February 2026

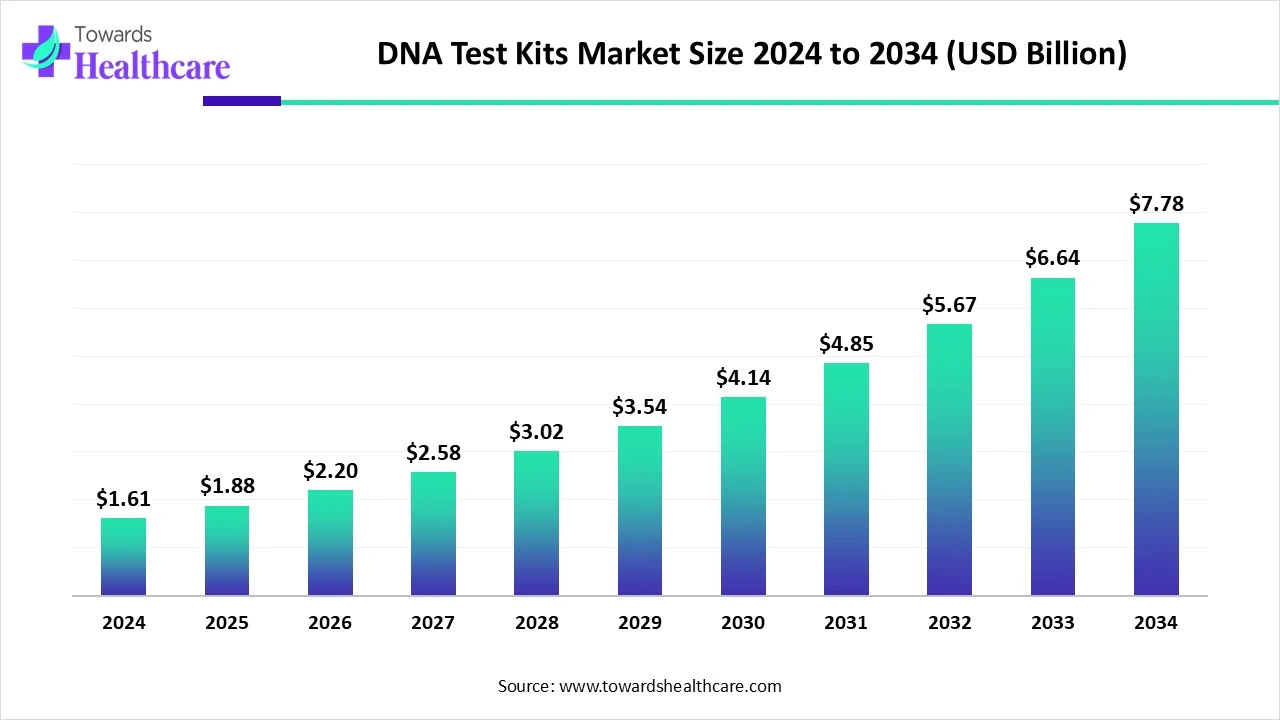

The global DNA test kits market size is calculated at USD 1.61 billion in 2024, grew to USD 1.88 billion in 2025, and is projected to reach around USD 7.78 billion by 2034. The market is expanding at a CAGR of 17.04% between 2025 and 2034.

The DNA test kits market is primarily driven by the rising prevalence of chronic disorders and the growing demand for ancestry and wellness. Government bodies launch initiatives to create awareness among the general public about the screening and early diagnosis of a disease. Advancements in diagnostics and the rapidly expanding medical device sector contribute to market growth. Integrating artificial intelligence (AI) in DNA test kits introduces automation, as well as enhances the efficiency and accuracy of tests. The future is promising, with advances in DNA technologies.

| Table | Scope |

| Market Size in 2025 | USD 1.88 Billion |

| Projected Market Size in 2034 | USD 7.78 Billion |

| CAGR (2025 - 2034) | 17.04% |

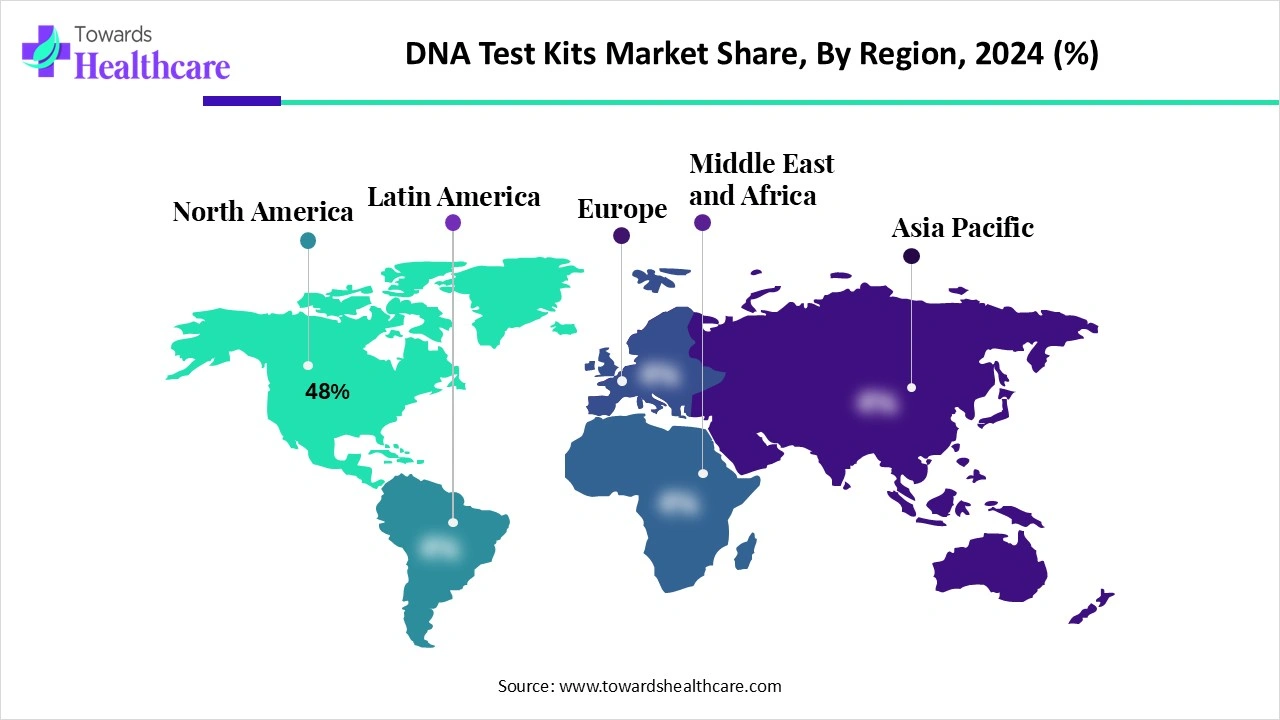

| Leading Region | North America Share 48% |

| Market Segmentation | By Test Type/Purpose, By Technology/Analysis Method, By Sample Type/Collection Method, By Distribution Channel, By Region |

| Top Key Players | 23andMe, AncestryDNA, MyHeritage DNA, FamilyTreeDNA, Living DNA, Nebula Genomics, Color Genomics, Invitae, Natera, FTDNA / Gene by Gene, LabCorp, Quest Diagnostics, BGI / MGI, Illumina, Thermo Fisher Scientific, Myriad Genetics, Invivoscribe / Orchid Biosciences, Prenetics, Fulgent Genetics, Eurofins Genomics |

The DNA test kits market covers at-home and clinical kits that collect biological samples (saliva, buccal swab, blood) for DNA analysis to provide consumers and clinicians with information on ancestry, health risks, carrier status, pharmacogenomics, paternity/relationship testing, forensic identification, and research. The market spans direct-to-consumer (DTC) ancestry/health kits, clinical diagnostics (e.g., carrier screening, pharmacogenomic panels, NIPT-related sequencing services), forensic/chain-of-custody testing, and research/biobank sample collection kits. Growth is driven by consumer interest in ancestry & wellness, falling sequencing costs, expanding clinically actionable genetic tests, integration of genomic data into primary care, and greater retail & telehealth distribution.

AI plays a vital role in accelerating the diagnosis and reducing the costs of testing. It introduces automation in genetic testing, simplifying the tasks of healthcare professionals. AI and machine learning (ML) algorithms analyze vast amounts of data and can spot chromosomal changes that are otherwise difficult to see by healthcare professionals. AI can also identify the function of mutations and their potential relationship to disease. It allows doctors to manage and interpret data more efficiently. AI and ML can identify and classify rare and common variants, facilitating early diagnosis of a disease.

Point-of-Care Diagnostics

The major growth factor of the DNA test kits market is the growing demand for point-of-care diagnostics. Point-of-care diagnostics refers to clinical laboratory tests performed at or near the site of patient care. This eliminates the need for a patient to visit a laboratory. The growing geriatric population, the increasing number of employed people, and the rising prevalence of chronic disorders potentiate the demand for DNA test kits. Point-of-care diagnostics offer numerous benefits, such as rapid results, portability, minimal storage requirements, and simplicity of use. This helps healthcare professionals and patients to make effective clinical decisions.

Disease Prediction

DNA test kits can identify genetic mutations within a body fluid sample, thereby assessing the presence of a disease. The major limitation of the test kit is that it cannot assess future disease development. It does not definitely tell whether a patient will develop a particular health condition; it only tells the risk levels.

What is the Future of the DNA Test Kits Market?

The market future is promising, driven by advances in DNA technology, such as single-cell sequencing and CRISPR-Cas9. Innovative DNA technologies enable researchers and geneticists to study multiple disorders and identify genetic mutations. The advent of liquid biopsies in DNA testing revolutionizes the diagnosis of tumors and disease progression. The development of advanced sequencing technologies has made genetic sequencing faster and more accurate. Advances in DNA technology have provided widespread applications, including the development of personalized medicines, the identification of disease-causing genes, and the enhancement of disease prevention.

By test type/purpose, the ancestry & ethnicity segment held a dominant presence in the market in 2024. This is due to the increasing crime rates and the growing need to analyze disease progression. Ancestry & ethnicity tests are performed to understand the ethnic and geographical origins and uncover a complete family tree. They also enable researchers to detect potential diseases by understanding personalized information about a patient’s genetic heritage. This helps them to develop personalized medicines.

By test type/purpose, the health & wellness/genetic predisposition segment is expected to grow at the fastest CAGR in the market during the forecast period. DNA tests are performed to assess whether a patient is genetically predisposed towards developing various diseases and medical conditions. DNA tests also provide an understanding of different nutrition and fitness-related parameters. Based on the results of DNA tests, healthcare professionals can suggest an ideal diet, fitness routines, and overall wellness recommendations.

By technology/analysis method, the microarray/SNP genotyping segment held the largest revenue share of the market in 2024. This is due to the numerous benefits of microarray/SNP genotyping, such as high-throughput and large-scale genetic testing. SNP microarray test detects SNPs and characterizes variations at a single base pair in the genome. It is cost-effective for ancestry and many pharmacogenomic panels. The characteristics of SNPs are suitable for research on genetic pleiotropy in complex traits and diseases and population-based gene recognition.

By technology/analysis method, the next-generation sequencing (NGS)/targeted panels segment is expected to grow with the highest CAGR in the market during the studied years. NGS is an advanced sequencing technique that facilitates simultaneous analysis of multiple genes. It offers the scalability, speed, and resolution to evaluate targeted genes of interest. Targeted gene sequencing derives a smaller, more manageable dataset compared to whole-genome sequencing, making analysis easier.

By sample type/collection method, the saliva/buccal swab kits segment contributed the biggest revenue share of the market in 2024. This segment dominated because withdrawing saliva samples from the buccal cavity is easier and harmless. The increasing demand for minimally invasive surgeries boosts the segment’s growth. Salivary tests are used for paternity testing, genetic analysis, and research studies. They eliminate the need for anticoagulants that are required to stabilize blood samples.

By sample type/collection method, the dried blood spot/capillary blood kits segment is expected to expand rapidly in the market in the coming years. DNA test kits enable the detection of dried blood spots and blood samples from a patient. The availability of needle-free alternatives for collecting blood samples augments the segment’s growth. The isolation of DNA from blood samples is comparatively easier, resulting in high-quality DNA. The purified DNA obtained is completely compatible with downstream applications, including PCR and qPCR.

By distribution channel, the direct-to-consumer online sales segment led the market in 2024. The segmental growth is attributed to the burgeoning e-commerce sector and the increasing adoption of smartphones. Patients and healthcare professionals prefer purchasing DNA test kits from online company websites and marketplaces, as they can compare prices of different kits. Online platforms offer affordable rates and same-day home delivery services, enabling consumers to directly purchase from the company.

By distribution channel, the pharmacies & retail channels segment is expected to witness the fastest growth in the market over the forecast period. The rising number of retail pharmacies increases the accessibility of DNA test kits to a larger patient population. Retail pharmacies possess skilled professionals to guide patients about the use of at-home DNA tests. They offer free home delivery, special discounts, and 24/7 facilities. Patients purchase DNA test kits from retail stores for various purposes, including paternity, ancestry, and early-detection gender tests.

North America dominated the global market share 48% in 2024. The presence of key players, the availability of state-of-the-art research and development facilities, and a robust healthcare infrastructure are the major growth factors that govern market growth in North America. North American countries have a large consumer uptake and established DTC brands. They have a suitable clinical genomics infrastructure. Favorable government support and increasing investments propel the market.

Key players, such as Quest Diagnostics, Illumina, and Thermo Fisher Scientific, are the major providers of DNA test kits in the U.S. About 2 in 10 Americans (21%) have conducted a mail-in DNA test, and around 27% of Americans’ close relatives have conducted a DNA test. The U.S. Food and Drug Administration (FDA) has only approved a DTC genetic test for inherited cancer risk as of January 2024.

The Canadian government has strict guidelines for DNA tests, ensuring that the genetic information is only used for verifying family relationships within the immigration context. The National DNA Data Bank contains 681,459 DNA profiles in the criminal indices. The increasing demand for personalized medicines encouraged the government to invest approximately $200 million as part of the Canadian Precision Health Initiative (CPHI).

Asia-Pacific is expected to grow at the fastest CAGR in the DNA test kits market during the forecast period. The growing consumer adoption and rapidly expanding clinical genomics sector boost the market. The region has a well-established retail distribution infrastructure and localized testing capacity, potentiating the need for DNA tests. Government organizations launch initiatives to encourage people to screen for and seek early diagnosis of chronic disorders. The increasing population and the rising demand for maintaining good health and well-being promote the demand for DNA test kits.

China has the world’s largest dataset of genomic information. It has become the first country to build a nationwide genomic database covering its entire population by 2049. It has also accelerated the integration of genomics into national proactive health management in the last two decades, supported by advanced genetic technologies, supportive policies, and pressing public health needs.

The Indian government announced an investment of Rs 245.29 crore to strengthen DNA Analysis and Cyber Forensic Capabilities in State Forensic Science Laboratories. The Genome India Project (GIP) achieved a significant milestone by making the genomic data of 10,000 individuals and making it publicly accessible.

Research activities are conducted to develop innovative DNA test kits to detect unknown biomarkers, optimize DNA extraction and analysis techniques, and interpret data. Novel DNA test kits offer more accuracy, precision, and faster results.

Key Players: 23andMe, Ancestry, and MyHeritage

DNA test kits undergo clinical trials to assess their safety and efficacy. Test kit manufacturers need to receive approval from regulatory agencies to sell their products in the market.

Key Players: QIAGEN Gaithersburg, Inc., ReCode Therapeutics, and Creative Biosciences (Guangzhou) Co., Ltd.

DNA test kits offer patient support and services by enabling genetic information and providing an idea about nutrition and wellness.

Ms Mary Josephine Rapadas, Director of Gene Solutions Philippines, commented that the company had to send samples to Gene Solutions’ central laboratories in Singapore and Vietnam before partnering with the Medical City (TMC), resulting in longer wait times and higher logistics costs. The collaboration will bring significant benefits and greater accessibility to Filipino patients.

By Test Type/Purpose

By Technology/Analysis Method

By Sample Type/Collection Method

By Distribution Channel

By Region

February 2026

February 2026

February 2026

February 2026