.

The US is experiencing a major growth in the market due to the rising emphasis on price reductions by leading producers, along with the approval of various biosimilars to accelerate competition, and the development of new technologies, like "smart insulin". Recently, the FDA has approved Insulet Omnipod 5 for adults with Type 2 diabetes; this is the foremost AID system indicated for both Type 1 and Type 2. In the US, it is projected that 39.7 million adults will be diabetes affected by 2030 and 60.6 million by 2060.

Canada’s insulin degludec market is also impacting the overall expansion, with expanded emphasis on integrated diabetes management. Primarily, diverse healthcare sectors are fostering partnerships among pharmaceutical companies and medical device manufacturers to develop comprehensive platforms. This enables the combination of insulin therapy with continuous glucose monitoring (CGM) and mobile health apps.

For instance,

In the prospective period, the Asia Pacific is estimated to register rapid expansion in the insulin degludec market. China and India are facing significant growth in diabetic patients, as well as the rise in involvement of major countries like Australia and Japan is propelling the ASAP market growth. These countries are widely adopting insulin analogs, and the presence of advanced healthcare systems is ensuring patient access. Alongside, vital companies, such as Health2Sync and Sanofi in Taiwan, are boosting their alliance for insulin management approaches, and Eris Lifesciences and MJ Biopharm in India for marketing human and analogue insulins.

Day by day, Japan is greatly exploring its advances in delivery devices, specifically smart pens and wearable pumps, which enhance patient convenience and adherence to treatment. Additionally, Japan has provided the TIDE-J study, which is the first and only comprehensive, multi-center cohort study for type 1 diabetes. This study has offered insights into the speed of beta-cell depletion and its predictors, probably resulting in earlier interventions.

The insulin degludec market in China is putting efforts to accelerate awareness regarding diabetes and the significance of management, which further bolsters diagnosis and treatment. Besides this, the Chinese government is leveraging the wider access to high-quality diabetes care in underserved areas through the increased reimbursement for therapies and the progress of Metabolic Management Centers in hospitals.

For instance,

Europe is experiencing a notable growth in the insulin degludec market. Europe is bolstering biosimilar competition, where many companies are introducing biosimilar insulins for products, mainly insulin glargine (Abasaglar and Semglee). Eventually, they are putting efforts into lowering prices in many European countries, though price diversity persists across the region. Along with this, several key players are establishing integrated systems, such as the Abbott and Sanofi collaboration on tools that integrate Freestyle Libre CGM data with Sanofi's insulin dosing information.

The UK’s market, with its significant expansion, is acquiring funds for transforming a novel molecule that integrates insulin and glucagon. This "smart" insulin supports in mitigating dangerously low blood glucose levels (hypoglycaemia) with the automation in adjusting the insulin dose in response to blood sugar changes. Some researchers are emphasizing a needle-free oral insulin tablet that employs "nanocarriers" to deliver insulin directly to the liver.

For instance,

The market is mainly focusing on modifying human insulin to develop an ultra-long-acting analog with a unique protraction mechanism.

Key Players: Sanofi, Eli Lilly, Gan & Lee Pharmaceuticals, etc.

A major contribution of early investigations into the drug's properties to large-scale, long-term comparisons against existing basal insulins supports the various phases of trials for identifying efficacy, potency, and safety.

Key Players: Wockhardt, MannKind Corporation, University of Hull, US FDA, EMA, etc.

The latest services include Tresiba Savings Offer, NovoCare Patient Assistance Program (PAP), Immediate Supply Program, and other educational programs.

Key Players: Novo Nordisk, Novocare, etc.

By Drug Type

By Presentation/Device Format

By Indication/Therapeutic Use

By Route of Administration

By Distribution Channel

By Region

January 2026

December 2025

December 2025

December 2025