November 2025

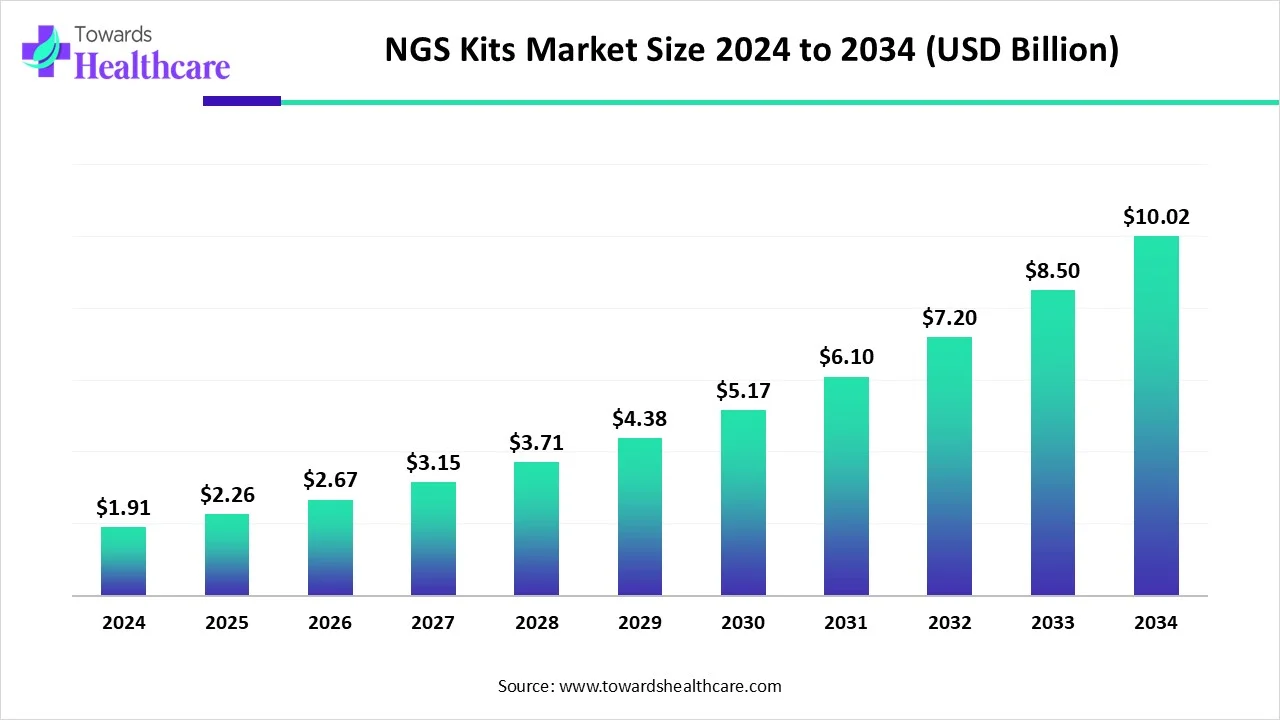

The global NGS kits market size is calculated at USD 1.91 billion in 2024, grows to USD 2.26 billion in 2025, and is projected to reach around USD 10.02 billion by 2034. The market is expanding at a CAGR of 18.03% between 2025 and 2034.

| Metric | Details |

| Market Size in 2025 | USD 2.26 Billion |

| Projected Market Size in 2034 | USD 10.02 Billion |

| CAGR (2025 - 2034) | 18.03% |

| Leading Region | North America |

| Market Segmentation | By Nucleotide Sequenced, By End-User, By Region |

| Top Key Players | Illumina, Inc., Thermo Fisher Scientific Inc., Roche Holding AG, Danaher Corporation, MGI Tech Co., Ltd., Agilent Technologies, Inc., PerkinElmer, Inc., Takara Bio Inc., Oxford Nanopore Technologies plc, Twist Bioscience Corporation |

The NGS kits include products used in next-generation sequencing, providing essential reagents and tools for DNA/RNA preparation, sequencing, and analysis in research and clinical applications. The market is growing rapidly due to rising demand for accurate, high-throughput genetic analysis in research and clinical diagnostics. Increasing applications in personalized medicine, Oncology, rare disease detection, and infection disease monitoring are major divers. Technological advancements have made sequencing faster and more cost-effective, encouraging widespread adoption. Government funding for genomics research and expanding the use of NGS in drug development and biomarkers discovery further support the market growth. Additionally, growing awareness of precision medicine is boosting the market growth.

AI is enhancing advancements in the market by improving data analysis speed and accuracy, enabling more efficient interpretation of complex genomic data. It helps identify genetic variants, patterns, and mutations with greater precision, supporting personalized medicine and disease diagnosis. AI-driven automation also optimizes sequencing workflows, reduces errors, and lowers costs. Overall, AI integration accelerates research and clinical applications, making NGS more accessible and effective for diverse genomics studies.

For Instance,

Rising Demand for Precision Medicines

NGS enables detailed genetic profiling, which helps identify specific mutations linked to various diseases, especially cancer and rare genetic disorders. This supports the development of targeted therapies tailored to individual patients. As healthcare moves towards customized treatment, clinicians and efficient genomics analysis are required. Additionally, the growing use of pharmacogenomics, which studies how genes affect drug response, further boosts demand.

High-Cost Equipment and Data Analysis

The initial investment in the NGS platform is substantial, and the recurring expenses for reagents, maintenance, and software add to the financial burden. Additionally, the complex bioinformatics required for interpreting large volumes of sequencing data demands skilled professionals and robust IT infrastructure, which are not always readily available. These financial and technical barriers slow down the widespread adoption of NGS kits, particularly in clinical settings where cost-efficiency and ease of use are critical.

Integration of AI and Machine Learning

The integration of AI and machine learning presents a future opportunity for the NGS kits market by transforming how genomic data is analyzed. NGS generates vast, complex datasets that require advanced interpretation to identify key genetic variations. AI and ML can automate and accelerate this process, improving accuracy, reducing error, and cutting down analysis time. These technologies also enable predictive insights for earlier disease detection and personalized treatment decisions. As AI-powered tools become more widely adopted in healthcare, the demand for NGS kits designed to work seamlessly with such technologies will increase, driving market growth and innovation.

For Instance,

By Nucleotide sequenced, the DNA segment dominated the market in 2024, due to its widespread application in clinical diagnostics and research. DNA sequencing is essential for identifying genetic mutations linked to cancer, rare diseases, and inherited conditions, making it a cornerstone of personalized medicine. Its high accuracy, stability, and ease of handling compared to RNA further support its use. Additionally, the rising adoption of whole-genome sequencing for non-invasive testing methods such as liquid biopsies and prenatal screening contributed to its leading position in the NGS kits market.

By Nucleotide sequenced, the RNA segment is projected to grow at the fastest rate between 2025 and 2034, due to its expanding role in gene expression analytics, disease mechanism studies, and drug development. Unlike DNA, RNA provides dynamic insights into how genes are regulated in real-time, making it highly valuable in areas like cancer research, immunology, and infection disease monitoring. The growing popularity of RNA-based therapeutics and vaccines, particularly following the success of mRNA vaccines, has also accelerated investment in RNA sequencing technologies. Additionally, innovations in single-cell RNA sequencing are further boosting the demand for the NGS kits market.

By end-user, the pharmaceutical and biotechnology companies segment was dominant in the market in 2024, due to their extensive use of sequencing technologies in drug discovery and development, and precision technologies in drug discovery, development, and precision medicine. NGS plays a crucial role in identifying genetic targets, understanding disease pathways, and developing personalized therapies, especially in oncology and rare diseases. These companies invest heavily in R and D and rely on NGS for biomarker discovery, patient stratification, and companion diagnostics. Their strong financial resources and advanced infrastructure further support the widespread adoption of NGD kits, driving market growth.

By end-user, the academic and research institutes segment is expected to grow at the fastest rate in the market during the forecast period, due to increasing investment in genomics research and growing adoption of NGS technologies in academic studies. Universities and research institution are expanding their focus on genetics studies, personalized medicines, and disease mechanisms, all of which rely heavily on NGS. Government funding, collaborative research projects, and the rising need for advanced genomic tools in education and innovation are also contributing to the rapid growth of the market.

In 2024, North America led the market, driven by its advanced healthcare infrastructure, significant R&D investments, and strong presence of key genomic companies. The region’s early adoption of innovative technologies, growing emphasis on precision medicine, and robust government support for genomics initiatives further contributed to its dominance. The U.S., in particular, is home to major industry players and top-tier research institutions engaged in cutting-edge genomic studies. Favorable regulatory frameworks and increasing demand for personalized healthcare also reinforced North America's leading role in the NGS kits market.

For Instance,

The U.S. market is growing due to rising demand for precision medicine, strong government funding for genomic research, and the presence of leading biotech companies. Advanced healthcare infrastructure, increased adoption of NGS in clinical diagnostics, and expanding applications in oncology and rare disease detection further drive market growth. Additionally, ongoing innovations and supportive regulatory frameworks enhance the use of NGS technologies across the healthcare and research sectors.

The country has seen increased government and private investments in genomics research, bolstering the development and adoption of NGS technologies. Advancements in bioinformatics and the decreasing cost of sequencing have made NGS more accessible for both clinical and research applications. Additionally, Canada's focus on precision medicine and the integration of AI in genomic data analysis are driving demand for NGS kits, positioning the country as a growing hub for genomic innovation.

For Instance,

The Asia-Pacific region is anticipated to grow at the fastest rate in the NGS kits market during the forecast period due to rising healthcare investments, increasing awareness of precision medicine, and rapid expansion of genomic research. Countries like China, India, and Japan are investing heavily in biotechnology and personalized healthcare initiatives. Additionally, a growing patient population, government-supported genomics programs, and improving healthcare infrastructure are driving demand for NGS technologies. Collaborations between local institutions and global companies are also enhancing access to advanced sequencing tools, fueling market growth across the region.

For Instance,

The country has made lucrative investments in genomics research and infrastructure, leading to advancements in sequencing technologies and bioinformatics. The declining cost of sequencing has made NGS more accessible for clinical and research applications. Additionally, China's focus on precision medicine and the integration of AI in genomic data analysis are driving demand for NGS kits, positioning the country as a growing hub for genomic innovation.

India's market is expanding rapidly because the country has seen increased government and private investments in genomics research, bolstering the development and adoption of NGS technologies. Advancements in bioinformatics and the decreasing cost of sequencing have made NGS more accessible for both clinical and research applications. Additionally, India's focus on precision medicine and the integration of AI in genomic data analysis are driving demand for NGS kits, positioning the country as a growing hub for genomic innovation.

Europe is expected to see significant growth in the NGS kits market due to increasing government investments in genomics research, rising adoption of precision medicine, and expanding applications in oncology and rare disease diagnostics. Countries like Germany and France are leading large-scale initiatives to integrate NGS into clinical practice, supported by advanced healthcare infrastructure and collaborative research projects. Additionally, the declining cost of sequencing and advancements in bioinformatics are making NGS technologies more accessible, further driving market expansion across the region.

The UK's market is experiencing significant growth, driven by substantial government investments in genomics research and initiatives like Genomics England's newborn genome sequencing program. The National Health Service (NHS) is integrating NGS into clinical practice, enhancing diagnostics for rare diseases and cancers. Additionally, the presence of leading companies such as Oxford Nanopore Technologies fosters innovation and adoption of NGS technologies. These factors collectively contribute to the robust expansion of the UK's NGS kits market.

The country's strong emphasis on precision medicine and personalized healthcare has led to increased adoption of NGS technologies in clinical diagnostics, particularly in oncology and rare disease detection. Government initiatives and funding support large-scale genomic projects, fostering innovation and research. Additionally, Germany's advanced healthcare infrastructure and collaborations between academic institutions and biotech companies contribute to the expanding use of NGS kits across various applications. These elements collectively drive the significant growth of the NGS kits market in Germany.

In May 2025, Watchmaker Genomics partnered with Revvity to automate its entire DNA and RNA library preparation kit portfolio on the Sciclone™ G3 NGSx system. This automation boosts efficiency by reducing hands-on time, minimizing errors, and supporting up to 96 samples per run. Sandra Rowe, VP of Marketing at Watchmaker Genomics, stated they are excited to expand the partnership with Revvity to deliver high-performance, automation-ready NGS solutions to more labs. (Source - businesswire)

By Nucleotide Sequenced

By End-User

By Region

November 2025

November 2025

November 2025

November 2025