March 2026

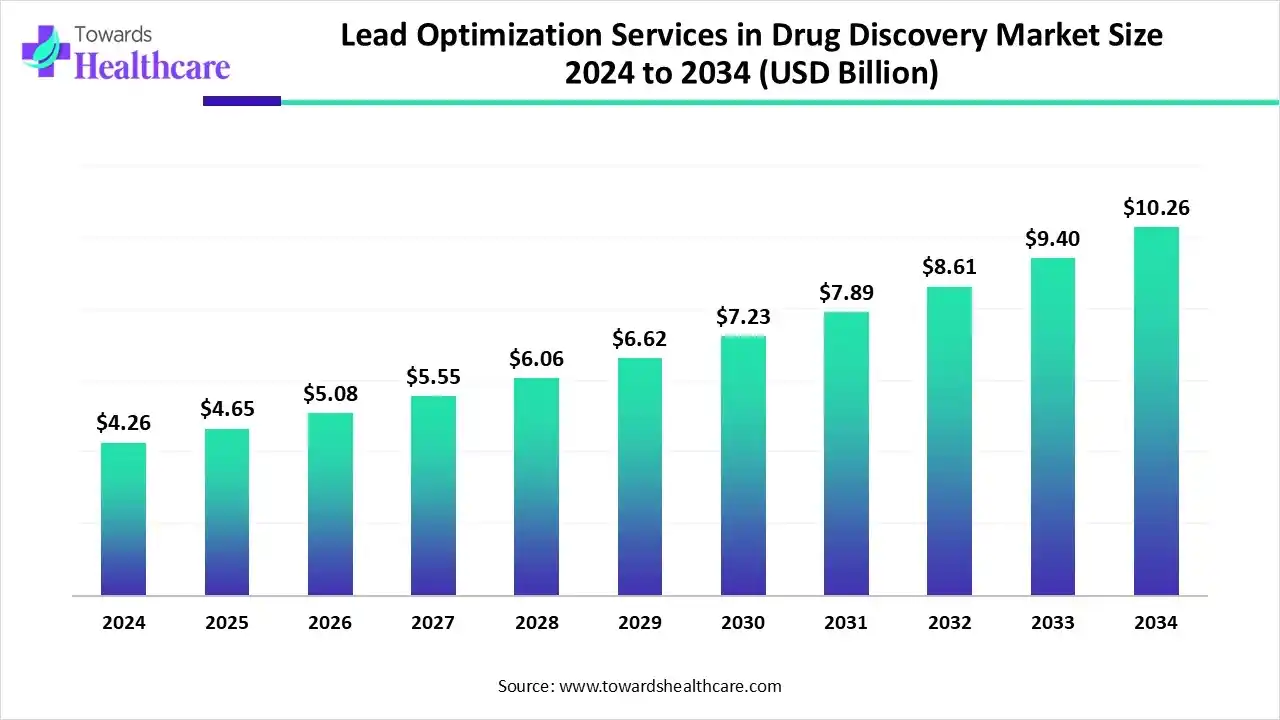

The global lead optimization services in drug discovery market size is calculated at US$ 4.26 billion in 2024, grew to US$ 4.65 billion in 2025, and is projected to reach around US$ 10.26 billion by 2034. The market is expanding at a CAGR of 9.23% between 2025 and 2034.

The growing research and development are increasing the use of lead optimization services globally. This, in turn, is driving the use of AI to advance the applications of these services, where the companies are investing, collaborating, developing, and launching various new platforms to accelerate the ADME studies, molecular docking, SAR analysis, cellular activities, etc. At the same time, the growing diseases, expanding healthcare, and technological innovations are driving their use across various regions, promoting market growth.

| Table | Scope |

| Market Size in 2025 | US$ 4.65 Billion |

| Projected Market Size in 2034 | US$ 10.26 Billion |

| CAGR (2025 - 2034) | 9.23% |

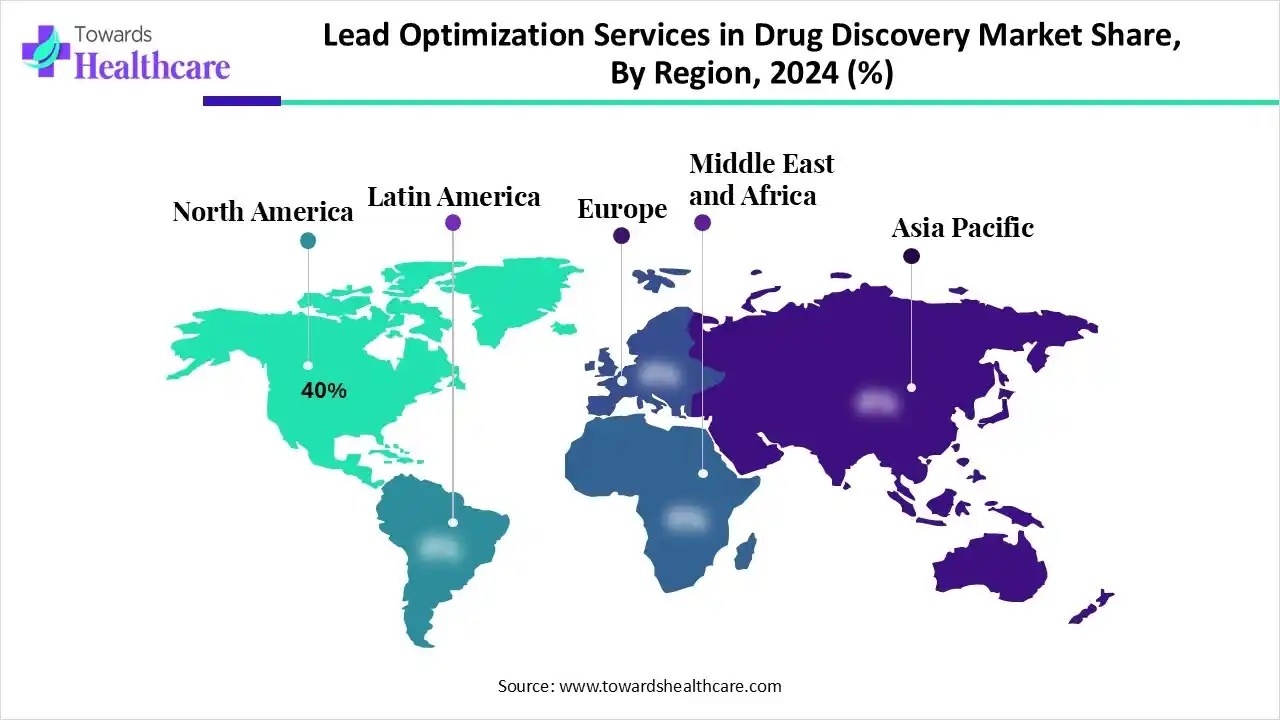

| Leading Region | North America by 40% |

| Market Segmentation | By Target Molecule Type, By Therapeutic Area, By End-User, By Region |

| Top Key Players | Labcorp Drug Development, Pharmaron, Jubilant Biosys, BioDuro, Medicilon, Covance (Labcorp), PPD (Thermo Fisher), Enamine, ChemPartner, Oncodesign, Accelera, Cerep (Eurofins), Aptuit (Evotec), Reaction Biology Corporation, Selvita |

The lead optimization services in drug discovery market are driven by, growing demand for outsourcing the critical resource-intensive processes. The lead optimization services in drug discovery involve specialized services that help pharmaceutical and biotechnology companies refine potential drug candidates for potency, selectivity, pharmacokinetics, and safety before preclinical and clinical development. These services include structure-activity relationship (SAR) analysis, medicinal chemistry, computational modeling, ADME/Tox profiling, high-throughput screening, and molecular modification to improve efficacy and reduce toxicity.

Industry Growth Overview: The industry growth in the lead optimization services in drug discovery market is due to growing demand for outsourced R&D to enhance efficiency and minimize the high costs of drug discovery. Additionally, the technological advancements and increasing focus on complex areas like biological medicines and personalization are also contributing to the same.

Major Investors: The major investors include the large pharmaceutical industry and venture capital firms specializing in life sciences. They are focusing on acquiring specialized technologies, expertise, and offering their services.

Startup Ecosystem: The startup ecosystem in the lead optimization services in drug discovery market is focusing on developing and utilizing advanced technologies like artificial intelligence, machine learning to enhance the accuracy, efficiency, and speed of the design and refining new drug candidates.

The AI in the lead optimization services in drug discovery market is transforming and accelerating the drug discovery process, as it offers various applications. It provides faster drug discovery and helps in selecting the drug candidate with higher efficacy and selectivity. At the same time, AI also helps in detecting the side effects or toxicity of the drug candidate, which in turn helps in enhancing their safety profile, and also promotes the development of personalized medicines depending on their genetic or phenotypic data.

For instance,

Table: Recently Launched Molecular Modeling Platforms

| Company | Platform | Application | Source |

| METiS TechBio | NanoForge | Nano-delivery discovery and design AI platform | METiS Launches World's First AI-Driven Nano-Delivery Platform NanoForge |

| Massachusetts Institute of Technology (MIT) Jameel Clinic for Machine Learning in Health | Boltz-2 | Predicts molecular binding affinity at enhanced speed and accuracy | Boltz-2 Released to Democratize AI Molecular Modeling for Drug Discovery |

| Viva Biotech | AI-Driven Drug Discovery (AIDD) platform | Accelerate the discovery of novel therapeutics with an intelligent, integrated, and efficient approach. | Viva Biotech Launches the AI-Driven Drug Discovery Platform, Transforming New Drug R&D Logic, Enabling One-Stop Innovative Drug Discovery |

| Qubit Pharmaceuticals | FeNNix-Bio1 | Simulate molecular interactions with unprecedented precision | Qubit Pharmaceuticals launches FeNNix-Bio1, a quantum AI model transforming drug discovery | Noah News |

| VantAI | Neo-1 | Systematic re-wiring of possible protein interactions | VantAI Launches Neo-1, the First AI Model to Rewire Molecular Interactions by Unifying Structure Prediction and Generation for Therapeutic Design |

Increasing demand for efficient drug development: With the growing R&D, the industries are using lead optimization services in drug discovery to minimize the chances of failure and accelerate the process. Therefore, new funding or investments are being announced to support these developments and to encourage innovations, promoting the lead optimization services in drug discovery market growth.

For instance,

By service type, the medicinal chemistry services segment held the dominating share of approximately 40% in the lead optimization services in drug discovery market in 2024, as it is essential for the modification of chemical structures. It was also used for SAR analysis and to improve the pharmacokinetics of the product. This contributed to the market growth.

By service type, the computational & in silico services segment is expected to show the fastest growth rate during the predicted time. These services are accelerating the drug design and discovery process. It also helps in enhancing the ADME properties and the identification of the targets.

By target molecule type, the small molecules segment led the lead optimization services in drug discovery market with approximately a 50% share in 2024, due to their increased development. The lead optimization services were used to enhance the bioavailability of the small molecules. Additionally, to discover a wide range of targets, their use increased.

By target molecule type, the peptides segment is expected to show the highest growth during the upcoming years. The growing application of peptides in various disease treatments is increasing the use of lead optimization services for their innovations. They are also being used to develop different types of peptide delivery systems.

By therapeutic area type, the oncology segment held the largest share of approximately 35% share in the lead optimization services in drug discovery market in 2024, driven by their growing incidences. This increased the development of various cancer treatment options, increasing the use of lead optimization services. Additionally, the growth in personalized cancer therapies also contributes to this growth.

By therapeutic area type, the rare diseases segment is expected to show the fastest growth rate during the predicted time. The growing R&D to overcome the unmet medical need is driving the use of lead optimization services. Moreover, growing genomics and targeted drug delivery options are increasing their use.

By end user, the pharmaceutical companies segment led the global lead optimization services in drug discovery market with approximately 45% share in 2024, due to growing R&D activities. At the same time, growing drug development and advancement of therapies production, the demand for lead optimization services has increased. Additionally, the growth in outsourcing also enhanced their use.

By end user, the contract research organizations (CROs) segment is expected to show the highest growth during the upcoming years. The presence of flexible and affordable lead optimization services increased the dependence on CROs. Moreover, they also provided expertise, which is also increasing their collaborations, supporting the outsourcing trends.

North America dominated the lead optimization services in drug discovery market with 40% in 2024, due to the presence of strong industries. At the same time, the growing R&D supported by investments is driving the demand for lead optimization services in drug discovery. Moreover, the growing CRO services also contributed to the market growth.

The growing research and development in the industries of the U.S. industries is increasing the use of lead optimization services in drug discovery. Moreover, the presence of CRO is also increasing its use for medicinal chemistry and ADME profiling. Additionally, the growing technological innovation and collaboration are also enhancing their utilization.

As per the Advancing Health Through Innovation, the total number of CDER-approved novel drugs in the U.S. in 2022 was 37, which increased to 50 in 2024.

The expanding industries in Canada are using the lead optimization services in drug discovery due to growing drug development. The growing government funds are encouraging innovation, supporting the institutions as well. Moreover, the increasing outsourcing trends are also increasing their use by the CROs.

Asia Pacific is expected to host the fastest-growing lead optimization services in drug discovery market during the forecast period. The expanding industries are increasing the use of the lead optimization service due to growing drug discovery and development. Additionally, the growing patient volume is driving innovation, which is supported by investments from various sources, promoting market growth.

The incorporation of advanced technologies like AI for efficient and rapid testing, identifying, and refining potential drug candidates for improving the safety, efficacy, and drug-like properties is the focus of the lead optimization services in drug discovery R&D.

Key players: Charles River Laboratories, WuXi AppTec, Evotec SE, Labcorp Drug Development.

The preclinical trials approvals in the lead optimization services in drug discovery focus on developing a drug with optimized properties, extensive animal testing, and toxicology studies before clinical trials.

Key players: Charles River Laboratories, WuXi AppTec, Evotec SE, Labcorp Drug Development, ICON plc.

The lead optimization services in drug discovery do not offer direct patient support and services, but are involved in developing safe and effective treatments for the patients.

Key players: Charles River Laboratories, WuXi AppTec, Evotec SE, Labcorp Drug Development, Sygnature Discovery.

By Service Type

By Target Molecule Type

By Therapeutic Area

By End-User

By Region

March 2026

March 2026

March 2026

March 2026