February 2026

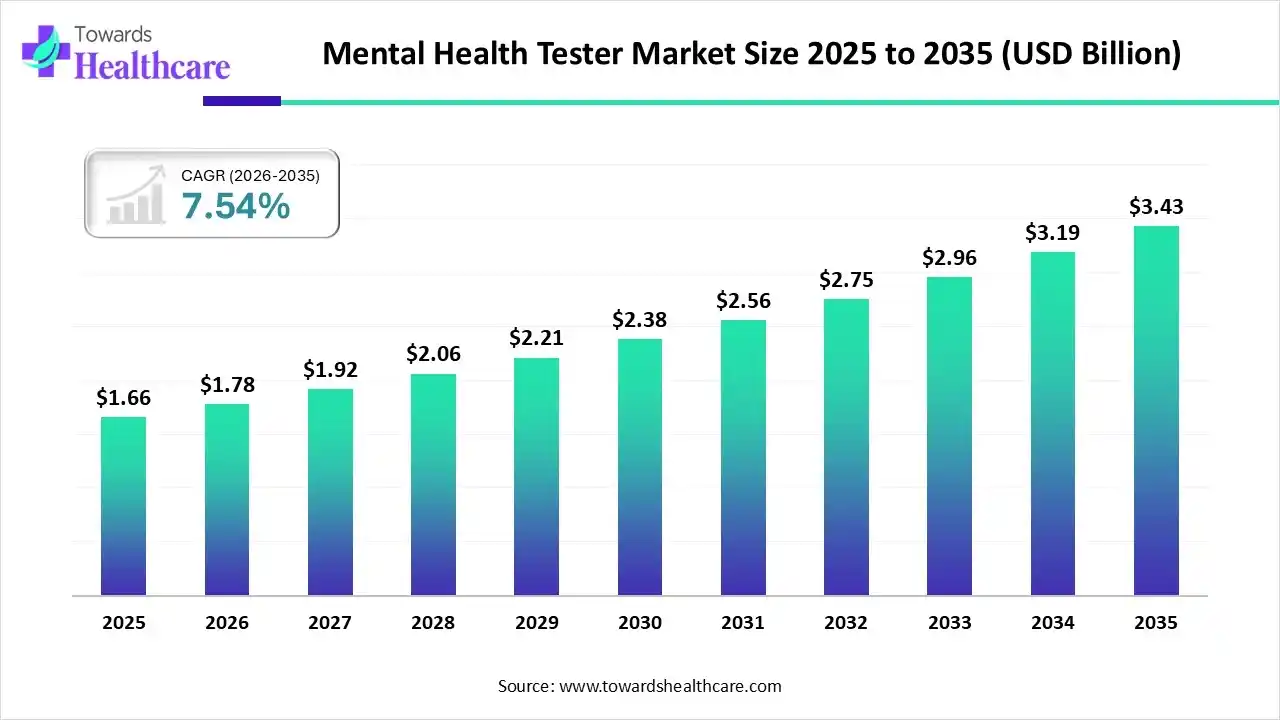

The global mental health tester market size was estimated at USD 1.66 billion in 2025 and is predicted to increase from USD 1.78 billion in 2026 to approximately USD 3.43 billion by 2035, expanding at a CAGR of 7.54% from 2026 to 2035.

Expanding urbanization and modernization among developed and developing countries are facing a huge rise in cases of depression, anxiety, dementia, and other mental disorders. This further escalates demand for more effective and advanced technological solutions, like virtual assessment, teletherapy, and wearable devices. Whereas the global firms are promoting hybrid models, in which digital tools and AI assist human mental health professionals.

| Key Elements | Scope |

| Market Size in 2026 | USD 1.78 Billion |

| Projected Market Size in 2035 | USD 3.43 Billion |

| CAGR (2026 - 2035) | 7.54% |

| Leading Region | North America |

| Market Segmentation | By Product Type, By Application, By End-User, By Technology, By Region |

| Top Key Players | BetterHelp, Talkspace, Headspace Health, Lyra Health, Woebot Health, Mind Diagnostics, Calm, SilverCloud Health,Modern Health, Spring Health |

Mainly, the global mental health tester market comprises a structured assessment where a healthcare provider notices and asks questions about your behavior, appearance, mood, thinking, and cognitive skills for assessing your mental state, identifying concerns, including anxiety or depression. Moreover, the market is significantly fueled by an immense government support, integration into primary care, emphasis on early detection, and workplace wellness. Current breakthroughs cover establishing wearable devices, which can monitor stress levels, emotional well-being, and sleep patterns, further facilitating users with actionable insights into their mental state.

Primarily, the tech firms are greatly leveraging AI-enabled tools in the analysis of survey responses, text (social media, messages), and behavioral patterns (sleep, activity from wearables) to address early symptoms of anxiety, depression, bipolar disorder, and suicide risk. However, the widespread adoption of machine learning supports in detecting subtle patterns in complex data, especially in EHRs , wearables, and habits, which further enables the estimation of emergencies or relapse to facilitate proactive care.

Specifically, various devices have a major role in monitoring sleep patterns, heart rate variability, and physical activity levels to offer insights into stress and mood disturbances.

The global healthcare providers are increasingly using AI-assisted chatbots and virtual companions, which provide 24/7, stigma-free, confidential initial support and screening, guiding users to professional support when essential.

During the prospective period, researchers will highly participate in developing hybrid models where digital tools and AI help human mental health professionals. Also, AI tools will support therapists with administrative tasks and data analysis, enabling them to emphasize direct patient care and the substantial human connection.

Which Product Type Led the Mental Health Tester Market in 2025?

The mobile applications segment held a dominant share of the market in 2025. They have major benefits, such as affordability, convenient options to traditional therapy, and eliminating gaps in professional access, primarily for Gen Z/Millennials. Also, they facilitate privacy, flexibility, and on-demand access, with vital advances, like Sanvello, which offers self-assessments using clinically validated measures & enables users to export data to share with their doctors.

AI-Driven Diagnostic Tools

The AI-driven diagnostic tools segment will expand rapidly. It is mainly propelled by the broader adoption of natural language processing (NLP), machine learning (ML), and predictive analytics. Moreover, these novel solutions integrate data from multiple inputs, including speech patterns, facial expressions, physiological signals (heart rate, sleep), and text analysis to develop a complete "digital psychological signature" for dynamic and consistent monitoring. Ellipsis Health emphasises voice-based assessment of mental health status and tracking changes over time.

Why did the Clinical Diagnosis Segment Dominate the Market in 2025?

The clinical diagnosis segment registered dominance in the mental health tester market in 2025. Across the globe, a rise in instances of depression, anxiety, PTSD, and ADHD, due to the modern stressors and the COVID-19 pandemic, has fostered demand for efficient diagnostic and screening tools. The emerging solutions, like Ginger, are increasingly utilising predictive analytics for finding users at risk of developing mental health illnesses, which enables proactive intervention by a mental health coach.

Personal Use/Self-Monitoring

In the prospects, the personal use/self-monitoring segment is anticipated to register the fastest growth. It is specifically impelled by the accelerating awareness and acceptance of mental health concerns and crucial technological breakthroughs. Sophisticated measures, such as federated learning, enable AI models to learn from user data, whereas the data remains decentralized on the user's device. However, different smartwatches (Apple Watch, Fitbit, Garmin) and fitness bands are promoting the integration of AI to monitor physiological indicators of stress and anxiety in real-time.

How did the Hospitals Segment Lead the Mental Health Tester Market in 2025?

With a major share, the hospitals segment dominated the market in 2025. They significantly facilitate necessary inpatient care, emergency services, and integrate assessments into routine checkups. These solutions offer objective data, including cognitive function and personality traits, supports clinicians in diagnosing complex issues. Specifically, Cerebral employs AI to assist therapists in refining customised treatment strategies, and Kintsugi uses voice analysis to offer real-time emotional feedback during teletherapy sessions.

Clinics & Mental Health Centers

In the coming era, the clinics & mental health centers segment is predicted to register the fastest growth. A prominent catalyst is a raised integration of advanced measures into primary care, corporate wellness programs, and educational institutions, to allow early detection and intervention. Also, they are embedding steps in using data from a patient's existing smartphone sensors for the creation of behavioral metrics, which bolsters passive tracking of behavior changes indicative of conditions, especially depression or psychosis.

Which Technology Dominated the Mental Health Tester Market in 2025?

In 2025, the telehealth & virtual platforms segment captured the biggest share of the market. With the elimination of regional obstacles, these solutions enable access to individuals in remote or underserved areas, also for those with mobility issues. However, the government’s suitable policies are leveraging insurance coverage for telehealth services, which promotes both providers and patients to adopt these solutions.

AI & Machine Learning Based Tools

The AI & machine learning based tools segment will expand rapidly. The recently developed tools, like Psynth and Heidi, are using AI in automating time-consuming administrative tasks, like report writing, note-taking, and documentation, enabling clinicians to focus more on patient care. Furthermore, computer vision and deep learning techniques are supporting the analysis of facial expressions and micro-expressions to infer emotional states.

In 2025, North America registered dominance in the market due to the possession of excellent technology, favourable policies, and employer adoption for early screening. Alongside, the region is fostering diverse standardized and validated clinical assessment tools, particularly the PHQ-9 for depression and GAD-7 for anxiety, which are highly available in free digital formats from the American Psychiatric Association (APA) and other sources, supporting robust and persistent screening.

Whereas the mental health tester market in the U.S. has been exploring major AI-powered conversational agents, specifically Woebot and Wysa, which provide 24/7 support and conduct initial screenings using clinically validated questionnaires, like PHQ-9 and GAD-7. Moreover, the Kintsugi uses voice and facial analysis to offer real-time emotional feedback to therapists.

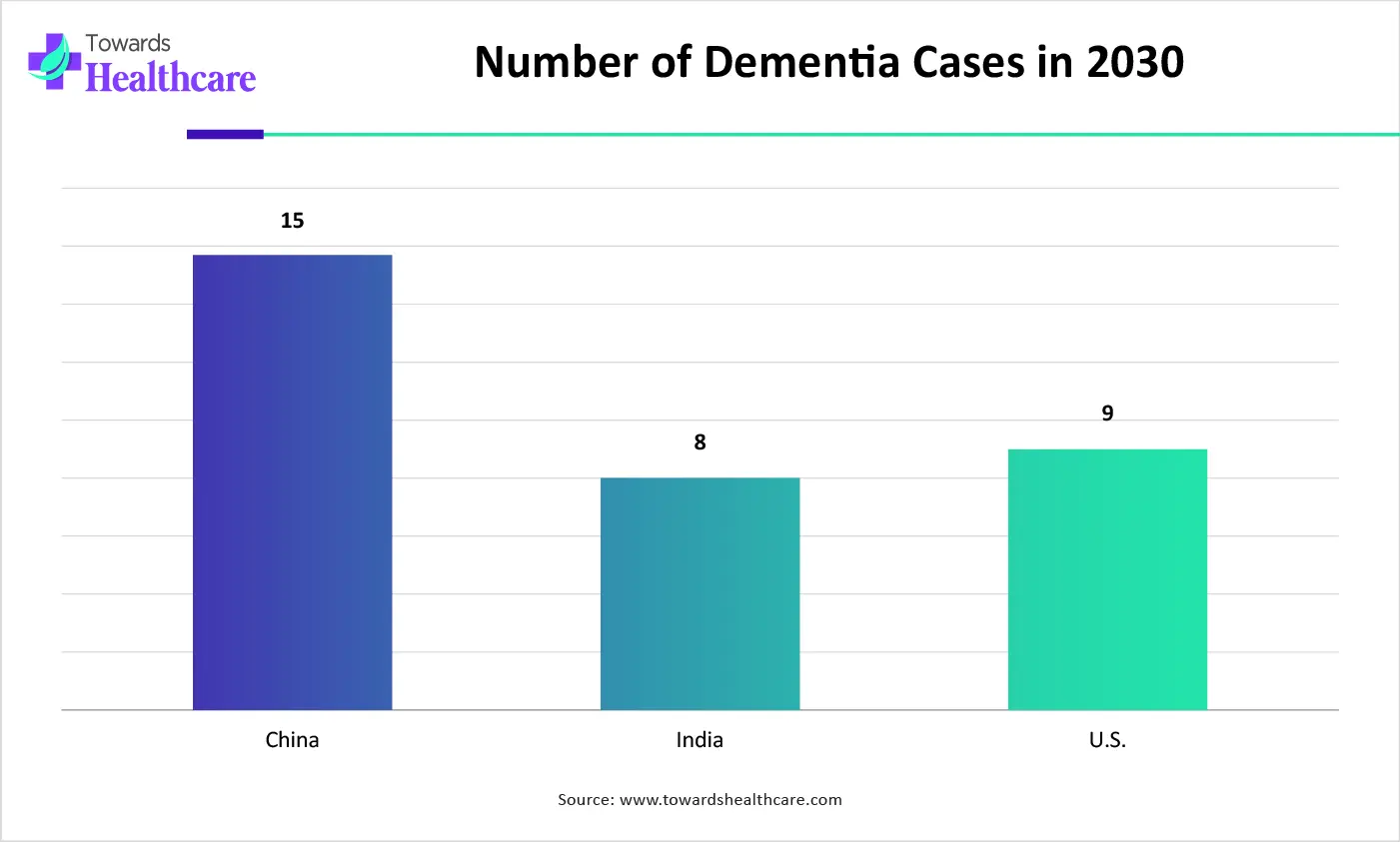

In the future, the Asia Pacific will expand at the fastest CAGR, due to the rising cases of depression, anxiety, stress, and dementia, primarily among working-age adults & ageing population. Besides this, expanding public discourse, advocacy campaigns, and media coverage are efficiently lowering the stigma around mental disorders, coupled with the use of self-help tools and online platforms. In Australia, government-led digital services, such as Head to Health, are immensely connecting people with certified mental wellness apps & resources.

Japan will expand rapidly in the mental health tester market, as many organizations, including NPO Silver Ribbon Japan, are continuing large-scale awareness activities, like illuminating landmarks (like Tokyo Tower) in silver and green on World Mental Health Day 2025 to encourage correct recognition and lower stigma around mental illness.

In the coming era, Europe will expand notably in the mental health tester market, as several European countries are planning to execute the WHO's "Comprehensive Mental Health Action Plan 2013–2030," which provides a global environment to enhance mental health, with escalated governance and services. Particularly, France has been devoting funds to digital health services, consisting of mental health platforms.

Recently, the Medicines and Healthcare products Regulatory Agency (MHRA) released new guidance for assisting manufacturers of digital mental health tools, like apps and AI assessments, in navigating UK medical device regulations, while ensuring their effectiveness and safety for clinical use.

| Company | Description |

| BetterHelp | It specifically facilitates a platform for individuals to receive mental health services from licensed professionals. |

| Talkspace | This widely provides various free online mental health "tests" or screenings. |

| Headspace Health | A firm mainly leverages guided meditations, sleep tools, mindfulness exercises, AI support (Ebb), unlimited behavioral health coaching (text/video), and therapy/psychiatry services. |

| Lyra Health | Its provision consists of personalized therapy and coaching, medication management, and digital self-care tools. |

| Woebot Health | This prominently explores an AI-enabled, chat-based platform that serves as a digital mental health companion (called Woebot). |

| Mind Diagnostics | It substantially facilitates over 25 free, confidential, and scientifically validated online mental health self-assessments. |

| Calm | Its major offering encompasses a free, anonymous online mental health screening. |

| SilverCloud Health | A company widely implements a platform of over 30 on-demand, evidence-based digital mental health and wellbeing programs. |

| Modern Health | This specializes in personalized mental health support, emphasizing less on generic "tests" and more on holistic assessment. |

| Spring Health | It explored tailored mental health support through its "Precision Mental Healthcare". |

Mainly, tools making diagnostic claims without FDA or other regulatory approval face potential imposition actions and legal limitations.

By Product Type

By Application

By End-User

By Technology

By Region

February 2026

February 2026

February 2026

January 2026