February 2026

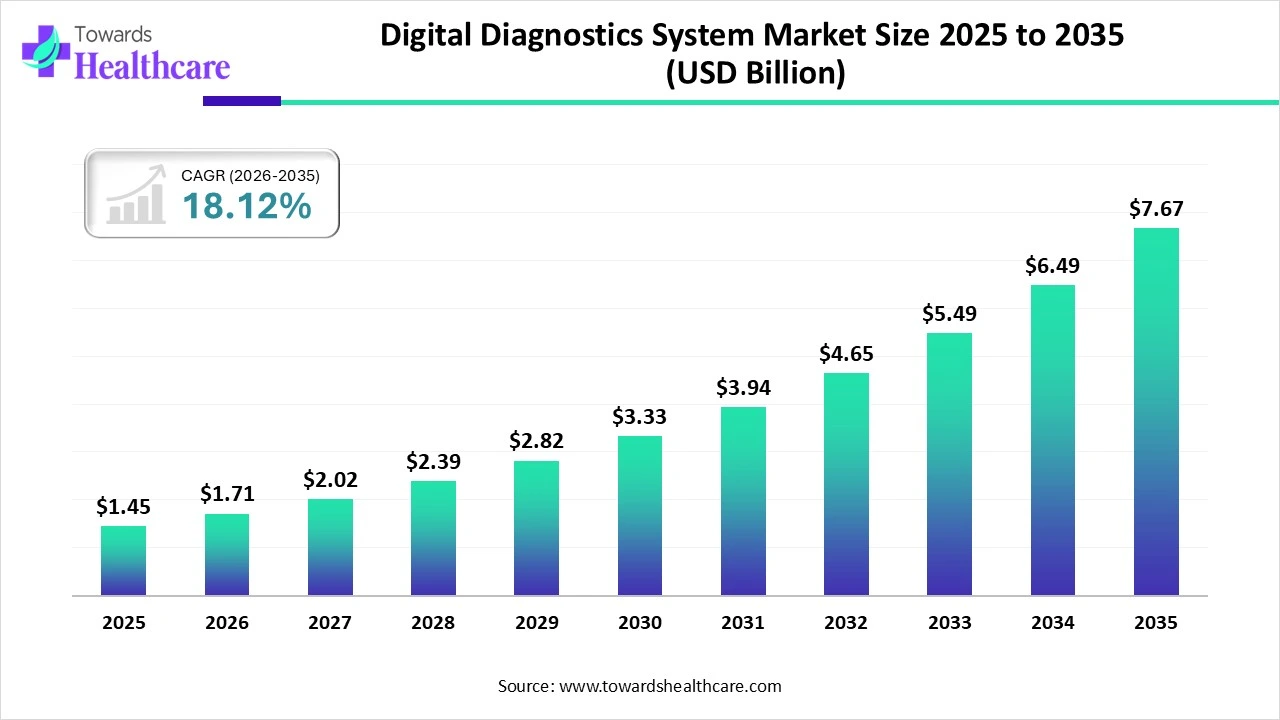

The global digital diagnostics system market size was estimated at USD 1.45 billion in 2025 and is predicted to increase from USD 1.71 billion in 2026 to approximately USD 7.67 billion by 2035, expanding at a CAGR of 18.12% from 2026 to 2035.

The growing chronic diseases and rising remote health monitoring are increasing the demand for digital diagnostic systems. The growing technological advancements and new launches are also promoting the market growth.

The digital diagnostics system market is driven by growing AI and ML integration into medical workflows. The digital diagnostics system refers to the digital tools, data analytics, and software used to detect, monitor, and diagnose diseases. These systems encompass AI-powered imaging, cloud-based diagnostic platforms, and point-of-care (POC) digital tools that enable faster, data-driven disease identification.

AI plays an important role in the market by offering accurate image interpretations, prediction of disease onset, and progression, providing early and effective treatment options. It also assists in remote diagnosis and decision support, promoting the development of personalized treatment options. It also offers workflow automation, where these advantages encouraging AI use in the development of new diagnostic systems.

The growing use of telehealth platforms is driving the demand for remote diagnostics solutions for chronic disease monitoring and management, which is increasing the adoption of digital diagnostic systems.

The growing health awareness is increasing the shift towards personalized medications and preventive care, which in turn is increasing the use of digital diagnostic systems for early and accurate disease detection.

The growing advancements in digital diagnostic systems are driving the development of new wearable, portable, point-of-care systems and mobile health tools, along with the integration of a cloud platform to offer real-time health monitoring.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.71 Billion |

| Projected Market Size in 2035 | USD 7.67 Billion |

| CAGR (2026 - 2035) | 18.12% |

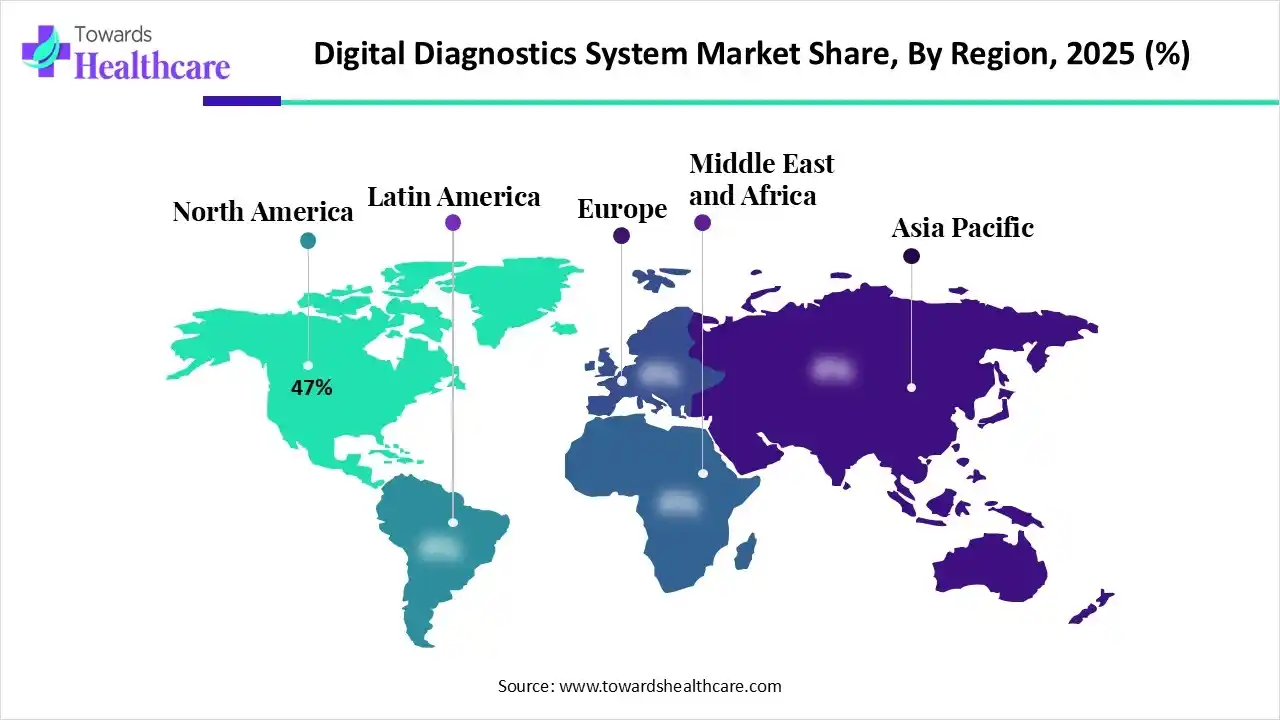

| Leading Region | North America by 47% |

| Market Segmentation | By Product & Service, By Technology, By Application, By End-User, By Region |

| Top Key Players | Siemens Healthineers AG, GE HealthCare, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Digital Diagnostics Inc., Koninklijke Philips N.V, Abbott Laboratories, Aperio, Fujifilm Holdings Corporation |

Why Did the Software and AI Services Segment Dominate in the Digital Diagnostics System Market in 2025?

The software and AI services segment held the largest share of approximate 56.5% in the market in 2025, as they were essential for image analysis and pattern recognition. Moreover, the analysis of large datasets, regular updates, and easy integration with healthcare systems also increased their adoption rates.

AI-Integrated Software

The AI-Integrated software segment is expected to show the highest growth during the upcoming years, due to growing demand for automated diagnosis. They also offer enhanced accuracy and speed, providing faster analysis. Additionally, increasing investments and adoption of telehealth platforms are also encouraging their use.

How Artificial Intelligence/ML Segment Dominated the Digital Diagnostics System Market in 2025?

The artificial intelligence/ML segment led the market with approximate 42.0% share in 2025, due to its enhanced diagnostic accuracy. They also helped in processing the large volume of data, reducing the chances of human errors. Moreover, its faster diagnosis and decision support also increased its use.

Tele-diagnostics/Telemedicine

The tele-diagnostics/telemedicine segment is expected to show the fastest growth during the upcoming years, driven by remote patient diagnosis. These platforms also offer faster scheduling and seamless data sharing, which is increasing patient convenience and driving their adoption rates.

Which Application Type Segment Held the Dominating Share of the Digital Diagnostics System Market in 2025?

The oncology segment held the dominating share of approximate 34.2% in the market in 2025, due to growth in its incidence rates. The growth in the R&D investment and demand for precision medicine also increased the use of digital diagnostic systems. Moreover, their advanced imaging and molecular analysis also increased their use.

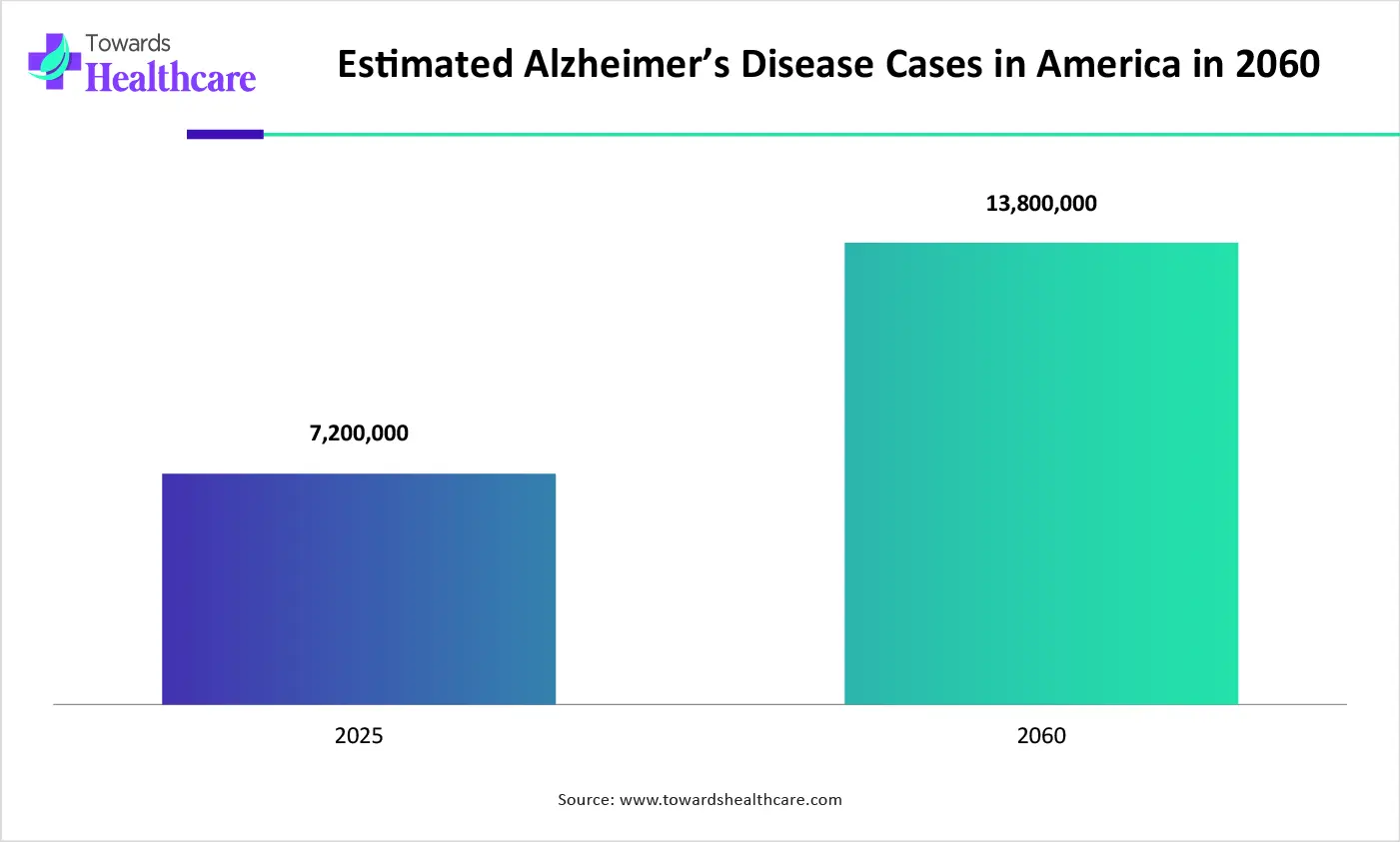

Neurology and Others

The neurology and others segment is expected to show the highest growth during the predicted time, due to growing neurological disorders, which are increasing the demand for advanced diagnostic tools. The expanding portable diagnostic systems and remote patient monitoring trends are also increasing the use of digital diagnostic systems.

What Made Hospitals and ASCs the Dominant Segment in the Digital Diagnostics System Market in 2025?

The hospitals and ASCs segment led the market with approximate 45.0% share in 2025, due to high patient volume. The presence of robust infrastructure and multispecialty care units also increased the use of digital diagnostic systems. Furthermore, enhanced diagnostic accuracy and workflow efficiency also increased their use.

Diagnostic Laboratories

The diagnostic laboratories segment is expected to show the fastest growth during the predicted time, due to the growing number of diverse tests. They also offer specialized and advanced digital diagnostic tools, which provide faster and more accurate disease detection. The growing shift towards preventive care is also increasing its use.

North America dominated the digital diagnostics system market with approximate 47% share in 2025, due to the presence of advanced healthcare infrastructure, which is increasing the adoption and use of digital diagnostic systems. Increased early adoption of advanced technologies and R&D activities also increased their innovations, where the growth in healthcare investments also contributed to the market growth.

U.S. Market Trends

The U.S. consists of a well-developed healthcare sector, which is increasing the use of digital diagnostic system from the early detection and effective management of growing chronic diseases. The growing innovation backed by investment from various sources is also increasing its advancements.

Asia Pacific is expected to host the fastest-growing digital diagnostics system market during the forecast period, due to expanding healthcare and growing chronic diseases. The increasing adoption of telemedicine and growing government initiatives are also increasing the use of digital diagnostic systems, where blooming medical tourism is also enhancing the market growth.

China Market Trends

The rapid expansion of healthcare in China is increasing the adoption of advanced technologies, such as digital diagnostics systems. These systems are being used for early and accurate detection of growing chronic diseases and remote patient monitoring, where government investments are also encouraging their use.

Europe is expected to grow significantly in the digital diagnostics system market during the forecast period, due to growing health awareness and robust healthcare systems. This is increasing the use of digital diagnostic systems and is encouraging their innovations, which are backed by government initiatives. The growing disease burden is also promoting the market growth.

UK Market Trends

The presence of advanced healthcare systems in the UK is increasing the use of digital diagnostics systems for the detection of various diseases. The growing health awareness, shift towards preventive care, and government support are also increasing their demand and driving their innovations.

| Companies | Headquarters | Digital Diagnostic Systems |

| Siemens Healthineers AG | Erlangen, Germany | syngo.via |

| GE HealthCare | Chicago, U.S. | Edison |

| F. Hoffmann-La Roche Ltd. | Basel, Switzerland | navify |

| Thermo Fisher Scientific Inc. | Waltham, U.S. | High-throughput molecular and genomic testing platforms |

| Digital Diagnostics Inc | Coralville, U.S. | LumineticsCore |

| Koninklijke Philips N.V. | Amsterdam, Netherlands | IntelliSite Pathology Solution and telehealth platforms |

| Abbott Laboratories | Abbott Park, U.S. | Lingo |

| Danaher Corporation (Leica Biosystems) | Washington, U.S. | Aperio |

| Canon Medical Systems Corporation | Otawara, Japan | Alphenix and Aquilion digital imaging systems |

| Fujifilm Holdings Corporation | Tokyo, Japan | REiLI |

In February 2026, four new diagnostic testing tools, namely GWSMART05, which is a 5" handheld bidirectional diagnostic tool, GWSMART10, a 10" pro command wireless bidirectional diagnostic tablet with charge docking station, GWTPMS, which is a universal tire pressure monitoring system programming and diagnostic tool, and GWSCOPE, a high-definition flexible inspection endoscope, were launched by GEARWRENCH.

In January 2026, a whole slide imaging (WSI) digital scanner, that is Agilent S540MD Slide Scanner System, was launched by Agilent Technologies Inc., which consists of AI-assisted tissue detection and automated scanning modes, implementing digital and AI features, enhancing the diagnostic workflows and patient outcomes

By Product & Service

By Technology

By Application

By End-User

By Region

February 2026

February 2026

February 2026

February 2026