December 2025

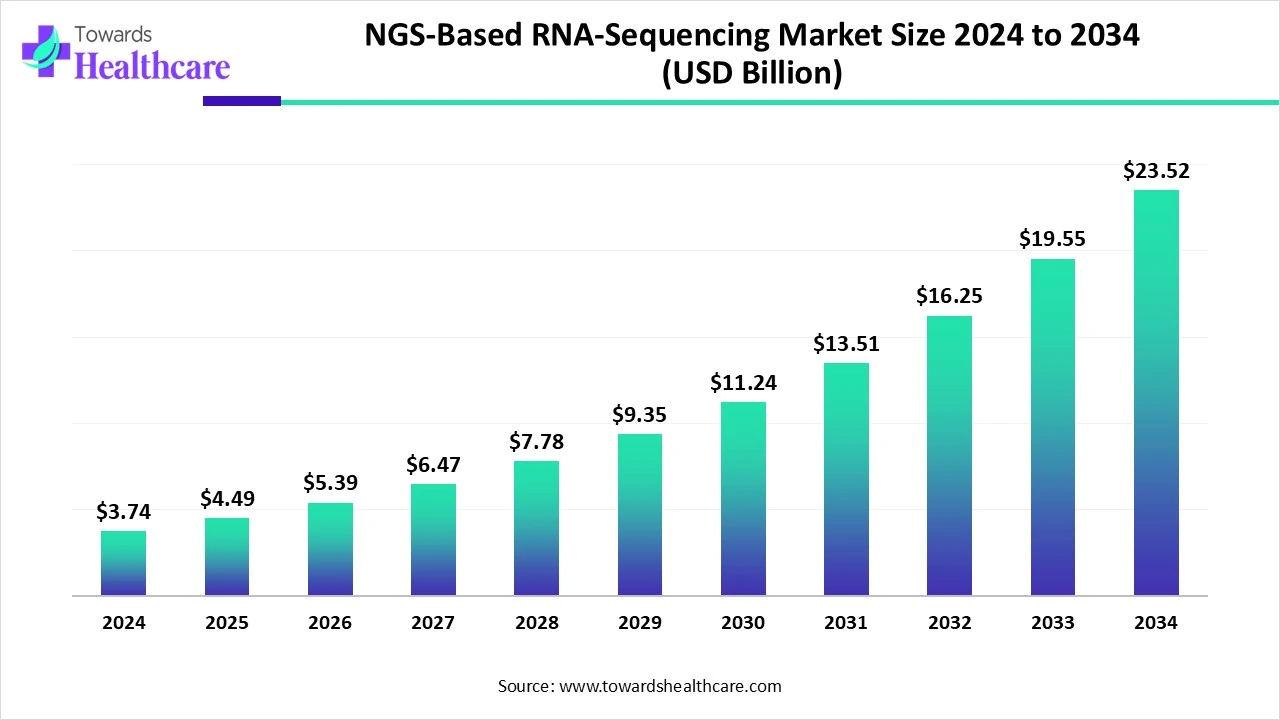

The global NGS-based RNA-sequencing market size is calculated at USD 3.74 billion in 2024, grow to USD 4.49 billion in 2025, and is projected to reach around USD 23.52 billion by 2034. The market is expanding at a CAGR of 20.1% between 2025 and 2034.

The NGS-based RNA-sequencing market is witnessing steady growth, driven by advancements in sequencing technology, reduced costs, and increasing applications in clinical diagnostics and biomedical research. Its use in identifying gene expression patterns, detecting mutations, and supporting precision medicine has expanded across pharmaceutical and academic sectors. Rising demand for personalized treatments and global investments in genomics research are further fueling market expansion, with Asia-Pacific emerging as a key growth region.

| Metric | Details |

| Market Size in 2025 | USD 4.49 Billion |

| Projected Market Size in 2034 | USD 23.52 Billion |

| CAGR (2025 - 2034) | 20.1% |

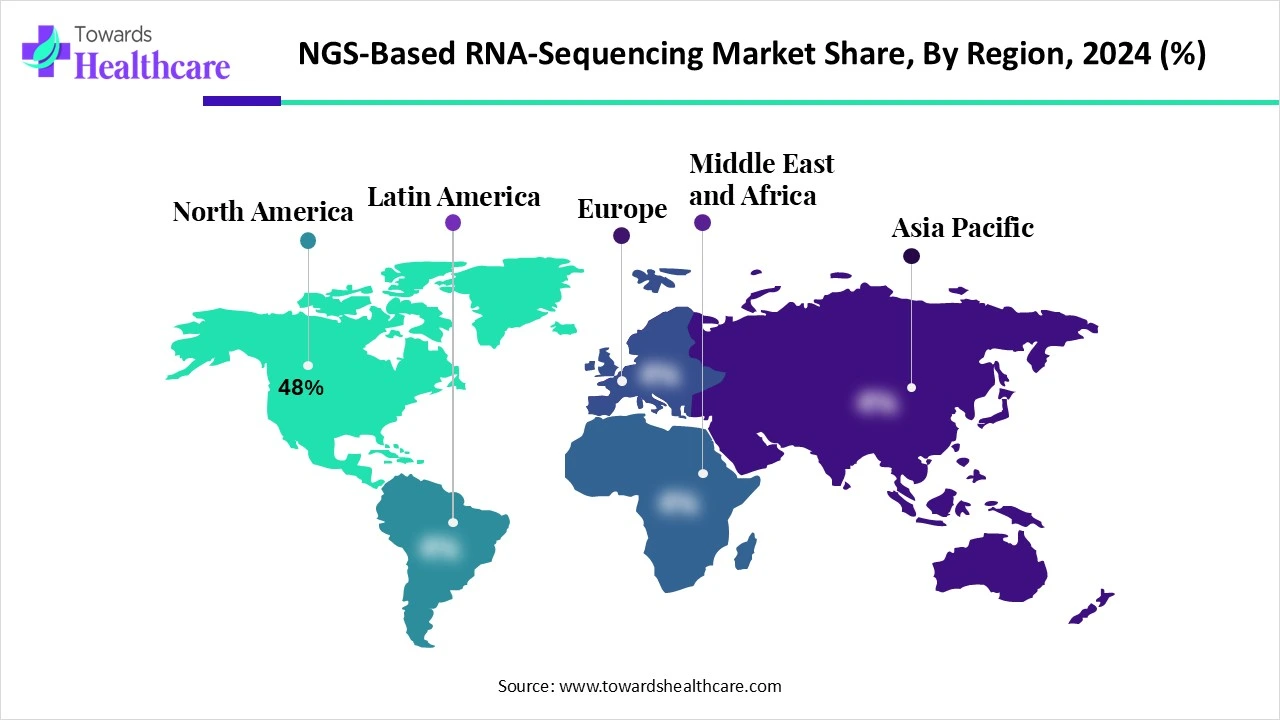

| Leading Region | North America share by 48% |

| Market Segmentation | By Type, By Technology, By Application, By End User, By Workflow Component, By Region |

| Top Key Players | Illumina, Inc., Thermo Fisher Scientific, Oxford Nanopore Technologies, Pacific Biosciences (PacBio), Agilent Technologies, QIAGEN, Takara Bio Inc., 10x Genomics, BGI Genomics, PerkinElmer (Revvity), CD Genomics, Novogene Corporation, Eurofins Genomics, Fulgent Genetics, Macrogen Inc., Bio-Rad Laboratories, Genewiz (Azenta Life Sciences), Parse Biosciences, Element Biosciences |

The NGS-Based RNA-Sequencing Market refers to the segment of next-generation sequencing (NGS) technologies and services specifically used for transcriptome analysis, allowing researchers and clinicians to analyze the quantity and sequences of RNA in a sample. RNA-Sequencing enables the discovery of gene expression patterns, transcript isoforms, fusion genes, alternative splicing, and non-coding RNAs.

It is widely used in oncology, immunology, infectious diseases, neuroscience, and developmental biology, as well as for biomarker discovery and personalized medicine. The market is driven by increased research funding, single-cell innovations, and expanding clinical applications. The NGS-based RNA-sequencing market is advancing with improved sequencing speed, data quality, and integration with AI-driven analytics. Its growing targeted therapies are expanding its relevance in both research and clinical settings.

For Instance,

AI is transforming the market by enhancing data analysis, interpretation, and accuracy. It enables rapid identification of gene expression patterns, simplifies large-scale data processing, and improves variant detection. AI-driven tools also support predictive modeling and biomarker discovery, accelerating research and clinical decision-making. This integration of AI boosts efficiency, reduces turnaround times, and helps unlock deeper biological insights from complex RNA sequencing datasets.

Rising Demand For Personalized Medicine

The increasing focus on personalized medicine is boosting the NGS-based RNA-sequencing market, as it helps uncover patient-specific gene activity and disease mechanisms. This technology allows researchers and clinicians to design more effective, individualized treatments by identifying key molecular targets.

With growing interest in precision healthcare, especially for complex conditions like cancer and genetic disorders, RNA sequencing has become an essential tool for guiding therapy decisions and improving patient care outcomes.

High Cost of Sequencing Technologies

The high cost of sequencing technologies poses a challenge to the growth of the NSG-based RNA sequencing market, as it demands significant investment in equipment, maintenance, and technical expertise. These financial demands can hinder adoption, particularly in resource-limited research centers and healthcare facilities. As a result, despite the benefits of RNA sequencing, many institutions may delay implementation due to budget constraints, slowing down the broader integration of this technology into routine use.

Expansion into Emerging Markets

The growing focus on health are modernization, and genomics research in emerging economies creates new avenues for the NGS-based RNA-sequencing market. These regions are witnessing a surge in funding, improved laboratory capabilities, and increased patient access to molecular diagnostics. Additionally, collaborations between local institutions and global biotech firms are accelerating adoption. As affordability improves and regulatory frameworks become more favorable, these markets offer untapped potential for growth and innovation in RNA sequencing applications.

In 2024, the mRNA sequencing segment held the largest revenue share in the NGS-based RNA-sequencing market due to its widespread use in analyzing gene expression patterns and identifying disease-related biomarkers. Its ability to provide insights into coding regions' biomarkers. Its ability to provide insights into coding regions of the genome made it essential for cancer research, drug development, and personalized medicine. Additionally, its compatibility with various sample types and ease of data interpretation supported its dominance across both research and clinical applications.

The single-cell RNA sequencing segment is projected to grow at the fastest CAGR during the forecast period due to its capability to analyze gene expression at an individual cell level, offering unparalleled resolution and insights into cellular heterogeneity. This technology is increasingly used in cancer research, immunology, and developmental biology to uncover rare cell populations and disease mechanisms. Advancements in microfluidics and bioinformatics tools are also accelerating their adoption in both academic and clinical research settings.

The sequencing by synthesis (SBS) segment led the NGS-based RNA-sequencing market in 2024 owing to its reliable performance, efficient data output, and widespread integration into established sequencing platforms. Its capacity to deliver high-throughput results with a low error rate made it the preferred method for transcriptomic studies. The technology’s compatibility with a broad range of applications, including disease research and diagnostics, further boosted its market share across academic, clinical, and pharmaceutical sectors.

The third-generation sequencing segment is projected to grow at the highest CAGR during the forecast period due to its capacity to analyze full-length RNA molecules with minimal processing. This technology offers deeper insights into transcriptome complexing, capturing structural variations and rare transcripts more effectively than traditional methods. Its expanding use in precision medicine, along with advancements in accuracy and throughput, is attracting significant attention from researchers and healthcare providers, fueling its rapid adoption across multiple applications.

The drug discovery and development segment dominated the NGS-based RNA- sequencing market in 2024 due to its increasing use in uncovering novel therapeutic targets and understanding gene expression changes in response to compounds. This application supports more precise and efficient development of new drugs, especially in oncology and genetic disorders. Additionally, the push for personalized treatment strategies and advancements in sequencing technologies have further encouraged in integration into pharmaceutical research pipelines, strengthening its market lead.

The single-cell transcriptomics in the immune-oncology segment is projected to experience the highest CAGR due to its unique capability to decode immune responses at the individual cell level within tumors. This precision enables researchers to discover new biomarkers, understand tumor heterogeneity, and design more effective immunotherapies. As the focus on tailored cancer treatments intensifies and single-cell technologies become more accessible, this segment is gaining momentum across pharmaceutical, clinical, and academic research environments.

For Instance,

The academic and research institution segment led the NGS-based RNA-sequencing market in 2024 due to its ongoing efforts in advancing genetic and molecular biology studies. These institutions are at the forefront of basic and translational research, using RNA sequencing to explore gene expression, discover therapeutic targets, and understand complex diseases. Supportive public funding, access to high-end sequencing platforms, and a strong focus on innovation contributed to their dominant role in driving market demand.

The clinical and diagnostic laboratories segment is anticipated to register the highest CAGR during the forecast period as RNA sequencing becomes more integral to routine diagnostics and precision healthcare. Growing reliance on molecular profiling for early disease detection, especially in cancer and rare genetic conditions, is fueling adoption. Enhanced affordability, faster workflows, and increasing physician awareness of RNA-based insights are encouraging clinical labs to incorporate NGS technologies, significantly boosting the growth of the market.

In 2024, the library preparation and sample processing segment captured the largest market share as it serves as a crucial step in maintaining RNA integrity and preparing high-quality input for sequencing. The demand for reliable, streamlined protocols to handle diverse sample types, especially in clinical and translational research, boosted their use. Innovation in automation, reagent kits, and sample handling efficiency further enhanced its adoption, making it the most utilized component across various end-use applications.

The data analysis and interpretation segment is projected to witness the highest CAGR due to the growing emphasis on extracting actionable insights from complex RNA sequencing datasets. With advancements in sequencing technologies generating massive volumes of data, the need for robust computational tools and skilled analytics platforms has intensified. Increased adoption of cloud-based analytics, machine learning algorithms, and integrated reporting solutions is driving demand, particularly in clinical research and personalized medicine applications.

North America dominated the market share by 48% in 2024, due to its well-established healthcare infrastructure, strong presence of leading sequencing technology providers, and significant investment in genomics research. High adoption of advanced diagnostic tools, increasing focus on personalized medicine, and supportive government funding further strengthened the region’s market position. Additionally, a strong network of academic institutions and biotech firms actively engaged in RNA-based studies contributed to North America's leadership in the market.

For Instance,

The U.S. market is expanding due to growing demand for precision medicine, increasing research funding, and rapid adoption of advanced genomic technologies. A strong presence of biotech companies, academic institutions, and clinical research organizations drives innovation. Additionally, supportive regulatory frameworks and rising applications in cancer diagnostics and drug development are fueling market growth across both research and clinical settings.

Canada’s market is growing due to increasing focus on genomics research, rising adoption of precision medicine, and strong government support. National initiatives and funding programs are encouraging advancements in transcriptomics and molecular diagnostics. Additionally, collaborations between academic institutions, biotech firms, and healthcare providers are boosting the integration of RNA sequencing into both research and clinical applications across the country.

Asia-Pacific is projected to grow at the fastest CAGR in the market due to rising investments in genomic research, expanding healthcare infrastructure, and increasing demand for personalized medicine. Countries like China, India, and Japan are advancing national genomics programs and supporting large-scale sequencing projects. Additionally, the growing burden of chronic diseases, improving awareness of molecular diagnostics, and the presence of emerging biotech companies are accelerating the adoption of RNA sequencing technologies across the region.

China’s market is expanding due to heavy government investment in genomics and precision medicine, alongside the rapid growth of domestic biotech firms like BGI and MGI. These companies offer competitive, cost-effective sequencing platforms and services, driving adoption across research and clinical settings. Collaborative initiatives and population-scale projects further boost transcriptomics use, accelerating the integration of RNA sequencing technology nationwide.

India’s market is increasing due to robust government backing for genomics through initiatives like the Genome India Project, expanding investments in precision medicine, and growing R&D activity in biotech hubs like Bengaluru, Hyderabad, and Pune. Academic institutions and companies such as MedGenome and Mapmygenome are integrating NGS-based RNA-sequencing into diagnostics, oncology, and population genomics studies, boosting adoption across research and clinical sectors.

Europe’s approach to the market in 2024 was characterized by robust investment in genomics research, strong integration of sequencing technologies within healthcare systems, and active collaboration between academic institutions, biotech firms, and government agencies. The region supported personalized medicine and early disease detection initiatives, while Germany, the UK, and France drove significant market activity. Consumables remained the dominant product category, with services showing the fastest projected growth as translatable sequencing demand rose across research and clinical applications.

The UK’s cing market is expanding thanks to strong government support for genomics and precision medicine infrastructure. Ongoing initiatives like widespread newborn genome sequencing, the legacy of the 100,000 Genomes Project, and collaborations between the NHS, Genomics England, and academic centers are transforming the genomic landscape. The presence of UK-based sequencing innovators like Oxford Nanopore Technologies further accelerates adoption across research and clinical sectors.

Germany’s market is expanding due to substantial government support for genomics infrastructure (e.g., GenomDE), advanced healthcare systems, and strong research output from institutions like Max Planck and DKFZ. Leading biotech and diagnostic firms Qiagen, CeGaT, and Sophia Genetics offer services and platforms widely adopted in oncology and precision medicine applications, accelerating market growth.

The “RNA Sequencing: Technologies and Global Markets” report by ResearchAndMarkets.com highlights the rapid growth of the global RNA sequencing market through 2029. Driven by advancements in next-generation sequencing, RNA sequencing is replacing traditional methods, enabling detailed analysis of gene expression, mutations, and transcript variations. Its expanding use in research, diagnostics, and precision medicine, along with reduced costs and rising demand for accurate data tools, is fueling widespread adoption across the life sciences sector. (Source - Businesswire)

By Type

By Technology

By Application

By End User

By Workflow Component

By Region

December 2025

November 2025

November 2025

November 2025