February 2026

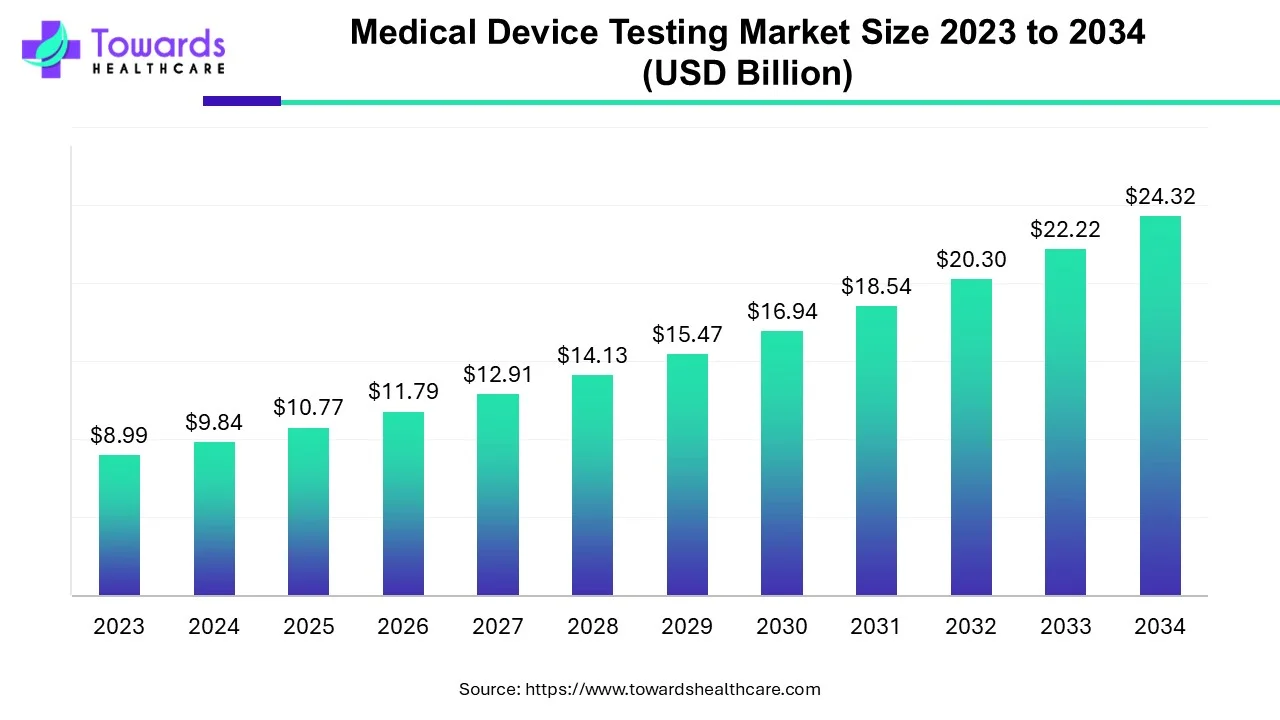

The global medical device testing market size was calculated at USD 10.77 billion in 2025 and is expected to reach around USD 24.32 billion by 2034, expanding at a CAGR of 9.47% from 2025 to 2034.

The global market for medical device testing is expanding rapidly because of the increasing need for reliable and high-quality medical devices, as well as the necessity to adhere to strict regulatory requirements.

Medical device testing involves evaluating the safety, functionality, and performance of medical instruments. It comprises a range of tests and assessments to verify that the devices comply with regulations and function as expected. The demand for advanced medical devices is rising due to factors such as an expanding population, increased disposable incomes, and heightened awareness of health and wellness. With an emphasis on patient safety and effectiveness, healthcare providers and manufacturers consider extensive testing of medical devices from initial development to post-market observation essential. With regulatory bodies tightening standards and the global emphasis on healthcare quality rising, the medical device testing market is set for significant growth. Manufacturers are increasingly prioritizing investments in advanced testing methods and technologies. These initiatives help to grow the medical device testing market.

Artificial intelligence (AI) and machine learning (ML) algorithms have emerged as essential components of the healthcare industry, fueling the most recent advancements. AI and ML are transforming the medical device testing industry by improving efficiency, precision, and affordability. ML algorithms are capable of swiftly examining large datasets and recognizing patterns and possible problems that human testers might miss. Automation powered by AI accelerates testing procedures and enhances precision in identifying anomalies, optimizes predictive maintenance, simplifies clinical trials, and facilitates real-time monitoring, while machine learning models forecast device performance and potential breakdowns, allowing for proactive modifications. Moreover, ML enables customized testing by mimicking actual patient scenarios. AI and ML assist in maintaining regulatory compliance via automated documentation and enhance post-market oversight by persistently tracking device performance. Collaboration is enabling them to enhance the speed, reliability, and safety of medical device testing.

The Global Growth of the Healthcare Sector

The global growth of the healthcare industry presents a major opportunity for stakeholders in the medical device testing market. As healthcare access improves, especially in emerging markets, there is an increasing demand for advanced medical devices. This demand is driven by factors like population growth, higher disposable incomes, and greater awareness of health and wellness. As a result, the need for thorough testing services to ensure device safety, effectiveness, and regulatory compliance is rising. Testing facilities are crucial in supporting the global healthcare expansion by providing manufacturers, healthcare providers, and patients with the assurance they need, which in turn enhances the growth and credibility of the medical device industry worldwide.

Risks Associated with the Medical Device Testing Market

The risks associated with medical device testing include issues like component failures, side effects, improper usage, software bugs, mishandling during shipping, production errors, and poor design. These factors can hinder the market’s growth. Additionally, concerns around data integrity and privacy arise when unauthorized access to devices or patient information occurs. Cybersecurity vulnerabilities, including exploitation by external parties, pose a growing threat to device functionality. Safety and cybersecurity risks are becoming increasingly important issues for the medical device industry, potentially limiting the growth of the medical device testing market.

The World Health Organisation (WHO) estimates that up to 30% of adverse events in healthcare settings are caused by medical device abuse, which may be caused by inappropriate handling, a lack of suitable training, or malfunctioning equipment that was not properly evaluated.

Increased Healthcare Spendings

Worldwide healthcare expenditures have grown as annual incomes have risen in numerous nations. To address the demands of the expanding population, governments and healthcare entities are vigorously increasing investment in healthcare. The rise in healthcare expenditures has likewise aided in the improvement of medical device testing services in recent years. Moreover, strategic actions by major market participants are anticipated to bolster the industry and generate future growth prospects for the medical device testing market from 2024 to 2031.

The Centers for Medicare & Medicaid Services (CMS) projected U.S. healthcare spending to reach $6.2 trillion by 2028, growing at an average rate of 5.4% per year. This increased spending boosts the need for high-quality medical devices, driving growth in the medical device testing market, which is essential to meet safety, regulatory, and performance standards.

By service, the biocompatibility tests segment led the global market in 2024. The increasing need for diverse medical device testing in areas such as cardiovascular, orthopedic, diagnostic devices, and others is fueling market expansion. Moreover, tighter regulations, technological progress, and an increasing emphasis on personalized medicine are expected to further boost the need for biocompatibility testing in the medical device testing services sector. Testing for biocompatibility is essential for medical devices, providing multiple advantages. It aids in safeguarding patient safety by identifying possible risks and harmful reactions early in the developmental stage. Moreover, it guarantees the general quality of medical devices and is crucial for gaining regulatory approval. These factors drive the biocompatibility tests segment and contribute to the overall expansion of the medical device testing market.

By service, the chemistry tests segment is anticipated to grow at a lucrative rate during the studied year. Pharmaceutical formulations and medical equipment are subjected to chemical testing in the medical sector. Along the whole value chain, these tests are essential to medical device companies. Chemistry tests for medical devices offer numerous benefits, such as ensuring compatibility with disinfectants to maintain the product's long-term value, assessing biological risks associated with the device, proving compliance with regulations on hazardous substances, and identifying potential risks and toxicities. These tests help minimize such risks, ultimately ensuring the safety and health of the patient. These factors drive the segment and play a key role in the overall expansion of the medical device testing market.

By phase, the clinical segment held a dominant presence in the market in 2024. Growing product portfolios and continuous regulatory standard development are driving this sector's growth. The necessity for comprehensive testing services in clinical trials is growing as the importance of clinical data in authorizing novel devices increases. Furthermore, it is projected that the growing need for market players that offer advanced testing methods at reasonable prices and with quicker response times for a range of clinical trials would further propel segment expansion.

By phase, the preclinical segment is estimated to show significant growth during the forecast period. Preclinical testing is essential in the creation and assessment of medical devices before their approval for human applications. These evaluations gauge the effectiveness, safety, and functionality of devices, aiding in risk reduction and enhancing patient results. In the realm of preclinical testing, the need for small animal research is increasing as domestic medical device producers concentrate on creating devices for these studies. This assists in tackling regulatory safety issues and minimizing risks during product validation. Likewise, the demand for large animal research is increasing to connect animal trials with human trials. These elements are anticipated to stimulate growth in the market.

Asia-Pacific dominated the global medical device testing market in 2024. The swift advancement of healthcare infrastructure, combined with enhanced regulatory scrutiny, is enhancing the region's position in the worldwide medical device testing services sector. Moreover, the rising need for varied testing approaches, competitive pricing strategies, and the expansion of domestic manufacturing centers are fueling the demand for top-notch testing services. This fosters innovation and promotes technological skills in the area. Moreover, the existence of affordable testing services and a proficient workforce are crucial elements driving the area's revenue increase.

China's cost advantages, rapid industrial growth, government initiatives, and strong manufacturing base have allowed it to dominate the medical device testing market. The National Medical Products Administration (NMPA) issued regulations on the supervision and administration of medical devices. The goal of this program, which went into force in 2023, is to raise the effectiveness, safety, and quality of medical devices in China. Through several initiatives, including the Made in China 2025 campaign, the Chinese government has also been making significant investments in the development of medical devices and testing facilities. Through the development of innovative technologies, such as AI-driven testing systems, biocompatibility testing, and automated testing solutions, this initiative aims to improve the nation's capacity for the manufacturing and testing of medical devices.

The increasing number of medical device startups supports market growth. There are around 800 small-scale medical device manufacturers in India. The Central Drug Standard Control Organization (CDSCO) regulates medical device testing laboratories (MTDLs) in India. As of 2023, CDSCO approved 39 MDTLs.

North America is anticipated to grow at a lucrative rate in the market during the forecast period. This expansion can be linked to the existence of established manufacturing centers in the area, which create highly dependable, sophisticated, and advanced medical equipment. Furthermore, numerous Original Equipment Manufacturers (OEMs) are progressively collaborating with electronics manufacturing service providers to handle the rising quantity of electronic components in contemporary medical devices. This change has led to an increase in the need for medical device testing services, promoting effective healthcare in the area, and is anticipated to play a crucial role in the ongoing growth of the medical device testing market.

Due to stringent FDA regulations, advanced technologies like AI, and a growing demand for personalized medicine and cybersecurity, the United States is a major player in the medical device testing market. The nation is a profitable center for medical device testing because of its excellent testing infrastructure, innovation-driven environment, and substantial healthcare market. The US is strong in sophisticated medical device testing, as demonstrated by Medtronic, a prominent U.S. medical device firm that employs AI-driven testing to guarantee FDA compliance and improve the safety of medical devices.

Health Canada approves novel medical devices in Canada. Health Canada’s Action Plan on Medical Devices focuses on improving the safety and effectiveness of medical devices and optimizing patients’ health outcomes.

Europe is considered to be a significantly growing area. The market for medical device testing in Europe is expanding as a result of tough laws like MDR and EMA, as well as developments in AI, automation, and 3D printing. The need for high-quality testing services is driven by the region's aging population and growing healthcare demands, and the industry's expansion is further bolstered by strong R&D investments.

Germany's market for testing medical devices is experiencing substantial growth attributed to several important regulations. The Medical Device Regulation (MDR) and In Vitro Diagnostic Regulation (IVDR) impose stringent safety and testing criteria throughout the EU, especially in Germany, leading to a heightened need for extensive testing services. Furthermore, the German Medical Devices Act (MPG) mandates stringent safety standards that conform to EU regulations. The necessity for CE marking promotes increased testing, as products need to fulfill strict safety and performance standards to be available in the market. These rules establish a solid basis for the expansion of the medical device testing market in Germany.

The increasing investments by the government and private organizations facilitate the development and production of medical devices in the UK. The UK government recently invested £10 million ($12.5 million) to accelerate the development of medical devices and bring them faster to the market. This investment was made to boost the NHS for developing medical devices across various fields, from identifying Alzheimer’s disease to predicting COPD.

The Middle East & Africa are expected to grow at a considerable CAGR in the medical device testing market in the upcoming period. The increasing development of medical devices and favorable regulatory policies bolster market growth. Government organizations support the development of medical devices. The growing adoption of advanced technologies also contributes to market growth. The increasing emphasis on digitization facilitates medical device testing in the Middle East & Africa.

The Ministry of Health and Prevention (MOHAP) regulates the approval of medical devices in the UAE. The UAE is a leading exporter of medical devices in Iran. This encourages the government to promote domestic production of medical devices. Companies like OMC Medical, SGS SA, and Qmaizen offer medical device testing solutions for their approval.

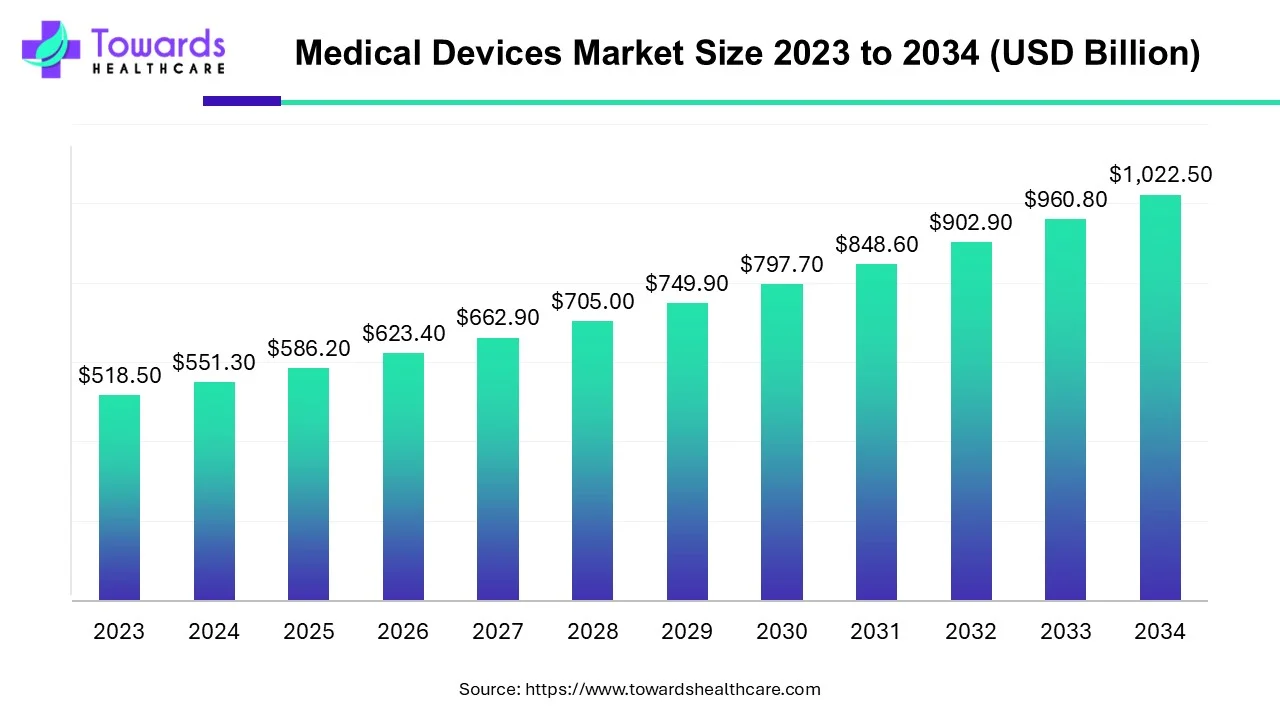

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

John Doe, CEO of MedTech Solutions, announced today, As the medical device market grows, the demand for reliable testing services is critical. We are committed to providing efficient, cost-effective testing solutions that ensure safety, compliance, and faster time-to-market, driving better healthcare outcomes globally.

By Service

By Phase

By Region

February 2026

February 2026

January 2026

January 2026