January 2026

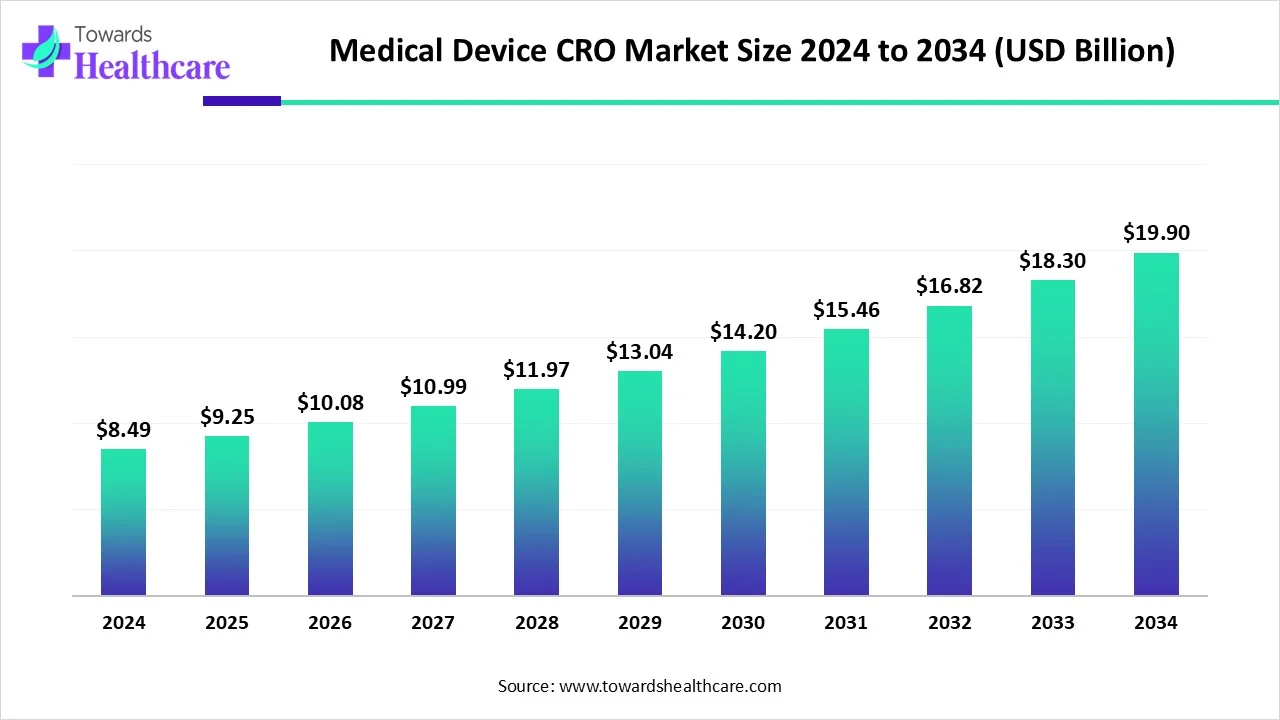

The global medical device CRO market size is calculated at USD 8.49 billion in 2024, grew to USD 9.25 billion in 2025, and is projected to reach around USD 19.9 billion by 2034. The market is expanding at a CAGR of 8.98% between 2025 and 2034.

Although there are many different kinds of CROs, the medical device industry frequently uses CRO services for regulatory affairs, clinical trial planning, site selection and initiation, recruitment assistance, clinical monitoring, data management, trial logistics, biostatistics, medical writing, and project management.

The market's growth may be attributed to a variety of factors, including a rise in clinical trials specifically for medical devices, a greater focus on cutting research expenses by medical device companies, and an increase in the demand for novel medical devices. During the forecast period, the medical device market is expected to be strengthened by the growing demand for innovative technologies as well as the drive to make devices more patient-friendly.

| Metric | Details |

| Market Size in 2025 | USD 9.25 Billion |

| Projected Market Size in 2034 | USD 19.9 Billion |

| CAGR (2025 - 2034) | 8.98% |

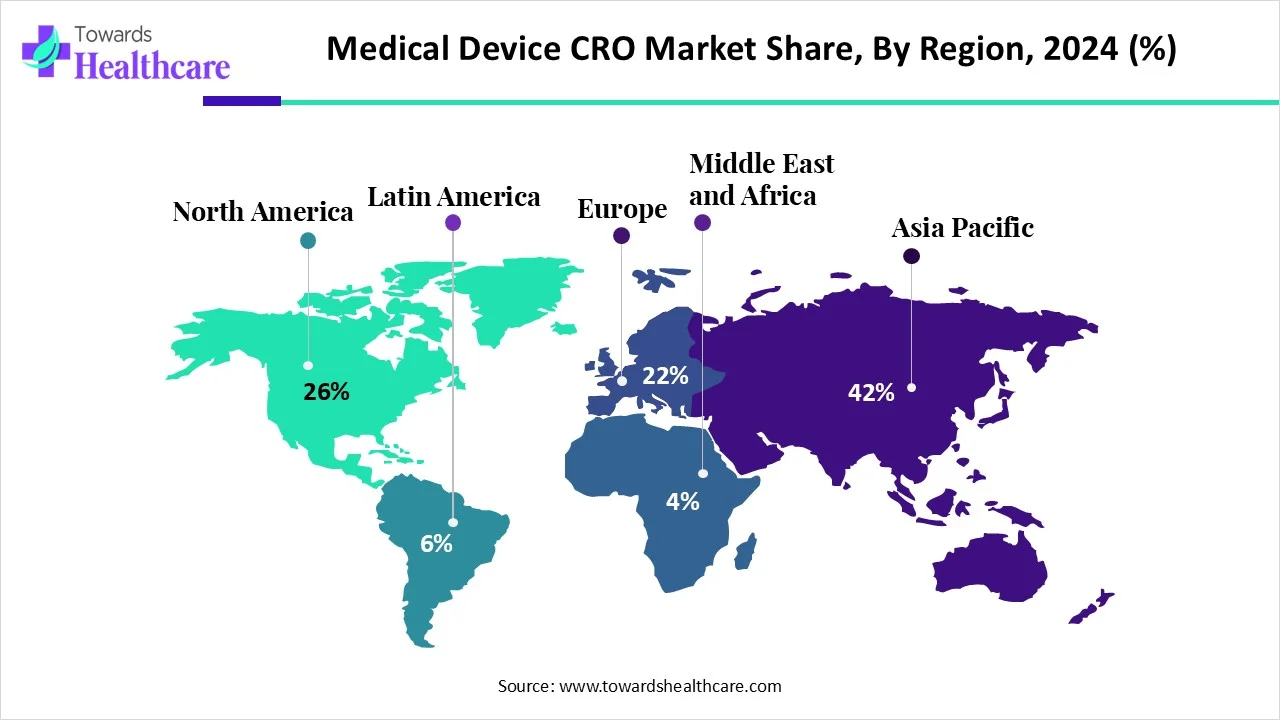

| Leading Region | Asia Pacific share by 26% |

| Market Segmentation | By Phase, By Service, By Device Type, By Region |

| Top Key Players | Avania B.V., Charles River Laboratories, CSSi Lifesciences, ICON plc., IQVIA, Labcorp Drug Development, Lindus Health, Medpace, NAMSA, Parexel, Syneos Health, WuXi AppTec |

Contract research organizations (CROs are companies that provide research and clinical trial services for medical device companies. Medical device CROs support the development and commercialization of innovative medical technologies. They assist medical device companies in navigating the complex landscape of regulatory compliance and clinical research. They offer comprehensive services, such as clinical trial design and management, regulatory affairs, post-market surveillance, and data management and analysis.

Numerous factors drive market growth, including the increasing number of clinical trials and advancements in medical technologies. Researchers are currently developing innovative medical devices for advanced treatment. Several government organizations provide funding to develop new devices. They also launch initiatives to promote early diagnosis and advanced treatment of chronic disorders, supporting the development of medical devices.

Artificial intelligence (AI) and machine learning (ML) algorithms play a vital role in automating several tasks of the medical device CRO. They can aid in decision-making and problem-solving, leading to better research outcomes. ML can analyze large datasets to identify patterns and make predictions. AI-enabled technologies can enhance the efficiency and efficacy of complex clinical trials, thereby reducing human intervention. AI and ML assist researchers and biostatisticians in saving time and accelerating the trial design processes. They can also monitor the behavior of patients in real-time and provide data to healthcare professionals, enabling them to make proactive decisions. Thus, AI and ML can completely revolutionize the operations of medical device CROs.

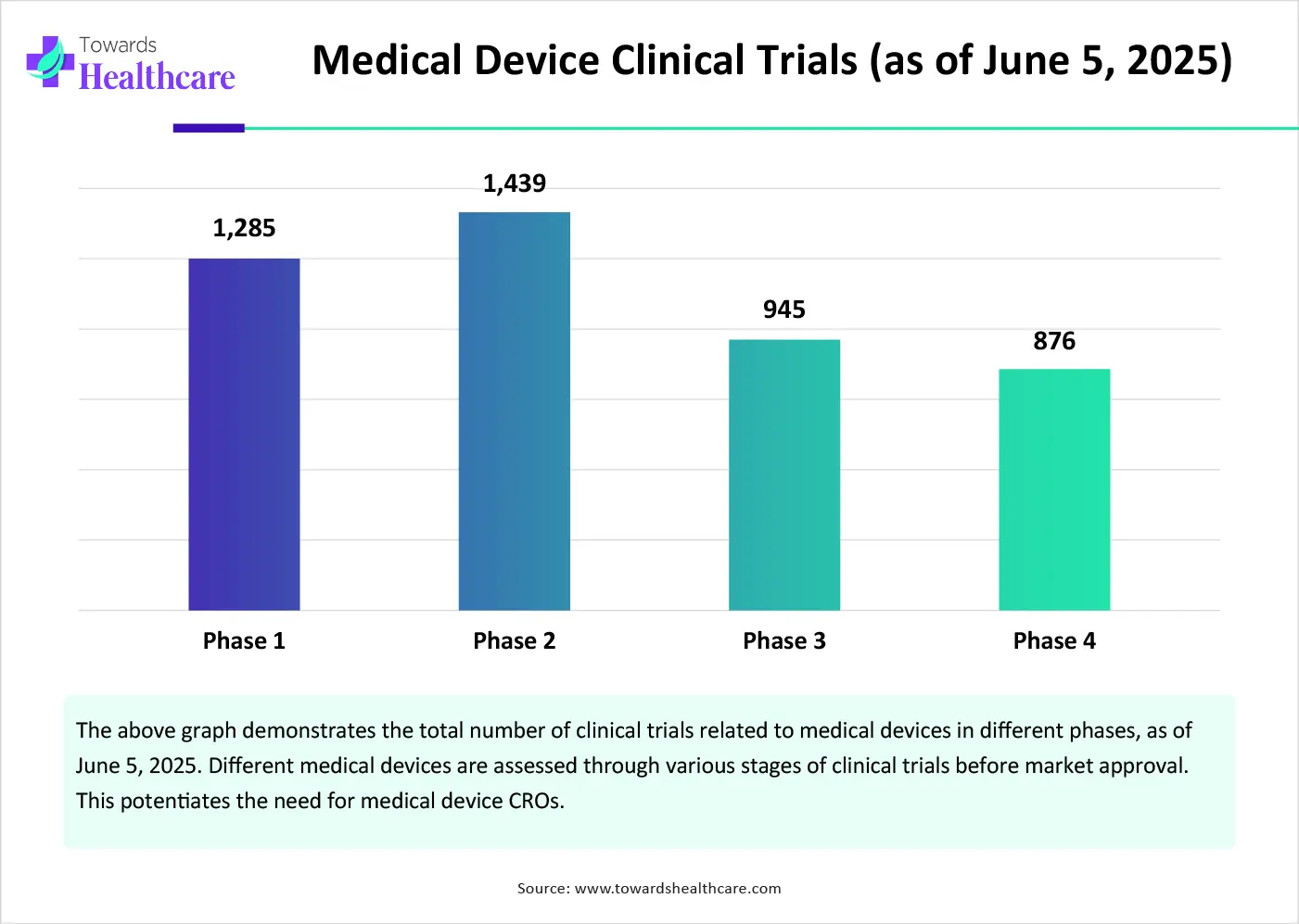

Increasing Number of Clinical Trials

The major growth factor of the medical device CRO market is the increasing number of clinical trials. The rising prevalence of chronic disorders and growing research and development activities encourage researchers to develop novel, innovative, and more advanced medical devices. Medical device companies need to follow stringent regulations and conduct clinical trials before market approval of a device. As of June 5, 2025, 28,926 medical device clinical trials were registered on the clinicaltrials.gov website. Even after market approval, the device needs to undergo post-market surveillance or Phase 4 clinical trials to assess its efficacy and potential harmful or adverse effects.

Regulatory Compliance

The major challenge of the market is the regulatory compliance of medical devices. Navigating the complex and ever-changing landscape of regulatory requirements is a major challenge for medical device CROs. They need to ensure that their processes and services remain compliant with the stringent regulations.

What is the Future of the Medical Device CRO Market?

The future of the market is promising, driven by increasing market competition among major players. The growing number of medical device companies/startups potentiates market competition. The rising demand for innovative technologies and pressure from healthcare cost containment initiatives also increase market competition. This encourages them to develop innovative medical devices that stand out from other products. Medical device CROs provide relevant expertise for all operations, from conducting clinical trials to regulatory affairs, enabling companies to focus on product sales and marketing. CROs also help in reducing the time-to-market approval and strengthening their market position.

By phase, the clinical segment held a dominant presence in the market in 2024. This segment dominated due to the increasing number of clinical trials and the rising complexity. Since clinical trials involve human subjects, they require stringent regulations and relevant expertise for their completion. Clinical trials, especially Phase 2 and Phase 3, need to be monitored from multiple locations. Medical device CROs assist medical device companies in data collection and analysis in larger studies. Moreover, they help in site selection and feasibility, site startup and management, clinical monitoring, patient recruitment, and retention.

By phase, the preclinical segment is expected to grow at the fastest CAGR in the market during the forecast period. Medical device CROs help medical companies accomplish pre-clinical research, providing appropriate facilities and services. They provide a customized, comprehensive portfolio of services from planning to execution and data analysis. They help to manage stringent regulations within the budget. They eliminate the need to purchase different animal models for multiple experiments. The lack of skilled professionals for performing preclinical studies also potentiates the demand for medical device CROs.

By service, the clinical monitoring segment dominated the market in 2024. Clinical monitoring of medical devices is essential for regulatory compliance, data integrity, and patient safety. The clinical monitoring segment dominated because of the increasing complexity of clinical trials and the growing demand for maintaining regulatory compliance. CROs possess extensive experience and expertise that help in executing and maintaining procedures, ensuring Good Clinical Practice (GCP) for the trials. Such an experienced and personalized approach ensures that the trial receives the desired attention and care.

By service, the regulatory/medical affairs segment is expected to grow with the highest CAGR in the market during the studied years. Medical device CROs assist in preparing and submitting documents to regulatory bodies, like the FDA, EMA, and other international agencies. They cover pre-marketing and post-marketing regulatory strategies for a wide range of medical devices. Additionally, they provide scientifically-based, therapeutically-focused regulatory services from strategy to execution.

By device type, the diagnostic devices segment led the global market in 2024. The demand for diagnostic devices increases due to the growing need for screening and early disease diagnosis of chronic disorders. Several government organizations launch initiatives to encourage the general public to screen for chronic disorders. The increasing number of new product launches also augments the segment’s growth. The U.S. Food and Drug Administration (FDA) has approved a total of 188 in vitro diagnostics as of March 2025. (Source - U.S. Food & Drugs)

By device type, the MedTech devices segment is projected to expand rapidly in the market in the coming years. MedTech devices are instruments, equipment, or software used to diagnose, prevent, treat, or alleviate diseases. They include a wide range of devices from tongue depressors to pacemakers and surgical robots. The segmental growth is attributed to technological advancements, such as AI and ML integrating into medical devices. As of March 2025, the U.S. FDA approved 1,016 AI/ML-enabled medical devices.

Asia-Pacific dominated the medical device CRO market share by 26% in 2024. The increasing number of medical device startups and the rising collaborations among key players boost the market. The rapidly expanding medical device sector and increasing investments by government and private organizations support market growth. The rising prevalence of chronic disorders and the growing geriatric population also contribute to market growth.

There are currently 1,104 medical device startups in China, out of which 556 startups are funded. Fortune India mentioned in its article that there were 32,000 medical device manufacturers in China at the end of 2023, generating $160 billion in revenue. (Source - Fortune)China’s medical device industry is driven by government initiatives, strong domestic demand, and rising innovation within the healthcare sector.

There are around 892 medical device startups in India as of May 2025. The Indian MedTech sector has made significant strides, driven by government initiatives, positioning India as a global hub. It is found that 79% of all innovations are driven by medical technology solutions and 21% are driven by digital solutions among all Indian MedTech startups. (Source - EY)

North America is estimated to grow at the fastest rate during the forecast period. The rising adoption of advanced technologies and the increasing launch of novel medical devices are the major factors that govern the market growth in North America. Several government organizations support the development of novel medical devices through funding and initiatives. The presence of stringent regulatory policies and increasing market competition also potentiates the demand for medical device CROs.

There were around 4,321 CROs in the U.S. in 2024, an increase of 2.1% from 2023. Key players, such as Fortrea, Medidata Solutions, and Medpace, are the major contributors to the market in the U.S. The U.S. conducts the world’s most clinical trials, accounting for 182,645 trials as of June 5, 2025. This results in approximately 33.8% of the total global clinical trials.

Canada conducts approximately 4% of the global clinical trials, and ranked fourth in the world for the total number of active trials in 2023. The Canadian Institute of Health Research (CIHR) allocates over $1 billion annually to health research funding and promotes major initiatives for clinical trials. (Source - Government of Canada)

Europe is expected to grow at a notable CAGR in the medical device CRO market in the foreseeable future. Favorable government initiatives for early disease diagnosis and treatment necessitate researchers to develop novel medical devices. The European Medicines Agency (EMA) regulates the approval of medical devices and imposes stringent regulations. The increasing exports of medical devices from European countries propel the market. The growing demand for personalized treatment also encourages the development of medical devices.

Germany is the second-largest exporter of medical devices in 2023. It exported about $18.4 billion of medical instruments. The top importers of these devices were the U.S. and the Netherlands. Germany also accounted for the largest trade surplus in medical instruments, worth $5.36 billion. (Source - OEC)

The UK is home to 161 medical device startups as of 2025. The UK government aims to provide £30 million in investment for innovative medical technology. The funding would be used for the expansion of 3D checks to speed up cancer tests and novel logistics solutions. The UK medical technology sector generates an annual turnover of approximately $33 billion. The NHS accounts for 86% of the country’s healthcare provision. (Source - Trade)

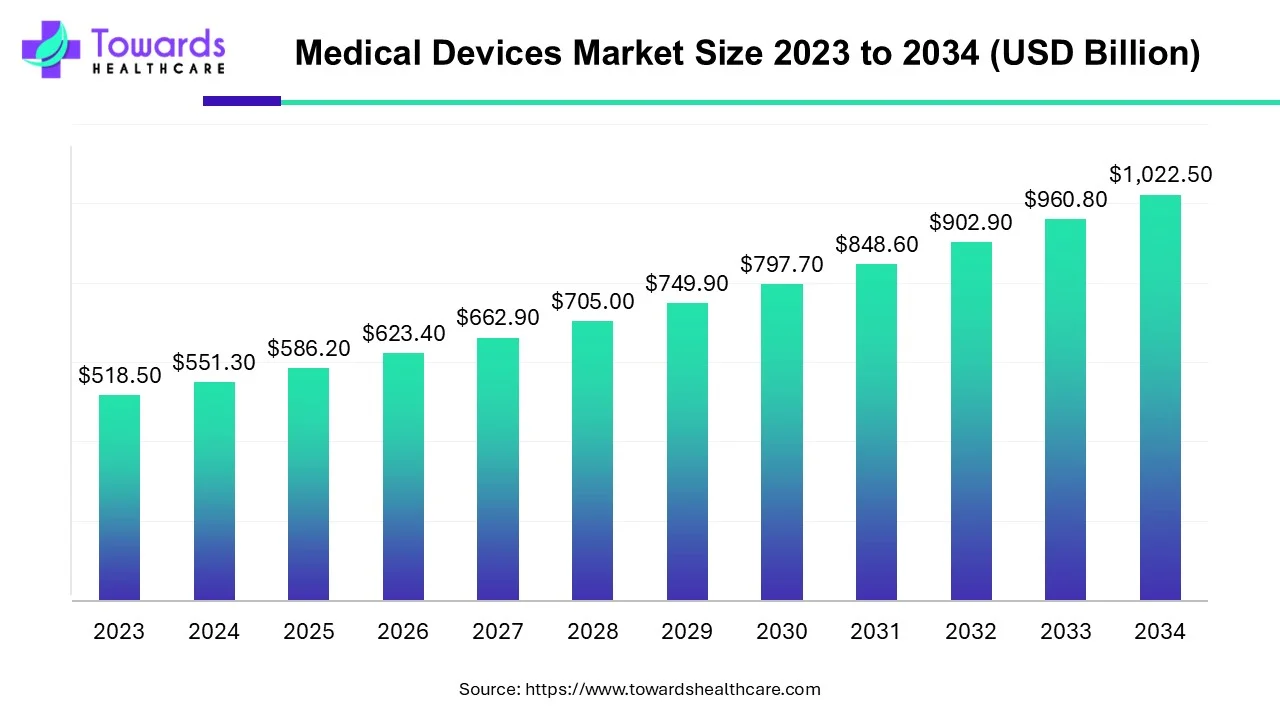

The global medical devices market size is calculated at USD 586.20 billion in 2025, grew to USD 623.37 billion in 2026, and is projected to reach around USD 1083.96 billion by 2035. The market is expanding at a CAGR of 6.34% between 2026 and 2035. Technological advancements and favorable government policies drive the market.

Evan Hughes, Vice President, Clinical Data Science, ICON plc, commented that the company is a leader in risk-based quality management, integrating Data Management and Central Monitoring teams in its Clinical Data Science group. The launch of the Clinical Data Studio platform meets growing data demands and customer expectations for speed and efficiency. The platform leverages AI and statistical modeling for faster, precise data delivery. (Source - Businesswire)

By Phase

By Service

By Device Type

By Region

January 2026

January 2026

January 2026

January 2026